Security Information and Event Management Market size was valued at USD 6.40 Billion in 2024 and the total Global Security Information and Event Management Market revenue is expected to grow at a CAGR of 7.4% from 2025 to 2032, reaching nearly USD 11.33 Billion.Security Information and Event Management Market Overview:

Security information and event management, or SIEM, is a security solution that helps organizations recognize and address potential security threats and vulnerabilities before they have a chance to disrupt business operations. SIEM systems help enterprise security teams detect user behavior anomalies and use artificial intelligence (AI) to automate many of the manual processes associated with threat detection and incident response. The original SIEM platforms were log management tools, combining security information management (SIM) and security event management (SEM) to enable real-time monitoring and analysis of security-related events, as well as tracking and logging of security data for compliance or auditing purposes. Over the years, SIEM software has evolved to incorporate user and entity behavior analytics (UEBA), as well as other advanced security analytics, AI, and machine learning capabilities for identifying anomalous behaviors and indicators of advanced threats. Today SIEM has become a staple in modern-day security operation centers (SOCs) for security monitoring and compliance management use cases. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Security Information and Event Management Market.To know about the Research Methodology:-Request Free Sample Report

Security Information and Event Management Market Dynamics

Increasing Cyber Threats and Growing Adoption of Cloud Services Boosting the Security Information and Event Management Market Growth The relentless surge in the frequency and complexity of cyber threats stands as a primary driver for the Security Information and Event Management (security information and event management) market. Organizations, grappling with the evolving nature of cyber threats, find themselves compelled to integrate security information and event management solutions. These solutions enhance their capacities to promptly detect and respond to security incidents, providing a crucial defence against sophisticated cyber-attacks. The escalating demand for advanced cybersecurity solutions is fuelled by the urgent need to counteract and stay ahead of the ever-evolving landscape of cyber threats. Stringent data protection regulations and compliance requirements act as a driving force for the security information and event management market. Organizations, bound by regulatory mandates aimed at safeguarding sensitive information, leverage security information and event management solutions to implement robust security measures. These solutions play a pivotal role in meeting compliance requirements by providing comprehensive security monitoring and reporting capabilities. The imperative to ensure compliance and avoid regulatory penalties motivates organizations to invest significantly in security information and event management solutions. The widespread adoption of cloud services and the shift to hybrid IT environments have significantly the attack surface for potential cyber threats. In response, security information and event management solutions adapted to cloud architectures are witnessing heightened demand. These solutions offer the advantage of centralized monitoring and analysis of security events across diverse cloud and on-premises environments. Security information and event management solutions tailored for cloud environments address the unique security challenges associated with the adoption of cloud services and the evolution toward hybrid IT infrastructures. Recognizing the criticality of real-time threat intelligence, organizations increasingly turn to security information and event management systems. These systems play a crucial role in aggregating and analysing security data, providing actionable insights that empower organizations to proactively defend against evolving cyber threats. Real-time threat intelligence enhances the agility and responsiveness of cybersecurity operations. Security information and event management's contribution to real-time threat detection and response is a key factor driving its adoption, aligning organizations with a proactive cybersecurity posture. The integration of automation and orchestration capabilities within security information and event management solutions is a driving factor in enhancing the efficiency of security operations. Automation streamlines the response to low-level security incidents, enabling security teams to allocate their resources and attention to more intricate and sophisticated threats. This, in turn, contributes to more effective and timely incident response. Automation within security information and event management solutions is instrumental in improving the overall speed, efficiency, and effectiveness of incident response, reducing the burden of manual intervention. Complex Implementations and High Costs restraining the Security Information and Event Management Market The implementation and configuration of security information and event management solutions intricate and resource-intensive, posing a challenge for organizations. Navigating the complexities of deployment requires expertise and resources, and some organizations encounter difficulties in ensuring the effective implementation and management of security information and event management systems. Complex implementations hinder the widespread adoption of security information and event management, particularly among organizations with limited cybersecurity expertise and resources. The security information and event management market faces a restraint in the form of high initial and ongoing costs associated with these solutions. This encompasses licensing fees, hardware investments, and the need for skilled personnel. The financial implications of security information and event management adoption significant, potentially posing a challenge for smaller organizations operating with limited budgets. Cost considerations emerge as a limiting factor, influencing the adoption of security information and event management solutions, particularly among small and medium-sized businesses (SMBs) with constrained financial resources. Security information and event management solutions, while crucial for security, generate a substantial volume of alerts. Security teams experience alert fatigue, a phenomenon where the sheer volume of alerts makes it challenging to discern and prioritize genuine threats promptly. This result in a less effective and timely response to security incidents. Alert fatigue poses a risk to the overall effectiveness of security information and event management, as overwhelmed security teams struggle to manage and respond to alerts efficiently. This challenge underscores the importance of refining alert mechanisms within security information and event management systems.Security Information and Event Management Market Segment Analysis

