Global Process Chillers Market size is expected to reach nearly US$ Bn by 2027 with the CAGR of 4.14% during the forecast period. The report study has analyzed revenue impact of COVID -19 pandemic on the sales revenue of market leaders, market followers and market disrupters in the report and same is reflected in our analysis. Process chillers are the type of equipment's that are used in industries to remove heat from a process. Process chillers use either water or air condenser in their cooling process. Process chillers include different components depending on the design like condensers, compressors, pumps, evaporators, pipes, high-pressure refrigerant relief valves & cooling towers, tanks, fans and filters.To know about the Research Methodology :- Request Free Sample Report Looking forward, the market is projected to reach a value of US$ XX million by 2027, expanding at a CAGR of around 6.45% during 2020-2027. The growth of the process chillers market is expected towards major relying factors such as rise in cooling process applications, increasing concern over energy efficiency, developing industrialization, growing use of environment-friendly products, progress in the manufacturing industries, mergers & acquisitions, and partnerships among key players in the global process chillers market etc. On the flip side, the global process chillers market is hampered by growing competition and increasing concerns regarding the efficacy of the machines, high raw material prices. According to the MMR study, the recent development trend of the process chillers market has affected the increasing number of various end-use industries like plastics and processed food industries and the growing demand for efficient industrial process cooling across the world. Likewise, the report covers all the trends and technologies playing a major role in the growth of the process chillers market over 2020-2027. In 2020, the water-cooled segment was dominated the process chillers market with valued around US$ XX Mn. Water-cooled chiller systems need a high supply of water to replace the dissolved volume of water. Such as the U.S. data centers necessary nearby XX billion liters of water in 2019, with the water used to make electricity to power, the data centers and the quantity of water directly spent on the sites. The plastics end-use industry segment is expected to account for XX% of the total market share in 2019 and is expected to grow at the highest CAGR of XX.33% during the forecast period. This growth is attributed to the wide use of chillers for cooling many types of machinery involved in the manufacturing of plastic products. Similarly, the MMR report will provide an accurate prediction of the contribution of the various segments to the growth of the process chillers market size. Geographically, the Asia Pacific region is expected to account for the largest XX% market share by 2027 thanks to ongoing investments in the residential and commercial construction industries across the region. The price for process chillers differs a lot across the world, conversely in Asian economies like China, India it appears to be a bit low owing to the presence of small players in the region. Key players in the process chillers market have adopted various strategies to expand their global presence and increase their market shares. Mergers and acquisitions, partnerships, agreements, and new product developments are some of the major strategies adopted by the companies, to achieve growth in the global process chillers market. For example, in 2019, Trane Technologies Inc. a leading player in the market for process chillers, launched three new process chillers by refrigerant R1234ze. The company claims that the compressor technology used in process chillers makes it nearly 38 % more efficient, making the product acquiescent with Ecodesign regulations. The objective of the report is to present a comprehensive analysis of the Global Process Chillers Market to the stakeholders in the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Global Process Chillers Market dynamics, structure by analyzing the market segments and project the Global Process Chillers Market size. It also gives a clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence which make the Global Process Chillers Market report the investors’ guide.

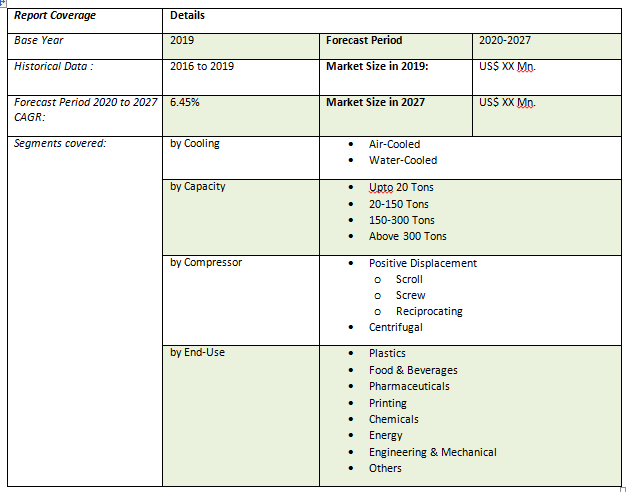

Scope of the Global Process Chillers Market: Inquire before buying

Global Process Chillers Market, By Region

• Asia Pacific • North America • Europe • South America • Middle East & AfricaKey Players Operating in the Global Process Chillers Market

• Motivair Corporation • Drake Refrigeration Inc • Thermal Care Inc • Airedale Air Conditioning • ICS Cool Energy Limited • Filtrine Manufacturing Company • Legacy Chiller Systems Inc • Cooling Technology, Inc • General Air Products, Inc. • Carrier Global Corporation • DAIKIN INDUSTRIES, Ltd. • Danfoss • Dimplex Thermal Solutions • Johnson Controls International plc • Motivair Corporation • Parker-Hannifin Corporation • Trane Technologies Inc.

