The global Submarine Power Cables Market size was valued at 20 billion in 2024, and the total Submarine Power Cables Market revenue is expected to grow by 10.51% from 2025 to 2032, reaching nearly USD 44.49 billion.Submarine Power Cables Market Overview

A submarine power cable is an electrical cable that transmits electrical power under bodies of water. This cable has multiple sophisticated materials, insulation, and protection systems to help it to operate dependably in a challenging subsea environment. Submarine power cable is crucial for the connections between power grids and electricity trading between nations, and for the interconnection of renewable energy generated from offshore locations.To know about the Research Methodology :- Request Free Sample Report In submarine power cable market report, we have witnessed a significant growth in the Submarine Power Cables Market due to a global shift to renewable energy, including making investments in offshore wind farms, increased interconnections to the electrical grid connections to help with decarbonization and enhance energy security due to raising energy prices and reducing energy per capita. With international hostilities prompting uncertainty in fossil fuel supply and dependence, various governments and energy companies are investing in subsea cable projects, looking to decarbonize energy systems, improve energy supply efficiency, and provide a reliable electricity supply between regions. The submarine cable technology has evolved from single-core designs to high-voltage direct current (HVDC) design and alternatives current (AC) systems that have a longer life expectancy, deeper embedding and developed smart monitoring systems. Suppliers have introduced new materials, including cross-linked polyethylene (XLPE) insulation and improved installation systems that enhance the transmission capacity and life expectancy. There is a solid pipeline in Europe and North America with demand for offshore wind energy growing rapidly, with grid modernization efforts gaining momentum as well. In the Asia-Pacific region, particularly in China, Japan, and Taiwan, demand will be driven by key renewable energy targets, more interregional energy (including trade), and government-led infrastructure funding support. Across the influence of demand, key market players are Prysmian Group, Nexans, NKT A/S, Sumitomo Electric and Tesmec. They have been advancing through R&D in high-capacity cables, installation and maintenance systems with robotics and lighter designs. Opportunities are also expanding for connections along interconnectors between countries, putting offshore energy hubs together, and further offshore projects with deep-water deployment capabilities. Rising Global Renewable Energy Investments to Drive the Growth of the Submarine Power Cables Market The increasing push towards renewable energy, specifically offshore wind generation and intercontinental grid connections, is driving demand for submarine power cables. Government agencies and energy companies are committed to creating transmission infrastructure to move power generated from renewable sources hundreds of miles away from consumption, and are investing heavily in underwater transmission. As a result of the increased innovation, investment, and expansion of renewable energy availability, high-capacity submarine cables have clearly seen considerable growth. Grid Modernisation and Cross-Border Interconnections to Drive Market Growth An increasing desire for energy security and grid reliability is stimulating huge investment in subsea interconnectors between countries and regions. Subsea cables improve energy diversity, allow for electricity trading, and can provide backup supply when there are ultimately disruptions on the grid. Also, initiatives for regional and transnational smart grids will continue to create large demands for reliable submarine cable systems. Technical Complexities and High Installation Costs to Restrain Market Growth The high initial cost of submarine cables, which includes the cost of specialized installation vessels, monitoring devices, and marine surveys, requires considerable capital, and remains the key hurdle to growth into the market. Technical difficulties, such as problems with installation in deep water, environmental challenges, and limitations on maintenance, may also restrict growth - particularly for developing economies with limited funds. Advancements in Cable Technology and Materials to Create Growth Opportunities Current research and development with high-voltage direct current (HVDC) technology, new insulation materials, and improved performing protective coatings will all increase the overall efficiency and longevity and reduce the cost of the cable itself. The increasing use of technology, and development of technology, is leading to new applications and potential new market opportunities in very challenging underwater conditions. Emerging Markets and Offshore Wind Expansion to Create Lucrative Opportunities The fast-tracked growth of offshore wind farms in the Asia-Pacific and North America, alongside investments in interregional power links in developing economies, creates a significant opportunity. Government support for renewable energy infrastructure, as well as international agreements on power sharing, is also helping to expand markets in areas that were previously underserved. Environmental Regulations and Permitting Challenges to Restrain Market Growth Some market participants still face challenges due to strict environmental regulations covering marine installations, lengthy permit approval processes, and ecological concerns. Complying with differing international standards and environmental conservation requirements remains a legitimate concern, often delaying projects and increasing project costs.

