Semiconductor Chip Handler Market was valued at USD 676.89 Mn in 2024, and total global Semiconductor Chip Handler Market revenue is expected to grow at CAGR of 4.7% & reaching nearly USD 977.44 Mn from 2025-2032.Semiconductor Chip Handler Market Overview

The semiconductor chip handler market comprises specialized equipment used to manage, test and transfer semiconductor chips during manufacturing and quality control processes. Market refers to ecosystem of toolmakers, integrators, and end users in the semiconductor industry, including OSATs and IDMs. Key driver of market growth has been the increasing adoption of advanced packaging technologies and 3D memory, mainly in high performance applications like automotive electronics, AI and mobile devices. The rising demand for MEMS and logic chips has accelerated the need for automated, precise chip handlers with multi-site capabilities. Supply is supported by robotics integration, AI driven testing systems and the miniaturization of components. Asia Pacific dominated global market, led by China, South Korea and Japan, by its strong manufacturing base and demand for consumer electronics. North America follows closely, backed by innovation led players and rising R&D investments. Major companies like Cohu (U.S.), Advantest (Japan) and Teradyne (U.S.) lead the competitive landscape by automation innovation and advanced handler platforms. OSATs the largest contributors by end-use, driven by outsourcing trends. Recent regulatory movements, like U.S-China trade tensions and European competition over large scale mergers, are shaping global strategic partnerships and technology access across the semiconductor supply chain. Report covers the Semiconductor Chip Handler Market dynamic, structure by analysing the market segments and projecting Semiconductor Chip Handler Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies and regional presence in the Semiconductor Chip Handler Market.To know about the Research Methodology:- Request Free Sample Report

Semiconductor Chip Handler Market Dynamics

MEMS, 3D Memory, and Next-Gen Testing to Drive the Semiconductor Chip Handler Market The Semiconductor chip handler market is continuously showing a northward direction growth, thanks to the growing popularity of micro-electrical-mechanical systems (MEMS) and 3D memory and logic chips. For example, the growing demand for MEMS systems in the automotive industry and advanced 3D stack ICs in consumer electronics is expected to boost semiconductor chip handler demand during the forecast period. Complex ICs are subjected to extensive testing by manufacturers. The demand for improved semiconductor chip handling equipment has risen as a result. In addition, the increasing trend of strip testing is expected to boost market growth throughout the forecast period. The semiconductor industry's rapid growth is driving up demand for automated testing equipment. In addition, the market's growth is expected to be aided by the industry's significant expenditure to increase production rates. Increasing automation and improving robotics quality for semiconductor manufacturing, such as IC tests, lead inspection, lead forming, epoxy operations, ink marking, and isolation purposes, are expected to create lucrative opportunities in the semiconductor chip handler market over the forecast period. In addition, the increasing commercialization of nanoscale technologies in material handling and the strong dynamics of machinery are factors that are expected to drive market growth throughout the forecast period. The demand for improved, automated semiconductor chip handlers is growing in tandem with the demand for new mobile devices. In the semiconductor chip handling industry, the introduction of novel chip production processes will also set the pace for innovation. A few key patents have come to the fore in the industry in recent years, and new competitive dynamics are expected to emerge. Singulation, isolation, epoxy operations, lead inspection, plating, lead making and ink marking are all done with them. High Maintenance Costs and Volatile Demand to Restrain the Semiconductor Chip Handler Market The high cost of maintaining and upgrading handler mechanisms, which limits adoption, especially among small and mid-sized manufacturers. Seasonal fluctuations in semiconductor supply and demand disrupt consistent investment and production planning. The lingering effects of the COVID-19 pandemic continue to affect industrial and transportation sectors, resulting in delays in equipment delivery, supply chain disruptions and operational inefficiencies. These factors collectively create uncertainties that may impact the pace of growth in the semiconductor chip handler market over the forecast period.Semiconductor Chip Handler Market Segment Analysis

