Towbar Market Executive Summary

Every decade redefines what vehicles can carry the next one will redefine what they can pull. The Global Towbar Market is standing at a crossroads of engineering, innovation, and smart mobility integration. Between 2025 and 2032, the market is expected to nearly double, expanding from USD 8.95 billion in 2024 to USD 12.44 billion by 2032, growing at a CAGR of 4.2%. The global towbar market volume is forecast to reach XX Thousand Units by 2032, up from USD XX Thousand Units in 2024, representing a 4.2% CAGR by Volume. What was once a simple mechanical bracket has now become a strategic mobility interface- a convergence points between vehicle architecture, AI-driven safety systems, and EV ecosystem integration. The demand curve mirrors a deeper mobility transformation: SUVs are evolving into multi-utility vehicles, EVs require adaptive lightweight towbars, and consumers are prioritizing modularity and sustainability over brute capacity. Europe leads with design maturity and regulatory push (UNECE R55 compliance), while Asia-Pacific is emerging as the fastest-growing ecosystem, powered by electric vehicle retrofits and aftermarket innovations. The market’s pulse is accelerating as OEMs, Tier-1 suppliers, and digital installers shift from steel and bolts to sensors and bytes. This Report isn’t just about data it’s about direction. It reveals where capital will flow, how design philosophies are changing, and why the towbar industry is becoming an inseparable chapter of the global smart mobility story.To know about the Research Methodology :- Request Free Sample Report

Towbar Market Objective & Scope

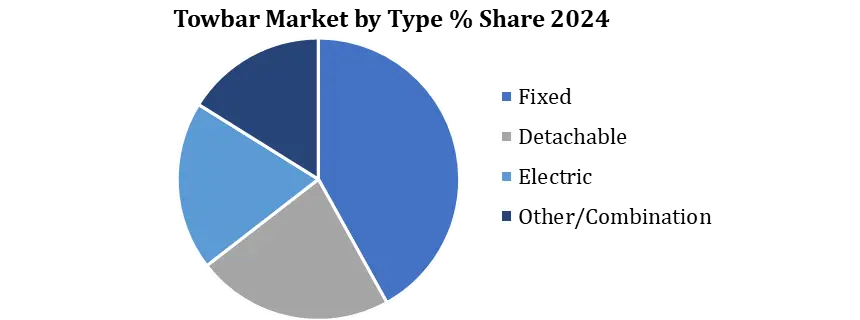

The goal of this report is simple yet strategic to equip OEMs, Tier-1 suppliers, aftermarket integrators, investors, and regulators with a panoramic understanding of the towbar market’s transformation into a high-precision, technology-anchored segment. The scope covers: • Market evolution (2021–2024) and forecast till 2032 • Demand segmentation by product, vehicle, and channel • Cost structure and margin models across OEM and aftermarket • Technological disruption – electric, retractable, sensor-embedded towbars • Regional intelligence – North America, Europe, APAC, MEA, and Latin America • Competitive benchmarking, value chain shifts, and regulatory frameworks This document is designed not as a static report but as a decision enabler merging industry foresight, macro-trends, and the precision of financial modelling. Towbar Market Definition & Strategic Context A towbar, or trailer hitch, is no longer a passive steel coupling. It’s now a vehicle-embedded utility node connecting mechanical load with digital intelligence. The modern towbar market extends across: • Fixed towbars – cost-efficient and durable; • Detachable towbars – design-forward and space-optimized; • Retractable & Electric towbars – the new premium standard, combining automation, aesthetics, and smart load sensors. These products integrate deeply into passenger vehicles, light and heavy commercial vehicles, SUVs, and electric vehicles — with usage expanding from logistics to leisure, from caravans to construction.

