Scent Beads Market size was valued at USD 4.50 Billion in 2024 and the total Global Scent Beads Market revenue is expected to grow at a CAGR of 7.2% from 2025 to 2032, reaching nearly USD 7.85 Billion.Scent Beads Market Overview

Scent beads are small, fragrance-infused beads designed to release pleasant aromas when exposed to air. They are commonly used in laundry, air fresheners, and decorative scent diffusers. Global scent beads market has been growing significantly, which is inspired by growing consumer demand for long -lasting and premium fragrance products, especially in laundry and home care applications. Major drivers include increasing focus on hygiene, developing lifestyle and innovation in microencapsulation and fragrance distribution technologies. North America dominated the market in 2024, headed by prominent players such as Proctor & Gamble, Henkel Corporation and SC Johnson, with strong brand portfolio such as Downey, Purex and Glade. the largest market shares due to the popularity of the in-wash fragrance booster in the washing care segment. Development of environmentally friendly, hypoallergenic and multi-functional fragrance beads, as well as expanding to the emerging markets in Asia-Pacific. With increasing consumer interest in durable and essential oil-based aroma, demand is expected to increase further. Major players are investing in product innovation, digital marketing and retail expansion to increase consumer preferences.To know about the Research Methodology :- Request Free Sample Report

Scent Beads Market Dynamics

Home Fragrance Trends and Wellness Awareness to Drive Market Growth Growing Focus on Home Fragrance and Personal Wellness to Boost Market Growth The shift in lifestyle patterns including remote working, online learning and reduced travel due to factors such as the COVID-19 pandemic, has resulted in people spending more time at home. As a result, individuals are growing up seeking ways to make their living spaces more comfortable, inviting and enjoyable. Scent beads offer an easy and affordable means to transform the atmosphere within the home, creating a pleasant and soothing environment that aligns with personal well-being. Scent beads provide a customizable fragrance experience, enabling individuals to choose scents that resonate with their preferences and needs. This personalization is an essential aspect of the growing home fragrance market. Consumers have chosen from a broad range of scents, from invigorating citrus to calming herbal blends, tailoring the ambiance to suit their desires and enhance their well-being. Scent beads come in several visually appealing designs and packaging options. Manufacturers have recognized the importance of aesthetics and have created products that seamlessly blend with home decor. This makes scent beads functional and an attractive addition to interior spaces. The combination of fragrance and aesthetics improves the overall sensory experience, contributing to personal wellness. Aromatherapy is holistic healing that uses fragrances to encourage physical as well as psychological well-being and has grown in acceptance. Consumers are becoming more conscious of the therapeutic benefits of necessary oils and they realize scent beads as a suitable way to assimilate aromatherapy into their daily routines. Innovation in Product Offerings and Designs to Fuel Scent Beads Market Growth Consumer preferences are continually changing, and the demand for new and exciting fragrances and designs keeps rising. Innovative product offerings allow manufacturers to stay ahead of these preferences, providing a wider range of tastes and needs. By introducing unique scents and designs, companies have captured the attention of consumers looking for novel and appealing options. Innovative scent bead products and designs set brands apart from competitors. When a company introduces distinctive fragrances, shapes, or packaging, it has to create a unique selling proposition that attracts customers and builds brand loyalty. Scent beads are often used as decorative elements in homes and cars. Innovative designs improve their visual appeal, making them more attractive to consumers. Elegant and eye-catching packaging or bead shapes that complement interior decor contribute to the product's desirability, boosting consumers to display them prominently. Innovative product offerings have included seasonal or limited-edition scent beads tied to holidays, seasons, or special occasions. These offerings create a sense of urgency and excitement among consumers, driving sales and fostering brand engagement. With rising environmental consciousness, the introduction of eco-friendly and sustainable scent bead options is a substantial innovation driver. Biodegradable beads, recycled packaging and sustainable sourcing of fragrance materials resonate with environmentally aware consumers. Environmental Concerns and Sustainability to Restraint Scent Beads Market Growth Many traditional scent beads are made from synthetic materials, primarily plastics, which are non-biodegradable. The persistence of these plastics in the environment contributes to plastic pollution, which has become a global environmental calamity. Concerns about microplastics, plastic waste in oceans and its impact on ecosystems have delicate consumer awareness. Consumers are increasingly aware of the environmental footprint of products they purchase. As awareness grows, individuals make more environmentally responsible choices and seek products with minimal environmental impact. This shift in consumer sentiment has led to reduced demand for traditional and non-sustainable scent beads. Regulatory bodies and governments in several regions are realising stricter rules and regulations to address plastic waste and encourage sustainability. This has included restrictions on the use of certain materials, the need for eco-friendly packaging, and measures to encourage recycling and reduce single-use plastics.Scent Beads Market Segment Analysis

