Rare Earth Element Market was valued at USD 8.42 Bn. in 2024 and the total Global Rare Earth Element Market revenue is Expected to grow at a CAGR of 12.3% from 2025 to 2032 reaching nearly USD 21.3 Bn. by 2032. Rare earth elements are a set of seventeen elements discovered in the earth's crust that have similar chemical and physical properties. Common rare earth elements include cerium, neodymium, erbium, holmium, lanthanum, praseodymium, yttrium, and dysprosium. High electrical conductivity, improved magnetism, and weight reduction are only a few of the advantages provided by these components. As a result, rare earth elements are used in a wide range of industries, including automobiles, transportation, power generation, construction, medical, and military applications.To know about the Research Methodology :- Request Free Sample Report

Rare Earth Element Market Dynamics:

Rare-earth permanent magnets are expected to be the fastest-growing market over the forecast period. The most common rare-earth elements used in permanent magnets are neodymium, praseodymium, dysprosium, terbium, and yttrium. These metals have special properties including remanence and high coercivity, which prevent permanent magnets from losing their magnetism over time. The automobile sector uses these magnets extensively, and their demand is impacted by them. Both conventional and hybrid autos employ rare-earth permanent magnets. In catalytic systems, rare-earth metals are widely used. Their primary function in a catalyst system is to absorb, store, and release oxygen while also regulating the environment in which they work. Rare-earth metals such as lanthanum and cerium are extensively used in catalyst systems. They are generally used as catalysts in automotive and other vehicle catalytic converters, as well as in oil refinery fluid cracking catalysts (FCCs). Apart from increased worldwide unit sales, auto-catalyst demand is being boosted by more rigorous laws controlling vehicle emissions across the world. The demand for rare-earth metals in autocatalysts is expected to grow during the forecast period. After China lowered its export quotas by 40% in 2015, claiming environmental concerns, prices for rare-earth metals surged. Due to growing demand and concerns about future availability, the price of dysprosium oxide, which is used in magnets, lasers, and nuclear reactors, climbed from USD 700 to USD 740 per kilogram. These price oscillations, which are amplified by rising energy prices, are destabilizing rare-earth element supply networks. This makes it difficult for manufacturers to develop high-quality products while still generating a profit. Producers must determine whether to tolerate greater expenses or boost product pricing as raw material prices vary. The applications for which rare-earth metals are utilized affect the demand for them. Rare-earth metals were comparatively affordable until new applications were discovered. The cost of rare-earth metals has risen dramatically, causing a gap in the supply and demand chain for the metals. Metals were not as essential in past years as they have been in the last five. Many of them were discarded as a result of demand and supply inconsistencies. Rare-earth metals are widely employed in a variety of critical applications, including green technology and the military. Recycling is a method of reducing the criticality of metals while also offering a secondary source of supply for critical metals. Rare-earth metals currently have a recycling rate of less than 5%, indicating that major recycling operations are possible. Recycling not only provides a backup supply but also helps the environment by lowering the need for mining. It will also cut down on the amount of garbage and toxins that end up in drinking water.Rare Earth Element Market Segmentation Analysis:

By Metal, Cerium was the most popular element in 2024, accounting for xx% of total volume. The rising popularity of hybrid vehicles is expected to boost rare earth demand during the forecast period. From 2025 to 2032, praseodymium volume is expected to grow at a CAGR of 6.4 percent. It is used as an alloying agent with magnesium in aviation engines to make high-strength metals. As the number of passengers from all over the world increases, so does the need for flights. GE Aviation, a part of General Electric, promised USD 12.3 billion in February 2017 to increase its aircraft engine production capacity. This is expected to raise praseodymium demand during the forecast period. By Application, the magnet segment dominated the market in 2024 and is expected to hold largest share during forecast period. Computer hard drives, linear actuators, servo motors, speakers, and sensors are all examples of where they're used. Rising demand for magnets in automobiles, turbines, and consumer electronics is expected to boost rare earth element utilization throughout the forecast period. Revenue for the application of ceramic is expected to expand at a CAGR of 7.0 percent from 2025 to 2032. Yttrium, lanthanum, cerium, neodymium, and praseodymium are frequently used in the ceramics industry in applications such as tiles, electronics, and engineering. According to numbers supplied by the Ceramic World Web, the output of ceramic tiles increased by 2.2 percent from 2016 to 2017.

