The Starch Market size was valued at USD 65.02 Billion in 2025, and the total revenue is expected to grow at CAGR of 5.7 % from 2026 to 2032, reaching nearly USD 95.85 Billion. The MMR report provides an in-depth analysis of the global Starch Market, covering key aspects such as production dynamics, raw material and agricultural dependency risks, regional pricing and profitability trends, evolving end-use demand patterns, customer procurement behavior, and technological and process innovations. It further examines global trade flows, supply chain resilience, capacity expansion and capital investment trends, sustainability and ESG considerations, and the regulatory, certification, and compliance landscape across key regions, providing a holistic view of market performance and future outlook.Starch Market Overview

The starch market has been witnessing significant growth owing to the increasing demand for starch in various industries such as food and beverages, pharmaceuticals, and textiles. The research objective of the starch market is to provide insights into the market size, growth rate, market share, and competitive landscape. This involves conducting both quantitative and qualitative research to analyze factors such as market trends, consumer preferences, and the competitive environment. Manufacturers are focusing on product innovation and expanding their product portfolios to meet the growing demand for starch. A report on the starch market includes an analysis of the market drivers, restraints, opportunities, and challenges. It also provides a comprehensive overview of the competitive landscape, including the market share of key players and their strategic initiatives. The report also includes insights into the regulatory landscape and its impact on the market. Quantitative research involves analyzing market data such as revenue, sales volume, and market share, while qualitative research would involve gathering insights from industry experts and stakeholders. In the Asia Pacific region, the starch market actively experiencing robust growth owing to the increasing population and rising disposable income. The region is witnessing a shift in consumer preferences towards natural and organic products, which is driving the demand for starch. Manufacturers in the region are focusing on expanding their production capacities to meet the growing demand. The starch market in Asia Pacific is also benefiting from the growing food and beverage industry in countries such as China and India. • World exports most of its Starch powder to Vietnam, United States and United Arab Emirates • The top 3 exporters of Starch powder in India with 14,302 shipments followed by Netherlands with 5,131 and Germany at the 3rd spot with 3,219 shipments.To know about the Research Methodology :- Request Free Sample Report

Dynamic Growth of the Starch Market

Growing Awareness of the Health Benefits of Starch Consumption The growing awareness of the health benefits associated with starch consumption is driving significant changes in the food industry. Starch, known for its versatile applications in food products, is increasingly recognized for its role in providing energy, promoting digestive health, and aiding in weight management. As consumers become more health-conscious, there is a rising demand for products with natural and functional ingredients like starch. This trend has led to a surge in sales volume for starch-based products, boosting the profit margins of companies operating in this sector. Food manufacturers are now focusing on developing innovative products that cater to this demand, further driving the growth of the starch market.• Canada and the United States are the two countries in North America with the highest consumption of wheat and potato goods. • In 2021, Belarus ranked the highest in potato consumption per capita with 155 kg followed by Ukraine and Kyrgyzstan. On the other end of the scale was South Sudan with 0.130 kg, Central African Republic with 0.150 kg, and Sierra Leone with 0.310 kg.

Increasing use of Starch in Various Industries such as Food and Beverage, Pharmaceuticals and Cosmetics. The growth of the e-commerce industry business has resulted in significant changes in customer purchasing and the shift of business from the physical store to the online store. The increased use of starch in various industries such as food and beverage, pharmaceuticals, and cosmetics is significantly impacting the global starch market. Starch, known for its functional properties, is being utilized as a key ingredient in a wide range of products in these industries. In the food and beverage sector, starch is used as a thickening agent, stabilizer, and texture enhancer, driving its market volume. Similarly, in the pharmaceutical industry, starch is used in tablet formulations and as a binder in drug manufacturing, further contributing to market growth. In cosmetics, starch is used in formulations for its absorbent properties and as a natural ingredient, fueling its adoption in the industry. This trend is expected to continue driving the growth of the starch market as industries increasingly recognize the value of starch in product development.Limited availability of Raw Materials, Environmental Concerns Related to the Production of Starch The starch industry faces challenges owing to limited raw material availability and environmental concerns. Variations in crop yields can impact the availability of raw materials, leading to supply chain disruptions and increased production costs. The environmental impact of starch production, including greenhouse gas emissions and water usage, has raised concerns about sustainability. To address these issues, sustainable sourcing strategies, environmentally friendly production processes, and exploring alternative raw materials are needed. Failure to do so could hinder the industry's growth and limit its ability to meet demand for starch-based products.

