The Adaptive Optics Market size was valued at USD 1990.2 Mn in 2023 and market revenue is growing at a CAGR of 35.2 %from 2023 to 2030, reaching nearly USD 16433.63 Mn by 2030.Adaptive Optics Market Overview

The Adaptive Optics market is expected to grow, due to the imperative need for advanced optical systems such as the Overwhelmingly Large Telescope (OWL). OWL's spectroscopy and imaging capabilities rely heavily on Adaptive Optics to concentrate light and achieve diffraction-limited performance. The Adaptive Optics market trajectory is guided by a three-generation implementation plan. The 1st generation AO emphasizes Natural Guide Stars (NGSs) and ground layer correction. The 2nd generation introduces Multi-Conjugate Adaptive Optics, employing additional deformable mirrors for enhanced correction. The 3rd generation focuses on Laser Guide Stars (LGSs), particularly Sodium LGSs, offering broader sky coverage and superior correction.To know about the Research Methodology:-Request Free Sample Report Performance projections are optimistic, leveraging expected technological advancements, particularly in deformable mirror sizes and actuator densities. While current technology does not fully meet all requirements, confidence is high in future advancements reshaping the market landscape. The Adaptive Optics Market is poised for growth, driven by the increasing demand for high-performance optical systems such as those required for OWL. With advancements in AO technology, the market is expected to boost further, offering enhanced capabilities and broader applications.

Adaptive Optics Market Dynamics

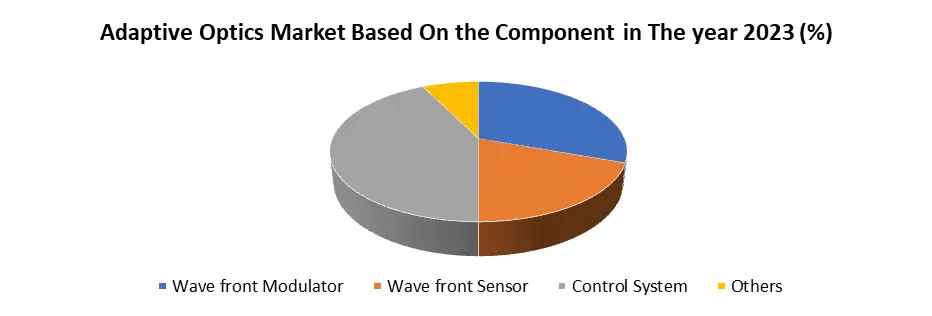

Driver Rising Demand in Astronomy Boosts Adaptive Optics Market Growth The rising demand in astronomy for high-resolution imaging and spectroscopy significantly boosts the Adaptive Optics Market. AO systems are crucial for correcting atmospheric distortions in real time, enabling telescopes to produce sharper and clearer images of celestial objects. This capability is essential for studying phenomena such as exoplanets, galaxies, and black holes in unprecedented detail, advancing scientific research and discovery. Observatories and research institutions prioritize the adoption of AO technology to maintain competitiveness in astronomical observations, attracting funding and support from various sources. The technological advancements spurred by AO development in astronomy often lead to applications in other industries such as medicine, defense, and telecommunications, fostering innovation and boosting the market further. As astronomers continually push the boundaries of observational capabilities, the demand for AO-equipped telescopes and systems is expected to rise, driving further investment, innovation, and growth in the Adaptive Optics market. This symbiotic relationship between astronomy's quest for a deeper understanding of the cosmos and AO technology's capability to meet these demands underscores the significant role AO plays in advancing both scientific knowledge and technological progress, ensuring its continued relevance and growth.Restrain High Cost of the AO System limits the Market growth The high cost of Adaptive Optics (AO) systems significantly constrains the growth of the Adaptive Optics market due to several reasons. The complex technology and specialized components required for AO systems lead to substantial manufacturing costs. These expenses are then passed on to consumers, making AO systems prohibitively expensive for many potential buyers, including researchers, observatories, and industrial users. The maintenance and operational costs of AO systems also be substantial. These systems often require skilled personnel for installation, calibration, and ongoing support, adding to the overall expense. The need for regular upgrades and software updates further contributes to the total cost of ownership. The high initial investment required for AO systems acts as a barrier to entry for smaller research institutions, universities, and businesses, limiting the potential market size. This, in turn, hampers the economies of scale that drive down costs through mass production and widespread adoption. To address these challenges and stimulate Adaptive Optics market growth, efforts to reduce production costs, enhance efficiency, and develop more affordable alternatives to traditional AO systems are crucial. Collaboration between industry, academia, and government entities also plays a significant role in driving innovation and expanding access to AO technology. Opportunity Technological advancement creates lucrative growth opportunities for Market Growth Technological advancements catalyze lucrative growth opportunities within the Adaptive Optics market by revolutionizing system capabilities, broadening applicability, and fostering innovation. Breakthroughs in wavefront sensing, modulation, and control algorithms enable AO systems to achieve unprecedented levels of precision in correcting optical aberrations. This enhanced performance is particularly appealing for industries requiring superior imaging quality, such as astronomy, microscopy, and medical imaging. Also, advancements in component design and manufacturing processes lead to cost reductions, making AO technology more accessible to a wider range of customers. This affordability drives adoption across various sectors, including research, defense, and healthcare, boosting Adaptive Optics market growth. Technological innovation fuels the development of novel AO solutions and applications, providing companies with opportunities to differentiate themselves and capture niche markets. By investing in research and development, companies stay ahead of the curve and offer cutting-edge products that meet evolving customer needs. AO technology has become more versatile and adaptable, it penetrates emerging markets and industries. Rapid industrialization, infrastructure development, and increasing healthcare expenditures in regions such as Asia-Pacific and Latin America create new demand for AO solutions, further driving market growth. Adaptive Optics Market Segment Analysis Based On the Component, the Control system segment dominated the Component segment of the Adaptive Optics Market in the year 2023. The dominance of the Control System segment in the Adaptive Optics industry is due to its central role in optimizing AO system performance. Control systems are integral for processing data from wavefront sensors and driving wavefront modulators to correct optical aberrations in real time. Their effectiveness directly impacts image quality, resolution, and sensitivity across diverse applications, from astronomy to medical imaging. As the backbone of AO functionality, advancements in control algorithms, hardware, and software integration are essential for achieving precise corrections and adapting to changing environmental conditions. Continuous innovation in control system technologies drives market growth by enabling AO systems to meet evolving demands and expand into new applications. The critical role, broad applicability, and ongoing research and development efforts in control systems position this segment as a dominant force shaping the future of the Adaptive Optics market.

