Solar Inverter Market size was valued at US$ 12.79 Bn. in 2022 and the total revenue is expected to grow at 5.78% of CAGR from 2023 to 2029, reaching nearly US$ 18.96 Bn.Solar Inverter Market Overview:

An essential component of the solar system, the solar inverter transforms the DC power coming from the solar panels into AC power. In addition to converting power, solar inverters track voltage, permit communication with the grid, & shut down in emergencies. As a result, greater use of on-grid solar inverters protects the security and effectiveness of home appliances. On-grid solar inverters produce a pure sine wave of AC electricity as opposed to off-grid inverters. Most frequently utilized in residential and utility applications, solar inverters are also being employed more frequently worldwide in commercial & industrial projects.To know about the Research Methodology :- Request Free Sample Report

Solar Inverter Market Dynamics

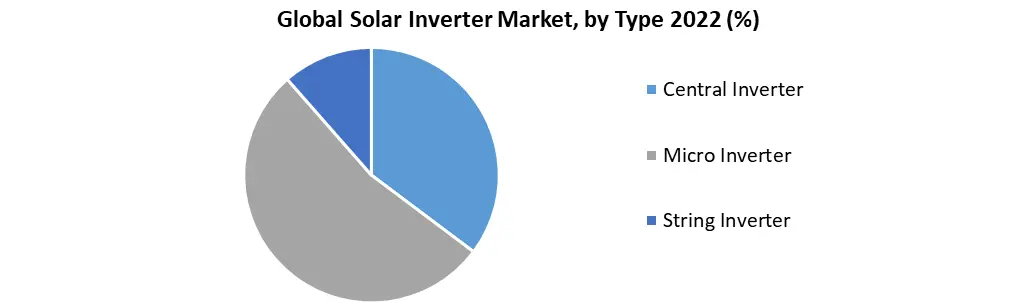

Solar inverter installation is simple, and rapid advancements in renewable energy are the main drivers of market growth throughout the forecast period. Excessive costs, the lack of panel-level monitoring, and high heat loss in large solar inverters are the main problems limiting industry growth during the forecast period. On the other hand, it is expected that increased government initiatives and investments in the electrification of remote & rural areas would present chances for major players in the global solar inverter market. In the year 2022, the U.S. overtook Canada as North America's largest market. There is a substantial market for several types of PV inverters. The scale of central inverters (1.5 MW or more) and three-phase string inverters are two recent inverter trends in the United States (60 kW). Although string inverters have steadily increased in popularity in the U.S., central inverters are expected to continue to dominate the market. Solar inverter manufacturers, component manufacturers, inverter manufacturers, distributors, sellers, & end users make up the highly complicated value chain. Since panels make up the majority of the solar value chain, followed by inverters & batteries, different parts generate varying amounts of revenue. Given that solar devices have relatively high efficiency, there is minimal potential for technical distinction due to the complexity of the supply chain. Unlocking the growth potential of the solar Inverter Industry: Manufacturers must separate themselves from rivals in the highly competitive solar inverter market to survive. According to MMR report analysis, price pressure and intense competition caused the Top 5 global inverter makers' total revenue to drop 10% last year. ABB paid Fimer to take over its inverter company, Schneider Electric quit the utility-scale inverter market, and KACO sold its string and central inverter operations to Siemens and OCI Power, respectively. These are just a few of the many acquisitions and departures that have occurred in 2019 alone. Yaskawa Solectria Solar, an American inverter maker, believes it has the responsive local customer service and visionary leadership necessary to remain competitive. One of only three major manufacturers of solar power electronics that is based entirely in the United States is Solectria. The others are hybrid inverter vendor Pika Energy, power optimizer producer Alencon Systems, and manufacturer of microinverters Chilicon Power (which was recently acquired by another U.S. company, Generac). Although Solectria assembles its goods in the United States, its inverters contain certain foreign parts. While combiners and earlier inverter types are produced in Oak Creek, Wisconsin, Yaskawa America facilities in Buffalo Grove, Illinois, manufacture its new inverters. Solectria wants to maintain its position as a Made-in-USA choice for installers in the New England region & beyond by staying at the front of technological and Cybersecurity improvements. Investment in Solar Inverter Industry: Many people find solar inverters to be attractive alternative investments. When used by businesses or local governments, these technologies are at the front of enabling continuous improvement in energy production and consumption, which can substantially improve environmental conditions and save costs. Solar inverters combine innovation and efficiency in production to provide smart renewable energy with low consumption costs, making them, particularly appealing to companies with environmental, social, and governance (ESG) portfolios. In the solar inverter business, SMA Solar Technology of Germany held 30% of the market share just 11 years ago; today, Huawei and Sungrow of China control the majority of the market. Despite losing 