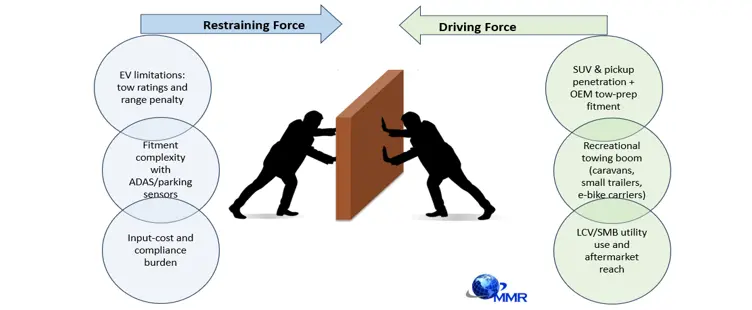

Towbar Market Dynamics: The Transformation Story

The towbar industry’s narrative is one of reinvention a move from rugged mechanics to responsive mobility technology. 1. The SUV & Outdoor Revolution: Global SUV sales surged beyond 35 million units in 2024. Each of these vehicles represents not just transport, but lifestyle utility. The towbar once optional is now a default inclusion. In Europe and Australia, caravan tourism and outdoor mobility have created a demand wave that OEMs are embedding directly into product lines.2. Electrification and Lightweight Design: EVs brought a paradox massive torque, but fragile range. Traditional steel towbars added weight and reduced efficiency. Enter lightweight aluminum and carbon-reinforced composites. Tesla, BMW, and Polestar are already deploying integrated electric towbars, designed for torque-responsive towing without compromising efficiency. 3. Smart Technology Integration: AI-based systems detect towing weight, synchronize it with vehicle stability control, and recalibrate braking and torque in real time. In premium segments, voice-activated and motorized retractable systems are now standard. “Smart towbars” are emerging as data interfaces logging usage, wear, and load, feeding it back into OEM analytics. 4. ESG & Circular Manufacturing: Sustainability is becoming the new differentiator. Leading suppliers like Bosal and Brink Group have moved to green steel and recyclable aluminum frameworks, reducing CO₂ emissions per unit by over 30%. This convergence of environmental awareness, digital capability, and mechanical reliability marks the beginning of Towbar 4.0 — where coupling meets computing.

Towbar Market Growth Drivers & Restraints 2024

Regional Intelligence: Global Growth, Local Momentum

Europe – The Innovation Heartland: Europe accounts for nearly 35% of global towbar revenue, underpinned by regulatory rigor (UNECE R55) and a robust caravan ecosystem. Germany, France, and the UK are hubs for both OEM integration and aftermarket installations. Electric retractable systems dominate new sales, while sustainability incentives (EU Fit for 55) are propelling modular and eco-certified towbar demand. North America – The Power Market: Towbars are synonymous with pickup culture. Over 78% of U.S. pickups and 60% of SUVs come factory-fitted with towbars. The aftermarket thrives on off-road and trailer enthusiasts. Recent innovations include smart brake synchronization and towing-assist sensors integrated into vehicle ADAS systems. Asia-Pacific – The Growth Engine: China, Japan, India, and Australia define the region’s rapid ascent. With a CAGR surpassing 5.2%, APAC’s aftermarket is transforming through e-commerce installations and EV-compatible accessories. India’s Tier-2 cities are seeing a surge in utility trailers, while Chinese OEMs now offer electric towbars in mid-range EVs a first globally. GCC & Latin America – The Frontier: In the Gulf, off-roading, desert tourism, and mega-project logistics are fueling demand, while Latin America’s agricultural logistics is expanding towing applications for small trucks and pickups.Towbar Market Revenue & Market Share (%) by region 2024

