Global Smart Wiring Devices Market size was valued at USD 8.52 Bn in 2023 and is expected to reach USD 24.43 Bn by 2030, at a CAGR of 12.7%.Smart Wiring Devices Market Overview

Smart wiring devices are designed for users to optimize their energy usage, which helps reduce energy costs and contribute to a more sustainable future. A smart wiring device is an upgraded electronic solution, such as electrical switches, outlets, and other devices, that is integrated with wireless connectivity and remotely controlled via voice commands, a smartphone app, or other network-enabled devices. These devices offer enhanced energy efficiency, convenience, and security for residential, business, and industrial applications.To know about the Research Methodology :- Request Free Sample Report Honeywell Nucleus is a smart home solution designed to be the core of your living space, providing convenience and control. Inspired by the complexity of genetic material, Nucleus transforms homes into personalized environments. With a sleek design, neutral colors, and progressive functionality, it offers familiarity through innovative use cases. The device enables users to control their entire home remotely, managing scenes, devices, and energy usage from anywhere in the world. The solution employs a mesh network for efficient signal transmission. Experience smart living with Honeywell Nucleus, where form meets function for a magical and connected home experience.

Smart Wiring Devices Market Dynamics

Smart Home Trend to Create an Opportunity for Market Growth The trend of smart homes is emerging at a rapid pace. Artificial intelligence integration in smart home appliances for smart features is predicted to increase product demand. In addition, the increasing use of the internet and smartphones is accelerating the development of internet- and smartphone-connected smart home devices. The rapid adoption of contemporary technologies such as the Internet of Things (IoT), smart speech recognition, blockchain, and artificial intelligence (AI), among others, substantially impacted the Smart Wiring Devices Market. This is expected to contribute to the growth of the market for smart wiring devices in the upcoming years. Statistics in Home Automation: The IOT (Internet of Things) trend continues to dominate the home automation sector, and new products are springing up daily. Here are a few hot statistics on home automation. Smart security systems continue to grow. Security systems that are controlled and viewed from mobile devices continue to gobble up market share. It is predicted that by 2023 they reach nearly 25% of the smart home market. The adoption of Smart home devices and rising tech trends influence the home automation Smart Wiring Devices Market. There are more than 175 million smart homes in the world. A smart home is classified as a modern home that is connected with smart wiring devices and/or appliances that are controlled remotely via the internet or apps. Smart thermostats still dominate. The smart thermostat industry is projected to top a value of $12 billion in the next few years. The Growing Needs of Homeowners: The global pandemic forced millions of people back into their homes, and we all had to adjust to a new way of life. The pandemic caused a global seismic rift in the economy and many businesses suffered. But it also spawned other business ideas and created jobs in different sectors. As people sequestered themselves inside, they relied on services to bring them food, medicine, and care. Service providers such as Uber, DoorDash and cable/internet providers are thriving as the work-from-home phenomenon. Home Electrical Trends: Smart Switches technology advances and electrical devices have joined the Internet of Things (IoT), facilitating efficient and seamless communication. Today, smart devices are helping enhance the safety, comfort, convenience, and security of homes and commercial spaces. One of the most helpful and exciting devices changing the technological landscape is the smart switch lighting control. This key factor is expected to propel theSmart Wiring Devices Market growth in the future. Elaborate Architectures: Supporting extra computer equipment, smart devices, smart appliances and networks requires upgrades to the home infrastructure. Here are some concepts and installations that have taken off. Smart panels, Battery storage, Electrical vehicle charger stations, Advances in lighting, numerous distributed devices and Sound systems, security and home automation. The Advent of Iot Enabled HVAC Systems IoT has penetrated the ventilation, heating, and air conditioning (HVAC) industry, resulting in unique and noteworthy improvements. The HVAC sector's collaboration with