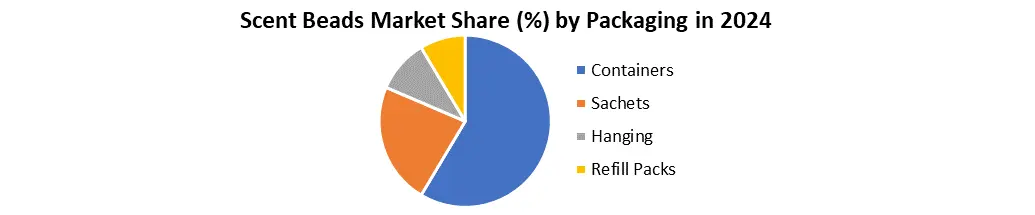

Based on Product Type, the market is segmented into Gel Beads, Wax Beads, Plastic Beads and Paper Beads. Gel Beads dominated the Scent Beads Market in 2024 and is expected to continue its dominance over the forecast period. Gel Beads are celebrated for their significant longevity in emitting fragrance. Distinct from some other scent bead Product Types that have lost their aroma relatively quickly, gel beads release scent gradually over an extended period. This enduring freshness resonates with consumers who want a consistent and long-lasting fragrance experience in their living spaces. Gel Beads are highly versatile in their End Users. They have been placed in several settings such as living rooms, bedrooms, bathrooms, and even automobiles. The flexibility of gel beads to adapt to different environments makes them a preferred choice for consumers looking to maintain a pleasant ambiance throughout their homes. Gel Beads often come in visually appealing translucent or transparent forms. This aesthetic quality improves their decorative value. Consumers appreciate the decorative aspect of gel beads, as they not only refresh the air but also contribute to the overall aesthetics of their spaces. The gel beads' attractive appearance aligns with the desire to beautify living areas while enjoying pleasant scents. Based on the Packaging Type, the market is segmented into Containers, Sachets, Hanging and Refill Packs. Containers dominated the scent beads market in 2024 and is expected to hold the are expected to hold the largest market share during the forecast period. Containers, often made from clear or translucent materials such as glass or plastic, provide consumers with a visually appealing way to experience scent beads. The transparency allows consumers to see the colorful or uniquely shaped beads inside, creating a visually pleasing and sensory-rich experience. The aesthetic appeal aligns with the desire for home decor that combines functionality with beauty. Containers are designed for reusability. After the initial supply of scent beads is used, consumers can conveniently refill the container with new beads. This aspect aligns with sustainability trends, as it reduces the requirement for single-use packaging and minimizes waste. Environmentally aware consumers appreciate the eco-friendly nature of containers. Containers offer a sealed and secure environment for scent beads. This inclusion is instrumental in preserving the fragrance and extending its longevity. By preventing rapid evaporation or dissipation of the scent, containers ensure a consistent and long-lasting fragrance experience. Consumers value containers for their capability to maintain the potency of the fragrance over time, reducing the necessity for frequent replacements. Containers are highly versatile and adaptable to several settings within the home.

