The Unmanned Underwater Vehicles Market size was valued at USD 4.72 Bn. In 2024 the total Unmanned Underwater Vehicles Market revenue is growing by 16.2 % from 2025 to 2032, reaching nearly USD 15.69 Bn.Overview

UUV (underwater drone, uncrewed underwater vehicle) is a submersible vehicle that operates underwater without a human occupant on board. This class includes remotely operated underwater vehicles (ROVs) and autonomous underwater vehicles (AUVs). UUVs are essential for underwater applications including military missions, search and rescue, inspection of critical infrastructure, oil and gas explorations, environmental monitoring, and science and engineering research, and with the increasing need and investment in the UUV industry, both commercial and military in nature, this demand is expected to grow both domestically and abroad. From 2025 to 2032, the global UUV market is expected grow at a compound annual growth rate (CAGR) of 16.2%, fueled by improved AI, sensor systems, and an increasing awareness on global maritime security threats. The industry worth USD 4.72 billion in 2024, now is expected to exceed USD 15.69 billion by. The U.S., China and Europe are the major three global markets and clearly the U.S. is leading in military UUV having witnessed extensive deployment of military UUV being co to the sea. Military, commercial, and research applications are the primary drivers affecting market demand for UUVs across all segments analyzed in the report. Approximately 60% of global production of missile systems occurs in North America and Europe, with manufacturers such as Lockheed Martin, Boeing, Saab, and Kongsberg Gruppen. While Asia-Pacific is the main contributor to a growing market for autonomous naval systems, China's push into the field also contributing to a regional increase in production, along with Japan and South Korea. More than half of UUV consumption belongs to the defense sector, including mine countermeasures (MCM), intelligence and anti-submarine warfare (ASW) carried out by navies. Roughly another 30% is attributable to the commercial sector (offshore oil & gas, deep-sea mining), with the remainder (20%) for scientific research and environmental monitoring. Over 200 UUVs alone are anticipated to be purchased by the United States Navy by 2026. UUVs manufacturing has been situated in North America, Europe, and Asia-Pacific countries but mainly dominated by several leaders like Boeing, Saab AB, Lockheed Martin, Kongsberg Gruppen, and Teledyne Technologies. The U.S.S navy by itself, has projected investments of more than $3 billion in UUV applications to bolster its underwater war-fighting capacities through. At the same time, China is expanding its own production capacity, state-controlled firms like China State Shipbuilding Corporation (CSSC) are working on sophisticated military and commercial UUVs equipped with AI. Norway, Germany and the UK are the current leaders in UUV manufacturing in Europe for offshore applications, especially for inspections of oil and gas pipelines and for deep-sea exploration. UUV prices vary widely depending on size, technology, and applications. Commercial UUVs are disposed in sub-class scale based on UUV usages, for instance, small-scale commercial UUVs intended to conduct elementary oceanographic research are obtainable for as little as US$ 50,000 to US$ 500,000, whereas far expensive high-end military-principle UUVs packed with top-level AI & stealth features may reach US$ 5 million to US$ 50 million/unit. The price structure will depend on sensor integration, battery life, AI-based autonomous systems, and underwater communication technology. The emergence of modular designs for unmanned underwater vehicle (UUV) is also driving down cost, enabling UUVs to be tailored for specific operational requirements by companies. But the high cost of R&D, regulatory compliance, and cyber risk causes price volatility. The latter option, leasing and operating services, is a model that is beginning to gain traction in the UUV industry and lowers the burden of a large capital investment while also increasing access for smaller research institutions and commercial enterprises. MMR report presented the comprehensive analysis of the Unmanned Underwater Vehicles (UUVs) market is at a crucial point of development due to technological progress, an increase in defense spending, and the growing demand for ocean exploration. The industry should see more growth, with more commercial and environmental monitoring applications, and defense will continue to also be at the forefront. AI, IoT and autonomous decision making will transform many industries completely, and so will UUVs.To know about the Research Methodology :- Request Free Sample Report

Global Unmanned Underwater Vehicles Market Trends:

1. The Unmanned Underwater Vehicles market is witnessing a surge in demand due to the growing need for deep-water offshore oil and gas production. Unmanned Underwater Vehicles are accelerating exploration, drilling, construction, and maintenance operations, facilitating the advancement of commercial oil and gas exploration efforts. 2. Heightened concerns surrounding maritime security and global threats are driving the adoption of Unmanned Underwater Vehicles for surveillance, reconnaissance, and defense purposes. 3. Governments, particularly in the United States and China, are increasingly leveraging Unmanned Underwater Vehicles in defense applications, fueling market growth and innovation. 4. Pioneering companies such as Aquabotix are introducing ground-breaking technologies, enabling users to remotely control drones and Unmanned Underwater Vehicles from any location via the internet. Additionally, the development of "hybrid" Unmanned Underwater Vehicles solutions, capable of autonomous and remote human operation, is opening up new possibilities for underwater exploration and operations.Unmanned Underwater Vehicles Market Dynamics:

Growing usage of naval applications boosts the market growth Naval applications use unmanned underwater vehicles (Unmanned Underwater Vehicles) in naval warfare, which includes combat in and on the sea, the ocean, or any other battlespace involving a major body of water such as a large lake or wide river. Unmanned Underwater Vehicles (Unmanned Underwater Vehicles) are becoming more important for keeping naval operations safe and secure. Unmanned Underwater Vehicles are used in various ways by the navy, like finding and dealing with underwater mines, spying and watching what's happening in the water, and tracking enemy submarines. Unmanned Underwater Vehicles are especially good at finding and getting rid of underwater mines, which can harm naval ships. They also help gather information about enemy ships and what's under the water. They play a big role in finding and keeping tabs on enemy submarines. Because Unmanned Underwater Vehicles are being used more and more in these naval tasks, the growing usage of Unmanned Underwater Vehicles in naval applications is expected to drive the growth of the Unmanned Underwater Vehicles market in the coming years. Technological advancements drive the Market Growth. Technological advancements propelling the Unmanned Underwater Vehicles Market forward. These continuous innovations bring about remarkable improvements in Unmanned Underwater Vehicles capabilities, making them increasingly attractive across various industries. Enhanced navigation and autonomy systems equipped with advanced sensors and machine learning algorithms empower Unmanned Underwater Vehicles to autonomously navigate intricate underwater terrains with unmatched precision, reducing the reliance on human intervention. Furthermore, ongoing developments in sensor technology enable Unmanned Underwater Vehicles to capture high-resolution images, sonar data, and environmental information, revolutionizing marine research, defense operations, and environmental monitoring. Improved communication systems allow real-time data transmission between Unmanned Underwater Vehicles and remote operators, ensuring swift decision-making. Additionally, the evolution of battery technology extends Unmanned Underwater Vehicles' operational endurance, facilitating longer and more complex missions. These advancements, coupled with miniaturization, multi-mission capability, and remote operability, collectively expand the Unmanned Underwater Vehicles market's horizons, enabling their use in diverse applications, from scientific research to underwater infrastructure inspection and beyond. High Cost and Affordability limit the Market Growth Unmanned Underwater Vehicles, especially those designed for deep-sea exploration and sophisticated applications, often come with high development, manufacturing, and maintenance costs. These expenses are prohibitive for smaller organizations, research