Market Trends of the Global Starch Market

The starch market is expected to be shaped by food brands and brands, with starch being used in various food products such as breads, soups, puddings, pies, meat products, and sauces. The demand for starch is increasing due to changing consumer preferences from fresh roots to processed, value-added food products. The bakery industry is emerging in the market, with developing African countries experiencing significant penetration for baked food products. Starch manufacturers are targeting bakery and convenience food manufacturers to gain market share. Non-food applications of starch include adhesive, paper, and pharmaceuticals. Table 1. Functions and applications of starch in food

Function Food Applications Adhesion Battered and breaded foods Binding Formed meat, snack seasonings Clouding Beverages Crisping Fried and baked foods, snacks Dusting Chewing gum, bakery products Emulsion stabilization Beverages, creamers Encapsulation Flavors, beverage clouds Expansion Snacks, cereals Fat replacement Ice cream, salad dressings, spreads Foam stabilization Marshmallows Starch Market Segment Analysis

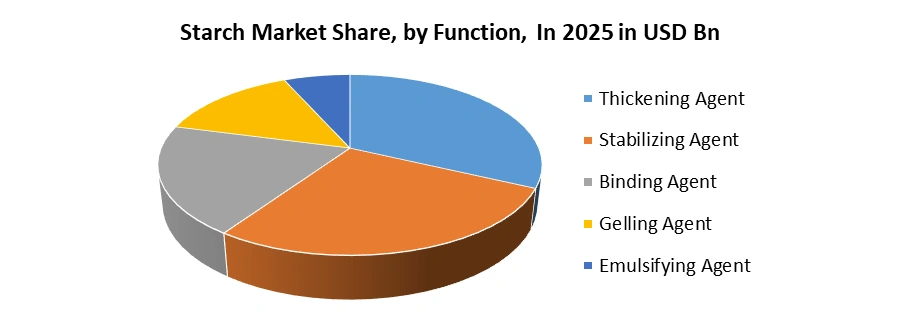

Based on Source, in 2025, corn-based starch dominates the global starch market in value terms, driven by its wide availability, cost efficiency, and extensive use across food processing, sweeteners, paper, and bio-based applications. Wheat starch follows, supported by strong demand from bakery, confectionery, and pharmaceutical excipients, particularly in Europe. Potato starch holds a moderate share, benefiting from its superior thickening properties and clean-label positioning in food and specialty industrial uses. Tapioca starch continues to gain traction due to rising preference for gluten-free and non-GMO ingredients, especially in Asia Pacific and food applications. Other sources, including rice and sorghum, represent a smaller but niche segment, mainly serving specialized food, cosmetic, and pharmaceutical applications. Based on Function, in 2025, thickening agents account for the largest share of the starch market, driven by extensive use in soups, sauces, dairy products, and processed foods to improve texture and viscosity. Stabilizing agents follow, supported by growing demand from ready-to-eat foods and beverages to maintain consistency and shelf life. Binding agents hold a steady share, widely used in bakery, meat processing, and pharmaceutical formulations for structural integrity. Gelling agents show moderate growth, particularly in confectionery, desserts, and specialty food applications requiring specific mouthfeel. Emulsifying agents represent a smaller but growing segment, driven by increasing use in sauces, dressings, and convenience foods requiring uniform phase dispersion.

Starch Market Regional Insights

North America dominates the starch market, accounting for a significant share of global production and consumption. The region's dominance is driven by factors such as the presence of major manufacturers, advanced technological capabilities, and a well-established value chain. North American countries are key players in the import and export of starch products, contributing to the region's strong position in the global market. The region's advanced infrastructure and logistics network facilitate efficient transportation and distribution of starch products, further strengthening its position in the market. Examples of companies operating in the starch market in North America include Cargill, Ingredion Incorporated, and Archer Daniels Midland Company (ADM). These companies have a strong presence in the region and are known for their high-quality starch products. They play a crucial role in the region's starch value chain, from sourcing raw materials to manufacturing and distribution. Their innovative products and customer-focused approach have helped them maintain a competitive edge in the market. Europe is considered a mature region for the starch market, with well-established infrastructure and a long history of starch production. The region's starch market has reached a level of maturity characterized by stable growth rates, established market players, and a high degree of market penetration. Despite being a mature market, Europe continues to be a key player in the global starch market, driven by factors such as technological advancements, sustainable production practices, and a strong focus on research and development. The region's mature market status provides a stable foundation for continued growth and innovation in the starch industry.• United Kingdom exports most of its Starch powder to Netherlands, France and Ireland. • The top 3 exporters of Starch powder are India with 14,302 shipments followed by Netherlands with 5,131 and Germany at the 3rd spot with 3,219 shipments.

