The Long Steel Market size was valued at USD 670.54 Billion in 2024 and the total Long Steel revenue is expected to grow at a CAGR of 4.5% from 2025 to 2032, reaching nearly USD 953.57 Billion.Long Steel Market Overview:

Global Long Steel is generally utilized in various construction and industrial applications, which come in a drawn bar, rebar, railway beam, long beam, wire, and rod. Long steel is a crucial component of the construction sector, and its market is expanding in response to growing demand from the infrastructure and construction industries. Homebuilders and construction companies are increasingly using it for building construction and other infrastructure projects. The increase in the steel market is mainly due to increased construction and infrastructure activities, industrialization, and population growth.To know about the Research Methodology :- Request Free Sample Report

Long Steel Market Dynamics:

Infrastructure Revamp and Automotive Innovation Fuel the Long Steel Market Growth The long steel market is witnessing new growth prospects through ongoing infrastructure development, including new subway projects, special freight corridors, road and rail bridge repairs, and modernization initiatives. On a global scale, major players continue to supply long steel products for heavy construction due to rising demand. In December 2024, ArcelorMittal Kuwait supplied a new LNG terminal with special rebar and rebar Drybar. Industries such as capital goods, aircraft, and railroads are increasingly adopting long steel products, contributing to the overall market growth of long steel. In the automotive sector, commercial bars and special profiles are used in vehicle body construction, while wire rods are essential for tire manufacturing. Consequently, the growth of the heavy construction and automotive industries is expected to positively influence the global long steel market demand. Rails and other structural steel products are used across multiple industries. The long steel market share continues to rise due to transportation route expansions and the increasing need for rapid maintenance and renewal activities. High-Strength Steel Demand and Infrastructure Investments Propel Long Steel Market Development Structural steel railings provide high tensile strength, corrosion resistance, and durability, making them ideal for heavy-duty construction. The rising need for high-strength long steel products is driving long steel market expansion. Additionally, the emergence of value-added rebar, technological advancements, and increased investment in global infrastructure development are expected to create new growth opportunities for the long steel market forecast period. Companies are accelerating project execution, as seen when ArcelorMittal Kuwait supplied a new LNG terminal with special rebar and rebar Krybar. In March 2022, Nucor Corporation established a new pipe mill at the Steel Gallatin Sheet Mill in Kentucky, enhancing its production capacity and adding galvanized lines strengthening its position in the long steel industry.Long Steel Market Segment Analysis

By Process Type, the Basic Oxygen Furnace (BOF) segment dominates the global long steel market. The BOF segment held a significant market share of xx% in 2024. The Basic Oxygen Furnace is the most preferred process for producing long steel due to commercial advantages such as high production capacity, reduced labor requirements, and low nitrogen content, which ensures top-quality long steel beams for multiple applications. Steel-producing countries such as New Zealand, the Netherlands, Austria, Belgium, and the Czech Republic continue to rely on BOF technology to manufacture long steel products, contributing to overall market demand.By Product Type, Rebar is the dominating segment in Global Long Steel Market. Rebar steel is the most commonly used steel type in construction, manufacturing, and industrial purposes and is expected to continue its growth throughout the forecasted period. Rebar is generally used in building structures, concrete blocks, and industrial structures and as raw material in the manufacturing industry. The new-gen process of manufacturing steel produces high-grade long steel beams, which as in high demand in developing countries as well as in megaprojects of developed countries, enabling high growth opportunities long steel market.

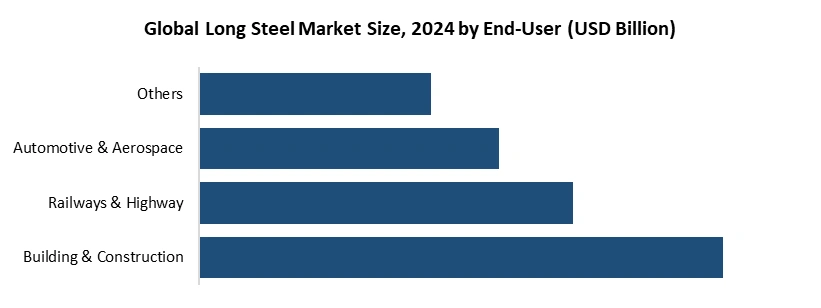

By End User, the Building & Construction segment is dominating in the Global Long Steel market. A large number of its revenue is generated from the building & construction segment in the global long steel industry. Long Steel products are largely used in residential, infrastructure, and construction applications. Steel products including beams, angles, sections, and railway rails are being produced to meet the demand of countries and and region all over the world including the Asia Pacific market with a large portion from developing countries such as India, Malaysia, Indonesia, also, China, Japan, and South Korea.

