HVDC Converter Station Market size was valued at USD 12.5 Bn. in 2024, and the total HVDC Converter Station Market revenue is expected to grow at 6.1% from 2025 to 2032, reaching nearly USD 22 Bn.HVDC Converter Station Market Overview:

The HVDC (High Voltage Direct Current) Converter Station is a crucial infrastructure facility that converts alternating current (AC) to direct current (DC) and vice versa, enabling efficient long-distance electricity transmission with minimal losses. The HVDC Converter Station Market refers to the global industry involved in the design, development, manufacturing, and deployment of these stations across power grids. The market witnesses high availability driven by technological advancements and robust manufacturing capacities, while demand surges due to increasing renewable energy integration and cross-border electricity trade. Supply remains strong, supported by key manufacturers across Asia-Pacific, Europe, and North America. Asia-Pacific dominated the HVDC Converter Station Market in 2024, led by rapid grid expansion in China and India. Major HVDC Converter Station Market key players include Siemens Energy (Germany), Hitachi Energy (Switzerland), General Electric (USA), and NR Electric (China). Utilities, industrial sectors, and offshore wind farms significantly contribute as end users, making this market a vital component of the global energy infrastructure transformation.To know about the Research Methodology :- Request Free Sample Report The purpose of the research is to give market players a broad understanding of the market for HVDC converter stations. The study examines recent, ongoing, and expected future developments in the market. It also offers a straightforward analysis of complicated data. Followers and new market entrants are two of the main forces that actively and meticulously do research. The study presents the findings of the PESTEL and PORTER analyses in addition to possible outcomes of the microeconomic market components. Decision-makers will have a clear futuristic view of the market after accounting for internal and external elements that can have a beneficial or unfavourable impact on the organisation. Investors can better grasp market dynamics and structure thanks to the market segmentation analysis and market size forecast in the report. The research serves as an investor’s guide for investors by briefly laying out the comparative analysis of the top HVDC Converter companies in terms of price, financial position, product, product portfolio, growth strategies, and geographical presence.

HVDC Converter Station Market Dynamics:

Supply Innovations and Growing Energy Demand to Drive HVDC Converter Station Market Growth

The HVDC Converter Station Market is driven by supply- and demand-side factors. On the supply side, manufacturers are innovating with compact, modular converter designs and expanding production capacity to support faster, cost-efficient deployment. Technological advancements in Voltage Source Converters (VSC) and Ultra-High Voltage DC (UHVDC) systems further enhance supply capabilities. On the demand side, governments and utilities are investing heavily in grid modernization, renewable energy integration, and long-distance, low-loss power transmission. The rising need for cross-border interconnections, urban power infeed, and industrial electrification continues to fuel demand, making HVDC converter stations vital for global energy infrastructure expansion.High Costs, Regulatory Hurdles, and Technical Barriers to Restrain the HVDC Converter Station Market

The HVDC Converter Station Market faces several key restraints that may hinder its growth trajectory. High initial capital investment and complex installation requirements continue to challenge project feasibility, particularly in developing regions. The lengthy regulatory approval processes and land acquisition hurdles further delay project execution timelines. Additionally, a shortage of skilled professionals and technical expertise in HVDC systems can limit the pace of deployment. Integration issues with existing AC grid infrastructure and concerns over electromagnetic interference also present operational challenges. These restraints collectively impact market penetration, especially in countries with limited financial and technical resources for large-scale transmission upgrades.Offshore Wind, Greenfield Projects, and Digital Solutions to Create HVDC Converter Station Market Opportunity

The HVDC Converter Station Market presents opportunities that industry leaders are actively capitalizing on. Manufacturers are now deploying next-generation Voltage Source Converter (VSC) systems tailored for offshore wind farms, unlocking new markets in Europe and East Asia. Governments are fast-tracking greenfield transmission projects under climate-action mandates, providing favorable funding frameworks and tax incentives. Strategic cross-border interconnectors in regions like ASEAN and Eastern Africa are opening avenues for multinational utility collaborations. Additionally, the availability of advanced digital monitoring and control platforms offers suppliers the chance to deliver integrated smart-HVDC solutions, enhancing grid stability and earning long-term service contracts across critical infrastructure projects.Interoperability Issues and High Component Costs to Create HVDC Converter Station Market Challenges

