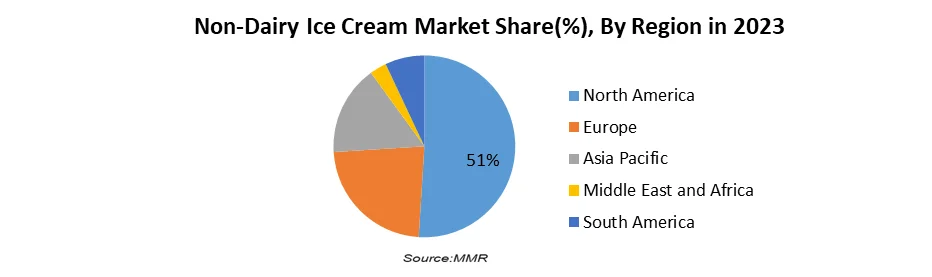

Global Non-Dairy Ice Cream Market size was valued at USD 855.28 Mn. in 2023 and the total Non-Dairy Ice Cream revenue is expected to grow by 8.4 % from 2024 to 2030, reaching nearly USD 1504.23 Mn. Non-Dairy Ice Cream Market Overview: The Non-Dairy Ice Cream Market is the frozen dessert market segment that focuses on the manufacturing and consumption of dairy-free ice cream alternatives. It refers to a wide range of products that have been specifically designed to emulate the flavor, texture, and enjoyment of classic dairy ice creams while employing plant-based components. Awareness of health and wellness is growing which led consumers to seek alternatives to traditional dairy products. Non-dairy ice cream often appeals to those looking for lower-calorie, lower-fat, and cholesterol-free options. Non-dairy ice cream products are now widely available in supermarkets, health food stores, and online platforms. Improved accessibility has contributed to increased consumer adoption. North America region dominated the Non-Dairy Ice Cream market in the year 2023. Major market players from the United States are Ben & Jerry's, Eden Creamery LLC, So Delicious Dairy Free, Cosmic Bliss, Häagen-Dazs, Tofutti Brands Inc., NadaMoo!, etc. are the companies that prioritize the creation of premium non-dairy ice creams that closely same as the taste and texture of conventional dairy varieties.To know about the Research Methodology :- Request Free Sample Report Drivers Adoption of plant-based diets, and rising lactose intolerance and dairy allergies to Drive Non-Dairy Ice Cream Market The Non-Dairy Ice Cream Market is characterized by dynamic and evolving dynamics driven by various factors. Changing consumer preferences and dietary habits, including the growing adoption of plant-based diets, have a profound impact on market dynamics. Increasing health consciousness and concerns about the environmental impact of dairy products have led consumers to seek non-dairy alternatives, stimulating market growth. Technology and product innovations also influence market dynamics. Non-dairy ice cream manufacturers use dairy-like ingredients and procedures to improve taste and texture. Innovation has increased flavor possibilities and product quality, attracting more non-dairy consumers. Marketing and promotional strategies adopted by key market players significantly influence market dynamics. Effective branding, advertising, and product positioning contribute to increased consumer awareness and acceptance of non-dairy ice cream options. The expansion of distribution channels, including online platforms and specialty stores, has also expanded market accessibility and contributed to market growth. The Non-Dairy Ice Cream Market is driven by a confluence of significant drivers. Non-dairy ice cream is in demand due to rising lactose intolerance and dairy allergies. Plant-based diets, driven by health and environmental concerns, also boost the industry. Consumer tastes and a desire for healthier desserts also drive non-dairy ice cream sales. The availability of diverse flavors and innovative product offerings appeals to consumers seeking novel taste experiences. Additionally, the robust marketing strategies and brand recognition employed by key market players play a pivotal role in driving consumer awareness and acceptance of non-dairy ice cream. Collectively, these drivers fuel the growth of the Non-Dairy Ice Cream Market, reflecting a paradigm shift towards plant-based alternatives in the frozen dessert industry. Restraints Limited consumer awareness and replicating the taste and texture of traditional dairy ice cream can hamper the market The Non-Dairy Ice Cream Market encounters a range of restraints and challenges that impact its progress. Firstly, limited consumer awareness and acceptance of non-dairy ice cream pose a hurdle to market growth. While the demand for plant-based alternatives grows, a substantial portion of the population remains unfamiliar or hesitant to try non-dairy options, affecting market reach. Another challenge