Acetic Acid Market size was valued at US$ 10.37 Bn. in 2022 and the total revenue is expected to grow at a CAGR of 5.2 % from 2023 to 2029, reaching nearly US$ 14.80 Bn.Acetic Acid Market Overview:

The Global Acetic Acid Market is expected to reach US$ 14.80 Bn. by 2029. Acetic acid has two carbons and is a monocarboxylic acid. It's a clear, colourless liquid with a harsh, vinegar-like odour. This report focuses on the different segments of the Acetic Acid market (End Use, Application, and Region). This report examines the major industry players and regions in depth (North America, Asia Pacific, Europe, Middle East & Africa, and South America). It provides a thorough study of today's rapid improvements across many industries. Facts and numbers, visualisations, and presentations are used to present the primary data analysis for the historical period from 2018 to 2022. The market drivers, restraints, opportunities, and challenges for Acetic Acid are examined in this report. The MMR report's investment suggestions are based on a thorough examination of the current competitive environment in the Acetic Acid market.To know about the Research Methodology :- Request Free Sample Report

Acetic Acid Market Dynamics:

Rising demand for the product from Vinyl Acetate Monomer (VAM) companies around the world is expected to keep the market growing. VAM is conventionally made by reacting acetic acid with ethylene and oxygen in the presence of a palladium catalyst in a gas phase reaction. VAM is polymerized to generate polyvinyl acetate or other polymers, which are essential parts in the paints industry, and a substantial amount of vinyl acetate monomer produced is used in paint and coating formulations. In its diluted form, acetic acid is commonly employed as a descaling agent in the home, while in the industrial sector; it is widely used as a key chemical reagent in the formulation of cellulose acetate. The chemical is also used as a condiment and acidity control in the food industry. Each year, about 1.5 million tonnes of the acid are recycled, while the rest is made from methanol. The material is hydrophilic in liquid form, making it suitable for a wide range of applications. The chemical's largest producers are British Petroleum Chemicals and Celanese Corporation. It's made in a commercial setting using bacterial fermentation and a synthetic approach. Biological production, on the other hand, accounts for around 10% of total global production. Celanese Corporation and other multinationals are introducing innovative technological techniques to develop new product lines in order to get into a larger market. Methanol carbonylation, acetaldehyde oxidation, ethylene oxidation, oxidative fermentation, and anaerobic fermentation are some of the most often used acetic acid production methods. The material is classified as harmful to human health under the European Chemicals Agency's (ECHA) harmonised classification and labelling system because it causes serious eye damage, skin burns, and other effects. The compound is, however, designated as safe to use as a food additive by the US Environmental Protection Agency (EPA) under acceptable levels as indicated by the agency in line with 184.1 of goods manufacturing procedures.Acetic Acid Market Segment Analysis:

Based on the Application, the market is segmented into Vinyl Acetate Monomer, Acetic Anhydride, Acetate Esters, Purified Terephthalic Acid, Ethanol, and Others. Vinyl Acetate Monomer application segment is expected to hold the largest market share of xx% by 2029. Water-based paints, adhesives, waterproofing coatings, and paper and paperboard coatings all use vinyl acetate monomer (VAM). Polyesters and polyamides based on PTA are also employed in hot melt adhesives. PTA is even employed as a carrier in paintings. Acetic acid and its derivatives are used in the automotive sector to manufacture adhesives and sealants. The growth of the acetic acid market is directly linked to the growth of the automotive adhesives and sealants market. However, demand for acetic acid is expected to rise during the forecast period as safety standards improve around the world. In recent years, the global EV (Electric Vehicle) market has experienced rapid growth. According to the International Energy Agency (IEA), new electric car registrations were surpassed 3 million in 2022, setting a new high. Because paints and coatings are utilised in the manufacture of electric vehicles, the market for acetic acid is expected to grow during the forecast period. Many construction items, such as paints, thinners, and glues, include acetic acid or its derivatives. Construction activity is increasing in countries like China, India, the United States, and Brazil. This, in turn, is expected to have a beneficial impact on the market for acetic acid end-use products. Based on the End Use, the market is segmented into Plastics and Polymer, Food and Beverage, Adhesives, Paints and Coatings, and Pharmaceuticals. Plastics and Polymer segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2023-2029. This is due to the increasing use of acetic acid in the Plastics and Polymer industries as acetic acid offers plenty of benefits to the Plastics and Polymer industries.