Global Process Chillers Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Global Process Chillers Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Global Process Chillers Market Analysis and Forecast 6.1. Global Process Chillers Market Size & Y-o-Y Growth Analysis 6.1.1. North America 6.1.2. Europe 6.1.3. Asia Pacific 6.1.4. Middle East & Africa 6.1.5. South America 7. Global Process Chillers Market Analysis and Forecast, By Cooling 7.1. Introduction and Definition 7.2. Key Findings 7.3. Global Process Chillers Market Value Share Analysis, By Cooling 7.4. Global Process Chillers Market Size (US$ Mn) Forecast, By Cooling 7.5. Global Process Chillers Market Analysis, By Cooling 7.6. Global Process Chillers Market Attractiveness Analysis, By Cooling 8. Global Process Chillers Market Analysis and Forecast, By Capacity 8.1. Introduction and Definition 8.2. Key Findings 8.3. Global Process Chillers Market Value Share Analysis, By Capacity 8.4. Global Process Chillers Market Size (US$ Mn) Forecast, By Capacity 8.5. Global Process Chillers Market Analysis, By Capacity 8.6. Global Process Chillers Market Attractiveness Analysis, By Capacity 9. Global Process Chillers Market Analysis and Forecast, By Compressor 9.1. Introduction and Definition 9.2. Key Findings 9.3. Global Process Chillers Market Value Share Analysis, By Compressor 9.4. Global Process Chillers Market Size (US$ Mn) Forecast, By Compressor 9.5. Global Process Chillers Market Analysis, By Compressor 9.6. Global Process Chillers Market Attractiveness Analysis, By Compressor 10. Global Process Chillers Market Analysis and Forecast, By End-Use 10.1. Introduction and Definition 10.2. Key Findings 10.3. Global Process Chillers Market Value Share Analysis, By End-Use 10.4. Global Process Chillers Market Size (US$ Mn) Forecast, By End-Use 10.5. Global Process Chillers Market Analysis, By End-Use 10.6. Global Process Chillers Market Attractiveness Analysis, By End-Use 11. Global Process Chillers Market Analysis, by Region 11.1. Global Process Chillers Market Value Share Analysis, by Region 11.2. Global Process Chillers Market Size (US$ Mn) Forecast, by Region 11.3. Global Process Chillers Market Attractiveness Analysis, by Region 12. North America Process Chillers Market Analysis 12.1. Key Findings 12.2. North America Process Chillers Market Overview 12.3. North America Process Chillers Market Value Share Analysis, By Cooling 12.4. North America Process Chillers Market Forecast, By Cooling 12.4.1. Air-Cooled 12.4.2. Water-Cooled 12.5. North America Process Chillers Market Value Share Analysis, By Capacity 12.6. North America Process Chillers Market Forecast, By Capacity 12.6.1. Upto 20 Tons 12.6.2. 20-150 Tons 12.6.3. 150-300 Tons 12.6.4. Above 300 Tons 12.7. North America Process Chillers Market Value Share Analysis, By Compressor 12.8. North America Process Chillers Market Forecast, By Compressor 12.8.1. Positive Displacement 12.8.1.1. Scroll 12.8.1.2. Screw 12.8.1.3. Reciprocating 12.8.2. Centrifugal 12.9. North America Process Chillers Market Value Share Analysis, By End-Use 12.10. North America Process Chillers Market Forecast, By End-Use 12.10.1. Plastics 12.10.2. Food & Beverages 12.10.3. Pharmaceuticals 12.10.4. Printing 12.10.5. Chemicals 12.10.6. Energy 12.10.7. Engineering & Mechanical 12.10.8. Others 12.11. North America Process Chillers Market Value Share Analysis, by Country 12.12. North America Process Chillers Market Forecast, by Country 12.12.1. U.S. 12.12.2. Canada 12.12.3. Mexico 12.13. North America Process Chillers Market Analysis, by Country 12.14. U.S. Process Chillers Market Forecast, By Cooling 12.14.1. Air-Cooled 12.14.2. Water-Cooled 12.15. U.S. Process Chillers Market Forecast, By Capacity 12.15.1. Upto 20 Tons 12.15.2. 20-150 Tons 12.15.3. 