Predictive Emission Monitoring Systems Market was worth USD 2.92 Bn. in 2023 and total revenue is expected to grow at a rate of 6 % CAGR from 2024 to 2030, to reach USD 4.66 Bn by 2030.Predictive Emission Monitoring Systems Market Overview:

PEMS (Predictive Emission Monitoring Systems) are systems that are programmed. It is utilized to provide precise and efficient emissions estimates. PEMS use a numerical model that incorporates various measurements, such as the temperature flow factor, as input data. Furthermore, you should be aware that emission monitoring process solutions are hardware-based. The majority of these hardware-based programmer systems are used in the manufacturing industry. PEMS is viewed as a powerful alternative to pollution monitoring process systems in the market. Many natural controllers utilize it to record and observe plant emissions.To know about the Research Methodology :- Request Free Sample Report

Predictive Emission Monitoring Systems Market Dynamics:

Countries around the world rely heavily on coal-fired power plants to generate electricity. A coal-burning power plant is a thermal power plant that generates energy from coal. Mercury, lead, sulphur dioxide, nitrogen oxides, particulates, and a variety of other heavy metals are all released into the air when coal is burned. Exposure to these pollutants can result in a variety of health concerns, including asthma and breathing problems, brain damage, heart problems, cancer, neurological disorders, and even death. The emission monitoring system determines the concentration of harmful gases or particulates emitted by industrial processes and guarantees that the emissions that industry is allowed to release do not exceed the permissible limits. Clean energy is becoming increasingly important. Renewable energy is rapidly overtaking fossil fuels as the fastest-growing source of electricity. Renewable energy sources such as hydropower, offshore and onshore wind, solar photovoltaic, and bioenergy are being developed by countries. Because they emit no carbon, these renewable energy sources are becoming more popular. As a result, the world must swiftly transition to low-carbon energy sources, such as nuclear and renewable technologies, in order to reduce CO2 emissions and local air pollution. As a result, hydro, solar, and wind power facilities generate electricity with minimal or no emissions, obviating the need for an emission monitoring system. Growing number of coal-fired power plants in APAC One of the most important locations for coal-fired power generation is APAC. Countries in the Asia-Pacific region, such as China and India, are among the greatest consumers of coal for electricity generation. The involvement of China and India in the construction of new coal-fired power plants to deliver electrification to the developing world and ensure their economies' growth is projected to create attractive prospects for pollution monitoring system manufacturers. Regulations placed on the control of air pollution are constantly getting more strict in China and India. As a result, there will be a high demand for emission monitoring systems to be installed in coal-fired power plants. Technical difficulties in adhering to regulatory standards Emission monitoring systems have some technical hurdles as a result of the stringent regulatory environment. These difficulties are related to the upkeep of instruments and designs. The pollution monitoring system is capable of operating in tough situations, including extreme weather. The emission monitoring system can be utilized in a variety of essential industries, including chemicals, petrochemicals, and oil and gas, which adds to the difficulty of providing highly accurate and trustworthy data because analyzers are situated in difficult-to-reach places. This may make calibration, maintenance, and replacement of such devices more complicated, perhaps causing more difficulties.Predictive Emission Monitoring Systems Market Segment Analysis:

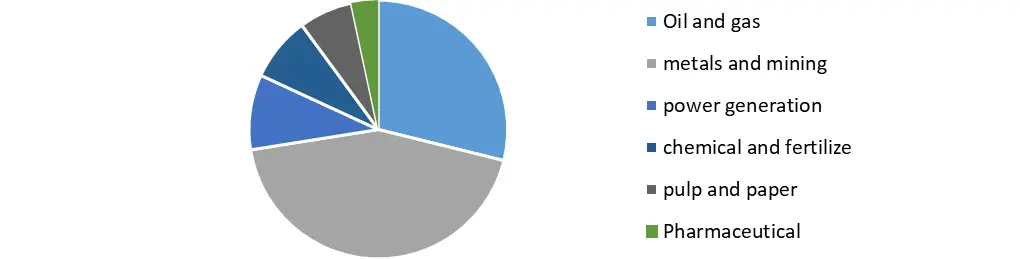

Based on Component, the market is sub-segmented into Software and Service. Real-time emission monitoring, periodic analyzers, recalibration software, and sensor validation software/system are all part of the software segment. Installation, training, and maintenance are the three subcategories of the services segment. During the projected period, the real-time emission monitoring segment is expected to dominate the software segment. Based on Industry, the market is sub-segmented into oil and gas, metals and mining, power generation, chemical and fertilizer, pulp and paper, and pharmaceutical are some of the main segments. Oil and gas accounted for a large portion of the market in 2023 and is expected to grow at the highest rate of xx% during the forecast period. The oil and gas industry to measure and reduce hazardous chemicals like sulphur dioxide (SO2) and methane (CH4), as well as collect data for reporting emissions to government regulatory agencies like the European Parliament's Industrial Emissions Directive (IED) and the EPA's Clean Air Act in the United States.Predictive Emission Monitoring Systems Market by Industry (%) in 2023

