Global Stretch Films Market size was valued at USD 5.1 Bn. in 2024 and the total Global Stretch Films Market revenue is expected to grow at a CAGR of 5.6% from 2025 to 2032, reaching nearly USD 7.89 Bn. by 2032.Global Stretch Films Market Overview

Stretch Films is a highly stretchable plastic film, usually made from polyethylene, which is used to tightly bind and secure items, especially for shipping and storage. The global stretch film market growth has been driven by increasing e-commerce platforms, growth in global logistics and transportation networks and growing demand for cost-effective packaging material. Additionally, the market is supported by the growth of food packaging needs and the development of advanced polymorphic films with advanced durability and performance. The push for automation in packaging processes is also increasing the demand for machine stretch films. North America dominated the global stretch film market in 2024 due to strong retail and food sectors, high adoption of automated pallet wrapping systems and mature packaging industry. Top key players of global stretch film market are Berry Global Inc., Amcor Plc, Sigma Plastics Group, Intertape Polymer Group, and AEP Industries. These companies mainly focus on film design, including downgauging, improved recyclability, and compatibility with high-speed wrapping equipment. They are also investing in the initiative of a circular economy and discovering biodegradable and compostable options to align with global stability goals and future regulatory requirements. Report covers the global stretch films market dynamics, structure by analyzing the market segments and projecting global stretch films market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies and regional presence in global stretch films market.To know about the Research Methodology :- Request Free Sample Report To know about the Research Methodology 78 million metric tons of plastic packaging are generated per year, with the vast majority following linear materials like PP, LDPE, HDPE, Etc. The commercial film alone contributes around 3 million metric tons annually in Europe and the US. In 2023, more than 76.98% of the stretch film was made via cast film and more than 83% of all the stretch film sold (cast and blown). The total machine wrap stretch film represented nearly 2.68 billion lb. i.e. 56 % of the Stretch Films Market. The hand-held stretch film represented about 40% of the Stretch Films Market in 2023, and stretch hood film represented about 2%. The stretch hood segment is expected to have the fastest growth of any stretch film product segment. Growth is determined by increased investment in hooding machinery that allows companies to package or wrap tiles and bricks, appliances, roofing material, and bulk warehouse packaging. PE materials with PP resin is a common blend of stretch film containing 5% to 25% LDPE resin with 75.0% to 95.0% representing LLDPE-butene, LLDPE-hexene, LLDPE-super hexene, LLDPE-octene, or mLLDPE resins. LDPE/LLDPE resin blends exhibit good clarity and a higher tendency to elongate under load, due to their lower degree of crystallinity and resultant modulus and PE resin consumption totaling 1.928 billion lb. 1. For instance, Scientex Packaging is currently spending USD 43 million to open its second stretch film manufacturing plant in Lancaster, S.C. in 2021. Stretch wrap is used to secure loads to pallets so that products can be transported safely. It performs well and is cost-effective, but it is also generally discarded after use, with only 21 % recycled in the US and 30 % in Europe, which adds restraint to the market. They estimated that at least 20% of total stretch film packaging could be replaced by reusable systems. Hand-applied films with a 45% market share, are mostly used for smaller operations, mixed pallets, and non-uniform pallets. These films are stretched ~30% in use and are typically the thickest of the three. Machine-applied films with a 55% market share are used on high-volume operations and uniform stretch film. They offer high efficiency but also involve higher costs. The global Stretch Films Market is expected to witness stable and healthy growth in 2024 driven by several key dynamics the Focus on Sustainability trend is pushing manufacturers to develop bio-based stretch films and recyclable options and restraints like the economic conditions may negatively impact our business operations and financial results. The many listed key players are mentioned in the report Berry Global, Dow, Anchor Packaging, and others.

