Solenoid Valves Market size was valued at USD 4.67 Billion in 2023 and the Solenoid Valves Market revenue is expected to reach USD 6.8 Billion by 2030, at a CAGR of 5.5 % over the forecast period.Solenoid Valves Market Overview

A solenoid valve is an electrically controlled valve that can open, close, dose, distribute, or mix the flow of gas or liquid in a pipe. Solenoid valves are designed to be used with clean liquids and gases. They are used in a wide range of industries, including water treatment, automotive, and food processing.To know about the Research Methodology:-Request Free Sample Report The solenoids are useful in many applications, from appliances to electron hobbies. They are usually found in applications that require a feature that can automatically turn the appliance on or off. For example, an electric torch or an engine kill switch is commonly used in motorbikes nowadays. Solenoid Valves are not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Solenoid Valves Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Solenoid Valves Market report showcases the Solenoid Valves market situation with Dynamics, Market Segment, Regional Analysis, and Top competitor's Market Position.

Solenoid Valves Market Dynamics

The increasing requirement in the wastewater treatment industries is driving the growth of the solenoid valve market. The research and development activities and technological advancement will boost the market growth. The poor consumption of power and lower prices is some of the features of the solenoid valves, making them a sustainable option. The increased incorporation of valves in different phases of the extraction process in the chemical and petrochemical industries could be a major driver for the solenoid valves market globally. The continuous retrofitting works in the aforementioned industries would significantly drive the solenoid valve market. Additionally, the rising need for automation in the power industry is expected to drive the market during the forecast period. Solenoid valves are significant components of the power generation industry, and so the growing investment in expanding power generation capacity will also be a market-driving factor. The solenoid valves are extensively used in the food industry as they are constructed to bear wet, corrosive atmospheres and extreme room temperatures and are made of stainless steel materials as these are contaminant resistant. Therefore, solenoid valves are the perfect option for food processing. The meat and abattoir industries, salting systems, fish canneries, ready meal manufacturing, and fruit and vegetable canneries use steel solenoid valves. Salmon packing lines, pasteurized systems, and fish fillet preparation systems make use of high-pressure solenoid valves. The solenoid valve has a mechanism that permits it to turn on and off, dose, release, mix fluids, or distribute. To handle the flow and direction of fluids, solenoid valves are employed and are also required in the activity that need batch control, like canneries and bottling facilities. The pneumatic and hydraulic systems, controlling cylinders, fluid power motors, and flush systems are powered by solenoid valves that control and power bigger industrial valves. In wastewater treatment, the solenoid valves help in removing organic contaminants from the polluted water and for many other additional purposes. The wastewater treatment industry makes use of valves made out of plastics, brass, and stainless steel, which can be utilized to fill the tank, pilot larger actuated valves with air or water, for service valves in water softeners, and many other different purposes. Thus, the material of solenoid valves used depends on the need of application and the working environment. Thus, driving the Solenoid Valve market revenue.

