India Master Batch Market size was valued at USD 12.4 billion in 2023 and the total India Master Batch Market revenue is expected to grow at a CAGR of 4.8 % from 2024 to 2030, reaching nearly USD 17.22 billion. India's Master Batch to a concentrated mixture of pigments, additives, or modifiers that are used in plastic processing to impart color, enhance properties, or improve processing characteristics. It is extensively used across various industries like packaging, automotive, construction, and more to improve the performance and aesthetics of plastic products. The Master Batch Market in India has experienced substantial growth owing to the rising demand for plastic products in different sectors. It includes the production, distribution, consumption, and trade of these masterbatch products, considering factors such as demand, supply chain dynamics, and technological advancements. The India Master Batch Market has witnessed significant growth due to the expanding applications of plastics in various industries. Factors driving this growth include increasing demand for plastics across end-use industries, technological advancements in manufacturing processes, and rising investments in infrastructure and construction projects. The market's growth is propelled by the country's favorable government policies, which support the manufacturing sector.To know about the Research Methodology:-Request Free Sample Report Several factors contribute to the growth of the India Master Batch Market. The booming packaging industry, particularly flexible packaging, has augmented the demand for masterbatch products. Additionally, the burgeoning automotive sector, coupled with the rising need for innovative and lightweight materials, has increased the usage of masterbatches in-vehicle components. The continuous development of new products and the emphasis on sustainable and eco-friendly masterbatches further drive market growth. Moreover, technological advancements in polymer science and increasing investments in research and development activities fuel the market growth. Trends in the India Master Batch Market include a shift towards bio-based and sustainable masterbatch solutions aligned with environmental concerns. Opportunities abound in the growing sectors of healthcare and electronics, which require specialized masterbatch formulations. Recent developments by key market players like introducing innovative color solutions and additives specifically designed for certain applications have propelled market growth. Ampacet, Penn Color, Inc., and PolyOne are among the companies that have introduced groundbreaking masterbatch products, catering to diverse industry needs.

Market Dynamics:

Plastics Demand in Packaging, Automotive, and Construction Sectors Fueling India's Master Batch Market growth: The demand for plastics across various sectors like packaging, automotive, and construction is propelling the growth of the India Master Batch Market. For instance, the rise in automotive production in India has increased the demand for masterbatches used in interior and exterior parts, driving India Master Batch Market growth. Ongoing technological advancements and innovations in master batch production, such as the development of bio-based and additive masterbatches, are fostering market growth. Companies like Alok Masterbatches have introduced antimicrobial masterbatches, catering to the increased need for hygiene in food packaging. India's rapid infrastructural development and construction projects require masterbatches for applications like pipes, cables, and sheets, augmenting market growth. Real estate ventures and government initiatives, such as the "Smart Cities Mission," are further boosting the demand for master batches. The robust growth of the packaging industry, particularly in food and beverage packaging, is a key driver for the India Master Batch Market. For instance, with rising consumer preferences for packaged foods, the demand for colorful and sustainable packaging solutions using master batches is surging. The agricultural sector's adoption of plastics for greenhouse films, mulch films, and irrigation systems, among others, is driving the demand for masterbatches. The use of specialized masterbatches in agricultural films, as exemplified by companies like Plastiblends India Limited, contributes to market growth. The increased demand for consumer goods and household items, including appliances, toys, and furniture, is fueling the India Master Batch Market. Players like Clariant are introducing masterbatch solutions for color and aesthetic appeal in various consumer goods, bolstering India Master Batch Market growth. The growing emphasis on sustainability and environmental concerns is pushing the market toward eco-friendly master batch solutions. Companies like Gabriel-Chemie India are focusing on bio-based masterbatches made from renewable sources, aligning with the market's sustainable trajectory. India Master Batch Market is benefiting from increased export opportunities, driven by quality production, cost-competitive pricing, and expanding global demand. The export-oriented approach of Indian master batch manufacturers, like Americhem India, is contributing significantly to India Master Batch Market growth. Investments in research and development for new formulations, color variations, and performance-enhancing additives are fostering market growth. Players like Ampacet Corporation are investing in advanced R&D centers to develop innovative master batch solutions tailored to diverse industry needs. Favorable government initiatives and policies, such as 'Make in India' and incentives for the plastics industry, are stimulating India Master Batch Market growth. The Indian government's focus on encouraging domestic manufacturing and promoting plastic-related industries augurs well for the master batch India Master Batch Market growth.Challenges Stemming from Fluctuating Polymer Costs Impacting Profitability: Fluctuating prices of key raw materials like polymers pose challenges. For instance, the increase in polymer resin costs in India impacts master batch manufacturing, hindering profitability and affecting India Master Batch Market competitiveness. The presence of numerous local and international players intensifies competition. For instance, the India Master Batch Market dominance of established companies like Plastiblends and Alok Masterbatches makes market entry challenging for new entrants, impacting India Master Batch Market share. Adherence to stringent regulations and environmental norms poses challenges. For example, compliance with India's Plastic Waste Management Rules requires investments in sustainable and eco-friendly manufacturing practices, impacting production costs. Constant technological advancements demand investment in R&D. For instance, incorporating innovative additives and colorants, such as UV stabilizers or antimicrobial agents, necessitates continuous technological upgrades, impacting production expenses. Growing environmental awareness demands eco-friendly solutions. For example, the push for bio-based or biodegradable master batches to reduce environmental impact poses challenges due to the higher costs associated with these alternatives. Disruptions in supply chains, like logistics issues or raw material shortages, impact production schedules. For instance, disruptions in transportation during periods of unrest or natural calamities impact the availability of raw materials. Maintaining consistent product quality poses challenges for the India Master Batch Market. For example, variations in color consistency or dispersion quality impact product acceptability and require stringent quality control measures. Evolving consumer preferences demand customized solutions. For instance, the demand for specialty master batches with specific properties, like flame retardancy or anti-static properties, requires customization, impacting production processes. Inadequate infrastructure and skilled labor availability affect India Master Batch Market growth. For instance, limited access to modern manufacturing facilities and skilled technicians in certain regions impacts production efficiency and quality sources. Consumer Awareness and Regulatory Support Spur Demand for Sustainable Masterbatch Solutions: The increasing need for advanced packaging techniques, such as UV protection and recyclable materials, drives the demand for masterbatches like PET UVA and AA Scavenger, which cater to specific packaging requirements. Continuous technological developments, like Penn Color's new facility in Thailand, facilitate enhanced manufacturing capabilities, expanded product portfolios, and improved service offerings, thereby capturing a larger market share. The industry's increasing focus on sustainability propels the demand for eco-friendly solutions. Initiatives promoting the use of recycled materials, as demonstrated by Ampacet's AA Scavenger, align with sustainability goals, fostering market growth. The establishment of new production facilities, like Penn Color's Rayong plant, represents a significant milestone in market expansion efforts, catering to regional demands and strengthening market presence. Collaborations between key players, such as PolyOne's partnership in eliminating paint from vehicle interiors, demonstrate the potential for collaborative innovation, driving market growth by offering innovative solutions. The introduction of versatile masterbatches compatible with multiple materials, as seen with Ampacet's UVA formulations for both PP and PE materials, enhances flexibility, caters to diverse industry needs, and expands market opportunities. Supportive government regulations promoting the use of advanced materials in packaging, such as those promoting recyclable materials, provide growth opportunities for masterbatch manufacturers complying with these regulations. Increasing awareness among consumers about the benefits of using masterbatches, especially those that contribute to product quality enhancement and environmental sustainability, drives market growth by stimulating demand. The expanding applications of masterbatches in diverse industries, such as automotive and packaging, present opportunities for manufacturers to tap into these sectors and expand their market reach. The ability to offer customized masterbatch solutions, catering to specific industry requirements, enables market players to differentiate themselves and capture niche markets, thereby fostering growth.

India Master Batch Market Segment Analysis:

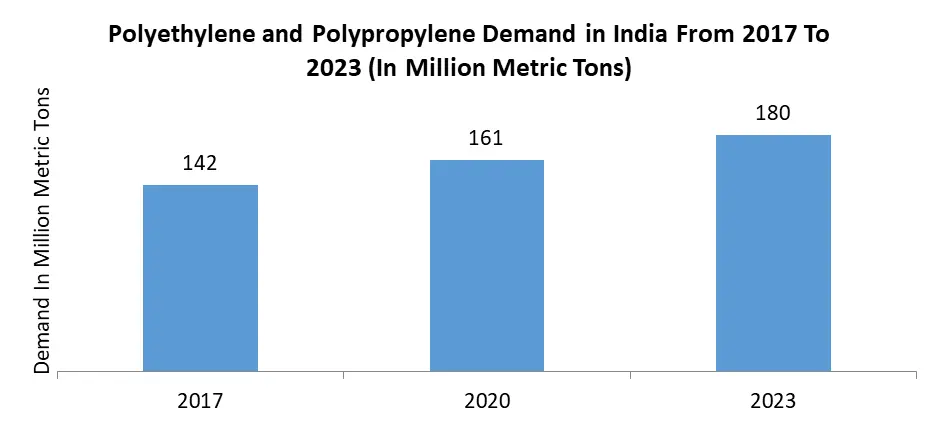

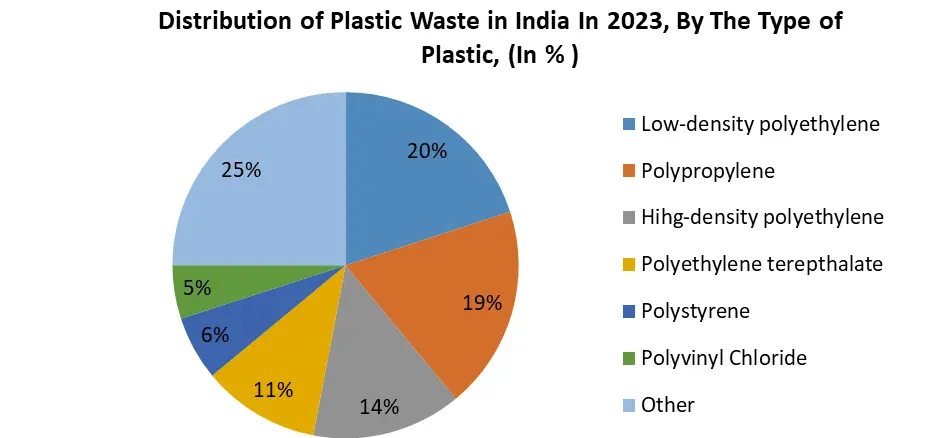

Based on Polymer Type, The India Master Batch Market shows significant segmentation based on polymer types, with Polyethylene (PE) and polypropylene (PP). Polyethylene commands a dominant position due to its extensive utilization in various industries such as packaging, consumer goods, and agriculture. The ease of process ability, versatility, and superior mechanical properties of PE bolster its demand, making it the leading segment. Additionally, Polypropylene holds a substantial market share, primarily attributed to its increasing adoption in the automotive, electrical, and construction sectors owing to its exceptional thermal and chemical resistance properties. While PE currently dominates, Polypropylene is projected to witness a substantial growth trajectory, driven by its rising applications in diverse industries. Polymer types, although comprising a smaller market share, contribute to specialized applications like ABS, PVC, and engineering plastics, showing potential for growth through targeted industry applications and technological advancements in niche sectors.

India Master Batch Market Regional Insights:

Western India leads the Master Batch Market in India. The region encompasses key industrial zones and harbors major manufacturing hubs. Gujarat, a significant state within Western India, hosts multiple industries, including plastics, packaging, automotive, and textiles, contributing substantially to the masterbatch India Master Batch Market. The vibrant chemical and polymer industries in Gujarat, supported by the presence of industrial clusters like Ankleshwar and Vapi, drive the demand for masterbatch products. Maharashtra, another prominent state in this region, hosts a multitude of manufacturing units, further augmenting the market. The concentration of plastic, packaging, and automobile industries in Maharashtra, particularly in cities like Mumbai and Pune, fuels the demand for masterbatches. Southern India exhibits promising potential for future growth in the India Master Batch Market. States like Tamil Nadu and Karnataka are witnessing a surge in industrial activities, especially in the plastics and packaging sectors. The robust growth of the automotive and electronics industries in these states contributes significantly to the demand for masterbatch products. Additionally, the establishment of manufacturing clusters and industrial zones in cities like Chennai, Coimbatore, and Bengaluru creates a conducive environment for India Master Batch Market growth. Tamil Nadu, in particular, is emerging as a key hub for plastic-related industries, attracting investments and driving the demand for masterbatch materials. The growing emphasis on innovation and technological advancements in the plastics processing and packaging sectors in Southern India positions the region for substantial growth in the forecast period. Competitive Landscape: Recent innovations and initiatives by key players in the masterbatch industry signal a transformative shift, propelling India Master Batch Market growth through enhanced functionality, sustainability, and market expansion. Ampacet's PET UVA and AA Scavenger 0846 address critical industry challenges like UV protection, preservation, and sustainability, augmenting product quality, and reducing waste. Penn Color's advanced facility in Thailand signifies India Master Batch Market penetration and advanced technological capabilities, catering to diverse customer needs in the Asia-Pacific market. PolyOne's collaboration with MIC parts in automotive applications demonstrates a shift towards sustainable solutions, reducing environmental impact and enhancing product aesthetics. These developments collectively drive India Master Batch Market growth by fostering innovation, meeting sustainability demands, and expanding application areas. In April 2023, Penn Color, Inc., a renowned manufacturer of colorant and additive masterbatches, achieved a significant milestone by inaugurating a cutting-edge facility in Rayong Province, Thailand. This strategic move aligns with their expansion initiative and solidifies their commitment to serving the Asia-Pacific India Master Batch Market. The state-of-the-art plant showcases Penn Color's advanced manufacturing capabilities, allowing it to deliver innovative color solutions and superior additive masterbatches to cater to the diverse requirements of regional and global customers. In June 2023, Ampacet, a prominent provider of masterbatches, introduced groundbreaking solutions to the packaging sector. With PET UVA, a newly engineered masterbatch, they ensure robust protection against harmful UV light, preserving food freshness and extending product shelf life, ultimately curbing wastage. Additionally, their AA Scavenger 0846 additive targets acetaldehyde reduction in PET and rPET bottles, demonstrating Ampacet's commitment to sustainability by promoting the use of recycled materials and enhancing product safety in the beverage industry. In May 2020, PolyOne collaborated with a leading global automotive OEM and an injection molder to revolutionize vehicle interiors. By eliminating paint and leveraging Molded-In-Color (MIC) part technology, PolyOne provided Smartbatch FX masterbatch colorants for two PC/ABS side panels on an SUV's center console, achieving a seamless, durable, and vibrant interior finish source.Scope of the India Master batch Market: Inquire before buying

India Master batch Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 12.4 Bn. Forecast Period 2024 to 2030 CAGR: 4.8% Market Size in 2030: US $ 17.22 Bn. Segments Covered: by Product Type White Black Additive by Polymer Type Polyethylene Polypropylene Others by End Use Type Packaging Building & Construction Automotive Others India Master Batch Market Key Players:

1. Cabot India Limited (Navi Mumbai, Maharashtra ) 2. Clariant Chemicals (India) Limited (Navi Mumbai, Maharashtra ) 3. Ampacet Speciality Product Pvt. Ltd. (Pune, Maharashtra) 4. Plastiblends India Ltd. (Mumbai, Maharashtra ) 5. Superme Petrochem Ltd (Mumbai, Maharashtra ) 6. Poddar Pigments Ltd. (Rajasthan,) 7. Polmann India Ltd. (Mumbai, Maharashtra ) 8. Rajiv Plastic Industries (Mumbai, Maharashtra) 9. Sharda Poly Colours Pvt. Ltd. (NAGPUR, Maharashtra) 10. Alok Masterbatches Pvt. Ltd. (Okhla ) 11. Newgen Specialty Plastics Ltd (New Delhi) 12. M G Polyblends Ltd. (New Delhi) 13. Blend Colors Pvt. Ltd. (HYDERABAD, Telangana.) 14. Blend Colours Private Limited (HYDERABAD, Telangana.) 15. M/S. Vivek Polychem Pvt. Ltd. (Kanpur, Uttar Pradesh,) 16. Allied Industries (Ludhiana City, Punjab[) 17. Clingtech Polymers(Vadodara, Gujarat,) 18. A.Schulman Plastics India Private Limited (Vadodara, Gujarat,) 19. Orbit Masterbatches Pvt. Ltd. (Vadodara, Gujarat) 20. Plastene India Limited (AHMEDABAD, Gujarat) 21. Polyfill Technologies Pvt Ltd (Gujarat) FAQs: 1. What are the growth drivers for the India Master Batch Market? Ans. Plastics Demand in Packaging, Automotive, and Construction Sectors Fueling India's Master Batch Market growth and is expected to be the major driver for the India Master Batch Market. 2. What is the major opportunity for the India Master Batch Market growth? Ans. Challenges Stemming from Fluctuating Polymer Costs Impacting Profitability. 3. Which country is expected to lead the India Master Batch Market during the forecast period? Ans. The Western India is expected to lead the India Master Batch Market during the forecast period. 4. What is the projected market size and growth rate of the India Master Batch Market? Ans. India Master Batch Market size was valued at USD 12.4 billion in 2023 and the total India Master Batch Market revenue is expected to grow at a CAGR of 4.8% from 2024 to 2030, reaching nearly USD 17.22 billion. 5. What segments are covered in the Market report? Ans. The segments covered in the Market report are by Product Type, Polymer Type, End User, and Region.

