The Global Protein Bar Market has witnessed robust expansion, driven by rising health consciousness, increased adoption of active lifestyles, and growing demand for convenient nutrition. The Protein Bar Industry, valued at USD 4.98 billion in 2024, is expected to reach USD 8.25 billion by 2032, with a CAGR of 6.5% (2025–2032).Protein Bar Market Overview

A Protein Bar is a convenient, ready-to-eat nutritional snack formulated with high protein content from whey, casein, or plant sources. Designed for muscle recovery, energy, weight management, and healthy snacking, it is widely used by athletes, fitness enthusiasts, and busy consumers. As fitness-conscious consumers, athletes, office professionals, and even students look for convenient yet nutritious options, high-protein snacks are increasingly replacing traditional sugary or fried snacks. This shift in preference is driving strong growth in the Protein Bar Market Size, with brands innovating around high-protein, low-sugar protein bars, vegan protein bars, and clean-label formulations that use natural ingredients and minimal additives. The rise of Plant-Based Protein Bar Market offerings, powered by pea, soy, and other plant proteins, is also expanding the consumer base to include vegans, flexitarians, and lactose-intolerant individuals. The rapid expansion of e-commerce and the Online Protein Bar Sales Market has transformed accessibility, allowing consumers to discover, compare, and subscribe to their preferred protein bar brands across regions. Digital platforms, D2C websites, and marketplaces have enabled targeted marketing, personalized bundles, and convenient doorstep delivery, reinforcing the growth of the Protein Bars Industry.To know about the Research Methodology :- Request Free Sample Report

Protein Bar Market Dynamics

Rising consumer awareness of balanced nutrition and high-protein snack consumption As individuals across all age groups become more conscious of their daily nutrient intake, protein bars have emerged as a convenient, efficient, and reliable source of high-quality protein that supports overall wellness. This shift is strongly influenced by increasing concerns related to obesity, diabetes, energy imbalance, and poor dietary patterns, motivating consumers. The people seek healthier alternatives to traditional snacks such as chips, biscuits, and confectionery, which boosts the Protein bars Market. Protein bars offer an attractive solution: they are portable, shelf-stable, and designed to deliver functional benefits such as muscle recovery, satiety, weight management, and sustained energy release. The alignment of protein bars with popular diet trends, including high-protein, low-carb, keto, intermittent fasting, and clean-label eating, has accelerated adoption. In addition, modern consumers prefer snacks that combine health with convenience, making protein bars a natural fit for busy professionals, gym-goers, students, and travelers. The bar format also supports portion control, helping consumers avoid overeating while still meeting daily protein requirements. As social media, fitness influencers, and health experts continue to promote protein-rich diets, awareness spreads rapidly across regions, boosting the Protein Snack Market and driving consistent sales momentum. Increasing Demand for Low-Sugar, Keto & High-Protein Formulations Driving the Future The global Protein Bar Market outlook is the rapid rise in demand for low-sugar, gluten-free, keto-friendly, and high-protein bars, which aligns perfectly with the global shift toward specialized and health-centric diets. As consumers become increasingly educated about the impact of sugar, artificial additives, and processed ingredients on long-term health, they are actively seeking snack options that support weight management, blood sugar control, muscle development, and overall metabolic wellness. This presents a major growth avenue for manufacturers to create functional protein bars that not only deliver high Price but also meet dietary restrictions and wellness preferences. Keto and low-carb diets, in particular, have grown massively in popularity, driving demand for bars formulated with natural sweeteners, healthy fats, and minimal carbohydrates. The surge in gluten intolerance awareness has driven interest in gluten-free protein bars, opening doors for grain-free, clean-label innovations. High-protein bars with 25–30 grams of protein are also becoming a preferred choice for athletes, bodybuilders, and busy consumers looking for a meal-replacement alternative without compromising nutritional value. This opportunity extends beyond premium products there is substantial potential to introduce affordable, diet-specific protein bars for mass-market consumption across regions such as Asia Pacific, South America, and the Middle East, where awareness of specialized nutrition is growing quickly. As consumers worldwide prioritize health-driven snacking, brands that successfully combine low sugar, high protein, clean-label, functional ingredients, and diet-specific formulations stand to capture strong, sustained demand and achieve significant competitive advantage in the evolving Protein Bar Industry. High Production Cost Associated with Premium Whey Proteins, Plant-Based Proteins, and Functional Additives As consumers increasingly demand clean-label, low-sugar, high-protein, and natural ingredient formulations, manufacturers are compelled to use superior-quality protein sources such as whey isolate, casein, pea protein, soy protein, and almond protein, each of which is considerably more expensive than traditional snack ingredients. The incorporation of functional components like probiotics, fiber blends, collagen, adaptogens, and superfoods drives up production costs due to their complexity, purity requirements, and sourcing challenges. The cost burden becomes even higher when brands comply with international standards for gluten-free, vegan, non-GMO, and organic certifications. As input costs rise, companies struggle to maintain competitive pricing in a market dominated by strong brand loyalty and private-label players offering lower-cost alternatives. Balancing affordability with premium nutrition becomes a major challenge, especially in price-sensitive markets across the Asia Pacific, South America, and Africa. The high production costs not only limit product innovation but also create barriers for new entrants, making it one of the most influential restraints restricting the broader expansion of the Protein Bar Industry.Protein Bar Market Segment Analysis

