Global Wearable Medical Devices Market size was valued at US$ 34.44 Bn in 2024 and the total Wearable Medical Devices revenue is expected to grow at 20.2% through 2025 to 2032, reaching nearly US$ 150.07 Bn.Wearable Medical Devices Market Overview:

Wearable Medical Devices are non-invasive, body worn electronic devices designed to monitor, diagnose or treat medical conditions in real time or over extended periods. The wearable medical devices market has been experiencing rapid growth driven by rising chronic diseases, telehealth adoption and AI integration with applications spanning fitness tracking to clinical grade remote patient monitoring. North America led the wearable medical devices market in 2024, fuelled by strong demand for remote healthcare monitoring and preventive medicine solution within its advanced medical infrastructure. Market pioneers like Dexcom, Abbott and Apple are driving innovation through breakthrough technology including AI powered diagnostics, continuous glucose monitoring systems and FDA approved smartwatches with medical grade health tracking capabilities. The sector benefit from widespread adoption across multiple user segment like healthcare providers utilizing clinical wearable for real time patient monitoring, fitness conscious consumer adopting smart devices for wellness tracking and chronic disease patient depending on connected health tool for personalized treatment management. This dynamic landscape where diabetes care, cardiac monitoring and telehealth integration serve as primary growth catalysts illustrate how wearable medical device are transforming global healthcare delivery while meeting stringent regulatory requirements and addressing growing consumer demand for accessible, precise and interconnected health management solutions. In this report, the wearable medical devices market's growth reasons, as well as the market's many segments (Product, Device Type, Grade Type, Application and, Region), are discussed. Data has been given by market players, regions, and specific requirements. This market report includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the wearable medical devices market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the global wearable medical devices market situation.To know about the Research Methodology:-Request Free Sample Report

Wearable Medical Devices Market Dynamics:

Rising Health Awareness to Drive Wearable Medical Devices Market A major driver of the wearable medical devices market is the increasing awareness of fitness and healthcare among consumers. The healthcare market has grown significantly in recent years, owing to the growing geriatric population, the rising incidences of chronic diseases, and the application of modern medical devices i.e. wearable medical devices that enable the delivery of high-quality care outside of hospitals. Regulatory Hurdles to Restrain Wearable Medical Devices Market A major restraint of the market are the unfavourable standards and regulations present in the healthcare sector. For example, in deciding compensation for mobile healthcare, national agencies play a significant role. National regulations in several European countries define medical treatment in terms of the patient and doctor's physical presence, which has an impact on payments for mobile and remote healthcare solutions. Wearables adoption in the healthcare sector is slowed by such regulations. AI, 5G and Predictive Medicine to Create Opportunity in Wearable Medical Devices Market The key opportunity in the wearable medical devices market is the increasing endorsement of Artificial Intelligence and other technologies. Artificial intelligence can be utilized in 5G to predict a patient's potential diagnosis and treatments. Moreover, AI can assist medical systems in predicting which patients are likely to experience postoperative difficulties, allowing for early intervention. In general, real-time learning with a large amount of data necessitates reliable and high-bandwidth networks. Healthcare businesses may leverage AI technologies to give the finest treatment possible in real-time, wherever they are, thanks to 5G networks. As a result, the utilization of new tools and technologies is predicted to give high-growth prospects in the wearable medical devices market. Rising Menace of Patent Rolls to Challenge Wearable Medical Devices Market The main challenge in the wearable medical devices market is the patent protections need for the devices. Clinical device makers in the United States and Europe confront significant hurdles from patent reform and patent trolls. Patent trolls are firms that buy patents in order to collect royalties from businesses that purportedly infringe on trademarks held by patent claim entities or non-practicing organizations. Patent trolls made their debut in the medical technology business in the last decade, when they filed a slew of violation cases against medical device manufacturers. Companies may secure the financial and legal rewards of properly filed patents and reduce possible losses caused by patent trolls by taking precautions efforts to safeguard mobile medical technology developments through patents. The key to success in the fast-developing clinical-grade wearables business is to protect patents.Wearable Medical Devices Market Segment Analysis:

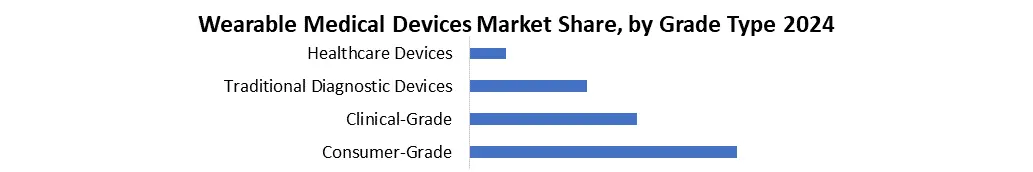

By Device Type, the Diagnostic and Monitoring devices segment dominated the wearable medical devices market in 2024. This segment is also projected to witness the highest CAGR of 10.3% in the forecast period (2025-2032). The increasing frequency of neurological and nephrological illnesses is the primary factor influencing the segment's growth. According to the 2024 survey, migraine was the most common neurological illness in the United States. In the United States, 92.5% of individuals suffer from migraines. Neuromodulation devices are the most commonly used to diagnose and treat migraine in this scenario. In addition, the wearable monitoring device segment is likely to grow as people become more aware of the capacity of neurological wearables to continually measure people's cognitive capacities while they go about their daily lives. Because of the rising intake of traditional diagnostic devices, the of traditional diagnostic device sector is expected to grow at the quickest rate throughout the projected period. Furthermore, market growth is expected to be aided by a robust portfolio of medical devices such as intelligent asthma action products, smart pain reliever gadgets, and insulin management devices. Pain control devices, glucose monitoring devices, recovery devices, and respiratory therapy devices make up the monitoring device segment. Due to the large population suffering from diabetes, insulin monitoring device sub-segment was dominant in 2024 and is expected to remain dominant over the forecast period (2025-2032). Based on Grade Type, Wearable Medical Devices Market is sub segmented into consumer grade, clinical grade, traditional diagnostic devices and healthcare devices. In 2024, the consumer-grade wearable medical devices segment dominated the market, accounting for the largest revenue share, driven by rising health awareness, affordability, and widespread adoption of fitness trackers and smartwatches. Brands like Apple (Apple Watch), Fitbit, and Garmin lead this segment by integrating FDA-cleared health features (e.g., ECG, SpO₂, sleep tracking) into user-friendly devices, appealing to both fitness enthusiasts and general consumers.

Wearable Medical Devices Market Regional Insights:

North America dominated Wearable Medical Devices Market The wearable medical devices market was led by North America, with the United States emerging as the leading contributor in 2024. Due to the high incidence of heart and lifestyle-related disorders, rising acceptance of wearable medical advances, and high per capita medical spending, the United States has the greatest share of the wearable medical device market. The North American market for wearable medical devices is forecast to grow at a modest rate of 12.3% over the forecast period, because of the growing illness prevalence in the region. The COVID-19 has influenced group and individual behaviour, affecting both the workplace and healthcare. Devices are available in the form of technology to meet these new problems. Wearables have an essential part in the full continuum of care, as well as in the professional and leisure life, when it comes to health, work, and economy during COVID-19. In the United States, Philips launched another whole wearable biosensor for early health deterioration detection in 2023, including clinical surveillance for COVID-19. The objective of the report is to present a comprehensive analysis of the Wearable Medical Devices market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Wearable Medical Devices market dynamics, structure by analysing the market segments and project the market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Wearable Medical Devices market make the report investor’s guide. Wearable Medical Devices Market Competitive Landscape iHealth Labs, Inc., a U.S.based subsidiary of Andon Health, competes in consumer and clinical wearable medical device market with products like smart blood pressure monitor, glucose meter and fitness trackers. Key competitors include Omron Healthcare (dominant in connected blood pressure monitors), Dexcom (leader in continuous glucose monitoring) and Fitbit (Google) & Garmin in fitness wearables. While iHealth leverage affordability and FDA cleared device it faces challenges from larger players with stronger brand recognition (e.g., Abbott’s FreeStyle Libre in diabetes) and tech giant like Apple (Apple Watch’s health features). Its differentiation lies in seamless smartphone integration and a focus on chronic condition management but scaling against entrenched rival remain a hurdle. Wearable Medical Devices Market Key Trends • AI & Predictive Analytics Integration: Wearables now leverage AI-driven diagnostics (e.g., early arrhythmia detection, diabetes risk prediction). Example: CGMs like Dexcom G7 use AI for real-time glucose trend forecasting. • Expansion into Chronic Disease Management: Devices are shifting from fitness tracking to clinical-grade monitoring (e.g., hypertension, COPD, heart failure). Example: Omron’s ECG-enabled smartwatches for atrial fibrillation detection. • 5G & Remote Patient Monitoring (RPM): 5G-enabled wearables support real-time data transmission for telehealth and proactive care. Example: Philips’ wearable biosensors for hospital-at-home programs. Wearable Medical Devices Market Key Developments • VitalConnect (US)- June 2024: Launched the VitalPatch RTM 2.0, an AI-powered biosensor for real-time sepsis detection in hospitalized patients. • Dexcom Inc. (US)- January 2025: Received FDA approval for its next-gen Dexcom G8 CGM, featuring 15-day wear and no fingerstick calibration. • Sky Medical Technology (UK)- March 2024: Partnered with the NHS to deploy its wearable compression monitor for post-surgical DVT prevention. • Siemens Healthineers (Germany)-September 2024: Unveiled the Magnetom Viato.Mobile, the first MRI-compatible wearable for cardiac arrhythmia monitoring. • Huawei Device Co. Ltd. (China)- November 2024: Integrated Pulse Wave Velocity (PWV) monitoring into its Huawei Watch 5, targeting hypertension management.Wearable Medical Devices Market Scope: Inquire before buying