150-300 Tons 12.15.4. Above 300 Tons 12.16. U.S. Process Chillers Market Forecast, By Compressor 12.16.1. Positive Displacement 12.16.1.1. Scroll 12.16.1.2. Screw 12.16.1.3. Reciprocating 12.16.2. Centrifugal 12.17. U.S. Process Chillers Market Forecast, By End-Use 12.17.1. Plastics 12.17.2. Food & Beverages 12.17.3. Pharmaceuticals 12.17.4. Printing 12.17.5. Chemicals 12.17.6. Energy 12.17.7. Engineering & Mechanical 12.17.8. Others 12.18. Canada Process Chillers Market Forecast, By Cooling 12.18.1. Air-Cooled 12.18.2. Water-Cooled 12.19. Canada Process Chillers Market Forecast, By Capacity 12.19.1. Upto 20 Tons 12.19.2. 20-150 Tons 12.19.3. 150-300 Tons 12.19.4. Above 300 Tons 12.20. Canada Process Chillers Market Forecast, By Compressor 12.20.1. Positive Displacement 12.20.1.1. Scroll 12.20.1.2. Screw 12.20.1.3. Reciprocating 12.20.2. Centrifugal 12.21. Canada Process Chillers Market Forecast, By End-Use 12.21.1. Plastics 12.21.2. Food & Beverages 12.21.3. Pharmaceuticals 12.21.4. Printing 12.21.5. Chemicals 12.21.6. Energy 12.21.7. Engineering & Mechanical 12.21.8. Others 12.22. Mexico Process Chillers Market Forecast, By Cooling 12.22.1. Air-Cooled 12.22.2. Water-Cooled 12.23. Mexico Process Chillers Market Forecast, By Capacity 12.23.1. Upto 20 Tons 12.23.2. 20-150 Tons 12.23.3. 150-300 Tons 12.23.4. Above 300 Tons 12.24. Mexico Process Chillers Market Forecast, By Compressor 12.24.1. Positive Displacement 12.24.1.1. Scroll 12.24.1.2. Screw 12.24.1.3. Reciprocating 12.24.2. Centrifugal 12.25. Mexico Process Chillers Market Forecast, By End-Use 12.25.1. Plastics 12.25.2. Food & Beverages 12.25.3. Pharmaceuticals 12.25.4. Printing 12.25.5. Chemicals 12.25.6. Energy 12.25.7. Engineering & Mechanical 12.25.8. Others 12.26. North America Process Chillers Market Attractiveness Analysis 12.26.1. By Cooling 12.26.2. By Capacity 12.26.3. By Compressor 12.26.4. By End-Use 12.27. PEST Analysis 12.28. Key Trends 12.29. Key Developments 13. Europe Process Chillers Market Analysis 13.1. Key Findings 13.2. Europe Process Chillers Market Overview 13.3. Europe Process Chillers Market Value Share Analysis, By Cooling 13.4. Europe Process Chillers Market Forecast, By Cooling 13.4.1. Air-Cooled 13.4.2. Water-Cooled 13.5. Europe Process Chillers Market Value Share Analysis, By Capacity 13.6. Europe Process Chillers Market Forecast, By Capacity 13.6.1. Upto 20 Tons 13.6.2. 20-150 Tons 13.6.3. 150-300 Tons 13.6.4. Above 300 Tons 13.7. Europe Process Chillers Market Value Share Analysis, By Compressor 13.8. Europe Process Chillers Market Forecast, By Compressor 13.8.1. Positive Displacement 13.8.1.1. Scroll 13.8.1.2. Screw 13.8.1.3. Reciprocating 13.8.2. Centrifugal 13.9. Europe Process Chillers Market Value Share Analysis, By End-Use 13.10. Europe Process Chillers Market Forecast, By End-Use 13.10.1. Plastics 13.10.2. Food & Beverages 13.10.3. Pharmaceuticals 13.10.4. Printing 13.10.5. Chemicals 13.10.6. Energy 13.10.7. Engineering & Mechanical 13.10.8. Others 13.11. Europe Process Chillers Market Value Share Analysis, by Country 13.12. Europe Process Chillers Market Forecast, by Country 13.12.1. Germany 13.12.2. U.K. 13.12.3. France 13.12.4. Italy 13.12.5. Spain 13.12.6. Sweden 13.12.7. CIS countries 13.12.8. Rest of Europe 13.13. Germany Process Chillers Market Forecast, By Cooling 13.13.1. Air-Cooled 13.13.2. Water-Cooled 13.14. Germany Process Chillers Market Forecast, By Capacity 13.14.1. Upto 20 Tons 13.14.2. 20-150 Tons 13.14.3. 150-300 Tons 13.14.4. Above 300 Tons 13.15. Germany Process Chillers Market Forecast, By Compressor 13.15.1. Positive Displacement 13.15.1.1. Scroll 13.15.1.2. Screw 13.15.1.3. Reciprocating 13.15.2. Centrifugal 13.16. Germany Process Chillers Market Forecast, By End-Use 13.16.1. Plastics 13.16.2. Food & Beverages 13.16.3. Pharmaceuticals 13.16.4. Printing 13.16.5. Chemicals 13.16.6. Energy 13.16.7. Engineering & Mechanical 13.16.8. Others 13.17. U.K. Process Chillers Market Forecast, By Cooling 13.17.1. Air-Cooled 13.17.2. Water-Cooled 13.18. U.K. Process Chillers Market Forecast, By Capacity 13.18.1. Upto 20 Tons 13.18.2. 20-150 Tons 13.18.3. 