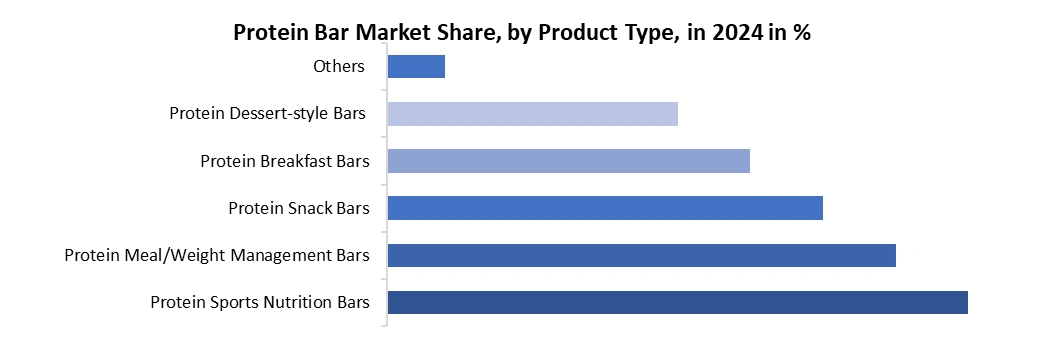

By Source, the market is segmented into the Plant-Based and Animal-Based. In the Protein Bar Market Segment Analysis, the animal-based protein bar segment remains the dominant source category, driven by the strong performance of whey, casein, and egg-based proteins. These protein sources are widely recognized for their complete amino acid profiles, high biological value, fast absorption rate, and superior muscle recovery benefits, making them the preferred choice for professional athletes, gym-goers, and individuals engaged in high-intensity training. Their scientifically proven effectiveness and longstanding presence in the sports nutrition industry ensure continued consumer trust and strong Protein Bar Market penetration, especially across North America and Europe, where fitness culture and protein supplementation awareness are highly advanced. The plant-based protein bar segment is witnessing the fastest growth, fueled by global shifts toward vegan diets, environmental consciousness, lactose intolerance, and increasing demand for clean-label and allergen-friendly products. Pea protein, soy, rice protein, and multi-plant blends are driving innovation in this space.By Product Type, the market is categorized into Protein Sports Nutrition Bars, Protein Meal/Weight Management Bars, Protein Snack Bars, Protein Breakfast Bars, Protein Dessert-style Bars, and Others. Their dominance stems from their broad consumer appeal, extending beyond athletes to include working professionals, students, travelers, and health-conscious individuals seeking convenient, portable, and nutritionally balanced snacks. Protein snack bars are widely available, competitively priced, and offered in diverse flavors and formulations, enhancing consumer adoption. The sports nutrition bars continue to grow as fitness participation rises, and meal/weight management bars gain traction among consumers pursuing structured diets.