Scent Beads Market Regional Insights

North America dominated the market in 2024 & is expected to hold largest share during the forecast period. North American consumers have a strong preference for creating pleasant and inviting indoor environments. The desire for well-scented homes and workplaces has driven the demand for home fragrances including scent beads. Many North Americans use scent beads to improve the environment of their living spaces and to mask unpleasant odors. The North American market provides a wide variety of fragrance options, providing to the diverse preferences of consumers. Scent bead manufacturers often introduce new and appealing fragrances to capture the interest of consumers, contributing to the Scent Beads Market growth. Companies in North America have been proactive in marketing and promoting scent beads. These products are often prominently displayed in retail stores, making them easily available to consumers. Effective marketing campaigns and product placement strategies have contributed to the popularity of scent beads in the region. The relatively high disposable income levels in North America enable consumers to spend on products that enhance their quality of life. Scent beads, being affordable and offering a long-lasting fragrance, have found favor among consumers who are willing to invest in home fragrance solutions. Scent Beads Market Competitive Landscape Major Key Players in Scent Beads Market are Procter & Gambal, Henkel Corporation, SC Johnson & Son, Inc., from backbone of the scent beads market. P&G holds a major position through its products such as Downey achieves unstoppable and fireworks. The company's giant distribution network, constant product innovation, and strong brand recognition enable it to maintain a competitive edge. P&G user takes advantage of consumer insight and advanced fragrance technologies to increase experience and brand loyalty. Henkel Corporation mainly competes through its Purex Crystal Line, targeting conscious consumers of the budget with inexpensive yet effective fragrant-laundering products. Henkel emphasizes value-operated innovation and has a strong retail appearance in North America and Europe. Increasing traction of the brand in online sales channels also supports its market appearance. SC Johnson & Son, Inc. The fragrance of the house with its glade and air care product lines keeps itself strongly in the segment. While the fragrance of completely laundry has not been focused on beads, the company's fragrance distribution system and specialization in marketing strategies give it competitive advantage in nearby markets. Scent Beads Market TrendsScent Beads Market Key Development • In 15 February 2024 Procter & Gamble (North America) launched a new variant of Downy Unstoppables in the U.S., offering extended 24-hour scent release. The product features upgraded microcapsule technology for long-lasting freshness. • In 10 April 2024 SC Johnson & Son, Inc. (North America) introduced Glade Beads in Germany and the UK, expanding its home air care portfolio. The product targets consumers seeking continuous, non-electric fragrance solutions. • In 18 March 2025 Reckitt Benckiser (Europe) launched Air Wick Scent Beads in the UK, infused with natural essential oils. The product offers a sustainable, flameless option for continuous home fragrance. • In 9 May 2025 Lion Corporation (Asia Pacific) launched premium laundry fragrance beads under its “Top Super Nanox” brand in Japan. The beads offer long-lasting freshness with antibacterial and deodorizing properties. • In 22 January 2025 Kao Corporation (Asia Pacific) expanded its Attack Beads product line in Japan with new variants featuring antibacterial and deodorizing functions. The updated formula enhances fabric freshness while targeting odor-causing bacteria.

Trend Description Rise in Premium Scented Products Growing consumer preference for long-lasting, luxury fragrance beads Eco-Friendly & Sustainable Formulations Increasing demand for biodegradable and plant-based scent bead ingredients. E-commerce Channel Expansion Surge in online sales via platforms like Amazon, Walmart, and brand websites. Scent Beads Market Scope: Inquiry Before Buying

Scent Beads Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.50 Bn. Forecast Period 2025 to 2032 CAGR: 7.2% Market Size in 2032: USD 7.85 Bn. Segments Covered: by Product Type Gel Beads Wax Beads Plastic Beads Paper Beads by Fragrance Type Floral Fruity Woody\Earthy Spicy Others by Packaging Type Containers Sachets Hanging Refill Packs by End-Users Residential Consumers Hospitality Industry Automotive Hospital and Healthcare Others by Distribution Channel Retail Stores E-commerce Direct Sales Scent Beads Market by Region

North America (United Packaging Types, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Scent Beads Market Key Players