Based on Component the market is segmented into solution and services. The solution segment is dominated the market in 2024 & is expected to hold the largest market share during the forecast period. The solution segment is dominated the market in 2024 & is expected to hold the largest market share during the forecast period. due to the increasing demand for real-time threat detection, log management, and compliance reporting across industries. Organizations are prioritizing advanced SIEM solutions to strengthen their cybersecurity posture amid rising cyber threats and regulatory requirements. These solutions offer integrated capabilities like automated incident response, behavioural analytics and centralized security monitoring, making them essential for IT infrastructure. Growth of cloud environments and hybrid IT systems further fuels the adoption of SIEM solutions, driving their dominance in the market. Based on Deployment Mode the market is segmented into On-Premises, cloud-based. The cloud-based segment dominated the market in 2024 & is expected to hold the largest market share during the forecast period. Growth is driven by the rising adoption of cloud computing, remote work models, and the need for scalable, cost-effective security solutions. Cloud-based SIEM offers faster deployment, real-time updates, lower upfront costs, and greater flexibility compared to on-premises systems. It is particularly favoured by small and medium enterprises (SMEs) and organizations with distributed operations. Increasing sophistication of cloud-native threats has pushed businesses to invest in advanced, cloud-integrated SIEM platforms, reinforcing the dominance of this deployment model.Security Information and Event Management Market Regional Analysis