Solenoid Valves Market Segment Analysis

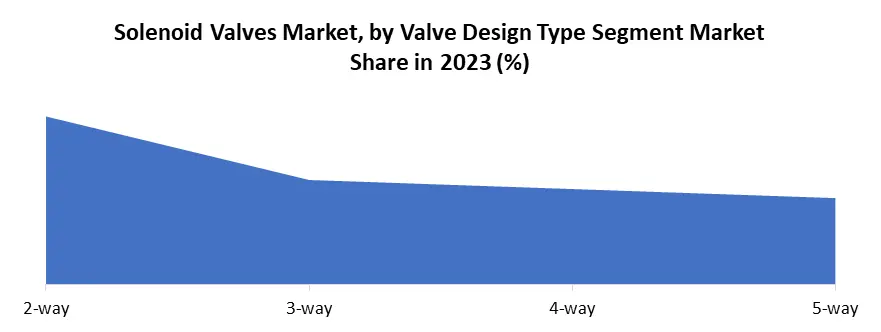

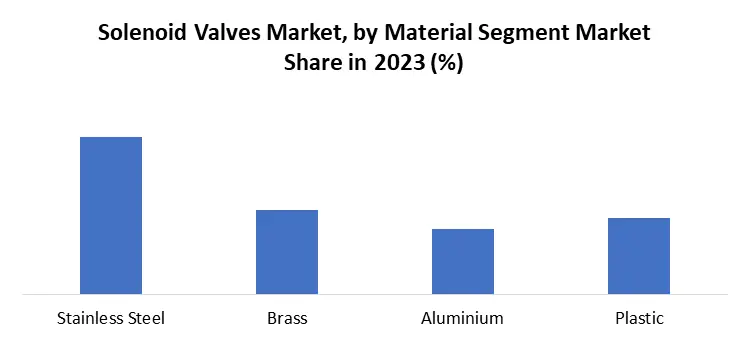

By Material Stainless Steel dominates the global solenoid valves market in terms of material, with the largest market share as of 2023, and is anticipated to continue its dominance over the estimated period. This is subsequently stainless steel solenoid valves are ideal for use in aggressive media and chemical applications. Brass is typically used for general purposes, controlling air, water, atmospheric gases, and non-aggressive or corrosive applications. Brass can withstand more heat compared to PVC but comes at a higher price. By Valve Design Type With regards to Valve Design Type, the 2-way segment leads the solenoid valves market in 2023, accounting for the largest share. 2-way solenoid valves have two ports - an inlet and an outlet. It is important to note the flow direction for proper operation, which is typically indicated by an arrow. A 2-way valve is utilized to open or close the orifice. The growth of this segment can be attributed to its properties, such as strong corrosion resistance and aesthetic appearance. However, the 5-way segment is expected to register the highest CAGR over the forecast period. Solenoid valves are classified by the number of ports they have. A 2-way solenoid valve has two ports, an inlet port and an outlet port, and can be controlled with an on-off switch. A 3-way solenoid valve has one inlet port and two outlet ports. Here are some more examples of different solenoid valve designs: 1. 4-way solenoid valve: Has four ports 2. 5/2 way solenoid valve: Has five ports and two positions, either normally closed or normally open 3. 5/3 way solenoid valve: Has five ports and three positions 4. 2-way solenoid valve: Operates like a single-pole single-throw (SPST) electrical switch 5. 3-way solenoid valve: Operates like a single-pole double-throw (SPDT) electrical switch 6. 5-way solenoid valve: Can provide additional flow control beyond routine on/off fluid service, such as mixing fluids from two different sources or diverting fluids from a common inlet to two destinations These types of Valves are used in a variety of applications as each type boosts the market growth due to their potential usage. The Solenoid Valve market segmentation, based on Industry, includes oil & gas, chemical & petrochemical, power generation, pharmaceutical, automotive, medical, and others. The chemical & photochemical category dominates the market as the solenoid valves play an important role in controlling gases, liquids, steam, or chemical compounds by controlling the flow level and pressure and distributing the energy of pressure differentials to maintain the integrity of the process in the chemical and petrochemical industry.