Submarine Power Cables Market Segment Analysis

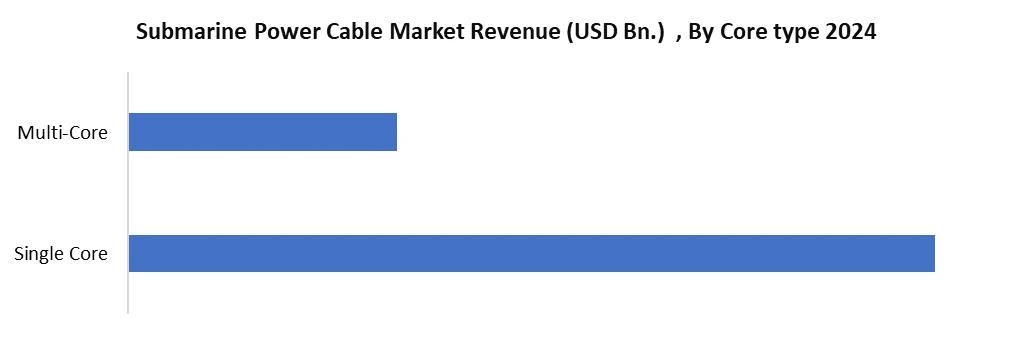

The Submarine Power Cables Market is segmented based on Core Type: Single Core and Multi-Core The single core segment is anticipated to dominate the market and grow at the highest CAGR throughout the forecast period, as they are the go-to design for higher voltage applications such as interconnectors, offshore wind farms, and cross-border/high voltage transmission applications. Single-core cables are ideal for long-distance HVDC and HVAC submarine deployments since they provide much better electrical performance and because only a single core cable must be laid in deep water, which has a smaller risk of failure than cables that have to work in high-stress marine environments. Whereas the multi-core segment is only implemented for shorter transmission distances in offshore oil and gas platforms and inter-platform cabling. Although the multi-core product structure serves specialized applications, it will have a lower share of the overall market due to limited implementation for large-scale power transmission projects.

Submarine Power Cables Market Regional Insights

With regard to the Submarine Power Cables Market share over the forecast period, we expect the Asia-Pacific to dominate the market, followed by Europe and North America. The developing markets in Asia-Pacific are expected to have a significant demonstrable commitment to develop additional offshore wind farms, principally in China, Taiwan, Japan, and South Korea. The area is positioned to make these connections go because the governments are credentialing renewables and create energy security. The area has high economic growth rates, high demand growth for electricity, and significant goals for renewable energy usage. These factors diverge with the need for marine power cable capabilities with intercountry and island connections. Within Europe, the development of submarine power cable installations is relatively mature. It is continuing through advanced development, particularly in the renewable energy market, as well as cross-border cooperation in the energy sector. The North Sea is the centre for wind farm activity and all the related interconnectors linking countries such as the UK, Germany, Norway, and the Netherlands. Again, the restrictiveness of EU policies on decarbonization and energy independence is the main driver of market conditions, making Europe a viable region where technology and projects can be demonstrated. North America is a significant and fast-growing market that is being driven primarily by new offshore wind projects on the northeastern and mid-Atlantic coasts of the U.S. There is both government support and federal targets to increase offshore wind capacity, which is establishing a substantial and growing pipeline of demand for submarine cables, and new projects electrifying islands and improving grid reliability in both Canada and the U.S. In the Middle East and Africa, the adoption of emerging markets is being developed slowly, with focus areas including the delivery of intercountry grid connections to strengthen energy trading and stability for countries that share similar energy demand patterns, as well as island electrification projects and the connection of offshore oil & gas infrastructure. Diminutive in size today, increasing investment in energy infrastructure and renewable projects leads to future opportunities for submarine cable projects. Advances in technology that enhance the performance of High-Voltage Direct Current (HVDC) transmission, increase cable capacity, and develop improved installation techniques are expected to fuel growth in all these markets. The global imperative to transition energy systems and grid interconnections will ensure that reliance on submarine power cables will only grow as they solidify their importance in the world's future energy infrastructure.Submarine Power Cables Market Competitive Landscape:

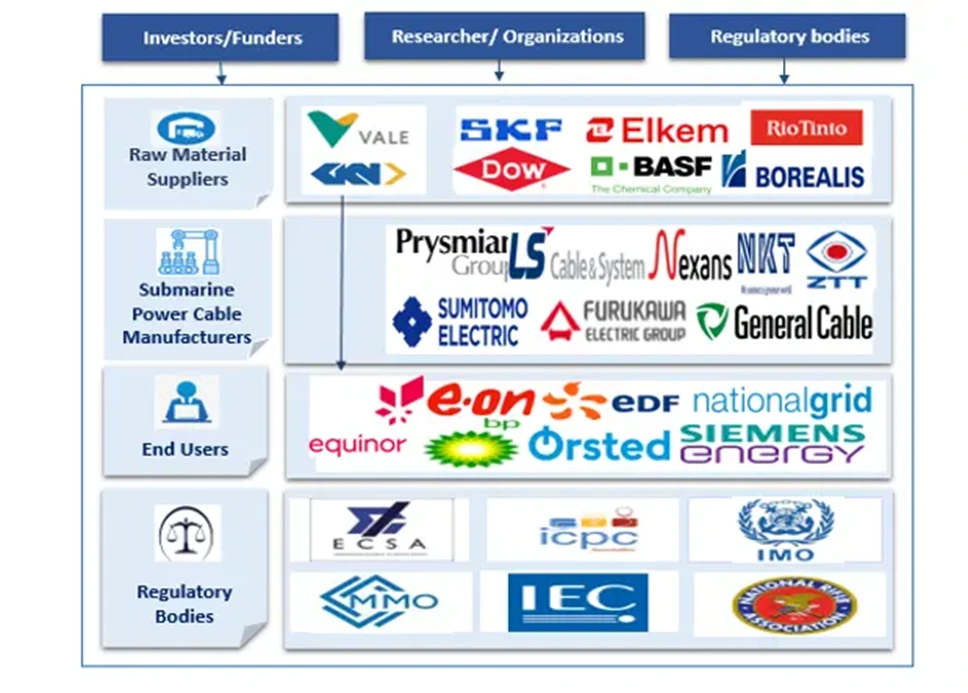

Asian cable manufacturers, particularly Sumitomo Electric (Japan), LS Cable & System (South Korea), and Zhongtian Technology (China), are aggressively expanding into the European and global markets by offering cost-competitive solutions and forming strategic joint ventures with offshore wind developers. Unlike European incumbents that emphasize turnkey solutions and in-house installation fleets, Asian challengers often partner with specialized marine contractors for project execution. Their competitive edge lies in lower manufacturing costs, strong government backing, and rapid scaling capacity, which makes them increasingly attractive for emerging offshore wind markets in Asia-Pacific (Taiwan, Japan, South Korea) and new interconnector projects in the Middle East and Africa. Additionally, Chinese companies such as ZTT and Orient Cable are gaining market share by targeting price-sensitive contracts and leveraging domestic offshore wind expansion to strengthen their expertise before moving into Western markets.Submarine Power Cables Market Key Developments:

• August 2025 – Nexans – Europe – Submarine Power Cables Market Nexans completed the repair of the Estlink 2 subsea interconnector between Finland and Estonia for Fingrid. A 1-km section of cable was replaced offshore, restoring a vital 650 MW connection. This project showcases Nexans' IMR capabilities and facilitates energy security and integration in the European subsea interconnector market. • June 2025 – NKT – Europe – Submarine Power Cables Market NKT announced investment in the world's most powerful subsea trencher, the 3,600HP NKT T3600, capable of burying cables to a maximum depth of 5.5 meters. Built with partners in the UK, it improves the protection of cables installed offshore, supports renewable energy ambitions, and helps to build NKT's capabilities as a full-service company in the European Submarine Power Cables Market. • August 2025 – Sumitomo Electric – Europe – Submarine Power Cables Market Sumitomo Electric was selected as the preferred bidder by National Grid for the 525kV Sea Link HVDC cable project, which was to be a 138 km subsea connection between Suffolk and Kent. Production of the cable will take place at the new factory being built by Sumitomo Electric at Port of Nigg in the UK, providing support for the upgrade of the UK’s grid, support for clean energy goals, and support for the development of a local supply chain.Submarine Power Cables Market Key Trends:

• Significant Investment in Offshore Wind Energy Infrastructure The biggest trend in our industry is the unprecedented global movement towards offshore wind farms, bringing billions of Euros in contracts for cable manufacturers. Large energy developers and transmission system operators, including TenneT, Ørsted, and National Grid, are heavily investing in large-scale projects mainly in Europe. The €1.8+ billion contract awarded by TenneT to Prysmian for grid connections in Germany and Nexans' contract to connect the Hornsea 3 farm in the UK are a testament to this trend. This trend has resulted in a pipeline of work for many years to come. The offshore wind sector is also creating opportunities for new manufacturing capacity for companies like Prysmian, which are building new specialized manufacturing facilities, given the amount of new work in North America and the Asia-Pacific region as well and Europe. • Policy Determining Focus on Interconnectors for Energy Security and Grid Stability In addition to developing offshore wind farms, much of the strategic focus is on deploying High-Voltage Direct Current (HVDC) submarine cables for international interconnectors. While these may seem like simply connecting to wind farms to share power, projects like this allow the national grids of separate countries to connect, share power, balance with renewables, and generate energy security. The successful early commissioning of the Sea Link interconnector between Great Britain and Ireland by Nexans is a great example, or ZTT's project in about a year connecting Chile to Brownsville, Texas. Submarine Power Cable Industry Ecosystem

Scope of the Submarine Power Cables Market report: Inquire before buying

Global Submarine Power Cables Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 20 Bn. Forecast Period 2025 to 2032 CAGR: 10.51% Market Size in 2032: USD 44.49 Bn. Segments Covered: by Type AC DC by Conductor Material Copper Aluminium by Core Type Single Core Multi-Core by Voltage Up to 66 KV 66 KV-220 KV Above 220 KV by End User Offshore Wind Power Generation Offshore Oil & Gas Island Connection Wave & Tidal Power Generation Submarine Power Cable Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Submarine Power Cable Market, Key Players:

North America 1. General Cable (North America) 2. Southwire Company, LLC (North America) Europe 1. Prysmian Group (Europe) 2. Nexans SA (Europe) 3. NKT A/S (Europe) 4. Hellenic Cables S.A. (Europe) 5. TF Kable (Europe) 6. Alcatel Submarine Networks (Europe) 7. ABB Ltd. (Europe) Asia-Pacific 1. Sumitomo Electric Industries, Ltd. (Asia-Pacific) 2. LS Cable & System Ltd. (Asia-Pacific) 3. Hengtong Group Co., Ltd. (Asia-Pacific) 4. ZTT Group (Asia-Pacific) 5. Ningbo Orient Wires & Cables Co., Ltd. (Asia-Pacific) 6. Furukawa Electric Co., Ltd. (Asia-Pacific) 7. VISCAS Corporation (Asia-Pacific) 8. KEI Industries Limited (Asia-Pacific) 9. Fujikura Ltd. (Asia-Pacific) 10. NEC Corporation (Asia-Pacific) 11. Taihan Electric Wire Co., Ltd. (Asia-Pacific)Frequently Asked Questions