Adaptive Optics Market Regional Analysis

North America dominated the Adaptive Optics Market in the year 2023. North America's dominance in the Adaptive Optics industry stems from several factors that collectively contribute to its leading position. The region boasts a strong and dynamic scientific and technological ecosystem, with renowned research institutions, universities, and high-tech industries driving innovation in optical sciences and engineering. North America is home to some of the world's largest astronomical observatories and space agencies, which heavily rely on AO systems for their research and exploration missions. These institutions foster a culture of collaboration and investment in innovative technologies, further solidifying the region's leadership in AO development and deployment. Also, North America benefits from a strong market infrastructure and a favorable regulatory environment that supports the growth and commercialization of AO technologies. The presence of major players in the aerospace, defense, and healthcare sectors further bolsters the market, driving demand for AO-enabled products and solutions across various industries. The strategic partnerships between government agencies, private companies, and academic institutions facilitate technology transfer and knowledge exchange, fueling innovation and driving market growth. North America's dominance in the Adaptive Optics market is a testament to its technological prowess, collaborative ecosystem, and strategic investments in research and development.Adaptive Optics Market Scope: Inquire before buying

Adaptive Optics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1990.2 Mn. Forecast Period 2024 to 2030 CAGR: 35.2% Market Size in 2030: US $ 16344.63 Mn. Segments Covered: by Component Wave front Modulator Wave front Sensor Control System Others by End-User Industry Consumer Astronomy Biomedical Military & Defense Industrial & Manufacturing Communication and Others Adaptive Optics Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Adaptive Optics Market Key players