Solenoid Valves Market Regional Analysis

North America dominated the global solenoid valve market share during the estimated period. During the estimated period, APAC is expected to increase at the fastest rate of 4.3%. Many sectors, including water supply management, food and drinks, and chemicals, are rapidly adopting automation solutions. As a result, the solenoid valve market is expected to develop. The solenoid valve market in this area has been driven by rising water and wastewater, oil and gas industries, automotive, and other factors in the country. According to the latest EIA figures, US crude oil output will average XX million barrels per day in 2019. The oil and gas industry's extensive use of solenoid valves has fueled the market expansion. Solenoid valves provide several advantages that enable the industry to regulate machinery, dose, mix, or restrict the flow of liquids or gases. Furthermore, companies use solenoid valves to regulate the flow of fluid and generate motions in the process in automated systems. The growing need for clean and sanitary water supplies in the country is driving up demand for water treatment plants, which is driving up demand for solenoid valves. Growing industries and their requirements for process automation, such as liquid or gas flow, are expected to drive demand for solenoid valves in the nation. The United States solenoid valve industry is expected to gain USD 73 million by 2033. Over the forecast period, the market is expected to register a CAGR of 3.5%, in contrast to the 2.4% CAGR observed in the historical period. The market is observing a rise in the adoption of advanced fluid automation technologies and the surging application in sectors like chemicals, oil and gas, water treatment, and food and beverages. The manufacturing units of end-users are updating different production processes to minimize the workforce and enhance efficiency. The China solenoid valve industry is expected to generate USD 56 million by 2033. In the meantime, the market is expected to assume a CAGR of 3.1%. Several sectors, like food and drinks, water supply management, and chemicals, are robustly adopting automation solutions. Thereby fuelling the growth of the solenoid valve industry. Thriving oil and gas industries, water and wastewater, and other factors are augmenting the sales of the solenoid valve industry. The United Kingdom is slated to reach USD XX million by 2030. From 2023 to 2030, the market is expected to assume a CAGR of XX%. In the historical period, however, the market is expected to register a CAGR of XX %. Increasing demand for clean and sanitary water supplies is catalyzing the prospects for water treatment plants. This is expected to have a positive impact on the solenoid valve industry. Surging industries and their need for process automation, like gas or liquid flow, are estimated to propel market growth. Solenoid Valves Market Competitive Landscape Leading market players are investing heavily in research and development to spread their product lines, which will help the Solenoid Valve market grow even more. Market participants are also undertaking various strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Solenoid Valve industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Solenoid Valve industry to benefit clients and increase the market sector. In recent years, the Solenoid Valve industry has offered some of the most significant advantages to different end-use industries. Major players in the Solenoid Valve market, including CKD Corporation, Emerson Electric Corporation, Kendrion, GF Piping, IMI Precision Engineering, Danfoss Industries Ltd., Curtiss Wright Corporation, Parker Hannifin Corporation, ASCO Valves Inc., Rotex SAutomation, SMC Corporation, The Lee Company, and others, are attempting to increase market demand by investing in research and development operations. Emerson Electric Co., headquartered in Ferguson, Missouri, is an American multinational corporation. The company avails engineering services for industrial, consumer, and commercial markets and manufactures the products. The technologies and services to enhance human comfort, safeguard food, protect the environment, provide sustainable food waste disposal, and support efficient construction are developed by the commercial and residential solutions of the company. In February 2022, an integrated facility was inaugurated by Emerson at Mahindra World City in Chennai. The manufacturing was integrated under one roof to strengthen the production synergies for some of its important products. The fluid control and pneumatic products like solenoid valves, air preparation units, cylinders, pneumatic valves and manifolds, position monitoring, and high-pressure regulators will be manufactured by the facility for the field-proven brand AVENTICS, ASCO, TopWorx, and TESCOM fields of Emerson. Founded in May 2005, Kendrion Suzhou is specialized in electromagnetic components: solenoids, brakes, and clutches for automotive and industrial sectors. The company manufactures and provides highly innovative and technologically sophisticated products: controllers and actuators. In October 2022, a New bistable solenoid valve 63.0 at COMPAMED 2022 was presented by Kendrion. This valve controls the flow rate with great precision and speed. It is kept de-energized by the integrated permanent magnet in the open or closed state without the coil being permanently energized. The valve is available in the 2/2 or 3/2-way version and can be adapted to reach the specific requirement. A lead wire or connector version for PCB interfacing, and common sealing materials like NBR, EPDM, or FPM is also available.Global Solenoid Valves Market Scope: Inquire before buying

Global Solenoid Valves Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.67 Bn. Forecast Period 2024 to 2030 CAGR: 5.5% Market Size in 2030: US $ 6.8 Bn. Segments Covered: By Material Stainless Steel Brass Aluminium Plastic By Valve Design Type 2-way 3-way 4-way 5-way By Industry Oil & Gas Chemical & Petrochemical Water & Wastewater Food & Beverages Power Generation Pharmaceuticals Automotive Medical Aerospace Others Global Solenoid Valves Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Solenoid Valves Key Players Includes

