The Pickleball Market size was valued at USD 1.61 Billion in 2024 and total Pickleball revenue is expected to grow at a CAGR of 10.2% from 2025 to 2032, reaching nearly USD 3.52 BillionPickleball Market Overview

The Pickleball Market is expanding rapidly, combining the tennis, badminton, and ping pong into one dynamic paddle sport. Originating in Washington, USA, pickleball is now played by over 36.5 million Americans as of 2024, with global participation exceeding 50 million players. The sport is played on a pickleball court smaller than a tennis court using a pickleball paddle (or pickleball racket) and a perforated pickleball ball. Around 19% of U.S. Gen Z online adults and 15% of Millennials play pickleball, making this younger generation a powerful force driving future market expansion. With low equipment costs, an inclusive playstyle, and social engagement benefits, the pickleball industry has become a mainstream recreational trend.To know about the Research Methodology :- Request Free Sample Report Technological advancements and brand innovation are influencing the pickleball paddle market, where over 100 new paddle models were introduced globally between 2023 and 2025. Leading manufacturers such as Selkirk, Franklin Sports, and Joola are investing in AI-based paddle testing, smart sensors, and eco-friendly materials to enhance performance and sustainability. The expansion of professional leagues and televised tournaments has increased global viewership by over 40% in just two years. This combination of innovation, accessibility, and entertainment value continues to elevate the global pickleball industry, positioning it as a major growth driver in the sports and fitness ecosystem. Over 25,000 new pickleball courts are expected to be built across the U.S. by 2026 to meet increasing demand. As the sport expands into Europe and Asia-Pacific, the global pickleball market revenue, cementing pickleball as one of the fastest-growing sports industries worldwide.

Pickleball Market Dynamics

The rising popularity of pickleball sport to boost the Pickleball Market growth The Pickleball Market has gained tremendous popularity across different age groups and demographics. The game’s simplicity, combined with its competitive nature, attracts both recreational players and serious athletes. As more individuals focus on health and fitness-seeking activities, pickleball provides the dual advantage of physical exercise and social interaction. The sport’s slower pace, smaller pickleball court size, and lighter pickleball equipment make it especially appealing to seniors. Many retirement communities and senior centers have embraced the sport by building dedicated pickleball courts and organizing pickleball tournaments, further boosting the pickleball industry among adult demographics and driving global pickleball market growth. Pickleball is often played in a doubles format, fostering social engagement and community connection. This presents opportunities for players to form friendships both on and off the court. The growing popularity of pickleball has led to a surge in infrastructure investments, with parks, recreation centers, schools, and private clubs adding pickleball facilities to meet demand. This increased availability of courts is fueling the expansion of the global pickleball market. The media has also played a key role, as sports networks broadcast major pickleball championships, enhancing visibility and legitimacy. There are over 36.5 million pickleball players in the United States, and 14% of Americans have played the game at least once significantly contributing to overall pickleball market revenue.The Pickleball Market is witnessing remarkable global growth as the sport attracts players of all ages. Rising participation, growing club memberships, and expanding recreational infrastructure continue to strengthen the pickleball market value. According to pickleball market analysis, equipment such as pickleball paddles, balls, shoes, and accessories remain top-selling categories, driven by innovation and brand competition. The pickleball paddle market is particularly strong, with manufacturers introducing graphite and carbon-fiber paddles for enhanced performance. The pickleball industry benefits from both professional tournaments and community-level adoption, fueling brand partnerships and player engagement. Recent pickleball insights indicate that approximately 1.2 million pickleball paddles are sold annually worldwide, underscoring the sport’s rapid expansion and high repeat purchase rate among active players. Overall, pickleball revenue continues to surge, marking its transformation from a niche pastime into a mainstream global fitness and social phenomenon.

