Tobacco Industry, valued at USD 964.99 billion in 2024, is expected to reach USD 1180.34 billion by 2032, with a CAGR of 2.55% (2025–2032). Growth Forecast, Industry Trends, Competitive Landscape, NGPs, Cigarettes Market Insights, Global Tobacco Market Analysis, Opportunities, Market Share, Key Players, Smokeless Tobacco, E-Cigarettes & Heated Tobacco Products Forecast.Tobacco Market Overview

Tobacco is a nicotine-containing plant whose leaves are dried and processed for smoking, chewing, or vaping, widely used globally despite significant health risks and addiction. Tobacco use remains one of the world’s most pressing public health challenges, causing over 7 million deaths annually, including 1.6 million non-smokers exposed to second-hand smoke, and affecting more than 1.3 billion users, of whom 80% live in low- and middle-income countries. Despite global policy interventions such as the WHO Framework Convention on Tobacco Control (FCTC) and the MPOWER strategies, tobacco consumption persists, especially in developing economies where poverty, limited awareness, and addiction reinforce dependency. The global Tobacco Market is undergoing a structural transformation driven by the rising awareness of health hazards, tightening regulations, aggressive taxation, public smoking bans, and plain packaging initiatives. China accounts for 38% of global tobacco production, while Brazil, India, and the U.S. contribute 25%, and Turkey, Zimbabwe, Indonesia, Italy, Greece, Malawi, and Argentina jointly add another 15%, meaning these 11 countries produce nearly 80% of global tobacco. In response to declining cigarette sales in mature markets, the industry is accelerating innovation in Reduced-Risk Products (RRPs) and Next-Generation Products (NGPs) such as e-cigarettes, heated tobacco devices, nicotine pouches, and smokeless tobacco. These categories are gaining momentum as consumers seek perceived lower-risk alternatives, although long-term health impacts remain under scrutiny.To Know About The Research Methodology :- Request Free Sample Report

Trend: Rapid Shift Toward Next-Generation Products (NGPs)

The Next-Generation Products (NGPs) include heated tobacco, e-cigarettes, nicotine pouches, and other reduced-risk alternatives. As traditional cigarette volumes decline in highly regulated markets, consumers increasingly seek smoke-free options perceived as less harmful, driving exponential growth of the E-cigarette and Vaping Market and heated tobacco products market. Manufacturers are investing heavily in R&D, device innovation, flavor engineering, and digital retailing to capture this shift. Countries such as Japan, South Korea, the U.S., and parts of Europe exhibit strong adoption, influencing global tobacco industry trends. The rising NGP penetration is supported by online sales expansion, advanced tobacco packaging innovations, and targeted marketing strategies, which drive the Tobacco Market. These transitions create new tobacco market opportunities, particularly in regions with strict smoking bans where smoke-free products offer alternative pathways for revenue diversification and tobacco market analysis.Tobacco Market Dynamics

Increasing Tobacco Demand in LMICs To Boost the Tobacco Market The sustained demand for cigarettes and smokeless tobacco products in low- and middle-income countries (LMICs), where 80% of the world’s 1 billion smokers reside. Despite rising awareness of health risks, tobacco use continues to escalate in these regions due to high addiction levels, aggressive marketing strategies by leading tobacco companies, urbanization, and affordability relative to income. Globally, tobacco kills over eight million people annually, nearly 22,000 deaths per day, yet consumption remains concentrated in developing markets where regulatory enforcement is weak. The Cigarettes Market especially benefits from large youth populations, expanding distribution networks, and limited public health campaigns. These nations experience higher vulnerability because tobacco use and second-hand smoke contribute significantly to cardiovascular diseases, accounting for 17% of CVD deaths worldwide. The Regulatory Pressure to restrain the Tobacco Market Growth Tobacco smoke contains over 7,000 chemicals, including 70 known carcinogens, while smokeless tobacco contains at least 30 cancer-causing agents, reinforcing global public health measures. Governments worldwide are enforcing stricter taxation policies, graphic health warnings, display bans, plain packaging mandates, and restrictions on advertising, significantly reducing cigarette affordability and accessibility. Global public health data show tobacco causes over eight million deaths annually, including deaths from second-hand smoke, and contributes to 17% of all cardiovascular disease deaths, making tobacco a top target for health policies. These measures are especially impactful in high-income regions, reducing cigarette sales volume and reshaping the tobacco industry's competitive landscape.Tobacco Market Segment Analysis