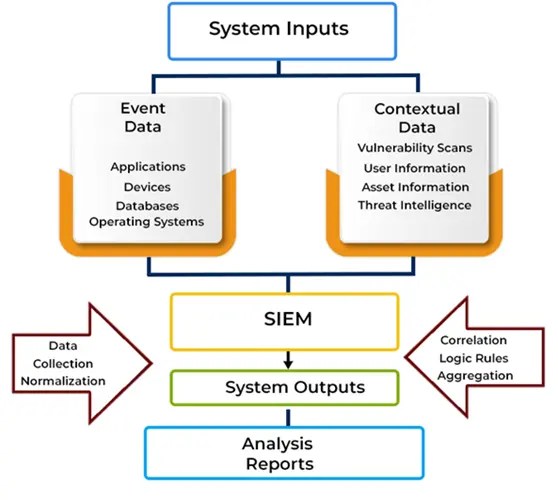

In North America, the Security Information and Event Management market showcases a mature and robust landscape, with regional growth in the US being particularly noteworthy. The region is characterized by a high level of awareness regarding cybersecurity threats, driving the adoption of advanced SIEM solutions. Key factors contributing to the market's growth include the presence of major cybersecurity solution providers, stringent data protection regulations, and a proactive approach to addressing evolving cyber threats. North America holds a dominant segment share in the Security Information and Event Management market, with major organizations across sectors prioritizing advanced security measures. The region's booming segment is fuelled by continuous innovations in Security Information and Event Management technologies, a strong emphasis on regulatory compliance, and a significant market share in the US. Europe's Security Information and Event Management market is characterized by a growing awareness of cybersecurity challenges and an increasing emphasis on data protection and privacy. The region witnesses significant SIEM adoption across industries, with potential growth factors in countries like Germany. This growth is driven by the need for regulatory compliance and a proactive stance against cyber threats. European organizations, particularly in finance and healthcare, are investing in Security Information and Event Management to fortify their cybersecurity postures. Europe represents a major segment in the Security Information and Event Management market, with a focus on compliance and data governance. The Security Information and Event Management market's dominant segment status is influenced by the region's commitment to strengthening cybersecurity frameworks, safeguarding sensitive information, and holding a notable market share in Germany. The Asia-Pacific Security Information and Event Management market is experiencing rapid growth, propelled by the increasing digitization of businesses and a rising number of cyber threats. Organizations in the region, including Japan, are recognizing the importance of proactive threat detection and are investing in Security Information and Event Management solutions to enhance their cybersecurity resilience. The dynamic nature of the Asia-Pacific market is characterized by a surge in cloud adoption and a focus on addressing unique regional cyber threats. Asia-Pacific emerges as a major and booming segment in the Security Information and Event Management market, fuelled by the region's economic growth, technological advancements, and a proactive approach to cybersecurity. The market's major segment status is supported by a surge in demand for Security Information and Event Management solutions across diverse industries, with notable regional growth in Japan. The Security Information and Event Management market in the Middle East and Africa is witnessing increased traction as organizations acknowledge the growing sophistication of cyber threats. Governments and enterprises in the region, including key players, are investing in cybersecurity measures, with Security Information and Event Management playing a crucial role in threat detection and incident response. The MEA region exhibits a growing awareness of the need for robust security solutions, particularly in critical sectors such as energy, government, and finance. MEA represents a regional segment with substantial potential in the Security Information and Event Management market. As the region strengthens its cybersecurity infrastructure, the market is to witness significant growth, positioning it as a major segment in the global Security Information and Event Management landscape. Key players in the MEA region contribute to the regional growth factors. The Architecture of Security Information and Event Management (SIEM): Log Management Security Information and Event Management (SIEM) intelligently collects data to offer a comprehensive range of user-friendly information, including insights into employee performance, company financial status, client patterns, and more. This crucial component oversees the processes of data collection, data management, and the examination of historical data retention. As depicted in the figure above, SIEM adeptly gathers both event data and contextual data, encompassing information from installed services, devices, network protocols, storage protocols, and streaming protocols. Log Normalization The provided figure also emphasizes that SIEM acquires both event and contextual data as input, making normalization a critical step. The significance lies in the process of transforming event data into essential security insights, achieved through filtering and eliminating irrelevant or unwanted data from the collected information. The primary objective here is the removal of useless and redundant data, ensuring that only pertinent data is retained for future analysis. Sources of Logs To gain a clear understanding of how logs are integrated into the SIEM framework, it is essential to explore the process of collecting, consolidating, and analysing internal logs. These logs sourced from various systems, including networking applications, security systems, or cloud-based systems. This component essentially focuses on identifying the origins of data and understanding its transportation. Hosting & Reporting of SIEM Various hosting models are available for SIEM, including self-hosting, cloud hosting, and hybrid hosting. SIEM plays a pivotal role in identifying and reporting irregular or malicious activities based on the available logs. Real-time Monitoring Data breaches stand out as one of the foremost concerns for businesses today. SIEM offers a real-time monitoring solution that not only detects malicious attacks but also pinpoints their origins, predicts potential threats, and takes necessary actions to prevent potential data leaks. This proactive approach ensures that organizations stay ahead of cybersecurity challenges and maintain the integrity of their data.