Trends in the Pickleball industry

Apparel and Fashion: The growing popularity of pickleball has led to a surge in demand for pickleball apparel and accessories that merge functionality, comfort, and style. Major sports brands are launching pickleball-specific clothing lines, including moisture-wicking shirts, flexible shorts, and lightweight shoes. This trend reflects the sport’s evolution from a casual pastime to a lifestyle activity, with players increasingly expressing their identity through pickleball fashion. The rise of branded pickleball accessories such as visors, wristbands, and gear bags further strengthens the pickleball apparel market and adds to overall pickleball market revenue. Technology-Enabled Training and Analysis: Innovation and technology are transforming the pickleball industry. Tools like video analysis software, wearable performance trackers, and smart court sensors help players monitor movement, speed, and shot accuracy. These advancements support pickleball player development and provide valuable insights for coaches, enhancing training efficiency. Social Media and Online Communities: Social media has become a major driver of the pickleball market growth, connecting millions of players worldwide. Enthusiasts share experiences, match highlights, and training tips, fostering a vibrant pickleball community. Platforms such as Instagram, Facebook, and YouTube also help brands promote pickleball events and pickleball products, amplifying engagement and visibility. Technology and Innovation in Equipment: The pickleball equipment market is evolving with continuous product innovation. Manufacturers are introducing carbon fiber paddles, aerodynamic balls, and durable accessories to enhance performance and durability. These advancements demonstrate how technology and innovation are shaping the future of the global pickleball market.Limited Professional Endorsements to restrain the Pickleball Market growth Despite its rapid rise, the Pickleball Market faces challenges due to limited professional endorsements and minimal presence in mainstream sports. While the game enjoys immense popularity among recreational players, the lack of high-profile sponsorships and professional leagues limits its global visibility and audience reach. Strengthening partnerships with sports brands, athletes, and global tournaments could help the pickleball industry overcome this restraint. Although pickleball popularity is soaring in North America, international expansion remains modest, constrained by cultural differences and logistical barriers in certain regions, which continue to restrict pickleball market penetration. The pickleball equipment is relatively affordable, the cumulative cost of paddles, balls, nets, and accessories can deter players in developing regions. To sustain pickleball market growth, increasing accessibility through community programs and cost-effective gear will be key. Additionally, media coverage for pickleball remains limited compared to established sports, reducing opportunities for brand sponsorship and fan engagement. Expanding pickleball media exposure through televised events, influencer partnerships, and social media campaigns could elevate the sport’s profile. Overcoming these barriers through enhanced professionalization, affordability, and visibility will be essential to unlocking the full potential of the global pickleball market and driving sustained pickleball industry growth.

