Telemetry Market size was valued at USD 148.11 Bn. in 2024 and the total Global Telemetry Market revenue is expected to grow at a CAGR of 10.1 % from 2025 to 2032, reaching nearly USD 319.80 Bn. by 2032.Telemetry Market Overview

Telemetry is an automated process of collecting and transmitting data from remote sources for monitoring and analysis. Global telemetry market growth has been driven by increasing demand for real-time data monitoring and remote communication in sector like healthcare, aerospace, automotive, energy, and defense. Growing continuous patient monitoring, remote diagnostics, and data-driven medical care boost the use of telemetry in medical applications. Similarly, the growing importance on predictive maintenance and operational efficiency is increasing its use in industrial and automotive sectors. Implementation of strict data agreement, cybersecurity standards, and regulatory advice are boosting the need for secure and reliable telemetry systems. Moreover, the market is fuelled by a shifting trend toward digital transformation, IoT integration, and development of advanced wireless technologies to improve data accuracy and communication potential. Stability in component sourcing and advancements in microelectronics are increasing the demand for high-precision modules and energy-efficient telemetry devices. North America dominated the telemetry market in 2024 due to technological maturity, strong presence of key aerospace and healthcare players, and high investment in smart infrastructure and defense modernization. Top key players of the telemetry market are Honeywell International Inc., GE Healthcare, Philips Healthcare, Siemens AG, and Schneider Electric. These companies are focus on product innovation, including cloud-based telemetry platforms, AI-enhanced analytics to meet global monitoring and communication standards. They are also investing in cybersecurity resilience, digital twin technologies, and sustainable, low-power communication protocols to match global safety and compliance targets and future regulatory requirements. Report covers the telemetry market dynamics, structure by analyzing the market segments and projecting telemetry market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies and regional presence in telemetry market.To know about the Research Methodology :- Request Free Sample Report To know about the Research Methodology The report includes an analysis of the drivers, restraints, and challenges that influence the telemetry market, and growth opportunities, through the forecast period. It also discusses the industry, market, technological trends that currently prevail in the market, and technological advancements expected to impact the telemetry demand, globally. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. Also, identifies and analyses important business strategies used by the main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

Global Telemetry Market Dynamics:

Remote Patient Monitoring and Predictive Maintenance to Drive the Telemetry Market The increased need for remote digital patient monitoring systems in the healthcare sector is driving the Telemetry Market. Wireless sensors and wireless communication are used to acquire and transmit data to the hospital while remote monitoring of patients. Sensors such as wearable and implantable (contact-based sensors) and non-contact ones are used through data acquisition. The acquired data is processed and transformed to a suitable form using an internal or external controller before being transmitted wirelessly to the hospital. Also, focusing on predictive Maintenance helps to drive the Telemetry Market. Industry 4.0 and smart manufacturing guidelines promote the use of data generated through manufacturing to improve factory performance, increase production agility, and reduce costs. Predictive maintenance in a semiconductor facility contributes to the areas such as fab, assembly, or test. Predictive maintenance is used to predict events and to minimize their negative impact on the target equipment’s performance and availability at an early stage, allowing corrective action to be taken before an event happens.Cyber Threats to Restrain the Telemetry Market Growth With the rise of cloud computing and IoT devices, the number and types of attacks also increase. Attackers often have a programmable infrastructure (e.g., botnets) to dynamically change the types and characteristics of the attacks to make the attacks harder to detect. To keep up with the attack dynamics, it is important to enable flexible measurement support that quickly captures attacks as they happen, rather than waiting for vendors to add a new attack detection feature at switches. Additionally, the limited resources and also limited time for collecting information is one of the challenges of the Telemetry Industry. For example, for a 40 Gbps port at a switch, we have 12 ns to process each packet. In such a short time, switches have to complete many packet forwarding functions such as packet header parsing and table lookups, in addition to network telemetry. Similarly, a 10 Gbps port at a host, has 70 ns to process a packet using the host CPU.