institutions, and emerging markets. Additionally, the need for specialized training and infrastructure to operate and maintain Unmanned Underwater Vehicles further inflates the total cost of ownership. The high cost of Unmanned Underwater Vehicles limits their adoption and accessibility across various sectors, including marine research, environmental monitoring, and offshore industries. Smaller organizations may struggle to procure and operate Unmanned Underwater Vehicles, leading to a concentration of this technology among larger, well-funded entities. To mitigate this restraining factor, ongoing efforts in research and development to create more cost-effective Unmanned Underwater Vehicles models, as well as collaborative initiatives among governments and industries, are essential. These endeavors help reduce the overall cost of Unmanned Underwater Vehicles and make them more accessible to a wider range of users and applications. Rising need for ocean data and mapping creates lucrative growth opportunities The rising need for ocean data and mapping is creating lucrative growth opportunities for the Unmanned Underwater Vehicles Market. The ocean is essential for all aspects of human well-being and livelihood, and it provides key services like climate regulation, energy budget, carbon cycle, and nutrient cycle. The need for ocean data and mapping is increasing to create a detailed map for navigation and mineral extraction. Unmanned Underwater Vehicles are used for ocean data and mapping, where they gather information about the underwater terrain and provide detailed maps of the ocean floor. Unmanned Underwater Vehicles also be used for oceanographic research, where they collect data on ocean currents, temperature, and salinity. Unmanned Underwater Vehicles are becoming indispensable tools for oceanographic research, environmental monitoring, offshore energy exploration, and defense applications. These autonomous or remotely operated underwater vehicles offer the capability to collect high-resolution data from the depths of the ocean, enabling scientists, industries, and governments to better understand marine ecosystems, geology, and climate patterns. The Unmanned Underwater Vehicles market is benefiting from technological advancements, such as improved navigation systems, longer endurance, and enhanced data transmission capabilities. Additionally, rising concerns about climate change and the need to protect and sustainably manage marine resources are further fueling the demand for Unmanned Underwater Vehicles. This market presents lucrative opportunities for companies involved in Unmanned Underwater Vehicles development, manufacturing, and service provision, making it a promising sector for future growth and innovation. Market Challenges Unmanned Underwater Vehicles encounter several challenges, including slow underwater survey speeds. Because of the conducting nature of saltwater, electromagnetic (EM) waves cannot function properly in underwater habitats with a depth of more than 200 meters. These slow acoustic waves are used by Unmanned Underwater Vehicles for deep-water surveys. FSO waves are not used by Unmanned Underwater Vehicles as these waves travel very short distances. The refraction, absorption, and scattering of signals sent by Unmanned Underwater Vehicles in the water further impact their propagation. The bouncing of signals from the seafloor and layers of water separated by changes in temperature or density cause reflection. Deep waters' high-pressure levels impede signal transmission even more, resulting in background noise and echoes. Due to the highly sophisticated signal processing, high-power levels are essential for underwater communication. Furthermore, environmental conflicts like weather changes, waves, wind patterns, & and ocean currents have an extensive impact on Unmanned Underwater Vehicles' communication. All of these characteristics provide difficulties for Unmanned Underwater Vehicles operators.Unmanned Underwater Vehicles Market Segment Analysis:

Based on Type, The ROV sub-segment dominates the Type segment of the Unmanned Underwater Vehicles Market in the year 2024. ROVs exhibit exceptional versatility and adaptability. They are capable of performing a wide range of tasks, from subsea inspections and maintenance to complex engineering operations. This versatility makes ROVs invaluable in numerous industries, such as offshore oil and gas, marine research, and underwater infrastructure. ROVs offer real-time control and feedback to operators on the surface. This level of control is crucial for tasks that require delicate manipulation, tool usage, and intricate subsea operations. It ensures precision and minimizes the risk of errors. ROVs excel in deep-sea exploration, where human divers cannot operate safely. They withstand extreme pressures and harsh underwater conditions, enabling scientists and engineers to access and study the depths of the ocean. ROV technology has been well-established and refined over decades, with numerous companies specializing in their design, manufacturing, and operation. This maturity in technology has led to the development of highly capable and reliable ROVs. ROVs are used worldwide and accessible to a wide range of industries and organizations. Their availability and adaptability contribute to their dominant market position.Unmanned Underwater Vehicles Market Based on Type in year 2024 (%)

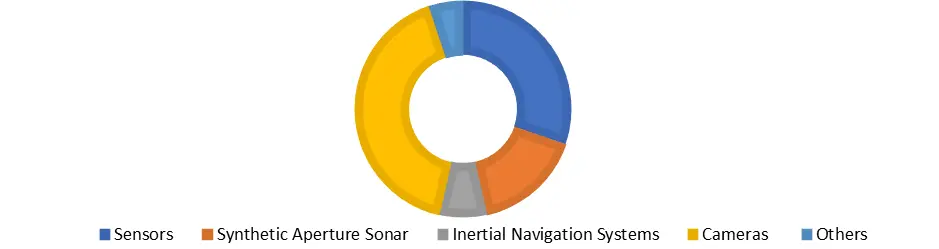

Based on Payload, The Camera sub-segment dominates the Payload segment of the Unmanned Underwater Vehicles Market in the year 2024. Cameras have been getting better and better, taking sharper pictures, working well in low light, and even capturing 3D and high-definition images. People want Unmanned Underwater Vehicles (Unmanned Underwater Vehicles) with these advanced cameras, especially in fields such as science and business. The part of the Unmanned Underwater Vehicles market that's growing the fastest is the sensor part. Sensors are such as tools that do lots of different jobs, like checking the environment, listening to sounds, and even sniffing out chemicals. These tools are super important for gathering information about what's going on underwater, in defense applications, sensors are crucial for detecting and identifying underwater threats. The versatility and diversity of sensors make them a dominant sub-segment within the Unmanned Underwater Vehicles payload category, providing a wide array of applications.

Unmanned Underwater Vehicles Market Based On Payload In Year 2024 (%)

Regional Insight:

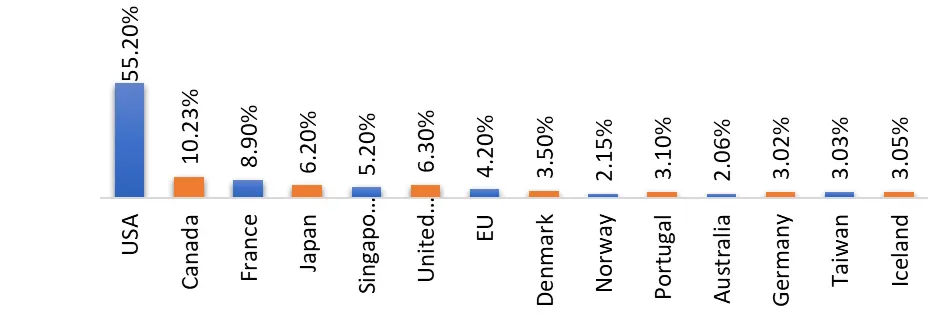

North America region dominates the Unmanned Underwater Vehicles Market in the year 2024. The region's strong defense and military presence, particularly in the United States. Unmanned Underwater Vehicles have become integral to various defense applications, including mine countermeasures, anti-submarine warfare, and underwater reconnaissance, with substantial investments from the U.S. Navy propelling their development and widespread adoption. Technological innovation is another driving force, with North America housing some of the globe's most prominent defense and technology companies. These firms continually push the boundaries of Unmanned Underwater Vehicles technology, producing cutting-edge systems applicable across diverse sectors. The region's commitment to research and development is evident through significant investments by government agencies and private enterprises, fostering a fertile environment for Unmanned Underwater Vehicles advancements and fostering collaboration among industry players and research institutions. North America's extensive maritime territories, spanning vast coastlines, abundant offshore energy resources, and significant bodies of water, further bolster the Unmanned Underwater Vehicles market. These vehicles are essential for monitoring, safeguarding, and exploring these expansive domains, In industries such as offshore energy, marine research, and environmental monitoring. North America capitalizes on a multitude of commercial applications for Unmanned Underwater Vehicles, including offshore oil and gas exploration, underwater infrastructure inspections, and cutting-edge scientific research in marine biology and oceanography. Collectively, these factors underline North America's pre-eminence in the global Unmanned Underwater Vehicles market, as it continues to drive innovation, foster adoption, and stimulate growth across an array of sectors and applications.Countries developing AUVs in (%) the Year 2023