4% of its global market share, the Chinese string inverter powerhouse maintained its position as the top provider for the fourth consecutive year, according to an MMR study report. With 64% of all sales globally, Asia-Pacific was once again the largest inverter market in 2019. The second and third-largest providers were Sungrow and SMA, respectively.By End-user, With a revenue share of over 44.0% in the year 2022, the utility segment dominated the solar inverter market. The central & string inverter is the solar inverter that is most frequently utilized in the utility segment. The utility sector is growing for several reasons, the rising demand for renewable energy, the falling cost of solar energy and equipment, and the emergence of government subsidies are primary reasons for the growth of the utility segment. In addition, the segment is rising as a result of the presence of major players who provide customers with market-leading utility-scale solutions through their pre-integrated power plants to increase efficiency and lower balance-of-system costs. By Type: The largest revenue share in the year 2022 more than 49.0% was accounted for by the central inverter. When properly maintained and installed, these inverters are very dependable and are kept in a secure position. The inverters take the DC electricity from all the PV panels and convert it into AC power, becoming a single point for power distribution. The inverters are integrated with big arrays put on field installations, industrial facilities, and buildings. In 2022, the string inverter market share was the second-largest. The commercial and residential sectors are where the string inverter is most commonly used. One of the key drivers of segment growth is the lower initial cost and simple installation. These inverters have three-phase variations, are strong, provide great design flexibility, are well-supported (by reputable brands), and have remote system monitoring capabilities. During the forecast period, the micro solar inverters market is expected to increase at a significant rate. Micro PV inverters, which are electronics at the module level, are now a common option for the commercial and industrial sectors. These inverters benefit from excellent levels of dependability, improved performance, and efficiency thanks to the Maximum Power Point Tracker (MPPT), ease of installation, no space limitations, and low cost.

Solar Inverter Market Segments:

Global Solar Inverter Market by Region:

Asia Pacific region is expected to hold the highest revenue share of over 43.0% by 2029. The solar market in this region is increasing quickly, and China is both a key global competitor and its largest provider. The growth of the industry in the region has also been greatly aided by the rising number of solar installations in developing countries. Top 5 States in India for Solar Power Generation: The Indian renewables industry progressed a lot in 2017, and Prime Minister Narendra Modi announced a new target of net-zero carbon emissions by 2070. The country's ability to produce green energy is expanding, and its two richest businesspeople recently announced plans to invest thousands of Crores in the industry. While still aiming for 170 GW by 2022, India has achieved its nationally set contributions objective with a total installed non-fossil energy capacity of 157.32 GW, or 40.1% of all installed electrical capacity. Solar, wind, and hydropower produced 57.71 GW, 40.79 GW, & 51.74 GW, respectively, as of the end of June 2022. The nation's solar industry, which was recently ranked fifth among the world's most attractive solar markets by IBEF, earned the highest-ever investment in the Union Budget for FY 2023, totaling Rs. 33.7 billion, an increase of 30% from Rs. 26 billion in FY21.In the year 2022, North America held a large revenue share, with the U.S. being the main driver of solar inverter market growth. A significant market for various kinds of solar inverters is the United States. Recent inverter trends in the nation include the predominance of 1.5 MW plus capacity central inverters and three-phase string inverters with a capacity of at least 60 kW. Although string inverters saw strong growth in North America, central PV inverters are expected to continue holding the biggest market share during the forecast period. Due to the presence of supportive government policies and the provision of subsidies like home feed-in tariffs (FITs), which encourage consumers to invest in renewable energy, Europe is expected to have a substantial CAGR over the projected period. Due to the high-tech nature of the inverters, Germany is a global leader in the production of solar inverters. As a result, German solar companies have an edge over rivals.

