Global Sterility Testing Market size was valued at USD 1.32 Billion in 2023 and the total Sterility Testing Market revenue is expected to grow at 10.25 % from 2024 to 2030, reaching nearly USD 2.61 Billion. Sterility testing is a crucial process that ensures the absence of viable microorganisms in pharmaceutical products, such as viruses, bacteria, or contaminants. The sterility testing market is essential for verifying the quality and safety of pharmaceutical products by confirming the absence of viable microorganisms.To know about the Research Methodology :- Request Free Sample Report The Sterility Testing Market is dedicated to evaluating and guaranteeing the sterility of pharmaceutical and medical products, playing a vital role in quality control to ensure their freedom from harmful microorganisms. This process is essential for maintaining patient safety and adhering to quality standards in the pharmaceutical and healthcare industries. The surge in point-of-care (POC) device adoption presents lucrative opportunities, providing affordable and accessible testing solutions. The Software & Services segment is experiencing the highest Compound Annual Growth Rate (CAGR), underscoring the increasing importance of advanced analytical services. The Asia-Pacific region is evolving into a prominent center for drug discovery and development, expecting a growth rate of 9.3% CAGR in the forecast period from 2024-2030. Key industry influencers such as Rigaku Corporation, Molecular Dimensions, QIAGEN, Bruker Corporation, and Thermo Fisher Scientific are instrumental in shaping the competitive landscape. Their substantial contributions, combined with the consistent growth of the biotherapeutics market, set the stage for robust growth in the Sterility Testing Market in 2023 and the forecast period.

Sterility Testing Market Dynamics:

The increasing Number of Drug Launches boosts the Sterility Testing market growth The Sterility Testing Market is witnessing growth driven by a surge in the number of drug launches and a growing demand for sterilized products. Global trend for the Sterility Testing Market is influenced by safety concerns related to intricate manufacturing processes and product characteristics. The sterility testing market growth is further propelled by the increasing severity of infections, rising demands for drugs and vaccines, and ongoing research and development in life sciences. For instance, in 2023, the Indian Government introduced the Quadrivalent Human Papillomavirus vaccine (qHPV) to combat cervical cancer, developed jointly by the Serum Institute of India and the DBT India. Also, the Sterility Testing industry benefits from the upsurge in healthcare research and the availability of Point of Care (POC) Devices. These devices, including blood glucose monitors and pregnancy tests, offer cost-effective options for at-home use, contributing to the overall market growth. Government Regulation for Sterility Testing Market Drives the Market Growth Government regulations are a significant driver behind the substantial growth observed in the Sterility Testing Market. Severe regulatory frameworks established by governmental bodies create a compelling environment, fostering acquiescence with sterility testing standards and contributing to market growth. Strict necessities mandated by global health authorities, including the FDA and the European Medicines Agency (EMA), play a pivotal role in shaping the industry landscape. These regulations are particularly crucial for pharmaceutical manufacturers and other industries, ensuring adherence to necessary sterility standards. Consequently, major players in the sterility testing market are compelled to invest in advanced technologies and methodologies to meet these regulatory standards effectively. The impact of government regulations in upholding elevated standards of sterility and safety across various sectors acts as a driving force behind the growth of the Sterility Testing Market. The Rise in the Sterility Testing Unit Price and the Increasing Cost of Raw Materials The escalation in the unit price of sterility testing and the rising expenses associated with raw materials pose restraints that could block the growth of the sterility testing market. These factors contribute to the overall operational expenditures for companies engaged in sterility testing, potentially resulting in elevated prices for testing services and products. Consequently, market participants encounter difficulties in maintaining competitive pricing and providing cost-effective solutions. The increasing costs of raw materials further contribute to production expenses, potentially affecting profit margins and overall sterility testing market competitiveness. The significance of adept cost management and operational efficiency in the sterility testing market, as companies strive to navigate the impact of heightened unit prices and material costs on their operations and market positioning.Establishment of Medical Infrastructures Offers Greater Opportunity for Sterility Testing Market The number of medical facilities opening globally is expected to generate a better opportunity to increase the demand for sterilized equipment. With the expansion of the healthcare infrastructure, the need for efficient and reliable Sterility Testing becomes increasingly important, which, in turn, directly impacts the growth of the sterility testing market globally. Market growth will be assisted by government initiatives such as the 'Production Linked Incentive (PLI) Scheme for Medical Devices and the establishment of medical parks, which provide a greater opportunity for the growth of the Sterility Testing industry.