Wearable Medical Devices Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 34.44 Bn. Forecast Period 2025 to 2032 CAGR: 20.2 % Market Size in 2032: USD 150.07 Bn. Segments Covered: by Product Trackers Smartwatches Patches Smart Clothing by Device Type Diagnostic and Monitoring Devices Multiparameter Tracker ECG\Heart Rate Monitors Pulse Oximeters by Grade Type • Traditional Diagnostic Devices • Consumer-Grade Wearable Healthcare Devices • Clinical-Grade Wearable Healthcare Devices by Application General Health and Fitness Remote Patient Monitoring Home Healthcare Wearable Medical Devices Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Wearable Medical Device Key Players

North America 1. Ihealth Lab, Inc (US) 2. Biotricity Inc (US) 3. Ge Healthcare (US) 4. Verily Life Sciences (US) 5. Vitalconnect (US) 6. Dexcom Inc, (US) 7. Abbot Laboratories (US) 8. TheraB Medical (US) 9. Edwards Lifesciences (US) 10. tandemdiabetes (US) Europe 11. Medibiosense Ltd (UK) 12. Sky Medical Technology (UK) 13. Siemens Healthineers (Germany) 14. Philips (Netherlands) 15. Braster SA (Poland) 16. Teleflex Medical Srl. (Italy) 17. Garmin Ltd. (Switzerland) 18. Alpha Wearables (Sweden) Asia-Pacific 19. Minttihealth (China) 20. Contec Medical Systems Co. Ltd (China) 21. Huawei Device Co. Ltd., (China) 22. Omron Healthcare Co., Ltd (Japan) 23. Ten3t Healthcare (India) Middle East and Africa 24. Bio-Beat (Israel) South America 25. SmartWalk (Brazil)FAQs:

1. Which is the potential market for Wearable Medical Devices in terms of the region? Ans. The wearable medical devices market was led by North America, with the United States emerging as the leading contributor in 2024. 2. What are the drivers for new market entrants? Ans. A major driver of the wearable medical devices market is the increasing awareness of fitness and healthcare among consumers. 3. What is expected to drive the growth of the Wearable Medical Devices Market in the forecast period? Ans. The healthcare market has grown significantly in recent years, owing to the growing geriatric population. 4. What is the projected market size & growth rate of the Wearable Medical Devices Market? Ans. Global Wearable Medical Devices Market size was valued at US$ 34.44 Bn in 2024 and the total Wearable Medical Devices revenue is expected to grow at 20.2% through 2025 to 2032, reaching nearly US$ 150.07 Bn. 5. What segments are covered in the Wearable Medical Devices Market report? Ans. The segments covered are Product, Device Type, Grade Type, Application and region.

