Global Transparent Ceramics Market size was valued at USD 782.62 Mn in 2024 and total Global Transparent Ceramics Market revenue is expected to reach USD 2862.92 Mn by 2032, at a CAGR of 17.6% over the forecast period.Transparent Ceramics Market Overview:

Transparent ceramic are high performance polycrystalline materials that combine optical clarity like glass with better mechanical strength and thermal resistance, ideal for extreme atmosphere. The global transparent ceramic industry is experiencing strong growth, operating by expanding application in defence systems, laser technologies and advanced electronics, focusing on increasing physical properties and production efficiency with innovation. Asia Pacific has emerged as a major force in the global transparent ceramic market, crossing other regions in both transparent ceramic production capacity and technological innovation. The transparent ceramic manufacturing landscape is dominated by CeramTec (Germany) for Medical/Laser Ceramics, Saint Gobain (France) for Engineer Solutions and CoorsTek (U.S.) for industrial applications. The versatility of end user transparent ceramic market materials dominates 45% shares (aircraft transparency, armour system), followed by optoelectronics (30%, lidar, smartphone lens) and healthcare (20%, such as, dental prosthetics, surgical laser). Transparent ceramic growth trajectory is being reshaped by global investments in hypersonic technologies, 5G infrastructure, and advanced optical systems, reshaping its role as an ambassador to the next generation of industrial and technological successes.To know about the Research Methodology :- Request Free Sample Report

Transparent Ceramics Market Dynamics:

Increased Demand in Optics and Optoelectronics to Drive Transparent Ceramics Market Growth The growing need for high-performance materials in optics and optoelectronic devices drives the Transparent Ceramics Market. For example, CeramTec's transparent ceramics find application in laser gain media, enabling high-power laser systems for industrial cutting and medical procedures due to their superior thermal conductivity and optical transparency. Transparent ceramics are increasingly utilized in aerospace and defense for windows, canopies, and sensor housings due to their exceptional durability and resistance to harsh environments. Surmet Corporation's ALON transparent ceramic is used in fighter jet canopies, offering superior scratch resistance and ballistic protection compared to traditional materials like glass or acrylic. The demand for transparent ceramics in medical imaging devices such as X-ray tubes and CT scanner components is on the rise due to their ability to withstand high temperatures and ionizing radiation. Toshiba's transparent ceramics are utilized in X-ray tubes, providing improved image quality and reliability for diagnostic procedures. Transparent ceramics play a crucial role in the energy sector for high-temperature applications like solid-state lasers and solar panels. II-VI Incorporated's transparent ceramics are used in laser fusion experiments, facilitating research into clean energy production through nuclear fusion. High Production Cost to Restrain the Transparent Ceramics Market Growth The high production costs associated with manufacturing processes, limiting widespread adoption hindering the growth of Transparent Ceramics Market. For example, the complex synthesis methods required for producing transparent ceramics such as ALON result in higher production expenses, hindering market growth by making the final products less cost-competitive compared to alternatives such as glass or plastics. Scalability issues pose a restraint on market growth as transparent ceramics manufacturing processes may struggle to meet the demands of large-scale applications. For instance, while transparent ceramics offer superior properties for use in aerospace and defense, the limited scalability of production methods hinders their widespread adoption in these industries for large-scale production of components like fighter jet canopies. Transparent ceramics present difficulties in machining and shaping due to their extreme hardness and brittleness, impacting manufacturing efficiency and increasing costs. Companies such as Surmet Corporation face challenges in machining ALON ceramics for use in transparent armor, requiring specialized equipment and processes that add to production costs and lead times. The limited availability of materials suitable for transparent ceramics production constrains market growth. For example, while ALON is a highly desirable transparent ceramic for its exceptional properties, its production relies on scarce raw materials like aluminum and oxygen, posing challenges in material sourcing and cost management.Transparent Ceramics Market Segment Analysis:

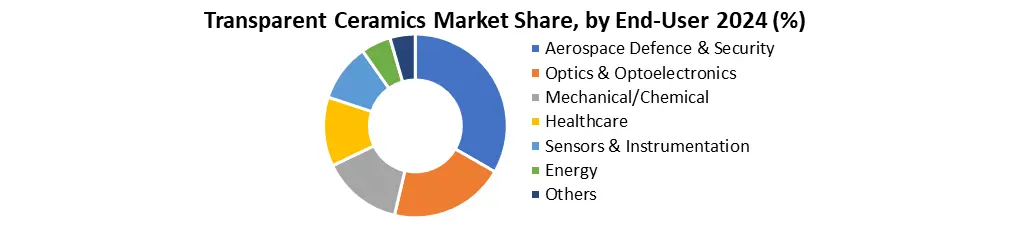

Based on Type, Monocrystalline transparent ceramics dominated the Transparent Ceramics Market in 2024 as it exhibits uniform crystal structure, offering exceptional optical clarity and mechanical properties suitable for high-performance applications like optics, lasers, and medical imaging devices. Polycrystalline transparent ceramics, while less uniform in structure, are cost-effective and find applications in aerospace, defence, and industrial sectors for components like windows, armor, and sensor housings. Other types of transparent ceramics encompass specialized formulations tailored for specific applications, such as transparent armor or thermal management systems. Adoption of monocrystalline ceramics is prominent in precision optics and laser technologies, while polycrystalline ceramics are favoured for their affordability in industries like aerospace and defence. Overall, each type of transparent ceramic offers unique advantages and is adopted based on its suitability for specific applications, driving diversity and innovation within the market segment. Based on End-User, the Transparent Ceramics Market is segmented into optics & optoelectronics, aerospace, defence & security, mechanical/chemical, healthcare, sensors & instrumentation, energy, etc. In 2024, the aerospace defence & security segment dominated the transparent ceramics market, accounting for over 40% of global demand, driven by massive adoption of ALON® and spinel armor systems (Surmet, Konoshima) and IR missile domes (Raytheon, BAE Systems). The U.S. DoD alone procured $580M worth of transparent ceramic armor this year, while hypersonic missile programs in China and Russia fuelled 35% YoY growth in IR-transparent ceramic components.

Transparent Ceramics Market Regional Insights:

Asia-Pacific Dominates in the Transparent Ceramics Market Asia-Pacific dominated countries like Japan, China, and South Korea lead the market in 2024 due to their strong presence in electronics manufacturing, aerospace, and defense industries. Japan, known for its technological prowess, particularly dominates in high-tech applications like optics, medical imaging, and semiconductor manufacturing, contributing significantly to regional market growth. Similarly, China's rapid industrialization and investments in advanced materials drive demand for transparent ceramics in diverse sectors, including optics, energy, and consumer electronics. North America, the United States spearheads market growth with a strong focus on aerospace, defense, and semiconductor industries, driven by robust R&D investments and technological innovations. Europe follows suit, with countries such as Germany and the UK driving market growth through advancements in optics, automotive, and renewable energy sectors. Stringent regulations promoting sustainable practices and eco-friendly materials favor the adoption of transparent ceramics in European markets. Transparent Ceramics Market Competitive Landscape: In 2024, Saint Gobain reinforced its leadership in the high-performance transparent ceramics segment, securing €380 million in revenue from its advanced ceramics division, with YAG (yttrium aluminium garnet) crystals capturing 35% of the global transparent ceramics market. The company's CERADIR infrared-transparent ceramics now equip 70% of European aerospace thermal imaging systems, while its Hexoloy silicon carbide dominates nuclear reactor viewing ports with 80% market penetration. Facing competition from CeramTec's medical-grade ceramics (holding 25% more hospital contracts) and Konoshima Chemical's spinel (45% cheaper for mid-IR applications), Saint Gobain invested €120 million to automate its Roussillon, France facility, boosting output by 30% and reducing defects to <0.5%. Transparent Ceramics Market Key Trends: • Military Modernization Driving Demand Hypersonic missile programs (U.S., China, Russia) are fueling 40% growth in IR-transparent ceramics (ALON, spinel) for radomes and sensor windows. • Semiconductor Industry Adoption EUV lithography and 5G/6G technologies are doubling demand for ultra-pure sapphire and YAG substrates, with Asia producing 70% of global supply. • Manufacturing Breakthroughs AI-driven sintering and nanoparticle inks are cutting production costs by 35% while enabling complex geometries for laser/medical applications. Transparent Ceramics Market Key Developments: • CoorsTek (Feb 2025): Unveiled high-purity transparent alumina tubes for semiconductor plasma etching, achieving 99.999% purity with 30% higher corrosion resistance. • Optics Balzers (Jan 2025): Launched ultra-durable IR coatings for spinel windows, extending lifespan of military thermal imagers by 5X in desert environments. • CeramTec (Mar 2025): Scaled production of 3D-printed YAG laser components for EUV lithography, reducing lead times from 8 weeks to 5 days. • Saint-Gobain (Dec 2024): Won €20M contract for CERADIR missile domes with MBDA, leveraging proprietary nanopore-free sintering tech. • CeraNova (Nov 2024): Demonstrated world's first curved ALON panels for hypersonic aircraft canopies, surviving Mach 7 wind tunnel tests.Transparent Ceramics Market Scope: Inquire before buying

Transparent Ceramics Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 782.62 Mn. Forecast Period 2025 to 2032 CAGR: 17.6% Market Size in 2032: USD 2862.92 Mn. Segments Covered: by Type Monocrystalline Transparent Ceramics Polycrystalline Transparent Ceramics Others by Material Sapphire Spinel Yttrium Aluminium Garnet Aluminium Oxynitride Others by End-use Industry Optics & Optoelectronics Mechanical/Chemical Aerospace, Defence & Security Healthcare Sensors & Instrumentation Energy Others Transparent Ceramics Market, by region:

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Transparent Ceramics Market Key Players:

North America 1. Surmet Corporation (US) 2. II-VI Incorporated (US) 3. CeraNova (US) 4. CoorsTek (US) 5. Advanced Ceramic Manufacturing (US) 6. Optics Balzers (US 7. Meller Optics (US) 8. INO (Canada) 9. Rubis Precis Inc. (Canada) Europe 10. CeramTec (Germany) 11. Morgan Advanced Materials (United Kingdom) 12. Schott AG (Germany) 13. Crystal GmbH (Germany) 14. CILAS (France) 15. Saint-Gobain (France) Asia Pacific 16. Bright Crystals Technology (China) 17. Shanghai Uniacryl Technology (China) 18. Konoshima Chemical Co., Ltd. (Japan) 19. Tosoh Corporation (Japan) 20. Murata Manufacturing Co., Ltd. (Japan) 21. KCC Corporation (South Korea) 22. Hindustan Ceramics (India)FAQs:

1] What Major Key players in the Global Market report? Ans. The Major Key players covered in the Market report are Surmet Corporation, II-VI Incorporated, CeramTec, Morgan Advanced Materials plc, Schott AG, Crystal GmbH 2] Which region is expected to hold the highest share in the Global Market? Ans. Asia Pacific region is expected to hold the highest share in the Market. 3] What is the market size of the Global Market by 2032? Ans. The market size of the Transparent Ceramics Market by 2032 is expected to reach US$ 2862.92 Million. 4] What is the forecast period for the Global Transparent Ceramics Market? Ans. The forecast period for the Transparent Ceramics Market is 2025-2032. 5] What was the market size of the Global Transparent Ceramics Market in 2024? Ans. The market size of the Transparent Ceramics Market in 2024 was valued at USD 782.62 Mn.