It is frequently necessary to customize HVDC transmission systems and equipment since they do not always meet national standards. This increases the price of the systems, which is ultimately charged to the end customers. To draw providers and increase the variety of solutions available, a standard is necessary. This, in turn, lowers the cost of the systems for end users. The following are some of the difficulties with HVDC systems: Hardware from multiple vendors can be integrated, and AC systems and technologies have high interoperability. With DC systems, however, every piece of gear must come from the same supplier. In addition, power devices for converter stations are expensive, scarcely available, and only available from major device makers. Therefore, standardization in HVDC is necessary since it could increase interoperability and lower costs both now and in the future, especially when maintenance and turnover are considered.HVDC Converter Station Market Segment Analysis:

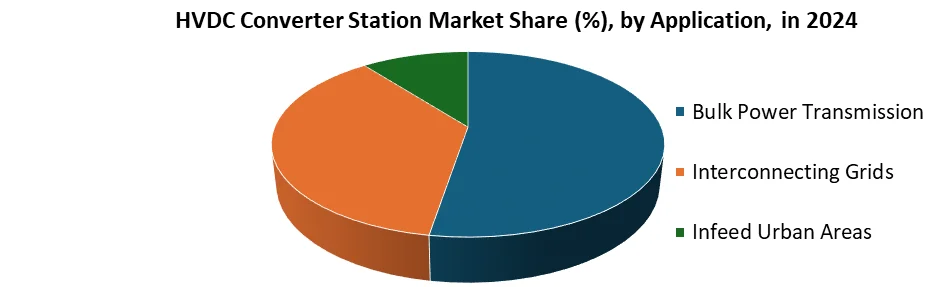

Based on Component, Converter valves dominated the HVDC Converter Station Market. They are the core components of an HVDC station, responsible for converting alternating current (AC) to direct current (DC) and vice versa, using advanced semiconductor devices like thyristors or IGBTs. Their high cost, critical functionality, and increasing demand in both Line Commutated Converter (LCC) and Voltage Source Converter (VSC) systems make them the most valuable part of the HVDC infrastructure. As grid operators focus on integrating renewable energy and upgrading transmission systems, the need for efficient, high-capacity converter valves continues to rise. Additionally, innovations in compact valve design and cooling technologies have further enhanced their performance and reliability, reinforcing their dominant position in the component segment of the market. Based on Technology, in 2024, the Line Commutated Converter (LCC) segment dominated the HVDC Converter Station Market. LCC technology, also known as Current Source Converter (CSC), has been widely adopted for several decades due to its proven reliability and cost-effectiveness in transmitting large amounts of power over long distances. It is primarily used in bulk power transmission projects, especially in countries like China, India, and Brazil, where ultra-high voltage direct current (UHVDC) lines span thousands of kilometers. LCC systems offer high efficiency and are well-suited for stable grid environments with strong short-circuit capacity. Despite the growing interest in Voltage Source Converter (VSC) technology for offshore and urban applications, LCC remains dominant due to its extensive deployment in large-scale infrastructure projects and lower operating costs at high power ratings. Its continued use in intercontinental and cross-border HVDC links reinforces its leading position in this segment. Based on the Application, the bulk power transmission segment dominated the HVDC Converter Station Market in 2024. This dominance is driven by the growing global need to transmit large volumes of electricity over long distances with minimal energy loss—something HVDC technology excels at compared to traditional AC systems. Bulk power transmission is especially critical in countries like China, India, and Brazil, where renewable energy generation sites (such as solar and hydro) are often located far from urban demand centers. HVDC converter stations enable efficient long-distance transmission, reducing line losses and improving grid stability. Additionally, bulk power transmission projects frequently involve ultra-high voltage direct current (UHVDC) systems, which further increase capacity and efficiency. The rising demand for inter-regional and cross-border power transfer, combined with expanding renewable capacity in remote regions, continues to drive the dominance of this application segment in the global market.