150-300 Tons 13.18.4. Above 300 Tons 13.19. U.K. Process Chillers Market Forecast, By Compressor 13.19.1. Positive Displacement 13.19.1.1. Scroll 13.19.1.2. Screw 13.19.1.3. Reciprocating 13.19.2. Centrifugal 13.20. U.K. Process Chillers Market Forecast, By End-Use 13.20.1. Plastics 13.20.2. Food & Beverages 13.20.3. Pharmaceuticals 13.20.4. Printing 13.20.5. Chemicals 13.20.6. Energy 13.20.7. Engineering & Mechanical 13.20.8. Others 13.21. France Process Chillers Market Forecast, By Cooling 13.21.1. Air-Cooled 13.21.2. Water-Cooled 13.22. France Process Chillers Market Forecast, By Capacity 13.22.1. Upto 20 Tons 13.22.2. 20-150 Tons 13.22.3. 150-300 Tons 13.22.4. Above 300 Tons 13.23. France Process Chillers Market Forecast, By Compressor 13.23.1. Positive Displacement 13.23.1.1. Scroll 13.23.1.2. Screw 13.23.1.3. Reciprocating 13.23.2. Centrifugal 13.24. France Process Chillers Market Forecast, By End-Use 13.24.1. Plastics 13.24.2. Food & Beverages 13.24.3. Pharmaceuticals 13.24.4. Printing 13.24.5. Chemicals 13.24.6. Energy 13.24.7. Engineering & Mechanical 13.24.8. Others 13.25. Italy Process Chillers Market Forecast, By Cooling 13.25.1. Air-Cooled 13.25.2. Water-Cooled 13.26. Italy Process Chillers Market Forecast, By Capacity 13.26.1. Upto 20 Tons 13.26.2. 20-150 Tons 13.26.3. 150-300 Tons 13.26.4. Above 300 Tons 13.27. Italy Process Chillers Market Forecast, By Compressor 13.27.1. Positive Displacement 13.27.1.1. Scroll 13.27.1.2. Screw 13.27.1.3. Reciprocating 13.27.2. Centrifugal 13.28. Italy Process Chillers Market Forecast, By End-Use 13.28.1. Plastics 13.28.2. Food & Beverages 13.28.3. Pharmaceuticals 13.28.4. Printing 13.28.5. Chemicals 13.28.6. Energy 13.28.7. Engineering & Mechanical 13.28.8. Others 13.29. Spain Process Chillers Market Forecast, By Cooling 13.29.1. Air-Cooled 13.29.2. Water-Cooled 13.30. Spain Process Chillers Market Forecast, By Capacity 13.30.1. Upto 20 Tons 13.30.2. 20-150 Tons 13.30.3. 150-300 Tons 13.30.4. Above 300 Tons 13.31. Spain Process Chillers Market Forecast, By Compressor 13.31.1. Positive Displacement 13.31.1.1. Scroll 13.31.1.2. Screw 13.31.1.3. Reciprocating 13.31.2. Centrifugal 13.32. Spain Process Chillers Market Forecast, By End-Use 13.32.1. Plastics 13.32.2. Food & Beverages 13.32.3. Pharmaceuticals 13.32.4. Printing 13.32.5. Chemicals 13.32.6. Energy 13.32.7. Engineering & Mechanical 13.32.8. Others 13.33. Sweden Process Chillers Market Forecast, By Cooling 13.33.1. Air-Cooled 13.33.2. Water-Cooled 13.34. Sweden Process Chillers Market Forecast, By Capacity 13.34.1. Upto 20 Tons 13.34.2. 20-150 Tons 13.34.3. 150-300 Tons 13.34.4. Above 300 Tons 13.35. Sweden Process Chillers Market Forecast, By Compressor 13.35.1. Positive Displacement 13.35.1.1. Scroll 13.35.1.2. Screw 13.35.1.3. Reciprocating 13.35.2. Centrifugal 13.36. Sweden Process Chillers Market Forecast, By End-Use 13.36.1. Plastics 13.36.2. Food & Beverages 13.36.3. Pharmaceuticals 13.36.4. Printing 13.36.5. Chemicals 13.36.6. Energy 13.36.7. Engineering & Mechanical 13.36.8. Others 13.37. CIS countries Process Chillers Market Forecast, By Cooling 13.37.1. Air-Cooled 13.37.2. Water-Cooled 13.38. CIS countries Process Chillers Market Forecast, By Capacity 13.38.1. Upto 20 Tons 13.38.2. 20-150 Tons 13.38.3. 150-300 Tons 13.38.4. Above 300 Tons 13.39. CIS countries Process Chillers Market Forecast, By Compressor 13.39.1. Positive Displacement 13.39.1.1. Scroll 13.39.1.2. Screw 13.39.1.3. Reciprocating 13.39.2. Centrifugal 13.40. CIS countries Process Chillers Market Forecast, By End-Use 13.40.1. Plastics 13.40.2. Food & Beverages 13.40.3. Pharmaceuticals 13.40.4. Printing 13.40.5. Chemicals 13.40.6. Energy 13.40.7. Engineering & Mechanical 13.40.8. Others 13.41. Rest of Europe Process Chillers Market Forecast, By Cooling 13.41.1. Air-Cooled 13.41.2. Water-Cooled 13.42. Rest of Europe Process Chillers Market Forecast, By Capacity 13.42.1. Upto 20 Tons 13.42.2. 20-150 Tons 13.42.3. 