Rare Earth Element Market Regional Insight

North America is expected to grow at an 8.2 percent CAGR in terms of revenue from 2024 to 2030. For example, Tesla, a major American electric vehicle manufacturer, announced in 2018 that its Model 3 Long Range vehicles will employ neodymium. This action is expected to increase neodymium demand during the forecast period. Consumer electronics and nuclear energy are likely to drive rare earth demand throughout the forecast period. Rare earth demand in Europe is expected to rise as a result of increased usage in magnets, metallurgy, catalysts, glass, and ceramics. According to the Organization for International Cooperation on Autos (OICA), Europe overtook the United States as the world's second-largest manufacturer of automobiles in 2018, accounting for 22.3 percent of worldwide output. As a result, the region's need for rare earth elements is likely to grow. The Asia Pacific was the leading producer and consumer of rare earth in 2023, with a market volume share of xx percent. The consumer electronics and vehicle sectors are key in the Asia Pacific rare earth elements market. This is owing to the rising usage of rare earth in magnets for electric car batteries, as well as the polishing of television glass to smoothen the surface and reduce the weight of the product. Skyworth, TCL, Xiaomi, BPL, and Thomson have all begun to expand their capacity to manufacture television components in India.Rare Earth Element Market Report Objectives:

Landscape analysis of the Rare Earth Element Market competitive benchmarking Past and current status of the industry with the forecasted market size and trends Evaluation of potential key players that include market leaders, followers, and new entrants Technology trends Potential impact of micro-economic factors of the market External and Internal factors affecting market have been analysed The report also helps in understanding the Rare Earth Element Market dynamics, structure by analysing the market segments and project the Rare Earth Element Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Rare Earth Element Market make the report investor’s guide.Rare Earth Element Market Scope: Inquire before buying

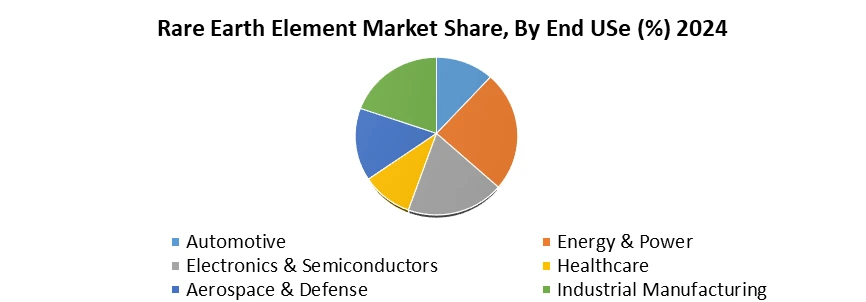

Global Rare Earth Element Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 8.42 Bn. Forecast Period 2025 to 2032 CAGR: 12.3% Market Size in 2032: USD 21.3 Bn. Segments Covered: by Metal Lanthanum Cerium Neodymium Praseodymium Samarium Europium by Element Light Rare Earth Elements (LREEs) Heavy Rare Earth Elements (HREEs) by Application Magnets Catalysts Metallurgy & Alloys Polishing Powders Glass & Ceramics Batteries & Energy Storage Electronics & Optoelectronics Defense & Aerospace by End-Use Automotive Energy & Power Electronics & Semiconductors Healthcare Aerospace & Defense Industrial Manufacturing Rare Earth Element Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Rare Earth Element Market Key Players

1. Ucore Rare Metals Inc 2. Arafura Resources Limited 3. Alkane Resources ltd 4. Lynas Corporation 5. Avalon Advanced Materials, Inc. 6. Canada Rare Earth Corporation 7. Iluka Resources Limited 8. Baotou Jinmeng Rare Earth Co 9. Northern Minerals Limited 10. Shin-Etsu Chemical Co. Ltd. 11. China Minmetals Rare Earth Co. Ltd. 12. China Northern Rare Earth (Group) High-Tech Co., Ltd. 13. Iluka Resource Ltd (Australia)Frequently Asked Questions:

1. Which region has the largest share in Global Rare Earth Element Market? Ans: North America region held the highest share in 2024. 2. What is the growth rate of Global Rare Earth Element Market? Ans: The Global Rare Earth Element Market is growing at a CAGR of 12.3% during forecasting period 2025-2032. 3. What is scope of the Global Rare Earth Element Market report? Ans: Global Rare Earth Element Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Rare Earth Element Market? Ans: The important key players in the Global Rare Earth Element Market are Ucore Rare Metals Inc, Arafura Resources Limited, Alkane Resources ltd, Lynas Corporation, Avalon Advanced Materials, Inc., Canada Rare Earth Corporation, Iluka Resources Limited, Baotou Jinmeng Rare Earth Co, Northern Minerals Limited, Shin-Etsu Chemical Co. Ltd., China Minmetals Rare Earth Co. Ltd., China Northern Rare Earth (Group) High-Tech Co., Ltd., Iluka Resource Ltd (Australia), Canada Rare Earth Corporation (Canada), and Others. 5. What is the study period of this Market? Ans: The Global Rare Earth Element Market is studied from 2024 to 2032.

1. Rare Earth Element Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Rare Earth Element Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Rare Earth Element Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Rare Earth Element Market: Dynamics 3.1. Rare Earth Element Market Trends by Region 3.1.1. North America Rare Earth Element Market Trends 3.1.2. Europe Rare Earth Element Market Trends 3.1.3. Asia Pacific Rare Earth Element Market Trends 3.1.4. Middle East and Africa Rare Earth Element Market Trends 3.1.5. South America Rare Earth Element Market Trends 3.2. Rare Earth Element Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Rare Earth Element Market Drivers 3.2.1.2. North America Rare Earth Element Market Restraints 3.2.1.3. North America Rare Earth Element Market Opportunities 3.2.1.4. North America Rare Earth Element Market Challenges 3.2.2. Europe 3.2.2.1. Europe Rare Earth Element Market Drivers 3.2.2.2. Europe Rare Earth Element Market Restraints 3.2.2.3. Europe Rare Earth Element Market Opportunities 3.2.2.4. Europe Rare Earth Element Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Rare Earth Element Market Drivers 3.2.3.2. Asia Pacific Rare Earth Element Market Restraints 3.2.3.3. Asia Pacific Rare Earth Element Market Opportunities 3.2.3.4. Asia Pacific Rare Earth Element Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Rare Earth Element Market Drivers 3.2.4.2. Middle East and Africa Rare Earth Element Market Restraints 3.2.4.3. Middle East and Africa Rare Earth Element Market Opportunities 3.2.4.4. Middle East and Africa Rare Earth Element Market Challenges 3.2.5. South America 3.2.5.1. South America Rare Earth Element Market Drivers 3.2.5.2. South America Rare Earth Element Market Restraints 3.2.5.3. South America Rare Earth Element Market Opportunities 3.2.5.4. South America Rare Earth Element Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Rare Earth Element Industry 3.8. Analysis of Government Schemes and Initiatives For Rare Earth Element Industry 3.9. Rare Earth Element Market Trade Analysis 3.10. The Global Pandemic Impact on Rare Earth Element Market 4. Rare Earth Element Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 4.1.1. Lanthanum 4.1.2. Cerium 4.1.3. Neodymium 4.1.4. Praseodymium 4.1.5. Samarium 4.1.6. Europium 4.2. Rare Earth Element Market Size and Forecast, by Element (2024-2032) 4.2.1. Light Rare Earth Elements (LREEs) 4.2.2. Heavy Rare Earth Elements (HREEs) 4.3. Rare Earth Element Market Size and Forecast, by Application (2024-2032) 4.3.1. Magnets 4.3.2. Catalysts 4.3.3. Metallurgy & Alloys 4.3.4. Polishing Powders 4.3.5. Glass & Ceramics 4.3.6. Batteries & Energy Storage 4.3.7. Electronics & Optoelectronics 4.3.8. Defense & Aerospace 4.4. Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 4.4.1. Automotive 4.4.2. Energy & Power 4.4.3. Electronics & Semiconductors 4.4.4. Healthcare 4.4.5. Aerospace & Defense 4.4.6. Industrial Manufacturing 4.5. Rare Earth Element Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Rare Earth Element Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 5.1.1. Lanthanum 5.1.2. Cerium 5.1.3. Neodymium 5.1.4. Praseodymium 5.1.5. Samarium 5.1.6. Europium 5.2. North America Rare Earth Element Market Size and Forecast, by Element (2024-2032) 5.2.1. Light Rare Earth Elements (LREEs) 5.2.2. Heavy Rare Earth Elements (HREEs) 5.3. North America Rare Earth Element Market Size and Forecast, by Application (2024-2032) 5.3.1. Magnets 5.3.2. Catalysts 5.3.3. Metallurgy & Alloys 5.3.4. Polishing Powders 5.3.5. Glass & Ceramics 