The Global Oat Milk Market is expected to grow from USD 3.22 Bn in 2024 to USD 8.27 Bn by 2032 at a 12.5% CAGR, driven by demand for plant-based, vegan, and organic oat milk, rising café adoption, sustainability trends, functional beverages, and strong growth across the Asia Pacific.Oat Milk Market Overview

Oat milk is a plant-based, dairy-free beverage made from whole oats, valued for its creamy texture, mild flavor, and high nutritional content. Naturally lactose-free, vegan, and environmentally friendly, it is widely used in coffees, smoothies, cereals, and cooking as a sustainable milk alternative. The Global Oat Milk Market has emerged as one of the fastest-growing segments within the broader Plant-Based Milk Market and dairy alternatives industry, driven by rising consumer demand for vegan, lactose-free, and sustainable beverage options. As health-conscious consumers increasingly shift toward non-dairy milk due to lactose intolerance, ethical concerns, and environmental awareness, oat milk is gaining strong market traction due to its creamy texture, nutritional benefits, and superior functionality in coffee-based applications. This makes it a preferred choice in cafés, QSRs, and specialty coffee chains across the U.S., Canada, the U.K., Sweden, Germany, China, Japan, India, and Australia. The global oat beverage market continues to expand as manufacturers introduce diverse product offerings such as organic oat milk, conventional oat milk, flavored oat milk, barista-grade oat milk, and ready-to-drink (RTD) oat beverages. These innovations cater to varied consumer preferences, supporting strong growth in both retail and foodservice channels. Increasing availability across supermarkets, hypermarkets, specialty stores, and online platforms boosts the Oat Milk Market size worldwide.To know about the Research Methodology :- Request Free Sample Report Increasing Demand for Plant-Based Milk & Dairy Alternatives to Drive Oat Milk Market Growth The rising health consciousness, increasing vegan populations, and the growing prevalence of lactose intolerance are pushing consumers to replace traditional dairy with non-dairy milk options. Oat milk has become one of the fastest-growing segments in the dairy alternatives market due to its creamier texture, higher sustainability profile, and superior compatibility with coffees, lattes, and barista applications. Demand for barista-grade oat milk has surged across the U.S. Oat Milk Market, Europe, and Asia Pacific’s coffee culture hubs, with major chains like Starbucks and Dunkin’ adding oat milk to their menus, boosting consumption. Growing awareness of oat milk’s nutritional benefits, including its high fiber content and low cholesterol profile, is attracting health-focused consumers. Rising demand for organic oat milk, flavored oat milk, and high-protein oat beverages is also accelerating expansion. As sustainability becomes a purchasing priority, oat milk’s lower carbon footprint compared to almond and dairy alternatives strengthens its appeal among environmentally conscious consumers. Expanding availability across supermarkets, hypermarkets, specialty stores, cafés, and e-commerce continues to increase the global Oat Milk Market size, making health, sustainability, and coffee culture the key drivers of Oat Beverage Market growth. Growth of Oat Milk in Functional & Fortified Beverage Categories The Oat Milk Market is experiencing the rapid expansion of functional oat beverages, particularly those fortified with protein, vitamins, minerals, probiotics, and immunity-boosting ingredients. As consumers increasingly seek products that deliver both taste and health value, the demand for high-protein oat milk, fortified oat drink variants, and clean-label organic beverages is rising sharply. This shift creates a lucrative pathway for manufacturers to diversify product portfolios across flavored oat milk, barista oat milk, and ready-to-drink oat