Starch Market Competitive Landscapes

The starch market is highly competitive, with major companies like Cargill Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères S.A., AGRANA Beteiligungs-AG, Grain Processing Corporation, Beneo GmbH, and MGP Ingredients, Inc. engaging in mergers, acquisitions, product innovations, partnerships, and expansions to strengthen their market position. Regional players cater to specific geographical markets, and factors like pricing strategies, distribution networks, and technological advancements shape the market. Companies are focusing on enhancing production capacities, improving product quality, and expanding their market presence. • Jan 10th, 2022, Ramping up its Research & Development (R&D) focus, Cargill today opened the Cargill Innovation Center in Gurugram, Haryana, to develop innovative solutions that address food and beverage (F&B) market trends. Cargill will partner with its F&B customers in India to identify consumer demands, translate global industry trends into local application and accelerate customer product innovation pipelines by co-developing healthy, nutritious food options for consumers. • July 22, 2022, Cargill and Continental Grain Company today announced the completion of the previously proclaimed acquisition of Sanderson Farms, Inc.) by a joint venture between Cargill and Continental Grain. The acquisition was declared on August 9, 2021 • On 15th Feb 2024 Cargill and ENOUGH expand partnership to provide consumers with innovative, sustainable protein options • February 2021, London, Tate & Lyle PLC (Tate & Lyle), a leading global provider of food and beverage ingredients and solutions, announces that it has today completed the acquisition of an 85% shareholding in Chaodee Modified Starch Co., Ltd., a well-established tapioca modified food starch manufacturer located in Thailand.Starch Market Scope: Inquiry Before Buying

Global Starch Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 65.02 Bn. Forecast Period 2026 to 2032 CAGR: 5.7% Market Size in 2032: USD 95.85 Bn. Segments Covered: by Starch Type Native Modified by Source Corn Wheat Potato Tapioca Others by Function Thickening Agent Stabilizing Agent Binding Agent Gelling Agent Emulsifying Agent by Form Liquid Dry by Price Range Economy Mid-Range Premium by Modification type Physically Modified Starch Chemically Modified Starch Enzymatically Modified Starch by Application Food & Beverages Paper & Packaging Textile Adhesives Pharmaceuticals Animal Feed Others by Distribution Channel Direct Institutional/Industrial Sales Distributors & Traders Online B2B Platforms Others Starch Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Starch Market, Key Players:

1. ADM 2. Cargill, Incorporated 3. Ingredion Incorporated 4. Tate & Lyle PLC 5. Roquette Frères S.A. 6. AGRANA Beteiligungs-AG 7. Beneo GmbH 8. Grain Processing Corporation 9. MGP Ingredients, Inc. 10. Manildra Group 11. Royal Avebe U.A. 12. Emsland Group 13. Tereos Group 14. Südzucker AG 15. Thai Flour Industry Limited 16. China Essence Group Ltd 17. Universal Starch-Chem Allied Ltd 18. Gulshan Polyols Ltd 19. Vimal PPCE 20. Sanstar Bio-Polymers Ltd 21. Tirupati Starch & Chemicals Ltd 22. The Sukhjit Starch & Chemicals Ltd 23. Sayaji Industries Limited 24. Gujarat Ambuja Exports Limited 25. HL Agro Products Pvt. Ltd. 26. Bluecraft Agro Private Limited 27. Angel Starch & Food Pvt. Ltd. 28. Visco Starch 29. Roquette Freres 30. Banpong Tapioca 31. OthersFAQs:

1] What segments are covered in the Starch Market report? Ans. The segments covered in the Starch Market report are based on Starch Type, Source, Form, Function, Price Range, Modification Type, Application, Distribution Channel and region 2] Which region is expected to hold the highest share of the Starch Market? Ans. The Asia Pacific region is expected to hold the highest share of the Starch Market. 3] What is the market size of the Starch Market by 2032? Ans. The market size of the Starch Market by 2032 is USD 95.85 Bn. 4] What is the growth rate of the Starch Market? Ans. The Global Starch Market is growing at a CAGR of 5.7 % during the forecasting period 2026-2032. 5] What was the market size of the Starch Market in 2025? Ans. The market size of the Starch Market in 2025 was USD 65.02 Bn.