1. CKD Corporation (Japan) 2. Emerson Electric Corporation (USA) 3. Kendrion (Germany) 4. GF Piping (Switzerland) 5. IMI Precision Engineering (Birmingham) 6. Danfoss Industries Ltd. (Denmark) 7. Curtiss Wright Corporation (USA) 8. Parker Hannifin Corporation (USA) 9. ASCO Valves Inc. (USA) 10. Rotex automation (India) 11. SMC Corporation (Japan) 12. The Lee Company (USA) 13. Asco Valve, Inc. (USA) 14. Christian Bürkert GmbH & Co. Kg (Germany) 15. Curtiss-Wright Corporation (USA) 16. Danfoss A/S (Denmark) 17. GSR Ventiltechnik GmbH & Co. Kg (Germany) 18. IMI PLC (UK) 19. Emerson Electric Co. (Missouri) Frequently Asked Questions in the Solenoid Valves Market: 1. Which region has the largest share in the Global Solenoid Valves Market? Ans: The North America region held the highest share in 2023. 2. What is the growth rate of the Global Solenoid Valves Market? Ans: The Global market is growing at a CAGR of 5.5 % during the forecasting period 2023-2030. 3. What is the scope of the Global Solenoid Valves market report? Ans: Global market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global Solenoid Valves market? Ans: The important key players in the Global market are – CKD Corporation (Japan), Emerson Electric Corporation (USA), Kendrion (Germany), GF Piping (Switzerland), IMI Precision Engineering (Birmingham), Danfoss Industries Ltd. (Denmark), Curtiss Wright Corporation (USA) 5. What is the study period of this market? Ans: The Global Solenoid Valves Market is studied from 2023 to 2030.