1. What are the growth drivers for the Submarine Power Cables Market? Ans. The increasing deployment of offshore renewable energy sources, such as wind, wave, and tidal installations, drives the demand for submarine power cables. These cables are essential for transmitting electricity generated offshore to mainland grids, supporting the growth of renewable energy projects. 2. What are the major restraints for the Submarine Power Cables Market growth? Ans. Price sensitivity among consumers may limit the market penetration of Submarine Power cables due to their higher cost. 3. Which region is expected to lead the global Submarine Power Cables Market during the forecast period? Ans. Asia Pacific is expected to lead the global Submarine Power Cables Market during the forecast period. 4. What is the projected market size and growth rate of the Submarine Power Cables Market? Ans. The Submarine Power Cables Market size was valued at USD 20 billion in 2024, and the total revenue is expected to grow at a CAGR of 10.51% from 2025 to 2032, reaching nearly USD 44.49 billion by 2032. 5. What segments are covered in the Submarine Power Cables Market report? Ans. The Submarine Power Cable report covers Type, Core Type, Voltage, Conductor Material, End-Use, and Region.

1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Submarine Power Cables Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Submarine Power Cables Market: Dynamics 3.1. Region-wise Trends of Submarine Power Cables Market 3.1.1. North America Submarine Power Cables Market Trends 3.1.2. Europe Submarine Power Cables Market Trends 3.1.3. Asia Pacific Submarine Power Cables Market Trends 3.1.4. Middle East and Africa Submarine Power Cables Market Trends 3.1.5. South America Submarine Power Cables Market Trends 3.2. Submarine Power Cables Market Dynamics 3.2.1. Global Submarine Power Cables Market Drivers 3.2.1.1. Offshore wind 3.2.1.2. HVDC 3.2.1.3. Interconnection 3.2.2. Global Submarine Power Cables Market Restraints 3.2.3. Global Submarine Power Cables Market Opportunities 3.2.3.1. Renewables 3.2.3.2. Offshore Storage 3.2.4. Global Submarine Power Cables Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Submarine Power Cables Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 4.1.1. AC 4.1.2. DC 4.2. Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 4.2.1. Copper 4.2.2. Aluminum 4.3. Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 4.3.1. Single Core 4.3.2. Multi-Core 4.4. Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 4.4.1. Up to 66KV 4.4.2. 66KV-220 KV 4.4.3. Above 220 KV 4.5. Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 4.5.1. OFFSHORE WIND POWER GENERATION 4.5.2. Offshore Oil and Gas 4.5.3. Island Connection 4.5.4. Wave and Tidal Power Generation 4.6. Submarine Power Cables Market Size and Forecast, By Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Submarine Power Cables Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 5.1.1. AC 5.1.2. DC 5.2. North America Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 5.2.1. Copper 5.2.2. Aluminum 5.3. North America Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 5.3.1. Single Core 5.3.2. Multi-Core 5.4. North America Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 5.4.1. Up to 66KV 5.4.2. 66KV-220 KV 5.4.3. Above 220 KV 5.5. North America Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 5.5.1. OFFSHORE WIND POWER GENERATION 5.5.2. Offshore Oil and Gas 5.5.3. Island Connection 5.5.4. Wave and Tidal Power Generation 5.6. North America Submarine Power Cables Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 5.6.1.1.1. AC 5.6.1.1.2. DC 5.6.1.2. United States Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 5.6.1.2.1. Copper 5.6.1.2.2. Aluminum 5.6.1.3. United States Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 5.6.1.3.1. Single Core 5.6.1.3.2. Multi-Core 5.6.1.4. United States Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 5.6.1.4.1. Up to 66KV 5.6.1.4.2. 66KV-220 KV 5.6.1.4.3. Above 220 KV 5.6.1.5. United States Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 5.6.1.5.1. OFFSHORE WIND POWER GENERATION 5.6.1.5.2. Offshore Oil and Gas 5.6.1.5.3. Island Connection 5.6.1.5.4. Wave and Tidal Power Generation 5.6.2. Canada 5.6.2.1. Canada Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 5.6.2.1.1. AC 5.6.2.1.2. DC 5.6.2.2. Canada Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 5.6.2.2.1. Copper 5.6.2.2.2. Aluminum 5.6.2.3. Canada Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 5.6.2.3.1. Single Core 5.6.2.3.2. Multi-Core 5.6.2.4. Canada Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 5.6.2.4.1. Up to 66KV 5.6.2.4.2. 66KV-220 KV 5.6.2.4.3. Above 220 KV 5.6.2.5. Canada Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 5.6.2.5.1. OFFSHORE WIND POWER GENERATION 5.6.2.5.2. Offshore Oil and Gas 5.6.2.5.3. Island Connection 5.6.2.5.4. Wave and Tidal Power Generation 5.6.3. Mexico 5.6.3.1. Mexico Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 5.6.3.1.1. AC 5.6.3.1.2. DC 5.6.3.2. Mexico Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 5.6.3.2.1. Copper 5.6.3.2.2. Aluminum 5.6.3.3. Mexico Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 5.6.3.3.1. Single Core 5.6.3.3.2. Multi-Core 5.6.3.4. Mexico Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 5.6.3.4.1. Up to 66KV 5.6.3.4.2. 