150-300 Tons 13.42.4. Above 300 Tons 13.43. Rest of Europe Process Chillers Market Forecast, By Compressor 13.43.1. Positive Displacement 13.43.1.1. Scroll 13.43.1.2. Screw 13.43.1.3. Reciprocating 13.43.2. Centrifugal 13.44. Rest of Europe Process Chillers Market Forecast, By End-Use 13.44.1. Plastics 13.44.2. Food & Beverages 13.44.3. Pharmaceuticals 13.44.4. Printing 13.44.5. Chemicals 13.44.6. Energy 13.44.7. Engineering & Mechanical 13.44.8. Others 13.45. Europe Process Chillers Market Attractiveness Analysis 13.45.1. By Cooling 13.45.2. By Capacity 13.45.3. By Compressor 13.45.4. By End-Use 13.46. PEST Analysis 13.47. Key Trends 13.48. Key Developments 14. Asia Pacific Process Chillers Market Analysis 14.1. Key Findings 14.2. Asia Pacific Process Chillers Market Overview 14.3. Asia Pacific Process Chillers Market Value Share Analysis, By Cooling 14.4. Asia Pacific Process Chillers Market Forecast, By Cooling 14.4.1. Air-Cooled 14.4.2. Water-Cooled 14.5. Asia Pacific Process Chillers Market Value Share Analysis, By Capacity 14.6. Asia Pacific Process Chillers Market Forecast, By Capacity 14.6.1. Upto 20 Tons 14.6.2. 20-150 Tons 14.6.3. 150-300 Tons 14.6.4. Above 300 Tons 14.7. Asia Pacific Process Chillers Market Value Share Analysis, By Compressor 14.8. Asia Pacific Process Chillers Market Forecast, By Compressor 14.8.1. Positive Displacement 14.8.1.1. Scroll 14.8.1.2. Screw 14.8.1.3. Reciprocating 14.8.2. Centrifugal 14.9. Asia Pacific Process Chillers Market Value Share Analysis, By End-Use 14.10. Asia Pacific Process Chillers Market Forecast, By End-Use 14.10.1. Plastics 14.10.2. Food & Beverages 14.10.3. Pharmaceuticals 14.10.4. Printing 14.10.5. Chemicals 14.10.6. Energy 14.10.7. Engineering & Mechanical 14.10.8. Others 14.11. Asia Pacific Process Chillers Market Value Share Analysis, by Country 14.12. Asia Pacific Process Chillers Market Forecast, by Country 14.12.1. China 14.12.2. India 14.12.3. Japan 14.12.4. South Korea 14.12.5. Australia 14.12.6. ASEAN 14.12.7. Rest of Asia Pacific 14.13. China Process Chillers Market Forecast, By Cooling 14.13.1. Air-Cooled 14.13.2. Water-Cooled 14.14. China Process Chillers Market Forecast, By Capacity 14.14.1. Upto 20 Tons 14.14.2. 20-150 Tons 14.14.3. 150-300 Tons 14.14.4. Above 300 Tons 14.15. China Process Chillers Market Forecast, By Compressor 14.15.1. Positive Displacement 14.15.1.1. Scroll 14.15.1.2. Screw 14.15.1.3. Reciprocating 14.15.2. Centrifugal 14.16. China Process Chillers Market Forecast, By End-Use 14.16.1. Plastics 14.16.2. Food & Beverages 14.16.3. Pharmaceuticals 14.16.4. Printing 14.16.5. Chemicals 14.16.6. Energy 14.16.7. Engineering & Mechanical 14.16.8. Others 14.17. India Process Chillers Market Forecast, By Cooling 14.17.1. Air-Cooled 14.17.2. Water-Cooled 14.18. India Process Chillers Market Forecast, By Capacity 14.18.1. Upto 20 Tons 14.18.2. 20-150 Tons 14.18.3. 150-300 Tons 14.18.4. Above 300 Tons 14.19. India Process Chillers Market Forecast, By Compressor 14.19.1. Positive Displacement 14.19.1.1. Scroll 14.19.1.2. Screw 14.19.1.3. Reciprocating 14.19.2. Centrifugal 14.20. India Process Chillers Market Forecast, By End-Use 14.20.1. Plastics 14.20.2. Food & Beverages 14.20.3. Pharmaceuticals 14.20.4. Printing 14.20.5. Chemicals 14.20.6. Energy 14.20.7. Engineering & Mechanical 14.20.8. Others 14.21. Japan Process Chillers Market Forecast, By Cooling 14.21.1. Air-Cooled 14.21.2. Water-Cooled 14.22. Japan Process Chillers Market Forecast, By Capacity 14.22.1. Upto 20 Tons 14.22.2. 20-150 Tons 14.22.3. 150-300 Tons 14.22.4. Above 300 Tons 14.23. Japan Process Chillers Market Forecast, By Compressor 14.23.1. Positive Displacement 14.23.1.1. Scroll 14.23.1.2. Screw 14.23.1.3. Reciprocating 14.23.2. Centrifugal 14.24. Japan Process Chillers Market Forecast, By End-Use 14.24.1. Plastics 14.24.2. Food & Beverages 14.24.3. Pharmaceuticals 14.24.4. Printing 14.24.5. Chemicals 14.24.6. Energy 14.24.7. Engineering & Mechanical 14.24.8. Others 14.25. South Korea Process Chillers Market Forecast, By Cooling 14.25.1. Air-Cooled 14.25.2. Water-Cooled 14.26. South Korea Process Chillers Market Forecast, By Capacity 14.26.1. Upto 20 Tons 14.26.2. 20-150 Tons 14.26.3. 