1. Solenoid Valves Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Solenoid Valves Market: Dynamics 2.1. Solenoid Valves Market Trends by Region 2.1.1. North America Solenoid Valves Market Trends 2.1.2. Europe Solenoid Valves Market Trends 2.1.3. Asia Pacific Solenoid Valves Market Trends 2.1.4. Middle East and Africa Solenoid Valves Market Trends 2.1.5. South America Solenoid Valves Market Trends 2.2. Solenoid Valves Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Solenoid Valves Market Drivers 2.2.1.2. North America Solenoid Valves Market Restraints 2.2.1.3. North America Solenoid Valves Market Opportunities 2.2.1.4. North America Solenoid Valves Market Challenges 2.2.2. Europe 2.2.2.1. Europe Solenoid Valves Market Drivers 2.2.2.2. Europe Solenoid Valves Market Restraints 2.2.2.3. Europe Solenoid Valves Market Opportunities 2.2.2.4. Europe Solenoid Valves Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Solenoid Valves Market Drivers 2.2.3.2. Asia Pacific Solenoid Valves Market Restraints 2.2.3.3. Asia Pacific Solenoid Valves Market Opportunities 2.2.3.4. Asia Pacific Solenoid Valves Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Solenoid Valves Market Drivers 2.2.4.2. Middle East and Africa Solenoid Valves Market Restraints 2.2.4.3. Middle East and Africa Solenoid Valves Market Opportunities 2.2.4.4. Middle East and Africa Solenoid Valves Market Challenges 2.2.5. South America 2.2.5.1. South America Solenoid Valves Market Drivers 2.2.5.2. South America Solenoid Valves Market Restraints 2.2.5.3. South America Solenoid Valves Market Opportunities 2.2.5.4. South America Solenoid Valves Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Solenoid Valves Industry 2.8. Analysis of Government Schemes and Initiatives For Solenoid Valves Industry 2.9. Solenoid Valves Market Trade Analysis 2.10. The Global Pandemic Impact on Solenoid Valves Market 3. Solenoid Valves Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Solenoid Valves Market Size and Forecast, by Material (2023-2030) 3.1.1. Stainless Steel 3.1.2. Brass 3.1.3. Aluminium 3.1.4. Plastic 3.2. Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 3.2.1. 2-way 3.2.2. 3-way 3.2.3. 4-way 3.2.4. 5-way 3.3. Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 3.3.1. Oil & Gas 3.3.2. Chemical & Petrochemical 3.3.3. Water & Wastewater 3.3.4. Food & Beverages 3.3.5. Power Generation 3.3.6. Pharmaceuticals 3.3.7. Automotive 3.3.8. Medical 3.3.9. Aerospace 3.3.10. Others 3.4. Solenoid Valves Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Solenoid Valves Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Solenoid Valves Market Size and Forecast, by Material (2023-2030) 4.1.1. Stainless Steel 4.1.2. Brass 4.1.3. Aluminium 4.1.4. Plastic 4.2. North America Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 4.2.1. 2-way 4.2.2. 3-way 4.2.3. 4-way 4.2.4. 5-way 4.3. North America Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 4.3.1. Oil & Gas 4.3.2. Chemical & Petrochemical 4.3.3. Water & Wastewater 4.3.4. Food & Beverages 4.3.5. Power Generation 4.3.6. Pharmaceuticals 4.3.7. Automotive 4.3.8. Medical 4.3.9. Aerospace 4.3.10. Others 4.4. North America Solenoid Valves Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Solenoid Valves Market Size and Forecast, by Material (2023-2030) 4.4.1.1.1. Stainless Steel 4.4.1.1.2. Brass 4.4.1.1.3. Aluminium 4.4.1.1.4. Plastic 4.4.1.2. United States Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 4.4.1.2.1. 2-way 4.4.1.2.2. 3-way 4.4.1.2.3. 4-way 4.4.1.2.4. 5-way 4.4.1.3. United States Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 4.4.1.3.1. Oil & Gas 4.4.1.3.2. Chemical & Petrochemical 4.4.1.3.3. Water & Wastewater 4.4.1.3.4. Food & Beverages 4.4.1.3.5. Power Generation 4.4.1.3.6. Pharmaceuticals 4.4.1.3.7. Automotive 4.4.1.3.8. Medical 4.4.1.3.9. Aerospace 4.4.1.3.10. Others 4.4.2. Canada 4.4.2.1. Canada Solenoid Valves Market Size and Forecast, by Material (2023-2030) 4.4.2.1.1. Stainless Steel 4.4.2.1.2. Brass 4.4.2.1.3. Aluminium 4.4.2.1.4. Plastic 4.4.2.2. Canada Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 4.4.2.2.1. 2-way 4.4.2.2.2. 3-way 4.4.2.2.3. 4-way 4.4.2.2.4. 5-way 4.4.2.3. Canada Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 4.4.2.3.1. Oil & Gas 4.4.2.3.2. Chemical & Petrochemical 4.4.2.3.3. Water & Wastewater 4.4.2.3.4. Food & Beverages 4.4.2.3.5. Power Generation 4.4.2.3.6. Pharmaceuticals 4.4.2.3.7. Automotive 4.4.2.3.8. Medical 4.4.2.3.9. Aerospace 4.4.2.3.10. Others 4.4.3. Mexico 4.4.3.1. Mexico Solenoid Valves Market Size and Forecast, by Material (2023-2030) 4.4.3.1.1. Stainless Steel 4.4.3.1.2. Brass 4.4.3.1.3. Aluminium 4.4.3.1.4. Plastic 4.4.3.2. Mexico Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 4.4.3.2.1. 2-way 4.4.3.2.2. 3-way 4.4.3.2.3. 4-way 4.4.3.2.4. 5-way 4.4.3.3. Mexico Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 4.4.3.3.1. Oil & Gas 4.4.3.3.2. Chemical & Petrochemical 4.4.3.3.3. Water & Wastewater 4.4.3.3.4. Food & Beverages 4.4.3.3.5. Power Generation 4.4.3.3.6. Pharmaceuticals 4.4.3.3.7. Automotive 4.4.3.3.8. Medical 4.4.3.3.9. Aerospace 4.4.3.3.10. Others 5. Europe Solenoid Valves Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.2. Europe Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.3. Europe Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4. Europe Solenoid Valves Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.1.2. United Kingdom Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.1.3. United Kingdom Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4.2. France 