The Smart Finance Hardware Market expected to hit USD 21.56 Bn by 2029 from USD 15.17 Bn in 2022 at a CAGR of 5.15 % during the forecast periodSmart Finance Hardware Market Overview

Smart Finance Hardware is a hybrid system that includes both hardware and software technologies. It performs operations through biometric authentication, contactless payment systems and near-field communication. These devices make payments conveniently and eliminate the need for cash or payment cards. Instead, consumers can make payments and other related operations through the smartphone.To know about the Research Methodology :- Request Free Sample Report

Smart Finance Hardware Market Research Methodology

Bottom-up approach has been used to estimate the market size by value and volume. The report includes growth hubs, investment feasibility, restraints, and competitive analysis of the market in five major geographic regions: North America, Asia Pacific, Middle East and Africa, Europe, and South America. The report presents a market analysis through segments such as type and end-user, along with multiple sub-segments. Additionally, the report involves data regarding mergers and acquisitions, as well as partnerships, by major key companies.The Smart Finance Hardware Market data has been collected through primary and secondary research methods. Collected data later analysed by tools such as SWOT, PORTER’s five force model and PESTLE analysis which provides political, social, economic, environmental, technological and legal aspects of the market.Smart Finance Hardware Market Dynamics

Drivers: The growing usage of smart ATMs in banks reduces the waiting time of customers for payments or other services. Also, it does not require any physical identity proof for these services. The system uses a software application to store payment information that can be operated from a smartphone or card. The pandemic exponentially boosts the digitization of financial services. Many top companies foresee opportunities in Smart Finance Hardware Market and came with their products in the market to hold the largest share. Smart Finance machines make financial services automated, which is expected to drive the market during the forecast period. Technology such as the internet of things (IoT) has a wide range of applications. Many banks are deploying IoT in smart finance devices to perform financial operations faster and with ease. Smart finance devices use the integration of data and biosensors for payments through smart ATMs, which can be maintained remotely. The report includes this and other several factors that are expected to drive the Smart Finance Hardware Market. Trends: 1. Customer-centricity and personalization Most governments across the world are promoting the digitization of financial services and deploying smart devices in public and private banks that is expected to drive the Smart Finance Hardware Industry. Change in customer behavior since the pandemic is also a major factor, which is expected to drive the Smart Finance Hardware Market. 2. Advanced risk management The biometric sensor and remote identification in Smart Finance devices eliminate cyber-attacks and reduce the risk of financial fraud. Financial institutions have been constantly working on developing new technologies to secure data from consumers. For this, major key companies are investing a large amount in research and developments that are expected to propel the growth of the Smart Finance Hardware Market. 3. Use of artificial intelligence (AI) to build a digital ecosystem The use of AI is expected to make smart financial services more secure for customer purposes. AI could use bots for service-related queries in banks or any financial organization and process documents through machine learning technology. This eliminates the need for human intervention in these operations, which is the major driver of the Smart Finance Hardware Market. Restraints: Data breaches, changing business models and continuous innovation by competitors are expected to constrain the growth of the Market. The report includes solutions regarding the challenges and factors that are affecting the Smart Finance Hardware Market. For example, address verification services and end-to-end encryptions are useful in avoiding any fraudulent activities in financial services. The Smart Finance Hardware devices are involved with upgraded security features such as biometric authentication and location-based authentication. These high-security features are expected to drive the popularity of Smart Finance Hardware market throughout the forecast period.Smart Finance Hardware Market Regional Insights

North America held the largest share of the Market in 2022. The developed IT infrastructure and major key companies have their origins in the US and the introduction of new technology solutions such as big data in online payments and alternative finance is being used for better financial administration. These factors have been driving the North America Smart Finance Hardware Market. Asia Pacific is expected to grow at a CAGR of 2.8 percent in the Smart Finance Hardware Market throughout the forecast period from 2023 to 2029. The government initiative is the main factor in the digitization of financial services along with the deployment of IoT in banking services. Over the past decade, China has been building a new financial system that is improving the operations of financial organizations, markets and regulations. Such developments are expected to drive the Asia Pacific Smart Finance Hardware Market.