lies in replicating the taste and texture of traditional dairy ice cream using non-dairy ingredients, as achieving the same level of creaminess and indulgence can be complex. Ingredient availability and affordability also present obstacles, with certain plant-based alternatives being costlier or subject to supply chain limitations. Furthermore, navigating regulatory constraints and labeling requirements regarding allergen declarations, nutritional claims, and ingredient labeling can be intricate for manufacturers. Lastly, intensifying competition in the market calls for differentiation through unique flavors, quality ingredients, and effective marketing strategies to stand out in the crowded landscape. Addressing these challenges requires continuous innovation, consumer education, ingredient sourcing strategies, regulatory compliance, and strategic branding efforts to drive market acceptance and growth. Opportunity Innovation in Flavors and Ingredients and growth in the retail industry create opportunities The Non-Dairy Ice Cream Market presents ample growth opportunities driven by the rising popularity of plant-based diets, consumer demand for unique and innovative flavors, the growth of distribution channels including online platforms, the potential for product diversification to cater to specific dietary needs, and the adoption of sustainable packaging and practices. As more individuals embrace dairy-free alternatives and seek indulgent frozen desserts, companies can capitalize on these trends to expand their market reach, attract a broader customer base, and enhance their brand reputation in the evolving landscape of non-dairy ice cream. There's room for creativity in developing new flavors and incorporating unique ingredients. Brands can experiment with exotic fruits, spices, and other innovative components to differentiate their products in a competitive market. Increasing availability in supermarkets, convenience stores, and online platforms allows non-dairy ice cream brands to reach a wider audience. Growth retail presence can lead to increased sales and market penetration.

Non-Dairy Ice Cream Market Segment Analysis

Based on the Source, The Non-Dairy Ice Cream Market exhibits source-based segmentation, encompassing a range of plant-based alternatives such as coconut milk, almond milk, soy milk, cashew milk, oat milk, and other options. Non-dairy ice creams derived from coconut milk delight consumers with their luxurious and creamy texture, providing a truly gratifying experience. Almond milk-based varieties present a delicately nutty flavor, appealing to those desiring a lighter taste sensation. Soy milk, a widely popular alternative, offers a smooth and creamy consistency accompanied by a neutral flavor, making it an ideal canvas for a wide array of flavor combinations.Indulging in cashew milk-based ice creams unveils a velvety texture complemented by a slightly sweet and buttery essence. Oat milk-based alternatives provide a creamy and smooth consistency, often preferred for their neutral taste. The "others" category includes non-dairy ice creams derived from sources like rice milk, hemp milk, and pea protein, offering a diverse range of flavors and textures to cater to different dietary preferences and allergen considerations. Based on the Product,The Non-Dairy Ice Cream Market is segmented by product into three categories such as impulse, artisanal, and take-home. Impulse non-dairy ice creams are typically single-serving products that are conveniently packaged and readily available for immediate consumption, catering to on-the-go consumers.

Artisanal non-dairy ice creams are handcrafted in small batches, often featuring unique flavors and premium ingredients, appealing to consumers seeking a gourmet experience. Take-home non-dairy ice creams come in larger containers and are intended for consumption at home, allowing individuals and families to enjoy indulgence over multiple servings. This segmentation caters to different consumer preferences, occasions, and consumption patterns within the non-dairy ice cream market.