Global Telemetry Market Segment Analysis:

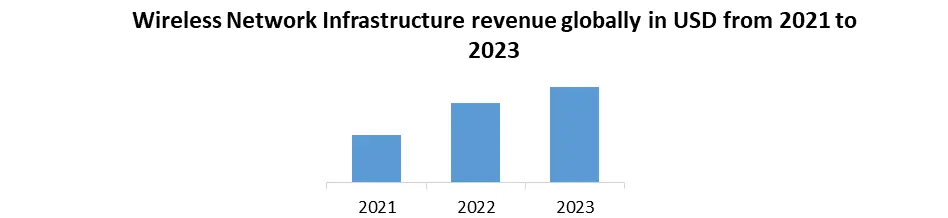

By Technology, wireless technology segment held largest share of 50 % in 2024. Wireless communication technology is a modern alternative to traditional wired networking. Stellar Telemetry represents the rearmost technology advancements in implantable physiologic monitoring. The system allows the monitoring of numerous creatures with just one receiver and facilitates group casing and social commerce. Stellar implants are used in beast models ranging from mice to tykes and larger creatures including phenotyping, pharmacology, metabolic, and general physiology assessment. future-facing wireless network environments, the radio space is seeing several developments. In the U.S., 6 GHz is all the buzz as it's been added to the 802.11ax standard, also known as Wi-Fi 6E. Office equipment manufacturers are turning to telemetry to track fax, copier, and printer usage. Instead of relying on the outdated, inaccurate manual reporting process wherein company employees’ phone in a meter count, the copy count is sent in wirelessly using N-PCS telemetry. In another innovative implementation of the technology, an automotive anti-theft and tracking device company takes advantage of telemetry to monitor vehicle location remotely instead of more expensive means of data transmission. Narrowband PCS uses Motorola's ReFLEX 25 two-way advanced messaging protocol to transmit the data in two-way telemetry applications. N-PCS is ideal for telemetry applications because its low bandwidth needs make its cost competitive with other technologies. As businesses become telemetry savvy, it is expected they begin to take advantage of telemetry that uses the technology more extensively.

Global Telemetry Market Regional Insight:

North America dominated the region in 2024 with a market share of x. The United States boasts a staggering 227 million wireless subscribers. The immense figure not only underscores the sheer magnitude of wireless connectivity in America but also sheds light on the undeniable integration of wireless technologies into the fabric of modern society. The United States serves as a springboard for several of the advanced mobile applications reviewed because of the advanced wireless 4G infrastructure, currently being deployed in the country. Already, 75% of the world’s 4G subscribers (combining LTE and mobile WiMAX) are in the U.S., making it a hotbed for developing and testing powerful new applications. While several applications are delivered over feature phones or smaller wireless devices, many of the advanced applications and integrated services are tailored to harness the power of smartphones or tablet computers. The advanced infrastructure unlocks an entirely new world of wireless possibilities from applications that enable students to trace planets across the sky on a tablet, to inventions that turn a smartphone into a mobile medical device that enables delivery of critical health care services to rural communities. The better the infrastructure to deliver the services becomes, the greater the impact on society. Europe was the fastest-growing region in the Telemetry Market. The adoption of Industry 4.0, which involves the use of advanced technologies such as IoT, AI, and robotics in manufacturing is driving the demand for the 5G market in Europe. There are several reasons why 5G is strategic for Europe and why it is urgent to address the issues limiting the financing and development of companies active in 5G communications and developing 5G applications. 5G is central to a large-scale technological, industrial, and innovation transition globally, which represents a significant opportunity for Europe. 5G technologies are a driver of European strategic digital autonomy. European businesses developing 5G technologies, equipment, and applications compete in a global market. 5G makes European supply chains and industrial ecosystems more efficient and resilient. It is deployed not only by traditional operators but also by industrial players, to cover specific industrial sites. Telemetry Market Competitive Landscape Top key players in telemetry market are Honeywell International Inc., GE Healthcare, Philips Healthcare, Siemens AG, and Schneider Electric. These players are focused on continuous innovation in wireless communication, sensor integration, and real-time data transmission technologies. Moreover, they concentrate on developing secure, power-efficient, and high-precision telemetry solutions, which are essential for industries such as healthcare, aerospace, automotive and defense. Honeywell International Inc. is known for its high-consistency telemetry systems used in aerospace and industrial automation, offering strong solutions for strict environments and mission-critical operations. The company continues to lead improvements in telemetry by compact hardware design, real-time analytics, and seamless system integration across platforms. GE Healthcare are known for its telemetry capabilities in patient monitoring, delivering scalable and flexible solutions that support continuous, remote observation in critical care environments. The company play an important role in clinical workflows and enhancing patient safety with its reliable telemetry infrastructure. Telemetry Market Trends • IoT & 5G–Driven Expansion Massive IoT growth continues to fuel demand: telemetry systems are essential for gathering data across smart cities, agriculture, industrial automation, and wearable health devices. • Edge Computing & AI Integration Telemetry devices are now including on-device processing, reducing latency and bandwidth needs through local analysis at the edge. • LPWAN & Remote Monitoring LPWANs (LoRaWAN, Sigfox) provide low-power, long-range telemetry ideal for environmental sensors, agriculture, logistics, and industrial sites. Telemetry Market Recent Development • On March 31, 2025, During Hannover Messe 2025, Siemens showcased its next generation industrial AI and automation solutions, including telemetry driven Industrial Foundation Model (IFM) and virtual PLC deployments. • On January 13, 2025, Philips Healthcare issued a Class I recall for its Mobile Cardiac Telemetry (MCT) Service and Event Diagnostic Service due to a software configuration issue affecting wearable remote-monitoring devices. • May 8, 2024, Siemens unveiled the Simatic Workstation at the Nuremberg Automation Fair. This industrial edge device centralizes OT control, enabling scalable high-throughput, low-latency telemetry alongside future ready AI in the control loop functionalities. • May 23, 2024, Honeywell launched its Forge analytics suite on Microsoft AppSource, introducing telemetry-enabled solutions like Honeywell Forge Flight Efficiency and Forge Performance+, which leverage cloud telemetry and machine learning for predictive maintenance and energy efficiency.Telemetry Market Scope: Inquire before buying