1. Wearable Medical Devices Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Wearable Medical Devices Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Application Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Wearable Medical Devices Market: Dynamics 3.1. Wearable Medical Devices Market Trends 3.1.1. North America Wearable Medical Devices Market Trends 3.1.2. Europe Wearable Medical Devices Market Trends 3.1.3. Asia Pacific Wearable Medical Devices Market Trends 3.1.4. Middle East and Africa Wearable Medical Devices Market Trends 3.1.5. South America Wearable Medical Devices Market Trends 3.2. Wearable Medical Devices Market Dynamics 3.2.1. Wearable Medical Devices Market Drivers 3.2.1.1. Rising Health Awareness 3.2.2. Wearable Medical Devices Market Restraints 3.2.3. Wearable Medical Devices Market Opportunities 3.2.3.1. AI, 5G and Predictive Medicine 3.2.4. Wearable Medical Devices Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.4.1. Regulatory Hurdles 3.4.2. Patent Costs 3.4.3. AI Integration 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Wearable Medical Devices Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 4.1.1. Trackers 4.1.2. Smartwatches 4.1.3. Patches 4.1.4. Smart Clothing 4.2. Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 4.2.1. Diagnostic and Monitoring Devices 4.2.2. Multiparameter Tracker 4.2.3. ECG\Heart Rate Monitors 4.2.4. Pulse Oximeters 4.3. Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 4.3.1. Traditional Diagnostic Devices 4.3.2. Consumer-Grade Wearable Healthcare Devices 4.3.3. Clinical-Grade Wearable Healthcare Devices 4.4. Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 4.4.1. General Health and Fitness 4.4.2. Remote Patient Monitoring 4.4.3. Home Healthcare 4.5. Wearable Medical Devices Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Wearable Medical Devices Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 5.1.1. Trackers 5.1.2. Smartwatches 5.1.3. Patches 5.1.4. Smart Clothing 5.2. North America Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 5.2.1. Diagnostic and Monitoring Devices 5.2.2. Multiparameter Tracker 5.2.3. ECG\Heart Rate Monitors 5.2.4. Pulse Oximeters 5.3. North America Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 5.3.1. Traditional Diagnostic Devices 5.3.2. Consumer-Grade Wearable Healthcare Devices 5.3.3. Clinical-Grade Wearable Healthcare Devices 5.4. North America Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 5.4.1. General Health and Fitness 5.4.2. Remote Patient Monitoring 5.4.3. Home Healthcare 5.5. North America Wearable Medical Devices Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 5.5.1.1.1. Trackers 5.5.1.1.2. Smartwatches 5.5.1.1.3. Patches 5.5.1.1.4. Smart Clothing 5.5.1.2. United States Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 5.5.1.2.1. Diagnostic and Monitoring Devices 5.5.1.2.2. Multiparameter Tracker 5.5.1.2.3. ECG\Heart Rate Monitors 5.5.1.2.4. Pulse Oximeters 5.5.1.3. United States Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 5.5.1.3.1. Traditional Diagnostic Devices 5.5.1.3.2. Consumer-Grade Wearable Healthcare Devices 5.5.1.3.3. Clinical-Grade Wearable Healthcare Devices 5.5.1.4. United States Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. General Health and Fitness 5.5.1.4.2. Remote Patient Monitoring 5.5.1.4.3. Home Healthcare 5.5.2. Canada 5.5.2.1. Canada Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 5.5.2.1.1. Trackers 5.5.2.1.2. Smartwatches 5.5.2.1.3. Patches 5.5.2.1.4. Smart Clothing 5.5.2.2. Canada Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 5.5.2.2.1. Diagnostic and Monitoring Devices 5.5.2.2.2. Multiparameter Tracker 5.5.2.2.3. ECG\Heart Rate Monitors 5.5.2.2.4. Pulse Oximeters 5.5.2.3. Canada Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 5.5.2.3.1. Traditional Diagnostic Devices 5.5.2.3.2. Consumer-Grade Wearable Healthcare Devices 5.5.2.3.3. Clinical-Grade Wearable Healthcare Devices 5.5.2.4. Canada Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. General Health and Fitness 5.5.2.4.2. Remote Patient Monitoring 5.5.2.4.3. Home Healthcare 5.5.3. Mexico 5.5.3.1. Mexico Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 5.5.3.1.1. Trackers 5.5.3.1.2. Smartwatches 5.5.3.1.3. Patches 5.5.3.1.4. Smart Clothing 5.5.3.2. Mexico Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 5.5.3.2.1. Diagnostic and Monitoring Devices 5.5.3.2.2. Multiparameter Tracker 5.5.3.2.3. ECG\Heart Rate Monitors 5.5.3.2.4. Pulse Oximeters 5.5.3.3. Mexico Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 5.5.3.3.1. Traditional Diagnostic Devices 5.5.3.3.2. Consumer-Grade Wearable Healthcare Devices 5.5.3.3.3. Clinical-Grade Wearable Healthcare Devices 5.5.3.4. Mexico Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. General Health and Fitness 5.5.3.4.2. Remote Patient Monitoring 5.5.3.4.3. Home Healthcare 6. Europe Wearable Medical Devices Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.2. Europe Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.3. Europe Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.4. Europe Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5. Europe Wearable Medical Devices Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.1.2. United Kingdom Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.1.3. United Kingdom Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.1.4. United Kingdom Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.2.2. France Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.2.3. France Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.2.4. France Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.3.2. Germany Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.3.3. Germany Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.3.4. Germany Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.4.2. Italy Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.4.3. Italy Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.4.4. Italy Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.5.2. Spain Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.5.3. Spain Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.5.4. Spain Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.6.2. Sweden Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.6.3. Sweden Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.6.4. Sweden Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.7.2. Russia Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.7.3. Russia Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.7.4. Russia Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 