Pickleball Market Segment Analysis

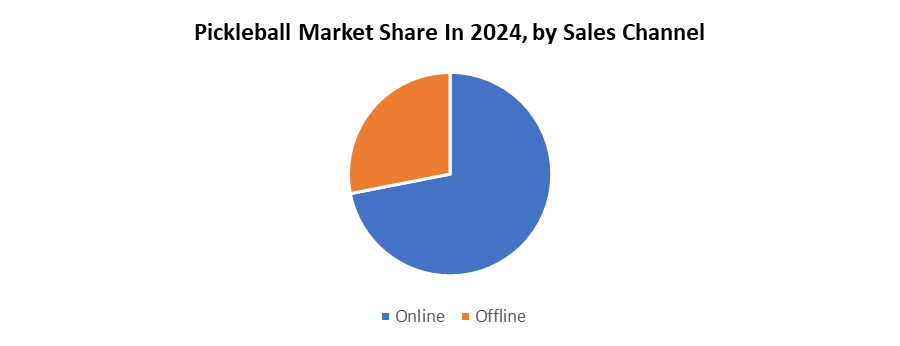

Based on Product Type, the Pickleball Market is segmented into Equipment, Apparel, Footwear, Accessories, and Court Infrastructure. The Equipment segment held the largest Pickleball Market share in 2024 and is expected to dominate the market over the forecast period. The rising popularity of pickleball paddles, balls, nets, and training gear has significantly boosted the pickleball equipment market. Technological innovations, such as carbon fiber paddles, polymer cores, and smart pickleball gear, are driving performance improvements and consumer interest. As recreational and competitive play expands globally, the pickleball paddle market continues to generate strong pickleball revenue. Moreover, the introduction of connected equipment and professional-grade paddles designed for both club and pro players is fueling premium demand. The expansion of pickleball coaching programs, coupled with the rise in indoor and outdoor court facilities, further supports sales growth. Increasing participation among adults and senior players, combined with accessible pricing across entry-level to premium tiers, is expected to sustain market momentum. With strong consumer engagement and brand competition, the pickleball equipment market remains a central driver of overall pickleball industry growth, contributing significantly to total pickleball market value and shaping future trends in recreational sports worldwide. Segment Analysis by Sales Channel Based on Sales Channel, the Pickleball Market is segmented into Online and Offline channels. The Online segment held the largest pickleball market share in 2024 and is expected to dominate during the forecast period. The surge in e-commerce platforms, D2C pickleball brands, and social commerce has transformed how consumers purchase pickleball paddles, balls, apparel, and footwear. Enhanced digital presence, influencer marketing, and brand websites offering custom-fit paddles and exclusive collections have accelerated pickleball equipment sales worldwide. The convenience of online shopping, combined with price transparency and global product availability, has expanded the pickleball paddle market reach. Additionally, the pickleball industry benefits from affiliate programs and community-driven promotions that boost customer engagement. In parallel, the offline segment including specialty sports retailers and pro shops continues to serve local players and clubs through personalized services and product demos. However, the rapid growth of the online pickleball market is expected to outpace offline retail, driven by mobile commerce and rising brand collaborations. Overall, the expansion of digital pickleball retail channels is enhancing accessibility, increasing pickleball market revenue, and reshaping the global pickleball industry landscape through innovation, direct engagement, and global connectivity.

Pickleball Market Regional Insight:

North America region held the largest Pickleball Market share in 2024 and is expected to dominate the market over the forecast period. United States is one of the leading country in the region and has established the Pickleball industry as pickleball was first invented in US. In the US there is a strong market presence of pickleball. Many communities, parks, and recreational centers in North America have dedicated pickleball courts, further fueling participation. North America has witnessed significant investment in pickleball infrastructure. There has been a surge in the construction of dedicated pickleball courts, including both outdoor and indoor facilities. This infrastructure development has been instrumental in accommodating the growing demand for pickleball and promoting its accessibility. The region also host robust tournament circuit, featuring various pickleball tournaments and championships at the local, regional, and national levels, which is expected to boost the regional Pickleball Market growth. Pickleball in North America has gained significant media coverage, with televised events, online streaming, and dedicated pickleball publications. The Pickleball Market in the United States has created significant business opportunities. Manufacturers of pickleball equipment, including paddles, balls, nets, and accessories, have experienced substantial growth. Additionally, retailers, coaches, trainers, and pickleball-focused businesses have emerged to cater to the needs of the expanding pickleball community. The United States Pickleball Market exemplifies a strong and thriving ecosystem, with widespread popularity, robust infrastructure, competitive opportunities, and organized community support. It serves as a benchmark for the global pickleball industry and continues to drive the sport’s growth and development, and significantly contributes to boost the Pickleball Market share. Seattle has experienced a surge in pickleball popularity in recent years. The city’s diverse population, focus on wellness and outdoor activities, and strong recreational sports scene have contributed to pickleball’s growth. Seattle offers a range of public and private facilities with pickleball courts, along with leagues, tournaments, and pickleball communities that foster engagement and participation.Pickleball Market Competitive Landscape

The Pickleball Market has experienced rapid growth and increased competition in recent years. As the sport gains popularity worldwide, several factors contribute to the competitive landscape of the Pickleball Market. Franklin Sports, Onix Sports, Selkirk Sport, and Paddletek are among the leading manufacturers of pickleball equipment, including paddles, balls, and accessories. These brands have established a strong presence and are recognized for their product quality, innovation, and commitment to meeting the needs of pickleball key players. Companies in the Pickleball Market strive to differentiate themselves through product innovation and a diverse product range. Brands focus on paddle designs that offer a balance of power, control, and maneuverability, catering to different playing styles and skill levels. Continued investment in research and development allows companies to introduce new materials, technologies, and features to enhance paddle performance and durability and also to increase Pickleball Market penetration. Established brands with a strong reputation and recognition have a competitive advantage in the market. Pickleball companies that have been in the pickleball industry for a longer time and have built a loyal customer base enjoy brand loyalty and trust. Brands often engage in sponsorships and partnerships with professional pickleball players, tournaments, and organizations. Collaborating with top players and sponsoring major tournaments helps raise brand visibility, credibility, and establishes a connection with the pickleball community. The Pickleball Market is expanding beyond North America, with growing interest and participation worldwide.Recent Development

