Global Wax Melts Market size was valued at USD 3.21 Bn. in 2024 and the total Wax Melts Market is expected to grow by 5.4% from 2025 to 2032, reaching nearly USD 4.89 Bn.Wax Melts Market Overview:

Wax melt is scented, flameless pieces of wax that melt using an electric or warm warmer to release the fragrance in the air. The wax melts market has been growing due to the increasing demand for flame-free, eco-friendly and customized home fragrance solutions operated by wellness trends and online retail expansion. A growing trend in the wax melt market is the increasing preference of consumers for environmentally friendly and durable products, with about 60% opting for natural wax such as soy, beeswax and palm wax, prompting manufacturers to adopt greener materials and practices. North America dominated the wax melt market in 2024, high consumer expenses on home fragrances, strong appearance of major brands such as Yankee Candle and Scentsy and rising preference for safe, flame-free aromatherapy products. Asia-Pacific emerged as the fastest-growing field, driven by increased awareness about rising middle-class spending and awareness of home fragrance products. Top key players in the Wax Melts Market are Yankee Candle Company (USA), Scentsy, Inc. (USA), S. C. Johnson & Son, Inc. (USA), NEST Fragrances (USA), and Colonial Candle (USA). On January 12, 2025, Scentsy, Inc. launched newly licensed wax melt collections, including Lilo & Stitch, Encanto, and Star Wars, and introduced their monthly "Whiff Box" membership to expand customer personalization and loyalty. The main end users of the Wax Melts Market include residential consumers, hospitality industries, retail stores, events and wellness centers that seek ambient fragrance and medical benefits. The report covers the Wax Melts Market dynamics and structure by analyzing market segments and projecting the Wax Melts Market size. It provides a clear representation of competitive analysis of key players by product type, by pack, financial performance, innovation strategies, and regional footprint in the Wax Melts Market.To know about the Research Methodology :- Request Free Sample Report

Global Wax Melts Market Dynamics

Growing Demand for Safe Home Fragrance Alternatives to boost Wax Melts Market Wax melts market is increasing demand for safer home fragrance options. People are becoming more aware of the potential risks associated with traditional home fragrance products such as candles, air fresheners, and incense. The product’s content of chemicals and synthetic fragrances release harmful compounds into the air, taking a breath in that air causing health concerns, and contributing to environmental issues. So, consumers are seeking out safer options that can provide pleasant scents for their homes without compromising their well-being or the planet. In wax melts market rising the popularity of alternatives such as essential oils, soy or beeswax candles, natural air fresheners, and do-it-yourself fragrance products. While specific statistics on this trend may vary, market research suggests that the global Market for natural and organic personal care products, which includes safe home fragrance alternatives, valued at approximately USD 12.5 billion, indicating a significant and growing consumer preference for healthier and eco-friendly options in the personal care and home fragrance industry. Rising Interest in Aromatherapy and Wellness to boost the wax melts market growth The wax melts market is set to experience significant growth, fueled by the rising interest in aromatherapy and wellness practices. Aromatherapy, which involves the use of essential oils for therapeutic purposes, has gained immense popularity as people seek natural and holistic approaches to enhance their well-being. Wax melts provide an excellent avenue for incorporating aromatherapy into daily routines. These scented wax products, when melted, release fragrances infused with essential oils, filling the space with therapeutic scents that promote relaxation, stress relief, and mood enhancement. With individuals increasingly embracing self-care and wellness, the demand for wax melts as a convenient and effective means of enjoying aromatherapy is poised to drive market growth. As more people discover the benefits of aromatherapy and its positive impact on their overall wellness, the market is expected to thrive, catering to the growing demand for fragrant and therapeutic experiences in homes and other spaces. Influence of Social Media and Digital Marketing to drive the market growth The fragrance and wellness industries have been greatly influenced by social media and digital marketing in Wax Melts Market. Platforms such as Instagram, Facebook, and YouTube have revolutionized the methods businesses employ to promote their products and engage with their audience. These platforms have provided new avenues for fragrance brands and wellness practitioners to showcase their offerings, educate consumers, and establish a brand presence. Through targeted advertisements and collaborations with influencers, companies have the power to shape consumer preferences and behaviors. This shift has resulted in a significant surge in online fragrance sales, with continued growth anticipated. Wax