Stretch Films Market Dynamics:

Innovation and Sustainability to Drive Growth in the Stretch Films Market As a leading materials science company, unique opportunity to contribute to more sustainable solutions for people and the global. To protect the climate, decarbonize and grow, advance a circular economy, cultivate a thriving team and community, and drive accountability and best-in-class performance. These environmental, social, and governance priorities are key to creating long-term value for key players, shareholders, and society. The Stretch Films Market is experiencing a robust driver fueled by a heightened emphasis on sustainability within the packaging industry. The growing awareness of environmental concerns and a pronounced focus on sustainable practices are instrumental in drives the demand for eco-friendly packaging solutions. The significant trend is particularly in the increasing adoption of stretch films made from recycled materials or bio-based polymers. High-performance films cater to industries demanding superior strength and durability, anti-static films serve sectors where static electricity control is crucial, and films with enhanced puncture resistance are tailored to applications requiring robust protective packaging. The Stretch Films Market is experiencing steady growth fueled by a potent combination of ongoing technological advancements and a growing focus on sustainability. Manufacturers are continuously pushing the boundaries of stretch film technology, developing high-performance films and anti-static films that address specific industry needs and improve overall packaging efficiency. Additionally, growing environmental concerns and a shift towards sustainable practices are driving the demand for eco-friendly packaging solutions. Global Economic Conditions to Impact Stretch Films Market Growth The Stretch Films Market faces potential constraints due to the main global economic conditions that adversely affect business operations and financial outcomes. Factors such as challenging global conditions, including inflation and military conflicts, pose risks to the market. In times of economic uncertainty, customers may defer, reduce, or cancel purchases, leading to delays or defaults in payments. Additionally, challenges in the supply chain, such as suppliers struggling to fulfill orders and distributors facing difficulties in product delivery, can impede the market's ability to meet customer demands, resulting in potential business loss. The weakened global economic conditions bring about unfavorable shifts in product prices, product mix, and profit margins within the Stretch Films Market. While proactive measures, including pricing actions and productivity programs, are applied to mitigate the impact of inflation, there is no guarantee of their full effectiveness. A time lag between implementing mitigating actions and experiencing the challenges could exist, and there's uncertainty regarding the complete success of these measures in offsetting negative impacts. Political volatility adds a layer of complexity, contributing to economic uncertainties and regulatory instability in the market's operational regions. Potential unrest and policy changes may have adverse effects on the financial condition of the Stretch Films Market. The Stretch Films Market is thus subject to potential restraints arising from a combination of economic, supply chain, and geopolitical challenges.Stretch Films Market Segment Analysis

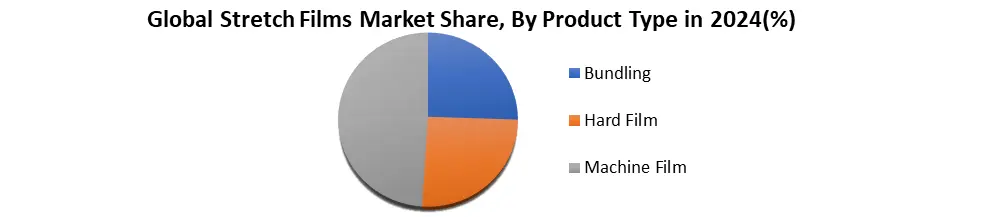

Based on product, the global stretch film market is segmented into bundling stretch film, hand stretch film and machine stretch film. Machine stretch film dominated the market and held largest market share in 2024. The dominance is due to rapid growth of large-scale logistics, e-commerce and manufacturing sectors which require high speed and automated packaging systems. Machine stretch films offer superior load stability, lower material usage per pallet, and reduced labor costs, making them the preferred choice for high-volume operations. For this factor, the machine stretch film is expected to continue growing during the forecast period.

Global Stretch Films Market Regional Insights:

In the global Stretch Films Market, North America held a significant 35% market share in 2024 and maintains its prominence. The dominance is attributed to evolving consumer preferences characterized by a burgeoning young population and shifts in buying patterns, with the rise of hypermarkets and supermarkets fueling the demand for secure and convenient packaging solutions, such as stretch film packs. The popularity of large format stores and the increasing trend of bulk buying, particularly in the beverage sector, drive the need for efficient multipack packaging solutions, further elevating the demand for Stretch Films Market. ME&A and the South America region are expected to see moderate growth due to increasing investment in infrastructure and development projects, leading to a rise in the demand for packaged goods and subsequently, stretch film. Global Stretch Films Market Competitive Landscape Top key players in the global stretch film market include Berry Global Inc., Amcor Plc, Sigma Plastics Group, Intertape Polymer Group, and AEP Industries. These players focus on filmmaking, multi-layer extrusion technology and innovation in the advancement of durable and high-performance packaging materials. Berry Global Inc. is a leader in stretch film innovation and it has a broad portfolio of machine, hand, and specialty films. The company emphasizes downgauging, sustainability, and automation-ready solutions. The company invests in circular economy initiatives by growing its range of recyclable and recycled-content films to meet global demand for eco-friendly packaging. Amcor Plc, known for its global manufacturing footprint, focuses on high-clarity and performance stretch films tailored for food, healthcare, and industrial packaging. Amcor is also at the lead of stability in packaging, developing bio-based and compostable stretch film options. Global Stretch Films Market Trends • Down-Gauging & High-Performance Films Companies are focusing on ultra-thin yet strong films to reduce plastic usage and cost. Advanced polymer blends, co-extruded multilayer structures, and nano-enhancements allow films to maintain high tear and puncture resistance despite reduced thickness. • Pre-Stretched & Machine-Specific Films Pre-stretched films, produced under tension during manufacturing, save material and improve load control. Additionally, machine stretch films are optimized for automated wrappers, allowing consistent tension and better efficiency in high-speed logistics environments. • Smart & Connected Stretch Films Stretch films integrated with RFID, sensors, or printed electronics are gaining traction. This “smart film” technology enables real-time tracking of load integrity, temperature, and location, significantly enhancing supply-chain visibility. Global Stretch Films Market Recent Development • On June 10, 2024, Sigma Plastics Group (Sigma Stretch Film) acquired the Midland, Georgia facility (formerly Zummit Plastics), including three cast film extrusion lines and 125,000 sq ft of capacity, marking its eighth stretch film plant and expanding its North American footprint. • On April 30, 2025, Amcor Plc finalized the acquisition of Berry Global Inc., strengthening its position in the stretch film market by integrating Berry’s advanced sustainable film technologies and global production capabilities. • On February 17, 2025, Berry Global Inc. launched its Bontite Sustane stretch film, featuring 30% post-consumer recycled (PCR) content, designed to deliver high load stability and puncture resistance while supporting circular economy initiatives. • On February 13, 2024, Berry Global Inc. inaugurated its Circular Innovation and Training Center in Tulsa, Oklahoma, a 12,000 sq ft facility focused on sustainable film development, performance testing, and distributor education.Stretch Films Market Scope: Inquire before buying

Stretch Films Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 5.1 Bn. Forecast Period 2025 to 2032 CAGR: 5.6% Market Size in 2032: USD 7.89 Bn. Segments Covered: by Material High-Density Polyethylene (HDPE) Low-Density Polyethylene (LDPE) Polyvinyl Chloride (PVC) Polypropylene (PP) by Product Type Bundling Stretch Film Hand Stretch Film Machine Stretch Film by End-user Constructions Food and Beverages Pharmaceutical Consumer Product Others Global Stretch Film Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of MEA) South America (Brazil, Argentina Rest of South America)Global Stretch Film Market Key Players

North America 1. Anchor Packaging (United States) 2. Berry Plastics (United States) 3. AEP Industries Inc. (United States) 4. Sealed Air Corporation (North Carolina, United States) 5. Intertape Polymer Group Inc. (Florida, United States) 6. Bemis Company Inc. (United States) 7. Dow Chemical Company (United States) 8. ePac Flexible Packaging (Austin, Texas, United States) 9. Sigma Plastics Group (Lyndhurst, United States) 10. Transcontinental Inc. (Canada) Europe 11. Emsur, Macdonell SA (Spain) 12. Clondalkin Group Holdings BV (Netherlands) 13. DUO PLAST AG (Germany) 14. Eurofilms extrusion (United Kingdom) 15. Deriblok (Italy) 16. Flexible Packaging Europe (FPE) (Germany) 17. Klockner Pentaplast Group (United Kingdom) 18. Amcor PLC (Zurich, Switzerland) Asia Pacific 19. Scientex Berhad (Malaysia) 20. EB Packaging Sdn. Bhd. (Malaysia) 21. CY Intertrade Sdn. Bhd. (Malaysia) 22. MMP Corporation Ltd. (Thailand) 23. Radha Madhav Corporation Limited (India) 24. SRF Limited (India) 25. Polyplex Corporation Ltd. (India) 26. Mitsubishi Plastics (Mitsubishi Chemical Group) (Japan) 27. Dongguan Zhiteng Plastic Product Co., Ltd. (China)FAQs:

1. Which region has the largest share in the Stretch Films Market? Ans: The North America region held the highest share in 2024 in the Stretch Films Market. 2. What are the key factors driving the growth of the Stretch Films Market? Ans: Innovation and Sustainability to driving Stretch Films Market Growth. 3. Who are the key competitors in the Stretch Films Market? Ans: Berry Global Inc., Amcor Plc, Sigma Plastics Group, Intertape Polymer Group, and AEP Industries. are the key competitors in the Stretch Films Market. 4. What are the opportunities for the Stretch Films Market? Ans: Increase in E-commerce and Retail Logistics creates opportunities in the Stretch Films Market. 5. Which product type segment dominates the Stretch Films Market? Ans: The machine stretches film segment dominated the Stretch Films Market in 2024.

1. Stretch Films Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Stretch Films Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Stretch Films Market: Dynamics 3.1. Region wise Trends of Stretch Films Market 3.1.1. North America Stretch Films Market Trends 3.1.2. Europe Stretch Films Market Trends 3.1.3. Asia Pacific Stretch Films Market Trends 3.1.4. Middle East and Africa Stretch Films Market Trends 3.1.5. South America Stretch Films Market Trends 3.2. Stretch Films Market Dynamics 3.2.1. Stretch Films Market Drivers 3.2.1.1. Growth in E-commerce & Retail Logistics 3.2.1.2. Rising Demand for Sustainable Packaging 3.2.2. Stretch Films Market Restraints 3.2.3. Stretch Films Market Opportunities 3.2.3.1. Sustainable & Recyclable Film Development 3.2.3.2. Automation-Compatible Film Demand 3.2.4. Stretch Films Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government regulations on plastic use and waste 3.4.2. Trade policies affecting raw material imports/exports 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Stretch Films Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 4.1. Stretch Films Market Size and Forecast, By Material (2024-2032) 4.1.1. High-Density Polyethylene (HDPE) 4.1.2. Low-Density Polyethylene (LDPE) 4.1.3. Polyvinyl Chloride (PVC) 4.1.4. Polypropylene (PP) 4.2. Stretch Films Market Size and Forecast, By Product Type (2024-2032) 4.2.1. Bundling Stretch Film 4.2.2. Hand Stretch Film 4.2.3. Machine Stretch Film 4.3. Stretch Films Market Size and Forecast, By End-user (2024-2032) 4.3.1. Constructions 4.3.2. Food and Beverages 4.3.3. Pharmaceutical 4.3.4. Consumer Product 4.3.5. Others 4.4. Stretch Films Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Stretch Films Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 5.1. North America Stretch Films Market Size and Forecast, By Material (2024-2032) 5.1.1. High-Density Polyethylene (HDPE) 5.1.2. Low-Density Polyethylene (LDPE) 5.1.3. Polyvinyl Chloride (PVC) 5.1.4. Polypropylene (PP) 5.2. North America Stretch Films Market Size and Forecast, By Product Type (2024-2032) 5.2.1. Bundling Stretch Film 5.2.2. Hand Stretch Film 5.2.3. Machine Stretch Film 5.3. North America Stretch Films Market Size and Forecast, By End-user (2024-2032) 5.3.1. Constructions 5.3.2. Food and Beverages 5.3.3. Pharmaceutical 5.3.4. Consumer Product 5.3.5. Others 5.4. North America Stretch Films Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Stretch Films Market Size and Forecast, By Material (2024-2032) 5.4.1.1.1. High-Density Polyethylene (HDPE) 5.4.1.1.2. Low-Density Polyethylene (LDPE) 5.4.1.1.3. Polyvinyl Chloride (PVC) 5.4.1.1.4. Polypropylene (PP) 5.4.1.2. United States Stretch Films Market Size and Forecast, By Product Type (2024-2032) 5.4.1.2.1. Bundling Stretch Film 5.4.1.2.2. Hand Stretch Film 5.4.1.2.3. Machine Stretch Film 5.4.1.3. Others United States Stretch Films Market Size and Forecast, By End-user (2024-2032) 5.4.1.3.1. Constructions 5.4.1.3.2. Food and Beverages 5.4.1.3.3. Pharmaceutical 5.4.1.3.4. Consumer Product 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Stretch Films Market Size and Forecast, By Material (2024-2032) 5.4.2.1.1. High-Density Polyethylene (HDPE) 5.4.2.1.2. Low-Density Polyethylene (LDPE) 5.4.2.1.3. Polyvinyl Chloride (PVC) 5.4.2.1.4. Polypropylene (PP) 5.4.2.2. Canada Stretch Films Market Size and Forecast, By Product Type (2024-2032) 5.4.2.2.1. Bundling Stretch Film 5.4.2.2.2. Hand Stretch Film 5.4.2.2.3. Machine Stretch Film 5.4.2.3. Canada