On April 11, 2025, G.O.A.T. Paddle announced at the US Open Pickleball Championships (Apr 26-May 3, 2025) a new high-performance paddle launch—the “Presidential Series”—as part of its elite gear line-up. The move underscores how the pickleball paddle market and broader pickleball equipment market are innovating for serious players and fostering growth in the global pickleball industry. On April 22, 2025, the major sporting brand Adidas unveiled a new high-tech paddle line and signed top professional players, marking a significant entry into the pickleball market. This helps boost the credibility of the pickleball industry, expand the pickleball paddle market, and signal mainstream sports brands are stepping up their investment and innovation.Pickleball Market Scope: Inquire before buying

Pickleball Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.61 Bn. Forecast Period 2025 to 2032 CAGR: 10.2% Market Size in 2032: USD 3.52 Bn. Segments Covered: by Based on Product Type Equipment Paddles Balls Nets & Court Equipment Training & Coaching Gear Smart/Connected Gear Apparel Tops Bottoms Outerwear Performance Attributes Collections Footwear Pickleball-specific Court Shoes Multi-court Shoes Stability vs Lightweight Wide-fit Options Accessories Bags & Backpacks Grips & Overgrips Edge Tape Vibration Dampeners Wristbands & Caps Eyewear Towels Socks Court Infrastructure Modular Court Flooring Resurfacing & Coatings Lighting Fencing Benches Scoreboards by Based on Price Tier Entry/Budget Mid-Range/Club Premium/Pro by Based on Gender Individual Consumers Skill Level Institutional/B2B Team/League Purchasers by Based on End User Online Brand D2C Websites Specialist Sports E-commerce Social Commerce Offline Specialty Sports Retailers & Pro Shops Sporting Goods Chains Department Stores & Hypermarkets Coaches & Academy Direct Sales Distributors & Wholesalers Pickleball Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pickleball Market, Key players

1. Onix Pickleball 2. Franklin Sports 3. Selkirk Sport 4. Paddletek 5. Engage Pickleball 6. Head Pickleball 7. Gamma Sports 8. ProLite Sports 9. Vulcan Sporting Goods 10. Wilson Sporting Goods 11. Pickleball Inc. 12. Gearbox Sports 13. PickleballCentral 14. PickleballDepot 15. PickleballNow 16. Pickleball Rocks 17. USA Pickleball (USAP) 18. EastPoint Sports 19. Pickleball Magazine 20. Selkirk Sport Apparel 21. Diadem Sports 22. Prince Pickleball 23. JOOLA USA 24. Electrum Pickleball 25. TMPR Sports 26. Recess Pickleball 27. Baddle Pickleball 28. ProKennex Pickleball 29. Holbrook Pickleball 30. NiupipoFrequently Asked Questions:

1] What is the growth rate of the Global Pickleball Market? Ans. The Global Pickleball Market is growing at a significant rate of 10.2% over the forecast period. 2] Which region is expected to dominate the Global Pickleball Market? Ans. North American region is expected to dominate the Pickleball Market over the forecast period. 3] What is the expected Global Pickleball Market size by 2032? Ans. The market size of the Pickleball Market is expected to reach USD 3.52 Bn by 2032. 4] Who are the top players in the Global Pickleball Industry? Ans. The major key players in the Global Pickleball Market are Head Pickleball, Gamma Sports, ProLite Sports, and Vulcan Sporting Goods. 5] Which factors are expected to drive the Global Market growth by 2032? Ans. The rising popularity of pickleball sport is expected to drive the Pickleball Market growth over the forecast period (2025-2032).