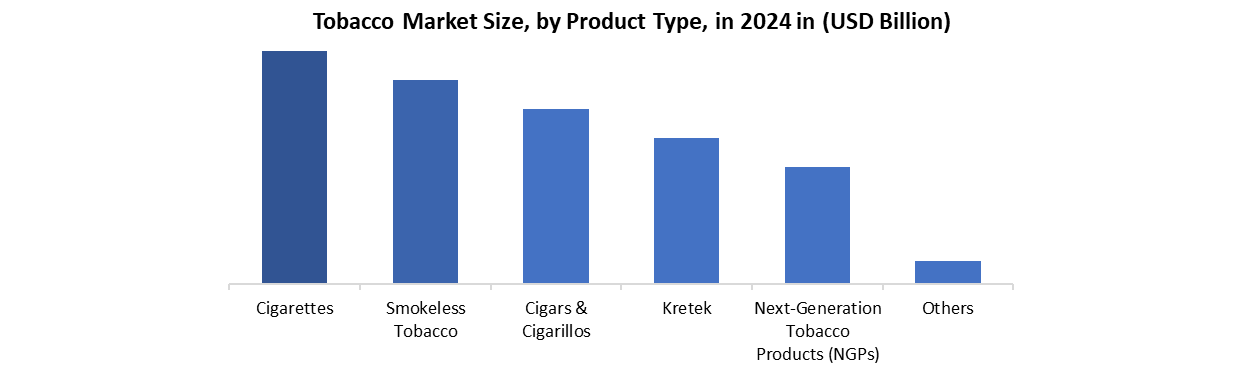

By Type, the market is segmented into Virginia, Burley, Nicotiana rustica, Oriental and Others. Virginia tobacco is the dominant Type in 2024, with the largest Tobacco Market and the most widely cultivated type, accounting for nearly 60–65% of global cigarette blends. Its high sugar content, mild aroma, and smooth-burning characteristics make it the preferred leaf for the modern cigarettes market, which represents the largest share of the Tobacco Market Size. Major producers such as China, India, Brazil, and Zimbabwe lead Virginia production, with China alone contributing more than 2.29 million metric tonnes of unmanufactured tobacco, positioning Virginia tobacco as the backbone of the Tobacco Industry. As consumer preferences shift, Virginia tobacco remains central to tobacco industry trends, particularly in American-blend cigarettes and next-generation hybrid formulations. The leaf’s versatility supports multiple product categories, including menthol cigarettes, flavored cigarettes, roll-your-own blends, and certain next-generation tobacco products (NGPs). With rising production efficiencies and strong demand in the Asia-Pacific, home to more than 241 million smokers and 80% of the world’s tobacco users, the importance of Virginia tobacco continues to increase.By Product Type, the market is categorized into Cigarettes, Smokeless Tobacco, Cigars & Cigarillos, Kretek, Next-Generation Tobacco Products (NGPs) and Others. Cigarettes continue to lead the Tobacco Market by product due to large-scale consumption in Asia-Pacific, Africa, and Eastern Europe, where smoking prevalence is highest, 27.9% in Southeast Asia alone, representing more than 241 million smokers. Growth is supported by affordability, addictive nicotine profiles, vast tobacco distribution channels, and strong brand loyalty. Even as regulations tighten and public health awareness increases, cigarette consumption remains concentrated in low- and middle-income countries, where 80% of the world’s smokers reside. These markets offer significant tobacco market opportunities due to rising population, urbanization, and weaker enforcement of advertising and tax policies. While the Next Generation Tobacco Products (NGPs) Market, including vaping and heated tobacco, shows rapid growth, it still contributes a much smaller share compared to traditional cigarettes.