Scope of the Global Security Information and Event Management Market: Inquire before buying

Global Security Information and Event Management Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 6.40 Bn. Forecast Period 2025 to 2032 CAGR: 7.4% Market Size in 2032: USD 11.33 Bn. Segments Covered: by Component Solution Services by Deployment Mode On-Premises Cloud-Based by Organization Size Small and Medium Enterprises Large Enterprises by Application Log Management Threat Intelligence Security Analytics Incident Management Compliance Management Others Security Information and Event Management Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Security Information and Event Management Market, Key Players:

Major Global Key Players: 1. IBM (Armonk, New York, USA) 2. Hewlett Packard (Palo Alto, California, USA) 3. McAfee (San Jose, California, USA) Leading Key Players in North America: 1. LogRhythm (Boulder, Colorado, USA) 2. Splunk (San Francisco, California, USA) 3. AlienVault (San Mateo, California, USA) 4. BlackStratus (Piscataway, New Jersey, USA) 5. EventTracker (Columbia, Maryland, USA) 6. Dell Technologies (Round Rock, Texas, USA) 7. Fortinet (Sunnyvale, California, USA) 8. SolarWinds (Austin, Texas, USA) 9. Symantec (Mountain View, California, USA) 10. Tenable Network Security (Columbia, Maryland, USA) 11. TIBCO Software (Palo Alto, California, USA) 12. Trustwave (Chicago, Illinois, USA) Market Follower key Players in Europe: 1. Micro Focus (Newbury, United Kingdom) Prominent Key player Asia Pacific: 1. ZOHO Corp (Chennai, Tamil Nadu, India) 2. Trend Micro, Inc. (Tokyo, Japan)FAQ’s:

1. What is SIEM, and why is it essential in the market? Ans: SIEM, or Security Information and Event Management, is crucial for cybersecurity. It provides real-time analysis of security alerts generated by applications and network hardware. It is essential to detect and respond to cybersecurity threats promptly. 2. What drives the growth of the SIEM market? Ans: The SIEM market is driven by factors such as the increasing frequency of cyber threats, regulatory compliance requirements, the growing adoption of cloud services, the need for real-time threat intelligence, and the integration of security automation. 3. What challenges does the SIEM market face? Ans: Challenges in the SIEM market include complex implementations, high costs associated with SIEM solutions, and alert fatigue due to the large volume of alerts generated. 4. Who are the key players in the SIEM market? Ans: Key players in the SIEM market include IBM, Hewlett Packard, McAfee, LogRhythm, Splunk, AlienVault, BlackStratus, EventTracker, Dell Technologies, Fortinet, Micro Focus, SolarWinds, Symantec, Tenable Network Security, TIBCO Software, Trustwave, ZOHO Corp, and Trend Micro, Inc.. 5. What regions contribute significantly to the SIEM market? Ans: Regions such as North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America contribute significantly to the growth of the SIEM market, each with its unique dynamics and market drivers.