the Internet of Things has made it possible to regulate appliances remotely and provide greater customer-centric services. This is expected to influence market expansion. For example, HVAC system management, data collection, and cloud data storage are all facilitated by IoT connections. The growth of global smart wiring devices is driven by the increasing adoption of IoT technology from smart homes and buildings. Also, the rising demand for energy efficiency is expected to influence the Smart Wiring Devices Market growth. Smart city development in emerging economies is expected to create lucrative opportunities for the smart wiring devices industry over the forecast period. IoT Privacy and Security Challenges for Smart wiring devices for Home Environments The Internet has grown from a useful research tool for universities into a fundamental utility, as important as electricity, water and gas. There is also a crime that seeks to gain value from the illicit use of that technology or to deny the use of that resource to others. The interconnected nature of the Internet means that Internet resources are attacked from any location in the world, and this makes cybersecurity a key issue. Cybersecurity revolves around three main themes. The increasing adoption of smart homes and buildings is key to the driving factor for the smart wiring devices market. Benefits of Smart Wiring Devices in Home Applications Insurance Perks: Investing in smart home wiring is indeed a winning investment that is fuelling market growth. The property insurance company knows the benefits of upgrading the wiring system to smart wiring. In turn, this has the leverage and enjoy affordable deals and to save money and make houses safer. Makes Your Home Energy Efficient: With smart home technology, is able to access electrical appliances and devices using a remote control. That means no one going back to make sure that the lights are off. It helps in maximizing the efficiency of the system while lowering energy consumption overall. Whole-House Surge Protection: smart home appliances are becoming more popular day by day. Adding a whole-house surge protector is a staple of smart home technology. It acts to protect home appliances from damaging power surges; because distortion in the electricity supply literally “destroys” electrical appliances. Maximizes Home Security: Smart home technology increases the security of the home and is probably the driving force that compels people to invest in it. Connecting cameras, motion detectors, door locks, etc., with the home automation networks, allows you to keep a check on the home in real-time. Home Management Insights: Investing in smart wiring devices and new technologies to boost the demand for smart wiring applications. Smart switches and drivers for robust, highly efficient and reliable automotive and industrial applications. These products combine flexibility, advanced protection and diagnostics through daisy chainable SPI for safe and robust designs. To upgrade the switches to the smart Smart Wiring Devices Market Restrain Factors are: Stringent requirements for quality and delivery: Quality requirements are extremely high, yet delivery schedules are tight. Design changes often happen late in the design process, causing delays. Meanwhile, legislation requiring traceability and documentation puts more pressure on manufacturers to implement continuous verification and validation processes. For example, ISO 26262 requires a certain level of redundancy in wire harnesses for autonomous vehicles. Complex processes and continuous change: The wiring systems in today’s wire harnesses are complex assemblies of multiple harnesses with vast amounts of components and an endless number of possible configurations. All these components must be managed and maintained in a database. To make matters worse, the majority — 80-85% — of wire harness is still handmade. However, the high installation cost for these devices is expected to hinder market growth. Loss of tribal knowledge: When senior designers leave the company or retire, it’s a huge risk. Without a way to capture tribal knowledge comprising organizational IP and best practices that they’ve acquired during their years of hard work, there’s no efficient way to pass it along to new team members. This fact is limited to the Security Threats in the Smart Home: Low margins of wire harness manufacturing has been a low-margin business. Harness manufacturers are under constant cost and price pressure from OEMs looking to reduce their manufacturing expenses, even as material shortages result from supply chain disruption. All of this leads to lower profit margins and tighter budgets.Smart Wiring Devices Market Segmentation

