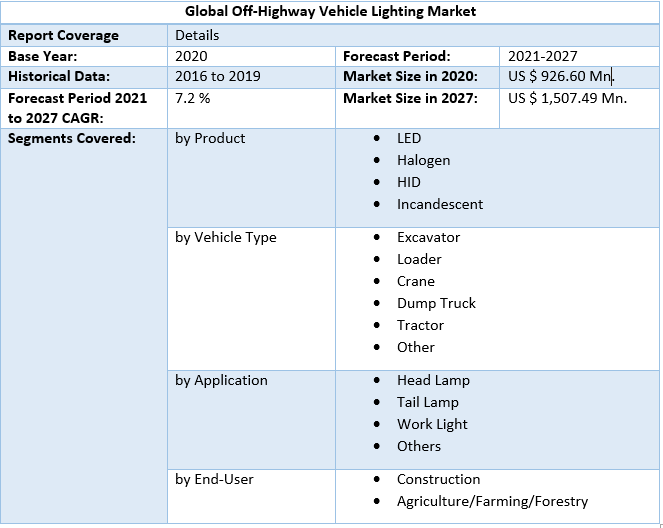

Off-Highway Vehicle Lighting Market size was valued at US$ 926.60 Mn. in 2020 and the total revenue is expected to grow at 7.2 % through 2021 to 2027, reaching nearly US$ 1507.49 Mn.Off-Highway Vehicle Lighting Market Overview:

An off-highway vehicle is one that is designed to be used in off-road environments, such as building projects, agricultural applications, and so on. Off-highway highway vehicle lighting is a type of high-intensity lighting that is installed on off-highway vehicles to improve mobility at night. As a light source inside the mounting, off-road highway vehicle illumination comprises HID, LED, Halogen, Incandescent lamps, and others. The building company has been growing at a healthy pace. Emission regulations are becoming more stringent, requiring manufacturers to experiment with different ways in order to create more efficient vehicles with lower power consumption and emissions.To know about the Research Methodology :- Request Free Sample Report 2020 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years trends are considered while forecasting the market through 2027. 2020 is a year of exception and analysed specially with the impact of lockdown by region.

Off-Highway Vehicle Lighting Market Dynamics:

Global urbanisation is increasing, particularly in rising regions such as China, India, and Mexico, which is boosting the sustainable construction and the off-highway vehicle lighting market. Furthermore, market growth is expected to be supported by continuing developments in product technology, as well as strict government restrictions, over the projection period. The need for improving public infrastructure in Asian countries such as China and India is being driven by population growth. These economies' governments are investing heavily in infrastructure development projects. In India, for example, the government plans to spend USD 670.5 billion (INR 50 trillion) on public infrastructure improvements. The government of the country has also outlined many infrastructure development initiatives for the coming years. The "Bharatmala Yojana," for instance, offers measures for strengthening the country's transportation systems. The Indonesian government is working on more than 20 initiatives to enhance approximately 52,000 rural communities by improving roads, housing, hospitals, and other essential infrastructure. Off-highway vehicle demand is likely to increase as a result of these ongoing and proposed infrastructures development projects, which bodes well for the off-highway vehicle lighting market. Despite planned HID and conventional bulb bans in a few countries, including the United Kingdom, Japan, India, and Canada, has had a modest impact on the business, both lighting types remain vital in the automotive and off-highway vehicle lighting markets. In addition, the Canadian government is developing a strategy to minimise greenhouse gas (GHG) emissions and encourage the adoption of zero-emission vehicles. However, the rising frequency of highway accidents is a factor that is anticipated to stifle the global market's overall growth.Global Off-Highway Vehicle Lighting Market Segment Analysis:

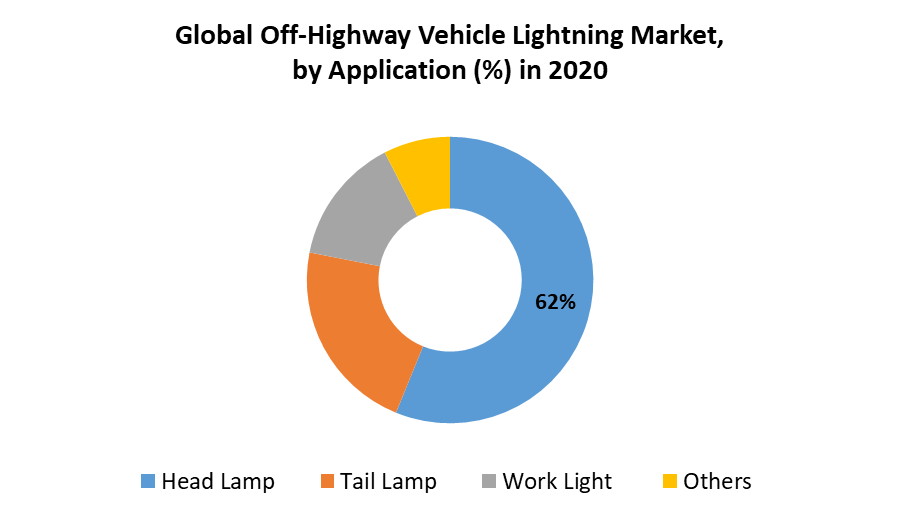

The global Off-Highway Vehicle Lighting Market is segmented by Product, Vehicle Type, Application and End-User. Based on the Product, the global Off-Highway Vehicle Lighting market is sub-segmented into LED, Halogen, HID, and Incandescent. The Halogen segment held the leading market share of 56% in 2020. When opposed to LEDs, these lights have a lower beginning cost. However, as LED lights have become more affordable in recent years, vehicle manufacturers have begun to switch to them. Furthermore, regulations require the use of the back, side, and front identifying lighting so that approaching drivers may evaluate the vehicle's dimensions and avoid a collision. In the anticipated period, the legislation governing vehicle illumination will boost demand for off-highway vehicle lighting. However, the LED segment is expected to grow at the highest CAGR of 10.5% in the global off-highway vehicle lighting market during the forecast period. The growing demand for energy-efficient illumination for off-highway vehicles is propelling the industry forward. The market share of LEDs is relied upon to increment as the cost of production falls.Based on the Application, the global Off-Highway Vehicle Lighting market is sub-segmented into Head Lamp, Tail Lamp, Work Light, and Others. The Head Lamp segment held the leading market share of 62% in 2020. This can be attributed to the introduction of advanced technologies such as adaptive headlights, night vision, and laser lights. It is expected that the work light part will also see considerable growth in the future. These lights are an integral part of the equipment used in construction and mining applications because they can increase visibility and safety in the workplace. In recent years, the demand for LED-based work lights has increased significantly due to better brightness and light quality.

Global Off-Highway Vehicle Lighting Market Regional Insights:

The Asia Pacific dominates the Global Off-Highway Vehicle Lighting market during the forecast period 2021-2027. The Asia Pacific held the largest market share of 35.5% in 2020 and it is expected to grow at the highest CAGR of 5.5% in the global Off-Highway Vehicle Lighting market during the forecast period. Because of the region's strong infrastructural and mining spending, it is led by Europe and North America. The increasing rate of urbanization and government investment in construction and mining activities in the region, which includes two of the world's largest developing countries, China and India, is driving demand. These countries' governments are heavily investing in the construction of motorways, bridges, and other infrastructures such as airports and athletic fields. For example, compared to the previous year, the Chinese government approved twice as many large-scale infrastructure projects in 2019. Last year's approvals totaled 374.3 billion yuan (USD 52.8 billion), which included 11 projects including trains, roads, and airports. The objective of the report is to present a comprehensive analysis of the global Off-Highway Vehicle Lighting Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also helps in understanding the global Off-Highway Vehicle Lighting Market dynamic, structure by analyzing the market segments and project the global Off-Highway Vehicle Lighting Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Off-Highway Vehicle Lighting Market make the report investor’s guide.Global Off-Highway Vehicle Lighting Market Scope: Inquire before buying

Global Off-Highway Vehicle Lighting Market, by Region

• North America • Europe • Asia Pacific • South America • Middle East and AfricaGlobal Off-Highway Vehicle Lighting Market Key Players

• OSRAM • Vision X Lighting • Truck-Lite • Grote Industries • PowerFleet • PALFINGER • Altec • NORDIC LIGHTS • APS Lighting and Safety • WESEM • ABL Lights Group • Peterson Manufacturing Co. • Hamsar Diversco Inc. • Koito Manufacturing Co., Ltd. • Valeo SA • Koninklijke Philips N.V. • Magneti Marelli S.p.A. • HELLA GmbH & Co. KGaA • LG Display Co., Ltd. • Hyundai Mobis Co., Ltd. • Neolite ZKW Lightings Pvt. Ltd. • Johnson Electric Holdings Limited • De Amertek Corp. Inc.Frequently Asked Questions:

1] What segments are covered in Off-Highway Vehicle Lighting Market report? Ans. The segments covered in Off-Highway Vehicle Lighting Market report are based on Product, Vehicle Type, Application and End-User. 2] Which region is expected to hold the highest share in the global Off-Highway Vehicle Lighting Market? Ans. Asia Pacific is expected to hold the highest share in the global Off-Highway Vehicle Lighting Market. 3] What is the market size of global Off-Highway Vehicle Lighting Market by 2027? Ans. The market size of global Off-Highway Vehicle Lighting Market by 2027 is US $ 1507.49 Mn. 4] Who are the top key players in the global Off-Highway Vehicle Lighting Market? Ans. OSRAM, Vision X Lighting, Truck Lite, Grote Industries and PowerFleet are the top key players in the global Off-Highway Vehicle Lighting Market. 5] What was the market size of global Off-Highway Vehicle Lighting Market in 2020? Ans. The market size of global Off-Highway Vehicle Lighting Market in 2020 was US $ 926.60 Mn.