Regional Insights:

Asia Pacific region is expected to dominate the Acetic Acid Market during the forecast period 2023-2029. The Asia Pacific region is expected to hold the largest market share of xx% by 2029. This can be due to the region's growing number of polymer formulators. Acetic acid is a crucial ingredient in a variety of industries in China, Japan, and India. Due to a rise in mergers and acquisitions, the region is seeing a surge in construction activity. Since the last decade, the region has attracted a slew of multinational corporations from a variety of industries, as well as a slew of manufacturing growth projects. Despite mild trade conflicts between China and the United States, prices for plastics and polymers remained constant in the Asia Pacific region. The need for plastics and plastic products has increased as additional countries, such as China, Japan, and India, develop their economies. PTA demand has increased significantly over the last decade, which is directly related to the region's rising acetic acid usage. The objective of the report is to present a comprehensive analysis of the Global Acetic Acid Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Acetic Acid Market dynamic and structure by analyzing the market segments and projecting the Global Acetic Acid Market size. Clear representation of competitive analysis of key players by Distribution Channel, price, financial position, product portfolio, growth strategies, and regional presence in the Acetic Acid Market make the report investor’s guide.Acetic Acid Market Scope: Inquiry Before Buying

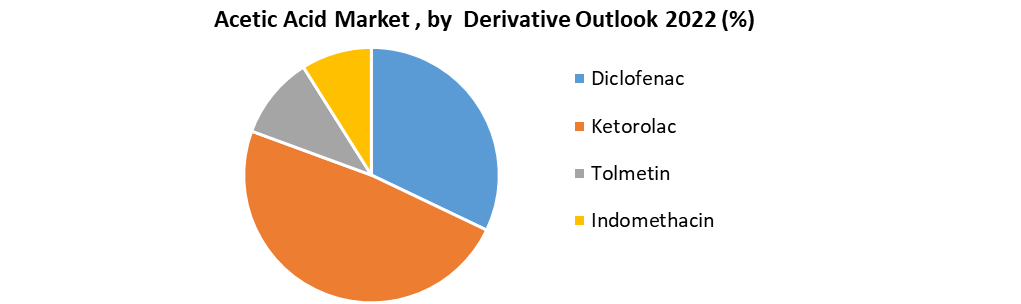

Global Acetic Acid Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 10.37 Bn. Forecast Period 2023 to 2029 CAGR: 5.2% Market Size in 2029: US $ 14.80 Bn. Segments Covered: by End Use 1. Plastics and Polymer 2. Food and Beverage 3. Adhesives 4. Paints and Coatings 5. Pharmaceuticals by Derivative Outlook 1. Diclofenac 2. Ketorolac 3. Tolmetin 4. Indomethacin by Manufacturing Process 1. Biological Route 2. Synthetic Route 1.1. Paraffin Oxidation 1.2. Methanol Carbonylation 1.3. Olefin Oxidation 1.4. Terephthalic/Isophthalic Acid Coproduct by Application 1. Vinyl Acetate Monomer 2. Acetic Anhydride 3. Acetate Esters 4. Purified Terephthalic Acid 5. Ethanol 6. Others Acetic Acid Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. Wacker Chemie 2. Saudi International Petrochemicals 3. DuPont 4. Eastman Chemical Company 5. Jiangsu Sopo (Group) Co., Ltd. 6. British Petroleum 7. Celanese Corporation 8. Mitsubishi Chemical Corporation 9. Daicel Corporation 10. GNFC Limited 11. HELM AG 12. LyondellBasell Industries N.V. 13. PetroChina 14. Sinopec 15. Indian Oil Corporation 16. Dow Chemicals Frequently Asked Questions: 1] Which region is expected to hold the highest share in the Acetic Acid Market? Ans. Asia Pacific is expected to hold the highest share in the Acetic Acid Market. 2] Who are the top key players in the Acetic Acid Market? Ans. Wacker Chemie, Saudi International Petrochemicals, DuPont, Eastman Chemical Company, Jiangsu Sopo (Group) Co., Ltd., and British Petroleum are the top key players in the Acetic Acid Market. 3] Which segment is expected to hold the largest market share in the Acetic Acid Market by 2029? Ans. Vinyl Acetate Monomer application segment is expected to hold the largest market share in the Acetic Acid Market by 2029. 4] What is the market size of the Acetic Acid Market by 2029? Ans. The market size of the Acetic Acid Market is expected to reach US $ 14.80 Bn. by 2029. 5] What was the market size of the Acetic Acid Market in 2022? Ans. The market size of the Acetic Acid Market was worth US $10.37 Bn. in 2022.