Melts Market, the health and personal care category, encompassing fragrances and wellness products, has witnessed substantial investments in digital marketing strategies. The impact of social media and digital marketing on the fragrance and wellness industries has been profound, transforming the way products are marketed and driving consumer choices social media and digital marketing have had a significant impact on the fragrance and wellness industries. Platforms like Instagram, Facebook, and YouTube have changed the way businesses promote their products and connect with customers. Fragrance brands and wellness practitioners can now use these platforms to showcase their offerings, educate consumers, and build brand awareness. Wax Melts Market Companies can influence consumer preferences and behaviour through targeted ads and collaborations with influencers. This has led to a significant increase in online fragrance sales, with projections showing continued growth in the future. Additionally, digital marketing spending in the health and personal care category, which includes fragrances and wellness products, has also seen substantial investment. Social media and digital marketing have revolutionized how fragrances and wellness products are marketed and sold, shaping the industry and consumer choices. Intense Competition and Market Saturation to Restraint the Wax Melts Market The Wax Melts Market, despite its significant growth prospects, is not without its restraints. The market witnesses intense competition among manufacturers and suppliers. With the growing popularity of wax melts as a convenient and aromatic alternative to traditional candles, numerous players have entered the market, leading to a saturated and competitive landscape. This heightened competition puts pressure on both established and emerging businesses to differentiate themselves and stand out from the crowd. Price wars and aggressive marketing strategies further intensify the competition, resulting in thinner profit margins and limited market share growth for individual companies. Moreover, the availability of numerous fragrance options and designs adds to the challenge of capturing and retaining consumer attention. To overcome this restraint, Wax Melts Market participants need to focus on product innovation, emphasizing unique scent combinations, visually appealing designs, and superior quality. Building strong brand identities, establishing strategic partnerships, and effectively leveraging digital marketing channels can also provide a competitive edge. Rising Environmental Sustainability Concerns to Restrain the Wax Melts Market By continually adapting to changing consumer preferences and investing in differentiation, players in the wax melt Market can thrive despite the intense competition. Restraint facing this industry lies in the increasing concerns regarding environmental sustainability. As consumers become more conscious of their carbon footprint, they are actively seeking eco-friendly alternatives to traditional wax melts. This shift in consumer preferences poses a challenge for market players who rely on petroleum-based waxes that contribute to pollution and greenhouse gas emissions. To address this restraint, companies need to invest in research and development to discover and implement sustainable materials and manufacturing processes. By proactively addressing these sustainability restraints, the wax melts market can ensure its long-term viability while contributing to a greener and more sustainable future.Wax Melts Market Segment Analysis

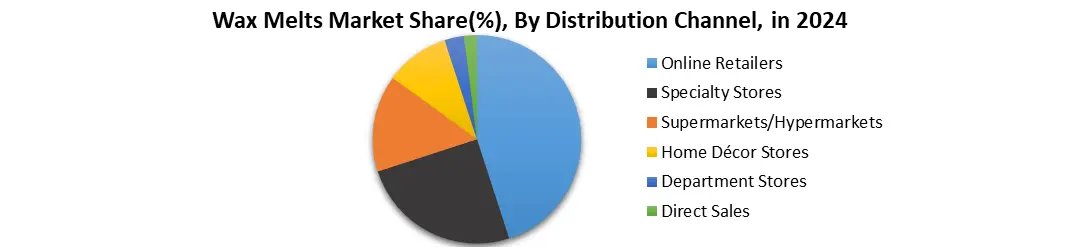

Based on type, currently, soy wax melts are dominating the Market due to their eco-friendly nature and growing consumer preference for sustainable products. Soy wax is derived from soybean oil, making it renewable and biodegradable. It also offers a cleaner and longer-lasting burn compared to paraffin wax. With increased awareness about environmental issues, consumers are actively seeking out soy wax melts, making them the dominant segment in the market.Wax Melts share by TypeBy Application, The home fragrance segment is currently dominating the Wax Melts Market due to its wide appeal and increasing demand for creating a pleasant ambiance at home. Home fragrance wax melts offer a convenient and customizable way to fill living spaces with delightful scents. As more people prioritize creating a comfortable and inviting environment, the home fragrance segment has experienced significant growth. Consumers appreciate the versatility of wax melts in enhancing the atmosphere of their homes, leading to the dominance of this segment in the market. Based on Distribution Channel, The online distribution channel is currently dominating the Wax Melts Market due to its convenience, wide reach, and increasing e-commerce trends. Online retailers provide a platform for consumers to easily browse and purchase a diverse range of wax melts from the comfort of their homes. Additionally, online channels offer the advantage of customer reviews, product comparisons, and competitive pricing. The ease of online shopping, coupled with the availability of a vast selection, has made the online distribution channel the dominant segment in the market.