1. Transparent Ceramics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Transparent Ceramics Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Industry Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Transparent Ceramics Market: Dynamics 3.1. Transparent Ceramics Market Trends 3.1.1. North America Transparent Ceramics Market Trends 3.1.2. Europe Transparent Ceramics Market Trends 3.1.3. Asia Pacific Transparent Ceramics Market Trends 3.1.4. Middle East and Africa Transparent Ceramics Market Trends 3.1.5. South America Transparent Ceramics Market Trends 3.2. Global Transparent Ceramics Market Dynamics 3.2.1. Global Transparent Ceramics Market Drivers 3.2.1.1. Increased Demand in Optics and Optoelectronics 3.2.2. Global Transparent Ceramics Market Restraints 3.2.3. Global Transparent Ceramics Market Opportunities 3.2.4. Global Transparent Ceramics Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.4.1. Geo-Power Shifts 3.4.2. Capital Currents 3.4.3. Material Revolutions 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Transparent Ceramics Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 4.1. Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 4.1.1. Monocrystalline Transparent Ceramics 4.1.2. Polycrystalline Transparent Ceramics 4.1.3. Others 4.2. Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 4.2.1. Sapphire 4.2.2. Spinel 4.2.3. Yttrium Aluminium Garnet 4.2.4. Aluminium Oxynitride 4.2.5. Others 4.3. Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 4.3.1. Optics & Optoelectronics 4.3.2. Mechanical/Chemical 4.3.3. Aerospace, Defence & Security 4.3.4. Healthcare 4.3.5. Sensors & Instrumentation 4.3.6. Energy 4.3.7. Others 4.4. Transparent Ceramics Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 5.1. North America Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 5.1.1. Monocrystalline Transparent Ceramics 5.1.2. Polycrystalline Transparent Ceramics 5.1.3. Others 5.2. North America Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 5.2.1. Sapphire 5.2.2. Spinel 5.2.3. Yttrium Aluminium Garnet 5.2.4. Aluminium Oxynitride 5.2.5. Others 5.3. North America Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 5.3.1. Optics & Optoelectronics 5.3.2. Mechanical/Chemical 5.3.3. Aerospace, Defence & Security 5.3.4. Healthcare 5.3.5. Sensors & Instrumentation 5.3.6. Energy 5.3.7. Others 5.4. North America Transparent Ceramics Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Monocrystalline Transparent Ceramics 5.4.1.1.2. Polycrystalline Transparent Ceramics 5.4.1.1.3. Others 5.4.1.2. United States Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 5.4.1.2.1. Sapphire 5.4.1.2.2. Spinel 5.4.1.2.3. Yttrium Aluminium Garnet 5.4.1.2.4. Aluminium Oxynitride 5.4.1.2.5. Others 5.4.1.3. United States Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 5.4.1.3.1. Optics & Optoelectronics 5.4.1.3.2. Mechanical/Chemical 5.4.1.3.3. Aerospace, Defence & Security 5.4.1.3.4. Healthcare 5.4.1.3.5. Sensors & Instrumentation 5.4.1.3.6. Energy 5.4.1.3.7. Others 5.4.2. Canada 5.4.2.1. Canada Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Monocrystalline Transparent Ceramics 5.4.2.1.2. Polycrystalline Transparent Ceramics 5.4.2.1.3. Others 5.4.2.2. Canada Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 5.4.2.2.1. Sapphire 5.4.2.2.2. Spinel 5.4.2.2.3. Yttrium Aluminium Garnet 5.4.2.2.4. Aluminium Oxynitride 5.4.2.2.5. Others 5.4.2.3. Canada Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 5.4.2.3.1. Optics & Optoelectronics 5.4.2.3.2. Mechanical/Chemical 5.4.2.3.3. Aerospace, Defence & Security 5.4.2.3.4. Healthcare 5.4.2.3.5. Sensors & Instrumentation 5.4.2.3.6. Energy 5.4.2.3.7. Others 5.4.3. Mexico 5.4.3.1. Mexico Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 5.4.3.1.1. Monocrystalline Transparent Ceramics 5.4.3.1.2. Polycrystalline Transparent Ceramics 5.4.3.1.3. Others 5.4.3.2. Mexico Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 5.4.3.2.1. Sapphire 5.4.3.2.2. Spinel 5.4.3.2.3. Yttrium Aluminium Garnet 5.4.3.2.4. Aluminium Oxynitride 5.4.3.2.5. Others 5.4.3.3. Mexico Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 5.4.3.3.1. Optics & Optoelectronics 5.4.3.3.2. Mechanical/Chemical 5.4.3.3.3. Aerospace, Defence & Security 5.4.3.3.4. Healthcare 5.4.3.3.5. Sensors & Instrumentation 5.4.3.3.6. Energy 5.4.3.3.7. Others 6. Europe Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 6.1. Europe Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.2. Europe Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.3. Europe Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4. Europe Transparent Ceramics Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.1.3. United