Non-Dairy Ice Cream Market Regional Insights:

Plant-based and dairy-free options are driving demand for non-dairy ice cream in North America. Ben & Jerry's, So Delicious Dairy Free, and Häagen-Dazs use their brand recognition and distribution networks throughout the region. Flavors and new products meet varied consumer tastes in the market, especially in the United States and Canada. Both established and developing businesses can succeed in this competitive landscape because North American customers value high-quality ingredients, organic alternatives, and innovative flavor profiles. Plant-based diets and sustainability consciousness are driving non-dairy ice cream sales in Europe. Alpro, Swedish Glace, and Oatly are meeting European demand for non-dairy alternatives. The region offers soy, almond, oat, and coconut-based non-dairy ice cream. Local and organic products, new flavors, and unusual textures appeal to European customers, grow the market, and attracting international and local businesses in various countries such as the United Kingdom, France, etc. Veganism and changing diets are driving demand for non-dairy ice cream in Asia-Pacific. Cocofrio, Non-Dairy Queen, and Yoconut Dairy Free are emerging in Australia, Japan, and India. These brands provide many non-dairy ice cream flavors and forms to satisfy consumer desires. As consumers seek healthier, more sustainable desserts, the market grows. Consumers in MEA are slowly adopting non-dairy ice cream as a healthier alternative to dairy treats. Smoocht, Yöru, and Coconutsy are growing by offering plant-based and dairy-free solutions. The industry is rising due to health awareness, lactose sensitivity, and veganism. International and regional players can capitalize on the increased interest in locally sourced and natural products. Health and environmental consciousness is driving the non-dairy ice cream business in South America. Plant-based and dairy-free brands like Frooty, Gelato & Grano, and Los Helados meet this demand. The region's tropical fruits and native ingredients appeal to South American tastes. South America's flourishing non-dairy ice cream business benefits from the region's abundant biodiversity, which allows for novel flavor development.

Competitive Landscape:

The Non-Dairy Ice Cream Market is marked by a competitive landscape with a wide array of players offering distinct products to meet the rising demand for plant-based and dairy-free alternatives. Key industry players like Ben & Jerry's, Häagen-Dazs, and So Delicious Dairy Free utilize their strong brand recognition and extensive distribution networks to secure a substantial market presence. These companies prioritize the creation of premium non-dairy ice creams that closely replicate the taste and texture of conventional dairy varieties. Through their commitment to quality, they cater to consumers seeking a comparable experience to traditional dairy ice creams while enjoying the benefits of a plant-based and dairy-free option. Additionally, innovative companies like Oatly and NadaMoo! specialize in creating non-dairy ice creams using unique ingredients such as oats and coconut, providing a distinct flavor profile. The competitive landscape is further enriched by smaller players offering niche flavors and focusing on organic, allergen-free, or locally sourced ingredients, catering to specific consumer preferences. The objective of the report is to present a comprehensive analysis of the Non-Dairy Ice Cream Market including all the stakeholders of the Technology. The past and current status of the Technology with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Technology with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Technology to the decision-makers. The report also helps in understanding the Non-Dairy Ice Cream Market dynamics, and structure by analyzing the market segments and projecting the Non-Dairy Ice Cream Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Non-Dairy Ice Cream Market makes the report an investor’s guide.Non-Dairy Ice Cream Market Scope: Inquire before buying

Non-Dairy Ice Cream Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 855.28 Mn Forecast Period 2024 to 2030 CAGR: 8.4% Market Size in 2030: US $ 1504.23 Mn. Segments Covered: by Source Coconut Milk Almond Milk Soy Milk Cashew Milk Oat Milk Others by Flavor Chocolate Caramel Coconut Vanilla Coffee Fruit Cookies & Cream Strawberry Others by Distribution Channel Supermarkets Hypermarkets Convenience Stores Speciality Stores Online Retail by Product Impulse Artisanal Take Home by Form Singles Blends Non-Dairy Ice Cream Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Non-Dairy Ice Cream Key Players