Predictive Emission Monitoring Systems Market Regional Insights:

North America led the market in 2023. The number of EMS deployments in North America is the highest. However, due to market saturation, the share of new installations in the region is likely to fall slightly over the forecast period. CEMS are also expected to be used as replacements or upgrades in North America and Europe because the markets are rather mature. Establishment of severe monitoring and air quality standards in India and China, Asia Pacific is predicted to develop significantly over the projection period. To simplify pollution-related legislation, the Chinese government renamed the Ministry of Environmental Protection (MEP) the Ministry of Ecology and Environment (MEE) in March 2018. Following its reorganization, the MEE declared in June 2019 that it will impose special restrictions on industrial units in 80 cities. Currently, only 28 cities are subject to these restrictions. The objective of the report is to present a comprehensive analysis of the global Predictive Emission Monitoring Systems market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global Predictive Emission Monitoring Systems market dynamics, Industry by analyzing the market segments and projecting the global Predictive Emission Monitoring Systems market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Predictive Emission Monitoring Systems market make the report investor’s guide.Predictive Emission Monitoring Systems Market Scope: Inquire before buying

Predictive Emission Monitoring Systems Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 2.92 Bn. Forecast Period 2024 to 2030 CAGR: 6% Market Size in 2030: USD 4.66 Bn. Segments Covered: by Component Software Service Hardware by Industry Oil and gas Metals and mining Power generation Chemical and fertilize Pulp and paper Pharmaceutical Other Predictive Emission Monitoring Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Predictive Emission Monitoring Systems Market, Key Players are

North America 1. Emerson Electric 2. Teledyne Technologies 3. Babcock & Wilcox Enterprises 4. AMETEK 5. Parker Hannifin 6. Rockwell Automation 7. Rockwell Automation 8. Thermo Fisher Scientific 9. Mks Instruments 10. Alliance Technical Group Europe 11. ABB 12. Sick 13. Siemens 14. Cura Terrae 15. Opsis 16. Nederman Holding 17. ETG Risorse e Tecnologia 18. DURAG GROUP APAC 19. Fuji Electric 20. Acoem 21. Cubic Sensor and Instrument Co.,Ltd 22. Applied Techno Engineers Private Limited 23. Alfa Engineering Solutions 24. PT Ecological Services Private LimitedFrequently Asked Questions:

1) What was the market size of Global Predictive Emission Monitoring Systems Market markets in 2023? Ans - Global Predictive Emission Monitoring Systems Market was worth US 2.92 Bn in 2023. 2) What is the market segment of the Predictive Emission Monitoring Systems Market? Ans -The market segments are based on Component, Development and Industry 3) What is the forecast period considered for Global Predictive Emission Monitoring Systems Market? Ans -The forecast period for Global Predictive Emission Monitoring Systems Market is 2024 to 2030. 4) What is the market size of Global Predictive Emission Monitoring Systems Market markets in 2030? Ans – Global Predictive Emission Monitoring Systems Market is estimated as worth USD 4.66 Bn in 2030. 5) Which region is dominated in Global Market? Ans -In 2023, the North America region dominated the Global Market.

