Global Natural Fiber Reinforcement Materials Market size was valued at USD 468.96 Mn. in 2024 and the total Natural Fiber Reinforcement Materials Market revenue is expected to grow by 6.76 % from 2025 to 2032, reaching nearly USD 791.42 Mn.Natural Fiber Reinforcement Materials Market Definition:

Natural fiber reinforcement materials are also known as natural fiber composites (NFCs), which are derived from natural sources. The fibers are characteristically extracted from plant-based materials, such as flax, hemp, jute, sisal, kenaf, bamboo, or coir. Natural fiber reinforcement materials are more environmentally. Ongoing researchers found varieties of natural fibers, which improved the mechanical strength of polymer composite. In the manufacture of goods and applications the renewability and longevity of materials are becoming extremely important concerns. With the environment concern, key players operating in the natural fiber reinforcement materials market are focusing on the deployment of the innovative natural fiber reinforcement materials. Natural fibre reinforced materials have emerged as potential environmentally friendly and cost-effective option to synthetic fibre reinforced composites. The availability of natural fibres and ease of manufacture have interested researchers to try locally available inexpensive fibres and a study of their probability for reinforcement purposes and the extent to which they satisfy the required specifications of good reinforced polymer composite for tribological applications. The natural fibres present a good, renewable and biodegradable alternative to the most common synthetic reinforcement with low cost and high specific mechanical properties. The major benefit of usages of natural fiber reinforcement material is their low specific weight resulting in greater physical strength and steadiness than glass. The application of natural inexhaustible filaments stimuluses practical growth.To know about the Research Methodology :- Request Free Sample Report

Natural Fiber Reinforcement Materials Market Overview:

Natural fiber reinforcement materials market growth: The natural fiber reinforcement materials are growing segment within the larger composite materials industry. Natural fibers, such as jute, flax, hemp, sisal, bamboo is increasingly used as reinforcement materials in various applications because of their renewable nature, low cost, low density, and desirable mechanical properties. The natural fiber reinforcement materials market is expected to drive the significant growth during the forecast period. The market growth is expected to attribute to the factors like high demand for sustainable and eco-friendly materials across various industries, including automotive, construction, aerospace, and consumer goods. Natural fiber reinforcement materials are used in a wide range of industries. In the automotive sector, they are used for interior components, door panels, trunk linings, and dashboard carriers. In the construction industry, natural fiber reinforcement materials are used in insulation materials, concrete reinforcement, and roofing and also used in the production of furniture, consumer goods, and packaging materials. Natural fiber reinforcement materials market outlook: Despite the numerous advantages, there are some challenges associated with natural fiber reinforcement materials. One challenge is the variability in mechanical properties due to the natural variations in the fibers. According to the regional analysis of the natural fiber reinforcement materials market, Europe region is at forefront of adopting of natural fiber reinforcement materials because of the strict environmental regulations and augmented focus on sustainability. The Asia Pacific region is expected to drive towards emerging market because of the rapid industrialization and the presence of a large consumer base. The natural fiber reinforcement materials market is expected to witness steady growth in the coming years. An increase in environmental awareness, government regulations promoting sustainable materials and need for lightweight and cost-effective solutions are driving the demand for natural fiber reinforcement materials. The natural fiber reinforcement materials market is gaining traction as industries seek sustainable alternatives to traditional reinforcement materials. With the ongoing advancements and increasing adoption natural fiber reinforcement materials are expected to play a significant role in the future of composite materials.

Natural Fiber Reinforcement Materials Market Dynamics:

The rising concern about environmental issues and the requirement to find a realistic alternative to glass or carbon reinforced composites are some of the prominent driving factors behind the natural fiber reinforcement materials market growth. High demand for natural fiber reinforcement materials have been placed on natural fibres by the automotive, construction, electrical and electronic industrial markets. The preference for natural fibre emanated from the growing environmental concern, which has led to continuous research on natural fibres and their composite for engineering material applications. Natural fibre composites are used increasingly in high performance, structurally demanding applications, in part because of their material properties and in part because they are a more sustainable choice than other engineering materials, such as mined or petroleum-based materials. Increasing Demand for Sustainable Materials are one of the key drivers in Natural Fiber Reinforcement Materials Market The global shift towards sustainable and eco-friendly products are expected to increase the demand for natural fiber reinforcement materials. The materials offer renewable and biodegradable substitutes to conventional synthetic fibers, and reducing environmental impacts and promoting a circular economy. The increase in awareness of the damage caused by synthetic materials on the environment is expected to increase the need for sustainable materials and development of eco-friendly materials. Natural fibers are sustainable materials which are easily available in nature and have benefits like low-cost, lightweight, renewability, biodegradability, and high specific properties. The sustainability of the natural fiber-based composite materials is expected to drive its applications in many manufacturing sectors. Natural fiber reinforcement materials, such as flax, hemp, jute, sisal, and kenaf, are derived from renewable plant sources, which offers several advantages over traditional synthetic reinforcement materials like fiberglass and carbon fiber. Natural fibers are biodegradable and have a lower carbon footprint over synthetic materials that helps to reduce the environmental impact of manufacturing processes and end-of-life disposal. Natural fibers possess good strength and stiffness properties, which are making them suitable for reinforcing composite materials. Key players operating in the market are actively incorporating natural fiber reinforcement materials into their product development and manufacturing processes to line up with sustainability goals, meet regulatory requirements, and provide eco-friendly products according to the consumer preference.An increase in recognition of the environmental impact of traditional materials and a growing interest in sustainable alternatives are expected to boost the demand for Natural Fiber Reinforcement Materials. End-user industries are becoming more aware of the environmental profits associated with natural fiber reinforcement materials because of their features like lower carbon footprint, require less energy during production, and easily recycled or composted. Working with natural fibers is generally safer compared to synthetic fibers. Natural fibers do not release harmful particles or fibers during manufacturing or in case of accidents, which is also providing a healthier working environment. Natural fibers have a high strength-to-weight ratio, which makes them suitable for lightweight applications. The characteristic of the natural fiber reinforcement materials is particularly advantageous in industries like automotive and aerospace, where reducing weight that led to improved fuel efficiency and reduced emissions. Natural fibers possess inherent damping and sound-absorbing properties, making them useful in applications where vibration damping or acoustic insulation is requiring. As the awareness and demand for sustainable and environmentally friendly products continue to grow, industries are exploring natural fiber reinforcement materials as viable alternatives. Despite the many benefits of the natural fiber reinforcement materials, limited availability and variability, lower mechanical properties compared to synthetic counterparts, Moisture sensitivity and degradation and Lack of standardized testing methods are some of the factors that are limiting the natural fiber reinforcement materials market growth. The natural fiber reinforcement materials market lacks extensively recognized standardized testing methods and performance evaluation criteria. The absence of standardized testing is expected to hamper the ability to compare and benchmark different natural fiber composites. Lack of awareness and Natural Fiber Reinforcement Materials acceptance are expected to limit the Natural Fiber Reinforcement Materials Market Growth. Natural fiber reinforcement materials are still relatively new in some industries across undeveloped countries market. A lack of awareness and market acceptance regarding with the natural fiber reinforcement materials are expected to limit the market growth. Many end-user industries, which are relying on synthetic fibers are hesitating to switch to natural fibers because of concerns about performance, durability, and reliability. The building market acceptance requires education, awareness campaigns, and demonstration of the benefits and viability of natural fiber reinforcement materials that also helps to overcome the lack of awareness. Natural Fibers Pricing Analysis: The prices of natural fiber reinforcement materials are influencing by several factors like the type of natural fiber, its availability, production costs, market demand, and other market dynamics. According to the research, 50 million households across the globe are involved in the natural fibre production. The world natural fibre production was valued US$ 80 Bn in 2022. Despite the jute prices have been trending downward India is mandating the use of jute as the packing material for 100% of grain sacks. Flax has also been trending upward, rising by an average of 27,000 tons/year, and production in 2022 was volumed above 1 million tons.

