The global Shea Butter Market size is expected to reach USD 6.69 billion by 2032, at a 13.1% CAGR. Explore market trends, segmentation by type, nature, application and distribution channel, regional outlook, competitive landscape, and key players in cosmetics, food, pharmaceuticals and cocoa butter equivalents across the Middle East & Africa, North America, Europe, Asia Pacific and South America.Shea Butter Market Overview

The rising demand for clean-label personal care products, functional food ingredients, and sustainable raw materials drives the Shea Butter Market. Growing consumer preference for natural, organic, and plant-based ingredients is strengthening the global shea butter Industry outlook, with increasing opportunities across cosmetics, food processing, pharmaceuticals, and chocolate/confectionery applications. In cosmetics and personal care, shea butter is widely used due to its high content of vitamins, essential fatty acids, and natural antioxidants. The expanding bakery, confectionery, and cocoa butter equivalent (CBE) sector further boosts demand, particularly from Europe and North America. The rising adoption of organic shea butter, growth in fair trade shea butter industry, and women-led cooperatives in West Africa are reshaping supply chain models, enhancing traceability and sustainability. The Shea Butter Market by application shows strong penetration in skincare, haircare, medicinal ointments, and food and beverage formulations. Increasing investments by leading players such as AAK, Bunge Loders Croklaan, Fuji Oil, and Olvea are driving innovation, supply chain modernization, and improved product grade diversification, raw, unrefined, refined, ultra-refined, cosmetic grade, and food grade shea butter.To know about the Research Methodology :- Request Free Sample Report

Trend: Increasing Demand for Organic, Sustainable, and Fair-Trade Shea Butter

The rapid shift toward sustainable shea butter sourcing, traceability, and ethically certified production drives the Shea Butter Market. Consumers and companies increasingly prefer organic shea butter and fair-trade certified shea butter, driving transparency across the West African shea butter supply chain analysis. As sustainability commitments rise among cosmetic, food, and chocolate manufacturers, demand for responsibly sourced shea products is accelerating globally. The emergence of women-empowered cooperatives in Ghana, Nigeria, Burkina Faso, and Mali. Over 16 million women in West Africa are engaged in shea collection and processing, highlighting strong socio-economic value. Multinationals such as AAK, Bunge Loders Croklaan, Fuji Oil, and Olvea are increasingly partnering with local communities to build transparent sourcing networks, reduce environmental impact, and ensure long-term supply stability. The expansion of organic certified shea butter, growth in cocoa butter equivalent shea markets, and rising demand for clean-label ingredients in pharmaceuticals, confectionery, and bakery products reinforce the trend. The digital traceability tools, carbon-neutral production, and regenerative agricultural practices are enhancing the credibility of sustainable shea value chains, shaping the future of the natural Shea Butter Market. Increase in Demand from the Cosmetics and Personal Care Industry to drive the Shea Butter Market The shift toward natural, organic, and plant-derived ingredients is accelerating the adoption of unrefined shea butter, organic shea butter, and cosmetic-grade shea butter, especially in skincare and haircare formulations. Premium beauty brands increasingly incorporate shea butter for its moisturizing, anti-inflammatory, and restorative properties, boosting the global shea butter market demand. The sector benefits from growing consumer awareness of sustainable and ethical sourcing practices, which has strengthened the fair-trade shea butter market and empowered women-led cooperatives across West Africa. As clean beauty trends rise in North America, Europe, and Asia-Pacific, the market is experiencing heightened opportunities in natural balms, lotions, serums, soaps, conditioners, and body butters. Furthermore, regulatory acceptance in major regions, including FDA compliance in the U.S. and EU cosmetics regulations, reinforces product credibility. Combined with increasing investments by global players such as BASF, Croda, and Clariant, this trend supports long-term shea butter industry analysis, supply chain expansion, and sustained market penetration. Six Key Benefits of Shea Butter in Skin CareSupply Chain Volatility and Limited Processing Infrastructure to Restrain the Shea Butter Market The shea industry heavily depends on wild shea trees in West Africa, which are not formally cultivated; this makes raw material availability vulnerable to climate shifts, seasonal variations, bushfires, and land-use changes. These disruptions significantly influence shea butter price trends, export volumes, and product quality. The fragmented nature of the shea butter supply chain, dominated by small-scale rural collectors with limited access to mechanized processing. This results in inconsistent quality across raw shea butter, refined shea butter, and ultra-refined shea butter markets, restricting their competitiveness in high-value cosmetics and food-grade applications. The lack of adequate storage, transportation, and quality testing facilities further weakens supply efficiency and increases production costs. The dependence on manual labor and underdeveloped infrastructure in many producing countries creates long lead times and fluctuating availability. This particularly impacts the cocoa butter equivalent shea market, pharmaceutical applications, and large-scale food processing industries that require standardized product supply. These constraints hinder scalability, limit the global Shea Butter Market outlook, and pose challenges for manufacturers seeking consistent, certified, and high-quality shea inputs.