1. Pickleball Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion) - By Segments, Regions, and Country 2. Pickleball Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Segment 2.3.4. End User Segment 2.3.5. Total Company Revenue (2024) 2.3.6. Market Share (%) 2.3.7. Profit Margin (%) 2.3.8. Growth Rate (%) 2.3.9. Integration Capabilities 2.3.10. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Pickleball Market: Dynamics 3.1. Pickleball Market Trends 3.2. Pickleball Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Pickleball Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Pickleball Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Pickleball Market Size and Forecast, By Product Type (2024-2032) 4.1.1. Equipment 4.1.1.1. Paddles 4.1.1.2. Balls 4.1.1.3. Nets & Court Equipment 4.1.1.4. Training & Coaching Gear 4.1.1.5. Smart/Connected Gear 4.1.2. Apparel 4.1.2.1. Tops 4.1.2.2. Bottoms 4.1.2.3. Outerwear 4.1.2.4. Performance Attributes 4.1.2.5. Collections 4.1.3. Footwear 4.1.3.1. Pickleball-specific Court Shoes 4.1.3.2. Multi-court Shoes 4.1.3.3. Stability vs Lightweight 4.1.3.4. Wide-fit Options 4.1.4. Accessories 4.1.4.1. Bags & Backpacks 4.1.4.2. Grips & Overgrips 4.1.4.3. Edge Tape 4.1.4.4. Vibration Dampeners 4.1.4.5. Wristbands & Caps 4.1.4.6. Eyewear 4.1.4.7. Towels 4.1.4.8. Socks 4.1.5. Court Infrastructure 4.1.5.1. Modular Court Flooring 4.1.5.2. Resurfacing & Coatings 4.1.5.3. Lighting 4.1.5.4. Fencing 4.1.5.5. Benches 4.1.5.6. Scoreboards 4.2. Pickleball Market Size and Forecast, By Price Tier (2024-2032) 4.2.1. Entry/Budget 4.2.2. Mid-Range/Club 4.2.3. Premium/Pro 4.3. Pickleball Market Size and Forecast, By Customer Type (2024-2032) 4.3.1. Individual Consumers 4.3.2. Skill Level 4.3.3. Institutional/B2B 4.3.4. Team/League Purchasers 4.4. Pickleball Market Size and Forecast, By Sales Channel (2024-2032) 4.4.1. Online 4.4.1.1. Brand D2C Websites 4.4.1.2. Specialist Sports E-commerce 4.4.1.3. Social Commerce 4.4.2. Offline 4.4.2.1. Specialty Sports Retailers & Pro Shops 4.4.2.2. Sporting Goods Chains 4.4.2.3. Department Stores & Hypermarkets 4.4.2.4. Coaches & Academy Direct Sales 4.4.2.5. Distributors & Wholesalers 4.5. Pickleball Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Pickleball Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Pickleball Market Size and Forecast, By Product Type (2024-2032) 5.1.1. Equipment 5.1.1.1. Paddles 5.1.1.2. Balls 5.1.1.3. Nets & Court Equipment 5.1.1.4. Training & Coaching Gear 5.1.1.5. Smart/Connected Gear 5.1.2. Apparel 5.1.2.1. Tops 5.1.2.2. Bottoms 5.1.2.3. Outerwear 5.1.2.4. Performance Attributes 5.1.2.5. Collections 5.1.3. Footwear 5.1.3.1. Pickleball-specific Court Shoes 5.1.3.2. Multi-court Shoes 5.1.3.3. Stability vs Lightweight 5.1.3.4. Wide-fit Options 5.1.4. Accessories 5.1.4.1. Bags & Backpacks 5.1.4.2. Grips & Overgrips 5.1.4.3. Edge Tape 5.1.4.4. Vibration Dampeners 5.1.4.5. Wristbands & Caps 5.1.4.6. Eyewear 5.1.4.7. Towels 5.1.4.8. Socks 5.1.5. Court Infrastructure 5.1.5.1. Modular Court Flooring 5.1.5.2. Resurfacing & Coatings 5.1.5.3. Lighting 5.1.5.4. Fencing 5.1.5.5. Benches 5.1.5.6. Scoreboards 5.2. North America Pickleball Market Size and Forecast, By Price Tier (2024-2032) 5.2.1. Entry/Budget 5.2.2. Mid-Range/Club 5.2.3. Premium/Pro 5.3. North America Pickleball Market Size and Forecast, By Customer Type (2024-2032) 5.3.1. Individual Consumers 5.3.2. Skill Level 5.3.3. Institutional/B2B 5.3.4. Team/League Purchasers 5.4. North America Pickleball Market Size and Forecast, By Sales Channel (2024-2032) 5.4.1. Online 5.4.1.1. Brand