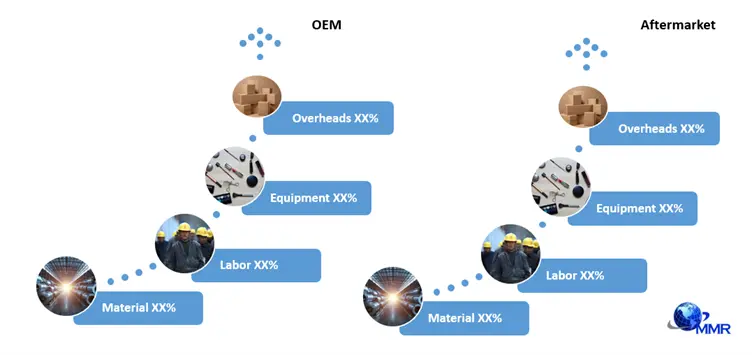

Cost Structure & Profitability Lens

In a typical towbar unit: • Raw Materials (Steel/Alloys): XX% • Labor & Assembly: 20–25% • Electrical Harness/Components: 10–15% • Logistics & Packaging: 10% • Gross Margin: XX% OEM | XX% Aftermarket The electric retractable towbar Priced between USD 600–1,000 per unit, delivers gross margins 2x higher than fixed or detachable systems. For a 25kg electric towbar, the CapEx breakeven is achieved at XX units annually, with IRR exceeding 15% for vertically integrated suppliers.Towbar Cost Structure, OEM vs Aftermarket (% of Revenue)

Towbar Market Competitive Landscape

The market is moderately consolidated, dominated by Bosal, Brink Group, Westfalia Automotive, Horizon Global, GDW, and TowTrust. These six players command over XX% of the market, but the next phase of competition will not be about capacity it will be about connectivity. • Bosal Group is pioneering electric actuation technology with OEM integrations for BMW and Volvo. • Brink Group leads in ADAS-compatible towbars, integrated with vehicle stability systems. • Westfalia focuses on modular design and circular material sourcing. • Horizon Global is betting on high-margin North American aftermarket sales. Emerging competitors in China and Eastern Europe are innovating with low-cost electric retractable kits, putting pricing pressure on incumbents.Competitive Market Share of Leading Manufacturers (%) 2024

Regulatory & Technological Integration

Safety, certification, and standardization define entry. UNECE R55 governs coupling and safety testing in Europe; SAE J684 remains the North American gold standard. China and India are harmonizing standards by 2026, paving the way for global interoperability. Technology-wise, towbar systems are merging with EV architecture sensors link to torque control, braking, and energy recovery. The next stage is predictive AI towing, where the system calculates drag coefficients to optimize range dynamically.Towbar Market Forecast & Financial Outlook

The global towbar market is forecast to reach USD 12.44 billion by 2032, up from USD 8.95 billion in 2024, representing a 4.2% CAGR. Regional split: • Europe: USD 3.34 Bn. • North America: USD XX Bn. • Asia-Pacific: USD XX Bn. • Rest of World: USD XX Bn. The global towbar market Volume is forecast to reach XX Thousand Units by 2032, up from USD XX Thousand Units in 2024, representing a 4.2% CAGR. Volume growth will come from EV adoption, SUV penetration, and outdoor mobility culture, while value growth will be driven by high-margin retractable and smart systems. Regional split: • Europe: XX Thousand Units • North America: 3906.267 Thousand Units • Asia-Pacific: XX Thousand Units • Rest of World: XX Thousand UnitsTowbar Market Strategic Recommendations

For OEMs: Embed smart towbars as a brand identity differentiator. Collaborate early with Tier-1 suppliers on EV-specific designs and software compatibility. For Aftermarket Players: Expand into AI-based installation diagnostics and e-commerce-enabled fitment services. Leverage data analytics to target consumer upgrades. For Investors: Prioritize firms innovating in sensor integration and lightweight materials. High ROI exists in the mid-tier supplier ecosystem. For Policymakers: Standardize tow capacity certification globally, incentivize recyclable materials, and integrate towing into EV policy frameworks. Analyst Insight: The Next Decade of Intelligent Towing The towbar once an afterthought in the automotive world is quietly becoming a symbol of convergence. Between steel and software, between mobility and modularity, lies the story of an industry reinventing itself. By 2032, every smart SUV, EV, and pickup will feature digitally responsive towing systems, connecting data, power, and purpose. The towbar is evolving into the handshake between machines a small component with colossal strategic weight. “Tomorrow’s vehicles will think before they tow. And the smartest towbars will think for them.”Smart Towbar Adoption Curve 2024