North America 1. Procter & Gamble (USA) 2. Henkel Corporation (USA) 3. SC Johnson & Son, Inc. (USA) 4. Church & Dwight Co., Inc. (USA) 5. Bliss Fragrance (USA) 6. Gain (P&G brand) (USA) Europe 7. Unilever (UK/Netherlands) 8. RB (Reckitt Benckiser) (UK) 9. Lenor (Germany/UK) 10. Symrise AG (Germany) 11. Givaudan SA (Switzerland) 12. Firmenich (Switzerland) 13. Robertet Group (France) 14. Sensient Technologies (Germany/France) Asia-Pacific 15. Kao Corporation (Japan) 16. Lion Corporation (Japan) 17. LG Household & Health Care (South Korea) 18. Pigeon Corporation (Japan) 19. Marico Limited (India) 20. Godrej Consumer Products Ltd. (India) 21. Shanghai Jahwa United Co., Ltd. (China) Middle East & Africa 22. Alokozay Group (UAE) 23. Saudi Industrial Detergents Co. (SIDCO) (Saudi Arabia) 24. Aspen Fine Chemicals (South Africa) South America 25. Natura &Co (Brazil)Frequently Asked Questions

Q1: What was the value of the global Scent Beads Market in 2024? Ans: Global Scent Beads Market was valued at USD 4.50 billion in 2024. Q2: Which product type dominated the Scent Beads Market in 2024? Ans: Gel Beads dominated due to their long-lasting fragrance and aesthetic appeal. Q3: Which region held the largest market share in 2024? Ans: North America led the market, driven by strong demand for in-wash fragrance boosters. Q4: What is one major factor driving market growth? Ans: Increasing focus on home fragrance and personal wellness. Q5: Which company launched a new variant of Downy Unstoppables in February 2024? As: Procter & Gamble introduced the product with upgraded 24-hour scent-release technology.

