The Tattoo Ink Market size was valued at USD 258.75 Million in 2024, and the total Revenue is expected to grow at a CAGR of 5.36 % from 2025 to 2032, reaching nearly USD 392.9 Million.Tattoo Ink Market Overview:

The MMR report offers the global Tattoo Ink Market through advanced analytical, technological, regulatory, and behavioural lenses. It covers detailed consumer behaviour insights, including motivations, demographic shifts, and preference transitions toward premium, vegan, hypoallergenic, and personalized inks. Demand-side dynamics are thoroughly evaluated, mapping growth patterns across professional studios, medical tattooing, seasonal spikes, and amateur usage. The report further analyzes pricing structures, premiumization trends, margin variations, and cost drivers. Manufacturing and formulation aspects—pigment sourcing, biocompatible innovations, sterilization methods, and quality-control norms—are extensively assessed. A full technology and innovation landscape highlights breakthroughs such as micro-encapsulated pigments, plant-based formulations, laser-responsive inks, and AI-driven trend forecasting. The study also examines the tattoo artist ecosystem, studio purchasing behaviour, and adoption barriers. Additionally, it provides robust trade analysis, supply chain mapping, distributor networks, e-commerce strategies, sustainability and ESG benchmarks, and global regulatory frameworks including REACH, FDA, and pigment restrictions, ensuring a 360-degree market understanding.To know about the Research Methodology :- Request Free Sample Report

Tattoo Ink Market Dynamics:

Global tattoo ink usage will continue to rise as more individuals get tattooed. Global consumption climbed by 5.46 % over the last five years, from 376.44 MT in 2012 to 465.6 MT in 2022. The tattoo ink industry will become more common in the future. Global consumption will rise to 717.75 MT in 2023, representing a 6.54 % CAGR from 2022. Tattoos are a motivation for many young people. Tattooing is a rapidly increasing fashion trend that has attracted over 100 million young adult’s globe. Tattooing and piercing have become more popular in Western culture. The younger generation, who are wealthier and more aware of Western trends than ever before, is driving up demand, but so are the older generation, especially those in their 50s and 60s. Young people believe that getting a tattoo enhances their attractiveness. Even older people are now willing to have tattoos since society has gotten more liberal. Wearing a symbol attracts people. As a result, as the desire for tattoos among young people rises, so does the market's growth. Tattoos have become increasingly trendy in recent years. However, this has raised questions regarding the safety of tattoo inks, which could pose both viral and non-infectious dangers. Tattoo inks may include potentially harmful chemical and microbiological elements. They can be used in places where sanitation is a problem. In addition to formaldehyde, glycerol, and isopropyl alcohol, tattoo inks contain a number of other compounds. The skin becomes more porous when these substances penetrate deep into the skin. To put it another way, the chemicals used in tattoo ink are harmful and can openly alter the body's blood circulation.Tattoo Ink Market Segment Analysis:

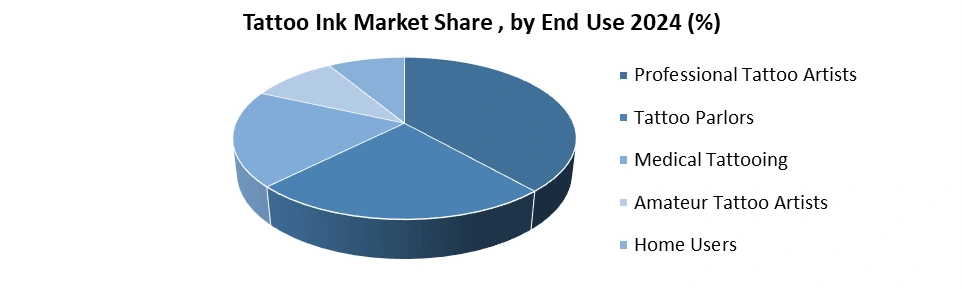

Based on Type, in 2024, Black Tattoo Ink is expected to dominate the Tattoo Ink Market, supported by its universal use in outlining, shading, permanent makeup, and micro-tattooing, making it the highest-volume and most frequently purchased segment. Colored Tattoo Ink ranks second, driven by rising demand for realism, neo-traditional, and full-color designs. White Tattoo Ink holds the third position due to its use in highlights and blending, though limited as a standalone pigment. Metallic Tattoo Ink follows, benefiting from niche demand for reflective and fashion-driven effects. Invisible (UV) Tattoo Ink remains the smallest segment, growing slowly amid regulatory concerns and selective artist adoption. Based on End-User Industry, in 2024, Professional Tattoo Artists are expected to dominate the Tattoo Ink Market, driven by high-volume consumption, premium ink preferences, and adherence to global safety standards. Tattoo Parlors rank second, supported by continuous client footfall, multi-artist operations, and frequent restocking cycles. Medical Tattooing holds the third position, fueled by rising demand for cosmetic reconstruction, areola restoration, and scar camouflage. Amateur Tattoo Artists follow, with growing interest in practice inks but lower spending. Home Users remain the smallest segment, limited by safety concerns, regulatory restrictions, and low-frequency usage.

Tattoo Ink Market Regional Insights:

The two most populous tattoo ink-consuming regions are Europe and America. When looking at the results by country, Italy has the greatest percentage of tattooed people, at 48%. Sweden and the United States come in second and third, with 47 % and 46 %, respectively. The average number of tattoos per person is roughly 3, although it is around 4 in the United States and Sweden. Four or more tattoos are worn by half of all tattooed Americans and Swedes. In 2023, tattoo ink sales in North America were at an all-time high, owing to a spike in demand for tattoos among the region's youth. The US Food and Drug Administration, on the other hand, intends to impose new rules on tattoo ink components. During the forecast period, this is expected to hamper the tattoo inks market in North America. Due to the rising popularity of tattoos among a growing number of young people, Asia Pacific is expected to be the fastest-growing market for tattoo inks throughout the forecast period. The objective of the report is to present a comprehensive analysis of the Global Tattoo Ink market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Tattoo Ink market dynamics, structure by analyzing the market segments and project the Global Tattoo Ink market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Tattoo Ink market make the report investor’s guide.Tattoo Ink Market Scope: Inquire before buying

Global Tattoo Ink Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 258.75 Mn. Forecast Period 2025 to 2032 CAGR: 5.36% Market Size in 2032: USD 392.9 Mn. Segments Covered: by Type Black Tattoo Ink Colored Tattoo Ink White Tattoo Ink Invisible Tattoo Ink Metallic Tattoo Ink by Pigment Mineral Organic Vegetable-based Plastic-based Others by Packaging Outlook Bottles Tubes Sachets Pre-Filled Cartridges Bulk Containers by End-User Industry Professional Tattoo Artists Amateur Tattoo Artists Tattoo Parlors Home Users Medical Tattooing by Distribution Channel Online Offline Tattoo Ink Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tattoo Ink Market, Key Players are

1. Eternal Tattoo Ink. 2. Intenze Tattoo Ink 3. Millennium Colors (MOMS) 4. Kuro Sumi 5. Dynamic Color Co. 6. StarBrite Colors 7. Radiant Colors 8. Fantasia Tattoo Inks 9. Electric Ink 10. Tommy’s Supplies 11. Dragonhawk Tattoo 12. World Famous Tattoo Ink 13. Fusion Ink LLC 14. Quantum Tattoo Ink 15. Solid Ink (U.S.) 16. Allegory Ink (U.S.) 17. Dermaglo Tattoo Ink (U.K.) 18. Micky Sharp Ink 19. Magic Ink 20. Cosmo Ink 21. Sayona group 22. Tattoo Gizmo 23. Raw Pigments 24. Eclipse Tattoo Ink 25. Carbon Black Tattoo Ink 26. Kingpin Tattoo Supply 27. OthersFrequently Asked Questions:

1] What segments are covered in the Tattoo Ink Market report? Ans. The segments covered in the Tattoo Ink Market report are based on Type, Pigment, Packaging Outlook, End-User Industry, Distribution Channel, and region 2] Which region is expected to hold the highest share of the Tattoo Ink Market? Ans. The North America region is expected to hold the highest share of the Tattoo Ink Market. 3] What is the market size of the Tattoo Ink Market by 2032? Ans. The market size of the Tattoo Ink Market by 2032 is USD 392.9 Mn. 4] What is the growth rate of the Tattoo Ink Market? Ans. The Global Tattoo Ink Market is growing at a CAGR of 5.36% during the forecasting period 2025-2032. 5] What was the market size of the Tattoo Ink Market in 2024? Ans. The market size of the Tattoo Ink Market in 2024 was USD 258.75 Mn.

1. Tattoo Ink Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Million, Volume in Metric Tons) - By Segments, Regions, and Country 2. Tattoo Ink Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Revenue 2024 2.3.5. Market Share (%) by Region 2.3.6. Growth Rate (%) 2.3.7. Production Capacity (Metric Tons) 2.3.8. Marketing Channels 2.3.9. Certification 2.3.10. R&D Investments 2.3.11. Packaging Design 2.3.12. Sale Channels 2.3.13. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Tattoo Ink Market: Dynamics 3.1. Tattoo Ink Market Trends 3.2. Tattoo Ink Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Tattoo Ink Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Consumer Behaviour Insights 4.1. Motivations Behind Tattoo Adoption Across Demographics 4.2. Preference Shift Toward Premium, Vegan, And Hypoallergenic Inks 4.3. Role Of Social Media, Influencers, And Online Communities In Shaping Tattoo Choices 4.4. Increasing Inclination Toward Personalized And Customized Tattoo Designs 4.5. Gender-based Variations In Ink Color Selection And Tattoo Style Preferences 4.6. Impact Of Cultural Acceptance And Workplace Policies On Tattoo Visibility Choices 4.7. Repeat Customer Behaviour And Its Role In Long-term Ink Consumption Patterns 5. Demand Analysis 5.1. Growth In Overall Tattoo Penetration Among Young Adults And Millennials 5.2. Rising Demand For Safe, Regulatory-compliant Tattoo Inks 5.3. Increasing Uptake Of Coloured, Metallic, And Specialty Inks For Artistic Expression 5.4. Seasonal And Event-driven Spikes In Tattoo Sessions (Festivals, Holidays, Cultural Events) 5.5. Expansion Of Professional Tattoo Studios Boosting Bulk Ink Purchases 5.6. Demand Momentum From Amateur Artists And Home Users 5.7. Influence Of Medical And Cosmetic Tattooing On Niche Ink Demand 6. Pricing, Profitability & Cost Analysis 6.1. Price Mapping Across Black, Colored, UV, Metallic, And Medical Inks 6.2. Premiumization Trends Driven By Organic And Vegan Inks 6.3. Margin Comparison For Bulk Containers Vs. Small Bottles/Tubes 6.4. Regional Price Variations Due To Regulation, Brand Presence, And Logistics 6.5. Cost Drivers: Pigments, Sterilization, Packaging, Compliance Certification 6.6. Artist Willingness To Pay For High-performance/Premium Inks 6.7. Price Elasticity Among Amateurs Vs. Professional Tattoo Studios 7. Manufacturing & Formulation Analysis 7.1. Raw Material Sourcing: Pigments, Carriers, Additives, Preservatives 7.2. Differences In Formulation Between Black, Colored, And Specialty Inks 7.3. Innovations In Biocompatible And Non-reactive Carrier Solutions 7.4. Sterilization Methods: Gamma Irradiation, Filtration, And Aseptic Filling 7.5. Quality-control Norms For Viscosity, Pigment Load, And Particle Sizing 7.6. Cost