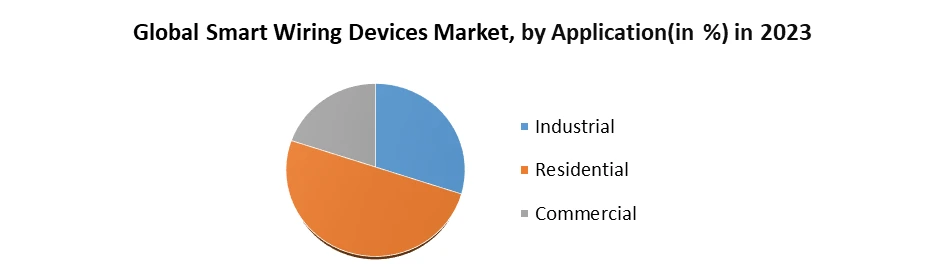

The global market is segmented into product type, application and region. By region market is segmented into North America, Europe, South America, Asia-Pacific and Middle East Africa and their corresponding countries. By Product Type Based on Product type, the Smart Wiring Devices Market is categorized into Smart Dimmers, Switches, Outlets, thermostats, sprinkler controllers, smoke alarms, video doorbells and others. The smart switches segment held the largest market share in 2023. Growth of urbanization, increasing penetration of the Internet and rapid advancement in the Internet of Things (IoT) is facilitating the smart switches segment growth in the market during upcoming years. Smart switches use radio frequency waves to transmit signals and communicate each other and control switches by accessing WIFI with the help of smartphones and tablets. Smart switches work through WI-FI, Bluetooth, Zigbee, Z-wave, proprietary system, and lighting control of the smart switch. It saves energy and feels more comfortable and secure and the adoption of such technology boosts Smart Wiring Devices Market growth. Leviton announced that its second-gen Decora Wi-Fi 2nd Gen Dimmer and Switch have gained Matter support in early 2023. Also makes a dimmer-only version and an on-off-only version of this switch, among others. For those with older homes, Leviton has the Decora No-Neutral Dimmer ($49, Amazon (opens in new tab)) and a No-Neutral Switch ($44, Amazon (opens in new tab)), which work with the Decora Smart Wi-Fi Bridge ($20, Amazon (opens in new tab)); all are compatible with Alexa, HomeKit, and Google Home, and look to be good, less expensive alternatives to Lutron's lineup. By Application Based on Application, the Smart Wiring Devices Market is segmented into industrial, commercial and residential. The residential segment held the largest market share in the global market in 2023. The segment growth is driven by more people using home security systems devices, which employ these gadgets as sporadic cameras with sound-activated feature facilities. In-home automation projects that let users operate various appliances through computers or smartphones employing Z-Wave technology or the ZigBee protocol (LIR).

Smart Wiring Devices Market Regional Insight

Urbanization in North American countries such as the United States, Canada, and Mexico continues to increase due to improved economic conditions. A high standard of living in wealthy countries creates a lucrative opportunity for market growth. Demand for luxurious interiors for commercial and residential buildings has skyrocketed. As a result, it is expected to rise the need for high-tech, multifunctional house interiors, and is expected to be a boom in demand for smart wiring devices in the future years in the area. The U.S. accounts for a dominating position in the smart wiring devices market, due to the presence of key players in this region investing in next-generation Internet of Things solutions. These IoT solutions investment is expected to create a major opportunity for the investor in the future for market growth. For Example, The growing adoption of smart home technology in US households is expected to key driver for market growth. Companies such as Premium Digital Control & Automation in South Florida are already providing smart integrated systems that make customers enjoy their homes and workplaces even more. In Europe, the UK is expected to emerge as one of the fastest-growing countries with a CAGR of 12.7 percent a significant development in the Internet of Things and consumer electronics solutions is expected to fuel the market in the UK. Germany held the largest market in terms of revenue in 2023 and is expected to follow the same trend over the forecast period, which is explained in the report. In Asia-Pacific, China accounted for a dominant market share in 2023. The market growth is driven by an increase in investment by prime players in next-generation smart home automation solutions, which is expected to drive the market in China during the forecast period.Competitive Landscape

The profiles of the major Smart Wiring Devices Market players that have been given in the report include Schneider Electric, Siemens AG, ABB Ltd., Leviton Manufacturing Co Inc., Lutron Electronics Co., Inc., Crestron Electronics, Control4 Corp., Eaton Corporation, Legrand S.A., and Honeywell International Inc. Key market participants gives opportunities for other players prepared to accept the industry's significant risks. The report explains the most recent strategies and advancements implemented by the leading industry participants in the smart wiring devices market. A company must collaborate with the top market leaders, acquire comparatively weaker companies, offer new products and technology to the market, and upgrade current products. The various strategic developments such as key mergers & acquisitions, future capacities, partnerships, financial overviews, collaborations, new product developments, new product launches, and other developments. For example, Schneider collaborated with Sendal, Inc., the healthy home solution that connects smart devices. Under this collaboration, both companies would integrate digital air quality management through Schneider Electric’s Square D X Series Connected Wiring Devices ventilation system with the help of Sendal’s Breathe air quality management solution and intelligent home app to deliver a highly flexible, adaptable system of providing better air quality.Smart Wiring Devices Market Scope: Inquire before buying

Smart Wiring Devices Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.52 Bn. Forecast Period 2024 to 2030 CAGR: 12.7% Market Size in 2029: US $ 24.43 Bn. Segments Covered: by Product Type Smart Dimmers Smart Switches Smart Outlets Smart Thermostat Smart Sprinkler Controllers Smart Smoke Alarms Smart Video Doorbells Others by Application Industrial Residential Commercial Smart Wiring Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Smart Wiring Devices Market, Key players are