Natural Fiber Reinforcement Materials Market Segment Analysis:

Based on the Type, natural fiber reinforcement materials market is segmented into Hemp, Flax, Kenaf, Jute and Others. Flax segment is held the dominant position in 2024 and projected to be leading segment during the forecast period. Flax fibers are derived from the flax plant (Linum usitatissimum) and used in the production of linen textiles. In recent years, flax fibers have gained attention as reinforcement materials because of their exceptional mechanical properties like high tensile strength, good flexibility, and low density. Flax fibers find applications in industries like automotive, aerospace, construction, and consumer goods. Flax fibers are also considered environmentally friendly because of their biodegradability and low environmental impact. Kenaf fibers held the second dominated position in the natural fiber reinforcement materials market by type segment. Kenaf fibers possess properties similar to jute and flax fibers. They offer benefits like good tensile strength, low density, and biodegradability. Kenaf fibers are used in applications like automotive interiors, insulation materials, packaging, and paper products. An increase in demand for sustainable and lightweight materials in various industries are increasing the usage of kenaf fibers as reinforcement materials. Hemp fibers are expected to grow at a 3.85% rate of CAGR during the forecast period. The segment is expected to contribute a share followed by flax fibers and Kenaf fibers. Hemp fibers are derived from the plant and offers a suitable features like high strength, durability, and lightweight nature. They are used in numerous applications like automotive, construction, textiles, and packaging. Hemp fibers have excellent mechanical properties like high tensile strength, stiffness, and impact resistance. It also provides good biodegradability and low cost, which is making them a preferred choice in eco-friendly and sustainable industries. Based on the End User, Automotive segment held the dominant position in the global market in 2024 and is expected to dominate during forecast period. The demand for natural fiber reinforcement materials in the automotive industry is increasing in recent years because of need for weight reduction and fuel efficiency, cost advantage and noise, vibration, and harshness (NVH) performance. As the automotive industry seeks to reduce its environmental impact and move towards more sustainable practices, the use of natural fibers has gained attention. The automotive industry is constantly striving to reduce the weight of vehicles to enhance fuel efficiency and reduce emissions. Natural fibers reinforce material offer a lightweight alternative to conventional reinforcements. They have a high strength-to-weight ratio and offer comparable mechanical properties to certain synthetic fibers. Key players operating in the automotive market achieve weight reduction without compromising structural integrity by incorporating natural fibers into automotive components. Natural fibers possess excellent damping properties, which can help reduce noise and vibrations in vehicles. The Noise, Vibration, and Harshness (NVH) Performance characteristic is particularly beneficial for improving the overall ride comfort and reducing noise levels within the cabin. Automakers are expected to enhance the NVH performance of their vehicles by integrating natural fiber reinforcements. Additionally, increasingly stringent regulations regarding emissions and sustainability in the automotive sector are encouraging key players to explore alternative materials.Natural Fiber Reinforcement Materials Market Regional Insights:

Europe held the dominant position in the Natural Fiber Reinforcement Materials Market Europe is a prominent market for natural fiber reinforcement materials because of stringent regulations on reducing carbon emissions and encouraging sustainable practices. The Germany, France, and the United Kingdom have a strong presence in the automotive industry, which drives the demand for lightweight and eco-friendly materials, including natural fiber composites. European countries are investing in research and development of natural fiber composites, that led to the development of advanced manufacturing techniques and innovative applications. The automotive, construction, aerospace, and packaging industries in Europe have witnessed a strong interest in usages of natural fiber reinforcement materials as an alternative to traditional synthetic materials. Several European countries like Germany, France, and the Netherlands are actively promoting the usage of natural fibers as reinforcements because of their recompenses like low environmental impact, lightweight properties, and recyclability. The stringent regulations of European Union on sustainability and carbon footprint reduction are expected to accelerate the demand for natural fiber-based products. Asia Pacific region is emerging region in Global Natural Fiber Reinforcement Materials Market The Asia Pacific region is beholding rapid growth in the natural fiber reinforcement materials market, the market growth is mainly driven by countries like China, India, and Japan. High environmental concerns, rapid industrialization and urbanization are increasing the demand for sustainable materials in various industries. The availability of abundant natural resources, like jute, bamboo, and coir, in countries like India and Bangladesh are expected to contribute to the growth of the Asia Pacific natural fiber reinforcement materials market. The demand for Natural Fiber Reinforcement Materials (NFRMs) in India is steadily growing in recent years. In India, the demand for NFRMs is primarily driven by the automotive, construction, and packaging sectors. In the automotive industry, NFRMs are used for interior components, door panels, dashboards, and seat backs, as they provide lightweight and eco-friendly alternatives to traditional materials like glass fibers and plastics. The construction industry is another major consumer of NFRMs in India. Government initiatives and policies promoting sustainable and eco-friendly practices, such as the Make in India campaign and the Plastic Waste Management Rules are expected to increase the demand for natural fiber reinforcement materials.Natural Fiber Reinforcement Materials Market Scope: Inquire before buying