150-300 Tons 14.26.4. Above 300 Tons 14.27. South Korea Process Chillers Market Forecast, By Compressor 14.27.1. Positive Displacement 14.27.1.1. Scroll 14.27.1.2. Screw 14.27.1.3. Reciprocating 14.27.2. Centrifugal 14.28. South Korea Process Chillers Market Forecast, By End-Use 14.28.1. Plastics 14.28.2. Food & Beverages 14.28.3. Pharmaceuticals 14.28.4. Printing 14.28.5. Chemicals 14.28.6. Energy 14.28.7. Engineering & Mechanical 14.28.8. Others 14.29. Australia Process Chillers Market Forecast, By Cooling 14.29.1. Air-Cooled 14.29.2. Water-Cooled 14.30. Australia Process Chillers Market Forecast, By Capacity 14.30.1. Upto 20 Tons 14.30.2. 20-150 Tons 14.30.3. 150-300 Tons 14.30.4. Above 300 Tons 14.31. Australia Process Chillers Market Forecast, By Compressor 14.31.1. Positive Displacement 14.31.1.1. Scroll 14.31.1.2. Screw 14.31.1.3. Reciprocating 14.31.2. Centrifugal 14.32. Australia Process Chillers Market Forecast, By End-Use 14.32.1. Plastics 14.32.2. Food & Beverages 14.32.3. Pharmaceuticals 14.32.4. Printing 14.32.5. Chemicals 14.32.6. Energy 14.32.7. Engineering & Mechanical 14.32.8. Others 14.33. ASEAN Process Chillers Market Forecast, By Cooling 14.33.1. Air-Cooled 14.33.2. Water-Cooled 14.34. ASEAN Process Chillers Market Forecast, By Capacity 14.34.1. Upto 20 Tons 14.34.2. 20-150 Tons 14.34.3. 150-300 Tons 14.34.4. Above 300 Tons 14.35. ASEAN Process Chillers Market Forecast, By Compressor 14.35.1. Positive Displacement 14.35.1.1. Scroll 14.35.1.2. Screw 14.35.1.3. Reciprocating 14.35.2. Centrifugal 14.36. ASEAN Process Chillers Market Forecast, By End-Use 14.36.1. Plastics 14.36.2. Food & Beverages 14.36.3. Pharmaceuticals 14.36.4. Printing 14.36.5. Chemicals 14.36.6. Energy 14.36.7. Engineering & Mechanical 14.36.8. Others 14.37. Rest of Asia Pacific Process Chillers Market Forecast, By Cooling 14.37.1. Air-Cooled 14.37.2. Water-Cooled 14.38. Rest of Asia Pacific Process Chillers Market Forecast, By Capacity 14.38.1. Upto 20 Tons 14.38.2. 20-150 Tons 14.38.3. 150-300 Tons 14.38.4. Above 300 Tons 14.39. Rest of Asia Pacific Process Chillers Market Forecast, By Compressor 14.39.1. Positive Displacement 14.39.1.1. Scroll 14.39.1.2. Screw 14.39.1.3. Reciprocating 14.39.2. Centrifugal 14.40. Rest of Asia Pacific Process Chillers Market Forecast, By End-Use 14.40.1. Plastics 14.40.2. Food & Beverages 14.40.3. Pharmaceuticals 14.40.4. Printing 14.40.5. Chemicals 14.40.6. Energy 14.40.7. Engineering & Mechanical 14.40.8. Others 14.41. Asia Pacific Process Chillers Market Attractiveness Analysis 14.41.1. By Cooling 14.41.2. By Capacity 14.41.3. By Compressor 14.41.4. By End-Use 14.42. PEST Analysis 14.43. Key Trends 14.44. Key Developments 15. Middle East & Africa Process Chillers Market Analysis 15.1. Key Findings 15.2. Middle East & Africa Process Chillers Market Overview 15.3. Middle East & Africa Process Chillers Market Value Share Analysis, By Cooling 15.4. Middle East & Africa Process Chillers Market Forecast, By Cooling 15.4.1. Air-Cooled 15.4.2. Water-Cooled 15.5. Middle East & Africa Process Chillers Market Value Share Analysis, By Capacity 15.6. Middle East & Africa Process Chillers Market Forecast, By Capacity 15.6.1. Upto 20 Tons 15.6.2. 20-150 Tons 15.6.3. 150-300 Tons 15.6.4. Above 300 Tons 15.7. Middle East & Africa Process Chillers Market Value Share Analysis, By Compressor 15.8. Middle East & Africa Process Chillers Market Forecast, By Compressor 15.8.1. Positive Displacement 15.8.1.1. Scroll 15.8.1.2. Screw 15.8.1.3. Reciprocating 15.8.2. Centrifugal 15.9. Middle East & Africa Process Chillers Market Value Share Analysis, By End-Use 15.10. Middle East & Africa Process Chillers Market Forecast, By End-Use 15.10.1. Plastics 15.10.2. Food & Beverages 15.10.3. Pharmaceuticals 15.10.4. Printing 15.10.5. Chemicals 15.10.6. Energy 15.10.7. Engineering & Mechanical 15.10.8. Others 15.11. Middle East & Africa Process Chillers Market Value Share Analysis, by Country 15.12. Middle East & Africa Process Chillers Market Forecast, by Country 15.12.1. GCC countries 15.12.2. Nigeria 15.12.3. Egypt 15.12.4. South Africa 15.12.5. Rest of Middle East & Africa 15.13. GCC countries Process Chillers Market Forecast, By Cooling 15.13.1. Air-Cooled 15.13.2. Water-Cooled 15.14. GCC countries Process Chillers Market Forecast, By Capacity 15.14.1. Upto 20 Tons 15.14.2. 20-150 Tons 15.14.3. 