Sterility Testing Market Segment Analysis:

By Product Type, sterility testing is categorized into Kits and Reagents, Instruments, and Services. Kits and Reagents dominate this segment, holding a substantial 52.6% market share. The prevalence of mandatory sterility testing in the pharmaceutical and medical device sectors contributes to the continuous demand for new kits. The dominance of Kits and Reagents is expected to persist due to frequent kit purchases, user-friendly nature, and cost-effectiveness. Notably, advancements in the medical field have enhanced the efficiency of kits, delivering results within 5 days compared to the 14 days required by instruments and services. The service segment of sterility testing exhibits steady growth with a constant CAGR of 13%, driven by the presence of testing facilities across the USA. Key players such as BioMerieux, Charles River Laboratories, Inc., Merck KGaA, and Sartorius AG are notable contributors to this growth, known for providing high-quality sterility testing services.By Application, Membrane Filtration is dominating the Sterility Testing Market share by 46.2% in 2023 thanks to advancements in membrane filtration design and operations and is expected to continue its dominance over the forecast period. The emphasis on product quality and the introduction of new drugs and medical devices also contribute to the expansion of the Membrane Filtration segment. The sterility testing market is witnessing a rise in demand for connected health solutions, Market is expected to increase their usage of membrane filtration in the coming years. Moreover, Direct Inoculation, Container Closure Integrity Test and Rapid Micro Test are some available testing types which are expected to uplift the Sterility Testing industry size.

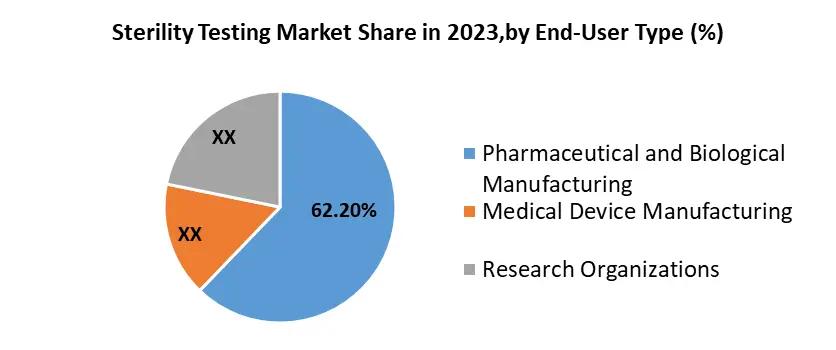

By End-User, Pharmaceutical, and Biological manufacturing commands the market, holding a dominant 67.2% market share, a position expected to sustain. The dominance is attributed to the escalating demand for drugs and vaccines, robust growth in the pharmaceutical industry, and heightened regulatory mandates, including mandatory sterility testing for equipment. The imperative role of sterility testing in mitigating the risk of contamination during the production of pharmaceutical products further reinforces this market dominance. As the field of medicine continues to expand, the frequency of sterility testing is on the rise, consequently amplifying the sterility testing market. Significantly USD 248 billion is allocated to pharmaceutical Research and Development (R&D), underscoring the industry commitment to innovation. The surge in R&D expenditures is expected to drive market growth over the forecast period.