Protein Bar Market Regional Insights

North America dominated the Protein Bar Market in 2024 and is expected to continue its dominance over the forecast period. The North America protein bar market remains the largest and most mature regional market globally, driven by a strong fitness-oriented culture, widespread adoption of high-protein diets, and deep consumer awareness regarding balanced nutrition and healthy snacking. The region has consistently shown high acceptance of meal replacement protein bars, sports nutrition bars, and high-protein, low-sugar bars, with consumers integrating them into daily routines for weight management, muscle recovery, and convenient on-the-go nutrition. The presence of leading global brands such as Quest Nutrition, Clif Bar, RXBAR, KIND Snacks, Premier Protein, and PowerBar has helped shape consumer preferences through continuous innovation in flavors, protein sources, and functional ingredients. These brands maintain strong visibility across supermarkets, hypermarkets, gyms, health stores, convenience outlets, and specialty nutrition retailers, ensuring widespread access. A major growth catalyst is the rapid expansion of the Online Protein Bar Market in the U.S., where e-commerce platforms, subscription models, and direct-to-consumer (D2C) strategies have made protein bars more discoverable, customizable, and affordable.Protein Bar Market Competitive Landscape

The competitive landscape of the global Protein Bar Market is highly dynamic, characterized by a mix of established multinational brands, emerging innovators, and rapidly expanding plant-based and clean-label manufacturers. Leading players such as Quest Nutrition, Clif Bar, RXBAR, KIND Snacks, Optimum Nutrition, and PowerBar dominate the market through strong brand recognition, extensive distribution networks, and continuous product innovation. These companies focus heavily on developing high-protein, low-sugar, gluten-free, and functional bars, aligning with evolving consumer preferences. The premium and specialty brands such as GoMacro, Barebells, Lenny & Larry’s, and Vega are gaining Protein Bar Market share by promoting plant-based, organic, and clean-label formulations. Supermarket private labels and budget-friendly brands are intensifying price competition, offering cost-effective alternatives to mainstream products. The surge in e-commerce and D2C channels has enabled newer entrants and niche brands to scale rapidly, leveraging influencer marketing, personalized nutrition, and subscription models. Companies are increasingly focusing on innovations in taste, texture, protein source, and functional ingredients, while also adopting sustainable packaging to appeal to environmentally conscious consumers. Overall, differentiation through nutritional quality, branding, and digital engagement has become crucial for gaining a competitive advantage in the fast-evolving protein bar industry.Recent Developments

• In December 2024, Clif Bar & Company became the focus of a major update in its ongoing legal case, as the U.S. District Court for the Northern District of California extended the deadline for filing claims to February 2025. This follows a $12 million settlement resolving allegations that Clif Bar misled consumers by marketing its Clif Bars and Clif Kid ZBars as healthier than they were due to added sugar content. The lawsuit challenged phrases like “Nutrition for Sustained Energy” and “Nourishing Kids in Motion.” While agreeing to the settlement terms, Clif Bar denied any wrongdoing and maintains its products are not unhealthy. • In April 2024, Ready Nutrition launched its Kids Whole Grain Protein Bars, expanding its active-nutrition portfolio into the children’s functional-snack segment. The bars are formulated to support energy, growth, and activity levels in young athletes and active children. Made with whole grains, natural ingredients, and balanced macros, they aim to provide a healthier alternative to conventional kids’ snack bars. Ready Nutrition emphasized clean formulations, no artificial additives, and kid-friendly flavors to appeal to both parents and children. This launch reflects the growing trend of youth-oriented performance nutrition, aligning with consumer demand for high-quality, on-the-go functional snacksProtein Bar Market Trends