Global Natural Fiber Reinforcement Materials Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 468.96 Mn. Forecast Period 2025 to 2032 CAGR: 6.76% Market Size in 2032: USD 791.42 Mn. Segments Covered: by Type Hemp Flax Kenaf Jute Others by Polymer Matrix Thermoplastic Polymers Thermosetting Polymers Biodegradable Polymers by Product Form Continuous Fibers Discontinuous Fibers Mats Prepregs by Fiber Type Lignocellulosic Fibers Animal Fibers Mineral Fibers Synthetic Fibers by End User Automotive Building & Construction Aerospace & Defense Consumer Goods Electrical & Electronics Others (packaging, marine, furniture, etc.) Natural Fiber Reinforcement Materials Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Natural Fiber Reinforcement Materials Market, Key Players:

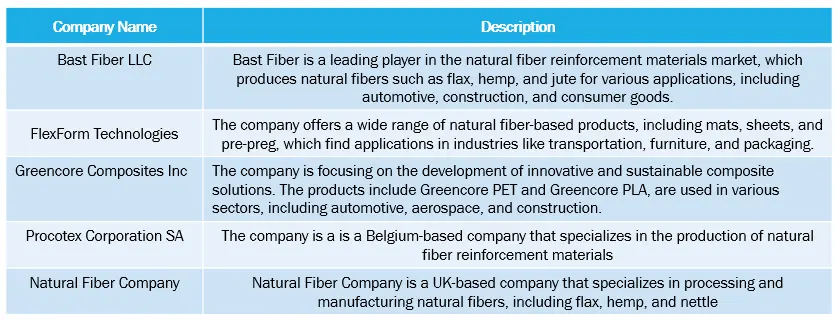

1. Agrofiber Sas 2. Bast Fiber LLC 3. Braskem S.A. 4. Greencore Composites Inc. 5. Procotex Corporation SA 6. UPM Biocomposites 7. Bast Fibers LLC 8. FlexForm Technologies 9. Tecnaro GmbH 10.Natural Fiber Welding Inc. 11.The Natural Fiber Company 12.FiberCore Europe B.V. 13.GreenGran BV 14.HempFlax BV 15.JELU-WERK J. Ehrler GmbH & Co. KG 16.LINTEC Corporation 17.Greiner Holding AG 18.Bast Fiber Tech LLC 19.Green Dot Bioplastics Inc. 20.Trifilon AB 21.Natural Composites Inc.FAQs:

1. What are the growth drivers for the Natural Fiber Reinforcement Materials market? Ans. Stringent Government Regulations, Increasing Demand for Sustainable and Environmentally Friendly Materials and Growing Automotive Industry are expected to be the major driver for the Natural Fiber Reinforcement Materials market. 2. What is the major restraint on the Natural Fiber Reinforcement Materials market growth? Ans. The limited availability and inconsistent quality of raw materials are expected to be the major restraining factor for the market growth. 3. Which region is expected to lead the global market during the forecast period? Ans. Europe is expected to lead the global market during the forecast period. 4. What is the projected market size & growth rate of the Market? Ans. The Global Market size was valued at USD 468.96 Million in 2024 and the total Natural Fiber Reinforcement Materials revenue is expected to grow at a CAGR of 6.76% from 2024 to 2032, reaching nearly USD 791.42 Million. 5. What segments are covered in the Market report? Ans. The segments covered in the market report are End Use Industry, Type, Polymer matrix, Product form, Fiber type and Region.