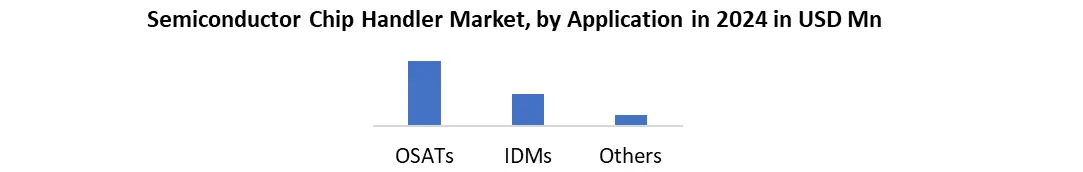

Based on Type, the market is segmented into Pick and Place Handlers, Rotary Handlers, Goniometer Handlers, Linearity Handlers and Others. The Pick and Place Handlers segment held a dominant position of the global Semiconductor Chip Handler Market in 2024. This segment leads primarily due to its versatility and efficiency in handling a wide range of semiconductor chips. The predominant reason for the leading position of the Pick-and-Place Handlers segment is its advanced technology that supports rapid processing times without compromising accuracy. These handlers utilize sophisticated robotics and vision systems to precisely pick chips from a wafer and place them into test sockets. Pick and Place Handlers are constantly evolving to manage more delicate and complex chip architectures. As chips shrink and pack more transistors, precision handling becomes crucial. Continuous advancements in this technology keep it at the forefront, meeting the high demands of modern semiconductor production.Based on Application, the market is segmented into OSATs, IDMs and Others. OSATs (Outsourced Semiconductor Assembly and Test) segment held a dominant market position in the Semiconductor Chip Handler Market in 2024. The dominance of OSATs is driven by semiconductor companies outsourcing chip assembly, testing, and packaging to specialized providers. As demand for advanced semiconductors rises, OSATs play a crucial role in offering cost-effective, high-quality services, allowing manufacturers to focus on design and development while leveraging OSAT expertise for complex post-manufacturing tasks. OSATs are well-equipped to support emerging technologies like 5G, automotive electronics, and AI, which require complex semiconductors. With specialized equipment and expertise, OSATs provide essential services such as wafer testing, packaging, and final testing, ensuring the reliability and performance of these advanced products.

Semiconductor Chip Handler Market Regional Analysis

In 2024, Asia-Pacific held a dominant market position in the Semiconductor Chip Handler Market. This region leads due to its robust manufacturing base, with key semiconductor hubs in China, South Korea and Japan. The rapid technological advancements and the high demand for semiconductor chips in industries such as automotive, consumer electronics, and telecommunications contribute to the region’s significant share. Low-cost labor, a strong supply chain, and significant R&D investments reinforce Asia-Pacific’s leadership in the semiconductor market. The demand for semiconductor chip handlers in Asia-Pacific is also driven by the increasing adoption of next-generation technologies like 5G, artificial intelligence, and the Internet of Things (IoT). As these technologies proliferate, the need for high-performance semiconductor chips and efficient handling equipment becomes even more critical. Semiconductor Chip Handler Market Competitive Landscape The semiconductor chip handler market is led by a few dominant players Cohu, Inc. (U.S.), Advantest Corporation (Japan) and Teradyne, Inc. (U.S.) each shaping industry dynamics through innovation, scale and strategic positioning. • Cohu, Inc. is remarkable for its broad test handling portfolio across MEMS, RF and power devices. Its latest TAIKO platform offers high parallelism and advanced thermal management addressing growing demand from automotive and AI semiconductor manufacturers. The company's integration of automation and real time diagnostics in handlers enhances by reliability. • Advantest Corporation, a global leader in SoC and memory test solutions, continues to push the boundaries of precision and speed. Its recently launched M4872 pick-and-place handler integrates advanced vision alignment and miniaturized component handling ideal for 5G and mobile chipsets. Advantest’s innovations are driven by AI algorithms for predictive maintenance and adaptive testing. • Teradyne, Inc. is a smart automation and robotics to drive innovation in handler systems. Its UltraFLEXplus platform, combined with the Dominator handler, supports high density testing for AI and HPC chips, offering thermal control and customizable site configurations. Semiconductor Chip Handler Market Key TrendsSemiconductor Chip Handler Market Recent Development • 15th January 2025, Synopsys (United States) received approval from the U.S. and European authorities for its $35 billion acquisition of Ansys (United States). China’s antitrust review was still pending. Meanwhile, the UK Competition and Markets Authority raised concerns and suggested Synopsys divest its optical simulation business to Keysight Technologies (United States) to allow the deal to proceed. • 9th February 2025, NXP Semiconductors (Netherlands) acquired Kinara (United States), an AI inference accelerator start-up, to enhance its capabilities in edge AI processing for automotive and industrial applications. • 6th November 2024, Analog Devices (United States) announced the acquisition of Flex Logix (United States), entering the embedded FPGA (eFPGA) market to support reconfigurable logic in SoCs and high-performance computing platforms. • 23rd May 2025, Advantest (Japan) unveiled a suite of advanced testing innovations including, new V93000 EXA Scale test system for high-performance RF and power devices, HA1200 die-level handler with integrated active thermal control, APOS, a power optimization solution designed to reduce test-related energy usage. • December 2024, Teradyne (United States) began collaborating with National Instruments (United States) to integrate Archimedes, a real-time test analytics platform, into NI’s global operations. This integration supports AI-driven insights and efficiency in semiconductor handler and test operations. • October 2024, Jolt Capital (France) spun off the IP business of Dolphin Design (France) to form Dolphin Semiconductor (France) a new company focused on low power, mixed signal IP for audio, automotive and edge AI markets.