North America: 1. Ben & Jerry's (United States) 2. So Delicious Dairy Free (United States) 3. Cosmic Bliss (United States) 4. Häagen-Dazs (United States) 5. Tofutti Brands Inc. (United States) 6. NadaMoo! (United States) 7. Eden Creamery LLC (United States) 8. Dream (United States) 9. Trader Joe’s (United States) 10. Van Leeuwen Artisan Ice Cream (United States) 11. General Mills (United States) 12. Bliss Unlimited, LLC. (United States) Europe 1. Swedish Glace (Sweden) 2. Unilever (United Kingdom/Netherlands) 3. Danone (France) 4. The Booja-Booja Co. Central Europe Ltd. (United Kingdom) 5. Happy Cow Limited (United Kingdom) Asia Pacific 1. Over The Moo (Australia) Frequently Asked Questions: 1] What segments are covered in the Global Non-Dairy Ice Cream Market report? Ans. The segments covered in the Non-Dairy Ice Cream Market report are based on Source, Flavor, Distribution Channel, Product, Form, and Region. 2] Which region is expected to hold the highest share of the Global Non-Dairy Ice Cream Market? Ans. The North American region is expected to hold the highest share of the Non-Dairy Ice Cream Market. The United States and Canada are the countries in this region where Flavors and new products meet varied consumer tastes. 3] What is the market size of the Global Non-Dairy Ice Cream Market by 2030? Ans. The market size of the Non-Dairy Ice Cream Market by 2029 is expected to reach US$ 1504.98 Mn. 4] What is the forecast period for the Global Non-Dairy Ice Cream Market? Ans. The forecast period for the Non-Dairy Ice Cream Market is 2024-2030. 5] What was the market size of the Global Non-Dairy Ice Cream Market in 2023? Ans. The market size of the Non-Dairy Ice Cream Market in 2023 was valued at US$ 855.82Mn.

1. Non-Dairy Ice Cream Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Non-Dairy Ice Cream Market: Dynamics 2.1. Non-Dairy Ice Cream Market Trends by Region 2.1.1. North America Non-Dairy Ice Cream Market Trends 2.1.2. Europe Non-Dairy Ice Cream Market Trends 2.1.3. Asia Pacific Non-Dairy Ice Cream Market Trends 2.1.4. Middle East and Africa Non-Dairy Ice Cream Market Trends 2.1.5. South America Non-Dairy Ice Cream Market Trends 2.2. Non-Dairy Ice Cream Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Non-Dairy Ice Cream Market Drivers 2.2.1.2. North America Non-Dairy Ice Cream Market Restraints 2.2.1.3. North America Non-Dairy Ice Cream Market Opportunities 2.2.1.4. North America Non-Dairy Ice Cream Market Challenges 2.2.2. Europe 2.2.2.1. Europe Non-Dairy Ice Cream Market Drivers 2.2.2.2. Europe Non-Dairy Ice Cream Market Restraints 2.2.2.3. Europe Non-Dairy Ice Cream Market Opportunities 2.2.2.4. Europe Non-Dairy Ice Cream Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Non-Dairy Ice Cream Market Drivers 2.2.3.2. Asia Pacific Non-Dairy Ice Cream Market Restraints 2.2.3.3. Asia Pacific Non-Dairy Ice Cream Market Opportunities 2.2.3.4. Asia Pacific Non-Dairy Ice Cream Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Non-Dairy Ice Cream Market Drivers 2.2.4.2. Middle East and Africa Non-Dairy Ice Cream Market Restraints 2.2.4.3. Middle East and Africa Non-Dairy Ice Cream Market Opportunities 2.2.4.4. Middle East and Africa Non-Dairy Ice Cream Market Challenges 2.2.5. South America 2.2.5.1. South America Non-Dairy Ice Cream Market Drivers 2.2.5.2. South America Non-Dairy Ice Cream Market Restraints 2.2.5.3. South America Non-Dairy Ice Cream Market Opportunities 2.2.5.4. South America Non-Dairy Ice Cream Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Non-Dairy Ice Cream Industry 2.8. Analysis of Government Schemes and Initiatives For Non-Dairy Ice Cream Industry 2.9. Non-Dairy Ice Cream Market Trade Analysis 2.10. The Global Pandemic Impact on Non-Dairy Ice Cream Market 3. Non-Dairy Ice Cream Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2030 3.1. Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 3.1.1. Coconut Milk 3.1.2. Almond Milk 3.1.3. Soy Milk 3.1.4. Cashew Milk 3.1.5. Oat Milk 3.1.6. Others 3.2. Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 3.2.1. Chocolate 3.2.2. Caramel 3.2.3. Coconut 3.2.4. Vanilla 3.2.5. Coffee 3.2.6. Fruit 3.2.7. Cookies & Cream 3.2.8. Strawberry 3.2.9. Others 3.3. Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 3.3.1. Supermarkets 3.3.2. Hypermarkets 3.3.3. Convenience Stores 3.3.4. Speciality Stores 3.3.5. Online Retail 3.4. Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 3.4.1. Impulse 3.4.2. Artisanal 3.4.3. Take Home 3.5. Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 3.5.1. Singles 3.5.2. Blends 3.6. Non-Dairy Ice Cream Market Size and Forecast, by Region (2024-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Non-Dairy Ice Cream Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2030 4.1. North America Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 4.1.1. Coconut Milk 4.1.2. Almond Milk 4.1.3. Soy Milk 4.1.4. Cashew Milk 4.1.5. Oat Milk 4.1.6. Others 4.2. North America Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 4.2.1. Chocolate 4.2.2. Caramel 4.2.3. Coconut 4.2.4. Vanilla 4.2.5. Coffee 4.2.6. Fruit 4.2.7. Cookies & Cream 4.2.8. Strawberry 4.2.9. Others 4.3. North America Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 4.3.1. Supermarkets 4.3.2. Hypermarkets 4.3.3. Convenience Stores 4.3.4. Speciality Stores 4.3.5. Online Retail 4.4. North America Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 4.4.1. Impulse 4.4.2. Artisanal 4.4.3. Take Home 4.5. North America Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 4.5.1. Singles 4.5.2. Blends 4.6. North America Non-Dairy Ice Cream Market Size and Forecast, by Country (2024-2030) 4.6.1. United States 4.6.1.1. United States Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 4.6.1.1.1. Coconut Milk 4.6.1.1.2. Almond Milk 4.6.1.1.3. Soy Milk 4.6.1.1.4. Cashew Milk 4.6.1.1.5. Oat Milk 4.6.1.1.6. Others 4.6.1.2. United States Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 4.6.1.2.1. Chocolate 4.6.1.2.2. Caramel 4.6.1.2.3. Coconut 4.6.1.2.4. Vanilla 4.6.1.2.5. Coffee 4.6.1.2.6. Fruit 4.6.1.2.7. Cookies & Cream 4.6.1.2.8. Strawberry 4.6.1.2.9. Others 4.6.1.3. United States Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 4.6.1.3.1. Supermarkets 4.6.1.3.2. Hypermarkets 4.6.1.3.3. Convenience Stores 4.6.1.3.4. Speciality Stores 4.6.1.3.5. Online Retail 4.6.1.4. United States Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 4.6.1.4.1. Impulse 4.6.1.4.2. Artisanal 4.6.1.4.3. Take Home 4.6.1.5. United States Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 4.6.1.5.1. Singles 4.6.1.5.2. Blends 4.6.2. Canada 4.6.2.1. Canada Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 4.6.2.1.1. Coconut Milk 4.6.2.1.2. Almond Milk 4.6.2.1.3. Soy Milk 4.6.2.1.4. Cashew Milk 4.6.2.1.5. Oat Milk 4.6.2.1.6. Others 4.6.2.2. Canada Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 4.6.2.2.1. Chocolate 4.6.2.2.2. Caramel 4.6.2.2.3. Coconut 4.6.2.2.4. Vanilla 4.6.2.2.5. Coffee 4.6.2.2.6. Fruit 4.6.2.2.7. Cookies & Cream 4.6.2.2.8. Strawberry 4.6.2.2.9. Others 4.6.2.3. Canada Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 4.6.2.3.1. Supermarkets 4.6.2.3.2. Hypermarkets 4.6.2.3.3. Convenience Stores 4.6.2.3.4. Speciality Stores 4.6.2.3.5. Online Retail 4.6.2.4. Canada Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 4.6.2.4.1. Impulse 4.6.2.4.2. Artisanal 4.6.2.4.3. Take Home 4.6.2.5. Canada Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 4.6.2.5.1. Singles 4.6.2.5.2. Blends 4.6.3. Mexico 4.6.3.1. Mexico Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 4.6.3.1.1. Coconut Milk 4.6.3.1.2. Almond Milk 4.6.3.1.3. Soy Milk 4.6.3.1.4. Cashew Milk 4.6.3.1.5. Oat Milk 4.6.3.1.6. Others 4.6.3.2. Mexico Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 4.6.3.2.1. Chocolate 4.6.3.2.2. Caramel 4.6.3.2.3. Coconut 4.6.3.2.4. Vanilla 4.6.3.2.5. Coffee 4.6.3.2.6. Fruit 4.6.3.2.7. Cookies & Cream 4.6.3.2.8. Strawberry 4.6.3.2.9. Others 4.6.3.3. Mexico Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 4.6.3.3.1. Supermarkets 4.6.3.3.2. Hypermarkets 4.6.3.3.3. Convenience Stores 4.6.3.3.4. Speciality Stores 4.6.3.3.5. Online Retail 4.6.3.4. Mexico Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 4.6.3.4.1. Impulse 4.6.3.4.2. Artisanal 4.6.3.4.3. Take Home 4.6.3.5. Mexico Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 4.6.3.5.1. Singles 4.6.3.5.2. Blends 5. Europe Non-Dairy Ice Cream Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2030 5.1. Europe Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.2. Europe Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.3. Europe Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 5.4. Europe Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.5. Europe Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6. Europe Non-Dairy Ice Cream Market Size and Forecast, by Country (2024-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.1.2. United Kingdom Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.1.3. United Kingdom Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 5.6.1.4. United Kingdom Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.1.5. United Kingdom Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6.2. France 5.6.2.1. France Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.2.2. France Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.2.3. France Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel(2024-2030) 5.6.2.4. France Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.2.5. France Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6.3. Germany 5.6.3.1. Germany Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.3.2. Germany Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.3.3. Germany Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 5.6.3.4. Germany Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.3.5. Germany Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6.4. Italy 