6.5.8.2. Rest of Europe Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 6.5.8.3. Rest of Europe Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 6.5.8.4. Rest of Europe Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Wearable Medical Devices Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.3. Asia Pacific Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.4. Asia Pacific Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Wearable Medical Devices Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.1.2. China Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.1.3. China Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.1.4. China Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.2.2. S Korea Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.2.3. S Korea Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.2.4. S Korea Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.3.2. Japan Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.3.3. Japan Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.3.4. Japan Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.4.2. India Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.4.3. India Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.4.4. India Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.5.2. Australia Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.5.3. Australia Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.5.4. Australia Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.6.2. Indonesia Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.6.3. Indonesia Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.6.4. Indonesia Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.7.2. Malaysia Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.7.3. Malaysia Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.7.4. Malaysia Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.8.2. Philippines Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.8.3. Philippines Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.8.4. Philippines Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.9.2. Thailand Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.9.3. Thailand Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.9.4. Thailand Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.10.2. Vietnam Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.10.3. Vietnam Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.10.4. Vietnam Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 7.5.11.2. Rest of Asia Pacific Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 7.5.11.3. Rest of Asia Pacific Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 7.5.11.4. Rest of Asia Pacific Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Wearable Medical Devices Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 8.3. Middle East and Africa Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 8.4. Middle East and Africa Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Wearable Medical Devices Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 8.5.1.2. South Africa Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 8.5.1.3. South Africa Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 8.5.1.4. South Africa Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 8.5.2.2. GCC Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 8.5.2.3. GCC Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 8.5.2.4. GCC Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 8.5.3.2. Egypt Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 8.5.3.3. Egypt Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 8.5.3.4. Egypt Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 8.5.4.2. Nigeria Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 8.5.4.3. Nigeria Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 8.5.4.4. Nigeria Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 8.5.5.2. Rest of ME&A Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 8.5.5.3. Rest of ME&A Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 8.5.5.4. Rest of ME&A Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 9. South America Wearable Medical Devices Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 9.2. South America Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 9.3. South America Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 9.4. South America Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 9.5. South America Wearable Medical Devices Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 9.5.1.2. Brazil Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 9.5.1.3. Brazil Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 9.5.1.4. Brazil Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 9.5.2.2. Argentina Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 9.5.2.3. Argentina Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 9.5.2.4. Argentina Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 9.5.3.2. Colombia Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 9.5.3.3. Colombia Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 9.5.3.4. Colombia Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 9.5.4.2. Chile Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 9.5.4.3. Chile Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 9.5.4.4. Chile Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 9.5.5. Rest Of South America 9.5.5.1. Rest Of South America Wearable Medical Devices Market Size and Forecast, By Product (2024-2032) 9.5.5.2. Rest Of South America Wearable Medical Devices Market Size and Forecast, By Device Type (2024-2032) 9.5.5.3. Rest Of South America Wearable Medical Devices Market Size and Forecast, By Grade Type (2024-2032) 9.5.5.4. Rest Of South America Wearable Medical Devices Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. Ihealth Lab, Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Biotricity Inc 10.3. Ge Healthcare 10.4. Verily Life Sciences 10.5. Vitalconnect 10.6. Dexcom Inc, 10.7. Abbot Laboratories 10.8. TheraB Medical 10.9. Edwards Lifesciences 10.10. tandemdiabetes 10.11. Medibiosense Ltd 10.12. Sky Medical Technology 10.13. Siemens Healthineers 10.14. Philips 10.15. Braster SA 10.16. Teleflex Medical Srl. 10.17. Garmin Ltd. 10.18. Alpha Wearables 10.19. Minttihealth 10.20. Contec Medical Systems Co. Ltd 10.21. Huawei Device Co. Ltd., 10.22. Omron Healthcare Co., Ltd 10.23. Ten3t Healthcare 10.24. Bio-Beat 10.25. SmartWalk 11. Key Findings 12. Industry Recommendations 13. Wearable Medical Devices Market: Research Methodology