1. Natural Fiber Reinforcement Material Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Natural Fiber Reinforcement Material Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Natural Fiber Reinforcement Material Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Natural Fiber Reinforcement Material Market: Dynamics 3.1. Natural Fiber Reinforcement Material Market Trends by Region 3.1.1. North America Natural Fiber Reinforcement Material Market Trends 3.1.2. Europe Natural Fiber Reinforcement Material Market Trends 3.1.3. Asia Pacific Natural Fiber Reinforcement Material Market Trends 3.1.4. Middle East and Africa Natural Fiber Reinforcement Material Market Trends 3.1.5. South America Natural Fiber Reinforcement Material Market Trends 3.2. Natural Fiber Reinforcement Material Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Natural Fiber Reinforcement Material Market Drivers 3.2.1.2. North America Natural Fiber Reinforcement Material Market Restraints 3.2.1.3. North America Natural Fiber Reinforcement Material Market Opportunities 3.2.1.4. North America Natural Fiber Reinforcement Material Market Challenges 3.2.2. Europe 3.2.2.1. Europe Natural Fiber Reinforcement Material Market Drivers 3.2.2.2. Europe Natural Fiber Reinforcement Material Market Restraints 3.2.2.3. Europe Natural Fiber Reinforcement Material Market Opportunities 3.2.2.4. Europe Natural Fiber Reinforcement Material Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Natural Fiber Reinforcement Material Market Drivers 3.2.3.2. Asia Pacific Natural Fiber Reinforcement Material Market Restraints 3.2.3.3. Asia Pacific Natural Fiber Reinforcement Material Market Opportunities 3.2.3.4. Asia Pacific Natural Fiber Reinforcement Material Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Natural Fiber Reinforcement Material Market Drivers 3.2.4.2. Middle East and Africa Natural Fiber Reinforcement Material Market Restraints 3.2.4.3. Middle East and Africa Natural Fiber Reinforcement Material Market Opportunities 3.2.4.4. Middle East and Africa Natural Fiber Reinforcement Material Market Challenges 3.2.5. South America 3.2.5.1. South America Natural Fiber Reinforcement Material Market Drivers 3.2.5.2. South America Natural Fiber Reinforcement Material Market Restraints 3.2.5.3. South America Natural Fiber Reinforcement Material Market Opportunities 3.2.5.4. South America Natural Fiber Reinforcement Material Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Natural Fiber Reinforcement Material Industry 3.8. Analysis of Government Schemes and Initiatives For Natural Fiber Reinforcement Material Industry 3.9. Natural Fiber Reinforcement Material Market Trade Analysis 3.10. The Global Pandemic Impact on Natural Fiber Reinforcement Material Market 4. Natural Fiber Reinforcement Material Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 4.1.1. Hemp 4.1.2. Flax 4.1.3. Kenaf 4.1.4. Jute 4.1.5. Others 4.2. Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 4.2.1. Thermoplastic Polymers 4.2.2. Thermosetting Polymers 4.2.3. Biodegradable Polymers 4.3. Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 4.3.1. Continuous Fibers 4.3.2. Discontinuous Fibers 4.3.3. Mats 4.3.4. Prepregs 4.4. Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 4.4.1. Lignocellulosic Fibers 4.4.2. Animal Fibers 4.4.3. Mineral Fibers 4.4.4. Synthetic Fibers 4.5. Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 4.5.1. Automotive Building & Construction 4.5.2. Aerospace & Defense 4.5.3. Consumer Goods 4.5.4. Electrical & Electronics 4.5.5. Others (packaging, marine, furniture, etc.) 4.6. Natural Fiber Reinforcement Material Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Natural Fiber Reinforcement Material Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 5.1.1. Hemp 5.1.2. Flax 5.1.3. Kenaf 5.1.4. Jute 5.1.5. Others 5.2. North America Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 5.2.1. Thermoplastic Polymers 5.2.2. Thermosetting Polymers 5.2.3. Biodegradable Polymers 5.3. North America Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 5.3.1. Continuous Fibers 5.3.2. Discontinuous Fibers 5.3.3. Mats 5.3.4. Prepregs 5.4. North America Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 5.4.1. Lignocellulosic Fibers 5.4.2. Animal Fibers 5.4.3. Mineral Fibers 5.4.4. Synthetic Fibers 5.5. North America Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 5.5.1. Automotive Building & Construction 5.5.2. Aerospace & Defense 5.5.3. Consumer Goods 5.5.4. Electrical & Electronics 5.5.5. Others (packaging, marine, furniture, etc.) 5.6. North America Natural Fiber Reinforcement Material Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 5.6.1.1.1. Hemp 5.6.1.1.2. Flax 5.6.1.1.3. Kenaf 5.6.1.1.4. Jute 5.6.1.1.5. Others 5.6.1.2. United States Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 5.6.1.2.1. Thermoplastic Polymers 5.6.1.2.2. Thermosetting Polymers 5.6.1.2.3. Biodegradable Polymers 5.6.1.3. United States Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 5.6.1.3.1. Continuous Fibers 5.6.1.3.2. Discontinuous Fibers 5.6.1.3.3. Mats 5.6.1.3.4. Prepregs 5.6.1.4. United States Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 5.6.1.4.1. Lignocellulosic Fibers 5.6.1.4.2. Animal Fibers 5.6.1.4.3. Mineral Fibers 5.6.1.4.4. Synthetic Fibers 5.6.1.5. United States Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 5.6.1.5.1. Automotive Building & Construction 5.6.1.5.2. Aerospace & Defense 5.6.1.5.3. Consumer Goods 5.6.1.5.4. Electrical & Electronics 5.6.1.5.5. Others (packaging, marine, furniture, etc.) 5.6.2. Canada 5.6.2.1. Canada Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 