Smart Labels Market size is expected to reach 17.23 US$ Bn in year 2029, at a CAGR of 17% during the forecast period. The report includes an analysis of the impact of COVID-19 lockdown on the revenue of market leaders, followers, and disruptors. Since the lockdown was implemented differently in various regions and countries; the impact of the same is also seen differently by regions and segments. The report has covered the current short-term and long-term impact on the market, and it would help the decision-makers to prepare the outline and strategies for companies by region.Smart Labels Definition:

Smart Label also called smart tag is an extremely flat configured transponder under a conventional print coded label, which includes a chip, antenna, and bonding wires. A smart label has various features like automated reading, quick identification, re-programmability, high tolerance, and reduced errors.To know about the Research Methodology :- Request Free Sample Report

Smart Labels Market Dynamics:

The Internet-of-Things (IoT) aims at connecting information systems with real-world objects. It enables automatic acquisition, process, and reaction to real-world data in real-time. One of the promising technologies enabling IoT is Radio Frequency Identification. RFID labels that are the smart labels are attached to physical objects provide unique identification and other object information directly acquired from those objects. RFID technology provides an accurate real-time representation of ’things’ to the information systems. As a consequence, labeling the world with RFID is business relevant. It enables enterprises to measure and manage real-world objects in real-time, which acts as the main driving factor for the growth of the Global Smart Labels Market. With the use of smart labels objects become smarter devices that combine identification with sensors. For instance, smart labels with temperature sensors that are attached to every item of perishable goods can measure their storage quality. A direct implication is an increase in the information load. From a small heap of information from a single RFID label on a pallet, it scales up to two or three magnitudes when 100s or 1000s of items on a pallet are interrogated for their information. And it takes two or three magnitudes more time to interrogate so many RFID labels. The situation even intensifies in the context of multi-tagging, whereas multiple RFID labels are attached to a single object. Product manufacturer's concerns regarding the practice of counterfeiting of their products can also be resolved to a great extent by using Smart Labels enabled with bar codes and RFID technologies. Counterfeiting has become a worldwide phenomenon, which has been impacting industrial manufacturers severely, by affecting their scales revenue and also respective brand image. It has prompted manufacturers to use effective anti-counterfeiting technologies based on unique codes on labels. Various Smart Labels are available in the market that is enabled with both track &trace and anti-counterfeit technologies. Track &trace technology helps manufacturers to maintain proper tracking of products, while anti-counterfeit technology helps to protect products from counterfeits. The high and fluctuating cost of raw material act as a restraint to the growth of the Global Smart Labels Market.Smart Labels Market Segment Analysis:

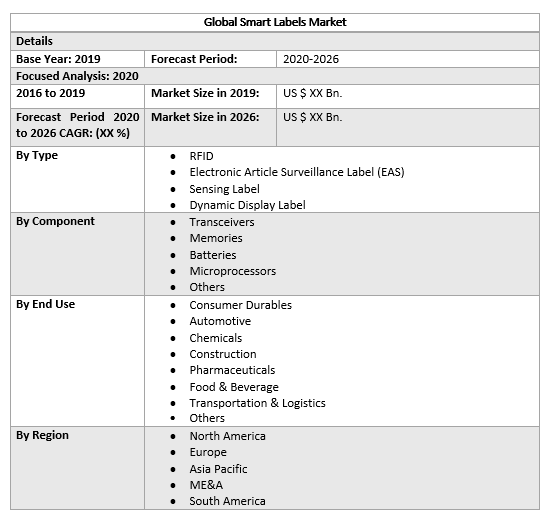

The report groups the Global Smart Labels Market in different segments by Type, Component, End-Use, and region to forecast the revenues and analyze the market share of each segment over the forecast period. Based on End Use, the Global Industrial Label Market is segmented into Consumer Durables, Automotive, Chemicals, Construction, Pharmaceuticals, Food & Beverage, Transportation & Logistics, and Others. The Food & Beverage segment was dominant in 2021 and is expected to command a market share of xx% by 2029. The Food and Drug Administration (FDA) is responsible for assuring that foods sold are safe, and properly labeled. This applies to foods produced domestically, as well as foods from foreign countries. The Federal Food, Drug, and Cosmetic Act and the Fair Packaging and Labeling Act are the Federal laws governing food products under FDA's jurisdiction. The Nutrition Labeling and Education Act (NLEA), which amended the FD&C Act requires most foods to bear nutrition labeling and requires food labels that bear nutrient content claims and certain health messages to comply with specific requirements, which is contributing to the growth of the demand of labels in the segment. Based on Type, the Global Smart Label Market is segmented into RFID, Electronic Article Surveillance Label (EAS), Sensing Label and Dynamic Display Label. The RFID segment was dominant in 2021 and is expected to command a market share of xx% by 2029. An RFID label equipped with a temperature sensor detects when a temperature range is exceeded and starts recording these data for reporting. The benefit of using RFID labels in large quantities, e.g., on every single item within a supply chain, has to outweigh the costs to be feasible from an economic point of view. For instance, the manufacturer makes the investment to attach RFID labels and the retailer may have the benefit. The costs of item-level RFID deployments could be shared among supply chain partners such that the overall supply chain profit is optimized.Smart Labels Market Regional Insights:

Asia Pacific is expected to command the largest market share of xx% by 2029 Increasing awareness and a huge consumer base in developing economies of APAC, like India and China are expected to boost the growth of the Global Smart Labels Market. With the growth of consumer goods packaging with the rise in the e-commerce industry and industrialization in the region, the demand for labels has increased. Also, with the growth in industries like construction, food and beverages, and the automotive industry, the need for warning or security labels has increased. Vendors in different regions are also entering into merger acquisition strategies to enhance their footprint. In January 2021, Toronto-based specialty label, security, and packaging solutions provider CCL Industries Inc. has acquired two Spanish companies that make labels for clothing and other products. The objective of the report is to present a comprehensive analysis of the Global Smart Labels Market to the stakeholders in the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Global Smart Labels Market dynamics, structure by analyzing the market segments and projects Global Smart Labels Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Global Smart Labels Market make the report investor’s guide.Smart Labels Market Scope: Inquire before buying

Smart Labels Market Key Players:

• Avery Dennison Corporation • Henkel AG & Company • 3M • CILS Ltd. • Cenveo Inc. • ILN • Saint Gobain SA • GR Label • Fuji Seal International, Inc. • GSM Graphics Arts • Brady Corporation • DuPont • H.B. Fuller Co. • Herma Labels • Flexcon Company, Inc. • Dunmore Corporation • CCL Industries Inc. • TSC Auto ID Frequently Asked Questions: 1. Which region has the largest share in Global Smart Labels Market? Ans: Asia Pacific region holds the highest share in 2021. 2. What is the growth rate of Global Smart Labels Market? Ans: The Global Smart Labels Market is growing at a CAGR of 17% during forecasting period 2022-2029. 3. What is scope of the Global Smart Labels market report? Ans: Global Smart Labels Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Smart Labels market? Ans: The important key players in the Global Smart Labels Market are – Avery Dennison Corporation, Henkel AG & Company, 3M, CILS Ltd., Cenveo Inc., ILN, Saint Gobain SA, GR Label, Fuji Seal International, Inc., GSM Graphics Arts, Brady Corporation, DuPont, H.B. Fuller Co., Herma Labels, Flexcon Company, Inc., Dunmore Corporation, CCL Industries Inc., and TSC Auto ID 5. What is the study period of this market? Ans: The Global Smart Labels Market is studied from 2021 to 2029.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Smart Labels Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2021 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the Smart Labels Market 3.4. Geographical Snapshot of the Smart Labels Market, By Manufacturer share 4. Global Smart Labels Market Overview, 2021-2029 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Global Smart Labels Market 5. Supply Side and Demand Side Indicators 6. Global Smart Labels Market Analysis and Forecast, 2021-2029 6.1. Global Smart Labels Market Size & Y-o-Y Growth Analysis. 7. Global Smart Labels Market Analysis and Forecasts, 2021-2029 7.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 7.1.1. RFID 7.1.2. Electronic Article Surveillance Label (EAS) 7.1.3. Sensing Label 7.1.4. Dynamic Display Label 7.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 7.2.1. Transceivers 7.2.2. Memories 7.2.3. Batteries 7.2.4. Microprocessors 7.2.5. Others 7.3. Market Size (Value) Estimates & Forecast By End-use, 2021-2029 7.3.1. Consumer Durables 7.3.2. Automotive 7.3.3. Chemicals 7.3.4. Construction 7.3.5. Pharmaceuticals 7.3.6. Food & Beverage 7.3.7. Transportation & Logistics 7.3.8. Others 8. Global Smart Labels Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2021-2029 8.1.1. North America 8.1.2. Europe 8.1.3. Asia-Pacific 8.1.4. Middle East & Africa 8.1.5. South America 9. North America Smart Labels Market Analysis and Forecasts, 2021-2029 9.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 9.1.1. RFID 9.1.2. Electronic Article Surveillance Label (EAS) 9.1.3. Sensing Label 9.1.4. Dynamic Display Label 9.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 9.2.1. Transceivers 9.2.2. Memories 9.2.3. Batteries 9.2.4. Microprocessors 9.2.5. Others 9.3. Market Size (Value) Estimates & Forecast By End-use, 2021-2029 9.3.1. Consumer Durables 9.3.2. Automotive 9.3.3. Chemicals 9.3.4. Construction 9.3.5. Pharmaceuticals 9.3.6. Food & Beverage 9.3.7. Transportation & Logistics 9.3.8. Others 10. North America Smart Labels Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2021-2029 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Smart Labels Market Analysis and Forecasts, 2021-2029 11.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 11.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 11.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 12. Canada Smart Labels Market Analysis and Forecasts, 2021-2029 12.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 12.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 12.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 13. Mexico Smart Labels Market Analysis and Forecasts, 2021-2029 13.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 13.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 13.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 14. Europe Smart Labels Market Analysis and Forecasts, 2021-2029 14.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 14.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 14.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 15. Europe Smart Labels Market Analysis and Forecasts, By Country 15.1. Market Size (Value) Estimates & Forecast By Country, 2021-2029 15.1.1. U.K 15.1.2. France 15.1.3. Germany 15.1.4. Italy 15.1.5. Spain 15.1.6. Sweden 15.1.7. CIS Countries 15.1.8. Rest of Europe 16. U.K. Smart Labels Market Analysis and Forecasts, 2021-2029 16.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 16.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 16.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 17. France Smart Labels Market Analysis and Forecasts, 2021-2029 17.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 17.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 17.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 18. Germany Smart Labels Market Analysis and Forecasts, 2021-2029 18.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 18.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 18.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 19. Italy Smart Labels Market Analysis and Forecasts, 2021-2029 19.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 19.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 19.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 20. Spain Smart Labels Market Analysis and Forecasts, 2021-2029 20.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 20.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 20.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 21. Sweden Smart Labels Market Analysis and Forecasts, 2021-2029 21.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 21.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 21.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 22. CIS Countries Smart Labels Market Analysis and Forecasts, 2021-2029 22.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 22.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 22.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 23. Rest of Europe Smart Labels Market Analysis and Forecasts, 2021-2029 23.