milk categories. The growing penetration of oat milk in the coffee shop segment, especially with barista-grade formulations, presents significant potential for partnerships with premium cafés, QSR chains, and specialty roasters worldwide. The escalating online sales through e-commerce platforms enable greater visibility for niche brands and emerging companies offering organic, pesticide-free, or sustainably packaged oat beverages. Geographically, expanding into fast-growing emerging markets such as the India Oat Milk Market, China, Brazil, and the Middle East (UAE, Saudi Arabia) presents a huge opportunity due to rising vegan populations, urbanization, and lifestyle transitions. The demand for dairy alternatives across APAC and LATAM markets accelerates growth prospects. Sustainability-Focused Consumption & Premiumization of Oat Milk Consumers are increasingly comparing the carbon footprint of oat milk vs. almond milk, with oat beverages emerging as the more environmentally responsible choice due to lower water usage and reduced greenhouse gas emissions. This sustainability-driven perception significantly boosts consumer preference for oat-based dairy alternatives, especially among eco-conscious millennials and Gen Z audiences. The demand for barista-grade oat milk, optimized for frothing and latte art, is rapidly rising in cafés across the U.S., Europe, and Asia Pacific, particularly in markets like the U.K., Sweden, Germany, Australia, and Japan. Coffee chains increasingly promote oat milk as a default plant-based option, making it central to the evolving specialty coffee ecosystem. The rise of functional oat milk, including variants enriched with protein, omega-3, probiotics, calcium, vitamin D, and digestive health additives. This aligns with global wellness trends and positions oat milk as a superior, nutrient-rich oat beverage. Innovations in flavors such as mocha, hazelnut, vanilla, and coconut contribute to premiumization. Sustainable packaging innovations, including eco-friendly cartons, recyclable PET bottles, and biodegradable materials, are also gaining traction, as consumers increasingly demand ethical, low-impact packaging. Digital retail expansion through Amazon, Walmart Online, InstaMart, and specialty vegan e-commerce platforms continues to strengthen the Online Oat Milk Market share, influencing purchase behavior across regions. High Production Costs & Price Sensitivity to Hamper Oat Milk Market The high production cost associated with oat processing, enzymatic hydrolysis, fortification, and packaging hampers the Oat Milk Market. Compared to conventional dairy and some plant-based milk alternatives, oat milk is significantly more expensive due to higher ingredient costs, advanced processing technologies, and the use of sustainable packaging solutions such as Tetra Pak cartons. This price gap limits mass-market penetration in cost-sensitive regions such as India, Southeast Asia, Africa, and Latin America, where consumers prefer more affordable dairy alternative options like soy or conventional dairy. The volatile price of oats, which fluctuates due to weather conditions, supply chain disruptions, and crop yield variations. As the demand for organic and pesticide-free oats increases, supply shortages can further elevate raw material costs, affecting the production of organic oat milk and flavored oat beverages. The market faces challenges related to shelf stability, taste standardization, and the need for additives, which may conflict with consumer preference for clean-label products. The competition from well-established alternatives such as almond milk, soy milk, and coconut milk creates pricing pressure for oat milk brands across global markets. Regulatory complexities related to labeling, fortification norms, and dairy terminology restrictions (e.g., “milk” vs. “oat beverage”) in markets such as the U.S., EU, and Canada also hinder smooth commercialization.