5.6.2.1.1. Hemp 5.6.2.1.2. Flax 5.6.2.1.3. Kenaf 5.6.2.1.4. Jute 5.6.2.1.5. Others 5.6.2.2. Canada Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 5.6.2.2.1. Thermoplastic Polymers 5.6.2.2.2. Thermosetting Polymers 5.6.2.2.3. Biodegradable Polymers 5.6.2.3. Canada Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 5.6.2.3.1. Continuous Fibers 5.6.2.3.2. Discontinuous Fibers 5.6.2.3.3. Mats 5.6.2.3.4. Prepregs 5.6.2.4. Canada Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 5.6.2.4.1. Lignocellulosic Fibers 5.6.2.4.2. Animal Fibers 5.6.2.4.3. Mineral Fibers 5.6.2.4.4. Synthetic Fibers 5.6.2.5. Canada Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 5.6.2.5.1. Automotive Building & Construction 5.6.2.5.2. Aerospace & Defense 5.6.2.5.3. Consumer Goods 5.6.2.5.4. Electrical & Electronics 5.6.2.5.5. Others (packaging, marine, furniture, etc.) 5.6.3. Mexico 5.6.3.1. Mexico Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 5.6.3.1.1. Hemp 5.6.3.1.2. Flax 5.6.3.1.3. Kenaf 5.6.3.1.4. Jute 5.6.3.1.5. Others 5.6.3.2. Mexico Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 5.6.3.2.1. Thermoplastic Polymers 5.6.3.2.2. Thermosetting Polymers 5.6.3.2.3. Biodegradable Polymers 5.6.3.3. Mexico Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 5.6.3.3.1. Continuous Fibers 5.6.3.3.2. Discontinuous Fibers 5.6.3.3.3. Mats 5.6.3.3.4. Prepregs 5.6.3.4. Mexico Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 5.6.3.4.1. Lignocellulosic Fibers 5.6.3.4.2. Animal Fibers 5.6.3.4.3. Mineral Fibers 5.6.3.4.4. Synthetic Fibers 5.6.3.5. Mexico Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 5.6.3.5.1. Automotive Building & Construction 5.6.3.5.2. Aerospace & Defense 5.6.3.5.3. Consumer Goods 5.6.3.5.4. Electrical & Electronics 5.6.3.5.5. Others (packaging, marine, furniture, etc.) 6. Europe Natural Fiber Reinforcement Material Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.2. Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.3. Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.4. Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.5. Europe Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6. Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.1.2. United Kingdom Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.1.3. United Kingdom Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.1.4. United Kingdom Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.1.5. United Kingdom Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6.2. France 6.6.2.1. France Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.2.2. France Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.2.3. France Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.2.4. France Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.2.5. France Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.3.2. Germany Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.3.3. Germany Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.3.4. Germany Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.3.5. Germany Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.4.2. Italy Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.4.3. Italy Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.4.4. Italy Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.4.5. Italy Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.5.2. Spain Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.5.3. Spain Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.5.4. Spain Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.5.5. Spain Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.6.2. Sweden Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.6.3. Sweden Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.6.4. Sweden Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.6.5. Sweden Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.7.2. Austria Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.7.3. Austria Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.7.4. Austria Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.7.5. Austria Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 6.6.8.2. Rest of Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 6.6.8.3. Rest of Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 6.6.8.4. Rest of Europe Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 6.6.8.5. Rest of Europe Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.3. Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.4. Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.5. Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6. Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.1.2. China Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.1.3. China Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.1.4. China Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.1.5. China Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.2.2. S Korea Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.2.3. S Korea Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.2.4. S Korea Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.2.5. S Korea Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.3.2. Japan Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.3.3. Japan Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.3.4. Japan Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.3.5. Japan Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.4. India 