HVDC Converter Station Market Regional Insights:

Asia-Pacific dominated the HVDC Converter Station Market in 2024, due to rapid industrialization, expanding energy demand, and strong government support for renewable energy integration. Countries like China lead globally with extensive ultra-high voltage (UHVDC) projects, while India is actively expanding its grid under national energy initiatives. Europe follows as a mature market with advanced technology deployment, driven by energy decarbonization goals and inter-country power transmission projects such as those between Germany, Norway, and the UK. The presence of major players like Siemens Energy and Hitachi Energy further accelerates regional growth. North America, led by the United States and Canada, is witnessing the steady adoption of HVDC systems to modernize aging infrastructure and facilitate long-distance transmission of renewable energy. In the Middle East & Africa, countries like Saudi Arabia, UAE, and Egypt are investing in HVDC to strengthen grid reliability and support solar power integration. Latin America shows gradual progress, particularly in Brazil and Chile, where HVDC is being explored to connect remote renewable resources and enhance grid efficiency, although growth is moderated by cost and regulatory challenges.HVDC Converter Station Competitive Market Landscape

Global competition is led by ABB Ltd. (Switzerland) and Siemens Energy AG (Germany), which hold approximately 22% and 18% of market share, respectively. ABB has commissioned over 120 HVDC projects and exports converter transformers worldwide, including to China’s State Grid. Siemens’ Grid Technologies division earned XX billion in revenue in 2024, and an aggressive XX billion investment program to expand manufacturing in the US, Europe, and Asia. Hitachi Energy Ltd. (Switzerland), the former ABB Power Grids, continues to export HVDC systems globally and notably upgraded Brazil’s Garabi station in 2023. The GE Grid Solutions (USA) unit also competes strongly, particularly in North America, with HVDC orders from utilities like PGCIL in India. Mitsubishi Electric (Japan) and Toshiba (Japan) participate through offshore wind and eco-friendly insulation technologies. Regional players such as Bharat Heavy Electricals (India) and NR Electric (China) gain traction domestically and increasingly export, with China notably supplying UHVDC project components globally. Manufacturers differentiate via digital, AI-enabled control, modular designs, and localized production to reduce tariff risks and accelerate deployment.HVDC Converter Station Market Development

Germany (2024) – Hitachi Energy secured a $2 billion contract with Amprion to build four converter stations for the Korridor B UHVDC project, enhancing North–South energy transmission capacity and supporting renewable integration. Australia (2024) – Marinus Link (Tasmania–mainland) selected Hitachi Energy to design and supply an HVDC link for renewable energy exchange. China/Tibet (2024) – The Qinghai–Tibet DC Phase II expansion was approved in April, doubling power transfer capacity from 600 MW to 1,200 MW, expected to go operational by 2025. Italy (2024)– Siemens Energy, alongside FATA, won a €1.07 billion contract from Terna to deliver four converter stations for the Tyrrhenian Link (1 GW each), connecting Sicily and Sardinia to the Italian mainland.HVDC Converter Station Market Trends

1. Increasing Integration of Renewable Energy With a global push toward decarbonization, there is a growing trend of integrating large-scale solar and wind energy projects into the grid. HVDC converter stations play a critical role in transmitting this power efficiently across long distances, especially from remote renewable sites to consumption centres. 2. Expansion of Cross-Border Interconnections Countries are investing in cross-border HVDC transmission links to enhance energy security, stabilize grids, and enable electricity trading. Projects like NordLink (Germany-Norway) and Greenlink (Ireland-Wales) highlight this trend. 3. Shift from LCC to VSC Technology There's a growing shift from traditional Line Commutated Converters (LCC) to Voltage Source Converters (VSC) due to their compact size, black-start capability, and suitability for integrating weak and offshore grids, especially in urban and offshore wind applications. 4. Advancements in UHVDC (Ultra High Voltage DC) China and other nations are adopting UHVDC systems (above 800 kV) to transmit power over thousands of kilometres with minimal loss. These technologies allow for more efficient handling of bulk power loads.HVDC Converter Station Market Scope: Inquire before buying

Global HVDC Converter Station Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 12.5 Bn. Forecast Period 2025 to 2032 CAGR: 6.1% Market Size in 2032: USD 22 Bn. Segments Covered: by Component Converter Valves Transformer Harmonic Filters Circuit Breakers by Technology Line Commutated Converter Voltage Source Converter Hybrid HVDC by Application Bulk Power Transmission Interconnecting Grids Infeed Urban Areas HVDC Converter Station Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)HVDC Converter Station Market, Key Players are:

North America 1. General Electric (USA) 2. ABB Ltd (USA operations) 3. Quanta Services (USA) 4. American Superconductor Corporation (USA) Europe 5. Siemens Energy (Germany) 6. Hitachi Energy (Switzerland) 7. NKT A/S (Denmark) 8. Prysmian Group (Italy) Asia-Pacific 9. NR Electric Co., Ltd. (China) 10. State Grid Corporation of China (China) 11. Toshiba Energy Systems & Solutions (Japan) 12. Mitsubishi Electric Corporation (Japan) Middle East & Africa 13. Alstom Grid (France, projects in MEA) 14. Elsewedy Electric (Egypt)FAQs:

1. Which is the potential market for the HVDC Converter Station Market in terms of the region? Ans. In the North America region, the growing business and educational sectors are expected to help drive the use of collaborative screens. 2. What are the opportunities for new HVDC Converter Station Market Entrants? Ans. The key opportunity in the market is new initiatives from governments that provide funding for the HVDC Converter Station Market in educational institutes. 3. What is expected to drive the growth of the HVDC Converter Station Market in the forecast period? Ans. A major driver in the HVDC Converter Station Market is the prevalence of work from home and remote collaboration created by the COVID-19 pandemic. 4. What is the projected market size & growth rate of the HVDC Converter Station Market? Ans. The HVDC Converter Station Market size was valued at USD 12.5 billion in 2024, and the total HVDC Converter Station Market revenue is expected to grow at 6.1% through 2025 to 2032, reaching nearly USD 2 billion. 5. What segments are covered in the HVDC Converter Station Market report? Ans. The segments covered are Type, Technology, Application, and Region.