1. ABB Ltd. 2. Honeywell International Inc. 3. Control4 Corp 4. Crestron Electronics, Inc. 5. Legrand S.A. 6. Johnson Controls International plc. 7. Lutron Electronics Co., Inc 8. Leviton Manufacturing Co., Inc. 9. LG Electronics 10. Schneider Electric 11. Samsung 12. Apple 13. General Electric 14. Siemens 15. Schneider Electric 16. IDEA SMART By VIMAR 17. Eaton 18. Legrand 19. Panasonic 20. Eaton 21. Leviton 22. Lutron Electronics 23. Signify (Philips) 24. Acuity Brands Lighting 25. Lite-Puter Enterprise 26. Hubbell 27. GE Lighting 28. Bull 29. Orbit Frequently Asked Questions: 1] What is the growth rate of the Global Smart Wiring Devices Market? Ans. The Global Smart Wiring Devices Market is growing at a significant rate of 12.7% during the forecast period. 2] Which region is expected to dominate the Global Smart Wiring Devices Market? Ans. Europe is expected to dominate the Smart Wiring Devices Market during the forecast period. 3] What is the expected Global Smart Wiring Devices Market size by 2030? Ans. The Smart Wiring Devices Market size is expected to reach USD 24.43 Bn by 2030. 4] Which are the top players in the Global Smart Wiring Devices Market? Ans. The major top players in the Global Smart Wiring Devices Market are ABB Ltd., Honeywell International Inc., Control4 Corp and others. 5] What are the factors driving the Global Smart Wiring Devices Market growth? Ans. The increasing adoption of smart homes and buildings is driving the smart wiring devices market. 6] Which country dominated the largest Smart Wiring Devices Market share in 2023? Ans. The United Kingdom held the largest Smart Wiring Devices Market share in 2023.