Oat Milk Market Segment Analysis

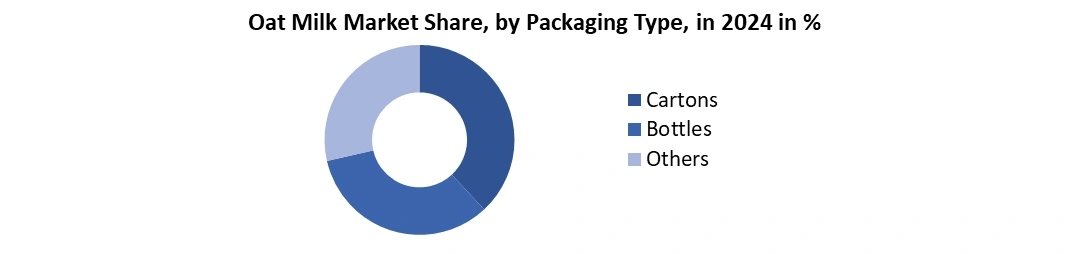

Based on the Nature, the market is segmented into organic and Conventional. Organic dominates the market by nature, driven by rising consumer preference for clean-label, chemical-free, and sustainably produced plant-based beverages. As health consciousness increases globally, consumers are actively shifting away from conventionally processed dairy alternatives and choosing organic oat milk due to its perceived higher nutritional value, minimal pesticide exposure, and environmentally responsible production methods. Organic oat milk is especially popular among millennials, Gen Z, and parents seeking safe, allergen-free, and non-GMO plant-based options for families. The expanding popularity of organic foods in regions such as North America, Europe, and the Asia Pacific significantly strengthens the leadership of this segment. Countries including the U.S., U.K., Germany, Sweden, Australia, and Japan show particularly strong demand due to established organic certification systems and high purchasing power. Organic oat milk is also preferred in cafés, specialty coffee shops, and premium retail outlets because of its clean taste, smoother texture, and compatibility with barista-style beverages. Major players such as Oatly, Danone (So Delicious, Alpro), Califia Farms, Earth’s Own, Minor Figures, and PureHarvest continue to expand their organic product lines, strengthening market leadership. The strong association of organic foods with wellness, sustainability, and premium quality ensures that the Organic segment remains the dominant nature category in the Oat Milk Industry.Based on Packaging Type, the market is categorized into Cartons, Bottles and Others. Cartons represent the dominant packaging type, accounting for the largest share of global sales. Carton packaging, primarily Tetra Pak and similar shelf-stable formats, has become the preferred choice due to its durability, extended shelf life, eco-friendliness, and suitability for both refrigerated and ambient oat milk products. Cartons provide excellent protection from light and oxygen, helping preserve flavor, nutritional value, and overall product quality without requiring artificial preservatives. This makes them ideal for organic, clean-label, and non-GMO oat milk formulations. The carton packaging aligns strongly with sustainability trends, as many cartons are recyclable, FSC-certified, or made from plant-based materials. As consumers increasingly prioritize environmentally responsible packaging, cartons continue to outperform plastic bottles and other formats. The lightweight nature of cartons reduces transportation emissions and storage costs, making them more attractive for manufacturers and retailers.

Oat Milk Market Regional Insights

The Asia Pacific region dominated the Oat Milk Market in 2024 and is expected to continue its dominance over the forecast period. The Global Oat Milk Market, driven by rapid urbanization, rising health consciousness, growing vegan populations, and a strong shift toward plant-based milk consumption. Countries such as China, India, Japan, Australia, South Korea, and Southeast Asian markets are witnessing a substantial increase in demand for non-dairy milk due to lactose intolerance, digestive health concerns, and increased awareness about the environmental impact of dairy production. Oat Milk is increasingly viewed as a healthier, more sustainable alternative to conventional dairy and other dairy substitutes. The premium café culture, the rise of boutique coffee chains, and deep online retail penetration make oat beverages widely accessible, driving China Oat Milk Market. In Japan and South Korea, consumers prefer oat milk for its mild flavor, smooth texture, and excellent compatibility with lattes, aligning well with clean-label, minimal-ingredient, and low-allergen trends. Australia, an early adopter of plant-based diets, continues to fuel demand for organic oat milk, barista-grade variants, and flavored oat beverages, supported by its strong café network and growing sustainability awareness. In India, increasing Western influence, rising lactose intolerance, and growing preference for functional beverages are accelerating oat milk consumption. Both regional and global brands are expanding aggressively, introducing RTD oat milk, fortified oat beverages, and Tetra Pak packaging suited for tropical climates. E-commerce platforms such as Alibaba, JD.com, BigBasket, and Amazon India boost market growth by providing easy access to premium oat milk products.Oat Milk Market Competitive Landscape

The Oat Milk Market is highly competitive, shaped by both established global brands and rapidly emerging plant-based beverage companies. Leading players such as Oatly AB, Califia Farms, Danone, Planet Oat, Alpro, Elmhurst, and Pacific Foods dominate the category with strong distribution networks, extensive product portfolios, and continuous innovation in barista blends, flavored oat milk, organic variants, and fortified functional beverages. These companies invest heavily in marketing, sustainability initiatives, and plant-based advocacy to strengthen brand visibility. Private-label brands from major retailers and online platforms, including Thrive Market and specialty vegan brands, are intensifying competition through affordable pricing and clean-label formulations. The regional companies, such as Earth’s Own, PureHarvest, Minor Figures, Happy Planet, Boring, and Smile Foods, are gaining traction by targeting niche segments such as premium barista oat milk, organic oat beverages, and sustainably packaged options.Recent developments