5.3.6. Batteries & Energy Storage 5.3.7. Electronics & Optoelectronics 5.3.8. Defense & Aerospace 5.4. North America Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 5.4.1. Automotive 5.4.2. Energy & Power 5.4.3. Electronics & Semiconductors 5.4.4. Healthcare 5.4.5. Aerospace & Defense 5.4.6. Industrial Manufacturing 5.5. North America Rare Earth Element Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 5.5.1.1.1. Lanthanum 5.5.1.1.2. Cerium 5.5.1.1.3. Neodymium 5.5.1.1.4. Praseodymium 5.5.1.1.5. Samarium 5.5.1.1.6. Europium 5.5.1.2. United States Rare Earth Element Market Size and Forecast, by Element (2024-2032) 5.5.1.2.1. Light Rare Earth Elements (LREEs) 5.5.1.2.2. Heavy Rare Earth Elements (HREEs) 5.5.1.3. United States Rare Earth Element Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Magnets 5.5.1.3.2. Catalysts 5.5.1.3.3. Metallurgy & Alloys 5.5.1.3.4. Polishing Powders 5.5.1.3.5. Glass & Ceramics 5.5.1.3.6. Batteries & Energy Storage 5.5.1.3.7. Electronics & Optoelectronics 5.5.1.3.8. Defense & Aerospace 5.5.1.4. United States Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 5.5.1.4.1. Automotive 5.5.1.4.2. Energy & Power 5.5.1.4.3. Electronics & Semiconductors 5.5.1.4.4. Healthcare 5.5.1.4.5. Aerospace & Defense 5.5.1.4.6. Industrial Manufacturing 5.5.2. Canada 5.5.2.1. Canada Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 5.5.2.1.1. Lanthanum 5.5.2.1.2. Cerium 5.5.2.1.3. Neodymium 5.5.2.1.4. Praseodymium 5.5.2.1.5. Samarium 5.5.2.1.6. Europium 5.5.2.2. Canada Rare Earth Element Market Size and Forecast, by Element (2024-2032) 5.5.2.2.1. Light Rare Earth Elements (LREEs) 5.5.2.2.2. Heavy Rare Earth Elements (HREEs) 5.5.2.3. Canada Rare Earth Element Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Magnets 5.5.2.3.2. Catalysts 5.5.2.3.3. Metallurgy & Alloys 5.5.2.3.4. Polishing Powders 5.5.2.3.5. Glass & Ceramics 5.5.2.3.6. Batteries & Energy Storage 5.5.2.3.7. Electronics & Optoelectronics 5.5.2.3.8. Defense & Aerospace 5.5.2.4. Canada Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 5.5.2.4.1. Automotive 5.5.2.4.2. Energy & Power 5.5.2.4.3. Electronics & Semiconductors 5.5.2.4.4. Healthcare 5.5.2.4.5. Aerospace & Defense 5.5.2.4.6. Industrial Manufacturing 5.5.3. Mexico 5.5.3.1. Mexico Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 5.5.3.1.1. Lanthanum 5.5.3.1.2. Cerium 5.5.3.1.3. Neodymium 5.5.3.1.4. Praseodymium 5.5.3.1.5. Samarium 5.5.3.1.6. Europium 5.5.3.2. Mexico Rare Earth Element Market Size and Forecast, by Element (2024-2032) 5.5.3.2.1. Light Rare Earth Elements (LREEs) 5.5.3.2.2. Heavy Rare Earth Elements (HREEs) 5.5.3.3. Mexico Rare Earth Element Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Magnets 5.5.3.3.2. Catalysts 5.5.3.3.3. Metallurgy & Alloys 5.5.3.3.4. Polishing Powders 5.5.3.3.5. Glass & Ceramics 5.5.3.3.6. Batteries & Energy Storage 5.5.3.3.7. Electronics & Optoelectronics 5.5.3.3.8. Defense & Aerospace 5.5.3.4. Mexico Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 5.5.3.4.1. Automotive 5.5.3.4.2. Energy & Power 5.5.3.4.3. Electronics & Semiconductors 5.5.3.4.4. Healthcare 5.5.3.4.5. Aerospace & Defense 5.5.3.4.6. Industrial Manufacturing 6. Europe Rare Earth Element Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.2. Europe Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.3. Europe Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.4. Europe Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5. Europe Rare Earth Element Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.1.2. United Kingdom Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.1.3. United Kingdom Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5.2. France 6.5.2.1. France Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.2.2. France Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.2.3. France Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.3.2. Germany Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.3.3. Germany Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.4.2. Italy Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.4.3. Italy Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.5.2. Spain Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.5.3. Spain Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.6.2. Sweden Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.6.3. Sweden Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.7.2. Austria Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.7.3. Austria Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 6.5.8.2. Rest of Europe Rare Earth Element Market Size and Forecast, by Element (2024-2032) 6.5.8.3. Rest of Europe Rare Earth