Global Sports Footwear Market size was valued at USD 187.94 Bn in 2024 and the total Sports Footwear Market revenue is expected to grow at a CAGR of 4.7% from 2025 to 2032, reaching nearly USD 271.39 Bn by 2032.Sports Footwear Market Overview

Sports footwear refers to specialized shoes designed for athletic activities, offering performance-enhancing features like cushioning, stability, traction, and support tailored to specific sports (e.g., running, basketball, soccer). Global sports footwear market has been experiencing robust growth fuelled by rising demand for performance enhancing, comfortable and stylish footwear across athletic, casual and fitness segment supported by increasing health consciousness and sports participation. Asia Pacific dominated sports footwear market in 2024, driven by rapid urbanization, growing disposable income and strong sneaker culture in countries like China, India and Japan alongside region's role as manufacturing hub for major brand. Innovation leader like Nike, Adidas and ASICS are pioneering advanced technology such as energy returning foams, 3D printed midsoles and sustainable material (recycled polyester, plantbased alternatives) to cater to performance and eco conscious consumer. Sports Footwear market thrives on diverse application as running shoes lead demand followed by basketball and lifestyle sneaker while emerging trend like smart footwear with embedded sensor gain traction. This dynamic landscape underscore how sports footwear is evolving with cutting edge design, sustainability initiative and digital integration aligning with modern consumer demand for functionality, fashion and environmental responsibility.To know about the Research Methodology :- Request Free Sample Report

Sports Footwear Market Dynamics

Rising Participation in Sports by Kids and Teenagers to boost Sports Footwear Market Growth The growing participation of kids and teenagers in sports activities serves as a potent driver driving the growth of the sports footwear market. With a surge in interest and involvement in various sports disciplines among the younger demographic, the demand for specialized footwear tailored to different athletic pursuits has escalated significantly. This trend not only translates into heightened market revenue but also contributes to enhanced profit margins for industry players. As more youngsters engage in sports, the need for durable, supportive, and performance-enhancing footwear becomes imperative, fostering innovation and competition within the market landscape. Consequently, manufacturers are strategically capitalizing on this trend by introducing a diverse range of footwear options designed to cater to the specific requirements of different sports, thereby expanding their customer base and augmenting overall market growth. Growing E-Commerce Retail Market to Drive Sports Footwear Market Growth The growth of the e-commerce industry business has resulted in significant changes in customer purchasing and the shift of business from the physical store to the online store. The exponential expansion of the e-commerce retail market has catalyzed profound transformations in consumer purchasing behavior, leading to a notable migration of business operations from brick-and-mortar establishments to online platforms. This paradigm shift has ushered in a countless of opportunities and challenges for businesses across various industries. With the ease of access and convenience offered by online shopping, consumers are increasingly inclined towards digital avenues for their purchases, resulting in a surge in sales volume for e-commerce retailers. Moreover, the streamlined nature of online operations often translates into lower overhead costs compared to maintaining physical storefronts, thereby potentially enhancing profitability. However, this transition also entails adjustments in marketing strategies, supply chain logistics, and customer service infrastructure to effectively capitalize on the burgeoning e-commerce landscape while managing the evolving cost of production to maintain competitive pricing amidst the dynamic market environment. Presence of Counterfeit Products to Restrain Sports Footwear Market The prevalence of counterfeit products poses a significant restraint to the sports footwear market, undermining consumer trust and brand reputation while impeding legitimate businesses' growth. Counterfeit sports footwear not only compromises the quality and performance standards expected by consumers but also creates unfair competition for authentic manufacturers. The proliferation of counterfeit goods in the market not only diminishes the perceived value of genuine products but also poses potential safety risks to consumers. Furthermore, combating counterfeit products requires substantial investment in anti-counterfeiting measures, such as advanced authentication technologies and legal enforcement, thereby escalating operational costs for legitimate businesses. Consequently, the presence of counterfeit products undermines market integrity, hampers revenue potential, and necessitates continuous efforts to safeguard intellectual property rights and maintain consumer confidence within the sports footwear industry.Sports Footwear Market Segment Analysis