• On January 8, 2024, Oatly Group AB announced a major portfolio expansion with the U.S. launch of two new oat milk innovations, Oatly Unsweetened and Oatly Super Basic. These represent the company’s first significant beverage innovations in five years in its core North American lineup. Oatly Unsweetened features a newly developed oat base offering 0g sugar and only 40 calories, designed for health-conscious consumers. Oatly Super Basic contains just four clean-label ingredients: water, oats, sea salt, and upcycled citrus zest fiber providing natural texture and simplicity. • On May 1, 2023, So Delicious Dairy Free, a leading brand under Danone North America, announced its entry into the Oat Milk category with the launch of So Delicious Organic Oatmilk. This marks the brand’s first-ever oat milk beverage innovation, available in Original and Extra Creamy variants. According to the company, the launch responds to growing consumer demand for clean-label, organic plant-based beverages. The new Organic Oatmilk is certified vegan, organic, gluten-free, and Non-GMO Project Verified, catering to health-conscious and dairy-free consumers.Oat Milk Market Scope: Inquire before buying

Oat Milk Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.22 Bn. Forecast Period 2025 to 2032 CAGR: 12.5% Market Size in 2032: USD 8.27 Bn. Segments Covered: by Nature Organic Conventional by Packaging Type Cartons Bottles Others by Flavor Flavored Non-Flavored by Distribution Channel Supermarkets/Hypermarkets Convenience Stores Online Retail Others Oat Milk Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Holland, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, New Zealand, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Oat Milk Key Players

1. Oatly Group AB 2. Califia Farms 3. Danone S.A. 4. Elmhurst Milked Direct LLC 5. Happy Planet Foods Inc. 6. Planet Oat 7. HP Hood LLC 8. PureHarvest 9. Alpro 10. Rude Health 11. Minor Figures 12. Pacific Foods of Oregon LLC 13. Thrive Market Inc. 14. Earth's Own Food Company Inc. 15. Nestlé S.A. 16. Chobani, LLC 17. Campbell Soup Company 18. Hain Celestial Group, Inc. 19. Smile Foods 20. Boring 21. Silk 22. Rise Brewing Co. 23. Oatside 24. Good & Gather 25. Marks & Spencer Plant Kitchen 26. Trader Joe’s Oat Beverage 27. Sprouts Farmers Market 28. Woolworths Plant-Based Oat Milk 29. Tesco Plant-Chef Oat DrinkFrequently Asked Questions:

1] What is the growth rate of the Global Oat Milk Market? Ans. The Global Oat Milk Market is growing at a significant rate of 12.5 % during the forecast period. 2] Which region is expected to dominate the Global Oat Milk Market? Ans. Asia Pacific is expected to dominate the Oat Milk Market during the forecast period. 3] What was the Global Oat Milk Market size in 2024? Ans. The Oat Milk Market size is expected to reach USD 3.22 billion in 2024. 4] What is the expected Global Oat Milk Market size by 2032? Ans. The Oat Milk Market size is expected to reach USD 8.27 billion by 2032. 5] Which are the top players in the Global Oat Milk Market? Ans. The major players in the Global Oat Milk Market are Oatly Group AB, Califia Farms, Danone S.A., Elmhurst Milked Direct LLC, Happy Planet Foods Inc., and Others. 6] What are the factors driving the Global Oat Milk Market growth? Ans. The Global Oat Milk Market is driven by rising lactose intolerance, growing demand for plant-based and vegan beverages, increasing health and sustainability awareness, expanding product availability in retail and cafés, and innovations in flavors, fortified formulations, and clean-label ingredients that attract health-conscious consumers.