Element Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7. Asia Pacific Rare Earth Element Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.2. Asia Pacific Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.3. Asia Pacific Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5. Asia Pacific Rare Earth Element Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.1.2. China Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.1.3. China Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.2.2. S Korea Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.2.3. S Korea Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.3.2. Japan Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.3.3. Japan Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.4. India 7.5.4.1. India Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.4.2. India Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.4.3. India Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.5.2. Australia Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.5.3. Australia Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.6.2. Indonesia Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.6.3. Indonesia Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.7.2. Malaysia Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.7.3. Malaysia Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.8.2. Vietnam Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.8.3. Vietnam Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.9.2. Taiwan Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.9.3. Taiwan Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 7.5.10.2. Rest of Asia Pacific Rare Earth Element Market Size and Forecast, by Element (2024-2032) 7.5.10.3. Rest of Asia Pacific Rare Earth Element Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 8. Middle East and Africa Rare Earth Element Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 8.2. Middle East and Africa Rare Earth Element Market Size and Forecast, by Element (2024-2032) 8.3. Middle East and Africa Rare Earth Element Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 8.5. Middle East and Africa Rare Earth Element Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 8.5.1.2. South Africa Rare Earth Element Market Size and Forecast, by Element (2024-2032) 8.5.1.3. South Africa Rare Earth Element Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 8.5.2.2. GCC Rare Earth Element Market Size and Forecast, by Element (2024-2032) 8.5.2.3. GCC Rare Earth Element Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 8.5.3.2. Nigeria Rare Earth Element Market Size and Forecast, by Element (2024-2032) 8.5.3.3. Nigeria Rare Earth Element Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 8.5.4.2. Rest of ME&A Rare Earth Element Market Size and Forecast, by Element (2024-2032) 8.5.4.3. Rest of ME&A Rare Earth Element Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 9. South America Rare Earth Element Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 9.2. South America Rare Earth Element Market Size and Forecast, by Element (2024-2032) 9.3. South America Rare Earth Element Market Size and Forecast, by Application(2024-2032) 9.4. South America Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 9.5. South America Rare Earth Element Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 9.5.1.2. Brazil Rare Earth Element Market Size and Forecast, by Element (2024-2032) 9.5.1.3. Brazil Rare Earth Element Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 9.5.2.2. Argentina Rare Earth Element Market Size and Forecast, by Element (2024-2032) 9.5.2.3. Argentina Rare Earth Element Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Rare Earth Element Market Size and Forecast, by Metal (2024-2032) 9.5.3.2. Rest Of South America Rare Earth Element Market Size and Forecast, by Element (2024-2032) 9.5.3.3. Rest Of South America Rare Earth Element Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Rare Earth Element Market Size and Forecast, by End Use (2024-2032) 10. Company Profile: Key Players 10.1. Ucore Rare Metals Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Arafura Resources Limited 10.3. Alkane Resources ltd 10.4. Lynas Corporation 10.5. Avalon Advanced Materials, Inc. 10.6. Canada Rare Earth Corporation 10.7. Iluka Resources Limited 10.8. Baotou Jinmeng Rare Earth Co 10.9. Northern Minerals Limited 10.10. Shin-Etsu Chemical Co. Ltd. 10.11. China Minmetals Rare Earth Co. Ltd. 10.12. China Northern Rare Earth (Group) High-Tech Co., Ltd. 10.13. Iluka Resource Ltd (Australia) 11. Key Findings 12. Industry Recommendations 13. Rare Earth Element Market: Research Methodology 14. Terms and Glossary