Stretch Films Market Size and Forecast, By End-user (2024-2032) 5.4.2.3.1. Constructions 5.4.2.3.2. Food and Beverages 5.4.2.3.3. Pharmaceutical 5.4.2.3.4. Consumer Product 5.4.2.3.5. Others 5.4.2.4. Mexico Stretch Films Market Size and Forecast, By Material (2024-2032) 5.4.2.4.1. High-Density Polyethylene (HDPE) 5.4.2.4.2. Low-Density Polyethylene (LDPE) 5.4.2.4.3. Polyvinyl Chloride (PVC) 5.4.2.4.4. Polypropylene (PP) 5.4.2.5. Mexico Stretch Films Market Size and Forecast, By Product Type (2024-2032) 5.4.2.5.1. Bundling Stretch Film 5.4.2.5.2. Hand Stretch Film 5.4.2.5.3. Machine Stretch Film 5.4.2.6. Mexico Stretch Films Market Size and Forecast, By End-user (2024-2032) 5.4.2.6.1. Constructions 5.4.2.6.2. Food and Beverages 5.4.2.6.3. Pharmaceutical 5.4.2.6.4. Consumer Product 5.4.2.6.5. Others 6. Europe Stretch Films Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 6.1. Europe Stretch Films Market Size and Forecast, By Material (2024-2032) 6.2. Europe Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.3. Europe Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4. Europe Stretch Films Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.1.2. United Kingdom Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.1.3. United Kingdom Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4.2. France 6.4.2.1. France Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.2.2. France Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.2.3. France Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.3.2. Germany Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.3.3. Germany Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.4.2. Italy Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.4.3. Italy Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.5.2. Spain Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.5.3. Spain Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.6.2. Sweden Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.6.3. Sweden Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.7.2. Austria Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.7.3. Austria Stretch Films Market Size and Forecast, By End-user (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Stretch Films Market Size and Forecast, By Material (2024-2032) 6.4.8.2. Rest of Europe Stretch Films Market Size and Forecast, By Product Type (2024-2032) 6.4.8.3. Rest of Europe Stretch Films Market Size and Forecast, By End-user (2024-2032) 7. Asia Pacific Stretch Films Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 7.1. Asia Pacific Stretch Films Market Size and Forecast, By Material (2024-2032) 7.2. Asia Pacific Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.3. Asia Pacific Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4. Asia Pacific Stretch Films Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.1.2. China Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.1.3. China Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.2.2. S Korea Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.2.3. S Korea Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.3.2. Japan Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.3.3. Japan Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.4. India 7.4.4.1. India Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.4.2. India Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.4.3. India Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.5.2. Australia Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.5.3. Australia Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.6.2. Indonesia Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.6.3. Indonesia Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.7.2. Philippines Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.7.3. Philippines Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.8.2. Malaysia Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.8.3. Malaysia Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.9.2. Vietnam Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.9.3. Vietnam Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.10.2. Thailand Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.10.3. Thailand Stretch Films Market Size and Forecast, By End-user (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Stretch Films Market Size and