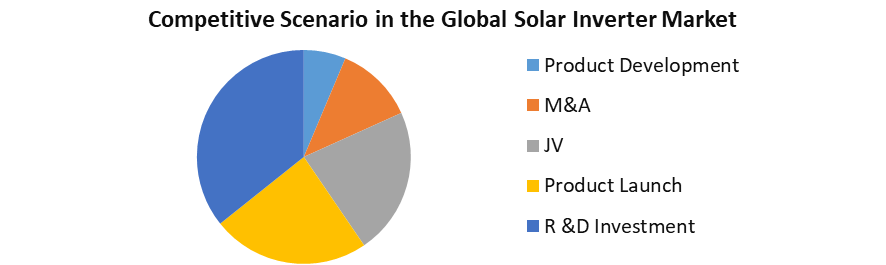

STATES SOLAR POWER GENERATION CAPACITY Rajasthan 13.58 GW Karnataka 7.5 GW Gujarat 6.3 GW Tamil Nadu 4.8 GW Telangana 4.5 GW Competitive Scenario in the Global Solar Inverter Market

Acquisition, business expansions & technological advancements are common strategies followed by major market players.

Solar Inverter Market Scope: Inquire before buying

Solar Inverter Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 12.79 Bn. Forecast Period 2023 to 2029 CAGR: 5.78% Market Size in 2029: US $ 18.96 Bn. Segments Covered: by Type 1. Central Inverter 2. Micro Inverter 3. String Inverter by Applications 1. Residential 2. Commercial 3. Utilities by Connection type 1. On-grid 2. Off-grid by Phase 1. Single-phase 2. Three-phase Solar Inverter Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Solar Inverter Market, Key Players are:

1. SMA Solar Technology AG (Germany) 2. Siemens AG (Germany) 3. GoodWe (Germany) 4. Omron Corporation (Japan) 5. TMEIC (Japan) 6. Canadian Solar Inc. (Canada) 7. ABB Ltd (Switzerland) 8. HUAWEI (China) 9. Sungrow (China) 10. Growatt (China) 11. Ginlong Technologies Co (China) 12. Sineng Electric Co. (China) 13. Solax Power (China) 14. Zhejiang Benyi Electrical Co., Ltd. (China) 15. SunPower Corporation (US) 16. Power Electronics (US) 17. Solectria Renewables LLC (US) 18. Hitachi Hi-Rel Power Electronics Pvt. Ltd. (Inida) 19. LENTO INDUSTRIES PRIVATE LIMITED (India) 20. SolarEdge (Israel) 21. LG Electronics (South Korea) 22. Fronius (Austria) 23. Delta Solar Solutions (Taiwan) 24. Fimer (Italy) Frequently Asked Questions: 1] What segments are covered in the Global Solar Inverter Market report? Ans. The segments covered in the Solar Inverter Market report are based on Type, Applications, Connection type and Phase. 2] Which region is expected to hold the highest share in the Global Solar Inverter Market? Ans. The Asia Pacific region is expected to hold the highest share in the Solar Inverter Market. 3] What is the market size of the Global Solar Inverter Market by 2029? Ans. The market size of the Solar Inverter Market by 2029 is expected to reach US$ 18.96 Bn. 4] What is the forecast period for the Global Solar Inverter Market? Ans. The forecast period for the Solar Inverter Market is 2023-2029. 5] What was the market size of the Global Solar Inverter Market in 2022? Ans. The market size of the Solar Inverter Market in 2022 was valued at US$ 12.79 Bn.