Smart Finance Hardware Market Competitive Landscape

Major Key players in the Smart Finance Hardware industry are Fujitsu ltd, Diebold Nixdorf, NCR Corp., Microchip Technology Inc. and InHand Networks. Recently, on January 18, 2023- Diebold Nixdorf wins the best banking technology solutions provider award. The company's digital-first solutions, including the DN Series ATMs, show the product line's ability to adapt to an ever-changing world of banking and finance. This will definitely be the major factor to drive the Market. The InHand launched their Smart ATM that provides high-speed, reliable and secure wireless connectivity in ATM operations, locates machine faults and reduces downtime and maintenance costs. The InHand smart ATM solution is expected to drive the Smart Finance Hardware Market. The MMR report provides detailed data regarding these organizations in company profiling. Whereas, Fujitsu has acquired a cyber-security firm in New Zealand named, InPhySec. The industries in New Zealand such as defence, public sector and financial services now have access to Fujitsu’s digital transformation services and solutions.Smart Finance Hardware Market Segment Analysis:

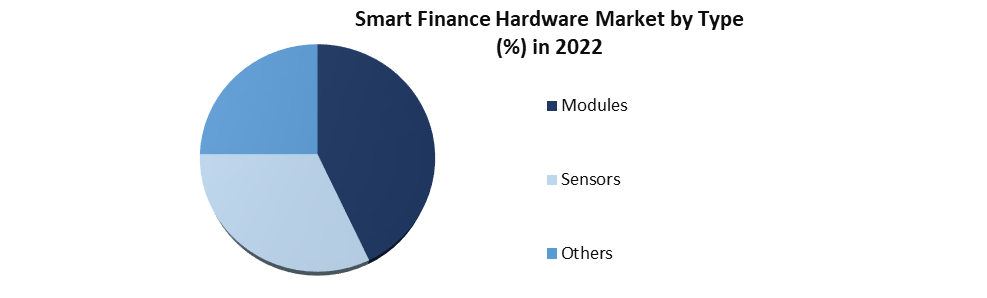

Based on type, the module segment is expected to dominate the Market. The growing adoption of smart ATMs by financial organizations for fast services is expected to drive the module segment in Market Industry. Smart ATMs involve IoT modules for communication, processing and data acquisition. These are the main performing operations that are driving the segment in Market. The growing usage of biometric, risk-based and location-based authentication is expected to drive the sensors, sub-segment of based on types. The smart ATMs and other devices used for authentications are equipped with high-quality wireless sensors, which are driving the share of sub-segment, Sensors during the forecast period. All financial organizations are adopting Market machines as a part of changing business models. The increased industry of Smart Finance Hardware is expected to increase share of the Smart Finance Hardware Market’s segments and sub-segments. Based on the end-user, Bank and financial organizations are the dominating sub-segments and independent ATM deployer is the second largest sub-segment in the Smart Finance Hardware Market. The growing Market is directly affecting the growth in both the end-user segments positively. The Market report involves a detailed analysis of the segment’s growth through authentic information.Market Scope: Inquiry Before Buying

Smart Finance Hardware Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 15.17 Bn. Forecast Period 2023 to 2029 CAGR: 5.15 % Market Size in 2029: US $ 21.56 Bn. Segments Covered: by Product 1.Modules 2.Sensors 3.Others by Type 1. Bank and Financial Institutions 2. Independent ATM Deployer Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Market Key Players include:

1. Fujitsu 2. Miles Technologies 3. Digi International Inc. 4. Diebold Nixdorf 5. InHand Networks 6. Microchip Technology Inc. 7. Multi-Tech Systems, Inc. 8. Intel Corp. 9. OptConnect Management, LLC 10. NCR Corp. 11. IMS Evolve 12. KT Corp. 13. Fiserv 14. Total System Services 15. FIS Frequently Asked Questions: 1] What is the growth rate of the Market? Ans. The Market is growing at a CAGR of 5.15% during the forecast period. 2] Which region is expected to dominate the Market? Ans. North America is expected to dominate the Smart Finance Hardware Market during the forecast period from 2023 to 2029. 3] What is the market size of the Market by 2029? Ans. The size of the Smart Finance Hardware Market by 2029 is expected to reach USD 21.56Bn. 4] Which are the top key players in the Market? Ans. The major key players in the Smart Finance Hardware Market are Digi International Inc., NCR Corporation, Miles Technologies and Fujitsu. 5] What factors are driving the growth of the Market in 2022? Ans. The Smart Finance Hardware Market is expected to grow due to technical advancements in IoT technologies, such as the incorporation of data analysis tools.

