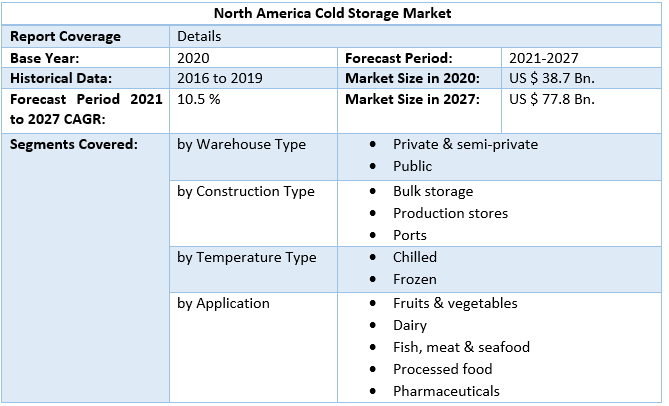

North America Cold Storage Market was valued at US$ 38.7 Bn. in 2020 and is expected to reach US$ 77.8 Bn. by 2027, at a CAGR of 10.5% during a forecast period.North America Cold Storage Market Overview:

North America cold storage market size was valued at US$ 38.7 Bn. in 2020. The increasing acceptance of connected devices and the availability of a large consumer base are the major trends driving market expansion. In addition, increased refrigerated warehouse automation is likely to drive up demand for the product. Warehouses are automated using cloud technology, conveyor belts, robotics, energy management systems, and truck loading automation. The integration of workforce management systems for picking optimization and manpower forecasting resulted in lower labor costs.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2016 to forecast the market through 2027. 2020 is considered a base year. Special attention is given to 2020 and effect of lockdown on the demand and supply, and also the impact of lockdown for next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

COVID-19 impact on North America cold storage market:

The COVID-19 viral pandemic has wrecked devastation on nearly every business on the planet. For end-user items, the global market is fully based on a stable demand-supply ratio. The cold storage market share was unavoidably lowered during the outbreak. Since the outbreak, lockdowns have been implemented in almost every country on the planet. Every country had its own set of restrictions on travel. With such a backdrop, it was impossible to keep the food market's supply chains unaffected.North America Cold Storage Market Dynamics:

Increasing demand for frozen and processed items, as well as the availability of well-organized retail sectors due to improved storage technology and better refrigeration than traditional stores, are expected to drive growth in the cold storage market throughout the forecast period. Furthermore, increased demand for refrigerated storage is expected to move the market ahead, owing to a growing desire for perishable products. The preservation of foods or other objects in a refrigerator or other cold environment is known as cold storage. Chilled storage is an important part of the supply chain management process when storing or transporting temperature-sensitive products.The absence of suitable infrastructure in North America is projected to be a major stumbling obstacle to the market's growth. Furthermore, a dearth of reliable power sources at cold warehouses and a sufficient number of power hook-ups at transportation hubs are expected to stymie the cold storage market's growth in the near future. The development of technologically innovative and unique solutions or alternative energy sources to overcome irregular power supply is anticipated to benefit manufacturers in the North American cold storage sector. In addition, the development of new transportation modes, such as the flexible refrigerated container transportation facility, is expected to provide small businesses and farmers with access to the global market in the near future. Furthermore, the market is constrained by high operating costs, capital expenditure, and the scalability of various selection approaches. A great demand for specialized workers has also come from advanced automation, software systems, and high-tech improvements in tracking systems and warehouses. A shortage of qualified workers could hinder the market from attaining its full potential.

North America Cold Storage Market Segment Analysis:

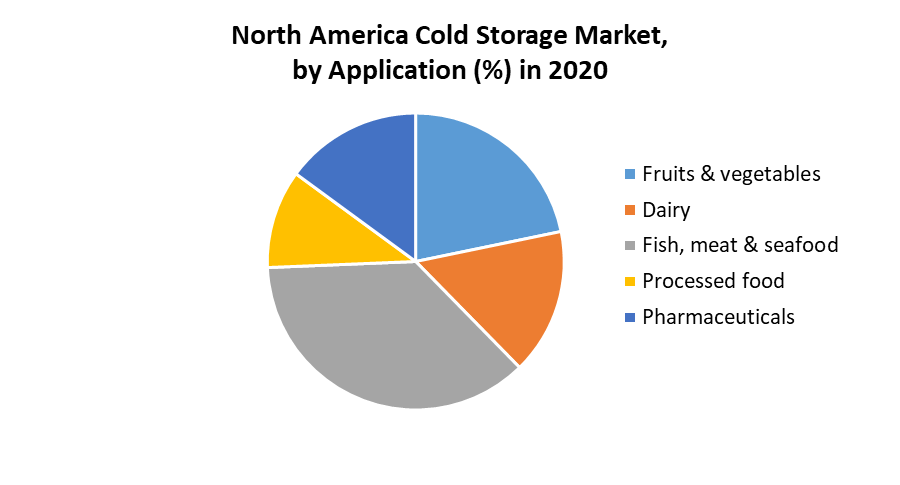

Based on type, the public warehouse segment held the largest share of 76% in 2020. Public warehouses, which provide duty-paid amenities, might be owned by individuals or agencies. A public warehouse is a self-contained company that offers services including storage, handling, and shipping for a set or variable fee. During the projected period, the private and semi-private segment is expected to increase at a high CAGR of xx %. Private warehouses offer a number of benefits, including the ability to make independent decisions about the warehouse's overall activities and goals, as well as cost management and flexibility. Due to the high costs of building and maintenance, private warehouse growth is restricted to major firms that can afford the operational costs of chilled warehouse facilities.Based on construction type, The Production stores segment held the largest share of 49% in 2020. The segment's rise is due to its adaptability and choice for preserving fruits, vegetables, flour, cooking materials, and canned goods for extended periods of time without spoiling. Over the next few years, the number of warehouses built at ports is expected to rise dramatically. These facilities can make customs procedures for importing and exporting temperature-controlled goods easier. Based on application, The Fish, meat & seafood segment held the largest share of 39% in 2020. Because of ongoing packaging material advances, the processed food segment is expected to grow at a high rate over the forecast period. Advances in packaging materials have enhanced the shelf life of foods, resulting in a surge in processed food trading in recent years. The pharmaceutical industry's growing demand for cold storage systems can be linked to their relevance in ensuring the efficacy and safety of medications. Keeping life science items at a consistent room temperature can be a time-consuming and expensive procedure. To ensure the quality of these products, they must be transported incorrect conditions.

North America Cold Storage Market Regional Insights:

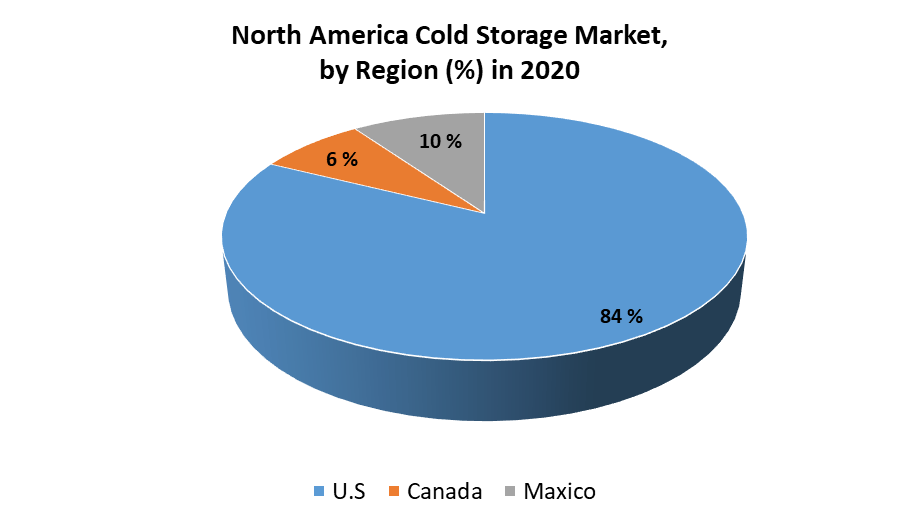

The U.S. segment held the largest share of 72% in 2020. Rising investment in material handling equipment automation in the United States is predicted to boost demand for the product. Material handling helps with product storage, protection, and control throughout the supply chain. The use of cold storage in material handling has resulted in significant developments and expenditures in recent years in the United States. Mexico's market growth is being aided by government initiatives to strengthen national infrastructure and promote exports, which are causing industry companies to expand their capacity in the country. The country's refrigerated capacity increased by 32% between 2017 and 2019. Leading industry participants such as Bajo Cero Frigorific and Castelo Cold Storage Fruvemex Mexicali SA de CV have boosted their cold storage capacity to satisfy the increased demand.