1. Global Acetic Acid Market: Research Methodology 2. Global Acetic Acid Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Acetic Acid Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Acetic Acid Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Acetic Acid Market Segmentation 4.1 Global Acetic Acid Market, by End Use (2022-2029) • Plastics and Polymer • Food and Beverage • Adhesives • Paints and Coatings • Pharmaceuticals 4.2 Global Acetic Acid Market, by Derivative Outlook (2022-2029) • Diclofenac • Ketorolac • Tolmetin • Indomethacin 4.3 Global Acetic Acid Market, by Manufacturing Process (2022-2029) • Biological Route • Synthetic Route o Paraffin Oxidation o Methanol Carbonylation o Olefin Oxidation o Terephthalic/Isophthalic Acid Coproduct 4.4 Global Acetic Acid Market, by Application (2022-2029) • Vinyl Acetate Monomer • Acetic Anhydride • Acetate Esters • Purified Terephthalic Acid • Ethanol • Others 5. North America Acetic Acid Market(2022-2029) 5.1 North America Acetic Acid Market, by End Use (2022-2029) • Plastics and Polymer • Food and Beverage • Adhesives • Paints and Coatings • Pharmaceuticals 5.2 North America Acetic Acid Market, by Derivative Outlook (2022-2029) • Diclofenac • Ketorolac • Tolmetin • Indomethacin 5.3 North America Acetic Acid Market, by Manufacturing Process (2022-2029) • Biological Route • Synthetic Route o Paraffin Oxidation o Methanol Carbonylation o Olefin Oxidation o Terephthalic/Isophthalic Acid Coproduct 5.4 North America Acetic Acid Market, by Application (2022-2029) • Vinyl Acetate Monomer • Acetic Anhydride • Acetate Esters • Purified Terephthalic Acid • Ethanol • Others 5.5 North America Acetic Acid Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Acetic Acid Market (2022-2029) 6.1. European Acetic Acid Market, by End Use (2022-2029) 6.2. European Acetic Acid Market, by Derivative Outlook (2022-2029) 6.3. European Acetic Acid Market, by Manufacturing Process (2022-2029) 6.4. European Acetic Acid Market, by Application (2022-2029) 6.5. European Acetic Acid Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Acetic Acid Market (2022-2029) 7.1. Asia Pacific Acetic Acid Market, by End Use (2022-2029) 7.2. Asia Pacific Acetic Acid Market, by Derivative Outlook (2022-2029) 7.3. Asia Pacific Acetic Acid Market, by Manufacturing Process (2022-2029) 7.4. Asia Pacific Acetic Acid Market, by Application (2022-2029) 7.5. Asia Pacific Acetic Acid Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Acetic Acid Market (2022-2029) 8.1 Middle East and Africa Acetic Acid Market, by End Use (2022-2029) 8.2. Middle East and Africa Acetic Acid Market, by Derivative Outlook (2022-2029) 8.3. Middle East and Africa Acetic Acid Market, by Manufacturing Process (2022-2029) 8.4. Middle East and Africa Acetic Acid Market, by Application (2022-2029) 8.5. Middle East and Africa Acetic Acid Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Acetic Acid Market (2022-2029) 9.1. South America Acetic Acid Market, by End Use (2022-2029) 9.2. South America Acetic Acid Market, by Derivative Outlook (2022-2029) 9.3. South America Acetic Acid Market, by Manufacturing Process (2022-2029) 9.4. South America Acetic Acid Market, by Application (2022-2029) 9.5. South America Acetic Acid Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Wacker Chemie 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Saudi International Petrochemicals 10.3 DuPont 10.4 Eastman Chemical Company 10.5 Jiangsu Sopo (Group) Co., Ltd. 10.6 British Petroleum 10.7 Celanese Corporation 10.8 Mitsubishi Chemical Corporation 10.9 Daicel Corporation 10.10 GNFC Limited 10.11 HELM AG 10.12 LyondellBasell Industries N.V. 10.13 PetroChina 10.14 Sinopec 10.15 Indian Oil Corporation 10.16 Dow Chemicals