Global Specialty Paper Market size was valued at USD 33.41 Bn in 2024 and the total Specialty Paper Market revenue is expected to grow by 4.5% from 2025 to 2032, reaching nearly USD 47.51 Bn by 2032.Specialty Paper Market Overview:

Specialty paper refers to category of engineered paper products designed for specific functional or aesthetic purposes beyond conventional printing/writing applications. The global specialty paper market has been experiencing strong growth driven by rising demand across packaging, labelling and decorative application supported by stringent sustainability regulation and shifting consumer preferences toward ecofriendly alternatives. Europe dominated market fuelled by advanced packaging standards, thriving luxury goods industry and strict environmental policies promoting recyclable material with innovation leaders like Mondi, Stora Enso and UPM pioneering high performance solution such as compostable barrier papers, lightweight packaging substrates and premium decorative finishes. Specialty paper market benefit from diverse application like food and beverage packaging adopt grease resistant and biodegradable papers, construction sector utilizes masking tapes and decorative laminates and luxury brands employ high end specialty papers for premium branding. This dynamic landscape highlight how specialty papers are evolving with advanced coatings, fiber technologies and circular design principle meeting modern demands for functionality and sustainability while aligning with EU’s Green Deal and global decarbonization goals.To know about the Research Methodology:- Request Free Sample Report The objective of the report is to present a comprehensive analysis of the global Specialty Paper Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.

Specialty Paper Market Dynamics:

Modern Packaging & Construction to Boost Specialty Paper Market Growth Specialty paper is used in a variety of end-use industries besides printing and writing, such as packaging and building and construction. Non-reactive, temperature resistant, waterproof, attractive, colorful, and lightweight features of specialty paper have helped it to gain favor in the packaging industry. Also, a growing trend of decorative interiors has uplifted specialty paper sales in the construction industry. Rising Construction Activity to Boost Specialty Paper Market Expansion The building and construction industry has experienced significant growth in developed and developing countries across the globe. The Masking tapes, made from specialty paper are commonly used for designing, painting, and marking, in the construction industry. The growth in infrastructure development and construction projects has resulted in a significant increase in demand for masking tapes, which is expected to drive the specialty paper market growth throughout the forecast period. Packaged Food Demand to Drive Specialty Paper Market Growth The growing demand for packaged food products is rising significantly, thanks to the growing urban population along with rising per capita income and changing lifestyles across the globe. The growing consumption of packaged food products is boosting the demand for specialty paper, which is widely used in the foodservice industry for packaging prepared products. For example, according to Just Eat PLC, takeaway household expenditure in the United Kingdom, was expected to reach US$ 15.12 billion by 2023, which in turn, is expected to uplift the specialty paper market growth through the forecast period. Innovative Structures and Sustainability to Drive Specialty Paper Market The molecular structure of specialized paper makes it possible to create fresh product alternatives, which are custom-built to the needs of end customers. Nanomaterial in specialized papers also makes them appropriate for a variety of by-products from the paper. The biodegradable properties are expected to offer a profitable potential for all industry participants in the undeveloped region across the globe. Also, with a growing focus on sustainability, specialty paper such as glassine paper is expected to see significant growth in demand throughout forecast period.Specialty Paper Market Segment Analysis:

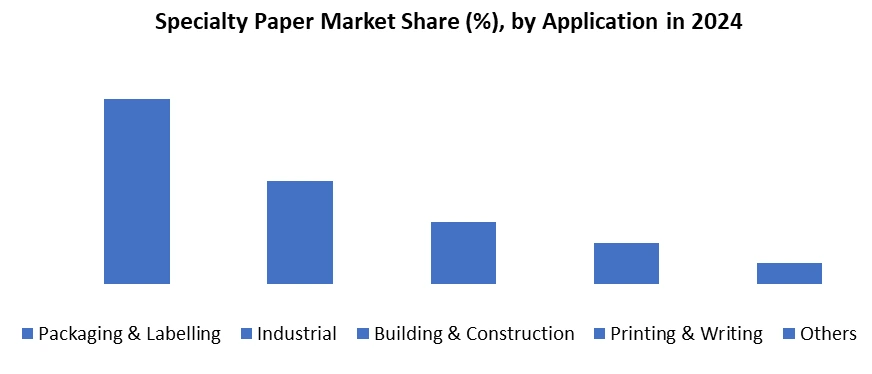

Based on the Type, the specialty paper market is segmented into Decor paper, Release Liner Paper, Packaging Paper, Printing Paper, and others. In 2024, Packaging Paper dominated the specialty paper market, accounting for the largest revenue share due to surging demand from e-commerce, food delivery, and sustainable packaging solutions. Its dominance stems from superior functionality (moisture resistance, durability, and printability) and regulatory tailwinds (plastic bans driving paper-based alternatives). The segment benefits from circular economy trends, with brands prioritizing recyclable/compostable packaging to meet ESG goals, while innovations like grease-resistant coatings expand its use in food packaging.Based on the Application, the specialty paper market is segmented into Building & Construction, Industrial, Packaging & labeling, Printing & Writing, and others. The Packaging & labeling segment held the largest market share, accounting for 37% in 2024. The growing demand for packaging material from several end-use industries including food & beverage, household, personal care, healthcare, and others to protect and ensure safety for the products, are driving the specialty paper market growth. The Printing & Witting segment is expected to witness significant growth at a CAGR of 5.67% during the forecast period. The growing adoption of specialty paper in currency, security papers, cheque paper, and postage stamps is expected to fuel the specialty paper market growth throughout the forecast period.

Specialty Paper Market Regional Insights:

European region held the largest market share accounted for 36.83% in 2024. Among the region, Europe was the largest exporter of specialty paper in the year 2024. The growing production of capacity of paper and paperboard products especially in countries like the UK, France, Germany, and Italy is driving the product demand in the region. For example, according to the German Paper and Pulp Association, packaging paper and board production volume in Germany reached 12,102 tonnes in 2023. North America region is expected to witness significant growth at a CAGR of 5.78% during the forecast period. The growing demand from the food and beverage industry along with the presence of major packaging players are booting the product demand in the region. The country is home to major food-producing companies that are anticipated to excel in the sales of specialty paper in the coming decade. The demand for specialty paper in the region is driven by the growing usage in the building and construction industry. The growing trend of decorative interiors in the building and construction sector is expected to fuel the demand for specialty paper during the forecast period.Specialty Paper Market Competitive Landscape:

Kruger Inc. is key player in North American specialty paper market competing with global leaders like Mondi (Europe), Stora Enso (Finland) and Nippon Paper (Japan) in segments such as recycled packaging papers, tissue product and industrial grade specialty papers. The company differentiate itself through sustainable production practices, leveraging its vertically integrated operation and focus on 100% recycled fiber content in product like Kruger Kraft Paper. While innovator such as UPM (Finland) pioneer bio-based barrier coating and Ahlstrom Munksjö (France) lead in filtration paper, Kruger maintain strength in cost competitive, ecofriendly solution for food packaging and construction applications. However, it faces pressure from European sustainability leaders and Asian low-cost producers pushing Kruger to invest in circular economy initiatives and niche markets like compostable foodservice papers to maintain relevance.Specialty Paper Market Key Trends:

• Phygital Fusion: AR-Enabled Specialty Papers Redefine Brand Engagement- Augmented reality-integrated specialty papers are transforming packaging and marketing, allowing consumers to scan wrappers for interactive content—blending physical durability with digital experiences. • Carbon-Negative Pulp Revolution: Specialty Papers That Sequester More Than They Emit- Pioneers are developing papers using carbon-capturing agricultural residues (e.g., hemp, banana stems) that achieve net-negative footprints, disrupting traditional wood pulp paradigms. • Self-Healing Coatings: Specialty Papers That Repair Scratches & Moisture Damage- Microencapsulated polymers in premium papers autonomously fix surface wear, extending shelf life for luxury packaging and critical documents—no human intervention needed. Specialty Paper Market Key Developments: • Glatfelter (US): March 2025: Launched "EcoVue™", a compostable, plant-based specialty paper for luxury packaging, using upcycled agricultural waste to replace plastic laminates—adopted by major beauty brands. • Domtar Corporation (Canada): January 2025: Debuted "ShieldFlex™", a puncture-resistant specialty paper for e-commerce packaging, combining recycled fibers with bio-based coatings to reduce plastic use by 30%. • Robert Wilson Paper (UK): November 2024: Introduced "ChromaLux+", a color-shifting security paper for high-end labels, integrating optically variable pigments to combat counterfeiting in pharmaceuticals. • Sequana (France): September 2024: Partnered with L’Oréal to develop "AquaGreen", a water-resistant specialty paper for shampoo bars, using algae-based coatings to replace plastic wraps. • Smurfit Kappa (Ireland): February 2025: Unveiled "SilentFiber™", an acoustic specialty paper for automotive interiors, made from recycled textile fibers to dampen noise in EV cabins.Specialty Paper Market Scope: Inquire before buying

Global Specialty Paper Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 33.41 Bn. Forecast Period 2025 to 2032 CAGR: 4.5% Market Size in 2032: USD 47.51 Bn. Segments Covered: by Type Decor paper Release Liner paper Packaging paper Kraft Paper Others by Raw Material Pulp Fillers & Binders Additives & Coatings Others by Application Building & construction Industrial Packaging & labelling Printing & writing Others Specialty Paper Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Specialty Paper Market,Key Players

North America 1. International Paper US 2. Verso Corporation US 3. Potsdam Specialty Paper Inc. US 4. Georgia-Pacific US 5. WestRock Company US 6. ND Paper LLC US 7. Glatfeller US 8. Kruger Inc. Canada 9. Domtar Corporation Canada Europe 10. Robert Wilson Paper UK 11. Sequana France 12. Smurfit Kappa Ireland 13. Stora Enso Finland 14. (UPM-Kymmene Oyj) Finland 15. Ahlstrom Finland 16. Fedrigoni Holding Limited Italy Asia Pacific 17. ITC Ltd. India 18. Nippon Paper Group Japan 19. Oji Holdings Corporation Japan 20. Asia Pulp & Paper Co. Limited Indonesia Middle East and Africa 21. Mondi Plc. South Africa 22. Sappi Ltd South Africa Frequently Asked Questions: 1] What segments are covered in the Specialty Paper Market report? Ans. The segments covered in the specialty paper market report are based on type, raw material, and application. 2] Which region is expected to hold the highest share in the Specialty Paper Market? Ans. The European region is expected to hold the highest share in the market. 3] What is the market size volume of the Specialty Paper Market by 2032? Ans. The market size by volume of the specialty paper market by 2032 is USD47.51 Bn. 4] What is the forecast period for the Specialty Paper Market? Ans. The forecast period for the specialty paper market is 2025-2032. 5] What was the market size volume of the Specialty Paper Market in 2024? Ans. The market size by volume of the specialty paper market in 2024 was USD 33.41 Bn.

