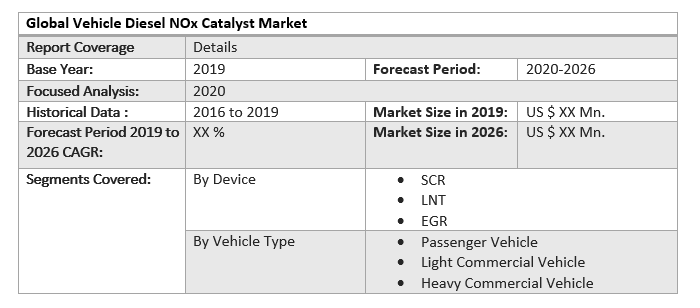

Global Vehicle Diesel NOx Catalyst Market is anticipated to reach US$ XX Mn by 2026 from US$ XX Mn in 2019 at a CAGR of 5.2% during a forecast period.Global Vehicle Diesel NOx Catalyst Market Overview

The demand for automotive diesel NOx catalysts provides a wide range of devices for reducing NOx emissions like Exhaust Gas Recirculation (EGR), Lean NOx Trap (LNT), and Selective Catalytic Reduction (SCR) (EGR). NOx pollution is harmful to human health, and vehicles are a significant cause of NOx pollution around the world. Where In 2019, America dominated the worldwide demand for vehicle diesel nitrogen oxide pollution control catalysts, accounting for about 43% of the market and is expected to continue its dominance during the forecast period. The report also covers the detailed analysis of the global vehicle diesel NOx catalyst industry with the classifications of the market based on device, vehicle type and region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key player's contribution in it.To know about the Research Methodology :- Request Free Sample Report

Global Vehicle Diesel NOx Catalyst Market Dynamics

One of the most prominent industry developments is the introduction of advanced Euro emission standards in developing markets. The Euro 6 emission standards are the most recent, and they regulate and manage toxic contaminants and emissions like CO, NOx, HC, and PM. To reduce the use of leaded gasoline and regulate CO emissions, various Euro emission standards were established. For example, vehicular emissions contributed 18 per cent NOx, 50 per cent HC, and 59 per cent CO emissions in India, and it is also set to adopt Bharat Stage 6, while China is set to adopt China 6, which are Europe-equivalent norms. Thus, the global vehicle NOx catalyst demand is expected to be driven by the implementation of Euro 6 equivalent norms in countries such as China, India, Mexico, and Brazil. Also, NOx emissions from diesel cars must be less than 126 mg/km under more strict Euro 6 stage rules, such as Euro 6c and Euro 6d. Euro6d is set to go into operation in 2021, and all new cars manufactured in Europe are expected to meet the Euro 6 standard. Thus, the demand for vehicle diesel NOx catalysts is expected to be driven by the implementation of strict NOx emission norms in Europe. In 2019, German automakers dominated the Euro 6 diesel passenger car market in the EU. BMW was the manufacturer with the largest market share; about 220,000 Euro 6 BMW diesel cars were sold, capturing 22% of the market. They were followed by Mercedes-Benz (21%), Audi (15%), and Volkswagen (13%). The first non-German manufacturer in terms of market share was Japanese manufacturer Mazda, which captured 7% of the market.Global Vehicle Diesel NOx Catalyst Market Segmentation Analysis

By Device, the LNT is predicted to be in high demand during the forecast period as it is a highly efficient NOx trapper. Light-duty vehicles, such as motor cars, benefit greatly from LNT. Unlike an SCR, the LNT is lightweight and does not need an extra tank. As a result, the LNT system is thought to be the best choice for trapping NOx in diesel passenger cars and light trucks. Also, SCR product demand is expected to rise over the projected period, as they are commonly used in heavy load applications such as commercial vehicles, and the Asia Pacific and Latin America have seen an increase in commercial vehicle demand.By Vehicle Type, The passenger vehicle segment dominated the global market for vehicle diesel NOx catalysts. Diesel passenger cars are selling in large numbers in Europe and the Asia Pacific. However, demand for diesel cars is decreasing in Europe, owing to diesel car taxes, strict emission standards, and a narrowing price disparity between gasoline and diesel cars. As compared to gasoline engines, diesel engines provide more driving power. As a result, for logistics and freight transportation, business fleet owners favor diesel vehicles. In comparison to gasoline engines, diesel engines produce a substantial NOx and PM. The atmosphere and human health are also harmed by these emissions. Due to the region's strong diesel car sales, Europe held a commanding share of the global automotive diesel NOx catalyst market. Due to regulatory reforms and the region's implementation of Euro6 equivalent emission standards, Asia Pacific is likely to see substantially high demand for vehicle diesel NOx catalysts. The Asia Pacific has strong commercial vehicle volumes, rising disposable incomes and increased consumer awareness regarding nitrogen oxide emissions, the region is expected to witness significant growth throughout the forecast period. Furthermore, because Asia is such a huge continent, it has developed as a hub for energy, vehicle and transportation, and other industries that use NOx control systems. Also, in 2019, the Americas led the global automotive vehicle diesel NOx catalyst catalysts market, accounting for nearly 43% market share and is projected to experience significant growth during the forecast period.

