Structural Adhesives Market size was valued at USD 16.97 Bn. in 2022 and the total Structural Adhesives Market revenue is expected to grow at 6.7 % from 2022 to 2029, reaching nearly USD 26.71 Bn.Structural Adhesives Market Overview:

Load-bearing adhesives, also known as structural adhesives, are substances with the ability to solidify on the substrate and connect two similar or dissimilar surfaces together through surface contact. These adhesives can keep two similar or dissimilar surfaces together. They sustain stresses for extended periods but are susceptible to shock, vibrations, and temperature changes, but effectively maintain the bonded surfaces. These adhesives are employed to join various substrate materials including ceramics, metal, wood, composites, and polymers. Different types of products are used to create structural adhesives, including epoxy, UV curable, methacrylates, polyurethane, and cyanoacrylate. Epoxy-based structural adhesives are used to bind automotive components to help to absorb high-impact energy, at various degrees of temperature. Additionally crash tests are frequently used in the car industry to guarantee the passengers in a collision. There is evidence that structural adhesives improve vehicles' crashworthiness and other objects’ vehicles for people. Excellent mechanical performance is offered by structural adhesives, which also make weight reduction possible. They provide great strength, load-bearing capacity, tensile strength, durability, and resistance to solvents, heat, impact, and fatigue. Additionally, they provide benefits like smoother lines in the body of vehicles, including cars, buses, and trucks, without swelling rivets, nails, or weld marks. All structural adhesives give the substrate an overlap shear strength of at least 1,000 psi. These adhesives are used to join a wide range of substrates, including masonry, plastics, rubber, glass, steel, aluminum, and copper. Report Scope: A quantitative analysis of the market's drivers, restraints, trends, and projections is provided by the research on structural adhesives. Porter's five forces analysis shows how buyers and suppliers can develop their supplier-buyer networks and make decisions that are motivated by profit. With the use of extensive analysis, market size, and segmentation, the current Structural Adhesives Market potential can be determined. Investors will gain a thorough understanding of the industry's future from the study, which also includes the factors expected to affect the company either favorably or unfavorably. The research offers a complete understanding of the market for those investors wishing to invest. This report contains scenarios for the Structural Adhesives Market from the past and present, along with projected market numbers. Analysis of important competitors, including market leaders, followers, and new entrants, covers every aspect of the market. The research contains strategic profiles of the top market participants, a full examination of their key competencies, and their company-specific plans for the introduction of new products, growth, partnerships, joint ventures, and acquisitions. With its clear portrayal of competitive analysis of significant companies by product, pricing, financial condition, product portfolio, growth strategies, and regional presence in the domestic and local markets, the research acts as an investor's guide.To know about the Research Methodology:-Request Free Sample Report

Structural Adhesives Market Dynamics:

Market Drivers: Adhesives are in high demand for wind energy and building & construction applications. Demand for high-quality goods is growing as a result of the developing middle class, changing lifestyles, and growing living standards in China, India, and Mexico. New applications including exterior insulation systems, carpet adhesives, tiling adhesives, and wallpaper are fueling the demand for structural adhesives in the building industry. The main uses of construction adhesives are in panels, wallboard, and floor systems. These adhesives are used to prevent nail or screw head stains from appearing on the exterior of walls. Curtain wall panels and insulating glass modules are fixed in place using construction adhesives. The growth in population, urbanization and growing affluence in India and other developing nations like Brazil, China, Indonesia, and Vietnam is principally responsible for the increasing need for permanent, non-slum housing globally. Demand for structural adhesives in the aerospace industry The primary factors fueling market growth are the growing demand for adhesives in the construction and wind energy industries as well as the fast uptake of the product in the automotive sector. Additionally, the market for structural adhesives is being driven by urbanization and increased industrialization. Strong demand from numerous end-use industries as well as technological advancements further accelerate the growth rate of the structural adhesives market. The growing popularity of lightweight, low-carbon-emitting automobiles also has a significant impact on the market for structural adhesives. The market for automotive plastics products is being fueled by the growing trend toward lightweight materials. Aluminum and plastic are lightweight materials that help make cars lighter and increase fuel efficiency. The need for structural adhesive products is expected to increase owing to the adhesion requirements for materials such as steel & magnesium, steel & plastic, and others. Fabricating parts for different vehicles is necessary for items like glass attachments, enclosures, doors, body panels, and friction pads, among others. In non-traditional applications such as the engine, dashboard, frames, and weather stripping, there has also been an increase in demand. During the forecast period, growing vehicle manufacturing in Brazil, India, China, and Mexico is probably going to increase the demand in the Structural Adhesives Market. Market Restraints: Different adhesives have different restrictions due to their properties. Mechanical qualities and features vary across structural adhesives. Epoxies are utilized in rigid bonding because of their exceptionally high shear strength, polyurethane is used in slightly flexible bonding because of its great strength, and acrylic is used in rigid to slightly flexible bonding because of its exceptionally high impact and fatigue resistance. There are some restrictions on the properties of each type of glue. Therefore, the type of application determines the choice of adhesives. The kind of glue to employ depend on the substrate being bonded, the level of strength needed, the surrounding environment, and other factors. For instance, in the aerospace sector, materials that are to be used in the construction of aircraft must pass demanding and drawn-out certification procedures, and they call for a higher grade of adhesives that must withstand harsh environmental conditions and be heat resistant, tough, moisture-resistant, and so on. As a result, the restrictions attached to each adhesive prevent the use of a particular glue in a variety of applications. Market Opportunities: Demand for eco-friendly, sustainable, and non-hazardous structural adhesives is growing The need for green adhesives or those with low VOCs is developing as a result of the increasing demand for eco-friendly or green products in a variety of applications. Manufacturers have been forced to produce eco-friendly adhesives with low VOC levels by strict regulations from the USEPA (United States Environmental Protection Association), Europe's REACH (Registration, Evaluation, Authorization, and Restrictions of Chemicals), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities. A growing tendency for eco-friendly or green buildings is present in the structural adhesives market as a result of these regulatory rules, which presents a chance for the development of eco-friendly and sustainable adhesive solutions. These eco-friendly and health-friendly adhesive options are created from renewable, recycled, remanufactured, or biodegradable components. As the public becomes more aware and there are numerous health regulations to follow relating to non-hazardous production, environmental safety, and green and sustainable production of structural adhesives, major companies have also started devoting significant resources to research and development for the production of structural adhesives in a non-hazardous and sustainable manner to meet the terms of global sustainability trends. The structural adhesives market has a large potential opportunity as a result of this. Additionally, the market for structural adhesives benefits from growing government spending and untapped potential in emerging markets. Market Challenges: Insufficient market potential in developed countries Developed nations with the developed public, commercial, and transportation infrastructure include the US, Germany, the UK, Japan, and other Western European nations. As civil constructions are created to endure a lifetime, the developed infrastructure in these nations indicates minimal prospects for new construction operations. Manufacturers must create novel goods to win over emerging customers including those in the healthcare, agriculture, and food packaging sectors. As a result, maintaining and growing a firm is extremely difficult for manufacturers in mature markets.Structural Adhesives Market Segment Analysis:

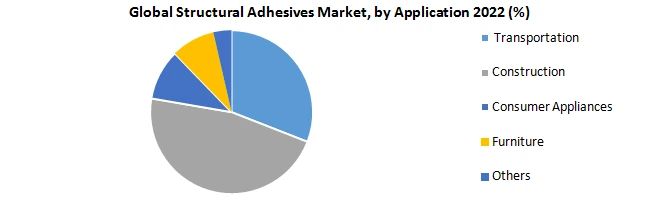

Based on Product, Urethanes segment is expected to grow at the highest CAGR during the forecast period. Products made of urethane have several uses in the construction and automotive industries for plastic bonding. Numerous end-use sectors are experiencing a constant growth in the need for plastics. Plastics Europe reports that manufacturing increased from 64.5 million tonnes in 2020 to 68.4 million tonnes in 2022. Cyanoacrylic products' attributes like low toxicity and quick setting time are expected to support the growing demand. These characteristics allow for their employment in products like consumer goods, industrial gear, domestic appliances, and medical devices. The aforementioned applications' high production output is expected to have a beneficial effect on the market.Based on Technology, the Water-based segment is expected to grow at the highest CAGR during the forecast period. Water-based compounds have many bonding applications in leather, wood, paper, and textiles and are inexpensive and eco-friendly. During the forecast year, the volume of products based on solvents is expected to increase at a CAGR of 6.7%. It is expected that the growing demand to reduce volatile organic compound (VOC) emissions during manufacturing hamper the market growth for these items. VOC emissions are strictly regulated by EPA and European Union law since they also negatively impact human health. Reactive technology adoption is growing, among other technologies, and this is helping the market. Reactive materials provide resistance to heat, chemicals, and moisture while forming a strong bond. During the forecast period, the market growth is expected to gain from products with increased durability and bond strength in harsh conditions. Based on Application, the Transportation segment is expected to grow at the highest CAGR during the forecast period. The rise of the shipbuilding, automobile, and aerospace industries is expected to result in profitable growth for transportation applications. Automobile manufacturers may find it easier to assemble vehicles if they use adhesives instead of fasteners. Additionally, fewer fasteners may enable vehicle weight to be reduced, which will increase fuel efficiency. Epoxy and polyester-based materials have expanded in application in the construction industry. One of the main factors driving the market is the population's increasing desire for homes. The adhesive is used in construction to combine materials including glass, solid concrete, metals, plastic, and oak, among others. Consumer appliances require materials that can endure high temperatures. Numerous appliances are also exposed to vibrations, heat, and wetness. Elastomeric materials can assist in resolving the aforementioned issues in appliances like cooktops and microwaves.

Structural Adhesives Market Regional Insights:

In 2022, Asia Pacific was the top-performing region, making up 50.4% of the total volume. India, China, and Southeast Asia's growing economies, populations, and industrial output are the region's main drivers of growth. China is expected to continue to be a significant consumer and producer in the area. Based on the production of automobiles in Germany, France, Italy, and Spain, Europe is expected to see a beneficial CAGR of 5.0% in terms of revenue during the forecast period. The region's growth is expected to be aided by growing bonding requirements for substrates like glass, plastics, metals, and composites used in the manufacturing of automobiles. In 2022, Central and South America made up 6.0% of the total volume. The growth of the industrial and construction industries in Brazil and Argentina is primarily responsible for the growth. Additionally, according to the UNCTAD 2020 study, the conclusion of a recession caused FDI inflows in Brazil and Argentina to rise by 12%.Structural Adhesives Market Scope :Inquire before buying

Global Structural Adhesives Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 16.97 Bn. Forecast Period 2023 to 2029 CAGR: 6.7 % Market Size in 2029: US $ 26.71 Bn. Segments Covered: by Product Urethanes Epoxy Acrylic Cyanoacrylic Others by Technology Water-based Solvent-based Others by Application Transportation Construction Consumer Appliances Furniture Others Structural Adhesives Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Structural Adhesives Market Key Players are:

1. 3M (US) 2. Huntsman International LLC (US) 3. Illinois Tool Works Inc. (US) 4. Arkema S.A. (France) 5. Bostik, Inc (US) 6. Permabond LLC. (US) 7. L&L Products (US) 8. Master Bond Inc (US) 9. Uniseal, Inc (US) 10.Dymax Corporation (US) 11.Hernon Manufacturing Inc.(US) 12.Parson Adhesives, Inc.(US) 13.Lord Corporation (US) 14.Dupont (US) 15.H.B. Fuller(US) 16.Acralock(US) 17.RS Industrial (US) 18.Hubei Huitian New Materials Co., Ltd.(China) 19.Scott Bader Company Ltd. (UK) 20.Bondloc (UK) 21.Forgeway Ltd (UK) 22.Delo Industrie Klebstoffe GmbH & Co. KGAA (Germany) 23.Weicon GmbH & Co. Kg (Germany) 24.Panacol-Elosol GmbH (Germany) 25.Henkel AG & Co. KGAA (Germany) 26.Riëd B.V. (Netherlands) 27.Sika AG (Switzerland) 28.Mapei S.P.A (Italy) Frequently Asked Questions: 1] What segments are covered in the Global Structural Adhesives Market report? Ans. The segments covered in the Structural Adhesives Market report are based on Product Technology, Application, and End User. 2] Which region is expected to hold the highest share in the Global Structural Adhesives Market? Ans. The Asia-pacific region is expected to hold the highest share in the Structural Adhesives Market. 3] What is the market size of the Global Structural Adhesives Market by 2029? Ans. The market size of the Structural Adhesives Market by 2029 is expected to reach US$ 26.71 Bn. 4] What is the forecast period for the Global Structural Adhesives Market? Ans. The forecast period for the Structural Adhesives Market is 2023-2029. 5] What was the market size of the Global Structural Adhesives Market in 2022? Ans. The market size of the Structural Adhesives Market in 2022 was valued at US$ 16.97 Bn.