Key Insides

August 2022 — Austal USA announced a partnership with California based Saildrone for the construction of Saildrone Surveyor autonomous 'uncrewed' surface vehicle at its Alabama facility. In a company statement, Raytheon stated: "The partnership enables Raytheon to offer U.S. Navy and other government agency customers an innovative solution for persistent wide area coverage repackaged to support maritime domain awareness, hydrographic survey, and other similar missions." November 2021 - Teledyne Marine teams up with Seatronics to bolster distribution of Bowtech underwater cameras, lights, and under water strobes range in Europe, Americas, and the Asia-Pacific. It also made its after-sale care operations through regional service centers based out of the United Kingdom, Singapore and the United States. Jul 2021 - Textron Systems revealed that it had been pre-awarded a United States Marine Corps Advanced Reconnaissance Vehicle (ARV) prototype contract for its CottonmouthTM purpose-built vehicle.[2] A Cookbook of Sorts" as it could possibly be a Cottonmouth vehicle for the Marine Corps and it may undergo a grueling test and evaluation. Information acquired from the ARV competitive prototyping efforts may be leveraged for a USMC decision point in 2023. BAE Systems – Riptide UUV-12 unmanned undersea vehicle (UUV) portfolio announced – March 2021 the Riptide UUV-12 is highly modular and suitable for numerous missions, including those mounting larger and more power-hungry payloads.Unmanned Underwater Vehicles Market Scope: Inquiry Before Buying

Global Unmanned Underwater Vehicles Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 4.72 Bn. Forecast Period 2025 to 2032 CAGR: 16.2% Market Size in 2032: USD 15.69 Bn. Segments Covered: by Type ROV AUV HUV by Product Type Small Vehicles Work-class Vehicles by Payload Sensors Synthetic Aperture Sonar Inertial Navigation Systems Cameras Others by Propulsion System Electric Systems Mechanical Systems Hybrid Systems Others by Application Search & Salvage Operations Archaeological & Exploration Oceanography Environmental & Meteorological Research Oil & Gas Naval & Coastal Défense Unmanned Underwater Vehicles Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Unmanned Underwater Vehicles Market Key Players

1. Lockheed Martin Corporation (Bethesda, Maryland, USA). 2. Northrop Grumman Corporation (Falls Church, Virginia, USA) 3. General Dynamics Mission Systems (Fairfax, Virginia, USA) 4. Teledyne Marine (Thousand Oaks, California, USA) 5. Saab Group (Stockholm, Sweden) 6. Kongsberg Gruppen (Kongsberg, Norway) 7. Boeing (Chicago, Illinois, USA) 8. BAE Systems (London, United Kingdom) 9. L3Harris Technologies (Melbourne, Florida, USA) 10. Thales Group (Paris, France) 11. Oceaneering International (Houston, Texas, USA) 12. Ocean Infinity (London, United Kingdom) 13. Subsea 7 (London, United Kingdom) 14. Eca Group (La Garde, France) 15. International Submarine Engineering (ISE) (Port Coquitlam, Canada) 16. Greensea Systems (Richmond, Vermont, USA) 17. Planck Aerosystems (San Diego, California, USA) 18. Ocean Aero (San Diego, California, USA) 19. L3 Harris Technologies Inc. (U.S.) 20. Fugro (Finland)FAQ

1] What segments are covered in the Global Unmanned Underwater Vehicles Market report? Ans. The segments covered in the Unmanned Underwater Vehicles Market report are based on Type, Payload, Propulsion System, Product Type, Application, and Regions. 2] Which region is expected to hold the highest share in the Global Unmanned Underwater Vehicles Market? Ans. The North American region is expected to hold the highest share of the Unmanned Underwater Vehicles Market. 3] What is the market size of the Global Unmanned Underwater Vehicles Market by 2032? Ans. The market size of the Unmanned Underwater Vehicles Market by 2032 is expected to reach USD 15.69 Bn. 4] What is the forecast period for the Global Unmanned Underwater Vehicles Market? Ans. The forecast period for the Unmanned Underwater Vehicles Market is 2025-2032. 5] What was the market size of the Global Unmanned Underwater Vehicles Market in 2024? Ans. The market size of the Unmanned Underwater Vehicles Market in 2024 was valued at USD 4.72 Bn.