1. Starch Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2025) & Forecast (2026-2032) 1.1.2. Market Size (Value in USD Billion, Volume in Metric Tons) - By Segments, Regions, and Country 2. Starch Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Product Portfolio 2.3.4. Market Share (%) by Region 2.3.5. Growth Rate (%) 2.3.6. Revenue 2025 2.3.7. Profit Margin (%) 2.3.8. R&D Investments 2.3.9. Ad Spend as % of Sales 2.3.10. Distribution Reach & Channel Performance 2.3.11. Certifications 2.3.12. ESG / Sustainability Policies 2.3.13. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Starch Market: Dynamics 3.1. Starch Market Trends 3.2. Starch Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Starch Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Starch Production Analysis (2025) 4.1. Global and regional starch production volumes and capacity utilization 4.2. Raw material availability impact on 2025 starch output levels 4.3. Production split between native and modified starch processing 4.4. Regional production cost competitiveness and efficiency benchmarks 4.5. Impact of energy, water, and labor costs on production economics 4.6. Capacity expansions, debottlenecking, and plant optimization trends in 2025 4.7. Supply–demand alignment and production adjustment strategies 5. Raw Material Risk & Agricultural Dependency Analysis 5.1. Sensitivity of starch production to crop yield variability 5.2. Impact of climate change on corn, wheat, and tapioca supply 5.3. Price volatility transmission from agriculture to starch pricing 5.4. Role of contract farming and long-term procurement agreements 5.5. Geographic concentration risks in raw material sourcing 5.6. Substitution flexibility between starch sources 5.7. Long-term raw material availability outlook 6. Pricing & Profitability Analysis By Region 6.1. Starch prices by starch type (2020–2024) 6.2. Historical starch price trends by application intensity 6.3. Impact of agricultural commodity price fluctuations 6.4. Premium pricing dynamics for specialty and modified starches 6.5. Cost pass-through capability across end-use industries 6.6. Pricing premium for resistant, functional, and specialty starches 6.7. Margin differentiation versus commodity starch products 6.8. Adoption in nutraceuticals and clinical nutrition 7. End-Use Demand Transformation Analysis 7.1. Rising demand for bio-based and biodegradable materials using starch 7.2. Growth of starch applications in sustainable packaging and bioplastics 7.3. Replacement of synthetic binders and polymers with starch-based alternatives 7.4. Role of starch in sugar reduction, fat replacement, and texture optimization 7.5. Demand for resistant starch and low-GI formulations 7.6. Impact of health regulations on starch selection in food processing 7.7. Substitution risk from gums, fibers, and synthetic polymers 7.8. Cost–performance trade-offs influencing substitution 7.9. Applications where starch remains irreplaceable 8. Customer Buying Behavior & Procurement Analysis 8.1. Institutional buyer procurement criteria and tender dynamics 8.2. Price versus performance trade-offs in starch selection 8.3. Long-term supply contracts versus spot purchasing behavior 8.4. Demand for customized starch formulations 8.5. Shift toward digital B2B procurement platforms 8.6. Use of long-term indexed pricing contracts 8.7. Demand forecasting collaboration between buyers and suppliers 9. Technology & Process Innovation Analysis 9.1. Advances in enzymatic modification technologies 9.2. Adoption of clean-label and non-GMO starch processing 9.3. Role of automation and process optimization in starch plants 9.4. Energy-efficient drying and wet milling innovations 9.5. Waste reduction and by-product utilization technologies 9.6. AI-driven crop yield forecasting for starch producers 9.7. Digital integration between farmers and processors 9.8. Predictive maintenance and cost optimization in plants 