1. Specialty Paper Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Specialty Paper Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Application Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Specialty Paper Market: Dynamics 3.1. Specialty Paper Market Trends 3.1.1. North America Specialty Paper Market Trends 3.1.2. Europe Specialty Paper Market Trends 3.1.3. Asia Pacific Specialty Paper Market Trends 3.1.4. Middle East and Africa Specialty Paper Market Trends 3.1.5. South America Specialty Paper Market Trends 3.2. Global Specialty Paper Market Dynamics 3.2.1. Global Specialty Paper Market Drivers 3.2.1.1. Modern Packaging & Construction 3.2.1.2. Rising Construction Activity 3.2.1.3. Packaged Food Demand 3.2.1.4. Innovative Structures and Sustainability 3.2.2. Global Specialty Paper Market Restraints 3.2.3. Global Specialty Paper Market Opportunities 3.2.4. Global Specialty Paper Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree Map Analysis 3.5. PESTLE Using Tree Map Analysis 3.5.1. Eco Regulations 3.5.2. Tech Innovation 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for the Global Industry 3.8. Analysis of Government Schemes and Initiatives for Industry 4. Specialty Paper Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Specialty Paper Market Size and Forecast, By Type (2024-2032) 4.1.1. Decor paper 4.1.2. Release Liner paper 4.1.3. Packaging paper 4.1.4. Kraft Paper 4.1.5. Others 4.2. Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 4.2.1. Pulp 4.2.2. Fillers & Binders 4.2.3. Additives & Coatings 4.2.4. Others 4.3. Specialty Paper Market Size and Forecast, By Application (2024-2032) 4.3.1. Building & construction 4.3.2. Industrial 4.3.3. Packaging & labelling 4.3.4. Printing & writing 4.3.5. Others 4.4. Specialty Paper Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Specialty Paper Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Specialty Paper Market Size and Forecast, By Type (2024-2032) 5.1.1. Decor paper 5.1.2. Release Liner paper 5.1.3. Packaging paper 5.1.4. Kraft Paper 5.1.5. Others 5.2. North America Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 5.2.1. Pulp 5.2.2. Fillers & Binders 5.2.3. Additives & Coatings 5.2.4. Others 5.3. North America Specialty Paper Market Size and Forecast, By Application (2024-2032) 5.3.1. Building & construction 5.3.2. Industrial 5.3.3. Packaging & labelling 5.3.4. Printing & writing 5.3.5. Others 5.4. North America Specialty Paper Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Specialty Paper Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Decor paper 5.4.1.1.2. Release Liner paper 5.4.1.1.3. Packaging paper 5.4.1.1.4. Kraft Paper 5.4.1.1.5. Others 5.4.1.2. United States Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 5.4.1.2.1. Pulp 5.4.1.2.2. Fillers & Binders 5.4.1.2.3. Additives & Coatings 5.4.1.2.4. Others 5.4.1.3. United States Specialty Paper Market Size and Forecast, By Application (2024-2032) 5.4.1.3.1. Building & construction 5.4.1.3.2. Industrial 5.4.1.3.3. Packaging & labelling 5.4.1.3.4. Printing & writing 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Specialty Paper Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Decor paper 5.4.2.1.2. Release Liner paper 5.4.2.1.3. Packaging paper 5.4.2.1.4. Kraft Paper 5.4.2.1.5. Others 5.4.2.2. Canada Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 5.4.2.2.1. Pulp 5.4.2.2.2. Fillers & Binders 5.4.2.2.3. Additives & Coatings 5.4.2.2.4. Others 5.4.2.3. Canada Specialty Paper Market Size and Forecast, By Application (2024-2032) 5.4.2.3.1. Building & construction 5.4.2.3.2. Industrial 5.4.2.3.3. Packaging & labelling 5.4.2.3.4. Printing & writing 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Specialty Paper Market Size and Forecast, By Type (2024-2032) 5.4.3.1.1. Decor paper 5.4.3.1.2. Release Liner paper 5.4.3.1.3. Packaging paper 5.4.3.1.4. Kraft Paper 5.4.3.1.5. Others 5.4.3.2. Mexico Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 5.4.3.2.1. Pulp 5.4.3.2.2. Fillers & Binders 5.4.3.2.3. Additives & Coatings 5.4.3.2.4. Others 5.4.3.3. Mexico Specialty Paper Market Size and Forecast, By Application (2024-2032) 5.4.3.3.1. Building & construction 5.4.3.3.2. Industrial 5.4.3.3.3. Packaging & labelling 5.4.3.3.4. Printing & writing 5.4.3.3.5. Others 6. Europe Specialty Paper Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.2. Europe Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.3. Europe Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4. Europe Specialty Paper Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.1.3. United Kingdom Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4.2. France 6.4.2.1. France Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.2.3. France Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.3.3. Germany Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.4.3. Italy Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.5.3. Spain Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.6.3. Sweden Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4.7. Russia 6.4.7.1. Russia Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Russia Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.7.3. Russia Specialty Paper Market Size and Forecast, By Application (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Specialty Paper Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 6.4.8.3. Rest