Forecast, By Material (2024-2032) 7.4.11.2. Rest of Asia Pacific Stretch Films Market Size and Forecast, By Product Type (2024-2032) 7.4.11.3. Rest of Asia Pacific Stretch Films Market Size and Forecast, By End-user (2024-2032) 8. Middle East and Africa Stretch Films Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 8.1. Middle East and Africa Stretch Films Market Size and Forecast, By Material (2024-2032) 8.2. Middle East and Africa Stretch Films Market Size and Forecast, By Product Type (2024-2032) 8.3. Middle East and Africa Stretch Films Market Size and Forecast, By End-user (2024-2032) 8.4. Middle East and Africa Stretch Films Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Stretch Films Market Size and Forecast, By Material (2024-2032) 8.4.1.2. South Africa Stretch Films Market Size and Forecast, By Product Type (2024-2032) 8.4.1.3. South Africa Stretch Films Market Size and Forecast, By End-user (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Stretch Films Market Size and Forecast, By Material (2024-2032) 8.4.2.2. GCC Stretch Films Market Size and Forecast, By Product Type (2024-2032) 8.4.2.3. GCC Stretch Films Market Size and Forecast, By End-user (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Stretch Films Market Size and Forecast, By Material (2024-2032) 8.4.3.2. Nigeria Stretch Films Market Size and Forecast, By Product Type (2024-2032) 8.4.3.3. Nigeria Stretch Films Market Size and Forecast, By End-user (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Stretch Films Market Size and Forecast, By Material (2024-2032) 8.4.4.2. Rest of ME&A Stretch Films Market Size and Forecast, By Product Type (2024-2032) 8.4.4.3. Rest of ME&A Stretch Films Market Size and Forecast, By End-user (2024-2032) 9. South America Stretch Films Market Size and Forecast by Segmentation (by Value in USD Bn.) (2024-2032) 9.1. South America Stretch Films Market Size and Forecast, By Material (2024-2032) 9.2. South America Stretch Films Market Size and Forecast, By Product Type (2024-2032) 9.3. South America Stretch Films Market Size and Forecast, By End-user (2024-2032) 9.4. South America Stretch Films Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Stretch Films Market Size and Forecast, By Material (2024-2032) 9.4.1.2. Brazil Stretch Films Market Size and Forecast, By Product Type (2024-2032) 9.4.1.3. Brazil Stretch Films Market Size and Forecast, By End-user (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Stretch Films Market Size and Forecast, By Material (2024-2032) 9.4.2.2. Argentina Stretch Films Market Size and Forecast, By Product Type (2024-2032) 9.4.2.3. Argentina Stretch Films Market Size and Forecast, By End-user (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Stretch Films Market Size and Forecast, By Material (2024-2032) 9.4.3.2. Rest of South America Stretch Films Market Size and Forecast, By Product Type (2024-2032) 9.4.3.3. Rest of South America Stretch Films Market Size and Forecast, By End-user (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1 Anchor Packaging (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2 Berry Plastics (United States) 10.3 AEP Industries Inc. (United States) 10.4 Sealed Air Corporation (North Carolina, United States) 10.5 Intertape Polymer Group Inc. (Florida, United States) 10.6 Bemis Company Inc. (United States) 10.7 Dow Chemical Company (United States) 10.8 ePac Flexible Packaging (Austin, Texas, United States) 10.9 Sigma Plastics Group (Lyndhurst, United States) 10.10 Transcontinental Inc. (Canada) 10.11 Emsur, Macdonell SA (Spain) 10.12 Clondalkin Group Holdings BV (Netherlands) 10.13 DUO PLAST AG (Germany) 10.14 Eurofilms extrusion (United Kingdom) 10.15 Deriblok (Italy) 10.16 Flexible Packaging Europe (FPE) (Germany) 10.17 Klockner Pentaplast Group (United Kingdom) 10.18 Amcor PLC (Zurich, Switzerland) 10.19 Scientex Berhad (Malaysia) 10.20 EB Packaging Sdn. Bhd. (Malaysia) 10.21 CY Intertrade Sdn. Bhd. (Malaysia) 10.22 MMP Corporation Ltd. (MMP Packaging Group) (Thailand) 10.23 Radha Madhav Corporation Limited (India) 10.24 SRF Limited (India) 10.25 Polyplex Corporation Ltd. (India) 10.26 Mitsubishi Plastics (Mitsubishi Chemical Group) (Japan) 10.27 Dongguan Zhiteng Plastic Product Co., Ltd. (China) 10 Key Findings 11 Analyst Recommendations 12 Stretch Films Market: Research Methodology