Tobacco Market Regional Insights

Asia Pacific dominated the Tobacco Market in 2024 and is expected to continue its dominance over the forecast period. The Asia-Pacific Tobacco Industry remains one of the most influential components of the global Tobacco Market, driven by massive population size, high addiction levels, and strong dominance of multinational and state-owned tobacco companies. The region accounts for the highest tobacco use prevalence worldwide, with 27.9% of adults consuming tobacco, and more than 241 million smokers, supported by deeply rooted cultural patterns and widespread availability of low-cost products. Asia-Pacific also hosts 81% of the world’s smokeless tobacco users, with India, Bangladesh, and Nepal leading consumption of gutkha, khaini, and other forms, reinforcing strong revenue streams in the smokeless tobacco market. Major players such as CNTC, BAT, PMI, JTI, ITC, and KT&G dominate the Tobacco Industry competitive landscape, supported by extensive tobacco distribution channels, political linkages, and corporate influence that often delays public health reforms. Despite the tobacco market growth in key producing nations such as India, Indonesia, Bangladesh, and Thailand, most Asia-Pacific governments struggle with industry interference, weak enforcement of tobacco regulations and taxation, and limited adoption of WHO FCTC Article 5.3 measures. The region’s production strength, over 750,000 tons from India and hundreds of thousands more from Indonesia and Bangladesh, positions Asia-Pacific as a core contributor to the global Tobacco Market Size. The rising smoking bans, rising taxes, and growth in the heated tobacco products market and E-Cigarettes and Vaping Market are reshaping demand. Top 10 Largest Tobacco Producing States in India, 2025

Rank State Tobacco Production Share (%) Major Tobacco-Producing Districts 1 Gujarat 41% Saurashtra, North Gujarat 2 Andhra Pradesh 22% Prakasam, Guntur, Krishna 3 Karnataka 16% Shivamogga, Chitradurga, Tumkur 4 Telangana 11% Adilabad, Karimnagar, Warangal 5 Uttar Pradesh 5% Jhansi, Mahoba, Banda 6 Rajasthan 4% Kota, Bundi, Baran 7 West Bengal 3% Cooch Behar, Jalpaiguri, Darjeeling 8 Tamil Nadu 2% Dindigul, Tiruchirappalli, Madurai 9 Madhya Pradesh 1% Sehore, Dewas, Rajgarh 10 Maharashtra 1% Hingoli, Nanded, Latur Global Tobacco Market Competitive Landscape

The global tobacco market is dominated by a small group of powerful multinational corporations that collectively control a significant share of global production, distribution, and brand portfolios. Key players include the China National Tobacco Corporation (CNTC)—the world’s largest by volume—followed by Philip Morris International (PMI), British American Tobacco (BAT), Japan Tobacco International (JTI), Imperial Brands, Altria Group, KT&G, and ITC Limited. These companies leverage extensive supply chains, aggressive marketing, and strong product diversification across cigarettes, next-generation tobacco products (NGPs), cigars, and smokeless tobacco. Competitive strategies increasingly focus on heated tobacco products, e-cigarettes, and nicotine pouches, as declining cigarette volumes in developed markets push innovation toward reduced-risk alternatives. In emerging markets—particularly Asia-Pacific and Africa traditional cigarette demand remains robust, strengthening competitive positioning.Recent Developments • 03 Apr 2025 – Philip Morris International (PMI): PMI released its 2024 Integrated Report, marking 10 years of its smoke-free transformation and showcasing major sustainability achievements. By the end of 2024, PMI reached 38.6 million adult users of smoke-free products across 95 markets, with smoke-free revenue accounting for 39% of total net revenues. The company highlighted over USD 14 billion in cumulative investment behind smoke-free innovation since 2008 and reported significant progress in carbon neutrality, youth-access prevention, and farmer livelihoods. PMI emphasized that transformation requires collective effort and reaffirmed its commitment to making cigarettes obsolete, strengthening sustainability governance, and accelerating the transition to reduced-risk products. • In February 2024, Reynolds American Inc., the U.S. subsidiary of the BAT Group and parent company of R.J. Reynolds, announced a partnership with the National Association of Convenience Stores (NACS) and Conexxus to support TruAge, an advanced digital age-verification platform. The initiative aims to modernize retail ID checks by providing a faster, more secure, and privacy-focused method for verifying customer age across convenience stores nationwide. By adopting TruAge, Reynolds American reinforces its commitment to responsible retailing, youth-access prevention, and industry-wide digital transformation while aligning with broader regulatory expectations for safer tobacco product sales.