Trends Description Automation & AI Integration Growing adoption of AI-driven and fully automated chip handlers for faster, more precise testing and reduced human error. Shift Toward Advanced Packaging Rise in demand for chip handlers compatible with advanced packaging (e.g., 2.5D/3D ICs, chiplets) due to miniaturization trends. High Thermal Control & Multi-site Handling Increasing need for handlers with thermal regulation and parallel testing capabilities to support power devices and high-throughput production. Semiconductor Chip Handler Market Scope:Inquire before buying

Semiconductor Chip Handler Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 676.89 Mn. Forecast Period 2025 to 2032 CAGR: 4.7% Market Size in 2032: USD 977.44 Mn. Segments Covered: by Type Pick and Place Handlers Rotary Handlers Goniometer Handlers Linearity Handlers Others by Function Automatic Semi-Automatic by Application OSATs IDMs Others by End-User Consumer Electronics Automotive Industrial Automation Telecom Others Semiconductor Chip Handler Market, By Region

North America (United states, Canada, Mexico) Europe (Germany, United Kingdom, France, Italy, Spain, Netherland, Sweden, Switzerland, Belgium, Russia, Poland, Finland, Norway, Austria, Ireland, Greece) South America (Brazil, Argentina, Chile, Colombia, Peru, Paraguay, Bolivia, Venezuela) Asia Pacific (China, India, Japan, Australia, South Korea, New Zealand, Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Bangladesh) Middle East and Africa (Saudi Arabia, Qatar, Kuwait, Oman, South Africa, Nigeria, Israel, Jordan)Semiconductor Chip Handler Market key players

North America 1. Cohu, Inc. (U.S.) 2. Teradyne, Inc. (U.S.) 3. Boston Semi Equipment LLC (U.S.) 4. Aehr Test Systems (U.S.) 5. lATE Systems, Inc. (U.S.) 6. National Instruments (U.S.) Europe 7. IPTE Factory Automation N.V. (Belgium) 8. Seica S.p.A. (Italy) 9. STMicroelectronics (Switzerland) 10. Xenon Automatics GmbH (Germany) 11. Testronic Labs (U.K.) 12. Camtek (Germany) 13. Kitov.ai (Israel) 14. Unisem (U.K.) 15. Yelo Ltd. (Northern Ireland) Asia Pacific 16. Advantest Corporation (Japan) 17. TSE Co., Ltd. (South Korea) 18. ASM Pacific Technology Ltd. (Hong Kong) 19. Chroma ATE Inc. (Taiwan) 20. Japan Unix Co., Ltd. (Japan) 21. Synax Co., Ltd. (Japan) 22. Shibaura Mechatronics Corporation (Japan) 23. CST Automation Pte Ltd. (Singapore) 24. Hangzhou Changchuan Technology Co., Ltd. (China) 25. Tokyo Electron Ltd. (Japan)Semiconductor Chip Handler Market Frequently Asked Questions

1. Who are the key players in the Semiconductor Chip Handler Market? Ans. Advantest Corporation (Japan), TSE Co., Ltd. (South Korea), ASM Pacific Technology Ltd. (Hong Kong), Cohu, Inc. (U.S.), Teradyne, Inc. (U.S.), Boston Semi Equipment LLC (U.S.) are some of the key players of the Semiconductor Chip Handler Market. 2. Which segment dominates the Semiconductor Chip Handler Market? Ans. By Application, is the dominating segment in Semiconductor Chip Handler Market. 3. How big is the Semiconductor Chip Handler Market? Ans. The Global Semiconductor Chip Handler Market size reached USD 676.89 Mn in 2024 and is expected to reach USD 977.44 Mn by 2032, growing at a CAGR of 4.7% during the forecast period. 4. What are the key regions in the global Semiconductor Chip Handler Market? Ans. Based On the region, the Semiconductor Chip Handler Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and South America. North America dominates the global Semiconductor Chip Handler Market. 5. What is the study period of this market? Ans. The Global Market is studied from 2024 to 2032.