1. Smart Finance Hardware Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Smart Finance Hardware Market: Dynamics 2.1. Smart Finance Hardware Market Trends by Region 2.1.1. North America Smart Finance Hardware Market Trends 2.1.2. Europe Smart Finance Hardware Market Trends 2.1.3. Asia Pacific Smart Finance Hardware Market Trends 2.1.4. Middle East and Africa Smart Finance Hardware Market Trends 2.1.5. South America Smart Finance Hardware Market Trends 2.2. Smart Finance Hardware Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Smart Finance Hardware Market Drivers 2.2.1.2. North America Smart Finance Hardware Market Restraints 2.2.1.3. North America Smart Finance Hardware Market Opportunities 2.2.1.4. North America Smart Finance Hardware Market Challenges 2.2.2. Europe 2.2.2.1. Europe Smart Finance Hardware Market Drivers 2.2.2.2. Europe Smart Finance Hardware Market Restraints 2.2.2.3. Europe Smart Finance Hardware Market Opportunities 2.2.2.4. Europe Smart Finance Hardware Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Smart Finance Hardware Market Drivers 2.2.3.2. Asia Pacific Smart Finance Hardware Market Restraints 2.2.3.3. Asia Pacific Smart Finance Hardware Market Opportunities 2.2.3.4. Asia Pacific Smart Finance Hardware Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Smart Finance Hardware Market Drivers 2.2.4.2. Middle East and Africa Smart Finance Hardware Market Restraints 2.2.4.3. Middle East and Africa Smart Finance Hardware Market Opportunities 2.2.4.4. Middle East and Africa Smart Finance Hardware Market Challenges 2.2.5. South America 2.2.5.1. South America Smart Finance Hardware Market Drivers 2.2.5.2. South America Smart Finance Hardware Market Restraints 2.2.5.3. South America Smart Finance Hardware Market Opportunities 2.2.5.4. South America Smart Finance Hardware Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Smart Finance Hardware Industry 2.8. Analysis of Government Schemes and Initiatives For Smart Finance Hardware Industry 2.9. Smart Finance Hardware Market Trade Analysis 2.10. The Global Pandemic Impact on Smart Finance Hardware Market 3. Smart Finance Hardware Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 3.1.1. Modules 3.1.2. Sensors 3.1.3. Others 3.2. Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 3.2.1. Bank and Financial Institutions 3.2.2. Independent ATM Deployer 3.3. Smart Finance Hardware Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Smart Finance Hardware Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 4.1.1. Modules 4.1.2. Sensors 4.1.3. Others 4.2. North America Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 4.2.1. Bank and Financial Institutions 4.2.2. Independent ATM Deployer 4.3. North America Smart Finance Hardware Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 4.3.1.1.1. Modules 4.3.1.1.2. Sensors 4.3.1.1.3. Others 4.3.1.2. United States Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 4.3.1.2.1. Bank and Financial Institutions 4.3.1.2.2. Independent ATM Deployer 4.7.2. Canada 4.3.2.1. Canada Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 4.3.2.1.1. Modules 4.3.2.1.2. Sensors 4.3.2.1.3. Others 4.3.2.2. Canada Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 4.3.2.2.1. Bank and Financial Institutions 4.3.2.2.2. Independent ATM Deployer 4.7.3. Mexico 4.3.3.1. Mexico Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 4.3.3.1.1. Modules 4.3.3.1.2. Sensors 4.3.3.1.3. Others 4.3.3.2. Mexico Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 4.3.3.2.1. Bank and Financial Institutions 4.3.3.2.2. Independent ATM Deployer 5. Europe Smart Finance Hardware Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.2. Europe Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3. Europe Smart Finance Hardware Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.1.2. United Kingdom Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3.2. France 5.3.2.1. France Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.2.2. France Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.3.2. Germany Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.4.2. Italy Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.5.2. Spain Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.6.2. Sweden Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.7.2. Austria Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 5.3.8.2. Rest of Europe Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6. Asia Pacific Smart Finance Hardware Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.7. Asia Pacific Smart Finance Hardware Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.1.2. China Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.2.2. S Korea Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.3.2. Japan Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.4. India 6.3.4.1. India Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.4.2. India Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.5.2. Australia Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.6.2. Indonesia Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.7.2. Malaysia Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.8.2. Vietnam Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.9.2. Taiwan Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 6.3.10.2. Rest of Asia Pacific Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 7. Middle East and Africa Smart Finance Hardware Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 7.7. Middle East and Africa Smart Finance Hardware Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.3.1.1. South Africa Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 7.3.1.2. South Africa Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 7.7.2. GCC 7.3.2.1. GCC Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 7.3.2.2. GCC Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 7.7.3. Nigeria 7.3.3.1. Nigeria Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 7.3.3.2. Nigeria Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 7.3.4.2. Rest of ME&A Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 8. South America Smart Finance Hardware Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 8.2. South America Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 8.7. South America Smart Finance Hardware Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 8.3.1.2. Brazil Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 8.3.2.2. Argentina Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Smart Finance Hardware Market Size and Forecast, by Product (2022-2029) 8.3.3.2. Rest Of South America Smart Finance Hardware Market Size and Forecast, by Type (2022-2029) 9. Global Smart Finance Hardware Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Smart Finance Hardware Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Fujitsu 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Miles Technologies 10.3. Digi International Inc. 10.4. Diebold Nixdorf 10.5. InHand Networks 10.6. Microchip Technology Inc. 10.7. Multi-Tech Systems, Inc. 10.8. Intel Corp. 10.9. OptConnect Management, LLC 10.10. NCR Corp. 10.11. IMS Evolve 10.12. KT Corp. 10.13. Fiserv 10.14. Total System Services 10.15. FIS 11. Key Findings 12. Industry Recommendations 13. Smart Finance Hardware Market: Research Methodology 14. Terms and Glossary