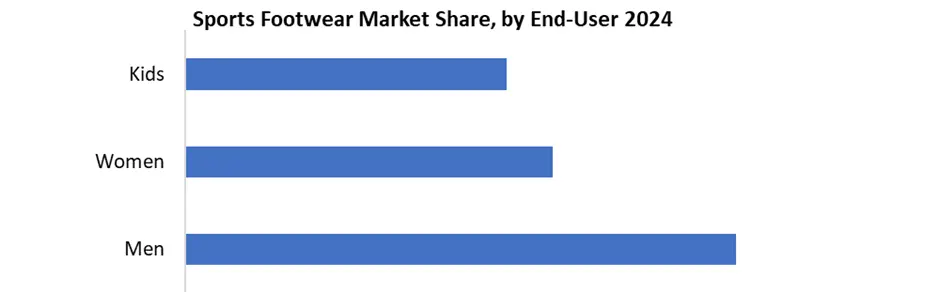

Based on Footwear Type, the dominance of the non-athletics segment in the sports footwear industry signifies a prominent shift in consumer preferences and market dynamics. While athletics footwear remains integral for performance-driven activities, the non-athletics segment encompasses a diverse range of lifestyle and fashion-oriented footwear that caters to broader consumer demographics. This segment includes casual sneakers, lifestyle runners, and fashion-forward designs that resonate with consumers seeking both style and comfort in their everyday footwear choices. Factors such as the rise of athleisure culture, urbanization, and changing fashion trends have driven the growth of the non-athletics segment, eclipsing the traditional dominance of athletics footwear in the market. As a result, manufacturers and retailers are increasingly focusing on expanding their offerings within the non-athletics category, capitalizing on the growing demand for versatile and trendsetting sports-inspired footwear. Based on End User, the men's segment owns the highest footwear market share and is estimated to exhibit a CAGR of 3.9% during the forecast period. Men’s sports footwear accounts for a substantial portion of total sales and profitability for many manufacturers and retailers the inclination of men toward outdoor activities has been boosting the demand for men's footwear. Sports like golf, cricket, hockey, and hiking have always been popular among men. Hence, product launches catering to specific sports categories will help boost the men's footwear market growth. In addition, multifunctional products remain relevant for the men's footwear market. Brands should focus on footwear that merges active and leisurewear attributes. The desire to reconnect with the outdoors continues to influence footwear ranges. Therefore, manufacturers are incorporating performance or outdoors-inspired features and retaining a fashion-driven aesthetic that works well for city pursuits. Several companies wholly dedicate their product lines to women, such as Rothy's, Nisolo, and ABLE. These provide a wide range of products like sandals, wedges, boots, heels, loafers, slip-ons, and sneakers. Women in developed countries, such as the U.S., tend to spend on sustainability because of the growing awareness of eco-friendly products and the rising number of women in the workforce.

Sports Footwear Market Regional Insights

Asia Pacific dominated the Sports Footwear Market with the highest share in 2024, owing to its robust growth, primarily fuelled by increasing disposable incomes, rapid urbanization, and evolving consumer preferences. Among the various segments, athletic and casual footwear are the dominant categories, with a noticeable uptick in demand for sustainable and technologically advanced products. E-commerce platforms have emerged as crucial distribution channels, enhancing market accessibility. However, the market is characterized by intense competition, prompting companies to emphasize innovation and form strategic partnerships to stay competitive. In terms of import-export dynamics, the region witnesses a significant flow of footwear products, contributing to the market's vibrancy. India exports most of its Sport’s shoes to United States, Belgium and Germany. Companies strategically engage in import-export activities to leverage cost efficiencies and tap into new markets, enhancing their profitability. The market's revenue continues to grow, driven by the aforementioned factors and the overall economic growth of the region. • For example, companies like Nike, Adidas, and Puma have established a strong presence in the Asia Pacific region, leveraging their brand reputation and innovative product offerings. These companies have also strategically expanded their manufacturing and distribution networks in the region, further driving their profitability and market share. • The top 3 exporters of Sports shoes are Vietnam with 1,471,097 shipments followed by China with 369,142 and Indonesia at the 3rd spot with 135,461 shipments. • Apache Footwear Ltd Co made 27,534 import and 7,976 export shipments. • Sega International Limited made 133 import shipments. • Marks Spencer Plc made 336,135 import and 157,684 export shipments.Europe is considered a mature market in the sports footwear industry, characterized by a high level of market saturation and intense competition. Despite this maturity, the region continues to be a significant player in the global sports footwear market, driven by strong consumer demand for innovative and fashionable sports footwear products. Key players in the European sports footwear market include Adidas AG, Nike, Inc., and Puma SE, all of which have a strong presence and brand recognition in the region. These companies often leverage their established market positions to introduce new products and technologies, maintaining their competitiveness in the market. Also, the rise of e-commerce has provided new growth opportunities for companies in Europe to expand their reach and increase sales in the sports footwear market. • United Arab Emirates Sports shoes Buyers & importers directory, there are 548 active Sports shoes Importers in United Arab Emirates Importing from 507 Suppliers. • FENG TAY ENTERPRISES CO LTD accounted for maximum import market share with 1,479 shipments followed by ADIDAS EMERGING MARKET FZE 848016 with 1,106 and APACHE FOOTWEAR LTD CO was at the 3rd spot with 788 shipments. • United Kingdom Sports shoes Buyers & importers directory, there are 501 active Sports shoes Importers in United Kingdom Importing from 394 Suppliers. • HOLD GOLD TRADING COMPANY LIMITED accounted for maximum import market share with 11,222 shipments followed by FENG TAY ENTERPRISES CO LTD with 7,862 and FEET BIT INTERNATIONAL COMPANY LIMITED was at the 3rd spot with 1,772 shipments. • Khatri Sports Ltd made 322 import shipment.