1. Semiconductor Chip Handler Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Semiconductor Chip Handler Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Semiconductor Chip Handler Market: Dynamics 3.1. Region wise Trends of Semiconductor Chip Handler Market 3.1.1. North America Semiconductor Chip Handler Market Trends 3.1.2. Europe Semiconductor Chip Handler Market Trends 3.1.3. Asia Pacific Semiconductor Chip Handler Market Trends 3.1.4. Middle East and Africa Semiconductor Chip Handler Market Trends 3.1.5. South America Semiconductor Chip Handler Market Trends 3.2. Semiconductor Chip Handler Market Dynamics 3.2.1. Global Semiconductor Chip Handler Market Drivers 3.2.1.1. 3D Memory Demand 3.2.1.2. MEMS Adoption Surge 3.2.1.3. Automated Testing Growth 3.2.2. Global Semiconductor Chip Handler Market Restraints 3.2.3. Global Semiconductor Chip Handler Market Opportunities 3.2.3.1. AI Integration Potential 3.2.3.2. Advanced Packaging Boom 3.2.3.3. Miniaturization Trend Support 3.2.4. Global Semiconductor Chip Handler Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. US-China Tensions 3.4.2. Trade Policy Changes 3.4.3. Technology Innovation Pace 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Semiconductor Chip Handler Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 4.1.1. Pick and Place Handlers 4.1.2. Rotary Handlers 4.1.3. Goniometer Handlers 4.1.4. Linearity Handlers 4.1.5. Others 4.2. Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 4.2.1. Automatic 4.2.2. Semi-Automatic 4.3. Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 4.3.1. OSATs 4.3.2. IDMs 4.3.3. Others 4.4. Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 4.4.1. Consumer Electronics 4.4.2. Automotive 4.4.3. Industrial Automation 4.4.4. Telecom 4.4.5. Others 4.5. Semiconductor Chip Handler Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Semiconductor Chip Handler Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 5.1.1. Pick and Place Handlers 5.1.2. Rotary Handlers 5.1.3. Goniometer Handlers 5.1.4. Linearity Handlers 5.1.5. Others 5.2. North America Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 5.2.1. Automatic 5.2.2. Semi-Automatic 5.3. North America Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 5.3.1. OSATs 5.3.2. IDMs 5.3.3. Others 5.4. North America Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 5.4.1. Consumer Electronics 5.4.2. Automotive 5.4.3. Industrial Automation 5.4.4. Telecom 5.4.5. Others 5.5. North America Semiconductor Chip Handler Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 5.5.1.1.1. Pick and Place Handlers 5.5.1.1.2. Rotary Handlers 5.5.1.1.3. Goniometer Handlers 5.5.1.1.4. Linearity Handlers 5.5.1.1.5. Others 5.5.1.2. United States Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 5.5.1.2.1. Automatic 5.5.1.2.2. Semi-Automatic 5.5.1.3. United States Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. OSATs 5.5.1.3.2. IDMs 5.5.1.3.3. Others 5.5.1.4. United States Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 5.5.1.4.1. Consumer Electronics 5.5.1.4.2. Automotive 5.5.1.4.3. Industrial Automation 5.5.1.4.4. Telecom 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 5.5.2.1.1. Pick and Place Handlers 5.5.2.1.2. Rotary Handlers 5.5.2.1.3. Goniometer Handlers 5.5.2.1.4. Linearity Handlers 5.5.2.1.5. Others 5.5.2.2. Canada Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 5.5.2.2.1. Automatic 5.5.2.2.2. Semi-Automatic 5.5.2.3. Canada Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. OSATs 5.5.2.3.2. IDMs 5.5.2.3.3. Others 5.5.2.4. Canada Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 5.5.2.4.1. Consumer Electronics 5.5.2.4.2. Automotive 5.5.2.4.3. Industrial Automation 5.5.2.4.4. Telecom 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 5.5.3.1.1. Pick and Place Handlers 5.5.3.1.2. Rotary Handlers 5.5.3.1.3. Goniometer Handlers 5.5.3.1.4. Linearity Handlers 5.5.3.1.5. Others 5.5.3.2. Mexico Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 5.5.3.2.1. Automatic 5.5.3.2.2. Semi-Automatic 5.5.3.3. Mexico Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. OSATs 5.5.3.3.2. IDMs 5.5.3.3.3. Others 5.5.3.4. Mexico Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 5.5.3.4.1. Consumer Electronics 5.5.3.4.2. Automotive 5.5.3.4.3. Industrial Automation 5.5.3.4.4. Telecom 5.5.3.4.5. Others 6. Europe Semiconductor Chip Handler Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.2. Europe Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.3. Europe Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.4. Europe Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5. Europe Semiconductor Chip Handler Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.1.2. United Kingdom Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.1.3. United Kingdom Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5.2. France 6.5.2.1. France Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.2.2. France Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.2.3. France Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.3.2. Germany Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.3.3. Germany Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.4.2. Italy Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.4.3. Italy Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.5.2. Spain Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.5.3. Spain Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.6.2. Sweden Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.6.3. Sweden Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.7.2. Russia Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.7.3. Russia Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Russia Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 6.5.8.2. Rest of Europe Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 6.5.8.3. Rest of Europe Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Semiconductor Chip Handler Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.3. Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5. Asia Pacific Semiconductor Chip Handler Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.1.2. China Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.1.3. China Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.2.2. S Korea Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.2.3. S Korea Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.3.2. Japan Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.3.3. Japan Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.4. India 7.5.4.1. India Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.4.2. India Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.4.3. India Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.5.2. Australia Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.5.3. Australia Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.6.2. Indonesia Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.6.3. Indonesia Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.7.2. Malaysia Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.7.3. Malaysia Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Malaysia Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.8.2. Philippines Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.8.3. Philippines Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Philippines Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.9.2. Thailand Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.9.3. Thailand Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Thailand Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.10.2. Vietnam Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.10.3. Vietnam Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Vietnam Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 7.5.11.3. Rest of Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Semiconductor Chip Handler Market Size and Forecast (by Value in USD Million) (2024-2032) 8.1. Middle East and Africa Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 8.3. Middle East and Africa Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 8.5. Middle East and Africa Semiconductor Chip Handler Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 8.5.1.2. South Africa Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 8.5.1.3. South Africa Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 8.5.2.2. GCC Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 8.5.2.3. GCC Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 8.5.3.2. Egypt Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 8.5.3.3. Egypt Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Egypt Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 8.5.4.2. Nigeria Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 8.5.4.3. Nigeria Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Nigeria Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 8.5.5.2. Rest of ME&A Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 8.5.5.3. Rest of ME&A Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 8.5.5.4. Rest of ME&A Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 9. South America Semiconductor Chip Handler Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. South America Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 9.2. South America Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 9.3. South America Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 9.4. South America Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 9.5. South America Semiconductor Chip Handler Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 9.5.1.2. Brazil Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 9.5.1.3. Brazil Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 9.5.2.2. Argentina Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 9.5.2.3. Argentina Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 9.5.3.2. Colombia Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 9.5.3.3. Colombia Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Colombia Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 9.5.4.2. Chile Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 9.5.4.3. Chile Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 9.5.4.4. Chile Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 9.5.5. Rest of South America 9.5.5.1. Rest of South America Semiconductor Chip Handler Market Size and Forecast, By Type (2024-2032) 9.5.5.2. Rest of South America Semiconductor Chip Handler Market Size and Forecast, By Function (2024-2032) 9.5.5.3. Rest of South America Semiconductor Chip Handler Market Size and Forecast, By Application (2024-2032) 9.5.5.4. Rest of South America Semiconductor Chip Handler Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players 10.1. Advantest Corporation (Japan) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Cohu, Inc. (U.S.) 10.3. Teradyne, Inc. (U.S.) 10.4. Boston Semi Equipment LLC (U.S.) 10.5. Aehr Test Systems (U.S.) 10.6. ATE Systems, Inc. (U.S.) 10.7. National Instruments (U.S.) 10.8. IPTE Factory Automation N.V. (Belgium) 10.9. Seica S.p.A. (Italy) 10.10. STMicroelectronics (Switzerland) 10.11. Xenon Automatics GmbH (Germany) 10.12. Testronic Labs (U.K.) 10.13. Camtek (Germany) 10.14. Kitov.ai (Israel) 10.15. Unisem (U.K.) 10.16. Yelo Ltd. (Northern Ireland) 10.17. TSE Co., Ltd. (South Korea) 10.18. ASM Pacific Technology Ltd. (Hong Kong) 10.19. Chroma ATE Inc. (Taiwan) 10.20. Japan Unix Co., Ltd. (Japan) 10.21. Synax Co., Ltd. (Japan) 10.22. Shibaura Mechatronics Corporation (Japan) 10.23. CST Automation Pte Ltd. (Singapore) 10.24. Hangzhou Changchuan Technology Co., Ltd. (China) 10.25. Tokyo Electron Ltd. (Japan) 11. Key Findings 12. Industry Recommendations 13. Semiconductor Chip Handler Market: Research Methodology