Long Steel Market Regional Insights:

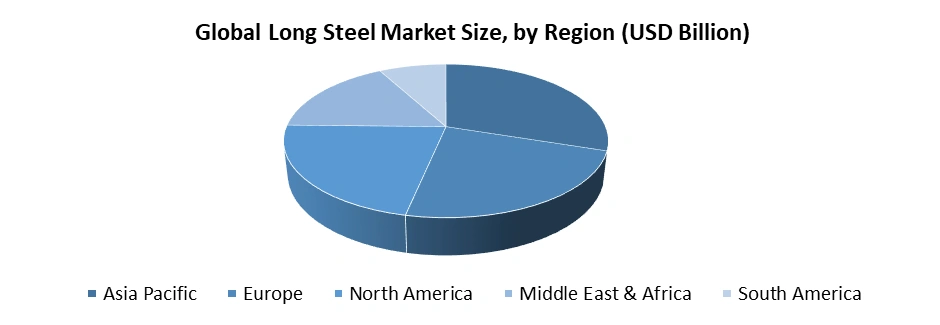

The Asia Pacific is a dominating region in the Global Long steel Market. The rise of international steelmakers such as ArcelorMittal, Nippon Steel & Sumitomo Metal, Tata Steel, and POSCO Steel in the region is contributing to this growth. The cheap labor and raw materials available in the region are additional benefits for these companies. Another factor that is expected to stimulate growth markets is the rapidly growing population and urbanization. Due to the limited local workforce and availability of raw materials, these companies operate primarily in China and India. Europe has emerged as a leading producer of crude steel in recent years. Europe and North America are the highest importers of crude iron a well. Luxembourg-based steel manufacturer ArcelorMittal was the largest steel producer with a total output of over 97 metric tons in 2024. The objective of the report is to present a comprehensive analysis of the Global Long Steel Market to the stakeholders in the industry. The past and current status of the industry, with the forecasted market size and trends, are presented in the report with the analysis of complicated data in simple language.

Long Steel Market Competitive Landscape

The competitive landscape of the long steel market is dominated by a few large integrated market participants as well as regional producers which has high production capacity, ability to influence pricing, as well as supply reliability, and quick technology adoption. Competitive advantage for the market majorly comes from enhanced plant utilization and flexible capacity. Some of the strategies use by market players basically includes acquisitions, joint ventures, and capacity expansion.Recent Developments

• In October 7, 2024 Fastmarkets announced the launch of a green long steel differential. The launch is targeted at the green long steel markets in Asia, where steelmakers attaining 0-600 kg of carbon dioxide per tonne of steel have started delivering premiums for clean, green steel, especially for the construction industry. The revised pricing will complement Fastmarkets’ flat steel base price assessments and differentials in Europe, Asia, and the United States • In October 19 2023, Tata Steel Long Products Ltd announced on that the National Company Law Tribunal (NCLT) has approved its merger with Tata Steel Ltd. Tata Steel will integrate Tata Steel Long Products along with six other subsidiaries into the parent company. In a regulatory filing, Tata Steel Long Products confirmed that the NCLT’s Cuttack bench sanctioned the amalgamation scheme on October 18.Long Steel Market Scope: Inquire before buying

Global Long Steel Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 670.54 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 953.57 Bn. Segments Covered: by Process Type Basic Oxygen Furnace Electric Arc Furnace by Product Type Rebar Wire Rod Merchant Bar Rail Others by End User Construction Industrial Others Global Long Steel Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Global Long Steel Market, Key Players

