Target Drone Market size was valued at USD 5.16 Billion in 2024 and the total Target Drone revenue is expected to grow at a CAGR of 7% from 2025 to 2032, reaching nearly USD 8.87 Billion by 2032.Target Drone Market Overview:

Target Drones are unmanned aerial vehicles (Unmanned Aerial Target, UAT) used for the development and testing of military systems, training military crews on threat identification, and destruction tests of both anti-aircraft systems, and piloted combat aircraft. These unmanned vehicles emulate the behavior of real aerial threats. For that purpose, these aircraft are required to reach very high speeds and are very dynamic. The increasing use of unmanned systems in military operations, including reconnaissance, surveillance, and target acquisition, is driving demand for advanced target drone technologies. The increasing defense budget is a primary driver for the target drone market, as military organizations seek to enhance their training and testing facilities with advanced drone systems that simulate realistic combat scenarios. Drones are increasingly being used to perform tasks that endanger people, including search and rescue activities and surveys of elevated infrastructure such as potentially unstable roofs and damaged power lines. Organizations easily justify investments in drone technologies if they reduce or eliminate safety risks for employees and others. Companies like Amazon, Google, Zipline, Flirtey, and Flytrex are rapidly increasing the technological capabilities of drones. The early adopters are also streamlining the delivery processes and forcing communities to redefine, clarify, and in some cases, relax regulatory restrictions. Those actions reduce the cost of entry to the drone delivery market for new developers and target drone solution providers, and operators. The Global Drones Exporters & Suppliers, there are 6,765 active drone exporters, serving 9,903 buyers. AUTEL ROBOTICS USA LLC accounted for the maximum export market share with 8,351 shipments followed by AUTEL ROBOTICS CO LTD with 4,336 and IFLIGHT TECHNOLOGY COMPANY LIMITED at the 3rd spot with 3,824 shipments.To know about the Research Methodology:-Request Free Sample Report

Target Drone Market Dynamics:

Advanced Target Drones Revolutionizing Military Training with AI, Enhanced Autonomy, and Real-Time Data Transmission The increasing need for realistic and dynamic training scenarios drives the demand for target drones, allowing armed forces to simulate complex combat situations. The deployment of target UAVs among air, ground, and naval forces around the world is the rising demand for targeting autonomously moving targets for military training exercises. Another factor encouraging the use of target drone technologies is increasing military spending in various countries. Additionally, armies are increasingly looking for high-speed unmanned aerial targets for use in naval and aerial combat training. Rapid advancements in drone technology, including improved maneuverability, target simulation capabilities, and real-time data transmission, enhance the overall effectiveness of target drones. Advancements in drone technology, such as enhanced autonomy, flight stability, and endurance, are a major factor in the growth of the target drone market. Advancements in AI, ML, and sensor technology have improved target drones, increasing their flexibility and efficiency in tasks like aerial target training, weapon testing, and anti-aircraft exercises. Enhanced Regulations and Growing Service Offerings Drive Growth in the Target Drone Market Target Drone manufacturers and Providers are typically positive about how enhanced regulations lead to new opportunities for their products. A positive outlook is based on the idea that simplified and helpful regulations make it easier to introduce and gain wider acceptance of drone technologies, ultimately speeding up market growth. Additionally, there is a noticeable trend towards increasing service offerings, with 44% of respondents considering it a primary factor for Target Drone growth and 40% as a secondary factor. The trend emphasizes the significance of not just improving the physical abilities of Target drones, but also increasing the variety of services they can offer. It covers a wide range of technologies, from high-level training simulations to instant data analysis, that provide great benefits to users.

Target Drone Market Segment Analysis:

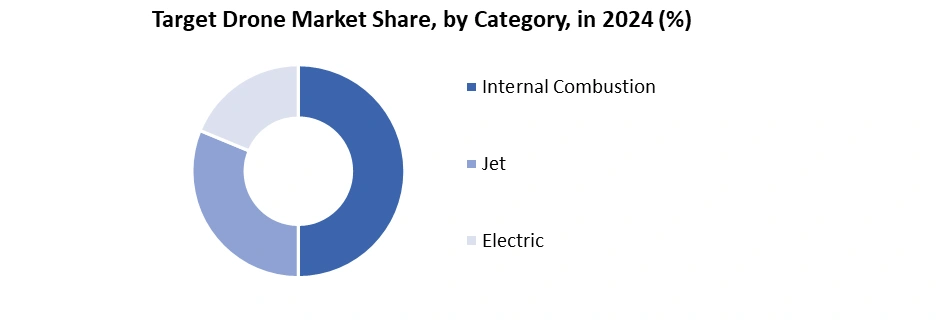

Based on Product Type, The Target Drone Market is segmented into Fixed Wing, Rotary Wing, and Hybrid drones. Fixed-wing drones, representing around 55% of global units in 2024, are preferred for long-range missile testing, radar calibration, and air-defense simulation due to their high endurance and flight stability. They are widely deployed in military programs across North America, Europe, and Asia Pacific where realistic flight profiles are essential. Rotary-wing drones, accounting for 30%, provide flexibility in urban and naval environments, allowing vertical takeoff/landing for shipborne operations and confined-area simulations. Hybrid drones, combining both fixed-wing and rotary capabilities, account for 15% of units, enabling multi-mission functionality including rapid deployment and extended surveillance. Their versatility is increasingly valued in advanced military exercises, such as electronic warfare (EW) training and high-speed target simulation. Analysts expect the hybrid segment to grow steadily, driven by ongoing R&D into multi-mode propulsion and modular payload integration, enhancing mission adaptability across varied terrains and environments.Based on Engine Type, Target drones utilize Internal Combustion, Jet, Electric, and other engine types, with internal combustion drones holding 40% of the market in 2024, favored for cost-effective endurance and easy maintenance. These drones are widely used in repetitive training missions and mid-range target simulation, offering a balance between operational cost and performance. Jet-powered drones accounted for 25%, supporting high-speed threat emulation, supersonic missile testing, and advanced EW exercises where realistic adversary simulation is critical. Electric drones, comprising 20% of the market, are increasingly adopted due to silent operation, reduced heat signatures, and lower maintenance costs, making them suitable for stealth and indoor simulations. Other propulsion systems, including hybrid engines, account for 15%, providing flexible, high-performance solutions for missions requiring speed bursts or combined endurance. Innovations in lightweight jet and hybrid engines are expected to further enhance performance and adoption in next-generation target drones.

Target Drone Market Regional Insight:

North America held xx% share in 2024 for the Target Drone Market. The demand for target drones in the sector is being fueled by the region's strong defense industry and ongoing military modernization efforts for weapon testing, surveillance, and military training. The US has played a significant role in the growth of the drone industry in North America. In April 2024, Northrop Grumman Corp’s aerial target specialists started developing supersonic target drones for the United States Navy to assist surface warship sailors in honing their abilities to identify and neutralize approaching supersonic anti-ship missiles.The FAA requires almost all operators of small unmanned aircraft systems in the US, even hobbyists doing freelance work, to get a remote pilot certificate. CompTIA surveyed several of these individuals about their future business prospects as part of the drone research project subset. Approximately 63% of the participants aim to increase their hobby into a full-time enterprise, with half already engaging in various commercial tasks like shooting videos and photos as well as conducting inspections, mapping, and surveys. With an increase in business-related scenarios and the use of drones, there is a growing demand for that expertise. The hobbyist community is an excellent source of recruits for organizations wanting to enhance their drone expertise, such as solution providers, operators, and other entities.

Global Export data, Drone export shipments stood from the World at 87K, exported by 6,765 World Exporters to 9,903 Buyers. The world exports most of its Drones to Vietnam, Peru, and the United States The top 3 exporters of Drones are China with 59,855 shipments followed by the United States with 12,980 and Vietnam at the 3rd spot with 1,725 shipments.