5.6.4.1. Italy Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.4.2. Italy Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.4.3. Italy Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel(2024-2030) 5.6.4.4. Italy Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.4.5. Italy Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6.5. Spain 5.6.5.1. Spain Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.5.2. Spain Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.5.3. Spain Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 5.6.5.4. Spain Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.5.5. Spain Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6.6. Sweden 5.6.6.1. Sweden Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.6.2. Sweden Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.6.3. Sweden Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 5.6.6.4. Sweden Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.6.5. Sweden Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6.7. Austria 5.6.7.1. Austria Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.7.2. Austria Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.7.3. Austria Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 5.6.7.4. Austria Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.7.5. Austria Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 5.6.8.2. Rest of Europe Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 5.6.8.3. Rest of Europe Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 5.6.8.4. Rest of Europe Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 5.6.8.5. Rest of Europe Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6. Asia Pacific Non-Dairy Ice Cream Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2030 6.1. Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.2. Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.3. Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.4. Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.5. Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6. Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Country (2024-2030) 6.6.1. China 6.6.1.1. China Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.1.2. China Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.1.3. China Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.1.4. China Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.1.5. China Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.2. S Korea 6.6.2.1. S Korea Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.2.2. S Korea Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.2.3. S Korea Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.2.4. S Korea Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.2.5. S Korea Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.3. Japan 6.6.3.1. Japan Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.3.2. Japan Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.3.3. Japan Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.3.4. Japan Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.3.5. Japan Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.4. India 6.6.4.1. India Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.4.2. India Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.4.3. India Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.4.4. India Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.4.5. India Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.5. Australia 6.6.5.1. Australia Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.5.2. Australia Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.5.3. Australia Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.5.4. Australia Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.5.5. Australia Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.6.2. Indonesia Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.6.3. Indonesia Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.6.4. Indonesia Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.6.5. Indonesia Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.7.2. Malaysia Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.7.3. Malaysia Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.7.4. Malaysia Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.7.5. Malaysia Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.8.2. Vietnam Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.8.3. Vietnam Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel(2024-2030) 6.6.8.4. Vietnam Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.8.5. Vietnam Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.9.2. Taiwan Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.9.3. Taiwan Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.9.4. Taiwan Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.9.5. Taiwan Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 