1. HVDC Converter Station Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. HVDC Converter Station Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global HVDC Converter Station Market: Dynamics 3.1. Region-wise Trends of HVDC Converter Station Market 3.1.1. North America HVDC Converter Station Market Trends 3.1.2. Europe HVDC Converter Station Market Trends 3.1.3. Asia Pacific HVDC Converter Station Market Trends 3.1.4. Middle East and Africa HVDC Converter Station Market Trends 3.1.5. South America HVDC Converter Station Market Trends 3.2. HVDC Converter Station Market Dynamics 3.2.1. Global HVDC Converter Station Market Drivers 3.2.1.1. Expanding production capacity to support faster 3.2.1.2. Modular converter designs 3.2.2. Growing consumer preference 3.2.3. Global HVDC Converter Station Market Restraints 3.2.4. Global HVDC Converter Station Market Opportunities 3.2.4.1. Deploying next-generation Voltage Source Converter 3.2.4.2. Technological Advancement 3.2.5. Global HVDC Converter Station Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Cross-Border Electricity Trade 3.4.2. Regulatory approvals 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. HVDC Converter Station Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 4.1.1. Converter Valves 4.1.2. Transformer 4.1.3. Harmonic Filters 4.1.4. Circuit Breakers 4.2. HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 4.2.1. Line Commutated Converter 4.2.2. Voltage Source Converter 4.2.3. Hybrid HVDC 4.3. HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 4.3.1. Bulk Power Transmission 4.3.2. Interconnecting Grids 4.3.3. Infeed Urban Areas 4.4. HVDC Converter Station Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America HVDC Converter Station Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 5.1.1. Converter Valves 5.1.2. Transformer 5.1.3. Harmonic Filters 5.1.4. Circuit Breakers 5.2. North America HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 5.2.1. Line Commutated Converter 5.2.2. Voltage Source Converter 5.2.3. Hybrid HVDC 5.3. North America HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 5.3.1. Bulk Power Transmission 5.3.2. Interconnecting Grids 5.3.3. Infeed Urban Areas 5.4. North America HVDC Converter Station Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 5.4.1.1.1. Converter Valves 5.4.1.1.2. Transformer 5.4.1.1.3. Harmonic Filters 5.4.1.1.4. Circuit Breakers 5.4.1.2. United States HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 5.4.1.2.1. Line Commutated Converter 5.4.1.2.2. Voltage Source Converter 5.4.1.2.3. Hybrid HVDC 5.4.1.3. United States HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Bulk Power Transmission 5.4.1.3.2. Interconnecting Grids 5.4.1.3.3. Infeed Urban Areas 5.4.2. Canada 5.4.2.1. Canada HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 5.4.2.1.1. Converter Valves 5.4.2.1.2. Transformer 5.4.2.1.3. Harmonic Filters 5.4.2.1.4. Circuit Breakers 5.4.2.2. Canada HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 5.4.2.2.1. Line Commutated Converter 5.4.2.2.2. Voltage Source Converter 5.4.2.2.3. Hybrid HVDC 5.4.2.3. Canada HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Bulk Power Transmission 5.4.2.3.2. Interconnecting Grids 5.4.2.3.3. Infeed Urban Areas 5.4.3. Mexico 5.4.3.1. Mexico HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 5.4.3.1.1. Converter Valves 5.4.3.1.2. Transformer 5.4.3.1.3. Harmonic Filters 5.4.3.1.4. Circuit Breakers 5.4.3.2. Mexico HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 5.4.3.2.1. Line Commutated Converter 5.4.3.2.2. Voltage Source Converter 5.4.3.2.3. Hybrid HVDC 5.4.3.3. Mexico HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 5.4.3.3.1. Bulk Power Transmission 5.4.3.3.2. Interconnecting Grids 5.4.3.3.3. Infeed Urban Areas 6. Europe HVDC Converter Station Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.2. Europe HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.3. Europe HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4. Europe HVDC Converter Station Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.1.2. United Kingdom HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.1.3. United Kingdom HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.2.2. France HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.2.3. France HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.3.2. Germany HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.3.3. Germany HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.4.2. Italy HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.4.3. Italy HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.5.2. Spain HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.5.3. Spain HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.6.2. Sweden HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.6.3. Sweden HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.7.2. Austria HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.7.3. Austria HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 6.4.8.2. Rest of Europe HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 6.4.8.3. Rest of Europe HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific HVDC Converter Station Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.2. Asia Pacific HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific HVDC Converter Station Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.1.2. China HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.1.3. China HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.2.2. S Korea HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.2.3. S Korea HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.3.2. Japan HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.3.3. Japan HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.4.2. India HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.4.3. India HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.5.2. Australia HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.5.3. Australia HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.6.2. Indonesia HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.6.3. Indonesia HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.7.2. Philippines HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.7.3. Philippines HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.8.2. Malaysia HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.8.3. Malaysia HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.9.2. Vietnam HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.9.3. Vietnam HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.10.2. Thailand HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.10.3. Thailand HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 7.4.11.2. Rest of Asia Pacific HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 7.4.11.3. Rest of Asia Pacific HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa HVDC Converter Station Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 8.2. Middle East and Africa HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa HVDC Converter Station Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 8.4.1.2. South Africa HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 8.4.1.3. South Africa HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 8.4.2.2. GCC HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 8.4.2.3. GCC HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 8.4.3.2. Nigeria HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 8.4.3.3. Nigeria HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 8.4.4.2. Rest of ME&A HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 8.4.4.3. Rest of ME&A HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 9. South America HVDC Converter Station Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 9.2. South America HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 9.3. South America HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 9.4. South America HVDC Converter Station Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 9.4.1.2. Brazil HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 9.4.1.3. Brazil HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 9.4.2.2. Argentina HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 9.4.2.3. Argentina HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America HVDC Converter Station Market Size and Forecast, By Component (2024-2032) 9.4.3.2. Rest of South America HVDC Converter Station Market Size and Forecast, By Technology (2024-2032) 9.4.3.3. Rest of South America HVDC Converter Station Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. General Electric (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. ABB Ltd (USA) 10.3. Mani, Inc. (France) 10.4. Kasai Kogyo Co (Japan) 10.5. Quanta Services (USA) 10.6. American Superconductor (USA) 10.7. Toshiba Energy System and Solution (Japan) 10.8. NR Electric Co., Ltd. (China) 10.9. Osstem Implant CO (South Korea) 10.10. Prysmian Group (Italy) 10.11. Siemens Energy (Germany) 10.12. Mitsubishi Electric Corporation (Japan) 10.13. Alstom Grid (France) 11. Key Findings 12. Analyst Recommendations 13. HVDC Converter Station Market: Research Methodology