Sports Footwear Market Competitive Landscape

In U.S. sports footwear market, Skechers USA, Inc. hold a strong position as a leading lifestyle and performance footwear brand, competing with global giants like Nike, Adidas and Puma which dominate athletic segment with advanced technology and endorsements. Skechers differentiate itself through comfort focused, affordable casual and athleisure footwear appealing to a broad demographic, including older adults and casual wearers. New Balance also competes closely with its performance and retro styles while Under Armour targets fitness enthusiasts with performance driven designs. Emerging brands like Hoka and On Running are gaining traction in the running niche and direct to consumer players like Allbirds focus on sustainability. Skechers’ growth is driven by its diversified product line, strong retail partnerships and marketing strategies though it faces pressure from both premium innovators and value-oriented brands like ASICS and Reebok.Sports Footwear Market Key Trends

• Sustainability & Eco-Friendly Materials: Brands like Adidas (Primegreen) and Nike (Space Hippie) are prioritizing recycled plastics, bio-based foams, and circular design to reduce environmental impact. • Smart & Connected Footwear: Sensor-embedded shoes (e.g., Nike Adapt, Under Armour HOVR) track gait, performance metrics, and real-time feedback via Bluetooth. • Athleisure & Hybrid Designs: Collaborations between sportswear brands and high-end designers (e.g., Gucci x Adidas) blur lines between performance and lifestyle. Sports Footwear Market Key Developments • Adidas AG (Germany) – June 2024: Launched the next-generation Adidas Ultraboost Light X, featuring a 30% lighter Energy Rod system and carbon-infused midsole for enhanced running performance. • Under Armour, Inc. (U.S.) – March 2025: Unveiled the UA Flow Velociti Elite 2, its lightest racing shoe yet, with a new nitrogen-infused midsole for improved energy return, targeting competitive marathoners. • Xtep International Holdings (China) – January 2025: Partnered with Chinese Olympic athletes to release the Xtep 260X 3.0, a carbon-plated running shoe with a proprietary XTEP Ace foam, boosting its presence in performance running. • Mizuno Corporation (Japan) – September 2024: Introduced the Mizuno Wave Rebellion Pro 2, featuring an updated MIZUNO ENERZY Lite++ foam and aggressive rocker geometry for elite marathoners ahead of the Tokyo Marathon. • Lotto Sport Italia (Italy) – May 2024: Revived its classic Lotto Mirage 2000 with modern updates, including a HYPERFOAM midsole, blending retro styling with contemporary performance for lifestyle and tennis markets.Sports Footwear Market Scope: Inquiry Before Buying

Sports Footwear Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 187.94 Bn. Forecast Period 2025 to 2032 CAGR: 4.7% Market Size in 2032: USD 271.39 Bn. Segments Covered: by Footwear Type Athletics Non-Athletics by Distribution Channel Online Offline by End User Men Women Kids Sports Footwear Market by Region:

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Sports Footwear Market Key Players