66KV-220 KV 5.6.3.4.3. Above 220 KV 5.6.3.5. Mexico Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 5.6.3.5.1. OFFSHORE WIND POWER GENERATION 5.6.3.5.2. Offshore Oil and Gas 5.6.3.5.3. Island Connection 5.6.3.5.4. Wave and Tidal Connection 6. Europe Submarine Power Cables Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.2. Europe Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.3. Europe Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.4. Europe Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.5. Europe Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6. Europe Submarine Power Cables Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.1.2. United Kingdom Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.1.3. United Kingdom Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.1.4. United Kingdom Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.1.5. United Kingdom Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6.2. France 6.6.2.1. France Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.2.2. France Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.2.3. France Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.2.4. France Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.2.5. France Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.3.2. Germany Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.3.3. Germany Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.3.4. Germany Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.3.5. Germany Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.4.2. Italy Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.4.3. Italy Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.4.4. Italy Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.4.5. Italy Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.5.2. Spain Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.5.3. Spain Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.5.4. Spain Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.5.5. Spain Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.6.2. Sweden Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.6.3. Sweden Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.6.4. Sweden Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.6.5. Sweden Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6.7. Russia 6.6.7.1. Russia Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.7.2. Russia Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.7.3. Russia Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.7.4. Russia Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.7.5. Russia Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 6.6.8.2. Rest of Europe Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 6.6.8.3. Rest of Europe Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 6.6.8.4. Rest of Europe Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 6.6.8.5. Rest of Europe Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7. Asia Pacific Submarine Power Cables Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.3. Asia Pacific Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.4. Asia Pacific Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.5. Asia Pacific Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6. Asia Pacific Submarine Power Cables Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.1.2. China Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.1.3. China Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.1.4. China Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.1.5. China Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.2.2. S Korea Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.2.3. S Korea Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.2.4. S Korea Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.2.5. S Korea Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.3.2. Japan Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.3.3. Japan Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.3.4. Japan Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.3.5. Japan Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.4. India 7.6.4.1. India Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.4.2. India Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.4.3. India Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.4.4. India Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.4.5. India Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.5.2. Australia Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.5.3. Australia Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.5.4. Australia Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.5.5. Australia Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.6.2. Indonesia Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.6.3. Indonesia Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.6.4. Indonesia Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.6.5. Indonesia Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.7.2. Malaysia Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.7.3. Malaysia Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.7.4. Malaysia Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.7.5. Malaysia France Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.8. Philippines 7.6.8.1. Philippines Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.8.2. Philippines Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.8.3. Philippines Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.8.4. Philippines Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.8.5. Philippines Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.9. Thailand 7.6.9.1. Thailand Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.9.2. Thailand Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.9.3. Thailand Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.9.4. Thailand Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.9.5. Thailand Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.10. Vietnam 7.6.10.1. Vietnam Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.10.2. Vietnam Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.10.3. Vietnam Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.10.4. Vietnam Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.10.5. Vietnam Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 