1. Oat Milk Market: Research Methodology 2. Oat Milk Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Oat Milk Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Oat Milk Market: Dynamics 4.1. Oat Milk Market Trends 4.2. Oat Milk Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Oat Milk Market 5. Oat Milk Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 5.1. Oat Milk Market Size and Forecast, by Nature (2024-2032) 5.1.1. Organic 5.1.2. Conventional 5.2. Oat Milk Market Size and Forecast, by Packaging Type (2024-2032) 5.2.1. Cartons 5.2.2. Bottles 5.2.3. Others 5.3. Oat Milk Market Size and Forecast, by Flavor (2024-2032) 5.3.1. Flavored 5.3.2. Non-Flavored 5.4. Oat Milk Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1. Supermarkets/Hypermarkets 5.4.2. Convenience Stores 5.4.3. Online Retail 5.4.4. Others 5.5. Oat Milk Market Size and Forecast, by Region (2024-2032) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Oat Milk Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 6.1. North America Oat Milk Market Size and Forecast, by Nature (2024-2032) 6.1.1. Organic 6.1.2. Conventional 6.2. North America Oat Milk Market Size and Forecast, by Packaging Type (2024-2032) 6.2.1. Cartons 6.2.2. Bottles 6.2.3. Others 6.3. North America Oat Milk Market Size and Forecast, by Flavor (2024-2032) 6.3.1. Flavored 6.3.2. Non-Flavored 6.4. North America Oat Milk Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.1. Supermarkets/Hypermarkets 6.4.2. Convenience Stores 6.4.3. Online Retail 6.4.4. Others 6.5. North America Oat Milk Market Size and Forecast, by Country (2024-2032) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Oat Milk Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 7.1. Europe Oat Milk Market Size and Forecast, by Nature (2024-2032) 7.2. Europe Oat Milk Market Size and Forecast, by Packaging Type (2024-2032) 7.3. Europe Oat Milk Market Size and Forecast, by Flavor (2024-2032) 7.4. Europe Oat Milk Market Size and Forecast, by Distribution Channel (2024-2032) 7.5. Europe Oat Milk Market Size and Forecast, by Country (2024-2032) 7.5.1. United Kingdom 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Russia 7.5.7. Rest of Europe 8. Asia Pacific Oat Milk Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 8.1. Asia Pacific Oat Milk Market Size and Forecast, by Nature (2024-2032) 8.2. Asia Pacific Oat Milk Market Size and Forecast, by Packaging Type (2024-2032) 8.3. Asia Pacific Oat Milk Market Size and Forecast, by Flavor (2024-2032) 8.4. Asia Pacific Oat Milk Market Size and Forecast, by Distribution Channel (2024-2032) 8.5. Asia Pacific Oat Milk Market Size and Forecast, by Country (2024-2032) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Rest of Asia Pacific 9. Middle East and Africa Oat Milk Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 9.1. Middle East and Africa Oat Milk Market Size and Forecast, by Nature (2024-2032) 9.2. Middle East and Africa Oat Milk Market Size and Forecast, by Packaging Type (2024-2032) 9.3. Middle East and Africa Oat Milk Market Size and Forecast, by Flavor (2024-2032) 9.4. Middle East and Africa Oat Milk Market Size and Forecast, by Distribution Channel (2024-2032) 9.5. Middle East and Africa Oat Milk Market Size and Forecast, by Country (2024-2032) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Nigeria 9.5.4. Rest of ME&A 10. South America Oat Milk Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 10.1. South America Oat Milk Market Size and Forecast, by Nature (2024-2032) 10.2. South America Oat Milk Market Size and Forecast, by Packaging Type (2024-2032) 10.3. South America Oat Milk Market Size and Forecast, by Flavor (2024-2032) 10.4. South America Oat Milk Market Size and Forecast, by Distribution Channel (2024-2032) 10.5. South America Oat Milk Market Size and Forecast, by Country (2024-2032) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Colombia 10.5.4. Chile 10.5.5. Rest Of South America 11. Company Profile: Key Players 11.1. Oatly Group AB 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Califia Farms 11.3. Danone S.A. 11.4. Elmhurst Milked Direct LLC 11.5. Happy Planet Foods Inc. 11.6. Planet Oat 11.7. HP Hood LLC 11.8. PureHarvest 11.9. Alpro 11.10. Rude Health 11.11. Minor Figures 11.12. Pacific Foods of Oregon LLC 11.13. Thrive Market Inc. 11.14. Earth’s Own Food Company Inc. 11.15. Nestlé S.A. 11.16. Chobani, LLC 11.17. Campbell Soup Company 11.18. Hain Celestial Group, Inc. 11.19. Smile Foods 11.20. Boring 11.21. Silk 11.22. Rise Brewing Co. 11.23. Oatside 11.24. Good & Gather 11.25. Marks & Spencer Plant Kitchen 11.26. Trader Joe’s Oat Beverage 11.27. Sprouts Farmers Market 11.28. Woolworths Plant-Based Oat Milk 11.29. Tesco Plant-Chef Oat Drink 12. Key Findings 13. Analyst Recommendations