Kingdom Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4.2. France 6.4.2.1. France Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.2.3. France Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.3.3. Germany Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.4.3. Italy Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.5.3. Spain Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.6.3. Sweden Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Russia Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.7.3. Russia Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 6.4.8.3. Rest of Europe Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7. Asia Pacific Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 7.1. Asia Pacific Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.3. Asia Pacific Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4. Asia Pacific Transparent Ceramics Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.1.3. China Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.2.3. S Korea Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.3.3. Japan Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.4. India 7.4.4.1. India Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.4.3. India Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.5.3. Australia Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.6.3. Indonesia Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Malaysia Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.7.3. Malaysia Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Philippines Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.8.3. Philippines Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Thailand Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.9.3. Thailand Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Vietnam Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.10.3. Vietnam Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 7.4.11.3. Rest of Asia Pacific Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 8. Middle East and Africa Transparent Ceramics Market Size and Forecast (by Value in USD Mn) (2024-2032) 8.1. Middle East and Africa Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 8.3. Middle East and Africa Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 8.4. Middle East and Africa Transparent Ceramics Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 8.4.1.3. South Africa Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 8.4.2.3. GCC Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Egypt Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 8.4.3.3. Egypt Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Nigeria Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 8.4.4.3. Nigeria Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 8.4.5.2. Rest of ME&A Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 8.4.5.3. Rest of ME&A Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 9. South America Transparent Ceramics Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 9.1. South America Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 9.2. South America Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 9.3. South America Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 9.4. South America Transparent Ceramics Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 9.4.1.3. Brazil Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 9.4.2.3. Argentina Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Colombia Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 9.4.3.3. Colombia Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 9.4.4.2. Chile Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 9.4.4.3. Chile Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Transparent Ceramics Market Size and Forecast, By Type (2024-2032) 9.4.5.2. Rest Of South America Transparent Ceramics Market Size and Forecast, By Material (2024-2032) 9.4.5.3. Rest Of South America Transparent Ceramics Market Size and Forecast, By End-User Industry (2024-2032) 10. Company Profile: Key Players 10.1. Surmet Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. II-VI Incorporated 10.3. CeraNova 10.4. CoorsTek 10.5. Advanced Ceramic Manufacturing 10.6. Optics Balzers 10.7. Meller Optics 10.8. INO 10.9. Rubis Precis Inc. 10.10. CeramTec 10.11. Morgan Advanced Materials 10.12. Schott AG 10.13. Crystal GmbH 10.14. CILAS 10.15. Saint-Gobain 10.16. Bright Crystals Technology 10.17. Shanghai Uniacryl Technology 10.18. Konoshima Chemical Co., Ltd. 10.19. Tosoh Corporation 10.20. Murata Manufacturing Co., Ltd. 10.21. KCC Corporation 10.22. Hindustan Ceramics 11. Key Findings 12. Industry Recommendations 13. Transparent Ceramics Market: Research Methodology