Tobacco Market Scope: Inquire Before Buying

Global Tobacco Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 964.99 Bn. Forecast Period 2025 to 2032 CAGR: 2.55% Market Size in 2032: USD 1180.34 Bn. Segments Covered: by Type Virginia Burley Nicotiana rustica Oriental Others by Product Type Cigarettes Smokeless Tobacco Cigars & Cigarillos Kretek Next-Generation Tobacco Products (NGPs) Others by Form Combustible Tobacco Non-Combustible Tobacco by Packaging Type Paper Plastic Jute Others by Distribution Channel Supermarkets & Hypermarkets Convenience Stores Specialty Tobacco Stores Online Retail Others Tobacco Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tobacco Key Players

1. China National Tobacco Corporation (CNTC) 2. Philip Morris International (PMI) 3. British American Tobacco (BAT) 4. Japan Tobacco International (JTI) 5. Imperial Brands 6. Altria Group 7. ITC Limited (India) 8. KT&G (Korea Tobacco & Ginseng Corporation) 9. Scandinavian Tobacco Group (STG) 10. Swedish Match 11. Gudang Garam 12. Djarum 13. Bentoel / BAT Indonesia 14. China Tobacco International 15. Habanos S.A. 16. Universal Corporation 17. Alliance One International 18. Godfrey Phillips India (GPI) 19. NTC Industries Ltd. 20. Reynolds American Inc. (RAI) 21. Neman Grodno Tobacco Factory 22. Dhaka Tobacco Industries 23. Surya Nepal Pvt. Ltd. 24. Ceylon Tobacco Company 25. Tabacalera / Altadis 26. Philip Morris Japan 27. Philip Morris Korea 28. British American Tobacco Kenya 29. Tobacco Authority of Thailand (TOAT) 30. Myanmar RothmansFrequently Asked Questions:

1] What is the growth rate of the Global Tobacco Market? Ans. The Global Tobacco Market is growing at a significant rate of 2.55 % during the forecast period. 2] Which region is expected to dominate the Global Tobacco Market? Ans. Asia Pacific is expected to dominate the Tobacco Market during the forecast period. 3] What was the Global Tobacco Market size in 2024? Ans. The Tobacco Market size is expected to reach USD 964.99 billion in 2024. 4] What is the expected Global Tobacco Market size by 2032? Ans. The Tobacco Market size is expected to reach USD 1180.34 billion by 2032. 5] Which are the top players in the Global Tobacco Market? Ans. The major players in the Global Tobacco Market are China National Tobacco Corporation (CNTC), Philip Morris International (PMI), British American Tobacco (BAT), Japan Tobacco International (JTI) and Others. 6] What are the factors driving the Global Tobacco Market growth? Ans. The Global Tobacco Market is driven by rising consumption in LMICs, strong addiction levels, expanding distribution networks, population growth, urbanization, and rapid adoption of next-generation tobacco products.