Telemetry Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 148.11 Bn. Forecast Period 2025 to 2032 CAGR: 10.1% Market Size in 2032: USD 319.80 Bn. Segments Covered: by Component Hardware Software by Technology Wire-link Technology Wireless Technology Digital Telemetry Data Loggers & Acoustics by Technology Healthcare Aerospace & Défense Industry & Automation Logistics & Transportation Others Telemetry Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Telemetry Market Key Players

North America 1. Honeywell International Inc. (United States) 2. General Electric Company (United States) 3. GE Healthcare (United States) 4. Emerson Electric Co. (United States) 5. Rockwell Automation, Inc. (United States) 6. Teledyne Technologies Incorporated (United States) 7. L3Harris Technologies, Inc. (United States) 8. Baker Hughes Company (United States) 9. Orbcomm Inc. (United States) 10. Iridium Communications Inc. (United States) 11. Trimble Inc. (United States) 12. Rogers Communications Inc. (Canada) Europe 13. Siemens AG (Germany) 14. Schneider Electric SE (France) 15. Philips Healthcare (Netherlands) 16. Kongsberg Gruppen ASA (Norway) 17. Leonardo S.p.A. (Italy) 18. Inmarsat plc (United Kingdom) 19. Telit Communications PLC (United Kingdom) 20. Laird Connectivity (United Kingdom) Asia-Pacific 21. Advantech Co., Ltd. (Taiwan) 22. Mitsubishi Electric Corporation (Japan)FAQs:

1. Which region has the largest share in the Telemetry Market? Ans: The North America region held the highest share in 2024 in the Telemetry Market. 2. What are the key factors driving the growth of the Telemetry Market? Ans: Remote Patient Monitoring and Predictive Maintenance to Drive the Telemetry Market growth. 3. Who are the key competitors in the Telemetry Market? Ans: Honeywell International Inc., GE Healthcare, Philips Healthcare, Siemens AG are the key competitors in the Telemetry Market. 4. What are the opportunities for the Telemetry Market? Ans: Growth in Remote Healthcare & Patient Monitoring creates opportunities in the Telemetry Market. 5. Which technology segment dominates the Telemetry Market? Ans: The wireless technology segment dominated the Telemetry Market.