1. Tow Bar Market: Executive Summary 1.1 Market Overview 1.2. Market Size (2024) & Forecast (2025-2032), 1.3. Market Size (Value and Volume) and Market Share (%) - By Region, Country, and Segments 1.4. Strategic Outlook by Region: Electrification, Regulation & OEM Trends 2. Tow Bar Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. MMR Competition Positioning (Product Revenue and Market Share (%) Analysis of Top 10 Towbar European Companies) 2.3. Key Players Benchmarking 2.3.1.Company Name 2.3.2.Headquarter 2.3.3.Product Segment 2.3.4.End User Segment 2.3.5.Technological Innovation 2.3.6.Revenue 2024 2.3.7. Geographical presence 2.4.Market Structure 2.4.1.Market Leaders 2.4.2.Market Followers 2.4.3.Emerging Players 2.5.Mergers & Acquisitions and Recent Developments 2.6 Entry Barriers for New Market Participants 3. OEM Consumer Landscape 3.1. Leading OEM Consumers 3.2. Factory-Fitted Adoption Trends 3.4. Growth of Chinese and Korean OEMs 3.4 OEM Dependence on Tier-1 Suppliers 3.5 Strategic Inputs from OEMs (WMS & LS Approach) 3.6. Transition from Fixed Supplier Models to Cartridge-Based Systems 4. Regional Demand Analysis 4.1. Europe Market Insights 4.2. North America Market Insights 4.2. Asia Pacific Market Insights 4.3. Middle East and Africa Market Insights 4.5. South America Market Insights 5. Aftermarket Landscape by Region 5.1 Aftermarket Revenue Share and Key Role of Dealers 5.2 Dealer and Retailer Flow 5.3 Tools & Technologies Used 6. OEM vs Aftermarket: Comparative Analysis by Region 6.1. Comparison: OEM Factory-Fit vs Aftermarket Sales 6.2. Product Personalization & Feature Packages 6.3. Channel Strategy Differentiation 7. Technology & Product Innovations 7.1 Electrically Retractable Tow Bars 7.2 Plug-and-Play Systems 7.3 Smart Tow Bars with Sensor Integration & Alert Systems 7.4 Modular & Lightweight Tow Bar Designs 7.5 Electrical vs Manual Tow Bars – Market Dynamics 7.6 Platform Integration Capabilities (GPS, Sensors, AI) 7.7 Range-Based Engineering Targets (e.g., 500km compliance) 8. Porter’s Five Forces Analysis 8.1. Threat of New Entrants 8.2. Supplier Bargaining Power 8.3. Buyer Bargaining Power 8.4. Threat of Substitutes 8.5. Competitive Rivalry 9. Regulatory Landscape 9.1 Current EU Tow Bar Regulations (Towing Load, Testing Norms, Fitment Rules) 9.2 Homologation Standards & Cross-Border Safety Mandates 9.3 Anticipated Regulation Roadmap (Emission, Electrification, Circularity) 9.4 Country-Specific Regulation & Approval Flow (Germany, France Focus) 9.5 OEM-Driven Regulatory Influence – Who is Shaping the Landscape? 9.6 Compliance as a Supplier Differentiator & Entry Filter 10. Tow Bar Market: Global Market Size and Forecast By Segmentation 10.1. Global Tow Bar Market Size and Forecast, By Product Type (2024-2032) 10.2. Global Tow Bar Market Size and Forecast, By Vehicle Type (2024-2032) 10.3. Global Tow Bar Market Size and Forecast, By Sales Channel (2024-2032) 10.4. Global Tow Bar Market Size and Forecast, By Material Type (2024-2032) 10.5. Global Tow Bar Market Size and Forecast, By Technology Type (2024-2032) 10.6. Global Tow Bar Market Size and Forecast, By Region (2024-2032) 11. Tow Bar Market: North America Market Size and Forecast by Segmentation (By Value in USD Billion and Volume in Units) (2024-2032) 11.1. North America Tow Bar Market Size and Forecast, By Product Type(2024-2032) 11.2. North America Tow Bar Market Size and Forecast, By Vehicle Type (2024-2032) 11.3. North America Tow Bar Market Size and