North America 1. Thorlabs, Inc. - Newton, New Jersey, USA 2. Northrop Grumman Corporation - Falls Church, Virginia, USA 3. Boston Micromachines Corporation - Cambridge, Massachusetts, USA 4. Iris AO, Inc. - Berkeley, California, USA 5. Imagine Optic SA - Orsay, France (not in the USA) 6. Baker Adaptive Optics - Boulder, Colorado, USA 7. Synopsys, Inc. - Mountain View, California, USA 8. Celestron LLC - Torrance, California, USA 9. Benchmark Electronics, Inc. - Tempe, Arizona, USA 10. 4D Technology Corporation - Tucson, Arizona, USA 11. Zygo Corporation (a part of Ametek) - Middlefield, Connecticut, USA Europe 1. ALPAO SAS - Montbonnot-Saint-Martin, France 2. Sacher Lasertechnik GmbH - Marburg, Germany 3. Phasics Corporation - Saint-Aubin, France 4. Schott AG - Mainz, Germany Asia Pacific 1. Hamamatsu Photonics K.K. -Japan 2. Canon Inc. - Tokyo, Japan Frequently Asked Questions 1] What segments are covered in the Global Adaptive Optics Market report? Ans. The segments covered in the Adaptive Optics Market report are based on, Component, Deployment, Application, and Regions. 2] Which region is expected to hold the highest share of the Global Adaptive Optics Market? Ans. The North America region is expected to hold the highest share of the Adaptive Optics Market. 3] What is the market size of the Global Adaptive Optics Market by 2030? Ans. The market size of the Adaptive Optics Market by 2030 is expected to reach US$ 16433.63 Mn. 4] What was the market size of the Global Adaptive Optics Market in 2023? Ans. The market size of the Adaptive Optics Market in 2023 was valued at US$ 1990.2 Mn. 5] Key players in the Adaptive Optics Market. Ans. Thorlabs, Inc. - Newton, New Jersey, USA, Northrop Grumman Corporation - Falls Church, Virginia, USA, Boston Micromachines Corporation - Cambridge, Massachusetts, USA, Iris AO, Inc. - Berkeley, California, USA, and Imagine Optic SA - Orsay, France (not in the USA)

