Global Therapeutic Respiratory Devices Market size was valued at USD 18.5 Bn in 2022 and the total Therapeutic Respiratory Devices revenue is expected to grow by 6.10 % from 2023 to 2029, reaching nearly USD 28.0 Bn.Therapeutic Respiratory Devices Market Overview:

The therapeutic respiratory devices market plays a crucial role in improving pulmonary function and providing assistance in the treatment of various chronic respiratory conditions. These devices are designed to enhance lung oxygen intake, clear the airway, and assist in the removal of mucus from the bronchi during respiratory therapies. Chronic ailments such as chronic obstructive pulmonary disease (COPD), bronchitis, sleep disorders, asthma, and other respiratory diseases can significantly benefit from therapeutic respiratory devices. These devices aid in managing symptoms, improving respiratory function, and enhancing overall quality of life for patients with respiratory malfunction. The market therapeutic respiratory devices offer a wide range of therapeutic respiratory devices with slight variations in their application purposes. Long-term respiratory devices are mainly used in intensive care settings, providing extended support and monitoring for patients. Mobile home respiratory devices are specifically designed for homecare settings, allowing patients to receive treatment in the comfort of their own homes. Portable respiratory devices, on the other hand, are designed for emergency situations, providing immediate point-of-care assistance. The therapeutic respiratory devices market is experiencing significant growth driven by technological advancements, user-friendly designs, and the increasing prevalence of respiratory diseases worldwide. These factors contribute to the rising demand for respiratory devices and are expected to drive market growth in the forecast period. Additionally, substantial investments in research and development activities by key industry players and government organizations are fueling innovation and driving the growth of the respiratory devices market. However, despite the positive outlook, the lack of awareness about innovative respiratory devices in emerging nations poses a challenge to market growth. Limited knowledge and understanding of the benefits and availability of advanced respiratory devices may hinder their adoption and restrict market expansion in these regions. Overall, with the continuous advancements in technology, the ease of use of respiratory devices, and the growing burden of respiratory diseases globally, the therapeutic respiratory devices market is poised for significant growth. Increased research and development efforts, coupled with effective awareness campaigns, can help overcome the barriers and unlock the full potential of the respiratory devices market in the forecast period.To know about the Research Methodology :- Request Free Sample Report

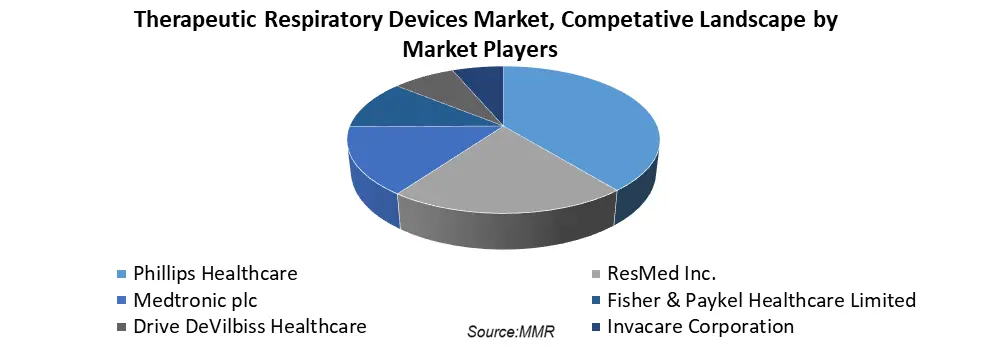

Therapeutic Respiratory Devices Market Competitive Landscape:

The therapeutic respiratory devices market is highly competitive, with major key players adopting various strategies to strengthen their market position and gain a competitive edge. These strategies include mergers and acquisitions, as well as new product launches aimed at expanding their market share and catering to the evolving needs of patients and healthcare providers. In June 2022, CAIRE, a prominent player in the therapeutic respiratory devices market, launched a portable oxygen concentrator called Lifestyle in the U.S. This product was designed to significantly enhance the quality of life for oxygen users across the country. The launch of innovative and user-friendly products like Lifestyle demonstrates CAIRE's commitment to meeting the needs of patients and improving their respiratory care experience. Similarly, in July 2022, Omron Healthcare, another Therapeutic Respiratory Devices Market key player in the industry, announced the launch of a portable oxygen concentrator, showcasing their latest advancement in the oxygen therapy category. This medical molecular sieve-based concentrator provides a continuous supply of high-purity oxygen, addressing the needs of patients requiring oxygen therapy in various healthcare settings. Such new product launches by major players reflect the industry's focus on innovation and meeting the growing demand for advanced therapeutic respiratory devices. These advancements aim to improve patient outcomes, enhance convenience, and optimize the delivery of respiratory care. The mergers and acquisitions also play a significant role in shaping the competitive landscape of the therapeutic respiratory devices market. Companies strategically acquire or merge with other organizations to expand their product portfolios, access new markets, and leverage synergies. These strategic moves strengthen their market position and enable them to offer comprehensive solutions to healthcare providers and patients. These activities drive industry rivalry and propel the market forward, enabling companies to meet the evolving needs of patients and healthcare professionals in the field of respiratory care.

Therapeutic Respiratory Devices Market Dynamics:

Therapeutic Respiratory Devices Market Drivers Growing Prevalence of Chronic Ailments to Drive Therapeutic Respiratory Devices Market Growth The therapeutic respiratory devices industry is poised for significant growth due to the increasing prevalence of chronic disorders that disrupt normal respiratory functioning. This rise in the patient pool suffering from respiratory ailments will be a key driver for the development and expansion of the therapeutic respiratory devices industry. breathing disorders affect approximately 100 million individuals, asthma affects over 235 million people, and around 200 million individuals are diagnosed with chronic obstructive pulmonary disease (COPD). These statistics underscore the magnitude of the issue and emphasize the need for effective therapeutic interventions. Multiple factors contribute to the rising prevalence of respiratory disorders. High levels of air pollution, exposure to toxic chemicals and gases, and a significant prevalence of tobacco smoking all contribute to airway obstruction and respiratory infections. These factors are observed in both developed and developing regions, further driving the demand for therapeutic respiratory devices. To address the growing burden of respiratory ailments, the therapeutic respiratory devices market offers a range of innovative solutions. These devices are designed to alleviate symptoms, improve lung function, and enhance the overall quality of life for patients. By delivering targeted therapy and support, these devices play a crucial role in managing chronic respiratory conditions. The expanding patient pool creates opportunities for the therapeutic respiratory devices market to develop and provide innovative solutions that improve respiratory function and enhance patient well-being. The industry's focus on delivering effective therapeutic interventions positions it for significant growth in the near future. The market for therapeutic respiratory devices is expected to witness substantial growth in the coming years as healthcare providers and patients recognize the importance of effective respiratory care. Manufacturers in the industry are continually innovating to develop advanced devices that cater to the specific needs of patients. This includes the development of portable devices, homecare solutions, and technologically advanced respiratory devices to ensure effective and convenient treatment options. Technological Developments Drive Therapeutic Respiratory Devices Market Growth The therapeutic respiratory devices market is experiencing significant growth, driven by continuous technological advancements in the field. Extensive research and development efforts have led to the creation of highly efficient, portable, lightweight, automated, and user-friendly medical devices, contributing to the increasing adoption of therapeutic respiratory devices. Moreover, ongoing research aims to develop even better and smarter technologies to further enhance patient care in this domain. Technological innovations have revolutionized the therapeutic respiratory devices industry, improving the effectiveness and convenience of treatments. Manufacturers are focused on developing advanced devices that address the specific needs of patients while ensuring ease of use and optimal outcomes. These advancements have resulted in the development of compact and lightweight devices that offer high portability, making them suitable for emergency situations. For Instance, the Z1 CPAP device introduced by Human Design Medical (HDM) Corporation boasts a lightweight and compact design, making it highly portable and suitable for on-the-go use. Its advanced technology ensures efficient respiratory therapy, providing patients with greater comfort and ease of use.The integration of advanced technologies in therapeutic respiratory devices has transformed the way respiratory disorders are managed. These technologies include features such as wireless connectivity, data monitoring and analysis, smart algorithms, and personalized settings, which enhance the overall patient experience and treatment outcomes. The availability of such innovative technologies has significantly improved patient adherence to therapy and facilitated remote monitoring by healthcare professionals. The continuous advancements in therapeutic respiratory devices not only improve patient care but also contribute to the growth of the industry. Manufacturers and researchers are focused on developing cutting-edge solutions that address the evolving needs of patients with respiratory disorders. This includes the exploration of emerging technologies such as artificial intelligence, telemedicine, wearable devices, and sensor technology, which have the potential to revolutionize respiratory care. In conclusion, technological developments play a pivotal role in driving the growth of the therapeutic respiratory devices market. The industry is witnessing remarkable advancements in terms of device efficiency, portability, automation, and user-friendliness. These advancements, coupled with ongoing research for smarter technologies, contribute to the increasing acceptance and adoption of therapeutic respiratory devices. As the field continues to evolve, further technological breakthroughs are anticipated, which will shape the future of respiratory care and drive market growth in the forecast period.Therapeutic Respiratory Devices Market Segment Analysis:

Based on Product The therapeutic respiratory devices market can be categorized into various product segments, including positive airway pressure (PAP) devices, oxygen concentrators, ventilators, inhalers, nebulizers, and humidifiers. The nebulizers segment dominated the market in 2022 and is expected to exhibit significant growth in the market, with a projected compound annual growth rate (CAGR) of over 9% during the forecast period from 2022 to 2030. This growth can be attributed to several factors, such as the increasing prevalence of chronic obstructive pulmonary disease (COPD) among the elderly population and the emergence of advanced nebulizers that offer multifunctionality and are suitable for regular use. Nebulizers have gained popularity due to their effectiveness in providing relief from breathlessness caused by conditions like asthma and chronic bronchitis. These devices offer high success rates when used with masks, making them an ideal choice for patients of all ages. The convenience and ease of use associated with nebulizers have contributed to their growing preference among healthcare providers and patients alike. The increasing adoption of therapeutic respiratory devices to manage respiratory diseases, particularly COPD, is expected to drive the segment growth. COPD has become a global health concern, leading to a surge in demand for respiratory devices that help alleviate symptoms and improve the quality of life for patients. This trend is anticipated to further propel the market growth of therapeutic respiratory devices. Based on the Application The therapeutic respiratory devices market can be segmented based on application, including COPD (chronic obstructive pulmonary disease), obstructive sleep apnea, asthma, respiratory distress syndrome, and cystic fibrosis. The COPD segment accounted for highest market share in 2022 and is expected to exhibit significant growth in the market, with a projected compound annual growth rate (CAGR) of over 4.5% during the forecast period from 2022 to 2030. This growth can be attributed to the increasing prevalence of COPD cases worldwide, which drives the adoption of respiratory devices such as soft mist inhalers (SMI), dry powder inhalers (DPI), nebulizers, and pressurized metered dose inhalers (pMDI). These devices are designed to deliver medication directly to the lungs, providing relief and improving respiratory function in COPD patients. Obstructive sleep apnea, asthma, respiratory distress syndrome, and cystic fibrosis are also significant application segments in the therapeutic respiratory devices market. Each condition requires specific devices tailored to address the unique respiratory challenges associated with them. With the advancements in technology and increasing awareness about these respiratory conditions, the demand for therapeutic devices in these application segments is expected to grow. The rapid advancements in emergency centers, including hospitals and clinics, are expected to push the expansion of the COPD segment in the therapeutic respiratory devices market. Based on the Application The therapeutic respiratory devices market is segmented based on the technology into Electrostatic Filtration, HEPA (High-Efficiency Particulate Air) Filter Technology, Microsphere Separation, and Hollow Fiber Filtration. Among the technology segments, the HEPA filter segment led the market with over 35.0% revenue share in 2022. HEPA filters are widely used in various therapeutic respiratory devices for particle removal and retention. These filters are designed to meet the air filtration requirements set by the Centers for Disease Control and Prevention (CDC) for therapeutic equipment. The prevalence of respiratory disorders and the need to prevent their spread have increased the demand for therapeutic devices equipped with HEPA filtration technology. HEPA filters are known for their high efficiency in eliminating particles larger than 0.3 microns. According to the Department of Energy (DOE) of the U.S., HEPA filters can remove 99.97% of particles of this size. This high level of filtration efficiency ensures that the air patients breathe through therapeutic respiratory devices is clean and free from harmful particles. Technological developments in the therapeutic respiratory devices market are expected to further benefit the market in the coming years. One such development is the Minimum Efficiency Reporting Value (MERV)-rated HEPA 4 technology, which provides enhanced filtration capabilities. Additionally, washable HEPA filters have been introduced, allowing for easier maintenance and longer usage life. The use of HEPA filters and other advanced filtration technologies is essential in therapeutic respiratory devices to ensure the delivery of clean and purified air to patients. These technologies play a crucial role in preventing the transmission of airborne pathogens and allergens, reducing the risk of respiratory infections and allergies.Based on the Filter The therapeutic respiratory devices market is segmented into Nebulizer Filters, Humidifier Filters, Positive Airway Pressure (PAP) Device Filters, Oxygen Concentrator Filters, and Ventilator Filters. Humidifier Filters segment dominated the market in 2022. The increasing demand for humidifiers for various therapeutic purposes is the key driver for the growth of the humidifier filter market. Humidifier filters are required to prevent the formation of fungus and bacteria in the circulating air, making them essential in households, healthcare institutions, hospitals, and schools. The rise in airborne illnesses, such as tuberculosis (TB), also contributes to the demand for humidifiers and their filters. Increasing awareness of ailments like sinusitis, asthma, and allergies further drives the demand for humidifier equipment, thereby boosting the market for humidifier filters. Ventilator Filters are also expected to have a significant impact on the market, accounting for over 23.5% of revenue share in 2022. Conditions such as chronic obstructive pulmonary disease (COPD) and asthma are major factors driving the use of ventilators, which in turn drives the demand for ventilator filters. The increasing prevalence of these respiratory diseases contributes to the growth of the ventilator filter market. Moreover, the growing demand for in-home healthcare and the use of homecare ventilators further boost the market for ventilator filters. Nebulizer Filters, Positive Airway Pressure (PAP) Device Filters, and Oxygen Concentrator Filters also play important roles in therapeutic respiratory devices. Nebulizer filters are crucial for preventing the entry of contaminants into the medication delivery system. PAP device filters help in filtering and purifying the air delivered to patients with conditions such as sleep apnea. Oxygen concentrator filters ensure the delivery of clean and concentrated oxygen to patients.