6.6.10.2. Rest of Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 6.6.10.3. Rest of Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 6.6.10.4. Rest of Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 6.6.10.5. Rest of Asia Pacific Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 7. Middle East and Africa Non-Dairy Ice Cream Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2030 7.1. Middle East and Africa Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 7.2. Middle East and Africa Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 7.3. Middle East and Africa Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 7.4. Middle East and Africa Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 7.5. Middle East and Africa Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 7.6. Middle East and Africa Non-Dairy Ice Cream Market Size and Forecast, by Country (2024-2030) 7.6.1. South Africa 7.6.1.1. South Africa Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 7.6.1.2. South Africa Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 7.6.1.3. South Africa Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 7.6.1.4. South Africa Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 7.6.1.5. South Africa Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 7.6.2. GCC 7.6.2.1. GCC Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 7.6.2.2. GCC Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 7.6.2.3. GCC Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 7.6.2.4. GCC Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 7.6.2.5. GCC Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 7.6.3.2. Nigeria Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 7.6.3.3. Nigeria Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 7.6.3.4. Nigeria Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 7.6.3.5. Nigeria Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 7.6.4.2. Rest of ME&A Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 7.6.4.3. Rest of ME&A Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 7.6.4.4. Rest of ME&A Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 7.6.4.5. Rest of ME&A Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 8. South America Non-Dairy Ice Cream Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2030 8.1. South America Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 8.2. South America Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 8.3. South America Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel(2024-2030) 8.4. South America Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 8.5. South America Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 8.6. South America Non-Dairy Ice Cream Market Size and Forecast, by Country (2024-2030) 8.6.1. Brazil 8.6.1.1. Brazil Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 8.6.1.2. Brazil Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 8.6.1.3. Brazil Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 8.6.1.4. Brazil Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 8.6.1.5. Brazil Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 8.6.2. Argentina 8.6.2.1. Argentina Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 8.6.2.2. Argentina Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 8.6.2.3. Argentina Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 8.6.2.4. Argentina Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 8.6.2.5. Argentina Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Non-Dairy Ice Cream Market Size and Forecast, by Source (2024-2030) 8.6.3.2. Rest Of South America Non-Dairy Ice Cream Market Size and Forecast, by Flavor (2024-2030) 8.6.3.3. Rest Of South America Non-Dairy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2030) 8.6.3.4. Rest Of South America Non-Dairy Ice Cream Market Size and Forecast, by Product (2024-2030) 8.6.3.5. Rest Of South America Non-Dairy Ice Cream Market Size and Forecast, by Form (2024-2030) 9. Global Non-Dairy Ice Cream Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Non-Dairy Ice Cream Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Ben & Jerry's 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. So Delicious Dairy Free 10.3. Cosmic Bliss 10.4. Häagen-Dazs 10.5. Tofutti Brands Inc. 10.6. NadaMoo! 10.7. Luna & Larry's Coconut Bliss 10.8. Alpro 10.9. Swedish Glace 10.10. Booja-Booja 10.11. Oatly 10.12. Valsoia 10.13. Almond Dream 10.14. Perfect World 10.15. NadaMoo! 10.16. Cocofrio 10.17. Häagen-Dazs 10.18. Non-Dairy Queen 10.19. Little Island Creamery 10.20. Zebra Dream 10.21. Over the Moo 10.22. Coconut Dairy Free 10.23. Smoocht 10.24. Yöru 10.25. Coconutsy 10.26. Frooty 10.27. Gelato & Grano 10.28. Los Helados 11. Key Findings 12. Industry Recommendations 13. Non-Dairy Ice Cream Market: Research Methodology