1. Unmanned underwater vehicles (UUVs) Market: Research Methodology 2. Unmanned underwater vehicles (UUVs) Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Consumption & Production Analysis 3.1. Global UUV Production Statistics 3.2. Top UUV Manufacturing Countries & Production Volumes 3.3. Raw Material & Component Sourcing Analysis 4. Supply Chain Overview & Key Suppliers 4.1. Global UUV Consumption Trends 4.2. Major Propulsion Systems (Defense, Commercial, Research, etc.) 4.3. Industry-Specific UUV Deployment Rates 4.4. Market Demand by Region (North America, Europe, Asia-Pacific, Middle East, Latin America, Africa) 5. AI & Automation Integration in UUVs 5.1. Role of Artificial Intelligence & Machine Learning in UUV Navigation 5.2. Autonomous Decision-Making Systems & Real-Time Data Processing 5.3. Integration of 5G & Satellite Communication for Real-Time Control 6. Customer Behavior & Adoption Trends 6.1. UUV Adoption Rates Across Different Sectors (Defense, Oil & Gas, Research, Fisheries, etc.) 6.2. Purchasing Patterns & Procurement Cycles for UUVs 6.3. Growth of Leasing & Rental Models for UUV Services 7. Industry Key Dynamics 7.1. Rising Defense Budgets for Underwater Surveillance & Warfare 7.2. Growth in Offshore Oil & Gas Exploration 7.3. Advancements in AI, Autonomy & Sensor Technology 7.4. Demand for Deep-Sea Exploration & Research 7.5. Environmental Monitoring & Sustainability Goals 8. Market Restraints 8.1. High Cost of UUV Development & Maintenance 8.2. Limited Battery Life & Energy Challenges 8.3. Regulatory & Safety Challenges 9. Market Opportunities 9.1. Integration of AI & Edge Computing for Fully Autonomous UUVs 9.2. Expansion in Civilian & Commercial Use Cases 9.3. Government & Private Sector Collaborations 10. (UUVs) Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units and Volume in Units) (2024-2032) 10.1. Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 10.1.1. ROV 10.1.2. AUV 10.1.3. HUV 10.2. Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 10.2.1. Small Vehicles 10.2.2. Work-class Vehicles 10.3. Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 10.3.1. Sensors 10.3.2. Synthetic Aperture Sonar 10.3.3. Inertial Navigation Systems 10.3.4. Cameras 10.3.5. Others 10.4. Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 10.4.1. Electric Systems 10.4.2. Mechanical Systems 10.4.3. Hybrid Systems 10.4.4. Others 10.5. Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 10.5.1. Search & Salvage Operations 10.5.2. Archaeological & Exploration 10.5.3. Oceanography 10.5.4. Environmental & Meteorological Research 10.5.5. Oil & Gas 10.5.6. Naval & Coastal Défense 10.6. Unmanned underwater vehicles (UUVs) Market Size and Forecast, by region (2024-2032) 10.6.1. North America 10.6.2. Europe 10.6.3. Asia Pacific 10.6.4. Middle East and Africa 10.6.5. South America 11. North America Unmanned underwater vehicles (UUVs) Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032) 11.1. North America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 11.1.1. ROV 11.1.2. AUV 11.1.3. HUV 11.2. North America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 11.2.1. Small Vehicles 11.2.2. Work-class Vehicles 11.3. North America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 11.3.1. Sensors 11.3.2. Synthetic Aperture Sonar 11.3.3. Inertial Navigation Systems 11.3.4. Cameras 11.3.5. Others 11.4. North America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 11.4.1. Electric Systems 11.4.2. Mechanical Systems 11.4.3. Hybrid Systems 11.4.4. Others 11.5. North America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 11.5.1. Search & Salvage Operations 11.5.2. Archaeological & Exploration 11.5.3. Oceanography 11.5.4. Environmental & Meteorological Research 11.5.5. Oil & Gas 11.5.6. Naval & Coastal Défense 11.6. North America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Country (2024-2032) 11.6.1. United States 11.6.1.1. United States Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 11.6.1.2. United States Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 11.6.1.3. United States Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 11.6.1.4. United States Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 11.6.1.5. United States Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 11.6.2. Canada 11.6.2.1. Canada Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 11.6.2.2. Canada Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 11.6.2.3. Canada Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 11.6.2.4. Canada Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 11.6.2.5. Canada Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 11.6.2.6. 