1. Arcelor Mittal 2. Gerdau Sa 3. Nippon Steel 4. Posco 5. Nucor Corporation 6. China Baowu Steel 7. Commercial Metals Company 8. Mechel Pao 9. Steel Dynamics, Inc. 10. Novolipetsk Steel 11. Outokumpu Oyj 12. Acerinox S.A. 13. Tata Steel 14. Daido Steel 15. Shagang Group 16. Ansteel Group 17. JFE Steel Corporation 18. Evraz Plc 19. HBIS Group 20. Hyundai Steel 21. Steel Authority 22. Metinvest Holding LLC 23. Severstal Jsc 24. Wuhan Iron 25. JSW Steel 26. Voestalpine AG 27. Liberty Steel Group (GFG Alliance) 28. Saarstahl AG 29. Kobe Steel, Ltd. 30. Magnitogorsk Iron & Steel Works (MMK)FAQ

1] What segments are covered in the Global Market report? Ans. The segments covered in the Global Market report are based on Process Type, Product Type, and End User. 2] Which region is expected to hold the highest share in the Global Market? Ans. Asia Pacific Region is expected to hold the highest share in the Global Market. 3] What was the Global Long Steel Market size in 2024? Ans: The Global Long Steel Market size was USD 670.54 Billion in 2024. 4] Who are the top key players in the Global Market? Ans. ArcelorMittal, Gerdau Sa, Nippon Steel, Posco, Nucor Corporation, China Baowu Steel, Commercial Metals Company, Mechel Pao, Steel Dynamics, Inc., Novolipetsk Steel, Outokumpu Oyj, Acerinox S.A., Tata Steel, Daido Steel, Shagang Group, Ansteel Group, JFE Steel Corporation, Evraz Plc, HBIS Group, Hyundai Steel, Steel Authority, Metinvest Holding LLC, Severstal Jsc, Wuhan Iron, JSW Steel. 5] What will be the market size of the Global Market in 2032? Ans. The market size of the Global Long Steel Market in 2032 was USD 953.57 Bn.