Global Vehicle Diesel NOx Catalyst Market Scope: Inquire before buying

Global Vehicle Diesel NOx Catalyst Market by Region

• North America • Asia pacific • Europe • Middle East and Africa • South AmericaGlobal Vehicle Diesel NOx Catalyst Market Key Players

• Robert Bosch GmbH • Tenneco Inc • Johnson Matthey • Continental AG • APC Automotive Technologies • DENSO Corporation • Futaba Industrial Co. Ltd. • Eberspacher Climate Control Systems GmbH & Co • BASF • Cataler • Clariant • Umicore • Corning • Solvay • Tenneco

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Vehicle Diesel NOx Catalyst Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Vehicle Diesel NOx Catalyst Market 3.4. Geographical Snapshot of the Vehicle Diesel NOx Catalyst Market, By Manufacturer share 4. Global Vehicle Diesel NOx Catalyst Market Overview, 2019-2026 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Vehicle Diesel NOx Catalyst Market 5. Supply Side and Demand Side Indicators 6. Global Vehicle Diesel NOx Catalyst Market Analysis and Forecast, 2019-2026 6.1. Global Vehicle Diesel NOx Catalyst Market Size & Y-o-Y Growth Analysis. 7. Global Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 7.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 7.1.1. SCR 7.1.2. LNT 7.1.3. EGR 7.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 7.2.1. Passenger Vehicle 7.2.2. Light Commercial Vehicle 7.2.3. Heavy Commercial Vehicle 8. Global Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2019-2026 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 9.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 9.1.1. SCR 9.1.2. LNT 9.1.3. EGR 9.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 9.2.1. Passenger Vehicle 9.2.2. Light Commercial Vehicle 9.2.3. Heavy Commercial Vehicle 10. North America Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 11.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 11.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 12. Canada Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 12.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 12.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 13. Mexico Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 13.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 13.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 14. Europe Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 14.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 14.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 15. Europe Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 16.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 16.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 17. France Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 17.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 17.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 18. Germany Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 18.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 18.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 19. Italy Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 19.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 19.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 20. Spain Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 20.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 20.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 21. Sweden Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 21.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 21.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 22. CIS Countries Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 22.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 22.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 23. Rest of Europe Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 23.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 23.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 24. Asia Pacific Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 24.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 24.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 25. Asia Pacific Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2019-2026 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 26.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 26.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 27. India Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 27.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 27.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 28. Japan Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 28.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 28.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 29. South Korea Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 29.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 29.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 30. Australia Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 30.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 30.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 31. ASEAN Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 31.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 31.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 32. Rest of Asia Pacific Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 32.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 32.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 33. Middle East Africa Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 33.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 33.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 34. Middle East Africa Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 35.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 35.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 36. GCC Countries Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 36.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 36.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 37. Egypt Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 37.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 37.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 38. Nigeria Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 38.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 38.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 39. Rest of ME&A Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 39.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 39.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 40. South America Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 40.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 40.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 41. South America Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2019-2026 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 42.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 42.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 43. Argentina Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 43.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 43.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 44. Rest of South America Vehicle Diesel NOx Catalyst Market Analysis and Forecasts, 2019-2026 44.1. Market Size (Value) Estimates & Forecast By Device, 2019-2026 44.2. Market Size (Value) Estimates & Forecast By Vehicle Type, 2019-2026 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Vehicle Diesel NOx Catalyst Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications and R&D investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Applications 45.2.3.2. M&A Key Players, Forward Integration and Backward Integration 45.3. Company Profile : Key Players 45.3.1. Tenneco Inc 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.4. Robert Bosch GmbH 45.5. Tenneco Inc 45.6. Johnson Matthey 45.7. Continental AG 45.8. APC Automotive Technologies 45.9. DENSO Corporation 45.10. Futaba Industrial Co. Ltd. 45.11. Eberspacher Climate Control Systems GmbH & Co 45.12. BASF 45.13. Cataler 45.14. Clariant 45.15. Umicore 45.16. Corning 45.17. Solvay 45.18. Tenneco 46. Primary Key Insights