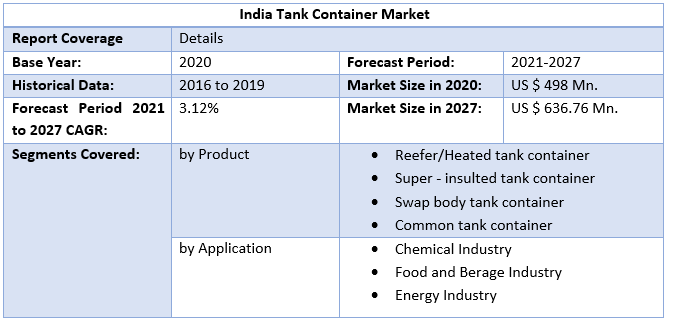

India Tank Container Market was worth US$ 498 Mn. in 2020 and total revenue is expected to grow at a rate of 3.12 % CAGR from 2021 to 2027, reaching almost US $ 636.76 Mn. in 2027.India Tank Container Market Overview:

A tank container is used to carry liquids, gases, and powders as bulk cargo. Tank Container's manufacturing method has been established for half a century. Technically it’s very developed. Indian cheap labor and high robotics level create it very reasonable in the worldwide market. Many other region manufacturers such as the UK have shifted their manufacturing plants to South Africa and East Asia. The product demand in different application industries in present years is growing with the continuous development of the manufacturing scale. At the same time, the Technology of supplies has already appeared. Surely it’s more expensive and resilient. The trends of Tank Container are effectual, safe, suitable, and cost-effective. The Indian Tank Container market was USD 498 Mn in the year 2019 and is anticipated to reach USD 636.76 Mn by 2027, rising at a CAGR of 3.11 percent during the forecast period. India has one of the biggest pharmaceutical industries worldwide & is one of the major three importers & exporters of medical goods. Big investments in drug development, manufacturing of various healthcare goods, & their exports are estimated to proposal opportunities for tank container vendors in the country. Maritime trade mentions to the transport of goods via sea. According to the MMR report study, about 11 Bn tons of goods are transported through shipping containers every year. Growing trading events throughout the country are estimated to support market growth. The outbreak of the Corona Virus from the beginning of the year 2020 negatively impacted the development of the tank container market. The pandemic caused in lockdown across the nations mostly to comprise the disease spread, which led to a reduction in demand for non-essential customer goods mainly in the 2nd & 3rd quarter of 2020.Global trade in 2020 (% change over 2019):

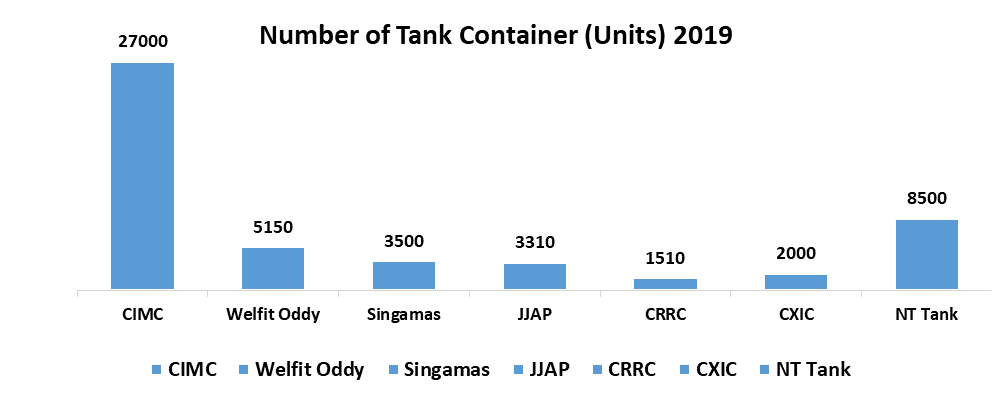

To know about the Research Methodology :- Request Free Sample Report In the year 2019, the most of new containers were bought by rental firms. As more rental firms for tank containers become available, the industry has seen the growth in the number of 3PLs and 4PLs entering the market; these firms often have the little-recognized infrastructure to support their growing fleet of tanks, which can assume they have taken on as of the low rental rates on offer, and on a shorter rental period.