Rating of Interest/ Anticipated Utilization Drone Use Cases Small Customers Medium Customer Large Customer Security, Surveillance, Or Monitoring 21 % 34% 35% Inspections, I.e. Infrastructure buildings etc. 20% 30% 30% Data Dreams gathered from drones for analytics 1 2% 23% 27% Informal photos/ video 23% 30% 24% Mapping And Surveys, i.e. agriculture, site selections etc. 19% 34% 20% Delivery of Goods 11% 22% 19% Emergency services, i.e. search and rescue. 8% 22% 17% Target Drone Market Competitive Landscape:

The competitive drone market is defined by multiple key players competing for market dominance by implementing innovation, forming strategic partnerships, and exploring new markets. The need for advanced technologies, cost-effective solutions, and robust training and testing systems is what motivates the competition. In May 2022, Rattan India Enterprises, an India-based company focused on businesses with cutting-edge technologies, acquired a 60 % stake in Throttle Aerospace System Private Limited for an undisclosed amount. The acquisitions enable customers with complete 360-degree drone solutions, including software as a service, drones as a service, and drones as a product (DAAp- drone Hardware) (SAAS-Drone Software). In February 2024, Kratos Defenses & Security Solutions, Located in San Diego was Given a USD 57.7 million Contract modification by the United States Navy to produce target drones that imitate anti-ship Missiles. In March 2023, The Japan Ground Self-defenses Force awarded Qinteiq a contract to supply Banshee jet 80+ unmanned aerial vehicle targets.Target Drone Market Scope: Inquire before buying

Global Target Drone Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.16 Bn. Forecast Period 2025 to 2032 CAGR: 7% Market Size in 2032: USD 8.87 Bn. Segments Covered: by Type Fixed wing Rotary wing Hybrid by Engine Type Internal Combustion Jet Electric Others by Target Type Full Scale Sub-Scaled Towing Others by Payload Capacity Low (<20 kg) Medium (20–40 kg) High (>40 kg) by Mode of Operation Remotely Operated Optionally Piloted Autonomous Operation by Platform Aerial Drones Marine Drones Ground Drones by Component Frames Controller systems Battery Navigation systems Electrical Systems & Wire Harnesses Others by Application Training & Simulation Weapon Testing & Evaluation Electronic Warfare Training Others by End User Defense Commercial Target Drone Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina Rest of South America)Target Drone Market, Key Players:

1. Kratos Defense & Security Solutions, Inc. 2. Northrop Grumman Corporation 3. The Boeing Company 4. Airbus SE 5. Lockheed Martin Corporation 6. BAE Systems plc 7. QinetiQ Group plc 8. Leonardo S.p.A. 9. Griffon Aerospace 10. Denel Dynamics 11. AeroTargets International LLC 12. Air Affairs Australia Pty Ltd. 13. Saab AB 14.OthersFAQs:

1] What is the growth rate of the Target Drone Market? Ans. The Global Target Drone Market is growing at a significant rate of 7 % during the forecast period. 2] What is the expected Target Drone market size by 2032? Ans. The Target Drone Market size is expected to reach USD 8.87 Billion by 2032. 3] What segments are covered in the Target Drone Market report? Ans. The segments covered in the market report are Types, Engine Types, and End-users. 4] What are the factors driving the Target Drone Market growth? Ans. Advancements in drone technology, such as enhanced autonomy, flight stability, and endurance, are a major factor in the growth of the target drone market. 5]Which are the top Key Players in the Target Drone Market? Ans. Top Key Players in the market are Thales Group; BAE Systems plc; Leonardo S.p.A; Raytheon Technologies Corporation; Kratos Defence & Security Solutions, Inc.