1. Adaptive Optics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Adaptive Optics Market: Dynamics 2.1. Adaptive Optics Market Trends by Region 2.1.1. North America Adaptive Optics Market Trends 2.1.2. Europe Adaptive Optics Market Trends 2.1.3. Asia Pacific Adaptive Optics Market Trends 2.1.4. Middle East and Africa Adaptive Optics Market Trends 2.1.5. South America Adaptive Optics Market Trends 2.2. Adaptive Optics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Adaptive Optics Market Drivers 2.2.1.2. North America Adaptive Optics Market Restraints 2.2.1.3. North America Adaptive Optics Market Opportunities 2.2.1.4. North America Adaptive Optics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Adaptive Optics Market Drivers 2.2.2.2. Europe Adaptive Optics Market Restraints 2.2.2.3. Europe Adaptive Optics Market Opportunities 2.2.2.4. Europe Adaptive Optics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Adaptive Optics Market Drivers 2.2.3.2. Asia Pacific Adaptive Optics Market Restraints 2.2.3.3. Asia Pacific Adaptive Optics Market Opportunities 2.2.3.4. Asia Pacific Adaptive Optics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Adaptive Optics Market Drivers 2.2.4.2. Middle East and Africa Adaptive Optics Market Restraints 2.2.4.3. Middle East and Africa Adaptive Optics Market Opportunities 2.2.4.4. Middle East and Africa Adaptive Optics Market Challenges 2.2.5. South America 2.2.5.1. South America Adaptive Optics Market Drivers 2.2.5.2. South America Adaptive Optics Market Restraints 2.2.5.3. South America Adaptive Optics Market Opportunities 2.2.5.4. South America Adaptive Optics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Adaptive Optics Industry 2.8. Analysis of Government Schemes and Initiatives For Adaptive Optics Industry 2.9. Adaptive Optics Market Trade Analysis 2.10. The Global Pandemic Impact on Adaptive Optics Market 3. Adaptive Optics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Adaptive Optics Market Size and Forecast, by Component (2023-2030) 3.1.1. Wave front Modulator 3.1.2. Wave front Sensor 3.1.3. Control System 3.1.4. Others 3.2. Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 3.2.1. Consumer 3.2.2. Astronomy 3.2.3. Biomedical 3.2.4. Military & Defense 3.2.5. Industrial & Manufacturing 3.2.6. Communication and Others 3.3. Adaptive Optics Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Adaptive Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Adaptive Optics Market Size and Forecast, by Component (2023-2030) 4.1.1. Wave front Modulator 4.1.2. Wave front Sensor 4.1.3. Control System 4.1.4. Others 4.2. North America Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 4.2.1. Consumer 4.2.2. Astronomy 4.2.3. Biomedical 4.2.4. Military & Defense 4.2.5. Industrial & Manufacturing 4.2.6. Communication and Others 4.3. North America Adaptive Optics Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Adaptive Optics Market Size and Forecast, by Component (2023-2030) 4.3.1.1.1. Wave front Modulator 4.3.1.1.2. Wave front Sensor 4.3.1.1.3. Control System 4.3.1.1.4. Others 4.3.1.2. United States Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 4.3.1.2.1. Consumer 4.3.1.2.2. Astronomy 4.3.1.2.3. Biomedical 4.3.1.2.4. Military & Defense 4.3.1.2.5. Industrial & Manufacturing 4.3.1.2.6. Communication and Others 4.3.2. Canada 4.3.2.1. Canada Adaptive Optics Market Size and Forecast, by Component (2023-2030) 4.3.2.1.1. Wave front Modulator 4.3.2.1.2. Wave front Sensor 4.3.2.1.3. Control System 4.3.2.1.4. Others 4.3.2.2. Canada Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 4.3.2.2.1. Consumer 4.3.2.2.2. Astronomy 4.3.2.2.3. Biomedical 4.3.2.2.4. Military & Defense 4.3.2.2.5. Industrial & Manufacturing 4.3.2.2.6. Communication and Others 4.3.3. Mexico 4.3.3.1. Mexico Adaptive Optics Market Size and Forecast, by Component (2023-2030) 4.3.3.1.1. Wave front Modulator 4.3.3.1.2. Wave front Sensor 4.3.3.1.3. Control System 4.3.3.1.4. Others 4.3.3.2. Mexico Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 4.3.3.2.1. Consumer 4.3.3.2.2. Astronomy 4.3.3.2.3. Biomedical 4.3.3.2.4. Military & Defense 4.3.3.2.5. Industrial & Manufacturing 4.3.3.2.6. Communication and Others 5. Europe Adaptive Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.2. Europe Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3. Europe Adaptive Optics Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.1.2. United Kingdom Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3.2. France 5.3.2.1. France Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.2.2. France Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.3.2. Germany Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.4.2. Italy Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.5.2. Spain Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.6.2. Sweden Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.7.2. Austria Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Adaptive Optics Market Size and Forecast, by Component (2023-2030) 5.3.8.2. Rest of Europe Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific Adaptive Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3. Asia Pacific Adaptive Optics Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.1.2. China Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.2.2. S Korea Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.3.2. Japan Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.4. India 6.3.4.1. India Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.4.2. India Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.5.2. Australia Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.6.2. Indonesia Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.7.2. Malaysia Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.8.2. Vietnam Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.9.2. Taiwan Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Adaptive Optics Market Size and Forecast, by Component (2023-2030) 6.3.10.2. Rest of Asia Pacific Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa Adaptive Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Adaptive Optics Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 7.3. Middle East and Africa Adaptive Optics Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Adaptive Optics Market Size and Forecast, by Component (2023-2030) 7.3.1.2. South Africa Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Adaptive Optics Market Size and Forecast, by Component (2023-2030) 7.3.2.2. GCC Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Adaptive Optics Market Size and Forecast, by Component (2023-2030) 7.3.3.2. Nigeria Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Adaptive Optics Market Size and Forecast, by Component (2023-2030) 7.3.4.2. Rest of ME&A Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 8. South America Adaptive Optics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Adaptive Optics Market Size and Forecast, by Component (2023-2030) 8.2. South America Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 8.3. South America Adaptive Optics Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Adaptive Optics Market Size and Forecast, by Component (2023-2030) 8.3.1.2. Brazil Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Adaptive Optics Market Size and Forecast, by Component (2023-2030) 8.3.2.2. Argentina Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Adaptive Optics Market Size and Forecast, by Component (2023-2030) 8.3.3.2. Rest Of South America Adaptive Optics Market Size and Forecast, by End User Industry (2023-2030) 9. Global Adaptive Optics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Adaptive Optics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Thorlabs, Inc. - Newton, New Jersey, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Northrop Grumman Corporation - Falls Church, Virginia, USA 10.3. Boston Micromachines Corporation - Cambridge, Massachusetts, USA 10.4. Iris AO, Inc. - Berkeley, California, USA 10.5. Imagine Optic SA - Orsay, France (not in the USA) 10.6. Baker Adaptive Optics - Boulder, Colorado, USA 10.7. Synopsys, Inc. - Mountain View, California, USA 10.8. Celestron LLC - Torrance, California, USA 10.9. Benchmark Electronics, Inc. - Tempe, Arizona, USA 10.10. 4D Technology Corporation - Tucson, Arizona, USA 10.11. Zygo Corporation (a part of Ametek) - Middlefield, Connecticut, USA 10.12. ALPAO SAS - Montbonnot-Saint-Martin, France 10.13. Sacher Lasertechnik GmbH - Marburg, Germany 10.14. Phasics Corporation - Saint-Aubin, France 10.15. Schott AG - Mainz, Germany 10.16. Hamamatsu Photonics K.K. -Japan 10.17. Canon Inc. - Tokyo, Japan 11. Key Findings 12. Industry Recommendations 13. Adaptive Optics Market: Research Methodology 14. Terms and Glossary