11.6.3. Mexico 11.6.3.1. Mexico Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 11.6.3.2. Mexico Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 11.6.3.3. Mexico Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 11.6.3.4. Mexico Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 11.6.3.5. Mexico Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 12. Europe Unmanned underwater vehicles (UUVs) Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units ) (2024-2032) 12.1. Europe Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 12.2. Europe Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 12.3. Europe Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 12.4. Europe Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 12.5. Europe Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 12.6. Europe Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Country (2024-2032) 12.6.1. United Kingdom 12.6.2. France 12.6.3. Germany 12.6.4. Italy 12.6.5. Spain 12.6.6. Sweden 12.6.7. Russia 12.6.8. Rest of Europe 13. Asia Pacific Unmanned underwater vehicles (UUVs) Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2024-2032) 13.1. Asia Pacific Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 13.2. Asia Pacific Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 13.3. Asia Pacific Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 13.4. Asia Pacific Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 13.5. Asia Pacific Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 13.6. Asia Pacific Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Country (2024-2032) 13.6.1. China 13.6.2. S Korea 13.6.3. Japan 13.6.4. India 13.6.5. Australia 13.6.6. Indonesia 13.6.7. Malaysia 13.6.8. Philippines 13.6.9. Thailand 13.6.10. Vietnam 13.6.11. Rest of Asia Pacific 14. Middle East and Africa Unmanned underwater vehicles (UUVs) Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units ) (2024-2032) 14.1. Middle East and Africa Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 14.2. Middle East and Africa Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 14.3. Middle East and Africa Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 14.4. Middle East and Africa Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 14.5. Middle East and Africa Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 14.6. Middle East and Africa Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Country (2024-2032) 14.6.1. South Africa 14.6.2. GCC 14.6.3. Nigeria 14.6.4. Rest of ME&A 15. South America Unmanned underwater vehicles (UUVs) Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units ) (2024-2032) 15.1. South America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Type (2024-2032) 15.2. South America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Product Type (2024-2032) 15.3. South America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Payload (2024-2032) 15.4. South America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Propulsion System (2024-2032) 15.5. South America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Application (2024-2032) 15.6. South America Unmanned underwater vehicles (UUVs) Market Size and Forecast, by Country (2024-2032) 15.6.1. Brazil 15.6.2. Argentina 15.6.3. Colombia 15.6.4. Chile 15.6.5. Rest of South America 16. Company Benchmarking & Branding Strategies 16.1. Market Positioning of Leading Unmanned underwater vehicles (UUVs) Manufacturers 16.2. Branding Strategies & Consumer Engagement Techniques 16.3. Role of Sustainability and Certifications in Brand Reputation 16.4. Marketing & Advertising Trends in the Unmanned underwater vehicles (UUVs) Industry 16.5. Influence of Digital Marketing and Social Media on Unmanned underwater vehicles (UUVs) Sales 17. Company Profile: Key Players 17.1. Lockheed Martin Corporation (Bethesda, Maryland, USA). 17.1.1. Company Overview 17.1.2. Business Portfolio 17.1.3. Branding & Market Positioning Strategies 17.1.4. Financial Overview 17.1.4.1. Revenue 17.1.4.2. Profit margin 17.1.4.3. Cost of Sales 17.1.4.4. Earnings 17.1.5. SWOT Analysis 17.1.6. Strategic Analysis 17.2. Northrop Grumman Corporation (Falls Church, Virginia, USA) 17.3. General Dynamics Mission Systems (Fairfax, Virginia, USA) 17.4. Teledyne Marine (Thousand Oaks, California, USA) 17.5. Saab Group (Stockholm, Sweden) 17.6. Kongsberg Gruppen (Kongsberg, Norway) 17.7. Boeing (Chicago, Illinois, USA) 17.8. BAE Systems (London, United Kingdom) 17.9. L3Harris Technologies (Melbourne, Florida, USA) 17.10. Thales Group (Paris, France) 17.11. Oceaneering International (Houston, Texas, USA) 17.12. Ocean Infinity (London, United Kingdom) 17.13. Subsea 7 (London, United Kingdom) 17.14. Eca Group (La Garde, France) 17.15. International Submarine Engineering (ISE) (Port Coquitlam, Canada) 17.16. Greensea Systems (Richmond, Vermont, USA) 17.17. Planck Aerosystems (San Diego, California, USA) 17.18. Ocean Aero (San Diego, California, USA) 17.19. L3 Harris Technologies Inc. (U.S.) 17.20. Fugro (Finland) 18. Key Findings 19. Analyst Recommendation