Wax Melts Market Regional Analysis:

The North American market held the largest market share of the Wax Melts Market in 2024. And expect to dominate the market during the forecast period. North America is traditionally has been dominant region in the Wax Melts Market. The popularity of scented candles and wax melts creates a cozy and inviting atmosphere further driving market growth in the region. The North American region has a large consumer base with a strong demand for the market. According to MMR reports the home fragrance market in North America reached 6.5 billion in 2023 and is expected to dominate the region. The market size indicates the high level of consumer interest and demand for wax melts in the region. The home decor industry in North America is booming, with consumers placing great importance on creating attractive and pleasant living spaces. Wax Melts Market not only provide delightful fragrances but also serve as decorative elements, enhancing the ambiance of a room. The synergy between the wax melt market and the booming home decor industry has contributed to the dominance of the market. The cultural significance of fragrances in North America plays a pivotal role in Market. This accessibility ensures that consumers have easy access to a wide range of wax melt products. North America has witnessed significant industry innovations, including the introduction of eco-friendly and natural wax melt options. With increasing consumer awareness of sustainability and environmental impact, the availability of eco-friendly wax melts has resonated strongly with North American consumers. Europe region has significant growth in the Wax Melts industry, due to several compelling reasons. The region has a history and tradition of using scented products, and making fragrances is a part of European culture this cultural affinity for fragrances has translated into a high demand for wax melts, contributing to the Market dominance. Moreover, Europe's strong home decor industry has played a pivotal role. Wax melts serve as both fragrance providers and decorative pieces, aligning perfectly with European consumers' preferences and contributing to the market's success this emphasis on sustainability has resonated strongly with European consumers, further driving the Market dominance. Manufacturers are continuously introducing new and captivating fragrances, experimenting with unique packaging designs, and incorporating technological advancements to enhance the overall consumer experience. These innovations have further propelled the market's dominance and fuelled its growth. Wax Melts Market: Competitive Landscape Top key players in the Wax Melts Market are Yankee Candle Company (USA), Scentsy, Inc. (USA), S. C. Johnson & Son, Inc. (USA), NEST Fragrances (USA), and Colonial Candle (USA). These companies are among the major global participants, supported by the development of environmentally friendly wax mixtures (such as soy or beeswax), stylized warmer designs, and expands omnichannel distribution. Yankee Candle, the leading player, generated an estimated USD 1.2 billion in revenue in 2024, with continued investment in seasonal innovation and personalization features. Competitive landscape trend indicate a change towards environmentally friendly wax mixtures, smart warmer technologies and personalization, which further intensifies the battle for market share. The intensity of the overall market rivalry is high, driven by low switching costs, high product availability and increasing demand for homes. Technological integration such as low-heat smart warmers, natural components uses, and strategic retail partnerships are re-shaping the competitive landscape, with these firms, the smell is at the lead of innovation and permanent development. Key Trends in the Wax Melts Market:Recent Devlopments in Wax Melts Market: On January 12, 2025, Scentsy, Inc. launched new licensed wax melt collections including Lilo & Stitch, Encanto, and Star Wars, and introduced its monthly “Whiff Box” subscription to expand customer personalization and loyalty. On February 5, 2025, Yankee Candle Company revealed its Hello Italy wax melts series inspired by Mediterranean scents like Capri Glow and Lemon Gelato, followed by the fall-themed Fantastical Fall Collection, highlighting its seasonal innovation strategy. On March 18, 2025, S. C. Johnson & Son, Inc. announced further enhancements to its Glade wax melts line, emphasizing clean ingredients, biodegradable packaging, and eco-label certifications to meet growing demand for sustainable home fragrances. On April 2, 2025, Colonial Candle introduced a Wellness Collection of wax melts featuring calming essential oil blends such as Eucalyptus Mint and Vanilla Sandalwood, aligning with wellness and aromatherapy trends in home scenting. On May 9, 2025, Candle Warmers Etc. launched its Spring 2025 line of decorative 2-in-1 wax warmers in partnership with Airomé, merging stylish designs with dual fragrance and candle functionality to attract modern home décor consumers.