Sterility Testing Market Regional Insights:

North America has 41% of global spending on the pharmaceutical industry, which fuels the expansion of sterility testing with a growing approval rate of new drugs. The United States and Canada hold the largest market share in the market and accounting a major share in 2023. Due to increasing investments in R&D, government initiatives, and advancements in pharmaceutical and biotechnology. The establishment of sterility testing facilities by companies like BioMerieux, Charles River Laboratories, Inc., Merck KGaA, and Sartorius AG fuels the growth of the sterility testing market in the North-America. Asia Pacific region is expected to grow at the fastest CAGR in the sterility testing market over the forecast period. The growth is attributed to the increasing harmonization of regulatory standards with international guidelines, such as those set by the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH), in developing nations and medical advancements from leading countries like India, China and Japan, Etc. and outsourcing medicines and vaccines gave rise to the sterility testing market. Sterility Testing Competitive Landscapes: In April 2023, Milliflex unveiled the Rapid System 2.0, an automated sterility testing kit capable of delivering calibrated test results in just 5 days, a significant reduction compared to the conventional 14-day timeframe. Milliflex harnesses advanced technologies, including membrane filtration, ATP bioluminescence, and image analysis, to achieve these swift results. The automated outcomes provide comprehensive insights in both 2D and 3D formats, accompanied by detailed analyses within a remarkable 90-second timeframe. This innovation marks a substantial advancement in sterility testing efficiency and accuracy, offering a streamlined and rapid solution for industries requiring stringent sterility testing protocols. In April 2023, STEMart, a U.S.-based service provider, launched sterility testing services for all medical devices following the ISO 11731 method. Bioburden Testing assesses the quantity of microorganisms on medical device surfaces, whereas Sterility Testing determines the sterility status of medical devices. Employing Sterility Testing is a preventive measure against false negatives in sterility tests, involving the assessment of bacterial and fungal growth. ISO 11731 outlines the methodology for analyzing the sterilization effectiveness of medical devices. STEMart's introduction of these services aligns with industry standards, providing a comprehensive solution for ensuring the sterility and safety of medical devices.Sterility Testing Market Scope: Inquire before buying

Sterility Testing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.32 Bn. Forecast Period 2024 to 2030 CAGR: 10.25 % Market Size in 2030: US $ 2.61 Bn. Segments Covered: by Product Kits and Reagents Instruments Service by Type In-house Outsourcing by Application Membrane Filtration Direct Inoculation Container Closure Integrity Test Antimicrobial Effectiveness Testing Rapid Micro Test by End-User Pharmaceutical and Biological Manufacturing Medical Device Manufacturing Research Organizations Sterility Testing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sterility Testing Market Key Players:

1. Eurofins Scientific (Luxembourg) 2. SGS SA (Switzerland) 3. Merck KGaA (Germany) 4. Sartorius AG (Germany) 5. bioMérieux SA (France) 6. Nelson Laboratories, LLC (United States) 7. Thermo Fisher Scientific Inc. (United States) 8. Laboratory Corporation of America Holdings (United States) 9. Boston Analytical (United States) 10. Charles River Laboratories (United States) 11. STERIS (United States) 12. Pace Analytical Services, LLC (United States) 13. Toxikon Corporation (United States) 14. Avista Pharma Solutions (United States) 15. North American Science Associates, Inc. (NAMSA)(United States) 16. Microbac Laboratories, Inc. (United States) 17. Gibraltar Laboratories (United States) 18. Pacific Biolabs (United States) 19. Analytical Lab Group (United States) 20. WuXi AppTec (China) FAQs: 1. What are the growth drivers for the Sterility Testing market? Ans. An increasing Number of Drug Launches, Out-Sourcing of Testing Services, and Growth of Pharmaceutical R&D, are expected to be the major drivers for the Sterility Testing market. 2. Which region is expected to lead the global Sterility Testing Market during the forecast period? Ans. North America is expected to lead the global Sterility Testing Market during the forecast period. 3. What is the projected market size and growth rate of the Sterility Testing Market? Ans. The Sterility Testing Market size was valued at USD 1.32 Billion in 2023 and the total Sterility Testing revenue is expected to grow at a CAGR of 10.25% from 2024 to 2030, reaching nearly USD 2.61 Billion by 2030. 4. What segments are covered in the Market report? Ans. The segments covered in the Sterility Testing Market report are By Product, By Type, By Application, By End-use, and Region. 5. What is the study period of the 2D Material Market? Ans: The Global Sterility Testing Market is studied from 2023 to 2030.