of Europe Specialty Paper Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Specialty Paper Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.3. Asia Pacific Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Specialty Paper Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.1.3. China Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.2.3. S Korea Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.3.3. Japan Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.4. India 7.4.4.1. India Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.4.3. India Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.5.3. Australia Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.6.3. Indonesia Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Malaysia Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.7.3. Malaysia Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.8. Philippines 7.4.8.1. Philippines Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Philippines Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.8.3. Philippines Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.9. Thailand 7.4.9.1. Thailand Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Thailand Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.9.3. Thailand Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.10. Vietnam 7.4.10.1. Vietnam Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Vietnam Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.10.3. Vietnam Specialty Paper Market Size and Forecast, By Application (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Specialty Paper Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 7.4.11.3. Rest of Asia Pacific Specialty Paper Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Specialty Paper Market Size and Forecast (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Specialty Paper Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 8.3. Middle East and Africa Specialty Paper Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Specialty Paper Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Specialty Paper Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 8.4.1.3. South Africa Specialty Paper Market Size and Forecast, By Application (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Specialty Paper Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 8.4.2.3. GCC Specialty Paper Market Size and Forecast, By Application (2024-2032) 8.4.3. Egypt 8.4.3.1. Egypt Specialty Paper Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Egypt Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 8.4.3.3. Egypt Specialty Paper Market Size and Forecast, By Application (2024-2032) 8.4.4. Nigeria 8.4.4.1. Nigeria Specialty Paper Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Nigeria Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 8.4.4.3. Nigeria Specialty Paper Market Size and Forecast, By Application (2024-2032) 8.4.5. Rest of ME&A 8.4.5.1. Rest of ME&A Specialty Paper Market Size and Forecast, By Type (2024-2032) 8.4.5.2. Rest of ME&A Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 8.4.5.3. Rest of ME&A Specialty Paper Market Size and Forecast, By Application (2024-2032) 9. South America Specialty Paper Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Specialty Paper Market Size and Forecast, By Type (2024-2032) 9.2. South America Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 9.3. South America Specialty Paper Market Size and Forecast, By Application (2024-2032) 9.4. South America Specialty Paper Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Specialty Paper Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 9.4.1.3. Brazil Specialty Paper Market Size and Forecast, By Application (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Specialty Paper Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 9.4.2.3. Argentina Specialty Paper Market Size and Forecast, By Application (2024-2032) 9.4.3. Colombia 9.4.3.1. Colombia Specialty Paper Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Colombia Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 9.4.3.3. Colombia Specialty Paper Market Size and Forecast, By Application (2024-2032) 9.4.4. Chile 9.4.4.1. Chile Specialty Paper Market Size and Forecast, By Type (2024-2032) 9.4.4.2. Chile Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 9.4.4.3. Chile Specialty Paper Market Size and Forecast, By Application (2024-2032) 9.4.5. Rest Of South America 9.4.5.1. Rest Of South America Specialty Paper Market Size and Forecast, By Type (2024-2032) 9.4.5.2. Rest Of South America Specialty Paper Market Size and Forecast, By Raw Material (2024-2032) 9.4.5.3. Rest Of South America Specialty Paper Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. International Paper 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Verso Corporation 10.3. Potsdam Specialty Paper Inc. 10.4. Georgia-Pacific 10.5. WestRock Company 10.6. ND Paper LLC 10.7. Glatfeller 10.8. Kruger Inc. 10.9. Domtar Corporation 10.10. Robert Wilson Paper 10.11. Sequana 10.12. Smurfit Kappa 10.13. Stora Enso 10.14. (UPM-Kymmene Oyj) 10.15. Ahlstrom 10.16. Fedrigoni Holding Limited 10.17. ITC Ltd. 10.18. Nippon Paper Group 10.19. Oji Holdings Corporation 10.20. Asia Pulp & Paper Co. Limited 10.21. Mondi Plc. 10.22. Sappi Ltd 11. Key Findings 12. Industry Recommendations 13. Specialty Paper Market: Research Methodology