Shea Butter Market Segmentation Analysis

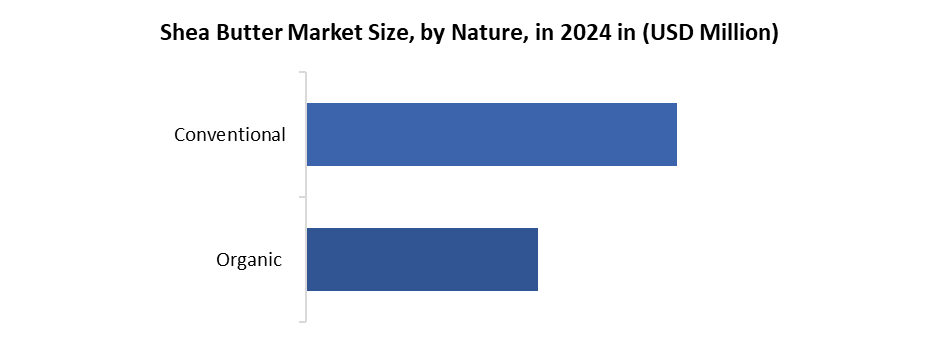

By Type, the market is segmented into Raw and Unrefined and Refined. The Raw and Unrefined Shea Butter industry dominates the Shea Butter Market Share due to its higher nutrient retention, natural aroma, and strong demand from clean-beauty brands. Unrefined shea butter is rich in vitamins A and E, antioxidants, and bioactive compounds, making it a preferred choice in the cosmetic grade shea butter for skincare and haircare products, and artisanal formulations. This segment also benefits from the rise of the organic shea butter, fair-trade sourcing, and sustainability-driven consumers. The Refined shea butter serves large-scale industrial applications, particularly in the food-grade shea butter market, cocoa butter equivalent shea market, and multinational cosmetic manufacturers requiring consistent color, odor, and texture. Refined and ultra-refined shea butter is widely used in shea butter in chocolates and confectionery, bakery fats, and pharmaceutical ointments where purity and stability are critical. While refined shea butter maintains strong commercial demand, the unrefined segment continues to outperform due to premium positioning, growing natural beauty trends.By Nature, the market is categorized into the Organic and Conventional. Conventional shea butter benefits from large-scale availability, cost-effectiveness, and broad adoption across industries, including the food processing shea butter market, industrial grade and shea butter usage in bakery and confectionery. Due to its strong supply base in West Africa and wide applicability, conventional shea butter meets most of the global shea butter Industry demand, especially for commercial-grade cosmetics and cocoa butter equivalents. The organic shea butter market is the fastest-growing segment, supported by rising demand for clean, traceable, and chemical-free ingredients. Organic-certified shea butter is increasingly preferred in premium skincare, haircare, and therapeutic formulations. The fair-trade cooperatives and eco-conscious consumer trends significantly boost its adoption. Organic shea butter also commands higher pricing, contributing to better margins for producers and exporters.