Structure: Pigments, Regulatory Compliance, Packaging, Labour 7.7. R&D Focus Areas: Fade-resistant, Skin-friendly, And Faster-healing Inks 8. Technology & Innovation Landscape 8.1. Micro-encapsulated Pigments For Better Stability And Skin Safety 8.2. Development Of Plant-based And Biodegradable Pigment Alternatives 8.3. Emerging Laser-responsive Inks For Easier Tattoo Removal 8.4. Innovation In Quick-dry, Fast-healing, And Antimicrobial Ink Formulations 8.5. Digital Color-matching Tools And Precision Dosing Systems For Artists 8.6. Automation In Ink Filling, Batching, And Contamination-free Packaging 8.7. Ai-driven Trend Forecasting For Ink Color And Style Preferences 9. Tattoo Artist & Studio Ecosystem Analysis 9.1. Ink Usage Patterns In Professional Studios Vs. Freelance Artists 9.2. Adoption Of Specialized Inks For Shading, Outlining, And Color Packing 9.3. Training Quality And Artist Awareness Of Safe Ink Practices 9.4. Studio Purchasing Behavior: Bulk Buying, Brand Loyalty, And Trial Packs 9.5. Availability Of Sterilized, Pre-filled Cartridges For Hygienic Operations 9.6. Impact Of Rising Tattoo Festivals And Conventions On Ink Sales 9.7. Barriers To Adoption: Costs, Ink Availability, And Regulatory Restrictions 10. Trade And Export Analysis 2024 10.1. Major Exporting Countries Tattoo Ink 10.2. Major Importing Countries Tattoo Ink 10.3. Impact Of Trade Regulations, Bans, And Quotas 10.4. Tariffs, Labeling, And Sanitary Regulations 11. Supply Chain, Distribution & Logistics Assessment 11.1. Global Supply Chain Flow: Pigment Suppliers → Ink Manufacturers → Distributors 11.2. Role Of E-commerce And Direct-to-artist Online Distribution 11.3. Distributor Networks In North America, Europe, And Emerging Asian Markets 11.4. Impact Of Raw Material Shortages And Regulatory Delays On Delivery Cycles 11.5. Inventory Management Strategies For Fast-moving Vs. Specialty Inks 11.6. Private-label Manufacturing And White-label Ink Production Trends 11.7. Influence Of Shipping Regulations For Hazardous Materials On Cost And Transit 12. Distribution, Retail & E-commerce Strategy 12.1. Growth Of Online Marketplaces For Tattoo Supplies 12.2. Expansion Of Artist-focused Subscription Models 12.3. Dealer Networks & Distributor-led Reach In Professional Studios 12.4. Cross-border E-commerce And Import-driven Supply Ecosystem 12.5. Role Of Tattoo Expos, Exhibitions, And Artist Communities In Product Visibility 12.6. Availability Of Starter Kits And Training Bundles 12.7. Influence Of Social Commerce Platforms For Tattoo Ink Sales 13. Sustainability & ESG Assessment 13.1. Use Of Biodegradable Pigments And Eco-friendly Carriers 13.2. Environmental Impact Of Chemical Pigment Manufacturing 13.3. Waste Management And Safe Disposal Of Ink Containers 13.4. ESG Initiatives By Leading Ink Manufacturers 13.5. Certification Trends: Vegan, Cruelty-free, Organic 13.6. Consumer Willingness To Pay For Sustainable Tattoo Inks 13.7. Life-cycle Environmental Footprint Of Ink Packaging 14. Regulatory, Compliance & Safety Framework 14.1. Global Regulations Including EU REACH, FDA Guidelines, And AP Certification 14.2. Restrictions On Specific Pigments (E.G., Blue 15:3, Green 7) And Heavy Metal Limits 14.3. Mandatory Safety Testing, Allergen Checks, And Sterilization Practices 14.4. Compliance Requirements On Labeling, Traceability, And Ink Ingredient Disclosure 14.5. Regulatory Distinctions Between Cosmetic Inks And Medical-grade Inks 14.6. Impact Of Stricter Health Regulations On Manufacturer Cost Structure 14.7. Certification Frameworks For Cruelty-free, Vegan, And Sustainable Inks 15. Tattoo Ink Market: Global Market Size and Forecast by Segmentation (by Value in USD Million, Volume in Metric Tons) (2024-2032) 15.1. Tattoo Ink Market Size and Forecast, By Type (2024-2032) 15.1.1. Black Tattoo Ink 15.1.2. Colored Tattoo Ink 15.1.3. White Tattoo Ink 15.1.4. Invisible Tattoo Ink 15.1.5. Metallic Tattoo Ink 15.2. Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 15.2.1. Mineral 15.2.2. Organic 15.2.3. Vegetable-based 15.2.4. Plastic-based 15.2.5. Others 15.3. Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 15.3.1. Bottles 15.3.2. Tubes 15.3.3. Sachets 15.3.4. Pre-Filled Cartridges 15.3.5. Bulk Containers 15.4. Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 15.4.1. Professional Tattoo Artists 15.4.2. Amateur Tattoo Artists 15.4.3. Tattoo Parlors 15.4.4. Home Users 15.4.5. Medical Tattooing 15.5. Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 15.5.1. Online 15.5.2. Offline 15.6. Tattoo Ink Market Size and Forecast, By Region (2024-2032) 15.6.1. North America 15.6.2. Europe 15.6.3. Asia Pacific 15.6.4. Middle East and Africa 15.6.5. South America 16. North America Tattoo Ink Market Size and Forecast by Segmentation (by Value in USD Million, Volume in Metric Tons) (2024-2032) 16.1. North America Tattoo Ink Market Size and Forecast, By Type (2024-2032) 16.1.1. Black Tattoo Ink 16.1.2. Colored Tattoo Ink 16.1.3. White Tattoo Ink 16.1.4. Invisible Tattoo Ink 16.1.5. Metallic Tattoo Ink 16.2. North America Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 16.2.1. Mineral 16.2.2. Organic 16.2.3. Vegetable-based 16.2.4. Plastic-based 16.2.5. Others 16.3. North America Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 16.3.1. Bottles 16.3.2. Tubes 16.3.3. Sachets 16.3.4. Pre-Filled Cartridges 16.3.5. Bulk Containers 16.4. North America Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 16.4.1. Professional Tattoo Artists 16.4.2. Amateur Tattoo Artists 16.4.3. Tattoo Parlors 16.4.4. Home Users 16.4.5. Medical Tattooing 16.5. North America Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 16.5.1. Online 16.5.2. Offline 16.6. North America Tattoo Ink Market Size and Forecast, by Country (2024-2032) 16.6.1. United States 16.6.1.1. United States Tattoo Ink Market Size and Forecast, By Type (2024-2032) 16.6.1.2. United States Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 16.6.1.3. United States Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 16.6.1.4. United States Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 16.6.1.5. United States Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 16.6.2. Canada 16.6.2.1. Canada Tattoo Ink Market Size and Forecast, By Type (2024-2032) 16.6.2.2. Canada Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 16.6.2.3. Canada Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 16.6.2.3.1. 16.6.2.4. Canada Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 16.6.2.5. Canada Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 16.6.3. Mexico 16.6.3.1. Mexico Tattoo Ink Market Size and Forecast, By Type (2024-2032) 16.6.3.2. Mexico Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 16.6.3.3. Mexico Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 16.6.3.4. Mexico Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 16.6.3.5. Mexico Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 17. Europe Tattoo Ink Market Size and Forecast by Segmentation (by Value in USD Million, Volume in Metric Tons) (2024-2032) 17.1. Europe Tattoo Ink Market Size and Forecast, By Type (2024-2032) 