Trend Description Rising Healthy Snacking & Convenience Demand Busy lifestyles are shifting consumers toward grab-and-go bars as meal replacements and healthy snacks. Snacking is replacing traditional three-meal patterns 79% of US consumers snacked on bars in the past 12 months Growing Preference for Specific Bar Formats Consumers are increasingly choosing targeted bar types such as muscle recovery bars, energy bars, indulgent bars, and meal replacement bars. Quality of Protein Becoming a Major Purchase Driver Consumers are prioritizing protein quality over quantity, seeking clean, natural, and moderate protein levels in bars. 48% of US consumers prefer moderate protein (5–14g) Importance of Protein Claims & Functional Benefits High-protein claims, clean-label ingredients, natural formulations, and functional benefits (probiotics, fiber, adaptogens) increase product appeal. 60% of US consumers value high-protein claims when buying healthy snacks Protein Bar Market Scope: Inquire before buying

Global Protein Bar Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.98 Bn. Forecast Period 2025 to 2032 CAGR: 5.2% Market Size in 2032: USD 8.25 Bn. Segments Covered: by Source Plant-Based Animal-Based by Product Type Protein Sports Nutrition Bars Protein Meal/Weight Management Bars Protein Snack Bars Protein Breakfast Bars Protein Dessert-style Bars Others by Protein Content Medium Protein High Protein Low Protein by Price Economy Premium Luxury by Distribution Channel Mass Merchandisers Specialty Stores Convenience Stores Online Channels Others Protein Bar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Protein Bar Key Players

1. Nestlé S.A. 2. The Kellogg Company 3. General Mills Inc. 4. Mars, Incorporated 5. Mondelez International 6. GNC Corporation 7. The Simply Good Foods Company 8. Hormel Foods Corporation 9. Abbott Laboratories 10. Fulfil Nutrition 11. Quest Nutrition 12. Clif Bar & Company 13. Ready Nutrition 14. RXBARKIND Snacks 15. Optimum Nutrition 16. MusclePharm 17. BSN (Bio-Engineered Supplements & Nutrition) 18. PowerBar 19. Premier Protein 20. Larabar 21. ProBar 22. Grenade 23. Lenny & Larry’s 24. MET-Rx 25. Pure Protein 26. GoMacro 27. NuGo Nutrition 28. Think! 29. Oatmega 30. Rise Bar 31. Gatorade 32. Atkins Nutritionals 33. MuscleTech 34. Myprotein 35. Universal Nutrition 36. Garden of Life 37. Vega (Danone) 38. Barebells 39. Nature Valley (General Mills) 40. Health Warrior (PepsiCo)Frequently Asked Questions:

1] What is the growth rate of the Global Protein Bar Market? Ans. The Global Protein Bar Market is growing at a significant rate of 5.2 % during the forecast period. 2] Which region is expected to dominate the Global Protein Bar Market? Ans. North America is expected to dominate the Protein Bar Market during the forecast period. 3] What was the Global Protein Bar Market size in 2024? Ans. The Protein Bar Market size is expected to reach USD 4.98 billion in 2024. 4] What is the expected Global Protein Bar Market size by 2032? Ans. The Protein Bar Market size is expected to reach USD 8.25 billion by 2032. 5] Which are the top players in the Global Protein Bar Market? Ans. The major players in the Global Protein Bar Market are Quest Nutrition, Clif Bar & Company, RXBAR, KIND Snacks, Optimum Nutrition and others. 6] What are the factors driving the Global Protein Bar Market growth? Ans. The Global Protein Bar Market is driven by rising health consciousness, demand for high-protein snacks, growing fitness culture, plant-based nutrition trends, busy on-the-go lifestyles, and expanding e-commerce distribution.