Trends Description Example Smart & Customizable Warmers Integration of smart features such as timers, intensity control, and app connectivity in wax warmers. Scentsy’s “Scentsy Go” and smart warmers with adjustable fragrance output. Sustainable & Natural Wax Blends Growing preference for soy, beeswax, and coconut-based wax melts that are biodegradable and toxin-free. NEST Fragrances and Happy Wax offer eco-conscious soy-based wax melt lines. Rise in Home Fragrance Gifting Increasing use of wax melts in gift sets and home décor amid demand for personalized and wellness gifts Yankee Candle’s seasonal gift bundles and Colonial Candle’s curated scent collections. Wax Melts Market Scope: Inquire before buying

Wax Melts Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.21 Bn. Forecast Period 2025 to 2032 CAGR: 5.4% Market Size in 2032: USD 4.89 Bn. Segments Covered: by Type Soy Wax Melts Paraffin Wax Melts Beeswax Melts Coconut Wax Melts Other Wax Melts by Pack Single Pack Multi Pack by Application Home Fragrance Aromatherapy/Wellness Decorative/Interior Design Gifts/Souvenirs Event/Party Favors by Distribution Channel Online Retailers Specialty Stores Department Stores Supermarkets/Hypermarkets Home Décor Stores Direct Sales Wax Melts Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America) North America: 1. Yankee Candle Company (USA) 2. Scentsy, Inc. (USA) 3. S. C. Johnson & Son, Inc. (USA) 4. Colonial Candle (USA) 5. Candle Warmers Etc. (USA) Europe: 6. East Coast Candle Co. (UK) 7. Bramble Bay Candle Co. (UK) 8. Ashleigh & Burwood (UK) 9. Kringle Candle Company (UK) 10. Voluspa (UK) Asia-Pacific: 11. IRIS Home Fragrances (India) 12. Matin Impex (India) 13. Kobo Candles (Australia) 14. Ramesh Flowers Pvt Ltd (India) 15. Kanika Enterprises (India) South America: 16. Aromaty (Brazil) 17. Velas Aromaticas (Argentina) 18. WaxColor (Brazil) 19. Vela Luz (Chile) 20. ArtCera (Colombia) Middle East & Africa: 21. Royal Candle Works (UAE) 22. Candle Deli (South Africa) 23. Al Fakher Candles (UAE) 24. El Noor Candles (Egypt) 25. Bliss Scented Candles (Kenya)Frequently Asked Questions:

1] What is the growth rate of the Global Wax Melts Market? Ans. The Global Market is growing at a significant rate of 5.4% over the forecast period. 2] Which region is expected to dominate the Global Wax Melts Market? Ans. North America region is expected to dominate the Wax Melts Market over the forecast period. 3] What was the Global Wax Melts Market size in 2024? Ans: The Global Wax Melts Market size was USD 3.21 Billion in 2024. 4] Who are the top players in the Global Ice Tools Industry? Ans. Top key players in the Wax Melts Market are Yankee Candle Company (USA), Scentsy, Inc. (USA), S. C. Johnson & Son, Inc. (USA), NEST Fragrances (USA), and Colonial Candle (USA). 5] Which factors are expected to drive the Global Wax Melts Market growth by 2032? Ans. Growing Demand for Safe Home Fragrance Alternatives is expected to drive the Market growth over the forecast period.