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 23.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 23.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 24. Asia Pacific Smart Labels Market Analysis and Forecasts, 2021-2029 24.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 24.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 24.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 25. Asia Pacific Smart Labels Market Analysis and Forecasts, by Country 25.1. Market Size (Value) Estimates & Forecast By Country, 2021-2029 25.1.1. China 25.1.2. India 25.1.3. Japan 25.1.4. South Korea 25.1.5. Australia 25.1.6. ASEAN 25.1.7. Rest of Asia Pacific 26. China Smart Labels Market Analysis and Forecasts, 2021-2029 26.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 26.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 26.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 27. India Smart Labels Market Analysis and Forecasts, 2021-2029 27.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 27.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 27.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 28. Japan Smart Labels Market Analysis and Forecasts, 2021-2029 28.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 28.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 28.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 29. South Korea Smart Labels Market Analysis and Forecasts, 2021-2029 29.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 29.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 29.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 30. Australia Smart Labels Market Analysis and Forecasts, 2021-2029 30.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 30.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 30.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 31. ASEAN Smart Labels Market Analysis and Forecasts, 2021-2029 31.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 31.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 31.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 32. Rest of Asia Pacific Smart Labels Market Analysis and Forecasts, 2021-2029 32.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 32.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 32.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 33. Middle East Africa Smart Labels Market Analysis and Forecasts, 2021-2029 33.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 33.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 33.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 34. Middle East Africa Smart Labels Market Analysis and Forecasts, by Country 34.1. Market Size (Value) Estimates & Forecast by Country, 2021-2029 34.1.1. South Africa 34.1.2. GCC Countries 34.1.3. Egypt 34.1.4. Nigeria 34.1.5. Rest of ME&A 35. South Africa Smart Labels Market Analysis and Forecasts, 2021-2029 35.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 35.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 35.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 36. GCC Countries Smart Labels Market Analysis and Forecasts, 2021-2029 36.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 36.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 36.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 37. Egypt Smart Labels Market Analysis and Forecasts, 2021-2029 37.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 37.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 37.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 38. Nigeria Smart Labels Market Analysis and Forecasts, 2021-2029 38.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 38.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 38.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 39. Rest of ME&A Smart Labels Market Analysis and Forecasts, 2021-2029 39.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 39.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 39.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 40. South America Smart Labels Market Analysis and Forecasts, 2021-2029 40.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 40.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 40.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 41. South America Smart Labels Market Analysis and Forecasts, by Country 41.1. Market Size (Value) Estimates & Forecast by Country, 2021-2029 41.1.1. Brazil 41.1.2. Argentina 41.1.3. Rest of South America 42. Brazil Smart Labels Market Analysis and Forecasts, 2021-2029 42.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 42.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 42.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 43. Argentina Smart Labels Market Analysis and Forecasts, 2021-2029 43.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 43.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 43.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 44. Rest of South America Smart Labels Market Analysis and Forecasts, 2021-2029 44.1. Market Size (Value) Estimates & Forecast By Type, 2021-2029 44.2. Market Size (Value) Estimates & Forecast By Component, 2021-2029 44.3. Market Size (Value) Estimates & Forecast By End users, 2021-2029 45. Competitive Landscape 45.1. Geographic Footprint of Major Players in the Global Smart Labels Market 45.2. Competition Matrix 45.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 45.2.2. New Product Launches and Product Enhancements 45.2.3. Market Consolidation 45.2.3.1. M&A by Regions, Investment and Verticals 45.2.3.2. M&A, Forward Integration and Backward Integration 45.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 45.3. Company Profile : Key Players 45.3.1. Avery Dennison Corporation 45.3.1.1. Company Overview 45.3.1.2. Financial Overview 45.3.1.3. Geographic Footprint 45.3.1.4. Product Portfolio 45.3.1.5. Business Strategy 45.3.1.6. Recent Developments 45.3.2. Henkel AG & Company 45.3.3. 3M 45.3.4. CILS Ltd. 45.3.5. Cenveo Inc. 45.3.6. ILN 45.3.7. Saint Gobain SA 45.3.8. GR Label 45.3.9. Fuji Seal International, Inc. 45.3.10. GSM Graphics Arts 45.3.11. Brady Corporation 45.3.12. DuPont 45.3.13. H.B. Fuller Co. 45.3.14. Herma Labels 45.3.15. Flexcon Company, Inc. 45.3.16. Dunmore Corporation 45.3.17. CCL Industries Inc. 45.3.18. TSC Auto ID 46. Primary Key Insights