1. Protein Bar Market: Research Methodology 2. Protein Bar Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Protein Bar Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Protein Bar Market: Dynamics 4.1. Protein Bar Market Trends 4.2. Protein Bar Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for Protein Bar Market 5. Consumer Behaviour Analysis 5.1. Shift Toward Healthy & Functional Snacking 5.2. Consumer Preferences: Protein Content, Taste, Clean-Label 5.3. Rise of Plant-Based & Vegan Choices 5.4. E-commerce Influence & Digital Buying Patterns 5.5. Brand Loyalty, Influencer Culture & Lifestyle Trends 6. Pricing Analysis 6.1. Pricing Structure Across Market Segments 6.2. Cost Breakdown: Ingredients, Processing & Packaging 6.3. Premium vs Economy Protein Bars 6.4. Price Sensitivity Across Regions 6.5. E-commerce Pricing, Discounts & Subscription Models 7. Technology & Product Innovations 7.1. Advances in Protein Extraction & Processing 7.2. Innovations in Taste, Texture & Shelf Stability 7.3. Clean Label & Natural Ingredients Technology 7.4. Functional Ingredients: Probiotics, Adaptogens, Collagen 7.5. Sustainable Packaging & Manufacturing Technologies 7.6. AI & Digital Tools in Product Development 8. Protein Bar Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 8.1. Protein Bar Market Size and Forecast, by Source (2024-2032) 8.1.1. Plant-Based 8.1.2. Animal-Based 8.2. Protein Bar Market Size and Forecast, by Product Type (2024-2032) 8.2.1. Protein Sports Nutrition Bars 8.2.2. Protein Meal/Weight Management Bars 8.2.3. Protein Snack Bars 8.2.4. Protein Breakfast Bars 8.2.5. Protein Dessert-style Bars 8.2.6. Others 8.3. Protein Bar Market Size and Forecast, by Protein Content (2024-2032) 8.3.1. Medium Protein 8.3.2. High Protein 8.3.3. Low Protein 8.4. Protein Bar Market Size and Forecast, by Price (2024-2032) 8.4.1. Economy 8.4.2. Premium 8.4.3. Luxury 8.5. Protein Bar Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.1. Specialty Stores 8.5.2. Convenience Stores 8.5.3. Online Channels 8.5.4. Others 8.6. Protein Bar Market Size and Forecast, by Region (2024-2032) 8.6.1. North America 8.6.2. Europe 8.6.3. Asia Pacific 8.6.4. Middle East and Africa 8.6.5. South America 9. North America Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 9.1. North America Protein Bar Market Size and Forecast, by Source (2024-2032) 9.1.1. Plant-Based 9.1.2. Animal-Based 9.2. North America Protein Bar Market Size and Forecast, by Product Type (2024-2032) 9.2.1. Protein Sports Nutrition Bars 9.2.2. Protein Meal/Weight Management Bars 9.2.3. Protein Snack Bars 9.2.4. Protein Breakfast Bars 9.2.5. Protein Dessert-style Bars 9.2.6. Others 9.3. North America Protein Bar Market Size and Forecast, by Protein Content (2024-2032) 9.3.1. Medium Protein 9.3.2. High Protein 9.3.3. Low Protein 9.4. North America Protein Bar Market Size and Forecast, by Price (2024-2032) 9.4.1. Economy 9.4.2. Premium 9.4.3. Luxury 9.5. North America Protein Bar Market Size and Forecast, by Distribution Channel (2024-2032) 9.5.1. Specialty Stores 9.5.2. Convenience Stores 9.5.3. Online Channels 9.5.4. Others 9.6. North America Protein Bar Market Size and Forecast, by Country (2024-2032) 9.6.1. United States 9.6.2. Canada 9.6.3. Mexico 10. Europe Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 10.1. Europe Protein Bar Market Size and Forecast, by Source (2024-2032) 10.2. Europe Protein Bar Market Size and Forecast, by Product Type (2024-2032) 10.3. Europe Protein Bar Market Size and Forecast, by Protein