1. Sterility Testing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Sterility Testing Market: Dynamics 2.1. Sterility Testing Market Trends by Region 2.1.1. North America Sterility Testing Market Trends 2.1.2. Europe Sterility Testing Market Trends 2.1.3. Asia Pacific Sterility Testing Market Trends 2.1.4. Middle East and Africa Sterility Testing Market Trends 2.1.5. South America Sterility Testing Market Trends 2.2. Sterility Testing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Sterility Testing Market Drivers 2.2.1.2. North America Sterility Testing Market Restraints 2.2.1.3. North America Sterility Testing Market Opportunities 2.2.1.4. North America Sterility Testing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Sterility Testing Market Drivers 2.2.2.2. Europe Sterility Testing Market Restraints 2.2.2.3. Europe Sterility Testing Market Opportunities 2.2.2.4. Europe Sterility Testing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Sterility Testing Market Drivers 2.2.3.2. Asia Pacific Sterility Testing Market Restraints 2.2.3.3. Asia Pacific Sterility Testing Market Opportunities 2.2.3.4. Asia Pacific Sterility Testing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Sterility Testing Market Drivers 2.2.4.2. Middle East and Africa Sterility Testing Market Restraints 2.2.4.3. Middle East and Africa Sterility Testing Market Opportunities 2.2.4.4. Middle East and Africa Sterility Testing Market Challenges 2.2.5. South America 2.2.5.1. South America Sterility Testing Market Drivers 2.2.5.2. South America Sterility Testing Market Restraints 2.2.5.3. South America Sterility Testing Market Opportunities 2.2.5.4. South America Sterility Testing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Sterility Testing Industry 2.8. Analysis of Government Schemes and Initiatives For Sterility Testing Industry 2.9. Sterility Testing Market Trade Analysis 2.10. The Global Pandemic Impact on Sterility Testing Market 3. Sterility Testing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Sterility Testing Market Size and Forecast, by Product (2023-2030) 3.1.1. Kits and Reagents 3.1.2. Instruments 3.1.3. Service 3.2. Sterility Testing Market Size and Forecast, by Type (2023-2030) 3.2.1. In-house 3.2.2. Outsourcing 3.3. Sterility Testing Market Size and Forecast, by Application (2023-2030) 3.3.1. Membrane Filtration 3.3.2. Direct Inoculation 3.3.3. Container Closure Integrity Test 3.3.4. Antimicrobial Effectiveness Testing 3.3.5. Rapid Micro Test 3.4. Sterility Testing Market Size and Forecast, by End User (2023-2030) 3.4.1. Pharmaceutical and Biological Manufacturing 3.4.2. Medical Device Manufacturing 3.4.3. Research Organizations 3.5. Sterility Testing Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Sterility Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Sterility Testing Market Size and Forecast, by Product (2023-2030) 4.1.1. Kits and Reagents 4.1.2. Instruments 4.1.3. Service 4.2. North America Sterility Testing Market Size and Forecast, by Type (2023-2030) 4.2.1. In-house 4.2.2. Outsourcing 4.3. North America Sterility Testing Market Size and Forecast, by Application (2023-2030) 4.3.1. Membrane Filtration 4.3.2. Direct Inoculation 4.3.3. Container Closure Integrity Test 4.3.4. Antimicrobial Effectiveness Testing 4.3.5. Rapid Micro Test 4.4. North America Sterility Testing Market Size and Forecast, by End User (2023-2030) 4.4.1. Pharmaceutical and Biological Manufacturing 4.4.2. Medical Device Manufacturing 4.4.3. Research Organizations 4.5. North America Sterility Testing Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Sterility Testing Market Size and Forecast, by Product (2023-2030) 4.5.1.1.1. Kits and Reagents 4.5.1.1.2. Instruments 4.5.1.1.3. Service 4.5.1.2. United States Sterility Testing Market Size and Forecast, by Type (2023-2030) 4.5.1.2.1. In-house 4.5.1.2.2. Outsourcing 4.5.1.3. United States Sterility Testing Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Membrane Filtration 4.5.1.3.2. Direct Inoculation 4.5.1.3.3. Container Closure Integrity Test 4.5.1.3.4. Antimicrobial Effectiveness Testing 4.5.1.3.5. Rapid Micro Test 4.5.1.4. United States Sterility Testing Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Pharmaceutical and Biological Manufacturing 4.5.1.4.2. Medical Device Manufacturing 4.5.1.4.3. Research Organizations 4.5.2. Canada 4.5.2.1. Canada Sterility Testing Market Size and Forecast, by Product (2023-2030) 4.5.2.1.1. Kits and Reagents 4.5.2.1.2. Instruments 