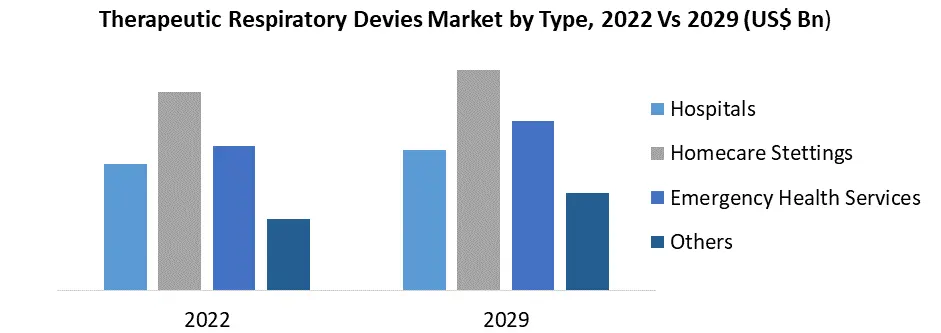

Based on End User The therapeutic respiratory devices market is segmented into hospitals, emergency centers, and homecare settings. The emergency centers segment dominates the market in 2022. This growth can be attributed to several factors. Firstly, emergency centers are known for their patient-centric treatment methodologies, where immediate and specialized care is provided to patients experiencing respiratory problems. These centers are equipped with advanced diagnostic modules, allowing for accurate and rapid assessment of respiratory conditions. This enables healthcare professionals to provide timely interventions and improve patient outcomes. The ease of access to emergency centers is driving patients towards these facilities for the diagnosis of respiratory problems. Emergency centers are strategically located and are accessible to patients in case of emergencies or urgent medical needs. The availability of professional medical practitioners who specialize in respiratory care further enhances the appeal of emergency centers for patients seeking respiratory diagnosis and treatment. Reimbursements for emergency services also contribute to the growth of the therapeutic respiratory devices market in emergency centers. Many healthcare systems and insurance providers offer coverage for emergency services, incentivizing patients to seek immediate medical attention in emergency centers for respiratory issues. This financial support plays a significant role in attracting patients to emergency centers, thereby driving the demand for therapeutic respiratory devices in this segment. Homecare settings represent a growing segment in the therapeutic respiratory devices market. With advancements in technology and the increasing preference for home-based healthcare, many respiratory devices are now designed for use in homecare settings. These devices enable patients to receive respiratory treatments and therapies in the comfort of their own homes, under the supervision of healthcare professionals or with proper training. Homecare settings offer convenience, cost-effectiveness, and the ability to monitor patients' conditions in a familiar environment, which drives the adoption of therapeutic respiratory devices in this segment.

Therapeutic Respiratory Devices Market Regional Insights:

The Therapeutic Respiratory Devices Market is geographically analyzed across several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America dominated the market with a share of over 30.0%. This can be attributed to several factors such as favorable reimbursement policies for outpatient treatments, the overall economic growth supported by increasing insurance coverage, the presence of renowned healthcare centers in the United States, improved healthcare awareness, and enhanced healthcare systems. These factors have contributed to the high adoption of therapeutic respiratory devices in the region. In the Asia Pacific region, the therapeutic respiratory devices market is expected to witness significant growth. The rising prevalence of respiratory illnesses like asthma in both adults and children, along with technological advancements in the healthcare sector, is driving the demand for therapeutic respiratory devices in the region. There is a growing need for medical oxygen concentrators in home healthcare settings, ambulatory surgical centers, and hospitals in the Asia Pacific region. This demand has been further amplified since the outbreak of the COVID-19 pandemic. Therapeutic respiratory devices market manufacturers in the region are also contributing to the growth of the market. Important regional players have been introducing new and innovative products, leading to increased demand for respiratory devices. For instance, in May 2022, Max Ventilator launched multifunctional non-invasive ventilators in India that also provide oxygen therapy. Such product releases and advancements by key regional players are expected to drive the market growth in the region. The focus on the development of novel respiratory devices is anticipated to boost the therapeutic respiratory devices market throughout the projected period. Manufacturers and healthcare organizations are investing in research and development activities to introduce advanced devices that cater to the evolving needs of patients. These efforts aim to improve the effectiveness, efficiency, and accessibility of therapeutic respiratory devices, leading to their increased adoption and market growth.Therapeutic Respiratory Devices Market Scope: Inquire before buying

Therapeutic Respiratory Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 18.5 Bn. Forecast Period 2023 to 2029 CAGR: 6.1% Market Size in 2029: US $ 28 Bn. Segments Covered: by Product • Positive Airway Pressure (PAP) Devices • Ventilators • Inhalers • Humidifiers • Oxygen Concentrators • Others by Technology • Electrostatic filtration • HEPA filter technology • Hollow fiber filtration • Microsphere Separation by Application • Chronic Obstructive Pulmonary Disease (COPD) • Asthma • Bronchitis • Sleep Apnea • Other Diseases by Filter • Nebulizer Filters • Humidifier Filters • Positive Airway Pressure (PAP) Device Filters • Oxygen Concentrator Filters • Ventilator Filters by End User • Hospitals • Homecare Settings • Emergency Health Services • Others Therapeutic Respiratory Devices Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Therapeutic Respiratory Devices Market Key Players