North America 1. Nike, Inc. (United States) 2. New Balance Athletics, Inc. (United States) 3. Skechers USA, Inc. (United States) 4. Under Armour, Inc. (United States) 5. Puma SE (United States) 6. Converse Inc. (United States) 7. Vans, Inc. (United States) 8. Reebok International Ltd. (United States) 9. ASICS America Corporation (United States) 10. Brooks Sports, Inc. (United States) Europe 11. Adidas AG (Germany) 12. Salomon S.A. (France) 13. Lotto Sport Italia S.p.A. (Italy) 14. Diadora Sport S.r.l. (Italy) 15. Fila Holdings Corporation (Italy) 16. Umbro International (United Kingdom) 17. Hummel International (Denmark) 18. Munich Sports, S.L. (Spain) 19. Kelme (Spain) 20. Hi-Tec Sports (Netherlands) Asia Pacific 21. Li-Ning Company Limited (China) 22. Anta Sports Products Limited (China) 23. Xtep International Holdings Limited (China) 24. Peak Sport Products Co. Limited (China) 25. 361 Degrees International Limited (China) 26. Mizuno Corporation (Japan) 27. ASICS Corporation (Japan) 28. Yonex Co., Ltd. (Japan) 29. Skechers USA, Inc. (Japan) 30. Fila Korea Ltd. (South Korea)Frequently Asked Questions

1. What are the growth drivers for the Sports Footwear Market? Ans. Rising Instances of Sports Activities are driving factors in the Sports Footwear Market. 2. What are the major restraining factors for the Sports Footwear Market growth? Ans. The product counterfeit is a restraining factor of the Sports Footwear Market. 3. Which region is expected to lead the Sports Footwear Market during the forecast period? Ans. Asia Pacific is expected to lead the Sports Footwear Market during the forecast period 4. What is the projected market size and growth rate of the Sports Footwear Market? Ans. The Sports Footwear Market size was valued at USD 187.94 Bn in 2024 and the total Sports Footwear revenue is expected to grow at a CAGR of 4.7, reaching nearly USD 271.39 Bn in 2032. 5. What segments are covered in the Sports Footwear Market report? Ans. The segments covered in the Sports Footwear Market report are Footwear Type, End User, Distribution Channel, and Region.