1. Telemetry Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Telemetry Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Telemetry Market: Dynamics 3.1. Region wise Trends of Telemetry Market 3.1.1. North America Telemetry Market Trends 3.1.2. Europe Telemetry Market Trends 3.1.3. Asia Pacific Telemetry Market Trends 3.1.4. Middle East and Africa Telemetry Market Trends 3.1.5. South America Telemetry Market Trends 3.2. Telemetry Market Dynamics 3.2.1. Telemetry Market Drivers 3.2.1.1. Rising demand for real-time data monitoring 3.2.1.2. Expansion of remote healthcare services 3.2.2. Telemetry Market Restraints 3.2.3. Telemetry Market Opportunities 3.2.3.1. Expansion in IoT and smart infrastructure 3.2.3.2. Growth in remote patient monitoring 3.2.4. Telemetry Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Rising smart manufacturing investment 3.4.2. Rising healthcare expenditure 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Telemetry Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Telemetry Market Size and Forecast, By Component (2024-2032) 4.1.1. Hardware 4.1.2. Software 4.2. Telemetry Market Size and Forecast, By Technology (2024-2032) 4.2.1. Wire-link Technology 4.2.2. Wireless Technology 4.2.3. Digital Telemetry 4.2.4. Data Loggers & Acoustics 4.3. Telemetry Market Size and Forecast, By Application (2024-2032) 4.3.1. Healthcare 4.3.2. Aerospace & Défense 4.3.3. Industry & Automation 4.3.4. Logistics & Transportation 4.3.5. Others 4.4. Telemetry Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Telemetry Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Telemetry Market Size and Forecast, By Component (2024-2032) 5.1.1. Hardware 5.1.2. Software 5.2. North America Telemetry Market Size and Forecast, By Technology (2024-2032) 5.2.1. Wire-link Technology 5.2.2. Wireless Technology 5.2.3. Digital Telemetry 5.2.4. Data Loggers & Acoustics 5.3. North America Telemetry Market Size and Forecast, By Application (2024-2032) 5.3.1. Healthcare 5.3.2. Aerospace & Défense 5.3.3. Industry & Automation 5.3.4. Logistics & Transportation 5.3.5. Others 5.4. North America Telemetry Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Telemetry Market Size and Forecast, By Component (2024-2032) 5.4.1.1.1. Hardware 5.4.1.1.2. Software 5.4.1.2. United States Telemetry Market Size and Forecast, By Technology (2024-2032) 5.4.1.2.1. Wire-link Technology 5.4.1.2.2. Wireless Technology 5.4.1.2.3. Digital Telemetry 5.4.1.2.4. Data Loggers & Acoustics 5.4.1.3. Others United States Telemetry Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Healthcare 5.4.1.3.2. Aerospace & Défense 5.4.1.3.3. Industry & Automation 5.4.1.3.4. Logistics & Transportation 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Telemetry Market Size and Forecast, By Component (2024-2032) 5.4.2.1.1. Hardware 5.4.2.1.2. Software 5.4.2.2. Canada Telemetry Market Size and Forecast, By Technology (2024-2032) 5.4.2.2.1. Wire-link Technology 5.4.2.2.2. Wireless Technology 5.4.2.2.3. Digital Telemetry 5.4.2.2.4. Data Loggers & Acoustics 5.4.2.3. Canada Telemetry Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Healthcare 5.4.2.3.2. Aerospace & Défense 5.4.2.3.3. Industry & Automation 5.4.2.3.4. Logistics & Transportation 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Telemetry Market Size and Forecast, By Component (2024-2032) 5.4.3.1.1. Hardware 5.4.3.1.2. Software 5.4.3.2. Mexico Telemetry Market Size and Forecast, By Technology (2024-2032) 5.4.3.2.1. Wire-link Technology 5.4.3.2.2. Wireless Technology 5.4.3.2.3. Digital Telemetry 5.4.3.2.4. Data Loggers & Acoustics 5.4.3.3. Mexico Telemetry Market Size and Forecast, By Application (2024-2032) 5.4.3.3.1. Healthcare 5.4.3.3.2. Aerospace & Défense 5.4.3.3.3. Industry & Automation 5.4.3.3.4. Logistics & Transportation 5.4.3.3.5. Others 6. Europe Telemetry Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Telemetry Market Size and Forecast, By Component (2024-2032) 6.2. Europe Telemetry Market Size and Forecast, By Technology (2024-2032) 6.3. Europe Telemetry Market Size and Forecast, By Application (2024-2032) 6.4. Europe Telemetry Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.1.2. United Kingdom Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.1.3. United Kingdom Telemetry Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.2.2. France Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.2.3. France Telemetry Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.3.2. Germany Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.3.3. Germany Telemetry Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.4.2. Italy Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.4.3. Italy Telemetry Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.5.2. Spain Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.5.3. Spain Telemetry Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.6.2. Sweden Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.6.3. Sweden Telemetry Market Size and Forecast, By Application (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.7.2. Austria Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.7.3. Austria Telemetry Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Telemetry Market Size and Forecast, By Component (2024-2032) 6.4.8.2. Rest