1. Scent Beads Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Scent Beads Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Packaging Type Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Scent Beads Market: Dynamics 3.1. Region wise Trends of Scent Beads Market 3.1.1. North America Scent Beads Market Trends 3.1.2. Europe Scent Beads Market Trends 3.1.3. Asia Pacific Scent Beads Market Trends 3.1.4. Middle East and Africa Scent Beads Market Trends 3.1.5. South America Scent Beads Market Trends 3.2. Scent Beads Market Dynamics 3.2.1. Global Scent Beads Market Drivers 3.2.1.1. Rising home fragrance demand 3.2.1.2. Advancements in fragrance technology 3.2.1.3. Growing hygiene awareness 3.2.2. Global Scent Beads Market Restraints 3.2.3. Global Scent Beads Market Opportunities 3.2.3.1. Smart home integration 3.2.3.2. E-commerce retail growth 3.2.4. Global Scent Beads Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Import-export regulatory shifts 3.4.2. Rising disposable income levels 3.4.3. Home ambiance preference rise 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Scent Beads Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Scent Beads Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Gel Beads 4.1.2. Wax Beads 4.1.3. Plastic Beads 4.1.4. Paper Beads 4.2. Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 4.2.1. Floral 4.2.2. Fruity 4.2.3. Woody/Earthy 4.2.4. Spicy Others 4.3. Scent Beads Market Size and Forecast, By Packing Type (2024-2032) 4.3.1. Containers 4.3.2. Sachets 4.3.3. Hanging 4.3.4. Refill Packs 4.4. Scent Beads Market Size and Forecast, By End-Users (2024-2032) 4.4.1. Residential Consumers 4.4.2. Hospitality Industry 4.4.3. Automotive 4.4.4. Hospital and Healthcare 4.4.5. Others 4.5. Scent Beads Market Size and Forecast, By Distribution Channel 4.5.1. Retail Stores 4.5.2. E-commerce 4.5.3. Direct Sales 4.6. Scent Beads Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Scent Beads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Scent Beads Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Gel Beads 5.1.2. Wax Beads 5.1.3. Plastic Beads 5.1.4. Paper Beads 5.2. North America Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 5.2.1. Floral 5.2.2. Fruity 5.2.3. Wood\Earthy 5.2.4. Spicy 5.2.5. Others 5.3. North America Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 5.3.1. Containers 5.3.2. Sachets 5.3.3. Hanging 5.3.4. Refill Packs 5.4. North America Scent Beads Market Size and Forecast, By End-Users (2024-2032) 5.4.1. Residential Consumers 5.4.2. Hospitality Industry 5.4.3. Automotive 5.4.4. Hospital and Healthcare 5.4.5. Others 5.5. North America Scent Beads Market Size and Forecast, by Distribution Channel 5.5.1. Retail Stores 5.5.2. E-commerce 5.5.3. Direct Sales 5.6. North America Scent Beads Market Size and Forecast, by Country (2024-2032) 5.6.1. United Packaging Types 5.6.1.1. United States Scent Beads Market Size and Forecast, By Product Type (2024-2032) 5.6.1.1.1. Gel Beads 5.6.1.1.2. Wax Beads 5.6.1.1.3. Plastic Beads 5.6.1.1.4. Paper Beads 5.6.1.2. United States Scent Beads Market Size and Forecast, By France Type (2024-2032) 5.6.1.2.1. Floral 5.6.1.2.2. Fruity 5.6.1.2.3. Wood\Earthy 5.6.1.2.4. Spicy 5.6.1.2.5. Others 5.6.1.3. United States Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 5.6.1.3.1. Containers 5.6.1.3.2. Sachets 5.6.1.3.3. Hanging 5.6.1.3.4. Refill Packs 5.6.1.4. United States Scent Beads Market Size and Forecast, By End-Users (2024-2032) 5.6.1.4.1. Residential Consumers 5.6.1.4.2. Hospitality Industry 5.6.1.4.3. Automotive 5.6.1.4.4. Hospital and Healthcare 5.6.1.4.5. Others 5.6.1.5. United States Scent Beads Market Size and Forecast, By Distribution Channel (2024-2032) 5.6.1.5.1. Retail Stores 5.6.1.5.2. E-commerce 5.6.1.5.3. Direct Sales 5.6.2. Canada 5.6.2.1. Canada Scent Beads Market Size and Forecast, By Product Type (2024-2032) 5.6.2.1.1. Gel Beads 5.6.2.1.2. Wax Beads 5.6.2.1.3. Plastic Beads 5.6.2.1.4. Paper Beads 5.6.2.2. Canada Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 5.6.2.2.1. Floral 5.6.2.2.2. Fruity 5.6.2.2.3. Wood\Earthy 5.6.2.2.4. Spicy 5.6.2.2.5. Others 5.6.2.3. Canada Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 5.6.2.3.1. Containers 5.6.2.3.2. Sachets 5.6.2.3.3. Hanging 5.6.2.3.4. Refill Packs 5.6.2.4. Canada Scent Beads Market Size and Forecast, By End-Users (2024-2032) 5.6.2.4.1. Residential Consumers 5.6.2.4.2. Hospitality Industry 5.6.2.4.3. Automotive 5.6.2.4.4. Hospital and Healthcare 5.6.2.4.5. Others 5.6.2.5. Canada Scent Beads Market Size and Forecast, By Distribution Channel (2024-2032) 5.6.2.6. Retail Stores 5.6.2.7. E-Commerce 5.6.2.8. Direct Sales 5.6.2.9. Mexico Scent Beads Market Size and Forecast, By Product Type (2024-2032) 5.6.2.9.1. Gel Beads 5.6.2.9.2. Wax Beads 5.6.2.9.3. Plastic Beads 5.6.2.9.4. Paper Beads 5.6.2.10. Mexico Scent Beads Market Size and Forecast, By France Type (2024-2032) 5.6.2.10.1. Floral 5.6.2.10.2. Fruity 5.6.2.10.3. Woody/Earthy 5.6.2.10.4. Spicy 5.6.2.10.5. Others 5.6.2.11. Mexico Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 5.6.2.11.1. Containers 5.6.2.11.2. Sachets 5.6.2.11.3. Hanging 5.6.2.11.4. Refill Packs 5.6.2.12. Mexico Scent Beads Market Size and Forecast, By End-Users (2024-2032) 5.6.2.12.1. Residential Consumers 5.6.2.12.2. Hospitality Industry 5.6.2.12.3. Automotive 5.6.2.12.4. Hospital and Healthcare 5.6.2.12.5. Others 5.6.2.13. Mexico Scent Beads Market Size and Forecast, By Distribution Channel (2024-2032) 5.6.2.13.1. Retail Stores 5.6.2.13.2. E-commerce 5.6.2.13.3. Direct Sales 6. Europe Scent Beads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.3. Europe Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.4. Europe Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.5. Europe