Shea Butter Market Regional Insights

The Middle East and Africa dominated the Shea Butter Industry in 2024 and are expected to continue their dominance over the forecast period. As most shea cultivation, harvesting, and primary processing take place across the West African “Shea Belt.” Countries such as Ghana, Burkina Faso, Nigeria, Mali, Benin, and Togo dominate West Africa's shea butter production, contributing significantly to global exports. With MEA producing more than 250,000–350,000 tons of dry kernels annually, the region holds the highest shea butter market share worldwide. Growing demand from cosmetics, pharmaceuticals, food, and chocolate manufacturers is accelerating. The region benefits from the rising global shift toward natural, organic, and ethically sourced ingredients, creating strong shea butter market opportunities for organic shea butter, raw and unrefined shea butter, and cosmetic grade shea butter exports. Increasing involvement of international companies such as AAK, Bunge Loders Croklaan, Fuji Oil, and Olvea supports infrastructure development, local value addition, and sustainable sourcing initiatives in West Africa. In the Middle East, demand for shea butter is expanding within the beauty, haircare, and personal care segments, driven by consumer preference for plant-based moisturizers. The popularity of shea butter for skincare and haircare products in GCC countries is rising, influencing shea butter price trends and import volumes. MEA’s role in supplying food-grade shea butter, especially for use in cocoa butter equivalent shea markets, bakery, and confectionery, contributes to regional growth. Women-led cooperatives across Ghana and Burkina Faso continue to be the backbone of the shea butter value chain in West Africa, empowering over 16 million women. Expansion of fair-trade certified shea butter demand, regional processing facilities, and export capabilities is shaping the Shea Butter Market, with strong prospects for both refined shea butter and ultra-refined shea butter production.Shea Butter Market Competitive Landscape

The shea butter market is highly competitive, driven by rising global demand across cosmetics, food, pharmaceuticals, and cocoa butter equivalent applications. Major players, including AAK, Bunge Loders Croklaan, Fuji Oil, BASF, Croda, Clariant, Olvea, and Ghana Nuts Company, have strong sourcing networks and advanced refining capabilities. West Africa remains the core of production, enhancing the shea butter market share through women-led cooperatives and sustainable sourcing programs. Companies compete based on product purity, supply reliability, and innovation in raw and unrefined shea butter, refined shea butter, cosmetic grade shea butter, and food grade shea butter. Growing emphasis on organic certification, fair-trade initiatives, and traceable supply chains shapes the Shea Butter Industry trends. • October 1, 2025 – AAK AB introduced its new Liquid Shea Butter Solutions as a major innovation in shea-based emollients for the personal care industry. The portfolio includes LIPEX 205 (base liquid shea butter), LIPEX SheaLiquid TR (climate-compensated, fully traceable), and LIPEX SheaClear (clear shea oil for translucent formulas). These ingredients deliver all the moisturizing and barrier-protecting benefits of traditional shea butter in a pumpable, non-crystallizing liquid form that simplifies processing, cuts energy use, and enhances formulation stability. They enable lighter, fluid textures and transparent products while keeping the same INCI and supporting minimalistic ingredient lists. AAK is promoting this launch through a dedicated webinar scheduled for November 5 to showcase new formulation opportunities. • In 2024, Bunge Loders Croklaan strengthened its local-impact strategy in West Africa through an expanded partnership with Mali Shi, the region’s first large-scale industrial shea crushing facility. Since commissioning the plant in 2020, the collaboration has helped keep sourcing, crushing, and early-stage processing within Mali, generating over 100 direct jobs and supporting 26,000+ women collectors. This initiative enhances the localized shea butter supply chain, boosts economic retention, and improves product quality through technical training, food-safety programs, and logistical support provided by Bunge. The company also announced future projects focused on women’s business training, cooperative development for 8,000 women, and environmental initiatives such as shea tree nurseries and replanting programs to strengthen long-term sustainability in the shea sector.Shea Butter Market Scope: Inquire before buying

Global Shea Butter Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.5 Bn. Forecast Period 2025 to 2032 CAGR: 13.1% Market Size in 2032: USD 6.69 Bn. Segments Covered: by Type Raw and Unrefined Refined by Nature Organic Conventional by Application Food Processing Pharmaceuticals Personal Care and Cosmetics Others by Distribution Channel Direct Sales Online Retail Specialty & Natural Product Stores Supermarkets & Hypermarkets Others Shea Butter Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Shea Butter Key Players

1. AAK AB 2. BASF SE 3. Bunge Limited 4. Cargill Incorporated 5. Croda International Plc 6. Fuji Oil Holdings Inc. 7. Ghana Nuts Company Limited 8. IOI Loders Croklaan Group BV 9. International Oils & Fats Limited 10. Sophim S.A. 11. Clariant AG 12. Wilmar Africa Ltd / Ghana Specialty Fats 13. The Savannah Fruits Company 14. Shebu Industries Limited 15. Vink Chemicals GmbH & Co. KG 16. Akoma Cooperative Multipurpose Society 17. Star Shea Ltd 18. Olvea Group / Olvea Vegetable Oils SAS 19. Shea Radiance 20. The Organic Shea Butter Company 21. Baraka Shea Butter 22. Shea Yeleen 23. Akoma Cooperative 24. Juka’s Organic Co. 25. Suru Chemicals 26. 3F Industries Ltd 27. All Organic Treasures GmbH 28. Agrobotanicals LLC 29. Shebu Industries 30. Ghana Nuts Company LtdFrequently Asked Questions:

1] What is the growth rate of the Global Shea Butter Market? Ans. The Global Shea Butter Market is growing at a significant rate of 13.1 % during the forecast period. 2] Which region is expected to dominate the Global Shea Butter Market? Ans. The Middle East and Africa are expected to dominate the Shea Butter Market during the forecast period. 3] What was the Global Shea Butter Market size in 2024? Ans. The Shea Butter Market size is expected to reach USD 2.5 billion in 2024. 4] What is the expected Global Shea Butter Market size by 2032? Ans. The Shea Butter Market size is expected to reach USD 6.69 billion by 2032. 5] Which are the top players in the Global Shea Butter Market? Ans. The major players in the Global Shea Butter Market are AAK AB, BASF SE, Bunge Limited, Cargill Incorporated, Croda International Plc and Others. 6] What are the factors driving the Global Shea Butter Market growth? Ans. The Global Shea Butter Market is driven by rising demand for natural skincare ingredients, growth in cosmetics and food applications, sustainable sourcing initiatives, and increasing consumer preference for organic, ethically produced products.

1. Shea Butter Market: Research Methodology 2. Shea Butter Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Shea Butter Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Headquarter 3.3.3. Type Segment 3.3.4. End User Segment 3.3.5. Revenue (2024) 3.3.6. Profit Margin (%) 3.4. Mergers and Acquisitions Details 4. Shea Butter Market: Dynamics 4.1. Shea Butter Market Trends 4.2. Shea Butter Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Value Chain Analysis 4.6. Analysis of Government Schemes and Initiatives for the Shea Butter Market 5. Consumer Behaviour & Market Trends 5.1. Shift Toward Natural & Organic Products 5.2. Clean Beauty & Minimalist Formulations 5.3. Rise of Ethical & Conscious Consumerism 5.4. Regional Buyer Preferences (US, EU, APAC, MEA) 5.5. Influence of Social Media & E-Commerce on Shea Demand 6. Regulatory Landscape 6.1. Global Cosmetic Regulations (FDA, EU, GCC) 6.2. Food-Grade Shea Compliance Standards (FSSAI, USDA, EU) 6.3. Organic Certification Requirements 6.4. Fair-Trade & Ethical Sourcing Standards 6.5. Import/Export Regulations for Raw & Refined Shea Butter 7. Sustainability & Ethical Sourcing 7.1. Sustainability Challenges in the Shea Belt 7.2. Women's Empowerment in Shea Value Chains 7.3. Fair-Trade Shea Butter Models 7.4. Climate-Resilient & Regenerative Practices 7.5. Traceability, Certifications & Carbon-Neutral 8. Shea Butter Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 8.1. Shea Butter Market Size and Forecast, by Type (2024-2032) 8.1.1. Raw and Unrefined 8.1.2. Refined 8.2. Shea Butter Market Size and Forecast, by Nature (2024-2032) 8.2.1. Organic 8.2.2. Conventional 8.3. Shea Butter Market Size and Forecast, by Application (2024-2032) 8.3.1. Food Processing 8.3.2. Pharmaceuticals 8.3.3. Personal Care and Cosmetics 8.3.4. Others 8.4. Shea Butter Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.1. Direct Sales 8.4.2. Online Retail 8.4.3. Specialty & Natural Product Stores 8.4.4. Supermarkets & Hypermarkets 8.4.5. Others 8.5. Shea Butter Market Size and Forecast, by Region (2024-2032) 8.5.1. North America 8.5.2. Europe 8.5.3. Asia Pacific 8.5.4. Middle East and Africa 8.5.5. South America 9. North America Shea Butter Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 9.1. North America Shea Butter Market Size and Forecast, by Type (2024-2032) 9.1.1. Raw and Unrefined 9.1.2. Refined 9.2. North America Shea Butter Market Size and Forecast, by Nature (2024-2032) 9.2.1. Organic 9.2.2. Conventional 9.3. North America Shea Butter Market Size and Forecast, by Application (2024-2032) 9.3.1. Food Processing 9.3.2. Pharmaceuticals 9.3.3. Personal