1. Wax Melts Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Wax Melts Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Distribution Channel Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Wax Melts Market: Dynamics 3.1. Region-wise Trends of Wax Melts Market 3.1.1. North America Wax Melts Market Trends 3.1.2. Europe Wax Melts Market Trends 3.1.3. Asia Pacific Wax Melts Market Trends 3.1.4. Middle East and Africa Wax Melts Market Trends 3.1.5. South America Wax Melts Market Trends 3.2. Wax Melts Market Dynamics 3.2.1. Global Wax Melts Market Drivers 3.2.1.1. Demand for safe scents 3.2.1.2. Aromatherapy trend 3.2.1.3. Social media impact 3.2.2. Global Wax Melts Market Restraints 3.2.3. Global Wax Melts Market Opportunities 3.2.3.1. Natural fragrance demand 3.2.3.2. E-commerce growth 3.2.3.3. Wellness trend 3.2.4. Global Wax Melts Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Safety & Labelling Norms 3.4.2. Rise in Online Retail 3.4.3. Eco-Friendly Packaging Shift 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Wax Melts Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Wax Melts Market Size and Forecast, By Type (2024-2032) 4.1.1. Soy Wax Melts 4.1.2. Paraffin Wax Melts 4.1.3. Beeswax Melts 4.1.4. Coconut Wax Melts 4.1.5. Other Wax Melts 4.2. Wax Melts Market Size and Forecast, By Pack (2024-2032) 4.2.1. Single Pack 4.2.2. Multi Pack 4.2.3. Passenger Car 4.3. Wax Melts Market Size and Forecast, By Application (2024-2032) 4.3.1. Home Fragrance 4.3.2. Aromatherapy/Wellness 4.3.3. Decorative/Interior Design 4.3.4. Gifts/Souvenirs 4.3.5. Event/Party Favors 4.4. Wax Melts Market Size and Forecast, By Distribution Channel (2024-2032) 4.4.1. Online Retailers 4.4.2. Specialty Stores 4.4.3. Department Stores 4.4.4. Supermarkets/Hypermarkets 4.4.5. Home Décor Stores 4.4.6. Direct Sales 4.5. Wax Melts Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Wax Melts Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Wax Melts Market Size and Forecast, By Type (2024-2032) 5.1.1. Soy Wax Melts 5.1.2. Paraffin Wax Melts 5.1.3. Beeswax Melts 5.1.4. Coconut Wax Melts 5.1.5. Other Wax Melts 5.2. North America Wax Melts Market Size and Forecast, By Pack (2024-2032) 5.2.1. Single Pack 5.2.2. Multi Pack 5.3. North America Wax Melts Market Size and Forecast, By Application (2024-2032) 5.3.1. Home Fragrance 5.3.2. Aromatherapy/Wellness 5.3.3. Decorative/Interior Design 5.3.4. Gifts/Souvenirs 5.3.5. Event/Party Favors 5.4. North America Wax Melts Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.1. Online Retailers 5.4.2. Specialty Stores 5.4.3. Department Stores 5.4.4. Supermarkets/Hypermarkets 5.4.5. Home Décor Stores 5.4.6. Direct Sales 5.5. North America Wax Melts Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Wax Melts Market Size and Forecast, By Type (2024-2032) 5.5.1.1.1. Soy Wax Melts 5.5.1.1.2. Paraffin Wax Melts 5.5.1.1.3. Beeswax Melts 5.5.1.1.4. Coconut Wax Melts 5.5.1.1.5. Other Wax Melts 5.5.1.2. United States Wax Melts Market Size and Forecast, By Pack (2024-2032) 5.5.1.2.1. Single Pack 5.5.1.2.2. Multi Pack 5.5.1.3. United States Wax Melts Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. Home Fragrance 5.5.1.3.2. Aromatherapy/Wellness 5.5.1.3.3. Decorative/Interior Design 5.5.1.3.4. Gifts/Souvenirs 5.5.1.3.5. Event/Party Favors 5.5.1.4. United States Wax Melts Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.1.4.1. Online Retailers 5.5.1.4.2. Specialty Stores 5.5.1.4.3. Department Stores 5.5.1.4.4. Supermarkets/Hypermarkets 5.5.1.4.5. Home Décor Stores 5.5.1.4.6. Direct Sales 5.5.2. Canada 5.5.2.1. Canada Wax Melts Market Size and Forecast, By Type (2024-2032) 5.5.2.1.1. Soy Wax Melts 5.5.2.1.2. Paraffin Wax Melts 5.5.2.1.3. Beeswax Melts 5.5.2.1.4. Coconut Wax Melts 5.5.2.1.5. Other Wax Melts 5.5.2.2. Canada Wax Melts Market Size and Forecast, By Pack (2024-2032) 5.5.2.2.1. Single Pack 5.5.2.2.2. Multi Pack 5.5.2.3. Canada Wax Melts Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. Home Fragrance 5.5.2.3.2. Aromatherapy/Wellness 5.5.2.3.3. Decorative/Interior Design 5.5.2.3.4. Gifts/Souvenirs 5.5.2.3.5. Event/Party Favors 5.5.2.4. Canada Wax Melts Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.2.4.1. Online