Scent Beads Market Size and Forecast, By Distribution Channel (2024-2032) 6.6. Europe Scent Beads Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.1.2. United Kingdom Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.1.3. United Kingdom Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.1.4. United Kingdom Scent Beads Market Size and Forecast, By End-User (2024-2032) 6.6.1.5. United Kingdom Scent Beads Market Size and Forecast, By Distribution Channel (2024-2032) 6.6.2. France 6.6.2.1. France Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.2.2. France Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.2.3. France Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.2.4. France Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.6.2.5. France Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.2.6. 6.6.3. Germany 6.6.3.1. Germany Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.3.2. Germany Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.3.3. Germany Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.3.4. Germany Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.6.3.5. Germany Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.3.6. 6.6.4. Italy 6.6.4.1. Italy Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.4.2. Italy Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.4.3. Italy Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.4.4. Italy Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.6.4.5. Italy Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.5.2. Spain Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.5.3. Spain Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.5.4. Spain Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.6.5.5. Spain Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.6.2. Sweden Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.6.3. Sweden Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.6.4. Sweden Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.6.6.5. Sweden Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.7.2. Austria Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.7.3. Austria Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.7.4. Austria Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.6.7.5. Austria Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Scent Beads Market Size and Forecast, By Product Type (2024-2032) 6.6.8.2. Rest of Europe Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 6.6.8.3. Rest of Europe Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 6.6.8.4. Rest of Europe Scent Beads Market Size and Forecast, By End-Users (2024-2032) 6.6.8.5. Rest of Europe Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7. Asia Pacific Scent Beads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.3. Asia Pacific Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.4. Asia Pacific Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.5. Asia Pacific Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6. Asia Pacific Scent Beads Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.1.2. China Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.1.3. China Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.1.4. China Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.1.5. China Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.2.2. S Korea Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.2.3. S Korea Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.2.4. S Korea Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.2.5. S Korea Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.3.2. Japan Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.3.3. Japan Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.3.4. Japan Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.3.5. Japan Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.4. India 7.6.4.1. India Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.4.2. India Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.4.3. India Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.4.4. India Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.4.5. India Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.5.2. Australia Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.5.3. Australia Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.5.4. Australia Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.5.5. Australia Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.6.2. Indonesia Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.6.3. Indonesia Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.6.4. Indonesia Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.6.5. Indonesia Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.7. Philippines 7.6.7.1. Philippines Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.7.2. Philippines Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.7.3. Philippines Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.7.4. Philippines Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.7.5. Philippines Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.8. Malaysia 7.6.8.1. Malaysia Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.8.2. Malaysia Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.8.3. Malaysia Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.8.4. Malaysia Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.8.5. Malaysia Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.9. Vietnam 7.6.9.1. Vietnam Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.9.2. Vietnam Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.9.3. Vietnam Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.9.4. Vietnam Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.9.5. Vietnam Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.10. Thailand 