Care and Cosmetics 9.3.4. Others 9.4. North America Shea Butter Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.1. Direct Sales 9.4.2. Online Retail 9.4.3. Specialty & Natural Product Stores 9.4.4. Supermarkets & Hypermarkets 9.4.5. Others 9.5. North America Shea Butter Market Size and Forecast, by Country (2024-2032) 9.5.1. United States 9.5.2. Canada 9.5.3. Mexico 10. Europe Shea Butter Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 10.1. Europe Shea Butter Market Size and Forecast, by Type (2024-2032) 10.2. Europe Shea Butter Market Size and Forecast, by Nature (2024-2032) 10.3. Europe Shea Butter Market Size and Forecast, by Application (2024-2032) 10.4. Europe Shea Butter Market Size and Forecast, by Distribution Channel (2024-2032) 10.5. Europe Shea Butter Market Size and Forecast, by Country (2024-2032) 10.5.1. United Kingdom 10.5.2. France 10.5.3. Germany 10.5.4. Italy 10.5.5. Spain 10.5.6. Russia 10.5.7. Rest of Europe 11. Asia Pacific Shea Butter Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 11.1. Asia Pacific Shea Butter Market Size and Forecast, by Type (2024-2032) 11.2. Asia Pacific Shea Butter Market Size and Forecast, by Nature (2024-2032) 11.3. Asia Pacific Shea Butter Market Size and Forecast, by Application (2024-2032) 11.4. Asia Pacific Shea Butter Market Size and Forecast, by Distribution Channel (2024-2032) 11.5. Asia Pacific Shea Butter Market Size and Forecast, by Country (2024-2032) 11.5.1. China 11.5.2. S Korea 11.5.3. Japan 11.5.4. India 11.5.5. Australia 11.5.6. Rest of Asia Pacific 12. Middle East and Africa Shea Butter Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 12.1. Middle East and Africa Shea Butter Market Size and Forecast, by Type (2024-2032) 12.2. Middle East and Africa Shea Butter Market Size and Forecast, by Nature (2024-2032) 12.3. Middle East and Africa Shea Butter Market Size and Forecast, by Application (2024-2032) 12.4. Middle East and Africa Shea Butter Market Size and Forecast, by Distribution Channel (2024-2032) 12.5. Middle East and Africa Shea Butter Market Size and Forecast, by Country (2024-2032) 12.5.1. South Africa 12.5.2. GCC 12.5.3. Nigeria 12.5.4. Rest of ME&A 13. South America Shea Butter Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Metric Tons) (2024-2032) 13.1. South America Shea Butter Market Size and Forecast, by Type (2024-2032) 13.2. South America Shea Butter Market Size and Forecast, by Nature (2024-2032) 13.3. South America Shea Butter Market Size and Forecast, by Application (2024-2032) 13.4. South America Shea Butter Market Size and Forecast, by Distribution Channel (2024-2032) 13.5. South America Shea Butter Market Size and Forecast, by Country (2024-2032) 13.5.1. Brazil 13.5.2. Argentina 13.5.3. Colombia 13.5.4. Chile 13.5.5. Rest Of South America 14. Company Profile: Key Players 14.1. AAK AB 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.2. BASF SE 14.3. Bunge Limited 14.4. Cargill Incorporated 14.5. Croda International Plc 14.6. Fuji Oil Holdings Inc. 14.7. Ghana Nuts Company Limited 14.8. IOI Loders Croklaan Group BV 14.9. International Oils & Fats Limited 14.10. Sophim S.A. 14.11. Clariant AG 14.12. Wilmar Africa Ltd / Ghana Specialty Fats 14.13. The Savannah Fruits Company 14.14. Shebu Industries Limited 14.15. Vink Chemicals GmbH & Co. KG 14.16. Akoma Cooperative Multipurpose Society 14.17. Star Shea Ltd 14.18. Olvea Group / Olvea Vegetable Oils SAS 14.19. Shea Radiance 14.20. The Organic Shea Butter Company 14.21. Baraka Shea Butter 14.22. Shea Yeleen 14.23. Akoma Cooperative 14.24. Juka’s Organic Co. 14.25. Suru Chemicals 14.26. 3F Industries Ltd 14.27. All Organic Treasures GmbH 14.28. Agrobotanicals LLC 14.29. Shebu Industries 14.30. Ghana Nuts Company Ltd 15. Key Findings 16. Analyst Recommendations