4.5.2.1.3. Service 4.5.2.2. Canada Sterility Testing Market Size and Forecast, by Type (2023-2030) 4.5.2.2.1. In-house 4.5.2.2.2. Outsourcing 4.5.2.3. Canada Sterility Testing Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Membrane Filtration 4.5.2.3.2. Direct Inoculation 4.5.2.3.3. Container Closure Integrity Test 4.5.2.3.4. Antimicrobial Effectiveness Testing 4.5.2.3.5. Rapid Micro Test 4.5.2.4. Canada Sterility Testing Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Pharmaceutical and Biological Manufacturing 4.5.2.4.2. Medical Device Manufacturing 4.5.2.4.3. Research Organizations 4.5.3. Mexico 4.5.3.1. Mexico Sterility Testing Market Size and Forecast, by Product (2023-2030) 4.5.3.1.1. Kits and Reagents 4.5.3.1.2. Instruments 4.5.3.1.3. Service 4.5.3.2. Mexico Sterility Testing Market Size and Forecast, by Type (2023-2030) 4.5.3.2.1. In-house 4.5.3.2.2. Outsourcing 4.5.3.3. Mexico Sterility Testing Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Membrane Filtration 4.5.3.3.2. Direct Inoculation 4.5.3.3.3. Container Closure Integrity Test 4.5.3.3.4. Antimicrobial Effectiveness Testing 4.5.3.3.5. Rapid Micro Test 4.5.3.4. Mexico Sterility Testing Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Pharmaceutical and Biological Manufacturing 4.5.3.4.2. Medical Device Manufacturing 4.5.3.4.3. Research Organizations 5. Europe Sterility Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.2. Europe Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.3. Europe Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.4. Europe Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5. Europe Sterility Testing Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.1.2. United Kingdom Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.1.3. United Kingdom Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.2.2. France Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.2.3. France Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.3.2. Germany Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.3.3. Germany Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.4.2. Italy Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.4.3. Italy Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.5.2. Spain Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.5.3. Spain Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.6.2. Sweden Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.6.3. Sweden Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.7.2. Austria Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.7.3. Austria Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Sterility Testing Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Sterility Testing Market Size and Forecast, by Product (2023-2030) 5.5.8.2. Rest of Europe Sterility Testing Market Size and Forecast, by Type (2023-2030) 5.5.8.3. Rest of Europe Sterility Testing Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Sterility Testing Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Sterility Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Sterility Testing Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.1.2. China Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.1.3. China Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.2.2. S Korea Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.2.3. S Korea Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.3.2. Japan Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.3.3. Japan Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.4.2. India Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.4.3. India Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.5.2. Australia Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.5.3. Australia Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.6.2. Indonesia Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.6.3. Indonesia Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.7.2. Malaysia Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.7.3. Malaysia Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.8.2. Vietnam Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.8.3. Vietnam Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.9.2. Taiwan Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.9.3. Taiwan Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Sterility Testing Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Sterility Testing Market Size and Forecast, by Product (2023-2030) 6.5.10.2. Rest of Asia Pacific