5.4.2.1. France Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.2.2. France Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.2.3. France Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.3.2. Germany Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.3.3. Germany Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.4.2. Italy Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.4.3. Italy Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.5.2. Spain Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.5.3. Spain Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.6.2. Sweden Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.6.3. Sweden Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.7.2. Austria Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.7.3. Austria Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Solenoid Valves Market Size and Forecast, by Material (2023-2030) 5.4.8.2. Rest of Europe Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 5.4.8.3. Rest of Europe Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6. Asia Pacific Solenoid Valves Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.2. Asia Pacific Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.3. Asia Pacific Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4. Asia Pacific Solenoid Valves Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.1.2. China Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.1.3. China Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.2.2. S Korea Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.2.3. S Korea Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.3.2. Japan Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.3.3. Japan Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.4. India 6.4.4.1. India Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.4.2. India Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.4.3. India Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.5.2. Australia Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.5.3. Australia Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.6.2. Indonesia Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.6.3. Indonesia Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.7.2. Malaysia Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.7.3. Malaysia Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.8.2. Vietnam Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.8.3. Vietnam Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.9.2. Taiwan Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.9.3. Taiwan Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Solenoid Valves Market Size and Forecast, by Material (2023-2030) 6.4.10.2. Rest of Asia Pacific Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 7. Middle East and Africa Solenoid Valves Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Solenoid Valves Market Size and Forecast, by Material (2023-2030) 7.2. Middle East and Africa Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 7.3. Middle East and Africa Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 7.4. Middle East and Africa Solenoid Valves Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Solenoid Valves Market Size and Forecast, by Material (2023-2030) 7.4.1.2. South Africa Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 7.4.1.3. South Africa Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Solenoid Valves Market Size and Forecast, by Material (2023-2030) 7.4.2.2. GCC Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 7.4.2.3. GCC Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Solenoid Valves Market Size and Forecast, by Material (2023-2030) 7.4.3.2. Nigeria Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 7.4.3.3. Nigeria Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Solenoid Valves Market Size and Forecast, by Material (2023-2030) 7.4.4.2. Rest of ME&A Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 7.4.4.3. Rest of ME&A Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 8. South America Solenoid Valves Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Solenoid Valves Market Size and Forecast, by Material (2023-2030) 8.2. South America Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 8.3. South America Solenoid Valves Market Size and Forecast, by Industry(2023-2030) 8.4. South America Solenoid Valves Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Solenoid Valves Market Size and Forecast, by Material (2023-2030) 8.4.1.2. Brazil Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 8.4.1.3. Brazil Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Solenoid Valves Market Size and Forecast, by Material (2023-2030) 8.4.2.2. Argentina Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 8.4.2.3. Argentina Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Solenoid Valves Market Size and Forecast, by Material (2023-2030) 8.4.3.2. Rest Of South America Solenoid Valves Market Size and Forecast, by Valve Design Type (2023-2030) 8.4.3.3. Rest Of South America Solenoid Valves Market Size and Forecast, by Industry (2023-2030) 9. Global Solenoid Valves Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Solenoid Valves Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. CKD Corporation (Japan) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Emerson Electric Corporation (USA) 10.3. Kendrion (Germany) 10.4. GF Piping (Switzerland) 10.5. IMI Precision Engineering (Birmingham) 10.6. Danfoss Industries Ltd. (Denmark) 10.7. Curtiss Wright Corporation (USA) 10.8. Parker Hannifin Corporation (USA) 10.9. ASCO Valves Inc. (USA) 10.10. Rotex automation (India) 10.11. SMC Corporation (Japan) 10.12. The Lee Company (USA) 10.13. Asco Valve, Inc. (USA) 10.14. Christian Bürkert GmbH & Co. Kg (Germany) 10.15. Curtiss-Wright Corporation (USA) 10.16. Danfoss A/S (Denmark) 10.17. GSR Ventiltechnik GmbH & Co. Kg (Germany) 10.18. IMI PLC (UK) 10.19. Emerson Electric Co. (Missouri) 11. Key Findings 12. Industry Recommendations 13. Solenoid Valves Market: Research Methodology 14. Terms and Glossary