1. Target Drone Market: Executive Summary 1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032), 1.1.2. Market Size (USD Million) and (Volume in 000'Units) and Market Share (%) - By Segments, Regions and Country 2. Global Target Drone Market: Competitive Landscape 2.1 MMR Competition Matrix 2.2 Target Drone Market : Competitive Positioning 2.3 Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Engine & Propulsion Technology 2.3.5. Payload & Sensor Capabilities 2.3.6. Mode of Operation 2.3.7. Technology Integration 2.3.8. Pricing Structure 2.3.9. Market Share (%) 2.3.10. Profit Margin (%) 2.3.11. Revenue (2025) 2.3.12. Y-O-Y (%) 2.3.13. R&D spending (%) 2.3.14. Applications & Use Cases 2.3.15. Certifications & Compliance 2.3.16. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Market Dynamics 3.1. Target Drone Market Trends 3.2. Target Drone Market Dynamics 3.1.1 Drivers 3.1.2 Restraints 3.1.3 Opportunities 3.1.4 Challenges 3.2 PORTER’s Five Forces Analysis 3.3 PESTLE Analysis 3.4 Analysis of Government Schemes and Initiatives on the Industry 4 Regulatory & Compliance Framework 4.1 Export control regulations (ITAR, MTCR, EAR) 4.2 Airspace & range safety governance rules 4.3 Navigation, telemetry & communication frequency regulations 4.4 Environmental & operational safety norms 4.5 Certification & performance testing requirements 4.6 Government procurement & compliance guidelines 5 Cost, Pricing & TCO (Total Cost of Ownership) Analysis (2024) 5.1 Price benchmarking across drone types (2019–2024) 5.2 CAPEX vs OPEX cost structure 5.3 Operating cost breakdown (fuel, propulsion, spares) 5.4 Lifecycle cost modelling & cost-per-mission 5.5 Regional pricing & budget variations 5.6 Impact of payload, endurance & speed on pricing 6 Demand Drivers & Use-Case Deep Dive 6.1 Military modernization programs driving drone demand 6.2 Need for realistic training, simulation & live-fire exercises 6.3 Growth in EW & decoy requirements 6.4 Rising cross-border threats 6.5 Naval gunnery, missile guidance & radar calibration uses 6.6 Demand from private training & defense contractors 7 Procurement, Testing & Certification Framework 7.1 Defense procurement cycles & acquisition programs 7.2 Tendering, contracting & vendor qualification 7.3 Military testing & evaluation standards (NATO, DoD, national) 7.4 Airworthiness & flight safety certification norms 7.5 Environmental, endurance & stress testing protocols 7.6 Cybersecurity, data link security & encryption compliance 8 Technology & Innovation Landscape 8.1 Advances in drone manufacturing & lightweight materials 8.2 Propulsion innovations (Jet, ICE, Electric, Hybrid) 8.3 EW, radar signature, IR augmentation & decoy payloads 8.4 AI-based autonomous maneuvering & swarm simulation 8.5 Sensor, telemetry & navigation system upgrades 8.6 Innovations in recovery, reusability & survivability 9 Investment Landscape 9.1 Government investments, defense budgets & funding allocations 9.2 R&D spending trends in target drone technologies 9.3 Private sector investments and defense contractor funding 9.4 Venture capital activity in UAV, AI & propulsion technologies 9.5 Public–private partnerships (PPP) and co-development programs 9.6 Investment outlook for emerging technologies (AI, EW, swarming, jet targets) 10 Supply Chain, Manufacturing & Component Analysis 10.1 Component breakdown: airframe, propulsion, telemetry, payload 10.2 Supplier ecosystem for engines, sensors, electronics 10.3 Manufacturing capabilities & assembly processes 10.4 Raw material dependencies (composites, electronics) 10.5 Supply-chain vulnerabilities & geopolitical risks 10.6 Cost contribution of major subsystems 11 Opportunity Assessment & Growth Hotspots 11.1 Regional growth hotspots driven by procurement expansions 11.2 Opportunities in autonomous, AI & swarm target drones 11.3 Demand for high-speed jet & EW-capable systems 11.4 Gaps in naval, airborne & ground training platforms 11.5 Opportunities in integrated simulation & training systems 11.6 Long-term opportunity outlook (2025–2032) 12 Procurement & Deployment Models 12.1 Direct procurement vs service-based models 12.2 Contractor-owned, military-managed training systems 12.3 Leasing & long-term support contracts 12.4 