1. Global Off-Highway Vehicle Lighting Market: Research Methodology 2. Global Off-Highway Vehicle Lighting Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Off-Highway Vehicle Lighting Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Global Off-Highway Vehicle Lighting Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Global Off-Highway Vehicle Lighting Market Segmentation 4.1 Global Off-Highway Vehicle Lighting Market, by Product (2020-2027) • LED • Halogen • HID • Incandescent 4.2 Global Off-Highway Vehicle Lighting Market, by Vehicle Type (2020-2027) • Excavator • Loader • Crane • Dump Truck • Tractor • Other 4.3 Global Off-Highway Vehicle Lighting Market, by Application (2020-2027) • Head Lamp • Tail Lamp • Work Light • Others 4.4 Global Off-Highway Vehicle Lighting Market, by End-User (2020-2027) • Construction • Agriculture/Farming/Forestry 5. North America Off-Highway Vehicle Lighting Market(2020-2027) 5.1 Global Off-Highway Vehicle Lighting Market, by Product (2020-2027) • LED • Halogen • HID • Incandescent 5.2 Global Off-Highway Vehicle Lighting Market, by Vehicle Type (2020-2027) • Excavator • Loader • Crane • Dump Truck • Tractor • Other 5.3 Global Off-Highway Vehicle Lighting Market, by Application (2020-2027) • Head Lamp • Tail Lamp • Work Light • Others 5.4 Global Off-Highway Vehicle Lighting Market, by End-User (2020-2027) • Construction • Agriculture/Farming/Forestry 5.5 North America Off-Highway Vehicle Lighting Market, by Country (2020-2027) • United States • Canada • Mexico 6. Asia Pacific Off-Highway Vehicle Lighting Market (2020-2027) 6.1. Asia Pacific Off-Highway Vehicle Lighting Market, by Product (2020-2027) 6.2. Asia Pacific Off-Highway Vehicle Lighting Market, by Vehicle Type (2020-2027) 6.3. Asia Pacific Off-Highway Vehicle Lighting Market, by Application (2020-2027) 6.4. Asia Pacific Off-Highway Vehicle Lighting Market, by End-User (2020-2027) 6.5. Asia Pacific Off-Highway Vehicle Lighting Market, by Country (2020-2027) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Off-Highway Vehicle Lighting Market (2020-2027) 7.1 Middle East and Africa Off-Highway Vehicle Lighting Market, by Product (2020-2027) 7.2. Middle East and Africa Off-Highway Vehicle Lighting Market, by Vehicle Type (2020-2027) 7.3. Middle East and Africa Off-Highway Vehicle Lighting Market, by Application (2020-2027) 7.4. Middle East and Africa Off-Highway Vehicle Lighting Market, by End-User (2020-2027) 7.5. Middle East and Africa Off-Highway Vehicle Lighting Market, by Country (2020-2027) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Off-Highway Vehicle Lighting Market (2020-2027) 8.1. Latin America Off-Highway Vehicle Lighting Market, by Product (2020-2027) 8.2. Latin America Off-Highway Vehicle Lighting Market, by Vehicle Type (2020-2027) 8.3. Latin America Off-Highway Vehicle Lighting Market, by Application (2020-2027) 8.4. Latin America Off-Highway Vehicle Lighting Market, by End-User (2020-2027) 8.5. Latin America Off-Highway Vehicle Lighting Market, by Country (2020-2027) • Brazil • Argentina • Rest Of Latin America 9. European Off-Highway Vehicle Lighting Market (2020-2027) 9.1. European Off-Highway Vehicle Lighting Market, by Product (2020-2027) 9.2. European Off-Highway Vehicle Lighting Market, by Vehicle Type (2020-2027) 9.3. European Off-Highway Vehicle Lighting Market, by Application (2020-2027) 9.4. European Off-Highway Vehicle Lighting Market, by End-User (2020-2027) 9.5. European Off-Highway Vehicle Lighting Market, by Country (2020-2027) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. OSRAM 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Vision X Lighting 10.3. Truck Lite 10.4. Grote Industries 10.5. PowerFleet 10.6. PALFINGER 10.7. Altec 10.8. NORDIC LIGHTS 10.9. APS Lighting and Safety 10.10. WESEM 10.11. ABL Lights Group 10.12. Peterson Manufacturing Co. 10.13. Hamsar Diversco Inc. 10.14. Koito Manufacturing Co., Ltd. 10.15. Valeo SA 10.16. Koninklijke Philips N.V. 10.17. Magneti Marelli S.p.A. 10.18. HELLA GmbH & Co. KGaA 10.19. LG Display Co., Ltd. 10.20. Hyundai Mobis Co., Ltd. 10.21. Neolite ZKW Lightings Pvt. Ltd. 10.22. Johnson Electric Holdings Limited 10.23. De Amertek Corp. Inc.