150-300 Tons 15.14.4. Above 300 Tons 15.15. GCC countries Process Chillers Market Forecast, By Compressor 15.15.1. Positive Displacement 15.15.1.1. Scroll 15.15.1.2. Screw 15.15.1.3. Reciprocating 15.15.2. Centrifugal 15.16. GCC countries Process Chillers Market Forecast, By End-Use 15.16.1. Plastics 15.16.2. Food & Beverages 15.16.3. Pharmaceuticals 15.16.4. Printing 15.16.5. Chemicals 15.16.6. Energy 15.16.7. Engineering & Mechanical 15.16.8. Others 15.17. Nigeria Process Chillers Market Forecast, By Cooling 15.17.1. Air-Cooled 15.17.2. Water-Cooled 15.18. Nigeria Process Chillers Market Forecast, By Capacity 15.18.1. Upto 20 Tons 15.18.2. 20-150 Tons 15.18.3. 150-300 Tons 15.18.4. Above 300 Tons 15.19. Nigeria Process Chillers Market Forecast, By Compressor 15.19.1. Positive Displacement 15.19.1.1. Scroll 15.19.1.2. Screw 15.19.1.3. Reciprocating 15.19.2. Centrifugal 15.20. Nigeria Process Chillers Market Forecast, By End-Use 15.20.1. Plastics 15.20.2. Food & Beverages 15.20.3. Pharmaceuticals 15.20.4. Printing 15.20.5. Chemicals 15.20.6. Energy 15.20.7. Engineering & Mechanical 15.20.8. Others 15.21. South Africa Process Chillers Market Forecast, By Cooling 15.21.1. Air-Cooled 15.21.2. Water-Cooled 15.22. South Africa Process Chillers Market Forecast, By Capacity 15.22.1. Upto 20 Tons 15.22.2. 20-150 Tons 15.22.3. 150-300 Tons 15.22.4. Above 300 Tons 15.23. South Africa Process Chillers Market Forecast, By Compressor 15.23.1. Positive Displacement 15.23.1.1. Scroll 15.23.1.2. Screw 15.23.1.3. Reciprocating 15.23.2. Centrifugal 15.24. South Africa Process Chillers Market Forecast, By End-Use 15.24.1. Plastics 15.24.2. Food & Beverages 15.24.3. Pharmaceuticals 15.24.4. Printing 15.24.5. Chemicals 15.24.6. Energy 15.24.7. Engineering & Mechanical 15.24.8. Others 15.25. Rest of Middle East & Africa Process Chillers Market Forecast, By Cooling 15.25.1. Air-Cooled 15.25.2. Water-Cooled 15.26. Rest of Middle East & Africa Process Chillers Market Forecast, By Capacity 15.26.1. Upto 20 Tons 15.26.2. 20-150 Tons 15.26.3. 150-300 Tons 15.26.4. Above 300 Tons 15.27. Rest of Middle East & Africa Process Chillers Market Forecast, By Compressor 15.27.1. Positive Displacement 15.27.1.1. Scroll 15.27.1.2. Screw 15.27.1.3. Reciprocating 15.27.2. Centrifugal 15.28. Rest of Middle East & Africa Process Chillers Market Forecast, By End-Use 15.28.1. Plastics 15.28.2. Food & Beverages 15.28.3. Pharmaceuticals 15.28.4. Printing 15.28.5. Chemicals 15.28.6. Energy 15.28.7. Engineering & Mechanical 15.28.8. Others 15.29. Middle East & Africa Process Chillers Market Attractiveness Analysis 15.29.1. By Cooling 15.29.2. By Capacity 15.29.3. By Compressor 15.29.4. By End-Use 15.30. PEST Analysis 15.31. Key Trends 15.32. Key Developments 16. South America Process Chillers Market Analysis 16.1. Key Findings 16.2. South America Process Chillers Market Overview 16.3. South America Process Chillers Market Value Share Analysis, By Cooling 16.4. South America Process Chillers Market Forecast, By Cooling 16.4.1. Air-Cooled 16.4.2. Water-Cooled 16.5. South America Process Chillers Market Value Share Analysis, By Capacity 16.6. South America Process Chillers Market Forecast, By Capacity 16.6.1. Upto 20 Tons 16.6.2. 20-150 Tons 16.6.3. 150-300 Tons 16.6.4. Above 300 Tons 16.7. South America Process Chillers Market Value Share Analysis, By Compressor 16.8. South America Process Chillers Market Forecast, By Compressor 16.8.1. Positive Displacement 16.8.1.1. Scroll 16.8.1.2. Screw 16.8.1.3. Reciprocating 16.8.2. Centrifugal 16.9. South America Process Chillers Market Value Share Analysis, By End-Use 16.10. South America Process Chillers Market Forecast, By End-Use 16.10.1. Plastics 16.10.2. Food & Beverages 16.10.3. Pharmaceuticals 16.10.4. Printing 16.10.5. Chemicals 16.10.6. Energy 16.10.7. Engineering & Mechanical 16.10.8. Others 16.11. South America Process Chillers Market Value Share Analysis, by Country 16.12. South America Process Chillers Market Forecast, by Country 16.12.1. Brazil 16.12.2. Colombia 16.12.3. Argentina 16.12.4. Rest of South America 16.13. Brazil Process Chillers Market Forecast, By Cooling 16.13.1. Air-Cooled 16.13.2. Water-Cooled 16.14. Brazil Process Chillers Market Forecast, By Capacity 16.14.1. Upto 20 Tons 16.14.2. 