1. Global Structural Adhesives Market Size: Research Methodology 2. Global Structural Adhesives Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Structural Adhesives Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Structural Adhesives Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Structural Adhesives Market Size Segmentation 4.1. Global Structural Adhesives Market Size, by Product (2022-2029) • Urethanes • Epoxy • Acrylic • Cyanoacrylic • Others 4.2. Global Structural Adhesives Market Size, by Technology (2022-2029) • Water-based • Solvent-based • Others 4.3. Global Structural Adhesives Market Size, by Application (2022-2029) • Transportation • Construction • Consumer Appliances • Furniture • Others 5. North America Structural Adhesives Market (2022-2029) 5.1. North America Structural Adhesives Market Size, by Product (2022-2029) • Urethanes • Epoxy • Acrylic • Cyanoacrylic • Others 5.2. North America Structural Adhesives Market Size, by Technology (2022-2029) • Water-based • Solvent-based • Others 5.3. North America Structural Adhesives Market Size, by Application (2022-2029) • Transportation • Construction • Consumer Appliances • Furniture • Others 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Structural Adhesives Market (2022-2029) 6.1. European Structural Adhesives Market , by Product (2022-2029) 6.2. European Structural Adhesives Market , by Technology (2022-2029) 6.3. European Structural Adhesives Market , by Application (2022-2029) 6.4. European Structural Adhesives Market , by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Structural Adhesives Market (2022-2029) 7.1. Asia Pacific Structural Adhesives Market , by Product (2022-2029) 7.2. Asia Pacific Structural Adhesives Market , by Technology (2022-2029) 7.3. Asia Pacific Structural Adhesives Market , by Application (2022-2029) 7.4. Asia Pacific Structural Adhesives Market , by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Structural Adhesives Market (2022-2029) 8.1. Middle East and Africa Structural Adhesives Market , by Product (2022-2029) 8.2. Middle East and Africa Structural Adhesives Market , by Technology (2022-2029) 8.3. Middle East and Africa Structural Adhesives Market , by Application (2022-2029) 8.4. Middle East and Africa Structural Adhesives Market , by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Structural Adhesives Market (2022-2029) 9.1. South America Structural Adhesives Market, by Product (2022-2029) 9.2. South America Structural Adhesives Market, by Technology (2022-2029) 9.3. South America Structural Adhesives Market , by Application (2022-2029) 9.4. South America Structural Adhesives Market , by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. 3M (US) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Huntsman International LLC (US) 10.3. Illinois Tool Works Inc. (US) 10.4. Arkema S.A. (France) 10.5. Bostik, Inc (US) 10.6. Permabond LLC. (US) 10.7. L&L Products (US) 10.8. Master Bond Inc (US) 10.9. Uniseal, Inc (US) 10.10. Dymax Corporation (US) 10.11. Hernon Manufacturing Inc.(US) 10.12. Parson Adhesives, Inc.(US) 10.13. Lord Corporation (US) 10.14. Dupont (US) 10.15. H.B. Fuller (US) 10.16. Acralock(US) 10.17. RS Industrial (US) 10.18. Hubei Huitian New Materials Co., Ltd.(China) 10.19. Scott Bader Company Ltd. (UK) 10.20. Bondloc (UK) 10.21. Forgeway Ltd (UK) 10.22. Delo Industrie Klebstoffe GmbH & Co. KGAA (Germany) 10.23. Weicon GmbH & Co. Kg (Germany) 10.24. Panacol-Elosol GmbH (Germany) 10.25. Henkel AG & Co. KGAA (Germany) 10.26. Riëd B.V. (Netherlands) 10.27. Sika AG (Switzerland) 10.28. Mapei S.P.A (Italy)