• Philips Healthcare - Netherlands • ResMed Inc. - United States • Medtronic plc - Ireland • Fisher & Paykel Healthcare Limited - New Zealand • Drive DeVilbiss Healthcare - United States • Invacare Corporation - United States • GE Healthcare - United States • Hamilton Medical AG - Switzerland • Smiths Medical - United Kingdom • Vyaire Medical - United States • Drägerwerk AG & Co. KGaA - Germany • Getinge AB - Sweden • Chart Industries, Inc. - United States • Masimo Corporation - United States • Inogen, Inc. - United States • Air Liquide Medical Systems - France • Teleflex Incorporated - United States • Hill-Rom Holdings, Inc. - United States • Ventec Life Systems - United States • Allied Healthcare Products, Inc. - United States • Precision Medical, Inc. - United States • Nihon Kohden Corporation - Japan • Becton, Dickinson and Company - United States • ZOLL Medical Corporation - United States • DeVilbiss Healthcare LLC - United State, Frequently Asked Questions: 1] What segments are covered in the Global Therapeutic Respiratory Devices Market report? Ans. The segments covered in the Therapeutic Respiratory Devices Market report are based on Type, Application, Technology, Filter, End Users and Region. 2] Which region is expected to hold the highest share in the Global Therapeutic Respiratory Devices Market? Ans. The North America region is expected to hold the highest share of the Therapeutic Respiratory Devices Market. 3] What is the market size of the Therapeutic Respiratory Devices Market by 2029? Ans. The market size of the Therapeutic Respiratory Devices Market by 2029 is expected to reach US$ 18.5 Bn. 4] What is the forecast period for the Global Therapeutic Respiratory Devices Market? Ans. The forecast period for the Therapeutic Respiratory Devices Market is 2023-2029. 5] What was the market size of the Therapeutic Respiratory Devices Market in 2022? Ans. The market size of the Therapeutic Respiratory Devices Market in 2022 was valued at USD 18.5 Bn.