1. Global Solar Inverter Market: Research Methodology 2. Global Solar Inverter Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Solar Inverter Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Solar Inverter Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Solar Inverter Market Segmentation 4.1 Global Solar Inverter Market, by Type (2022-2029) • Central Inverter • Micro Inverter • String Inverter 4.2 Global Solar Inverter Market, by Applications (2022-2029) • Residential • Commercial • Utilities 4.3 Global Solar Inverter Market, by Connection type (2022-2029) •On-grid •Off-grid 4.4 Global Solar Inverter Market, by Phase (2022-2029) • Single-phase • Three-phase 5. North America Solar Inverter Market(2022-2029) 5.1 North America Solar Inverter Market, by Type (2022-2029) • Central Inverter • Micro Inverter • String Inverter 5.2 North America Solar Inverter Market, by Applications (2022-2029) • Residential • Commercial • Utilities 5.3 North America Solar Inverter Market, by Connection type (2022-2029) •On-grid •Off-grid 5.4 North America Solar Inverter Market, by Phase (2022-2029) • Single-phase • Three-phase 5.5 North America Solar Inverter Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Solar Inverter Market (2022-2029) 6.1. European Solar Inverter Market, by Type (2022-2029) 6.2. European Solar Inverter Market, by Applications (2022-2029) 6.3. European Solar Inverter Market, by Connection type (2022-2029) 6.4. European Solar Inverter Market, by Phase (2022-2029) 6.5. European Solar Inverter Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Solar Inverter Market (2022-2029) 7.1. Asia Pacific Solar Inverter Market, by Type (2022-2029) 7.2. Asia Pacific Solar Inverter Market, by Applications (2022-2029) 7.3. Asia Pacific Solar Inverter Market, by Connection type (2022-2029) 7.4. Asia Pacific Solar Inverter Market, by Phase (2022-2029) 7.5. Asia Pacific Solar Inverter Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Solar Inverter Market (2022-2029) 8.1 Middle East and Africa Solar Inverter Market, by Type (2022-2029) 8.2. Middle East and Africa Solar Inverter Market, by Applications (2022-2029) 8.3. Middle East and Africa Solar Inverter Market, by Connection type (2022-2029) 8.4. Middle East and Africa Solar Inverter Market, by Phase (2022-2029) 8.5. Middle East and Africa Solar Inverter Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Solar Inverter Market (2022-2029) 9.1. South America Solar Inverter Market, by Type (2022-2029) 9.2. South America Solar Inverter Market, by Applications (2022-2029) 9.3. South America Solar Inverter Market, by Connection type (2022-2029) 9.4. South America Solar Inverter Market, by Phase (2022-2029) 9.5. South America Solar Inverter Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 SMA Solar Technology AG (Germany) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Siemens AG (Germany) 10.3 GoodWe (Germany) 10.4 Omron Corporation (Japan) 10.5 TMEIC (Japan) 10.6 Canadian Solar Inc. (Canada) 10.7 ABB Ltd (Switzerland) 10.8 HUAWEI (China) 10.9 Sungrow (China) 10.10 Growatt (China) 10.11 Ginlong Technologies Co (China) 10.12 Sineng Electric Co. (China) 10.13 Solax Power (China) 10.14 Zhejiang Benyi Electrical Co., Ltd. (China) 10.15 SunPower Corporation (US) 10.16 Power Electronics (US) 10.17 Solectria Renewables LLC (US) 10.18 Hitachi Hi-Rel Power Electronics Pvt. Ltd. (Inida) 10.19 LENTO INDUSTRIES PRIVATE LIMITED (India) 10.20 SolarEdge (Israel) 10.21 LG Electronics (South Korea) 10.22 Fronius (Austria) 10.23 Delta Solar Solutions (Taiwan) 10.24 Fimer (Italy)