Sterility Testing Market Size and Forecast, by Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Sterility Testing Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Sterility Testing Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Sterility Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Sterility Testing Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Sterility Testing Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Sterility Testing Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Sterility Testing Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Sterility Testing Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Sterility Testing Market Size and Forecast, by Product (2023-2030) 7.5.1.2. South Africa Sterility Testing Market Size and Forecast, by Type (2023-2030) 7.5.1.3. South Africa Sterility Testing Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Sterility Testing Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Sterility Testing Market Size and Forecast, by Product (2023-2030) 7.5.2.2. GCC Sterility Testing Market Size and Forecast, by Type (2023-2030) 7.5.2.3. GCC Sterility Testing Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Sterility Testing Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Sterility Testing Market Size and Forecast, by Product (2023-2030) 7.5.3.2. Nigeria Sterility Testing Market Size and Forecast, by Type (2023-2030) 7.5.3.3. Nigeria Sterility Testing Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Sterility Testing Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Sterility Testing Market Size and Forecast, by Product (2023-2030) 7.5.4.2. Rest of ME&A Sterility Testing Market Size and Forecast, by Type (2023-2030) 7.5.4.3. Rest of ME&A Sterility Testing Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Sterility Testing Market Size and Forecast, by End User (2023-2030) 8. South America Sterility Testing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Sterility Testing Market Size and Forecast, by Product (2023-2030) 8.2. South America Sterility Testing Market Size and Forecast, by Type (2023-2030) 8.3. South America Sterility Testing Market Size and Forecast, by Application(2023-2030) 8.4. South America Sterility Testing Market Size and Forecast, by End User (2023-2030) 8.5. South America Sterility Testing Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Sterility Testing Market Size and Forecast, by Product (2023-2030) 8.5.1.2. Brazil Sterility Testing Market Size and Forecast, by Type (2023-2030) 8.5.1.3. Brazil Sterility Testing Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Sterility Testing Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Sterility Testing Market Size and Forecast, by Product (2023-2030) 8.5.2.2. Argentina Sterility Testing Market Size and Forecast, by Type (2023-2030) 8.5.2.3. Argentina Sterility Testing Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Sterility Testing Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Sterility Testing Market Size and Forecast, by Product (2023-2030) 8.5.3.2. Rest Of South America Sterility Testing Market Size and Forecast, by Type (2023-2030) 8.5.3.3. Rest Of South America Sterility Testing Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Sterility Testing Market Size and Forecast, by End User (2023-2030) 9. Global Sterility Testing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Sterility Testing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Eurofins Scientific (Luxembourg) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. SGS SA (Switzerland) 10.3. Merck KGaA (Germany) 10.4. Sartorius AG (Germany) 10.5. bioMérieux SA (France) 10.6. Nelson Laboratories, LLC (United States) 10.7. Thermo Fisher Scientific Inc. (United States) 10.8. Laboratory Corporation of America Holdings (United States) 10.9. Boston Analytical (United States) 10.10. Charles River Laboratories (United States) 10.11. STERIS (United States) 10.12. Pace Analytical Services, LLC (United States) 10.13. Toxikon Corporation (United States) 10.14. Avista Pharma Solutions (United States) 10.15. North American Science Associates, Inc. (NAMSA)(United States) 10.16. Microbac Laboratories, Inc. (United States) 10.17. Gibraltar Laboratories (United States) 10.18. Pacific Biolabs (United States) 10.19. Analytical Lab Group (United States) 10.20. WuXi AppTec (China) 11. Key Findings 12. Industry Recommendations 13. Sterility Testing Market: Research Methodology 14. Terms and Glossary