7.6.11. Rest of Asia Pacific 7.6.11.1. Rest of Asia Pacific Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 7.6.11.2. Rest of Asia Pacific Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 7.6.11.3. Rest of Asia Pacific Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 7.6.11.4. Rest of Asia Pacific Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 7.6.11.5. Rest of Asia Pacific Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 8. Middle East and Africa Submarine Power Cables Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 8.3. Middle East and Africa Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 8.4. Middle East and Africa Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 8.5. Middle East and Africa Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 8.6. Middle East and Africa Submarine Power Cables Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 8.6.1.2. South Africa Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 8.6.1.3. South Africa Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 8.6.1.4. South Africa Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 8.6.1.5. South Africa Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 8.6.2.2. GCC Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 8.6.2.3. GCC Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 8.6.2.4. GCC Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 8.6.2.5. GCC Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 8.6.3. Egypt 8.6.3.1. Egypt Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 8.6.3.2. Egypt Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 8.6.3.3. Egypt Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 8.6.3.4. Egypt Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 8.6.3.5. Egypt Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 8.6.4. Nigeria 8.6.4.1. Nigeria Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 8.6.4.2. Nigeria Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 8.6.4.3. Nigeria Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 8.6.4.4. Nigeria Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 8.6.4.5. Nigeria Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 8.6.5. Rest of ME&A 8.6.5.1. Rest of ME&A Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 8.6.5.2. Rest of ME&A Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 8.6.5.3. Rest of ME&A Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 8.6.5.4. Rest of ME&A Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 8.6.5.5. Rest of ME&A Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 9. South America Submarine Power Cables Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 9.2. South America Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 9.3. South America Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 9.4. South America Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 9.5. South America Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 9.6. South America Submarine Power Cables Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 9.6.1.2. Brazil Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 9.6.1.3. Brazil Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 9.6.1.4. Brazil Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 9.6.1.5. Brazil Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 9.6.2.2. Argentina Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 9.6.2.3. Argentina Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 9.6.2.4. Argentina Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 9.6.2.5. Argentina Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 9.6.3. Colombia 9.6.3.1. Colombia Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 9.6.3.2. Colombia Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 9.6.3.3. Colombia Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 9.6.3.4. Colombia Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 9.6.3.5. Colombia Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 9.6.4. Chile 9.6.4.1. Chile Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 9.6.4.2. Chile Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 9.6.4.3. Chile Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 9.6.4.4. Chile Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 9.6.4.5. Chile Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 9.6.5. Rest of South America 9.6.5.1. Rest of South America Submarine Power Cables Market Size and Forecast, By Type (2024-2032) 9.6.5.2. Rest of South America Submarine Power Cables Market Size and Forecast, By Conductor Material (2024-2032) 9.6.5.3. Rest of South America Submarine Power Cables Market Size and Forecast, By Core Type (2024-2032) 9.6.5.4. Rest of South America Submarine Power Cables Market Size and Forecast, By Voltage (2024-2032) 9.6.5.5. Rest of South America Submarine Power Cables Market Size and Forecast, By End Use (2024-2032) 10. Company Profile: Key Players 10.1. Prysmian Group (Europe) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. General Cable (North America) 10.3. Southwire Company, LLC (North America) 10.4. Nexans SA (Europe) 10.5. NKT A/S (Europe) 10.6. Hellenic Cables S.A. (Europe) 10.7. TF Kable (Europe) 10.8. Alcatel Submarine Networks (Europe) 10.9. ABB Ltd. (Europe) 10.10. Sumitomo Electric Industries, Ltd. (Asia-Pacific) 10.11. LS Cable & System Ltd. (Asia-Pacific) 10.12. Hengtong Group Co., Ltd. (Asia-Pacific) 10.13. ZTT Group (Asia-Pacific) 10.14. Ningbo Orient Wires & Cables Co., Ltd. (Asia-Pacific) 10.15. Furukawa Electric Co., Ltd. (Asia-Pacific) 10.16. VISCAS Corporation (Asia-Pacific) 10.17. KEI Industries Limited (Asia-Pacific) 10.18. Fujikura Ltd. (Asia-Pacific) 10.19. NEC Corporation (Asia-Pacific) 10.20. Taihan Electric Wire Co., Ltd. (Asia-Pacific) 11. Key Findings 12. Industry Recommendations 13. Submarine Power Cables Market: Research Methodology