1. Security Information and Event Management Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Security Information and Event Management Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Security Information and Event Management Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Security Information and Event Management Market: Dynamics 3.1. Security Information and Event Management Market Trends by Region 3.1.1. North America Security Information and Event Management Market Trends 3.1.2. Europe Security Information and Event Management Market Trends 3.1.3. Asia Pacific Security Information and Event Management Market Trends 3.1.4. Middle East and Africa Security Information and Event Management Market Trends 3.1.5. South America Security Information and Event Management Market Trends 3.2. Security Information and Event Management Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Security Information and Event Management Market Drivers 3.2.1.2. North America Security Information and Event Management Market Restraints 3.2.1.3. North America Security Information and Event Management Market Opportunities 3.2.1.4. North America Security Information and Event Management Market Challenges 3.2.2. Europe 3.2.2.1. Europe Security Information and Event Management Market Drivers 3.2.2.2. Europe Security Information and Event Management Market Restraints 3.2.2.3. Europe Security Information and Event Management Market Opportunities 3.2.2.4. Europe Security Information and Event Management Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Security Information and Event Management Market Drivers 3.2.3.2. Asia Pacific Security Information and Event Management Market Restraints 3.2.3.3. Asia Pacific Security Information and Event Management Market Opportunities 3.2.3.4. Asia Pacific Security Information and Event Management Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Security Information and Event Management Market Drivers 3.2.4.2. Middle East and Africa Security Information and Event Management Market Restraints 3.2.4.3. Middle East and Africa Security Information and Event Management Market Opportunities 3.2.4.4. Middle East and Africa Security Information and Event Management Market Challenges 3.2.5. South America 3.2.5.1. South America Security Information and Event Management Market Drivers 3.2.5.2. South America Security Information and Event Management Market Restraints 3.2.5.3. South America Security Information and Event Management Market Opportunities 3.2.5.4. South America Security Information and Event Management Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Security Information and Event Management Industry 3.8. Analysis of Government Schemes and Initiatives For Security Information and Event Management Industry 3.9. Security Information and Event Management Market Trade Analysis 3.10. The Global Pandemic Impact on Security Information and Event Management Market 4. Security Information and Event Management Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 4.1.1. Solution 4.1.2. Services 4.2. Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 4.2.1. On-Premises 4.2.2. Cloud-Based 4.3. Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 4.3.1. Small and Medium Enterprises 4.3.2. Large Enterprises 4.4. Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 4.4.1. Log Management 4.4.2. Threat Intelligence 4.4.3. Security Analytics 4.4.4. Incident Management 4.4.5. Compliance Management 4.4.6. Others 4.5. Security Information and Event Management Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Security Information and Event Management Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 5.1.1. Solution 5.1.2. Services 5.2. North America Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 5.2.1. On-Premises 5.2.2. Cloud-Based 5.3. North America Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 5.3.1. Small and Medium Enterprises 5.3.2. Large Enterprises 5.4. North America Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 5.4.1. Log Management 5.4.2. Threat Intelligence 5.4.3. Security Analytics 5.4.4. Incident Management 5.4.5. Compliance Management 5.4.6. Others 5.5. North America Security Information and Event Management Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 5.5.1.1.1. Solution 5.5.1.1.2. Services 5.5.1.2. United States Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 5.5.1.2.1. On-Premises 5.5.1.2.2. Cloud-Based 5.5.1.3. United States Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 5.5.1.3.1. Small and Medium Enterprises 5.5.1.3.2. Large Enterprises 5.5.1.4. United States Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 5.5.1.4.1. Log Management 5.5.1.4.2. Threat Intelligence 5.5.1.4.3. Security Analytics 5.5.1.4.4. Incident Management 5.5.1.4.5. Compliance Management 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 5.5.2.1.1. Solution 5.5.2.1.2. Services 5.5.2.2. Canada Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 5.5.2.2.1. On-Premises 5.5.2.2.2. Cloud-Based 5.5.2.3. Canada Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 5.5.2.3.1. Small and Medium Enterprises 5.5.2.3.2. Large Enterprises 5.5.2.4. Canada Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 5.5.2.4.1. Log Management 5.5.2.4.2. Threat Intelligence 5.5.2.4.3. Security Analytics 5.5.2.4.4. Incident Management 5.5.2.4.5. Compliance Management 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 5.5.3.1.1. Solution 5.5.3.1.2. Services 5.5.3.2. Mexico Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 5.5.3.2.1. On-Premises 5.5.3.2.2. Cloud-Based 5.5.3.3. Mexico Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 5.5.3.3.1. Small and Medium Enterprises 5.5.3.3.2. Large Enterprises 5.5.3.4. Mexico Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 5.5.3.4.1. Log Management 5.5.3.4.2. Threat Intelligence 5.5.3.4.3. Security Analytics 5.5.3.4.4. Incident Management 5.5.3.4.5. Compliance Management 5.5.3.4.6. Others 6. Europe Security Information and Event Management Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.2. Europe Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.3. Europe Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.4. Europe Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5. Europe Security Information and Event Management Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.1.2. United Kingdom Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.1.3. United Kingdom Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.1.4. United Kingdom Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5.2. France 6.5.2.1. France Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.2.2. France Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.2.3. France Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.2.4. France Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.3.2. Germany Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.3.3. Germany Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.3.4. Germany Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.4.2. Italy Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.4.3. Italy Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.4.4. Italy Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.5.2. Spain Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.5.3. Spain Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.5.4. Spain Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.6.2. Sweden Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.6.3. Sweden Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.6.4. Sweden Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.7.2. Austria Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.7.3. Austria Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.7.4. Austria Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 