20-150 Tons 16.14.3. 150-300 Tons 16.14.4. Above 300 Tons 16.15. Brazil Process Chillers Market Forecast, By Compressor 16.15.1. Positive Displacement 16.15.1.1. Scroll 16.15.1.2. Screw 16.15.1.3. Reciprocating 16.15.2. Centrifugal 16.16. Brazil Process Chillers Market Forecast, By End-Use 16.16.1. Plastics 16.16.2. Food & Beverages 16.16.3. Pharmaceuticals 16.16.4. Printing 16.16.5. Chemicals 16.16.6. Energy 16.16.7. Engineering & Mechanical 16.16.8. Others 16.17. Argentina Process Chillers Market Forecast, By Cooling 16.17.1. Air-Cooled 16.17.2. Water-Cooled 16.18. Argentina Process Chillers Market Forecast, By Capacity 16.18.1. Upto 20 Tons 16.18.2. 20-150 Tons 16.18.3. 150-300 Tons 16.18.4. Above 300 Tons 16.19. Argentina Process Chillers Market Forecast, By Compressor 16.19.1. Positive Displacement 16.19.1.1. Scroll 16.19.1.2. Screw 16.19.1.3. Reciprocating 16.19.2. Centrifugal 16.20. Argentina Process Chillers Market Forecast, By End-Use 16.20.1. Plastics 16.20.2. Food & Beverages 16.20.3. Pharmaceuticals 16.20.4. Printing 16.20.5. Chemicals 16.20.6. Energy 16.20.7. Engineering & Mechanical 16.20.8. Others 16.21. Colombia Process Chillers Market Forecast, By Cooling 16.21.1. Air-Cooled 16.21.2. Water-Cooled 16.22. Colombia Process Chillers Market Forecast, By Capacity 16.22.1. Upto 20 Tons 16.22.2. 20-150 Tons 16.22.3. 150-300 Tons 16.22.4. Above 300 Tons 16.23. Colombia Process Chillers Market Forecast, By Compressor 16.23.1. Positive Displacement 16.23.1.1. Scroll 16.23.1.2. Screw 16.23.1.3. Reciprocating 16.23.2. Centrifugal 16.24. Colombia Process Chillers Market Forecast, By End-Use 16.24.1. Plastics 16.24.2. Food & Beverages 16.24.3. Pharmaceuticals 16.24.4. Printing 16.24.5. Chemicals 16.24.6. Energy 16.24.7. Engineering & Mechanical 16.24.8. Others 16.25. Rest of South America Process Chillers Market Forecast, By Cooling 16.25.1. Air-Cooled 16.25.2. Water-Cooled 16.26. Rest of South America Process Chillers Market Forecast, By Capacity 16.26.1. Upto 20 Tons 16.26.2. 20-150 Tons 16.26.3. 150-300 Tons 16.26.4. Above 300 Tons 16.27. Rest of South America Process Chillers Market Forecast, By Compressor 16.27.1. Positive Displacement 16.27.1.1. Scroll 16.27.1.2. Screw 16.27.1.3. Reciprocating 16.27.2. Centrifugal 16.28. Rest of South America Process Chillers Market Forecast, By End-Use 16.28.1. Plastics 16.28.2. Food & Beverages 16.28.3. Pharmaceuticals 16.28.4. Printing 16.28.5. Chemicals 16.28.6. Energy 16.28.7. Engineering & Mechanical 16.28.8. Others 16.29. South America Process Chillers Market Attractiveness Analysis 16.29.1. By Cooling 16.29.2. By Capacity 16.29.3. By Compressor 16.29.4. By End-Use 16.30. PEST Analysis 16.31. Key Trends 16.32. Key Developments 17. Company Profiles 17.1. Market Share Analysis, by Company 17.2. Competition Matrix 17.2.1. Competitive Benchmarking of key players by price, presence, market share, Applications, and R&D investment 17.2.2. New Product Launches and Product Enhancements 17.2.3. Market Consolidation 17.2.3.1. M&A by Regions, Investment and Application 17.2.3.2. M&A Key Players, Forward Integration and Backward Integration 17.3. Company Profiles: Key Players 17.3.1. Motivair Corporation 17.3.1.1. Company Overview 17.3.1.2. Financial Overview 17.3.1.3. Product Portfolio 17.3.1.4. Business Strategy 17.3.1.5. Recent Developments 17.3.1.6. Development Footprint 17.3.2. Drake Refrigeration Inc 17.3.3. Thermal Care Inc 17.3.4. Airedale Air Conditioning 17.3.5. ICS Cool Energy Limited 17.3.6. Filtrine Manufacturing Company 17.3.7. Legacy Chiller Systems Inc 17.3.8. Cooling Technology, Inc 17.3.9. General Air Products, Inc. 17.3.10. Carrier Global Corporation 17.3.11. DAIKIN INDUSTRIES, Ltd. 17.3.12. Danfoss 17.3.13. Dimplex Thermal Solutions 17.3.14. Johnson Controls International plc 17.3.15. Motivair Corporation 17.3.16. Parker-Hannifin Corporation 17.3.17. Trane Technologies Inc. 18. Primary Key Insights