Multi-year framework agreements 12.5 Budgeting, tendering & acquisition processes 12.6 Outsourced training by defense contractors 13 Test Range Infrastructure & Operational Readiness 13.1 Requirements for Air, Land & Naval Ranges 13.2 Instrumentation & Telemetry Setup 13.3 Range Safety Protocols 13.4 Weather & Environmental Constraints 13.5 Data Logging & Recording Infrastructure 13.6 Case Studies of Defense Range Upgrades 14 Weapon-System Compatibility & Test Integration Analysis 14.1 Compatibility with Surface-to-Air Missile Systems 14.2 Integration with Naval AA Guns & CIWS 14.3 Air-to-Air Missile Target Simulation 14.4 Radar Tracking & Signature Testing 14.5 EW Countermeasure Evaluation Protocols 14.6 Ballistic Testing Using Ground Targets 15 Case Studies & Defense Program Tracker 15.1 Global procurement program tracker (U.S., Europe, Asia) 15.2 U.S. Navy & USAF target drone training case study 15.3 NATO joint EW & live-fire training case study 15.4 India’s DRDO-led target drone modernization case study 15.5 Key global contract awards & procurement milestones 15.6 Lessons learned shaping future requirements 16 Wire Harnesses in Target Drones 16.1 Overview of wire harnesses in drones and their role in electrical systems 16.2 Market size and growth trends for wire harnesses (global & regional) 16.3 Key manufacturers and suppliers of wire harnesses 16.4 Cost contribution and impact on total drone TCO 16.5 Technological innovations in design, lightweight materials, and modular systems 16.6 Integration with avionics, propulsion, payloads, and telemetry systems 17 Global Target Drone Market :Size and Forecast By Segmentation (By Value in USD Billion & Volume in 000’Units) (2024-2032) 17.1 Global Target Drone Market Size and Forecast, By Type 17.1.1 Fixed wing 17.1.2 Rotary wing 17.1.3 Hybrid 17.2 Global Target Drone Market Size and Forecast, By Engine Type 17.2.1 Internal Combustion 17.2.2 Jet 17.2.3 Electric 17.2.4 Others 17.3 Global Target Drone Market Size and Forecast, By Target Type 17.3.1 Full Scale 17.3.2 Sub-Scaled 17.3.3 Towing 17.3.4 Others 17.4 Global Target Drone Market Size and Forecast, By Payload Capacity 17.4.1 Low (<20 kg) 17.4.2 Medium (20–40 kg) 17.4.3 High (>40 kg) 17.5 Global Target Drone Market Size and Forecast, By Mode of Operation 17.5.1 Remotely Operated 17.5.2 Optionally Piloted 17.5.3 Autonomous Operation 17.6 Global Target Drone Market Size and Forecast, By Platform 17.6.1 Aerial Drones 17.6.2 Marine Drones 17.6.3 Ground Drones 17.7 Global Target Drone Market Size and Forecast, By Component 17.7.1 Frames 17.7.2 Controller systems 17.7.3 Battery 17.7.4 Navigation systems 17.7.5 Electrical Systems & Wire Harnesses 17.7.6 Others 17.8 Global Target Drone Market Size and Forecast, By Applications 17.8.1 Training & Simulation 17.8.2 Weapon Testing & Evaluation 17.8.3 Electronic Warfare Training 17.8.4 Others 17.9 Global Target Drone Market Size and Forecast, By End User 17.9.1 Defense 17.9.2 Commercial 17.10 Target Drone Market Size and Forecast, By Region(2024-2032) 17.10.1 North America 17.10.2 Europe 17.10.3 Asia Pacific 17.10.4 South America 17.10.5 MEA 18 North America Target Drone Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in 000’Units) (2024-2032) 18.1.1 North America Market Size and Forecast, By Type 18.1.2 North America Market Size and Forecast, By Engine Type 18.1.3 North America Market Size and Forecast, By Target Type 18.1.4 North America Market Size and Forecast, By Payload Capacity 18.1.5 North America Market Size and Forecast, By Mode of Operation 18.1.6 North America Market Size and Forecast, By Platform 18.1.7 North America Market Size and Forecast, By Component 18.1.8 North America Market Size and Forecast, By Applications 18.1.9 North America Market Size and Forecast, By End User 18.1.10 North America Market Size and Forecast, By Country 18.1.10.1 United States 18.1.10.1.1 United States Market Size and Forecast, By Type 18.1.10.1.2 United States Market Size and Forecast, By Engine Type 18.1.10.1.3 United States Market Size and Forecast, By Target Type 18.1.10.1.4 United States Market Size and Forecast, By Payload Capacity 18.1.10.1.5 United States Market Size and Forecast, By Mode of Operation 18.1.10.1.6 United