Retailers 5.5.2.4.2. Specialty Stores 5.5.2.4.3. Department Stores 5.5.2.4.4. Supermarkets/Hypermarkets 5.5.2.4.5. Home Décor Stores 5.5.2.4.6. Direct Sales 5.5.3. Mexico 5.5.3.1. Mexico Wax Melts Market Size and Forecast, By Type (2024-2032) 5.5.3.1.1. Soy Wax Melts 5.5.3.1.2. Paraffin Wax Melts 5.5.3.1.3. Beeswax Melts 5.5.3.1.4. Coconut Wax Melts 5.5.3.1.5. Other Wax Melts 5.5.3.2. Mexico Wax Melts Market Size and Forecast, By Pack (2024-2032) 5.5.3.2.1. Single Pack 5.5.3.2.2. Multi Pack 5.5.3.3. Mexico Wax Melts Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. Home Fragrance 5.5.3.3.2. Aromatherapy/Wellness 5.5.3.3.3. Decorative/Interior Design 5.5.3.3.4. Gifts/Souvenirs 5.5.3.3.5. Event/Party Favors 5.5.3.4. Mexico Wax Melts Market Size and Forecast, By Distribution Channel (2024-2032) 5.5.3.4.1. Online Retailers 5.5.3.4.2. Specialty Stores 5.5.3.4.3. Department Stores 5.5.3.4.4. Supermarkets/Hypermarkets 5.5.3.4.5. Home Décor Stores 5.5.3.4.6. Direct Sales 6. Europe Wax Melts Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Wax Melts Market Size and Forecast, By Type (2024-2032) 6.2. Europe Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.3. Europe Wax Melts Market Size and Forecast, By Application (2024-2032) 6.4. Europe Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5. Europe Wax Melts Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.1.2. United Kingdom Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.1.3. United Kingdom Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5.2. France 6.5.2.1. France Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.2.2. France Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.2.3. France Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.3.2. Germany Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.3.3. Germany Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.4.2. Italy Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.4.3. Italy Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.5.2. Spain Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.5.3. Spain Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.6.2. Sweden Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.6.3. Sweden Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.7.2. Austria Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.7.3. Austria Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Austria Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Wax Melts Market Size and Forecast, By Type (2024-2032) 6.5.8.2. Rest of Europe Wax Melts Market Size and Forecast, By Pack (2024-2032) 6.5.8.3. Rest of Europe Wax Melts Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7. Asia Pacific Wax Melts Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Wax Melts Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.3. Asia Pacific Wax Melts Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5. Asia Pacific Wax Melts Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.1.2. China Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.1.3. China Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.2.2. S Korea Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.2.3. S Korea Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.3.2. Japan Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.3.3. Japan Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.4. India 7.5.4.1. India Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.4.2. India Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.4.3. India Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.5.2. Australia Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.5.3. Australia Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.6.2. Indonesia Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.6.3. Indonesia Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.7.2. Philippines Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.7.3. Philippines Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Philippines Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.8.2. Malaysia Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.8.3. Malaysia Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Malaysia Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.9.2. Vietnam Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.9.3. Vietnam Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Vietnam Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.10.2. Thailand Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.10.3. Thailand Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Thailand Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Wax