10. Trade Flow, Import–Export & Market Balance Analysis (2025) 10.1. Global and regional starch trade flow patterns 10.2. Export competitiveness of major starch-producing countries 10.3. Import dependency across demand-deficit regions 10.4. Impact of geopolitical tensions on corn and wheat trade flows 10.5. Export restrictions and food-security-driven trade policies 10.6. Currency volatility impact on starch export competitiveness 11. Supply Chain Structure & Resilience Analysis 11.1. Raw material sourcing and upstream supply dependencies 11.2. Impact of logistics disruptions on starch availability 11.3. Role of inventory management in stabilizing supply 11.4. Transportation, storage, and handling constraints 11.5. Regional supply concentration and risk exposure 11.6. Supply–demand imbalance across food and industrial sectors 12. Capacity Expansion & Capital Investment Analysis 12.1. Recent capacity additions and debottlenecking trends 12.2. Capital intensity across wet milling and dry processing 12.3. ROI timelines for starch processing investments 12.4. Financing patterns and government incentives 12.5. Demand scenarios under high food inflation versus stable agriculture 12.6. Impact of climate shocks on capacity utilization 12.7. Best-case, base-case, and downside scenarios 13. Sustainability & ESG Impact Analysis 13.1. ESG pressures on agricultural sourcing practices 13.2. Sustainability certifications influencing buyer selection 13.3. Water, energy, and carbon footprint considerations 13.4. Water stress exposure of major starch-producing regions 13.5. Plant location strategies driven by water availability 13.6. Rising cost of water treatment and compliance 14. Regulatory, Certification & Compliance Landscape By Region 14.1. Food safety and quality compliance requirements by region 14.2. Clean-label, additive, and ingredient disclosure regulations 14.3. Environmental regulations on water use and effluent treatment 14.4. Certification requirements (ISO, FSSC, Organic, Non-GMO) 14.5. Trade compliance, customs, and documentation standards 14.6. Long-term regulatory risk and compliance cost implications 15. Starch Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 15.1. Starch Market Size and Forecast, By Starch Type (2025-2032) 15.1.1. Native 15.1.2. Modified 15.2. Starch Market Size and Forecast, By Source (2025-2032) 15.2.1. Corn 15.2.2. Wheat 15.2.3. Potato 15.2.4. Tapioca 15.2.5. Others 15.3. Starch Market Size and Forecast, By Function (2025-2032) 15.3.1. Thickening Agent 15.3.2. Stabilizing Agent 15.3.3. Binding Agent 15.3.4. Gelling Agent 15.3.5. Emulsifying Agent 15.4. Starch Market Size and Forecast, By Form (2025-2032) 15.4.1. Liquid 15.4.2. Dry 15.5. Starch Market Size and Forecast, By Price Range (2025-2032) 15.5.1. Economy 15.5.2. Mid-Range 15.5.3. Premium 15.6. Starch Market Size and Forecast, By Modification Type (2025-2032) 15.6.1. Physically Modified Starch 15.6.2. Chemically Modified Starch 15.6.3. Enzymatically Modified Starch 15.7. Starch Market Size and Forecast, By Application (2025-2032) 15.7.1. Food & Beverages 15.7.2. Paper & Packaging 15.7.3. Textile 15.7.4. Adhesives 15.7.5. Pharmaceuticals 15.7.6. Animal Feed 15.7.7. Others 15.8. Starch Market Size and Forecast, By Distribution Channel (2025-2032) 15.8.1. Direct Institutional/Industrial Sales 15.8.2. Distributors & Traders 15.8.3. Online B2B Platforms 15.8.4. Others 15.9. Starch Market Size and Forecast, By Region (2025-2032) 15.9.1. North America 15.9.2. Europe 15.9.3. Asia Pacific 15.9.4. Middle East and Africa 15.9.5. South America 16. North America Starch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 16.1. North America Starch Market Size and Forecast, By Starch Type (2025-2032) 16.1.1. Native 16.1.2. Modified 16.2. North America Starch Market Size and Forecast, By Source (2025-2032) 16.2.1. Corn 16.2.2. Wheat 16.2.3. Potato 16.2.4. Tapioca 16.2.5. Others 16.3. North America