7.6.10.1. Thailand Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.10.2. Thailand Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.10.3. Thailand Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.10.4. Thailand Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.10.5. Thailand Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 7.6.11. Rest of Asia Pacific 7.6.11.1. Rest of Asia Pacific Scent Beads Market Size and Forecast, By Product Type (2024-2032) 7.6.11.2. Rest of Asia Pacific Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 7.6.11.3. Rest of Asia Pacific Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 7.6.11.4. Rest of Asia Pacific Scent Beads Market Size and Forecast, By End-Users (2024-2032) 7.6.11.5. Rest of Asia Pacific Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 8. Middle East and Africa Scent Beads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Scent Beads Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 8.3. Middle East and Africa Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 8.4. Middle East and Africa Scent Beads Market Size and Forecast, By End-Users (2024-2032) 8.5. Middle East and Africa Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6. Middle East and Africa Scent Beads Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Scent Beads Market Size and Forecast, By Product Type (2024-2032) 8.6.1.2. South Africa Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 8.6.1.3. South Africa Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 8.6.1.4. South Africa Scent Beads Market Size and Forecast, By End-Users (2024-2032) 8.6.1.5. South Africa Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Scent Beads Market Size and Forecast, By Product Type (2024-2032) 8.6.2.2. GCC Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 8.6.2.3. GCC Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 8.6.2.4. GCC Scent Beads Market Size and Forecast, By End-Users (2024-2032) 8.6.2.5. GCC Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Scent Beads Market Size and Forecast, By Product Type (2024-2032) 8.6.3.2. Nigeria Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 8.6.3.3. Nigeria Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 8.6.3.4. Nigeria Scent Beads Market Size and Forecast, By End-Users (2024-2032) 8.6.3.5. Nigeria Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Scent Beads Market Size and Forecast, By Product Type (2024-2032) 8.6.4.2. Rest of ME&A Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 8.6.4.3. Rest of ME&A Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 8.6.4.4. Rest of ME&A Scent Beads Market Size and Forecast, By End-Users (2024-2032) 8.6.4.5. Rest of ME&A Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 9. South America Scent Beads Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Scent Beads Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 9.3. South America Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 9.4. South America Scent Beads Market Size and Forecast, By End-Users (2024-2032) 9.5. South America Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 9.6. South America Scent Beads Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Scent Beads Market Size and Forecast, By Product Type (2024-2032) 9.6.1.2. Brazil Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 9.6.1.3. Brazil Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 9.6.1.4. Brazil Scent Beads Market Size and Forecast, By End-Users (2024-2032) 9.6.1.5. Brazil Scent Beads Market Size and Forecast, By Distribution Chanel (2024-2032) 9.6.1.6. 9.6.2. Argentina 9.6.2.1. Argentina Scent Beads Market Size and Forecast, By Product Type (2024-2032) 9.6.2.2. Argentina Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 9.6.2.3. Argentina Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 9.6.2.4. Argentina Scent Beads Market Size and Forecast, By End-Users (2024-2032) 9.6.2.5. Argentina Scent Beads Market Size and Forecast, By Distribution Channel (2024-2032) 9.6.3. Rest of South America 9.6.3.1. Rest of South America Scent Beads Market Size and Forecast, By Product Type (2024-2032) 9.6.3.2. Rest of South America Scent Beads Market Size and Forecast, By Fragrance Type (2024-2032) 9.6.3.3. Rest of South America Scent Beads Market Size and Forecast, By Packaging Type (2024-2032) 9.6.3.4. Rest of South America Scent Beads Market Size and Forecast, By End-Users (2024-2032) 9.6.3.5. Rest of South America Scent Beads Market Size and Forecast, By Distribution Channel (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Procter & Gamble (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Henkel Corporation (USA) 10.3. SC Johnson & Son, Inc. (USA) 10.4. Church & Dwight Co., Inc. (USA) 10.5. Bliss Fragrance (USA) 10.6. Gain (P&G brand) (USA) 10.7. Unilever (UK/Netherlands) 10.8. RB (Reckitt Benckiser) (UK) 10.9. Lenor (Germany/UK) 10.10. Symrise AG (Germany) 10.11. Givaudan SA (Switzerland) 10.12. Firmenich (Switzerland) 10.13. Robertet Group (France) 10.14. Sensient Technologies (Germany/France) 10.15. Kao Corporation (Japan) 10.16. Lion Corporation (Japan) 10.17. LG Household & Health Care (South Korea) 10.18. Pigeon Corporation (Japan) 10.19. Marico Limited (India) 10.20. Godrej Consumer Products Ltd. (India) 10.21. Shanghai Jahwa United Co., Ltd. (China) 10.22. Alokozay Group (UAE) 10.23. Saudi Industrial Detergents Co. (SIDCO) (Saudi Arabia) 10.24. Aspen Fine Chemicals (South Africa) 10.25. Natura &Co (Brazil) 10 Key Findings 11 Analyst Recommendations 12 Scent Beads Market: Research Methodology