17.2. Europe Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 17.3. Europe Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 17.4. Europe Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 17.5. Europe Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 17.6. Europe Tattoo Ink Market Size and Forecast, By Country (2024-2032) 17.6.1. United Kingdom 17.6.2. France 17.6.3. Germany 17.6.4. Italy 17.6.5. Spain 17.6.6. Sweden 17.6.7. Russia 17.6.8. Rest of Europe 18. Asia Pacific Tattoo Ink Market Size and Forecast by Segmentation (by Value in USD Million, Volume in Metric Tons) (2024-2032) 18.1. Asia Pacific Tattoo Ink Market Size and Forecast, By Type (2024-2032) 18.2. Asia Pacific Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 18.3. Asia Pacific Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 18.4. Asia Pacific Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 18.5. Asia Pacific Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 18.6. Asia Pacific Tattoo Ink Market Size and Forecast, by Country (2024-2032) 18.6.1. China 18.6.2. S Korea 18.6.3. Japan 18.6.4. India 18.6.5. Australia 18.6.6. Indonesia 18.6.7. Malaysia 18.6.8. Philippines 18.6.9. Thailand 18.6.10. Vietnam 18.6.11. Rest of Asia Pacific 19. Middle East and Africa Tattoo Ink Market Size and Forecast by Segmentation (by Value in USD Million, Volume in Metric Tons) (2024-2032) 19.1. Middle East and Africa Tattoo Ink Market Size and Forecast, By Type (2024-2032) 19.2. Middle East and Africa Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 19.3. Middle East and Africa Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 19.4. Middle East and Africa Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 19.5. Middle East and Africa Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 19.6. Middle East and Africa Tattoo Ink Market Size and Forecast, By Country (2024-2032) 19.6.1. South Africa 19.6.2. GCC 19.6.3. Nigeria 19.6.4. Rest of ME&A 20. South America Tattoo Ink Market Size and Forecast by Segmentation (by Value in USD Million, Volume in Metric Tons) (2024-2032) 20.1. South America Tattoo Ink Market Size and Forecast, By Type (2024-2032) 20.2. South America Tattoo Ink Market Size and Forecast, By Pigment (2024-2032) 20.3. South America Tattoo Ink Market Size and Forecast, By Packaging Outlook (2024-2032) 20.4. 20.5. South America Tattoo Ink Market Size and Forecast, By End-User Industry (2024-2032) 20.6. South America Tattoo Ink Market Size and Forecast, By Distribution Channel (2024-2032) 20.7. South America Tattoo Ink Market Size and Forecast, By Country (2024-2032) 20.7.1. Brazil 20.7.2. Argentina 20.7.3. Colombia 20.7.4. Chile 20.7.5. Rest of South America 21. Company Profile: Key Players 21.1. Eternal Tattoo Ink. 21.1.1. Company Overview 21.1.2. Business Portfolio 21.1.3. Financial Overview 21.1.4. SWOT Analysis 21.1.5. Strategic Analysis 21.2. Intenze Tattoo Ink 21.3. Millennium Colors (MOMS) 21.4. Kuro Sumi 21.5. Dynamic Color Co. 21.6. StarBrite Colors 21.7. Radiant Colors 21.8. Fantasia Tattoo Inks 21.9. Electric Ink 21.10. Tommy’s Supplies 21.11. Dragonhawk Tattoo 21.12. World Famous Tattoo Ink 21.13. Fusion Ink LLC 21.14. Quantum Tattoo Ink 21.15. Solid Ink (U.S.) 21.16. Allegory Ink (U.S.) 21.17. Dermaglo Tattoo Ink (U.K.) 21.18. Micky Sharp Ink 21.19. Magic Ink 21.20. Cosmo Ink 21.21. Sayona group 21.22. Tattoo Gizmo 21.23. Raw Pigments 21.24. Eclipse Tattoo Ink 21.25. Carbon Black Tattoo Ink 21.26. Kingpin Tattoo Supply 21.27. Others 22. Key Findings 23. Analyst Recommendations 24. Tattoo Ink Market – Research Methodology