D2C Websites 5.4.1.2. Specialist Sports E-commerce 5.4.1.3. Social Commerce 5.4.2. Offline 5.4.2.1. Specialty Sports Retailers & Pro Shops 5.4.2.2. Sporting Goods Chains 5.4.2.3. Department Stores & Hypermarkets 5.4.2.4. Coaches & Academy Direct Sales 5.4.2.5. Distributors & Wholesalers 5.5. North America Pickleball Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.2. Canada 5.5.3. Mexico 6. Europe Pickleball Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Pickleball Market Size and Forecast, By Product Type (2024-2032) 6.2. Europe Pickleball Market Size and Forecast, By Price Tier (2024-2032) 6.3. Europe Pickleball Market Size and Forecast, By Customer Type (2024-2032) 6.4. Europe Pickleball Market Size and Forecast, By Sales Channel (2024-2032) 6.5. Europe Pickleball Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.2. France 6.5.3. Germany 6.5.4. Italy 6.5.5. Spain 6.5.6. Sweden 6.5.7. Russia 6.5.8. Rest of Europe 7. Asia Pacific Pickleball Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Pickleball Market Size and Forecast, By Product Type (2024-2032) 7.2. Asia Pacific Pickleball Market Size and Forecast, By Price Tier (2024-2032) 7.3. Asia Pacific Pickleball Market Size and Forecast, By Customer Type (2024-2032) 7.4. Asia Pacific Pickleball Market Size and Forecast, By Sales Channel (2024-2032) 7.5. Asia Pacific Pickleball Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.2. S Korea 7.5.3. Japan 7.5.4. India 7.5.5. Australia 7.5.6. Indonesia 7.5.7. Malaysia 7.5.8. Philippines 7.5.9. Thailand 7.5.10. Vietnam 7.5.11. Rest of Asia Pacific 8. Middle East and Africa Pickleball Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Pickleball Market Size and Forecast, By Product Type (2024-2032) 8.2. Middle East and Africa Pickleball Market Size and Forecast, By Price Tier (2024-2032) 8.3. Middle East and Africa Pickleball Market Size and Forecast, By Customer Type (2024-2032) 8.4. Middle East and Africa Pickleball Market Size and Forecast, By Sales Channel (2024-2032) 8.5. Middle East and Africa Pickleball Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.2. GCC 8.5.3. Nigeria 8.5.4. Rest of ME&A 9. South America Pickleball Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Pickleball Market Size and Forecast, By Product Type (2024-2032) 9.2. South America Pickleball Market Size and Forecast, By Price Tier (2024-2032) 9.3. South America Pickleball Market Size and Forecast, By Customer Type (2024-2032) 9.4. South America Pickleball Market Size and Forecast, By Sales Channel (2024-2032) 9.5. South America Pickleball Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.2. Argentina 9.5.3. Colombia 9.5.4. Chile 9.5.5. Rest of South America 10. Company Profile: Key Players 10.1. Onix Pickleball 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.2. Franklin Sports 10.3. Selkirk Sport 10.4. Paddletek 10.5. Engage Pickleball 10.6. Head Pickleball 10.7. Gamma Sports 10.8. ProLite Sports 10.9. Vulcan Sporting Goods 10.10. Wilson Sporting Goods 10.11. Pickleball Inc. 10.12. Gearbox Sports 10.13. PickleballCentral 10.14. PickleballDepot 10.15. PickleballNow 10.16. Pickleball Rocks 10.17. USA Pickleball (USAP) 10.18. EastPoint Sports 10.19. Pickleball Magazine 10.20. Selkirk Sport Apparel 10.21. Diadem Sports 10.22. Prince Pickleball 10.23. JOOLA USA 10.24. Electrum Pickleball 10.25. TMPR Sports 10.26. Recess Pickleball 10.27. Baddle Pickleball 10.28. ProKennex Pickleball 10.29. Holbrook Pickleball 10.30. Niupipo 11. Key Findings 12. Analyst Recommendations 13. Pickleball Market – Research Methodology