1. Predictive Emission Monitoring Systems Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Predictive Emission Monitoring Systems Market: Dynamics 2.1. Predictive Emission Monitoring Systems Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Predictive Emission Monitoring Systems Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.3. Asia Pacific 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.4. Middle East and Africa 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.5. South America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.3. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis for Predictive Emission Monitoring Systems Industry 2.8. Analysis of Government Schemes and Initiatives for Predictive Emission Monitoring Systems Industry 2.9. Predictive Emission Monitoring Systems Market Trade Analysis 2.10. The Global Pandemic Impact on Predictive Emission Monitoring Systems Market 3. Predictive Emission Monitoring Systems Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 3.1.1. Software 3.1.2. Service 3.2. Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 3.3.1. Oil and gas 3.3.2. Metals and mining 3.3.3. Power generation 3.3.4. Chemical and fertilize 3.3.5. Pulp and paper 3.3.6. Pharmaceutical 3.3.7. Other 3.3. Predictive Emission Monitoring Systems Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.2.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Predictive Emission Monitoring Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 4.1.1. Software 4.1.2. Service 4.2. North America Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 4.2.1. Oil and gas 4.2.2. Metals and mining 4.2.3. Power generation 4.2.4. Chemical and fertilize 4.2.5. Pulp and paper 4.2.6. Pharmaceutical 4.2.7. Other 4.3. North America Predictive Emission Monitoring Systems Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 4.3.1.1.1. Software 4.3.1.1.2. Service 4.3.1.2. United States Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 4.3.1.2.1. Oil and gas 4.3.1.2.2. Metals and mining 4.3.1.2.3. Power generation 4.3.1.2.4. Chemical and fertilize 4.3.1.2.5. Pulp and paper 4.3.1.2.6. Pharmaceutical 4.3.1.2.7. Other 4.3.2. Canada 4.3.2.1. Canada Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 4.3.2.1.1. Software 4.3.2.1.2. Service 4.3.2.2. Canada Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 4.3.2.2.1. Oil and gas 4.3.2.2.2. Metals and mining 4.3.2.2.3. Power generation 4.3.2.2.4. Chemical and fertilize 4.3.2.2.5. Pulp and paper 4.3.2.2.6. Pharmaceutical 4.3.2.2.7. Other 4.3.3. Mexico 4.3.3.1. Mexico Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 4.3.3.1.1. Software 4.3.3.1.2. Service 4.3.3.3. Mexico Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 4.3.3.3.1. Oil and gas 4.3.3.3.2. Metals and mining 4.3.3.3.3. Power generation 4.3.3.3.4. Chemical and fertilize 4.3.3.3.5. Pulp and paper 4.3.3.3.6. Pharmaceutical 4.3.3.3.7. Other 5. Europe Predictive Emission Monitoring Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.2. Europe Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3. Europe Predictive Emission Monitoring Systems Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.1.3. United Kingdom Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3.2. France 5.3.2.1. France Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.2.2. France Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.3.2. Germany Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.4.2. Italy Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.5.2. Spain Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.6.2. Sweden Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.7.2. Austria Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 5.3.8.2. Rest of Europe Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6. Asia Pacific Predictive Emission Monitoring Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3. Asia Pacific Predictive Emission Monitoring Systems Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.2.1.2. China Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.2.2. S Korea Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.3.3. Japan Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.4. India 6.3.4.1. India Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.4.2. India Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.5.3. Australia Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.6.2. Indonesia Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.7.2. Malaysia Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.8.2. Vietnam Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.9.2. Taiwan Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 6.3.10.2. Rest of Asia Pacific Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 7. Middle East and Africa Predictive Emission Monitoring Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 7.3. Middle East and Africa Predictive Emission Monitoring Systems Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 7.3.1.2. South Africa Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 7.3.2.2. GCC Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 7.3.3.2. Nigeria Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 7.3.4.2. Rest of ME&A Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 8. South America Predictive Emission Monitoring Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 8.2. South America Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 8.3. South America Predictive Emission Monitoring Systems Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 8.3.1.2. Brazil Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 8.3.2.2. Argentina Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Predictive Emission Monitoring Systems Market Size and Forecast, by Component (2023-2030) 8.3.3.2. Rest Of South America Predictive Emission Monitoring Systems Market Size and Forecast, by Industry (2023-2030) 9. Global Predictive Emission Monitoring Systems Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Predictive Emission Monitoring Systems Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Emerson Electric 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Teledyne Technologies 10.3. Babcock & Wilcox Enterprises 10.4. AMETEK 10.5. Parker Hannifin 10.6. Rockwell Automation 10.7. Rockwell Automation 10.8. Thermo Fisher Scientific 10.9. Mks Instruments 10.10. Alliance Technical Group 10.11. ABB 10.12. Sick 10.13. Siemens 10.14. Cura Terrae 10.15. Opsis 10.16. Nederman Holding 10.17. ETG Risorse e Tecnologia 10.18. DURAG GROUP 10.19. Fuji Electric 10.20. Acoem 10.21. Cubic Sensor and Instrument Co.,Ltd 10.22. Applied Techno Engineers Private Limited 10.23. Alfa Engineering Solutions 10.24. PT Ecological Services Private Limited 11. Key Findings 12. Industry Recommendations 13. Predictive Emission Monitoring Systems Market: Research Methodology 14. Terms and Glossary