1. Smart Wiring Devices Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Smart Wiring Devices Market: Dynamics 2.1. Smart Wiring Devices Market Trends by Region 2.1.1. North America Smart Wiring Devices Market Trends 2.1.2. Europe Smart Wiring Devices Market Trends 2.1.3. Asia Pacific Smart Wiring Devices Market Trends 2.1.4. Middle East and Africa Smart Wiring Devices Market Trends 2.1.5. South America Smart Wiring Devices Market Trends 2.2. Smart Wiring Devices Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Smart Wiring Devices Market Drivers 2.2.1.2. North America Smart Wiring Devices Market Restraints 2.2.1.3. North America Smart Wiring Devices Market Opportunities 2.2.1.4. North America Smart Wiring Devices Market Challenges 2.2.2. Europe 2.2.2.1. Europe Smart Wiring Devices Market Drivers 2.2.2.2. Europe Smart Wiring Devices Market Restraints 2.2.2.3. Europe Smart Wiring Devices Market Opportunities 2.2.2.4. Europe Smart Wiring Devices Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Smart Wiring Devices Market Drivers 2.2.3.2. Asia Pacific Smart Wiring Devices Market Restraints 2.2.3.3. Asia Pacific Smart Wiring Devices Market Opportunities 2.2.3.4. Asia Pacific Smart Wiring Devices Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Smart Wiring Devices Market Drivers 2.2.4.2. Middle East and Africa Smart Wiring Devices Market Restraints 2.2.4.3. Middle East and Africa Smart Wiring Devices Market Opportunities 2.2.4.4. Middle East and Africa Smart Wiring Devices Market Challenges 2.2.5. South America 2.2.5.1. South America Smart Wiring Devices Market Drivers 2.2.5.2. South America Smart Wiring Devices Market Restraints 2.2.5.3. South America Smart Wiring Devices Market Opportunities 2.2.5.4. South America Smart Wiring Devices Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Smart Wiring Devices Industry 2.8. Analysis of Government Schemes and Initiatives For Smart Wiring Devices Industry 2.9. The Global Pandemic Impact on Smart Wiring Devices Market 3. Smart Wiring Devices Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2023-2030) 3.1. Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Smart Dimmers 3.1.2. Smart Switches 3.1.3. Smart Outlets 3.1.4. Smart Thermostat 3.1.5. Smart Sprinkler Controllers 3.1.6. Smart Smoke Alarms 3.1.7. Smart Video Doorbells 3.1.8. Others 3.2. Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 3.2.1. Industrial 3.2.2. Residential 3.2.3. Commercial 3.3. Smart Wiring Devices Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Smart Wiring Devices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Smart Dimmers 4.1.2. Smart Switches 4.1.3. Smart Outlets 4.1.4. Smart Thermostat 4.1.5. Smart Sprinkler Controllers 4.1.6. Smart Smoke Alarms 4.1.7. Smart Video Doorbells 4.1.8. Others 4.2. North America Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 4.2.1. Industrial 4.2.2. Residential 4.2.3. Commercial 4.3. North America Smart Wiring Devices Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 4.3.1.1.1. Smart Dimmers 4.3.1.1.2. Smart Switches 4.3.1.1.3. Smart Outlets 4.3.1.1.4. Smart Thermostat 4.3.1.1.5. Smart Sprinkler Controllers 4.3.1.1.6. Smart Smoke Alarms 4.3.1.1.7. Smart Video Doorbells 4.3.1.1.8. Others 4.3.1.2. United States Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Industrial 4.3.1.2.2. Residential 4.3.1.2.3. Commercial 4.3.2. Canada 4.3.2.1. Canada Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 4.3.2.1.1. Smart Dimmers 4.3.2.1.2. Smart Switches 4.3.2.1.3. Smart Outlets 4.3.2.1.4. Smart Thermostat 4.3.2.1.5. Smart Sprinkler Controllers 4.3.2.1.6. Smart Smoke Alarms 4.3.2.1.7. Smart Video Doorbells 4.3.2.1.8. Others 4.3.2.2. Canada Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Industrial 4.3.2.2.2. Residential 4.3.2.2.3. Commercial 4.3.3. Mexico 4.3.3.1. Mexico Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 4.3.3.1.1. Smart Dimmers 4.3.3.1.2. Smart Switches 4.3.3.1.3. Smart Outlets 4.3.3.1.4. Smart Thermostat 4.3.3.1.5. Smart Sprinkler Controllers 4.3.3.1.6. Smart Smoke Alarms 4.3.3.1.7. Smart Video Doorbells 4.3.3.1.8. Others 4.3.3.2. Mexico Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Industrial 4.3.3.2.2. Residential 4.3.3.2.3. Commercial 5. Europe Smart Wiring Devices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3. Europe Smart Wiring Devices Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.1.2. United Kingdom Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.2.2. France Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.3.2. Germany Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.4.2. Italy Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.5.2. Spain Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.6.2. Sweden Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.7.2. Austria Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 5.3.8.2. Rest of Europe Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Smart Wiring Devices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Smart Wiring Devices Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.1.2. China Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.2. China Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) S Korea 6.3.2.1. S Korea Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.2.2. S Korea Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.3.2. Japan Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.4.2. India Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.5.2. Australia Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.6.2. Indonesia Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.7.2. Malaysia Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.8.2. Vietnam Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.9.2. Taiwan Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Smart Wiring Devices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Smart Wiring Devices Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 7.3.1.2. South Africa Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 7.3.1.3. GCC GCC Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 7.3.1.4. GCC Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 7.3.2. Nigeria 7.3.2.1. Nigeria Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 7.3.2.2. Nigeria Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 7.3.3. Rest of ME&A 7.3.3.1. Rest of ME&A Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 7.3.3.2. Rest of ME&A Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 8. South America Smart Wiring Devices Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 8.3. South America Smart Wiring Devices Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 8.3.1.2. Brazil Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 8.3.2.2. Argentina Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Smart Wiring Devices Market Size and Forecast, by Product Type (2023-2030) 8.3.3.2. Rest Of South America Smart Wiring Devices Market Size and Forecast, by Application (2023-2030) 9. Global Smart Wiring Devices Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Smart Wiring Devices Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ABB Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Honeywell International Inc. 10.3. Control4 Corp 10.4. Crestron Electronics, Inc. 10.5. Legrand S.A. 10.6. Johnson Controls International plc. 10.7. Lutron Electronics Co., Inc 10.8. Leviton Manufacturing Co., Inc. 10.9. LG Electronics 10.10. Schneider Electric 10.11. Samsung 10.12. Apple 10.13. General Electric 10.14. Siemens 10.15. Schneider Electric 10.16. IDEA SMART By VIMAR 10.17. Eaton 10.18. Legrand 10.19. Panasonic 10.20. Eaton 10.21. Leviton 10.22. Lutron Electronics 10.23. Signify (Philips) 10.24. Acuity Brands Lighting 10.25. Lite-Puter Enterprise 10.26. Hubbell 10.27. GE Lighting 10.28. Bull 10.29. Orbit 11. Key Findings 12. Industry Recommendations 13. Smart Wiring Devices Market: Research Methodology