Forecast, By Sales Channel (2024-2032) 11.4. North America Tow Bar Market Size and Forecast, By Material Type (2024-2032) 11.5. North America Tow Bar Market Size and Forecast, By Technology Type (2024-2032) 11.6. North America Tow Bar Market Size and Forecast, By Country (2024-2032) 12. Tow Bar Market: Europe Market Size and Forecast by Segmentation (By Value in USD Billion and Volume in Units) (2024-2032) 12.1. Europe Tow Bar Market Size and Forecast, By Product Type(2024-2032) 12.2. Europe Tow Bar Market Size and Forecast, By Vehicle Type (2024-2032) 12.3. Europe Tow Bar Market Size and Forecast, By Sales Channel (2024-2032) 12.4. Europe Tow Bar Market Size and Forecast, By Material Type (2024-2032) 12.5. Europe Tow Bar Market Size and Forecast, By Technology Type (2024-2032) 12.6. Europe Tow Bar Market Size and Forecast, By Country (2024-2032) 13. Tow Bar Market: Asia Pacific Market Size and Forecast by Segmentation (By Value in USD Billion and Volume in Units) (2024-2032) 13.1. Asia Pacific Tow Bar Market Size and Forecast, By Product Type(2024-2032) 13.2. Asia Pacific Tow Bar Market Size and Forecast, By Vehicle Type (2024-2032) 13.3. Asia Pacific Tow Bar Market Size and Forecast, By Sales Channel (2024-2032) 13.4. Asia Pacific Tow Bar Market Size and Forecast, By Material Type (2024-2032) 13.5. Asia Pacific Tow Bar Market Size and Forecast, By Technology Type (2024-2032) 13.6. Asia Pacific Tow Bar Market Size and Forecast, By Country (2024-2032) 14. Tow Bar Market: MEA Market Size and Forecast by Segmentation (By Value in USD Billion and Volume in Units) (2024-2032) 14.1. MEA Tow Bar Market Size and Forecast, By Product Type(2024-2032) 14.2. MEA Tow Bar Market Size and Forecast, By Vehicle Type (2024-2032) 14.3. MEA Tow Bar Market Size and Forecast, By Sales Channel (2024-2032) 14.4. MEA Tow Bar Market Size and Forecast, By Material Type (2024-2032) 14.5. MEA Tow Bar Market Size and Forecast, By Technology Type (2024-2032) 14.6. MEA Tow Bar Market Size and Forecast, By Country (2024-2032) 15. Tow Bar Market: South America Market Size and Forecast by Segmentation (By Value in USD Billion and Volume in Units) (2024-2032) 15.1. South America Tow Bar Market Size and Forecast, By Product Type(2024-2032) 15.2. South America Tow Bar Market Size and Forecast, By Vehicle Type (2024-2032) 15.3. South America Tow Bar Market Size and Forecast, By Sales Channel (2024-2032) 15.4. South America Tow Bar Market Size and Forecast, By Material Type (2024-2032) 15.5. South America Tow Bar Market Size and Forecast, By Technology Type (2024-2032) 15.6. South America Tow Bar Market Size and Forecast, By Country (2024-2032) 16. Towbar Manufactures 16.1. Thule group 16.2. Brink Towing Systems B.V. 16.3. ACPS Automotive 16.4. Auto-Hak 16.5. Steinhof 16.6. Bruno Independent Living Aids, Inc. 16.7. Umbra Rimorchi S.r.L., 16.8. Bosal 16.9. ETowbars 16.10. HOOK CZ s.r.o. 16.11. PF Jones Ltd 16.12. Enganches y Remolques Aragón S.L. 16.13. MVG 16.14. Westfalia-Automotive 16.15. PCT Automotive Limited 16.16. GDW NV. 17. Future Outlook 17.1 Europe vs US Growth Outlook 17.2 Electrification and Hybrid Integration Roadmap 17.3 Compliance Pressure and Regulation-Driven Innovation 17.4 OEM Strategy Realignment by Platform and Region 18. Conclusion & Strategic Recommendations 18.1 High-Growth Opportunity Areas 18.2 Market Entry Readiness Assessment 18.3 Stakeholder-Specific Recommendations 18.4. OEMs, Tier-1s, Aftermarket Players 19. Tow Bar Market – Research Methodology