1. Tobacco Market: Research Methodology 2. Tobacco Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Tobacco Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Total Company Revenue (2024) 3.3.6. Market Share (%) 3.3.7. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Tobacco Market: Dynamics 4.1. Tobacco Market Trends 4.2. Tobacco Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for Tobacco Market 5. Global Tobacco Regulation 5.1. WHO FCTC & MPOWER Implementation 5.2. Country-wise Taxation Analysis 5.3. Age restrictions, packaging, pictorial warnings 5.4. E-cigarette/NGP regulatory map 5.5. Illicit Trade Control Measures 6. Sustainability, ESG & Supply Chain Analysis 6.1. Environmental Impact (GHG Emissions, Water Use) 6.2. Tobacco Farming & Labor Insights 6.3. Human Rights & Child Labor Prevention 6.4. ESG Scores of Major Companies 6.5. Carbon-Neutrality Initiatives (e.g., PMI, BAT) 7. Tobacco Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 7.1. Tobacco Market Size and Forecast, by Type (2024-2032) 7.1.1. Virginia 7.1.2. Burley 7.1.3. Nicotiana rustica 7.1.4. Oriental 7.1.5. Others 7.2. Tobacco Market Size and Forecast, by Product Type (2024-2032) 7.2.1. Cigarettes 7.2.2. Smokeless Tobacco 7.2.3. Cigars & Cigarillos 7.2.4. Kretek 7.2.5. Next-Generation Tobacco Products (NGPs) 7.2.6. Others 7.3. Tobacco Market Size and Forecast, by Form (2024-2032) 7.3.1. Combustible Tobacco 7.3.2. Non-Combustible Tobacco 7.4. Tobacco Market Size and Forecast, By Packaging Type (2024-2032) 7.4.1. Paper 7.4.2. Plastic 7.4.3. Jute 7.4.4. Others 7.5. Tobacco Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.1. Supermarkets & Hypermarkets 7.5.2. Convenience Stores 7.5.3. Specialty Tobacco Stores 7.5.4. Online Retail 7.5.5. Others 7.6. Tobacco Market Size and Forecast, by Region (2024-2032) 7.6.1. North America 7.6.2. Europe 7.6.3. Asia Pacific 7.6.4. Middle East and Africa 7.6.5. South America 8. North America Tobacco Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 8.1. North America Tobacco Market Size and Forecast, by Type (2024-2032) 8.1.1. Virginia 8.1.2. Burley 8.1.3. Nicotiana rustica 8.1.4. Oriental 8.1.5. Others 8.2. North America Tobacco Market Size and Forecast, by Product Type (2024-2032) 8.2.1. Cigarettes 8.2.2. Smokeless Tobacco 8.2.3. Cigars & Cigarillos 8.2.4. Kretek 8.2.5. Next-Generation Tobacco Products (NGPs) 8.2.6. Others 8.3. North America Tobacco Market Size and Forecast, by Form (2024-2032) 8.3.1. Combustible Tobacco 8.3.2. Non-Combustible Tobacco 8.4. North America Tobacco Market Size and Forecast, By Packaging Type (2024-2032) 8.4.1. Paper 8.4.2. Plastic 8.4.3. Jute 8.4.4. Others 8.5. North America Tobacco Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.1. Supermarkets & Hypermarkets 8.5.2. Convenience Stores 8.5.3. Specialty Tobacco Stores 8.5.4. Online Retail 8.5.5. Others 8.6. North America Tobacco Market Size and Forecast, by Country (2024-2032) 8.6.1. United States 8.6.2. Canada 8.6.3. Mexico 9. Europe Tobacco Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 9.1. Europe Tobacco Market Size and Forecast, by Type (2024-2032) 9.2. Europe Tobacco Market Size and Forecast, by Product Type (2024-2032) 9.3. Europe Tobacco Market Size and Forecast, by Form (2024-2032) 9.4. Europe Tobacco Market Size and Forecast, By Packaging Type (2024-2032) 9.5. Europe Tobacco Market Size and Forecast, by Distribution Channel (2024-2032) 9.6. Europe Tobacco Market Size and Forecast, by Country (2024-2032) 9.6.1. United Kingdom 9.6.2. France 9.6.3. Germany 9.6.4. Italy 9.6.5. Spain 9.6.6. Russia 9.6.7. Rest of Europe 10. Asia Pacific Tobacco Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 10.1. Asia Pacific Tobacco Market Size and Forecast, by Type (2024-2032) 10.2. Asia Pacific Tobacco Market Size and Forecast, by Product Type (2024-2032) 10.3. Asia Pacific Tobacco Market Size and Forecast, by Form (2024-2032) 