1. India Master Batch Market: Research Methodology 2. India Master Batch Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. India Master Batch Market: Dynamics 3.1 India Master Batch Market Trends 3.2 India Master Batch Market Dynamics by Region 3.2.1 Drivers 3.2.2 Restraints 3.2.3 Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape 3.7 Analysis of Government Schemes and Initiatives For the India Master Batch Industry 3.8 The Pandemic and Redefining of The India Master Batch Industry Landscape 3.9 Technological Road Map 4. India Master Batch Market: Market Size and Forecast by Segmentation (Value) (2023-2030) 4.1 India Master Batch Market Size and Forecast, By Product Type (2023-2030) 4.1.1 White 4.1.2 Black 4.1.3 Additive 4.2 India Master Batch Market Size and Forecast, By Polymer Type (2023-2030) 4.2.1 Polyethylene 4.2.2 Polypropylene 4.2.3 Others 4.3 India Master Batch Market Size and Forecast, By End User (2023-2030) 4.3.1 Packaging 4.3.2 Building & Construction 4.3.3 Automotive 4.3.4 Others 4.4 India Master Batch Market Size and Forecast, by Region (2023-2030) 4.4.1 North India 4.4.2 South India 4.4.3 West India 4.4.4 East India 5. India Master Batch Market: Competitive Landscape 5.1 MMR Competition Matrix 5.2 Competitive Landscape 5.3 Key Players Benchmarking 5.3.1 Company Name 5.3.2 Product Segment 5.3.3 End-user Segment 5.3.4 Revenue (2023) 5.3.5 Manufacturing Locations 5.4 Market Analysis by Organized Players vs. Unorganized Players 5.4.1 Organized Players 5.4.2 Unorganized Players 5.5 Leading India Master Batch Companies, by market capitalization 5.6 Market Structure 5.6.1 Market Leaders 5.6.2 Market Followers 5.6.3 Emerging Players 5.7 Mergers and Acquisitions Details 6. Company Profile: Key Players 6.1 A.Schulman Plastics India Private Limited (Vadodara, Gujarat,) 6.1.1 Company Overview 6.1.2 Business Portfolio 6.1.3 Financial Overview 6.1.4 SWOT Analysis 6.1.5 Strategic Analysis 6.1.6 Scale of Operation (small, medium, and large) 6.1.7 Details on Partnership 6.1.8 Regulatory Accreditations and Certifications Received by Them 6.1.9 Awards Received by the Firm 6.1.10 Recent Developments 6.2 Cabot India Limited (Navi Mumbai, Maharashtra ) 6.3 Clariant Chemicals (India) Limited (Navi Mumbai, Maharashtra ) 6.4 Ampacet Speciality Product Pvt. Ltd. (Pune, Maharashtra) 6.5 Plastiblends India Ltd. (Mumbai, Maharashtra ) 6.6 Superme Petrochem Ltd (Mumbai, Maharashtra ) 6.7 Poddar Pigments Ltd. (Rajasthan,) 6.8 Polmann India Ltd. (Mumbai, Maharashtra ) 6.9 Rajiv Plastic Industries (Mumbai, Maharashtra) 6.10 Sharda Poly Colours Pvt. Ltd. (NAGPUR, Maharashtra) 6.11 Alok Masterbatches Pvt. Ltd. (Okhla ) 6.12 Newgen Specialty Plastics Ltd (New Delhi) 6.13 M G Polyblends Ltd. (New Delhi) 6.14 Blend Colors Pvt. Ltd. (HYDERABAD, Telangana.) 6.15 Blend Colours Private Limited (HYDERABAD, Telangana.) 6.16 M/S. Vivek Polychem Pvt. Ltd. (Kanpur, Uttar Pradesh,) 6.17 Allied Industries (Ludhiana City, Punjab[) 6.18 Clingtech Polymers(Vadodara, Gujarat,) 6.19 Orbit Masterbatches Pvt. Ltd. (Vadodara, Gujarat) 6.20 Plastene India Limited (AHMEDABAD, Gujarat.) 6.21 Polyfill Technologies Pvt Ltd (Gujarat) 7. Key Findings 8. Industry Recommendations 9. Terms and Glossary