of Europe Telemetry Market Size and Forecast, By Technology (2024-2032) 6.4.8.3. Rest of Europe Telemetry Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Telemetry Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Telemetry Market Size and Forecast, By Component (2024-2032) 7.2. Asia Pacific Telemetry Market Size and Forecast, By Technology (2024-2032) 7.3. Asia Pacific Telemetry Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Telemetry Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.1.2. China Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.1.3. China Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.2.2. S Korea Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.2.3. S Korea Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.3.2. Japan Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.3.3. Japan Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.4.2. India Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.4.3. India Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.5.2. Australia Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.5.3. Australia Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.6.2. Indonesia Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.6.3. Indonesia Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.7.2. Philippines Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.7.3. Philippines Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.8.2. Malaysia Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.8.3. Malaysia Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.9.2. Vietnam Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.9.3. Vietnam Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.10.2. Thailand Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.10.3. Thailand Telemetry Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Telemetry Market Size and Forecast, By Component (2024-2032) 7.4.11.2. Rest of Asia Pacific Telemetry Market Size and Forecast, By Technology (2024-2032) 7.4.11.3. Rest of Asia Pacific Telemetry Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Telemetry Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Telemetry Market Size and Forecast, By Component (2024-2032) 8.2. Middle East and Africa Telemetry Market Size and Forecast, By Technology (2024-2032) 8.3. Middle East and Africa Telemetry Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Telemetry Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Telemetry Market Size and Forecast, By Component (2024-2032) 8.4.1.2. South Africa Telemetry Market Size and Forecast, By Technology (2024-2032) 8.4.1.3. South Africa Telemetry Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Telemetry Market Size and Forecast, By Component (2024-2032) 8.4.2.2. GCC Telemetry Market Size and Forecast, By Technology (2024-2032) 8.4.2.3. GCC Telemetry Market Size and Forecast, By Application (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Telemetry Market Size and Forecast, By Component (2024-2032) 8.4.3.2. Nigeria Telemetry Market Size and Forecast, By Technology (2024-2032) 8.4.3.3. Nigeria Telemetry Market Size and Forecast, By Application (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Telemetry Market Size and Forecast, By Component (2024-2032) 8.4.4.2. Rest of ME&A Telemetry Market Size and Forecast, By Technology (2024-2032) 8.4.4.3. Rest of ME&A Telemetry Market Size and Forecast, By Application (2024-2032) 9. South America Telemetry Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Telemetry Market Size and Forecast, By Component (2024-2032) 9.2. South America Telemetry Market Size and Forecast, By Technology (2024-2032) 9.3. South America Telemetry Market Size and Forecast, By Application (2024-2032) 9.4. South America Telemetry Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Telemetry Market Size and Forecast, By Component (2024-2032) 9.4.1.2. Brazil Telemetry Market Size and Forecast, By Technology (2024-2032) 9.4.1.3. Brazil Telemetry Market Size and Forecast, By Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Telemetry Market Size and Forecast, By Component (2024-2032) 9.4.2.2. Argentina Telemetry Market Size and Forecast, By Technology (2024-2032) 9.4.2.3. Argentina Telemetry Market Size and Forecast, By Application (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Telemetry Market Size and Forecast, By Component (2024-2032) 9.4.3.2. Rest of South America Telemetry Market Size and Forecast, By Technology (2024-2032) 9.4.3.3. Rest of South America Telemetry Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1 Honeywell International Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2 General Electric Company 10.3 GE Healthcare 10.4 Emerson Electric Co. 10.5 Rockwell Automation, Inc. 10.6 Teledyne Technologies Incorporated 10.7 L3Harris Technologies, Inc. 10.8 Baker Hughes Company 10.9 Orbcomm Inc. 10.10 Iridium Communications Inc. 10.11 Trimble Inc. 10.12 Rogers Communications Inc 10.13 Siemens AG 10.14 Schneider Electric SE 10.15 Philips Healthcare 10.16 Kongsberg Gruppen ASA 10.17 Leonardo S.p.A. 10.18 Inmarsat plc 10.19 Telit Communications PLC 10.20 Laird Connectivity 10.21 Advantech Co., Ltd. 10.22 Mitsubishi Electric Corporation 10 Key Findings 11 Analyst Recommendations 12 Telemetry Market: Research Methodology