North America Cold Storage Market Report Highlights:

• Service providers have stepped up their efforts to protect temperature-controlled items against tampering or other malicious actions involving food. • The closeness of warehouses to transportation hubs like airports, seaports, and major highway interchanges is likely to help service providers increase their efficiency by sending products on time. • Manufacturers are encouraged to create rigorous standards, and service providers are encouraged to engage in infrastructure improvements in order to get safety certifications, thanks to strict government rules. • Over the previous two years, Canada's cold storage capacity has increased by roughly 8%, thanks to strong growth in the pharmaceutical business and tightening food safety rules. The objective of the report is to present a comprehensive analysis of the North America Cold Storage market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the North America Cold Storage market dynamics, structure by analyzing the market segments and project the North America Cold Storage market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the North America Cold Storage market make the report investor’s guide.North America Cold Storage Market Scope: Inquire before buying

North America Cold Storage Market Key Players

• Americold Logistics • Agro Merchant • Burris Logistics • Cloverleaf Cold Storage • Henningsen Cold Storage • Kloosterboer • Lineage Logistic • Nordic Logistics • Preferred Freezer • Swire Group • United States Cold Storage • VersaCold Logistics • Nichirei Corporation • Tippmann Group • Congebac Inc • NewCold • Snowman Logistics • Wabash NationalFrequently Asked Questions:

1. What is the market size of North America Cold Storage Market in 2020? Ans: North America Cold Storage Market size was valued at US$ 38.7 Bn. in 2020 2. What is the growth rate of North America Cold Storage Market? Ans: The North America Cold Storage Market is growing at a CAGR of 10.5 % during forecasting period 2021-2027. 3. What segments are covered in North America Cold Storage market? Ans: North America Cold Storage Market is segmented into data type, industry, end-user and region. 4. Who are the key players in North America Cold Storage market? Ans: The important key players in the North America Cold Storage Market are – Americold Logistics, Agro Merchant, Burris Logistics, Cloverleaf Cold Storage, Henningsen Cold Storage, Kloosterboer, Lineage Logistic, Nordic Logistics, Preferred Freezer, Swire Group, United States Cold Storage, VersaCold Logistics, Nichirei Corporation, Tippmann Group, Congebac Inc, NewCold, Snowman Logistics, Wabash National. 5. What is the study period of this market? Ans: The North America Cold Storage Market is studied from 2020 to 2027.

1. North America Cold Storage Market: Research Methodology 2. North America Cold Storage Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to North America Cold Storage Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. North America Cold Storage Market: Competitive Analysis 3.1. MMR Competition Matrix 3.2. Consolidation in the Market 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America 3.12. COVID-19 Impact 4. North America Cold Storage Market Segmentation 4.1. North America Cold Storage Market, by Warehouse Type (2020-2027) • Private & semi-private • Public 4.2. North America Cold Storage Market, by Construction Type (2020-2027) • Bulk storage • Production stores • Ports 4.3. North America Cold Storage Market, by Temperature Type (2020-2027) • Chilled • Frozen 4.4. North America Cold Storage Market, by Application (2020-2027) • Fruits & vegetables • Dairy • Fish, meat & seafood • Processed food • Pharmaceuticals 4.5. North America Cold Storage Market, by Country (2020-2027) • United States • Canada • Mexico 5. Company Profile: Key players 5.1. Americold Logistics 5.1.1. Company Overview 5.1.2. Financial Overview 5.1.3. Global Presence 5.1.4. Capacity Portfolio 5.1.5. Business Strategy 5.1.6. Recent Developments 5.2. Agro Merchant 5.3. Burris Logistics 5.4. Cloverleaf Cold Storage 5.5. Henningsen Cold Storage 5.6. Kloosterboer 5.7. Lineage Logistic 5.8. Nordic Logistics 5.9. Preferred Freezer 5.10. Swire Group 5.11. United States Cold Storage 5.12. VersaCold Logistics 5.13. Nichirei Corporation 5.14. Tippmann Group 5.15. Congebac Inc 5.16. NewCold 5.17. Snowman Logistics 5.18. Wabash National