Melts Market Size and Forecast, By Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Wax Melts Market Size and Forecast, By Pack (2024-2032) 7.5.11.3. Rest of Asia Pacific Wax Melts Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 8. Middle East and Africa Wax Melts Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Wax Melts Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Wax Melts Market Size and Forecast, By Pack (2024-2032) 8.3. Middle East and Africa Wax Melts Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 8.5. Middle East and Africa Wax Melts Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Wax Melts Market Size and Forecast, By Type (2024-2032) 8.5.1.2. South Africa Wax Melts Market Size and Forecast, By Pack (2024-2032) 8.5.1.3. South Africa Wax Melts Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Wax Melts Market Size and Forecast, By Type (2024-2032) 8.5.2.2. GCC Wax Melts Market Size and Forecast, By Pack (2024-2032) 8.5.2.3. GCC Wax Melts Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Wax Melts Market Size and Forecast, By Type (2024-2032) 8.5.3.2. Nigeria Wax Melts Market Size and Forecast, By Pack (2024-2032) 8.5.3.3. Nigeria Wax Melts Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Nigeria Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Wax Melts Market Size and Forecast, By Type (2024-2032) 8.5.4.2. Rest of ME&A Wax Melts Market Size and Forecast, By Pack (2024-2032) 8.5.4.3. Rest of ME&A Wax Melts Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Rest of ME&A Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 9. South America Wax Melts Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Wax Melts Market Size and Forecast, By Type (2024-2032) 9.2. South America Wax Melts Market Size and Forecast, By Pack (2024-2032) 9.3. South America Wax Melts Market Size and Forecast, By Application (2024-2032) 9.4. South America Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 9.5. South America Wax Melts Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Wax Melts Market Size and Forecast, By Type (2024-2032) 9.5.1.2. Brazil Wax Melts Market Size and Forecast, By Pack (2024-2032) 9.5.1.3. Brazil Wax Melts Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Wax Melts Market Size and Forecast, By Type (2024-2032) 9.5.2.2. Argentina Wax Melts Market Size and Forecast, By Pack (2024-2032) 9.5.2.3. Argentina Wax Melts Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Wax Melts Market Size and Forecast, By Type (2024-2032) 9.5.3.2. Rest of South America Wax Melts Market Size and Forecast, By Pack (2024-2032) 9.5.3.3. Rest of South America Wax Melts Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Rest of South America Wax Melts Market Size and Forecast, Distribution Channel (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Yankee Candle Company (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Scentsy, Inc. (USA) 10.3. S. C. Johnson & Son, Inc. (USA) 10.4. Colonial Candle (USA) 10.5. Candle Warmers Etc. (USA) 10.6. East Coast Candle Co. (UK) 10.7. Bramble Bay Candle Co. (UK) 10.8. Ashleigh & Burwood (UK) 10.9. Kringle Candle Company (UK) 10.10. Voluspa (UK) 10.11. IRIS Home Fragrances (India) 10.12. Matin Impex (India) 10.13. Kobo Candles (Australia) 10.14. Ramesh Flowers Pvt Ltd (India) 10.15. Kanika Enterprises (India) 10.16. Aromaty (Brazil) 10.17. Velas Aromaticas (Argentina) 10.18. WaxColor (Brazil) 10.19. Vela Luz (Chile) 10.20. ArtCera (Colombia) 10.21. Royal Candle Works (UAE) 10.22. Candle Deli (South Africa) 10.23. Al Fakher Candles (UAE) 10.24. El Noor Candles (Egypt) 10.25. Bliss Scented Candles (Kenya) 11. Key Findings 12. Analyst Recommendations 13. Wax Melts Market: Research Methodology