Starch Market Size and Forecast, By Function (2025-2032) 16.3.1. Thickening Agent 16.3.2. Stabilizing Agent 16.3.3. Binding Agent 16.3.4. Gelling Agent 16.3.5. Emulsifying Agent 16.4. North America Starch Market Size and Forecast, By Form (2025-2032) 16.4.1. Liquid 16.4.2. Dry 16.5. North America Starch Market Size and Forecast, By Price Range (2025-2032) 16.5.1. Economy 16.5.2. Mid-Range 16.5.3. Premium 16.6. North America Starch Market Size and Forecast, By Modification Type (2025-2032) 16.6.1. Physically Modified Starch 16.6.2. Chemically Modified Starch 16.6.3. Enzymatically Modified Starch 16.7. North America Starch Market Size and Forecast, By Application (2025-2032) 16.7.1. Food & Beverages 16.7.2. Paper & Packaging 16.7.3. Textile 16.7.4. Adhesives 16.7.5. Pharmaceuticals 16.7.6. Animal Feed 16.7.7. Others 16.8. North America Starch Market Size and Forecast, By Distribution Channel (2025-2032) 16.8.1. Direct Institutional/Industrial Sales 16.8.2. Distributors & Traders 16.8.3. Online B2B Platforms 16.8.4. Others 16.9. North America Starch Market Size and Forecast, by Country (2025-2032) 16.9.1. United States 16.9.1.1. United States Starch Market Size and Forecast, By Starch Type (2025-2032) 16.9.1.2. United States Starch Market Size and Forecast, By Source (2025-2032) 16.9.1.3. United States Starch Market Size and Forecast, By Function (2025-2032) 16.9.1.4. United States Starch Market Size and Forecast, By Form (2025-2032) 16.9.1.5. United States Starch Market Size and Forecast, By Price Range (2025-2032) 16.9.1.6. United States Starch Market Size and Forecast, By Modification Type (2025-2032) 16.9.1.7. United States Starch Market Size and Forecast, By Application (2025-2032) 16.9.1.8. United States Starch Market Size and Forecast, By Distribution Channel (2025-2032) 16.9.2. Canada 16.9.2.1. Canada Starch Market Size and Forecast, By Starch Type (2025-2032) 16.9.2.2. Canada Starch Market Size and Forecast, By Source (2025-2032) 16.9.2.3. Canada Starch Market Size and Forecast, By Function (2025-2032) 16.9.2.4. Canada Starch Market Size and Forecast, By Form (2025-2032) 16.9.2.5. Canada Starch Market Size and Forecast, By Price Range (2025-2032) 16.9.2.6. Canada Starch Market Size and Forecast, By Modification Type (2025-2032) 16.9.2.7. Canada Starch Market Size and Forecast, By Application (2025-2032) 16.9.2.8. Canada Starch Market Size and Forecast, By Distribution Channel (2025-2032) 16.9.3. Mexico 16.9.3.1. Mexico Starch Market Size and Forecast, By Starch Type (2025-2032) 16.9.3.2. Mexico Starch Market Size and Forecast, By Source (2025-2032) 16.9.3.3. Mexico Starch Market Size and Forecast, By Function (2025-2032) 16.9.3.4. Mexico Starch Market Size and Forecast, By Form (2025-2032) 16.9.3.5. Mexico Starch Market Size and Forecast, By Price Range (2025-2032) 16.9.3.6. Mexico Starch Market Size and Forecast, By Modification Type (2025-2032) 16.9.3.7. Mexico Starch Market Size and Forecast, By Application (2025-2032) 16.9.3.8. Mexico Starch Market Size and Forecast, By Distribution Channel (2025-2032) 17. Europe Starch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 17.1. Europe Starch Market Size and Forecast, By Starch Type (2025-2032) 17.2. Europe Starch Market Size and Forecast, By Source (2025-2032) 17.3. Europe Starch Market Size and Forecast, By Function (2025-2032) 17.4. Europe Starch Market Size and Forecast, By Form (2025-2032) 17.5. Europe Starch Market Size and Forecast, By Price Range (2025-2032) 17.6. Europe Starch Market Size and Forecast, By Modification Type (2025-2032) 17.7. Europe Starch Market Size and Forecast, By Application (2025-2032) 17.8. Europe Starch Market Size and Forecast, By Distribution Channel (2025-2032) 17.9. Europe Starch Market Size and Forecast, By Country (2025-2032) 17.9.1. United Kingdom 17.9.2. France 17.9.3. Germany 17.9.4. Italy 17.9.5. Spain 17.9.6. Sweden 17.9.7. Russia 17.9.8. Rest of Europe 18. Asia Pacific