1. Long Steel Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Long Steel Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Long Steel Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Long Steel Market: Dynamics 3.1. Long Steel Market Trends by Region 3.1.1. North America Long Steel Market Trends 3.1.2. Europe Long Steel Market Trends 3.1.3. Asia Pacific Long Steel Market Trends 3.1.4. Middle East and Africa Long Steel Market Trends 3.1.5. South America Long Steel Market Trends 3.2. Long Steel Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Long Steel Market Drivers 3.2.1.2. North America Long Steel Market Restraints 3.2.1.3. North America Long Steel Market Opportunities 3.2.1.4. North America Long Steel Market Challenges 3.2.2. Europe 3.2.2.1. Europe Long Steel Market Drivers 3.2.2.2. Europe Long Steel Market Restraints 3.2.2.3. Europe Long Steel Market Opportunities 3.2.2.4. Europe Long Steel Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Long Steel Market Drivers 3.2.3.2. Asia Pacific Long Steel Market Restraints 3.2.3.3. Asia Pacific Long Steel Market Opportunities 3.2.3.4. Asia Pacific Long Steel Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Long Steel Market Drivers 3.2.4.2. Middle East and Africa Long Steel Market Restraints 3.2.4.3. Middle East and Africa Long Steel Market Opportunities 3.2.4.4. Middle East and Africa Long Steel Market Challenges 3.2.5. South America 3.2.5.1. South America Long Steel Market Drivers 3.2.5.2. South America Long Steel Market Restraints 3.2.5.3. South America Long Steel Market Opportunities 3.2.5.4. South America Long Steel Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Long Steel Industry 3.8. Analysis of Government Schemes and Initiatives For Long Steel Industry 3.9. Long Steel Market Trade Analysis 3.10. The Global Pandemic Impact on Long Steel Market 4. Long Steel Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Long Steel Market Size and Forecast, by Process Type (2024-2032) 4.1.1. Basic Oxygen Furnace 4.1.2. Electric Arc Furnace 4.2. Long Steel Market Size and Forecast, by Product Type (2024-2032) 4.2.1. Rebar 4.2.2. Wire Rod 4.2.3. Merchant Bar 4.2.4. Rail 4.2.5. Others 4.3. Long Steel Market Size and Forecast, by End User (2024-2032) 4.3.1. Building & Construction 4.3.2. Automotive & Aerospace 4.3.3. Railways & Highway 4.3.4. Others 4.4. Long Steel Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Long Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Long Steel Market Size and Forecast, by Process Type (2024-2032) 5.1.1. Basic Oxygen Furnace 5.1.2. Electric Arc Furnace 5.2. North America Long Steel Market Size and Forecast, by Product Type (2024-2032) 5.2.1. Rebar 5.2.2. Wire Rod 5.2.3. Merchant Bar 5.2.4. Rail 5.2.5. Others 5.3. North America Long Steel Market Size and Forecast, by End User (2024-2032) 5.3.1. Building & Construction 5.3.2. Automotive & Aerospace 5.3.3. Railways & Highway 5.3.4. Others 5.4. North America Long Steel Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Long Steel Market Size and Forecast, by Process Type (2024-2032) 5.4.1.1.1. Basic Oxygen Furnace 5.4.1.1.2. Electric Arc Furnace 5.4.1.2. United States Long Steel Market Size and Forecast, by Product Type (2024-2032) 5.4.1.2.1. Rebar 5.4.1.2.2. Wire Rod 5.4.1.2.3. Merchant Bar 5.4.1.2.4. Rail 5.4.1.2.5. Others 5.4.1.3. United States Long Steel Market Size and Forecast, by End User (2024-2032) 5.4.1.3.1. Building & Construction 5.4.1.3.2. Automotive & Aerospace 5.4.1.3.3. Railways & Highway 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Long Steel Market Size and Forecast, by Process Type (2024-2032) 5.4.2.1.1. Basic Oxygen Furnace 5.4.2.1.2. Electric Arc Furnace 5.4.2.2. Canada Long Steel Market Size and Forecast, by Product Type (2024-2032) 5.4.2.2.1. Rebar 5.4.2.2.2. Wire Rod 5.4.2.2.3. Merchant Bar 5.4.2.2.4. Rail 5.4.2.2.5. Others 5.4.2.3. Canada Long Steel Market Size and Forecast, by End User (2024-2032) 5.4.2.3.1. Building & Construction 5.4.2.3.2. Automotive & Aerospace 5.4.2.3.3. Railways & Highway 5.4.2.3.4. Others 5.4.3. Mexico 5.4.3.1. Mexico Long Steel Market Size and Forecast, by Process Type (2024-2032) 5.4.3.1.1. Basic Oxygen Furnace 5.4.3.1.2. Electric Arc Furnace 5.4.3.2. Mexico Long Steel Market Size and Forecast, by Product Type (2024-2032) 5.4.3.2.1. Rebar 5.4.3.2.2. Wire Rod 5.4.3.2.3. Merchant Bar 5.4.3.2.4. Rail 5.4.3.2.5. Others 5.4.3.3. Mexico Long Steel Market Size and Forecast, by End User (2024-2032) 5.4.3.3.1. Building & Construction 5.4.3.3.2. Automotive & Aerospace 5.4.3.3.3. Railways & Highway 5.4.3.3.4. Others 6. Europe Long Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.2. Europe Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.3. Europe Long Steel Market Size and Forecast, by End User (2024-2032) 6.4. Europe Long Steel Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.1.2. United Kingdom Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.1.3. United Kingdom Long Steel Market Size and Forecast, by End User (2024-2032) 6.4.2. France 6.4.2.1. France Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.2.2. France Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.2.3. France Long Steel Market Size and Forecast, by End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.3.2. Germany Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.3.3. Germany Long Steel Market Size and Forecast, by End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.4.2. Italy Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.4.3. Italy Long Steel Market Size and Forecast, by End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.5.2. Spain Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.5.3. Spain Long Steel Market Size and Forecast, by End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.6.2. Sweden Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.6.3. Sweden