1. Therapeutic Respiratory Devices Market: Research Methodology 2. Therapeutic Respiratory Devices Market: Executive Summary 3. Therapeutic Respiratory Devices Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Therapeutic Respiratory Devices Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Therapeutic Respiratory Devices Market: Segmentation (by Value USD and Volume Units) 5.1. Therapeutic Respiratory Devices Market, by Product (2022-2029) 5.1.1. Positive Airway Pressure (PAP) Devices 5.1.2. Ventilators 5.1.3. Inhalers 5.1.4. Humidifiers 5.1.5. Oxygen Concentrators 5.1.6. Others 5.2. Therapeutic Respiratory Devices Market, by Application (2022-2029) 5.2.1. Chronic Obstructive Pulmonary Disease (COPD) 5.2.2. Asthma 5.2.3. Bronchitis 5.2.4. Sleep Apnea 5.2.5. Other Diseases 5.3. Therapeutic Respiratory Devices Market, by Technology (2022-2029) 5.3.1. Electrostatic filtration 5.3.2. HEPA filter technology 5.3.3. Hollow fiber filtration 5.3.4. Microsphere Separation 5.4. Therapeutic Respiratory Devices Market, by Filter (2022-2029) 5.4.1. Nebulizer Filters 5.4.2. Humidifier Filters 5.4.3. Positive Airway Pressure (PAP) Device Filters 5.4.4. Oxygen Concentrator Filters 5.4.5. Ventilator Filters 5.5. Therapeutic Respiratory Devices Market, by Services (2022-2029) 5.5.1. Hospitals 5.5.2. Homecare Settings 5.5.3. Emergency Health Services 5.5.4. Others 5.6. Therapeutic Respiratory Devices Market, by Region (2022-2029) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Therapeutic Respiratory Devices Market (by Value USD and Volume Units) 6.1. North America Therapeutic Respiratory Devices Market, by Product (2022-2029) 6.1.1. Positive Airway Pressure (PAP) Devices 6.1.2. Ventilators 6.1.3. Inhalers 6.1.4. Humidifiers 6.1.5. Oxygen Concentrators 6.1.6. Others 6.2. North America Therapeutic Respiratory Devices Market, by Application (2022-2029) 6.2.1. Chronic Obstructive Pulmonary Disease (COPD) 6.2.2. Asthma 6.2.3. Bronchitis 6.2.4. Sleep Apnea 6.2.5. Other Diseases 6.3. North America Therapeutic Respiratory Devices Market, by Technology (2022-2029) 6.3.1. Electrostatic filtration 6.3.2. HEPA filter technology 6.3.3. Hollow fiber filtration 6.3.4. Microsphere Separation 6.4. North America Therapeutic Respiratory Devices Market, by Filter (2022-2029) 6.4.1. Nebulizer Filters 6.4.2. Humidifier Filters 6.4.3. Positive Airway Pressure (PAP) Device Filters 6.4.4. Oxygen Concentrator Filters 6.4.5. Ventilator Filters 6.5. North America Therapeutic Respiratory Devices Market, by Services (2022-2029) 6.5.1. Hospitals 6.5.2. Homecare Settings 6.5.3. Emergency Health Services 6.5.4. Others 6.6. North America Therapeutic Respiratory Devices Market, by Country (2022-2029) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Therapeutic Respiratory Devices Market (by Value USD and Volume Units) 7.1. Europe Therapeutic Respiratory Devices Market, by Product (2022-2029) 7.2. Europe Therapeutic Respiratory Devices Market, by Application (2022-2029) 7.3. Europe Therapeutic Respiratory Devices Market, by Technology (2022-2029) 7.4. Europe Therapeutic Respiratory Devices Market, by Filter (2022-2029) 7.5. Europe Therapeutic Respiratory Devices Market, by End User (2022-2029) 7.6. Europe Therapeutic Respiratory Devices Market, by Country (2022-2029) 7.6.1. UK 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Sweden 7.6.7. Austria 7.6.8. Rest of Europe 8. Asia Pacific Therapeutic Respiratory Devices Market (by Value USD and Volume Units) 8.1. Asia Pacific Therapeutic Respiratory Devices Market, by Product (2022-2029) 8.2. Asia Pacific Therapeutic Respiratory Devices Market, by Application (2022-2029) 8.3. Asia Pacific Therapeutic Respiratory Devices Market, by Technology (2022-2029) 8.4. Asia Pacific Therapeutic Respiratory Devices Market, by Filter (2022-2029) 8.5. Asia Pacific Therapeutic Respiratory Devices Market, by End User (2022-2029) 8.6. Asia Pacific Therapeutic Respiratory Devices Market, by Country (2022-2029) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Therapeutic Respiratory Devices Market (by Value USD and Volume Units) 9.1. Middle East and Africa Therapeutic Respiratory Devices Market, by Product (2022-2029) 9.2. Middle East and Africa Therapeutic Respiratory Devices Market, by Application (2022-2029) 9.3. Middle East and Africa Therapeutic Respiratory Devices Market, by Technology (2022-2029) 9.4. Middle East and Africa Therapeutic Respiratory Devices Market, by Filter (2022-2029) 9.5. Middle East and Africa Therapeutic Respiratory Devices Market, by End User (2022-2029) 9.6. Middle East and Africa Therapeutic Respiratory Devices Market, by Country (2022-2029) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Egypt 9.6.4. Nigeria 9.6.5. Rest of ME&A 10. South America Therapeutic Respiratory Devices Market (by Value USD and Volume Units) 10.1. South America Therapeutic Respiratory Devices Market, by Product (2022-2029) 10.2. South America Therapeutic Respiratory Devices Market, by Application (2022-2029) 10.3. South America Therapeutic Respiratory Devices Market, by Technology (2022-2029) 10.4. South America Therapeutic Respiratory Devices Market, by Filter (2022-2029) 10.5. South America Therapeutic Respiratory Devices Market, by End User (2022-2029) 10.6. South America Therapeutic Respiratory Devices Market, by Country (2022-2029) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Rest of South America 11. Company Profile: Key players 11.1. Phillips Healthcare 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. ResMed Inc. 11.3. Medtronic plc 11.4. Fisher & Paykel Healthcare Limited 11.5. Drive DeVilbiss Healthcare 11.6. Invacare Corporation 11.7. GE Healthcare 11.8. Hamilton Medical AG 11.9. Smiths Medical 11.10. Vyaire Medical 11.11. Drägerwerk AG & Co. KGaA 11.12. Getinge AB 11.13. Chart Industries, Inc. 11.14. Masimo Corporation 11.15. Inogen, Inc. 11.16. Air Liquide Medical Systems 11.17. Teleflex Incorporated 11.18. Hill-Rom Holdings, Inc. 11.19. Ventec Life Systems 11.20. Allied Healthcare Products, Inc. 11.21. Precision Medical, Inc. 11.22. Nihon Kohden Corporation 11.23. Becton, Dickinson and Company 11.24. ZOLL Medical Corporation 11.25. DeVilbiss Healthcare LLC 12. Key Findings 13. Industry Recommendation