6.5.8.2. Rest of Europe Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 6.5.8.3. Rest of Europe Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 6.5.8.4. Rest of Europe Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7. Asia Pacific Security Information and Event Management Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.2. Asia Pacific Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.3. Asia Pacific Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.4. Asia Pacific Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Security Information and Event Management Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.1.2. China Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.1.3. China Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.1.4. China Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.2.2. S Korea Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.2.3. S Korea Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.2.4. S Korea Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.3.2. Japan Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.3.3. Japan Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.3.4. Japan Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.4. India 7.5.4.1. India Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.4.2. India Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.4.3. India Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.4.4. India Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.5.2. Australia Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.5.3. Australia Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.5.4. Australia Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.6.2. Indonesia Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.6.3. Indonesia Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.6.4. Indonesia Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.7.2. Malaysia Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.7.3. Malaysia Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.7.4. Malaysia Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.8.2. Vietnam Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.8.3. Vietnam Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.8.4. Vietnam Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.9.2. Taiwan Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.9.3. Taiwan Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.9.4. Taiwan Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 7.5.10.2. Rest of Asia Pacific Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 7.5.10.3. Rest of Asia Pacific Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 7.5.10.4. Rest of Asia Pacific Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 8. Middle East and Africa Security Information and Event Management Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 8.2. Middle East and Africa Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 8.3. Middle East and Africa Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 8.4. Middle East and Africa Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Security Information and Event Management Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 8.5.1.2. South Africa Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.1.3. South Africa Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 8.5.1.4. South Africa Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 8.5.2.2. GCC Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.2.3. GCC Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 8.5.2.4. GCC Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 8.5.3.2. Nigeria Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.3.3. Nigeria Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 8.5.3.4. Nigeria Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 8.5.4.2. Rest of ME&A Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 8.5.4.3. Rest of ME&A Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 8.5.4.4. Rest of ME&A Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 9. South America Security Information and Event Management Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 9.2. South America Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 9.3. South America Security Information and Event Management Market Size and Forecast, by Organization Size(2024-2032) 9.4. South America Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 9.5. South America Security Information and Event Management Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 9.5.1.2. Brazil Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 9.5.1.3. Brazil Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 9.5.1.4. Brazil Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 9.5.2.2. Argentina Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 9.5.2.3. Argentina Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 9.5.2.4. Argentina Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Security Information and Event Management Market Size and Forecast, by Component (2024-2032) 9.5.3.2. Rest Of South America Security Information and Event Management Market Size and Forecast, by Deployment Mode (2024-2032) 9.5.3.3. Rest Of South America Security Information and Event Management Market Size and Forecast, by Organization Size (2024-2032) 9.5.3.4. Rest Of South America Security Information and Event Management Market Size and Forecast, by Application (2024-2032) 10. Company Profile: Key Players 10.1. IBM (Armonk, New York, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Hewlett Packard (Palo Alto, California, USA) 10.3. McAfee (San Jose, California, USA) 10.4. Leading Key Players in North America: 10.5. LogRhythm (Boulder, Colorado, USA) 10.6. Splunk (San Francisco, California, USA) 10.7. AlienVault (San Mateo, California, USA) 10.8. BlackStratus (Piscataway, New Jersey, USA) 10.9. EventTracker (Columbia, Maryland, USA) 10.10. Dell Technologies (Round Rock, Texas, USA) 10.11. Fortinet (Sunnyvale, California, USA) 10.12. SolarWinds (Austin, Texas, USA) 10.13. Symantec (Mountain View, California, USA) 10.14. Tenable Network Security (Columbia, Maryland, USA) 10.15. TIBCO Software (Palo Alto, California, USA) 10.16. Trustwave (Chicago, Illinois, USA) 10.17. Market Follower key Players in Europe: 10.18. Micro Focus (Newbury, United Kingdom) 10.19. Prominent Key player Asia Pacific: 10.20. ZOHO Corp (Chennai, Tamil Nadu, India) 10.21. Trend Micro, Inc. (Tokyo, Japan) 11. Key Findings 12. Industry Recommendations 13. Security Information and Event Management Market: Research Methodology 14. Terms and Glossary