Long Steel Market Size and Forecast, by End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.7.2. Austria Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.7.3. Austria Long Steel Market Size and Forecast, by End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Long Steel Market Size and Forecast, by Process Type (2024-2032) 6.4.8.2. Rest of Europe Long Steel Market Size and Forecast, by Product Type (2024-2032) 6.4.8.3. Rest of Europe Long Steel Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Long Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.2. Asia Pacific Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.3. Asia Pacific Long Steel Market Size and Forecast, by End User (2024-2032) 7.4. Asia Pacific Long Steel Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.1.2. China Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.1.3. China Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.2.2. S Korea Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.2.3. S Korea Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.3.2. Japan Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.3.3. Japan Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.4. India 7.4.4.1. India Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.4.2. India Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.4.3. India Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.5.2. Australia Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.5.3. Australia Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.6.2. Indonesia Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.6.3. Indonesia Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.7.2. Malaysia Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.7.3. Malaysia Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.8.2. Vietnam Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.8.3. Vietnam Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.9.2. Taiwan Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.9.3. Taiwan Long Steel Market Size and Forecast, by End User (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Long Steel Market Size and Forecast, by Process Type (2024-2032) 7.4.10.2. Rest of Asia Pacific Long Steel Market Size and Forecast, by Product Type (2024-2032) 7.4.10.3. Rest of Asia Pacific Long Steel Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Long Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Long Steel Market Size and Forecast, by Process Type (2024-2032) 8.2. Middle East and Africa Long Steel Market Size and Forecast, by Product Type (2024-2032) 8.3. Middle East and Africa Long Steel Market Size and Forecast, by End User (2024-2032) 8.4. Middle East and Africa Long Steel Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Long Steel Market Size and Forecast, by Process Type (2024-2032) 8.4.1.2. South Africa Long Steel Market Size and Forecast, by Product Type (2024-2032) 8.4.1.3. South Africa Long Steel Market Size and Forecast, by End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Long Steel Market Size and Forecast, by Process Type (2024-2032) 8.4.2.2. GCC Long Steel Market Size and Forecast, by Product Type (2024-2032) 8.4.2.3. GCC Long Steel Market Size and Forecast, by End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Long Steel Market Size and Forecast, by Process Type (2024-2032) 8.4.3.2. Nigeria Long Steel Market Size and Forecast, by Product Type (2024-2032) 8.4.3.3. Nigeria Long Steel Market Size and Forecast, by End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Long Steel Market Size and Forecast, by Process Type (2024-2032) 8.4.4.2. Rest of ME&A Long Steel Market Size and Forecast, by Product Type (2024-2032) 8.4.4.3. Rest of ME&A Long Steel Market Size and Forecast, by End User (2024-2032) 9. South America Long Steel Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Long Steel Market Size and Forecast, by Process Type (2024-2032) 9.2. South America Long Steel Market Size and Forecast, by Product Type (2024-2032) 9.3. South America Long Steel Market Size and Forecast, by End User(2024-2032) 9.4. South America Long Steel Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Long Steel Market Size and Forecast, by Process Type (2024-2032) 9.4.1.2. Brazil Long Steel Market Size and Forecast, by Product Type (2024-2032) 9.4.1.3. Brazil Long Steel Market Size and Forecast, by End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Long Steel Market Size and Forecast, by Process Type (2024-2032) 9.4.2.2. Argentina Long Steel Market Size and Forecast, by Product Type (2024-2032) 9.4.2.3. Argentina Long Steel Market Size and Forecast, by End User (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Long Steel Market Size and Forecast, by Process Type (2024-2032) 9.4.3.2. Rest Of South America Long Steel Market Size and Forecast, by Product Type (2024-2032) 9.4.3.3. Rest Of South America Long Steel Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Arcelor Mittal 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Gerdau Sa 10.3. Nippon Steel 10.4. Posco 10.5. Nucor Corporation 10.6. China Baowu Steel 10.7. Commercial Metals Company 10.8. Mechel Pao 10.9. Steel Dynamics, Inc. 10.10. Novolipetsk Steel 10.11. Outokumpu Oyj 10.12. Acerinox S.A. 10.13. Tata Steel 10.14. Daido Steel 10.15. Shagang Group 10.16. Ansteel Group 10.17. JFE Steel Corporation 10.18. Evraz Plc 10.19. HBIS Group 10.20. Hyundai Steel 10.21. Steel Authority 10.22. Metinvest Holding LLC 10.23. Severstal Jsc 10.24. Wuhan Iron 10.25. JSW Steel 10.26. Voestalpine AG 10.27. Liberty Steel Group (GFG Alliance) 10.28. Saarstahl AG 10.29. Kobe Steel, Ltd. 10.30. Magnitogorsk Iron & Steel Works (MMK) 10.31. Others 11. Key Findings 12. Industry Recommendations 13. Long Steel Market: Research Methodology 14. Terms and Glossary