7.6.4.1. India Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.4.2. India Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.4.3. India Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.4.4. India Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.4.5. India Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.5.2. Australia Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.5.3. Australia Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.5.4. Australia Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.5.5. Australia Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.6.2. Indonesia Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.6.3. Indonesia Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.6.4. Indonesia Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.6.5. Indonesia Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.7.2. Malaysia Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.7.3. Malaysia Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.7.4. Malaysia Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.7.5. Malaysia Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.8.2. Vietnam Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.8.3. Vietnam Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.8.4. Vietnam Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.8.5. Vietnam Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.9.2. Taiwan Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.9.3. Taiwan Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.9.4. Taiwan Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.9.5. Taiwan Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 7.6.10.2. Rest of Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 7.6.10.3. Rest of Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 7.6.10.4. Rest of Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 7.6.10.5. Rest of Asia Pacific Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Natural Fiber Reinforcement Material Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 8.3. Middle East and Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 8.4. Middle East and Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 8.5. Middle East and Africa Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 8.6. Middle East and Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 8.6.1.2. South Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 8.6.1.3. South Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 8.6.1.4. South Africa Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 8.6.1.5. South Africa Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 8.6.2.2. GCC Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 8.6.2.3. GCC Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 8.6.2.4. GCC Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 8.6.2.5. GCC Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 8.6.3.2. Nigeria Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 8.6.3.3. Nigeria Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 8.6.3.4. Nigeria Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 8.6.3.5. Nigeria Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 8.6.4.2. Rest of ME&A Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 8.6.4.3. Rest of ME&A Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 8.6.4.4. Rest of ME&A Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 8.6.4.5. Rest of ME&A Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 9. South America Natural Fiber Reinforcement Material Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 9.2. South America Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 9.3. South America Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form(2024-2032) 9.4. South America Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 9.5. South America Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 9.6. South America Natural Fiber Reinforcement Material Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 9.6.1.2. Brazil Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 9.6.1.3. Brazil Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 9.6.1.4. Brazil Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 9.6.1.5. Brazil Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 9.6.2.2. Argentina Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 9.6.2.3. Argentina Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 9.6.2.4. Argentina Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 9.6.2.5. Argentina Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Natural Fiber Reinforcement Material Market Size and Forecast, by Type (2024-2032) 9.6.3.2. Rest Of South America Natural Fiber Reinforcement Material Market Size and Forecast, by Polymer Matrix (2024-2032) 9.6.3.3. Rest Of South America Natural Fiber Reinforcement Material Market Size and Forecast, by Product Form (2024-2032) 9.6.3.4. Rest Of South America Natural Fiber Reinforcement Material Market Size and Forecast, by Fiber Type (2024-2032) 9.6.3.5. Rest Of South America Natural Fiber Reinforcement Material Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Agrofiber Sas 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bast Fiber LLC 10.3. Braskem S.A. 10.4. Greencore Composites Inc. 10.5. Procotex Corporation SA 10.6. UPM Biocomposites 10.7. Bast Fibers LLC 10.8. FlexForm Technologies 10.9. Tecnaro GmbH 10.10. Natural Fiber Welding Inc. 10.11. The Natural Fiber Company 10.12. FiberCore Europe B.V. 10.13. GreenGran BV 10.14. HempFlax BV 10.15. JELU-WERK J. Ehrler GmbH & Co. KG 10.16. LINTEC Corporation 10.17. Greiner Holding AG 10.18. Bast Fiber Tech LLC 10.19. Green Dot Bioplastics Inc. 10.20. Trifilon AB 10.21. Natural Composites Inc. 11. Key Findings 12. Industry Recommendations 13. Natural Fiber Reinforcement Material Market: Research Methodology 14. Terms and Glossary