10.4. Asia Pacific Tobacco Market Size and Forecast, By Packaging Type (2024-2032) 10.5. Asia Pacific Tobacco Market Size and Forecast, by Distribution Channel (2024-2032) 10.6. Asia Pacific Tobacco Market Size and Forecast, by Country (2024-2032) 10.6.1. China 10.6.2. S Korea 10.6.3. Japan 10.6.4. India 10.6.5. Australia 10.6.6. Rest of Asia Pacific 11. Middle East and Africa Tobacco Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 11.1. Middle East and Africa Tobacco Market Size and Forecast, by Type (2024-2032) 11.2. Middle East and Africa Tobacco Market Size and Forecast, by Product Type (2024-2032) 11.3. Middle East and Africa Tobacco Market Size and Forecast, by Form (2024-2032) 11.4. Middle East and Africa Tobacco Market Size and Forecast, By Packaging Type (2024-2032) 11.5. Middle East and Africa Tobacco Market Size and Forecast, by Distribution Channel (2024-2032) 11.6. Middle East and Africa Tobacco Market Size and Forecast, by Country (2024-2032) 11.6.1. South Africa 11.6.2. GCC 11.6.3. Nigeria 11.6.4. Rest of ME&A 12. South America Tobacco Market Size and Forecast by Segmentation (by Value in USD Billion and Volume in Metric Tons) (2024-2032) 12.1. South America Tobacco Market Size and Forecast, by Type (2024-2032) 12.2. South America Tobacco Market Size and Forecast, by Product Type (2024-2032) 12.3. South America Tobacco Market Size and Forecast, by Form (2024-2032) 12.4. South America Tobacco Market Size and Forecast, By Packaging Type (2024-2032) 12.5. South America Tobacco Market Size and Forecast, by Distribution Channel (2024-2032) 12.6. South America Tobacco Market Size and Forecast, by Country (2024-2032) 12.6.1. Brazil 12.6.2. Argentina 12.6.3. Colombia 12.6.4. Chile 12.6.5. Rest Of South America 13. Company Profile: Key Players 13.1. China National Tobacco Corporation (CNTC) 13.1.1. Philip Morris International (PMI) 13.1.2. British American Tobacco (BAT) 13.1.3. Japan Tobacco International (JTI) 13.1.4. Imperial Brands 13.1.5. Altria Group 13.1.6. ITC Limited (India) 13.1.7. KT&G (Korea Tobacco & Ginseng Corporation) 13.1.8. Scandinavian Tobacco Group (STG) 13.1.9. Swedish Match 13.1.10. Gudang Garam 13.1.11. Djarum 13.1.12. Bentoel / BAT Indonesia 13.1.13. China Tobacco International 13.1.14. Habanos S.A. 13.1.15. Universal Corporation 13.1.16. Alliance One International 13.1.17. Godfrey Phillips India (GPI) 13.1.18. NTC Industries Ltd. 13.1.19. Reynolds American Inc. (RAI) 13.1.20. Neman Grodno Tobacco Factory 13.1.21. Dhaka Tobacco Industries 13.1.22. Surya Nepal Pvt. Ltd. 13.1.23. Ceylon Tobacco Company 13.1.24. Tabacalera / Altadis 13.1.25. Philip Morris Japan 13.1.26. Philip Morris Korea 13.1.27. British American Tobacco Kenya 13.1.28. Tobacco Authority of Thailand (TOAT) 13.1.29. Myanmar Rothmans Company Overview 13.1.30. Business Portfolio 13.1.31. Financial Overview 13.1.32. SWOT Analysis 13.1.33. Strategic Analysis 13.1.34. Recent Developments 13.2. China National Tobacco Corporation (CNTC) 13.3. Philip Morris International (PMI) 13.4. British American Tobacco (BAT) 13.5. Japan Tobacco International (JTI) 13.6. Imperial Brands 13.7. Altria Group 13.8. ITC Limited (India) 13.9. KT&G (Korea Tobacco & Ginseng Corporation) 13.10. Scandinavian Tobacco Group (STG) 13.11. Swedish Match 13.12. Gudang Garam 13.13. Djarum 13.14. Bentoel / BAT Indonesia 13.15. China Tobacco International 13.16. Habanos S.A. 13.17. Universal Corporation 13.18. Alliance One International 13.19. Godfrey Phillips India (GPI) 13.20. NTC Industries Ltd. 13.21. Reynolds American Inc. (RAI) 13.22. Neman Grodno Tobacco Factory 13.23. Dhaka Tobacco Industries 13.24. Surya Nepal Pvt. Ltd. 13.25. Ceylon Tobacco Company 13.26. Tabacalera / Altadis 13.27. Philip Morris Japan 13.28. Philip Morris Korea 13.29. British American Tobacco Kenya 13.30. Tobacco Authority of Thailand (TOAT) 13.31. Myanmar Rothmans 14. Key Findings 15. Analyst Recommendations