States Market Size and Forecast, By Platform 18.1.10.1.7 United States Market Size and Forecast, By Applications 18.1.10.1.8 United States Market Size and Forecast, By End User 18.1.10.2 Canada 18.1.10.3 Mexico 19 Europe Target Drone Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in 000’Units) (2024-2032) 19.1 Europe Market Size and Forecast, By Type 19.2 Europe Market Size and Forecast, By Engine Type 19.3 Europe Market Size and Forecast, By Target Type 19.4 Europe Market Size and Forecast, By Payload Capacity 19.5 Europe Market Size and Forecast, By Mode of Operation 19.6 Europe Market Size and Forecast, By Platform 19.7 Europe Market Size and Forecast, By Component 19.8 Europe Market Size and Forecast, By Applications 19.9 Europe Market Size and Forecast, By End User 19.10 Europe Market Size and Forecast, By Country 19.10.1 United Kingdom 19.10.2 France 19.10.3 Germany 19.10.4 Italy 19.10.5 Spain 19.10.6 Sweden 19.10.7 Russia 19.10.8 Ukraine 19.10.9 Rest of Europe 20 Asia Pacific Target Drone Market Size and Forecast By Segmentation (By Value USD Million and ) (2024-2032) 20.1 Asia Pacific Market Size and Forecast, By Type 20.2 Asia Pacific Market Size and Forecast, By Engine Type 20.3 Asia Pacific Market Size and Forecast, By Target Type 20.4 Asia Pacific Market Size and Forecast, By Payload Capacity 20.5 Asia Pacific Market Size and Forecast, By Mode of Operation 20.6 Asia Pacific Market Size and Forecast, By Platform 20.7 Asia Pacific Market Size and Forecast, By Component 20.8 Asia Pacific Market Size and Forecast, By Applications 20.9 Asia Pacific Market Size and Forecast, By End User 20.10 Asia Pacific Market Size and Forecast, By Country 20.10.1 China 20.10.2 Japan 20.10.3 South Korea 20.10.4 India 20.10.5 Australia 20.10.6 Malaysia 20.10.7 Thailand 20.10.8 Vietnam 20.10.9 New Zealand 20.10.10 Philippines 20.10.11 Rest of Asia Pacific 21 Middle East and Africa Target Drone Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in 000’Units) (2024-2032) 21.1 Middle East and Africa Market Size and Forecast, By Type 21.2 Middle East and Africa Market Size and Forecast, By Engine Type 21.3 Middle East and Africa Market Size and Forecast, By Target Type 21.4 Middle East and Africa Market Size and Forecast, By Ingredients 21.5 Middle East and Africa Market Size and Forecast, By Mode of Operation 21.6 Middle East and Africa Market Size and Forecast, By Platform 21.7 Middle East and Africa Market Size and Forecast, By Component 21.8 Middle East and Africa Market Size and Forecast, By Applications 21.9 Middle East and Africa Market Size and Forecast, By End User 21.10 Middle East and Africa Market Size and Forecast, By Country 21.10.1 South Africa 21.10.2 GCC 21.10.3 Nigeria 21.10.4 Egypt 21.10.5 Turkey 21.10.6 Rest of ME&A 22 South America Target Drone Market Size and Forecast By Segmentation (By Value in USD Billion & Volume in 000’Units) (2024-2032) 22.1 South America Market Size and Forecast, By Type 22.2 South America Market Size and Forecast, By Engine Type 22.3 South America Market Size and Forecast, By Target Type 22.4 South America Market Size and Forecast, By Payload Capacity 22.5 South America Market Size and Forecast, By Mode of Operation 22.6 South America Market Size and Forecast, By Platform 22.7 South America Market Size and Forecast, By Component 22.8 South America Market Size and Forecast, By Applications 22.9 South America Market Size and Forecast, By End User 22.10 South America Market Size and Forecast, By Country 22.10.1 Brazil 22.10.2 Argentina 22.10.3 Colombia 22.10.4 Chile 22.10.5 Peru 22.10.6 Rest Of South America 23 Company Profile: Key Players 23.1 Kratos Defense & Security Solutions, Inc. 23.1.1 Overview 23.1.2 Business Portfolio 23.1.3 Financial Overview 23.1.4 SWOT Analysis 23.1.5 Strategic Analysis 23.1.6 Recent Developments 23.2 Northrop Grumman Corporation 23.3 The Boeing Company 23.4 Airbus SE 23.5 Lockheed Martin Corporation 23.6 BAE Systems plc 23.7 QinetiQ Group plc 23.8 Leonardo S.p.A. 23.9 Griffon Aerospace 23.10 Denel Dynamics 23.11 AeroTargets International LLC 23.12 Air Affairs Australia Pty Ltd. 23.13 Saab AB 24 Key Findings 25 Strategic Outlook & Future Opportunities 26 Global Target Drone Market – Research Methodology