1. Sports Footwear Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Sports Footwear Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Sports Footwear Market: Dynamics 3.1. Sports Footwear Market Trends 3.1.1. North America Sports Footwear Market Trends 3.1.2. Europe Sports Footwear Market Trends 3.1.3. Asia Pacific Sports Footwear Market Trends 3.1.4. Middle East and Africa Sports Footwear Market Trends 3.1.5. South America Sports Footwear Market Trends 3.2. Global Sports Footwear Market Dynamics 3.2.1. Global Sports Footwear Market Drivers 3.2.1.1. Rising Participation in Sports 3.2.1.2. Growing E-Commerce Retail Market 3.2.2. Global Sports Footwear Market Restraints 3.2.3. Global Sports Footwear Market Opportunities 3.2.4. Global Sports Footwear Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.4.1. Labour Regulations 3.4.2. Consumer Spending 3.4.3. Material Innovations 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Sports Footwear Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 4.1.1. Athletics 4.1.2. Non-Athletics 4.2. Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 4.2.1. Online 4.2.2. Offline 4.3. Sports Footwear Market Size and Forecast, By End-User (2024-2032) 4.3.1. Men 4.3.2. Women 4.3.3. Kids 4.4. Sports Footwear Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Sports Footwear Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 5.1.1. Athletics 5.1.2. Non-Athletics 5.2. North America Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 5.2.1. Online 5.2.2. Offline 5.3. North America Sports Footwear Market Size and Forecast, By End-User (2024-2032) 5.3.1. Men 5.3.2. Women 5.3.3. Kids 5.4. North America Sports Footwear Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 5.4.1.1.1. Athletics 5.4.1.1.2. Non-Athletics 5.4.1.2. United States Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.1.2.1. Online 5.4.1.2.2. Offline 5.4.1.3. United States Sports Footwear Market Size and Forecast, By End-User (2024-2032) 5.4.1.3.1. Men 5.4.1.3.2. Women 5.4.1.3.3. Kids 5.4.2. Canada 5.4.2.1. Canada Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 5.4.2.1.1. Athletics 5.4.2.1.2. Non-Athletics 5.4.2.2. Canada Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.2.2.1. Online 5.4.2.2.2. Offline 5.4.2.3. Canada Sports Footwear Market Size and Forecast, By End-User (2024-2032) 5.4.2.3.1. Men 5.4.2.3.2. Women 5.4.2.3.3. Kids 5.4.3. Mexico 5.4.3.1. Mexico Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 5.4.3.1.1. Athletics 5.4.3.1.2. Non-Athletics 5.4.3.2. Mexico Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.3.2.1. Online 5.4.3.2.2. Offline 5.4.3.3. Mexico Sports Footwear Market Size and Forecast, By End-User (2024-2032) 5.4.3.3.1. Men 5.4.3.3.2. Women 5.4.3.3.3. Kids 6. Europe Sports Footwear Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.2. Europe Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.3. Europe Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Sports Footwear Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.1.2. United Kingdom Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.1.3. United Kingdom Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4.2. France 6.4.2.1. France Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.2.2. France Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.2.3. France Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.3.2. Germany Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.3.3. Germany Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.4.2. Italy Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.4.3. Italy Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.5.2. Spain Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.5.3. Spain Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.6.2. Sweden Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.6.3. Sweden Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.7.2. Russia Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.7.3. Russia Sports Footwear Market Size and Forecast, By End-User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 6.4.8.2. Rest of Europe Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.8.3. Rest of Europe Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7. Asia Pacific Sports Footwear Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.2. Asia Pacific Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.3. Asia Pacific Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Sports Footwear Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.1.2. China Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.1.3. China Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.2.2. S Korea Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.2.3. S Korea Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.3.2. Japan Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.3.3. Japan Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.4. India 7.4.4.1. India Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.4.2. India Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.4.3. India Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.5.2. Australia Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.5.3. Australia Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.6.2. Indonesia Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.6.3. Indonesia Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.7.2. Malaysia Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.7.3. Malaysia Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.8.2. Philippines Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.8.3. Philippines Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.9.2. Thailand Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.9.3. Thailand Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.10.2. Vietnam Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.10.3. Vietnam Sports Footwear Market Size and Forecast, By End-User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.11.3. Rest of Asia Pacific Sports Footwear Market Size and Forecast, By End-User (2024-2032) 8. Middle East and Africa Sports Footwear Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 8.2. Middle East and Africa Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 8.3. Middle East and Africa Sports Footwear Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Sports Footwear Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 8.4.1.2. South Africa Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.1.3. South Africa Sports Footwear Market Size and Forecast, By End-User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 8.4.2.2. GCC Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.2.3. GCC Sports Footwear Market Size and Forecast, By End-User (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 8.4.3.2. Egypt Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.3.3. Egypt Sports Footwear Market Size and Forecast, By End-User (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 8.4.4.2. Nigeria Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.4.3. Nigeria Sports Footwear Market Size and Forecast, By End-User (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 8.4.5.2. Rest of ME&A Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.5.3. Rest of ME&A Sports Footwear Market Size and Forecast, By End-User (2024-2032) 9. South America Sports Footwear Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 9.2. South America Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 9.3. South America Sports Footwear Market Size and Forecast, By End-User (2024-2032) 9.4. South America Sports Footwear Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 9.4.1.2. Brazil Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.1.3. Brazil Sports Footwear Market Size and Forecast, By End-User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 9.4.2.2. Argentina Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.2.3. Argentina Sports Footwear Market Size and Forecast, By End-User (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 9.4.3.2. Colombia Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.3.3. Colombia Sports Footwear Market Size and Forecast, By End-User (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 9.4.4.2. Chile Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.4.3. Chile Sports Footwear Market Size and Forecast, By End-User (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Sports Footwear Market Size and Forecast, By Footwear Type (2024-2032) 9.4.5.2. Rest Of South America Sports Footwear Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.5.3. Rest Of South America Sports Footwear Market Size and Forecast, By End-User (2024-2032) 10. Company Profile: Key Players 10.1. Nike, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. New Balance Athletics, Inc. 10.3. Skechers USA, Inc. 10.4. Under Armour, Inc. 10.5. Puma SE 10.6. Converse Inc. 10.7. Vans, Inc. 10.8. Reebok International Ltd. 10.9. ASICS America Corporation 10.10. Brooks Sports, Inc. 10.11. Adidas AG 10.12. Salomon S.A. 10.13. Lotto Sport Italia S.p.A. 10.14. Diadora Sport S.r.l. 10.15. Fila Holdings Corporation 10.16. Umbro International 10.17. Hummel International 10.18. Munich Sports, S.L. 10.19. Kelme 10.20. Hi-Tec Sports 10.21. Li-Ning Company Limited 10.22. Anta Sports Products Limited 10.23. Xtep International Holdings Limited 10.24. Peak Sport Products Co. Limited 10.25. 361 Degrees International Limited 10.26. Mizuno Corporation 10.27. ASICS Corporation 10.28. Yonex Co., Ltd. 10.29. Skechers USA, Inc. 10.30. Fila Korea Ltd. 11. Key Findings 12. Industry Recommendations 13. Sports Footwear Market: Research Methodology