Starch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 18.1. Asia Pacific Starch Market Size and Forecast, By Starch Type (2025-2032) 18.2. Asia Pacific Starch Market Size and Forecast, By Source (2025-2032) 18.3. Asia Pacific Starch Market Size and Forecast, By Function (2025-2032) 18.4. Asia Pacific Starch Market Size and Forecast, By Form (2025-2032) 18.5. Asia Pacific Starch Market Size and Forecast, By Price Range (2025-2032) 18.6. Asia Pacific Starch Market Size and Forecast, By Modification Type (2025-2032) 18.7. Asia Pacific Starch Market Size and Forecast, By Application (2025-2032) 18.8. Asia Pacific Starch Market Size and Forecast, By Distribution Channel (2025-2032) 18.9. Asia Pacific Starch Market Size and Forecast, by Country (2025-2032) 18.9.1. China 18.9.2. S Korea 18.9.3. Japan 18.9.4. India 18.9.5. Australia 18.9.6. Indonesia 18.9.7. Malaysia 18.9.8. Philippines 18.9.9. Thailand 18.9.10. Vietnam 18.9.11. Rest of Asia Pacific 19. Middle East and Africa Starch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 19.1. Middle East and Africa Starch Market Size and Forecast, By Starch Type (2025-2032) 19.2. Middle East and Africa Starch Market Size and Forecast, By Source (2025-2032) 19.3. Middle East and Africa Starch Market Size and Forecast, By Function (2025-2032) 19.4. Middle East and Africa Starch Market Size and Forecast, By Form (2025-2032) 19.5. Middle East and Africa Starch Market Size and Forecast, By Price Range (2025-2032) 19.6. Middle East and Africa Starch Market Size and Forecast, By Modification Type (2025-2032) 19.7. Middle East and Africa Starch Market Size and Forecast, By Application (2025-2032) 19.8. Middle East and Africa Starch Market Size and Forecast, By Distribution Channel (2025-2032) 19.9. Middle East and Africa Starch Market Size and Forecast, By Country (2025-2032) 19.9.1. South Africa 19.9.2. GCC 19.9.3. Nigeria 19.9.4. Rest of ME&A 20. South America Starch Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2025-2032) 20.1. South America Starch Market Size and Forecast, By Starch Type (2025-2032) 20.2. South America Starch Market Size and Forecast, By Source (2025-2032) 20.3. South America Starch Market Size and Forecast, By Function (2025-2032) 20.4. South America Starch Market Size and Forecast, By Form (2025-2032) 20.5. South America Starch Market Size and Forecast, By Price Range (2025-2032) 20.6. South America Starch Market Size and Forecast, By Modification Type (2025-2032) 20.7. South America Starch Market Size and Forecast, By Application (2025-2032) 20.8. South America Starch Market Size and Forecast, By Distribution Channel (2025-2032) 20.9. South America Starch Market Size and Forecast, By Country (2025-2032) 20.9.1. Brazil 20.9.2. Argentina 20.9.3. Colombia 20.9.4. Chile 20.9.5. Rest of South America 21. Company Profile: Key Players 21.1. ADM 21.1.1. Company Overview 21.1.2. Business Portfolio 21.1.3. Financial Overview 21.1.4. SWOT Analysis 21.1.5. Strategic Analysis 21.1.6. Recent Developments 21.2. Cargill, Incorporated 21.3. Ingredion Incorporated 21.4. Tate & Lyle PLC 21.5. Roquette Frères S.A. 21.6. AGRANA Beteiligungs-AG 21.7. Beneo GmbH 21.8. Grain Processing Corporation 21.9. MGP Ingredients, Inc. 21.10. Manildra Group 21.11. Royal Avebe U.A. 21.12. Emsland Group 21.13. Tereos Group 21.14. Südzucker AG 21.15. Thai Flour Industry Limited 21.16. China Essence Group Ltd 21.17. Universal Starch-Chem Allied Ltd 21.18. Gulshan Polyols Ltd 21.19. Vimal PPCE 21.20. Sanstar Bio-Polymers Ltd 21.21. Tirupati Starch & Chemicals Ltd 21.22. The Sukhjit Starch & Chemicals Ltd 21.23. Sayaji Industries Limited 21.24. Gujarat Ambuja Exports Limited 21.25. HL Agro Products Pvt. Ltd. 21.26. Bluecraft Agro Private Limited 21.27. Angel Starch & Food Pvt. Ltd. 21.28. Visco Starch 21.29. Roquette Freres 21.30. Banpong Tapioca 21.31. Others 22. Key Findings 23. Analyst Recommendations 24. Starch Market – Research Methodology