Indonesia Electric Vehicle Market was valued at USD 780.13 Mn. in 2024. Indonesia Electric Vehicle Market size is estimated to grow at a CAGR of 20.96%. The market is expected to reach a value of USD 3,575.24 Mn. in 2032.Indonesia Electric Vehicle Market Overview:

Globally, the development of electric vehicles (EVs) signaled a fundamental shift in the Indonesian transportation sector's policies. Indonesia is ideally positioned to become a major player in the EV supply chain, given the country's nickel reserves. The Indonesia Electric Vehicle Market is growing due to government incentives, rising fuel costs, growing environmental awareness, and increasing adoption of electric two-wheelers and passenger cars across the country. To be a part of the region's EV future, Indonesia needs to invest in technology, talent resources, renewable energy, and infrastructure. To keep things in context, the world's largest island accounts for nearly a fourth of the world's nickel reserves. Nickel is an important component in the manufacture of batteries. Nickel reserves were around 94 million metric tons in 2022. Indonesia has 21 million metric tons of those totals, while Australia has 20 million metric tons. According to Indonesia's Coordinating Minister for Maritime Affairs and Investment, the country will require up to US$35 billion in investment over the next five to 10 years to develop its EV ecosystem and secure a vital position in the EV supply chain.To know about the Research Methodology:- Request Free Sample Report

Indonesia Electric Vehicle Market Dynamics:

Abundant natural resources: Nickel is considered a vital component in the production of electric car batteries. Indonesia boasts one of the world's largest nickel deposits and is a major hub for EV battery raw materials. Indonesia is home to a quarter of the world's known nickel resources. Indonesia produced 760,000 tons of nickel in 2022, with a total nickel reserve of 21 million metric tons. In addition to having the world's greatest gold reserve, Indonesia's Grasberg mine also has the world's second-largest copper deposit, which is required for the production of electric vehicle batteries. Indonesia's Electric Vehicle Roadmap: Indonesia has ambitious intentions to become a prominent player in the global EV market, with a $17 billion roadmap. The goal is to have 2.1 million electric motorcycles and 400,000 electric vehicles on the road by 2025, with 20% of them being manufactured locally. One of its objectives is to have an all-electric bus fleet for Jakarta's metropolitan mass public transportation system in less than seven years, requiring 14,000 electric buses. PLN, the state-owned power company, has committed to installing over 31,000 additional EV charging stations by 2030. PLN has made USD 3.7 billion available for commercial and public sector investment in Indonesia to meet its 10-year pledge. Various government programmes to improve EV manufacturing and EV technology are underway. Investors appear to be protected due to strong government participation in the Indonesian EV industry. Hyundai and LG signed an MoU with the Indonesian government to form a joint venture firm specialising in EV battery manufacturing, representing a $1.1 billion investment to produce 150,000 EV batteries per year. The Indonesian Electric Vehicle Market is still in its beginnings: The electric vehicle industry in Indonesia is still in its infancy, with EVs accounting for only 0.2% of vehicle sales in 2019. However, a University of Indonesia study in September 2022 found that over 70% of Indonesians are interested in purchasing an EV, citing environmental concerns, showing rising EV consumer awareness. According to MMR, Indonesia's EV sales will grow exponentially through 2030. Electric passenger vehicle sales are forecast to reach 250,000 units in 2030, accounting for 16% of all new car sales. Electric motorcycles are expected to reach 1.9 million units, driven by strong demand for sustainable mobility. With 22% of the world's nickel deposits and government actions to reduce emissions by 29%, Indonesia offers a strong environment for EV manufacturers and EV investors. Government Incentives for Electric Vehicles: The Indonesian EV industry is a priority sector in the government's Positive Investment List. Benefits such as foreign ownership allowances and multiple tax incentives attract global EV investors, which boosts the Indonesia Electric Vehicle Market. Companies investing more than IDR 500 billion receive a 100% corporate income tax credit; those investing IDR 100–500 billion receive 50%. The government announced its official EV roadmap in September 2022 under Minister of Industry Regulation No. 27/2022. The roadmap aims to achieve a local production capacity of 600,000 four-wheeled EVs and 2.45 million two-wheeled EVs annually by 2030. The supportive regulations, such as MoEMR Regulation No. 13/2022 and the updated Positive Investment List, offer incentives, including 0% luxury vehicle tax for zero-emission vehicles.Indonesia Electric Vehicle Market Segment Analysis:

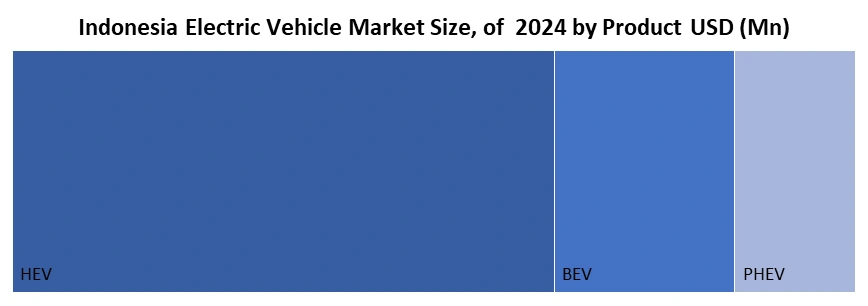

Based on product, the market is segmented into BEV, PHEV, and HEV. The Hybrid Electric Vehicle (HEV) segment led the market in 2022, with hybrids dominating due to limited charging infrastructure and lower cost compared to other segments. The lower upfront no charging infrastructure dependency, as well as and consumer familiarity boost this product preferences among consumers.

Report Objective:

The report provides a comprehensive analysis of the Indonesia Electric Vehicle Market, covering market leaders, trends, segmentation, competitive landscape, and future market projections. It includes PORTER and PESTEL analyses and insights into micro- and macroeconomic factors influencing the EV industry outlook.Indonesia Electric Vehicle Market Competitive Landscape

Market players in Indonesia’s EV sector are progressively shifting their focus on investing in premium, high-performance, and locally made electric vehicles to attract personal and commercial consumers. Major differences include using domestic nickel reserves for batteries, integrating battery management systems, and adopting fast-charging and IoT-enabled technologies. Companies are also focusing on sustainable production, local supply chain improvements, and reducing carbon footprints through green energy-powered assembly plants. Using automated manufacturing, digital logistics, and predictive maintenance systems helps improve efficiency, consistency, and safety. Strategic partnerships, government incentives, and an expanding charging infrastructure further boost competitiveness. This positions players to capture Indonesia Electric Vehicle Market .Recent Developments

• On August 7, 2024, The Indonesian government, along with China's BTR New Material Group, opened a large plant for anode materials used in EV batteries in Central Java (Kendal). This plant aims to support local EV battery production. The companies invested $478 million in the facility, which will produce 80,000 metric tons of materials each year, according to the Coordinating Ministry of Maritime and Investment Affairs. The start date for production has not been announced yet. • On May 22, 2025, PT PLN reported that it has built 3,772 public charging stations (SPKLU) for four-wheelers, 9,956 for two-wheelers, and 2,240 battery swap units (SPBKLU). PLN has provided home charging services to 33,086 customers and developed the Super Apps PLN Mobile. To encourage its use, electric vehicle (EV) users get a 30% discount on charging during off-peak hours, from 10 PM to 5 AM. Additionally, PLN offers EV owners a 98% discount on power capacity upgrades (tambah daya) and up to 88% off the installation cost of a home charging station.Indonesia Electric Vehicle Market Scope: Inquire before buying

Indonesia Electric Vehicle Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 780.13 Bn. Forecast Period 2025 to 2032 CAGR: 20.96% Market Size in 2032: USD 3575.24 Bn. Segments Covered: by Product BEV PHEV HEV by Vehicle Type Two-Wheeler Passenger Car Commercial Vehicle by End User Residential Commercial Indonesia Electric Vehicle Market Key Players

1. BMW AG 2. DFSK Motors 3. Honda Motor Co., Ltd. 4. Isuzu Motors Limited 5. Mazda 6. Mitsubishi Motors Corporation 7. Nissan Motor 8. Suzuki Motor Corporation 9. Toyota Motor Corporation 10. Wuling Motor (SGMW Motors) 11. Mercedes Benz 12. Tesla 13. Hyundai Motor Company 14. Kia Corporation 15. BYD Auto 16. Chery Automobile 17. Ora 18. MG Motor 19. Hozon Auto 20. Seres Auto 21. Xiaomi Auto 22. VinFast 23. Foton Motor 24. JAC Motors 25. Skywell / Skyworth Auto 26. Hino Motors 27. FAW Group 28. Maxus 29. Yadea 30. Segway–NinebotFrequently Asked Questions:

1] What segments are covered in the Indonesia Electric Vehicle Market report? Ans. The segments covered in the Indonesia Electric Vehicle Market report are based on Product, Vehicle Type and End-User. 2] Who are the top 5 key players for Indonesia Electric vehicle market? Ans. BMW AG, DFSK Motors, Honda motor, Mazda and Nissan motors. 3] What is the market size of the Indonesia Electric Vehicle Market by 2032? Ans. The market size of the Indonesia Electric Vehicle Market by 2032 is USD 3,57513 Mn. 4] What is the forecast period for the Indonesia Electric Vehicle Market? Ans. The Forecast period for the Indonesia Electric Vehicle Market is 2025-2032. 5] What was the market size of the Indonesia Electric Vehicle Market in 2024? Ans. The market size of the Indonesia Electric Vehicle Market in 2024 was worth USD 780.13 Mn.