Top Tank Container Companies:

Innovation and Development in the Tank Container shipping:

The tank container market has seen major growth in technical inventions & technological advances which have helped to raise efficiency & profitability. Vendors are concentrating on automating tank container shipping processes & equipment, by a data-driven method to enhance activities like exploration, drilling, & production, by capitalizing on high-performance tools & systems. Thus, the usage of advanced technologies in tank container shipping facilities is anticipated to be a key trend that will drive tank container market growth during the forecast period. Apart from the technical inventions in the tank container shipping market, other influences like the increasing investments in chemical manufacturing services in developing areas, & the rising LNG trade will have a major impact on the tank container market development during the forecast period.Application Overview:

Industrial transport dominated the application sector with a share of 56.6 percent by revenue in the year 2020. Extensive usage of tank containers for shipping of industrial raw materials & factory-made goods like metals, minerals, oil, and gases, etc. are credited to the maximum share of the industrial transport sector in the year 2020. The consumer goods segment is estimated to see major development in the market during the forecast period. It mainly contains transportation of electronic devices & others over shipping containers. Firm growth in imports of consumer goods in established regions is estimated to favor the development of the sector during the forecast period.Dry containers demand during the forecast period:

Dry containers led the market & accounted for 80.2 percent share of total revenue in the year 2020. Low cost, extensive availability, & wide application of dry containers for transport of dry materials chiefly contributed to its maximum share. Dry containers are sealed & efficiently avoid damage of inside goods from severe conditions. Maximum of the dry containers are made of steel; however, in some circumstances, aluminum is used. The objective of the report is to present a comprehensive analysis of the India Tank Container Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the India Tank Container Market dynamics, structure by analyzing the market segments and project the India Tank Container Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the India Tank Container Market make the report investor’s guide.India Tank Container Market Scope: Inquire before buying

India Tank Container Market key player

• Welfit Oddy • UBH International • Suretank • Nantong CIMC • SINGAMAS (CN) • Nttank • CXIC Group • MCC TianGong (Tianjin) • Yucai Dongte • OthersFrequently Asked Questions:

1) What was the market size of India Tank Container Market markets in 2020? Ans - India Tank Container Market was worth US $ 498 Mn in 2020. 2) What is the market segment of India Tank Container Market markets? Ans -The market segments are based on Product and Application. 3) What is forecast period consider for India Tank Container Market? Ans -The forecast period for India Tank Container Market is 2021 to 2027. 4) Which are the worldwide major key players covered for India Tank Container Market report? Ans – Welfit Oddy, UBH International, Suretank, Nantong CIMC, SINGAMAS (CN), Nttank, CXIC Group, MCC TianGong (Tianjin), Yucai Dongte, Others. 5) What was the market size of India Tank Container Market markets in 2027? Ans - India Tank Container Market was worth US $ 636.76 Mn in 2027.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: India Tank Container Market Size, by Market Value (US$ Mn) 3.1. India Market Segmentation 3.2. India Market Segmentation Share Analysis, 2020 3.3. Geographical Snapshot of the Tank Container Market 3.4. Geographical Snapshot of the Tank Container Market , By Manufacturer share 4. India Tank Container Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on Tank Container Market 5. Supply Side and Demand Side Indicators 6. India Tank Container Market Analysis and Forecast, 2020-2027 6.1. India Tank Container Market Size & Y-o-Y Growth Analysis. 6.2. Market Size (Value) Estimates & Forecast By Product, 2020-2027 6.2.1. Reefer/Heated tank container 6.2.2. Super - insulted tank container 6.2.3. Swap body tank container 6.2.4. Common tank container. 6.3. Market Size (Value) Estimates & Forecast By Application, 2020-2027 6.3.1. Chemical Industry 6.3.2. Food and Berage Industry 6.3.3. Energy Industry 7. India Tank Container Market Analysis and Forecasts, By Region 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the India Solid state car battery 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 8.2.2. New Product Launches and Product Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 8.3. Company Profile : Key Players 8.3.1. Welfit Oddy. 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Product Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. UBH International 8.3.3. Suretank 8.3.4. Nantong CIMC 8.3.5. SINGAMAS (CN) 8.3.6. Nttank 8.3.7. CXIC Group 8.3.8. MCC TianGong (Tianjin) 8.3.9. Yucai Dongte 8.3.10. Others 9 Primary Key Insights