Content (2024-2032) 10.4. Europe Protein Bar Market Size and Forecast, by Price (2024-2032) 10.5. Europe Protein Bar Market Size and Forecast, by Distribution Channel (2024-2032) 10.6. Europe Protein Bar Market Size and Forecast, by Country (2024-2032) 10.6.1. United Kingdom 10.6.2. France 10.6.3. Germany 10.6.4. Italy 10.6.5. Spain 10.6.6. Russia 10.6.7. Rest of Europe 11. Asia Pacific Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 11.1. Asia Pacific Protein Bar Market Size and Forecast, by Source (2024-2032) 11.2. Asia Pacific Protein Bar Market Size and Forecast, by Product Type (2024-2032) 11.3. Asia Pacific Protein Bar Market Size and Forecast, by Protein Content (2024-2032) 11.4. Asia Pacific Protein Bar Market Size and Forecast, by Price (2024-2032) 11.5. Asia Pacific Protein Bar Market Size and Forecast, by Distribution Channel (2024-2032) 11.6. Asia Pacific Protein Bar Market Size and Forecast, by Country (2024-2032) 11.6.1. China 11.6.2. S Korea 11.6.3. Japan 11.6.4. India 11.6.5. Australia 11.6.6. Rest of Asia Pacific 12. Middle East and Africa Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 12.1. Middle East and Africa Protein Bar Market Size and Forecast, by Source (2024-2032) 12.2. Middle East and Africa Protein Bar Market Size and Forecast, by Product Type (2024-2032) 12.3. Middle East and Africa Protein Bar Market Size and Forecast, by Protein Content (2024-2032) 12.4. Middle East and Africa Protein Bar Market Size and Forecast, by Price (2024-2032) 12.5. Middle East and Africa Protein Bar Market Size and Forecast, by Distribution Channel (2024-2032) 12.6. Middle East and Africa Protein Bar Market Size and Forecast, by Country (2024-2032) 12.6.1. South Africa 12.6.2. GCC 12.6.3. Nigeria 12.6.4. Rest of ME&A 13. South America Protein Bar Market Size and Forecast by Segmentation (by Value in USD Million and Volume in 000’Units) (2024-2032) 13.1. South America Protein Bar Market Size and Forecast, by Source (2024-2032) 13.2. South America Protein Bar Market Size and Forecast, by Product Type (2024-2032) 13.3. South America Protein Bar Market Size and Forecast, by Protein Content (2024-2032) 13.4. South America Protein Bar Market Size and Forecast, by Price (2024-2032) 13.5. South America Protein Bar Market Size and Forecast, by Distribution Channel (2024-2032) 13.6. South America Protein Bar Market Size and Forecast, by Country (2024-2032) 13.6.1. Brazil 13.6.2. Argentina 13.6.3. Colombia 13.6.4. Chile 13.6.5. Rest Of South America 14. Company Profile: Key Players 14.1. Nestlé S.A. 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.2. The Kellogg Company 14.3. General Mills Inc. 14.4. Mars, Incorporated 14.5. Mondelez International 14.6. GNC Corporation 14.7. The Simply Good Foods Company 14.8. Hormel Foods Corporation 14.9. Abbott Laboratories 14.10. Fulfil Nutrition 14.11. Quest Nutrition 14.12. Clif Bar & Company 14.13. Ready Nutrition 14.14. RXBARKIND Snacks 14.15. Optimum Nutrition 14.16. MusclePharm 14.17. BSN (Bio-Engineered Supplements & Nutrition) 14.18. PowerBar 14.19. Premier Protein 14.20. Larabar 14.21. ProBar 14.22. Grenade 14.23. Lenny & Larry’s 14.24. MET-Rx 14.25. Pure Protein 14.26. GoMacro 14.27. NuGo Nutrition 14.28. Think! 14.29. Oatmega 14.30. Rise Bar 14.31. Gatorade 14.32. Atkins Nutritionals 14.33. MuscleTech 14.34. Myprotein 14.35. Universal Nutrition 14.36. Garden of Life 14.37. Vega (Danone) 14.38. Barebells 14.39. Nature Valley (General Mills) 14.40. Health Warrior (PepsiCo) 15. Key Findings 16. Analyst Recommendations