1.Indonesia Electric Vehicle Market: Research Methodology 2. Indonesia Electric Vehicle Market: Executive Summary 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 2.3.1 Market Size (2024) & Forecast (2025-2032), 2.3.2 Market Size (Value USD) (Volume Units) and Market Share (%) - By Segments, Regions and Country 3. Indonesia Electric Vehicle Market: Competitive Landscapes 3.1. MMR Competition Matrix 3.2. Competitive Positioning of Top Key Players 3.3. Key Players Benchmarking 3.3.1 Company Name 3.3.2 Headquarter 3.3.3 Product Portfolio 3.3.4 Consumer Experience Rating 3.3.5 Net Profit Margin (%) 3.3.6 R&D Investment (USD Bn) 3.3.7 Market Share (%) 3.3.8 Revenue 2024 (USD) 3.3.9 Geographical Presence 3.4. Key Brands Comparison 3.5. Competitive Landscape 3.6. Market Structure 3.6.1 Market Leaders 3.6.2 Market Followers 3.6.3 Emerging Players 3.7. Mergers and Acquisitions Details 4. Indonesia Electric Vehicle Market: Dynamics 4.1. Indonesia Electric Vehicle Market Trends 4.2. Indonesia Electric Vehicle Market Dynamics 4.2.1 Drivers 4.2.2 Restraints 4.2.3 Opportunities 4.2.4 Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Key Opinion Leader Analysis for the Industry 4.6. Analysis of Government Schemes and Initiatives on the Industry 5. Technological Advancements of the Indonesia Electric Vehicle Market 5.1 Impact of adoption of automated EV manufacturing machinery to improve production speed and consistency 5.2 Contribution made by integration of robotics in assembly lines to reduce human error and enhance production efficiency 5.3 Development of advanced battery management systems (BMS) to improve EV performance and safety 5.4 Role of IoT-enabled monitoring for real-time diagnostics and predictive maintenance in EV manufacturing 6. Regulatory Framework & Compliance Standards By Region 6.1 Standards for EV battery safety, recycling guidelines, and hazardous material handling 6.2 Certification requirements for EV charging stations, connectors, and interoperability standards 6.3 Restrictions on carbon emissions and incentives promoting low-emission vehicle adoption 6.4 Government regulations promoting local EV component manufacturing and reducing reliance on imports 7. Pricing Analysis 7.1 Historical average EV price trends by vehicle type and region (2019–2024) 7.2 Forecast average EV price trends by vehicle type and region (2025–2032) 7.3 Seasonal demand variations driven by festive offers, government subsidy cycles, and fuel price fluctuations 7.4 Rise in EV prices due to lithium, nickel, and cobalt cost volatility and increasing battery pack innovations 8. Patent and Intellectual Property Landscape 8.1 Patents for new EV battery technologies such as solid-state, fast-charging, and high-density cells 8.2 Patents related to advanced power electronics, thermal management, and motor efficiency enhancements 8.3 Patents on lightweight EV body materials, aerodynamic designs, and energy-saving technologies 9. Indonesia Electric Vehicle Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032) 9.1. Indonesia Electric Vehicle Market Size and Forecast, By Product 9.1.1 BEV 9.1.2 PHEV 9.1.3 HEV 9.2. Indonesia Electric Vehicle Market Size and Forecast, By Vehicle Type 9.2.1 Two-Wheeler 9.2.2 Passenger Car 9.2.3 Commercial Vehicle 9.3. Indonesia Electric Vehicle Market Size and Forecast, By End User 9.3.1 Residential 9.3.2 Commercial 10. Company Profile: Key Players 10.1 BMW AG 10.1.1 Company Overview 10.1.2 Indonesia Electric Vehicle Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Recent Developments 10.2 DFSK Motors 10.3 Honda Motor Co., Ltd. 10.4 Isuzu Motors Limited 10.5 Mazda 10.6 Mitsubishi Motors Corporation 10.7 Nissan Motor 10.8 Suzuki Motor Corporation 10.9 Toyota Motor Corporation 10.10 Wuling Motor (SGMW Motors) 10.11 Mercedes Benz 10.12 Tesla 10.13 Hyundai Motor Company 10.14 Kia Corporation 10.15 BYD Auto 10.16 Chery Automobile 10.17 Ora 10.18 MG Motor 10.19 Hozon Auto 10.20 Seres Auto 10.21 Xiaomi Auto 10.22 VinFast 10.23 Foton Motor 10.24 JAC Motors 10.25 Skywell / Skyworth Auto 10.26 Hino Motors 10.27 FAW Group 10.28 Maxus 10.29 Yadea 10.30 Segway–Ninebot 11. Key Findings 12. Analyst Recommendations 13. Indonesia Electric Vehicle Market – Research Methodology