The Potassium Chloride Market size was valued at USD 23.63 Billion in 2024 and the total Potassium Chloride revenue is expected to grow at a CAGR of 4.19% from 2025 to 2032, reaching nearly USD 34.20 Billion.Executive Summary & Key Hooks in the Potassium Chloride Market

Potassium Chloride (KCl) is rapidly transcending its traditional role as a bulk fertilizer input to become a strategic growth driver across agriculture, pharmaceuticals, food preservation, de-icing, Industrial, and laboratory applications. Between 2024 and 2032, the global KCl market is expected to expand from USD 23.63 billion to USD 34.20 billion, at a CAGR of 4.19% percent. This transformation is underpinned by four converging forces: the precision-agriculture boom in North America, the surge in pharma-grade purity requirements across Europe, eco-friendly de-icing mandates in cold-climate regions, and emerging battery and laboratory research applications. Italy is poised to become Europe’s premier processing hub, potentially reducing EU import costs by 10 percent by 2030. Meanwhile, blockchain traceability, AI-driven quality control, and zero-waste brine recycling are elevating KCl’s value proposition—transforming it into a premium, differentiated product rather than a simple commodity.To know about the Research Methodology :- Request Free Sample Report

Why buy this report?

This definitive Research Description pairs deep quantitative analysis—including historical data, forecasts and Monte Carlo risk models—with a strategic, narrative-driven framework covering every facet of the KCl value chain. You receive PDF files, a visual PowerPoint deck, raw Excel financial models, boardroom-grade slide text, and over 250 targeted SEO keywords, ensuring both market leadership and online visibility. You receive an end-to-end blueprint—covering import–export flows, plant CapEx/Opex, and C-Suite-ready insights validated by consultants backed for zero-mistake approval, this is the ultimate guide for navigating and profiting from the rapidly evolving Potassium Chloride market and scenario-tested forecasts that de-risk strategic decisions.Potassium Chloride Market Objective & Scope

This Research Description equips both new entrants and established incumbents with data-driven strategies across the entire KCl value chain. Its scope encompasses: product-grade definitions; historical volume and price trends (2021–2024); import–export flow analysis; manufacturing and distribution cost structures; entry barriers and regulatory timelines; financial modeling with sensitivity analyses; technology roadmaps; supplier ecosystems; promotional tactics; competitive benchmarking of 30 key players as well as Key Supplier and Raw Material Suppliers benchmarking; and actionable strategic recommendations—all woven into a cohesive, narrative-driven format.Potassium Chloride Market Definition & Product Grades

KCl is sourced via underground sylvite mining or brine evaporation and processed into three main grades for distinct end uses. Standard Grade (95–96 percent purity) serves bulk fertilizers and municipal de-icing; Granular Grade (97–98 percent purity) addresses food/feed additives and water treatment; and Fine Powder Grade (99–99.9 percent purity) underpins pharmaceutical IV solutions and analytical reagents. This segmentation enables producers to optimize processing lines for maximum margin and ensures buyers receive precisely the performance characteristics they require.Potassium Chloride Market Dynamics

Four key trends are driving KCl demand. First, precision-agriculture in the U.S. Corn Belt and Canadian Prairies has fueled uptake of micro-dosed granular blends that improve nutrient efficiency and soil health. Second, EMA and FDA mandates for pharma-grade purity have created a 20–25 percent price premium, enabling producers to invest in enhanced QA/QC and clean-room packaging. Third, climate-smart de-icing in Canada, Germany and the Nordic nations prioritizes KCl’s lower corrosivity and reduced runoff toxicity, securing municipal contracts that grow at 5–7 percent annually. Finally, nascent battery‐electrolyte research and specialty food preservation applications are expanding KCl’s reach into high-growth adjacent markets.Potassium Chloride Market Challenges

Despite these tailwinds, the KCl industry faces significant hurdles. Geopolitical concentration of 70 percent of global potash reserves in Russia, Belarus and Canada creates supply vulnerabilities—sanctions can curtail up to 30 percent of volumes on short notice. REACH compliance in Europe demands USD 1–2 million per dossier and 12–18 months lead time, imposing high entry costs. Historical price volatility between USD XX and USD XX per ton (2021–2024) has squeezed margins for smaller players. Furthermore, logistics disruptions—from Panama Canal delays of up to 15 days to Baltic sea-ice constraints—can add 8–10 percent to landed costs. Effective scenario planning and strategic contracting are essential to mitigate these risks.Potassium Chloride Market Regional Intelligence

In North America, leading producers Nutrien (Saskatchewan) and Mosaic (Florida) dominate output. Their investments in blockchain-enabled supply-chain tracking and predictive mining have slashed raw-feedstock costs by 5–7 percent and accelerated delivery times. Conversely, Europe imports XX million tons of KCl annually (2024), driven by pharma and food-grade purity demands. Italy has emerged as the fastest-growing processing hub, supported by EU green-industry grants that subsidize modular granulation plants. By 2030, Italy is projected to process XX million tons domestically, cutting EU import reliance by 10 percent.Potassium Chloride Market Historical Trends (2021–2024)

Between 2021 and 2024, combined North American and European volumes climbed from XX kt to XX kt (a 4.5 percent CAGR). Fertilizer-grade prices rose from USD 300/ton to peaks of USD 580 during 2022–23 supply shocks before stabilizing near USD XX in 2024. Pharma-grade prices reached USD XX in 2023, then settled around USD XX, while EU pharma pricing averaged USD XX. North American exports to Latin America fell from XX kt to XX kt as domestic demand surged; EU shipments to Asia Pacific grew from XX kt to XX kt, reflecting rising pharma needs in emerging markets. In rest of regions the data will be depicted in the original reportPotassium Chloride Market Pricing Analysis & Forecasts (2025–2032)

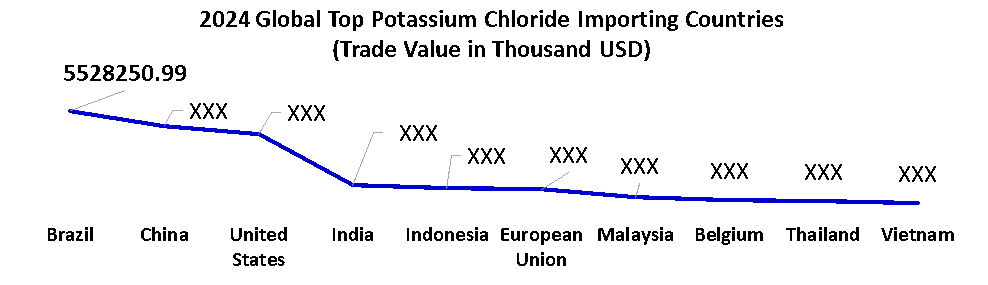

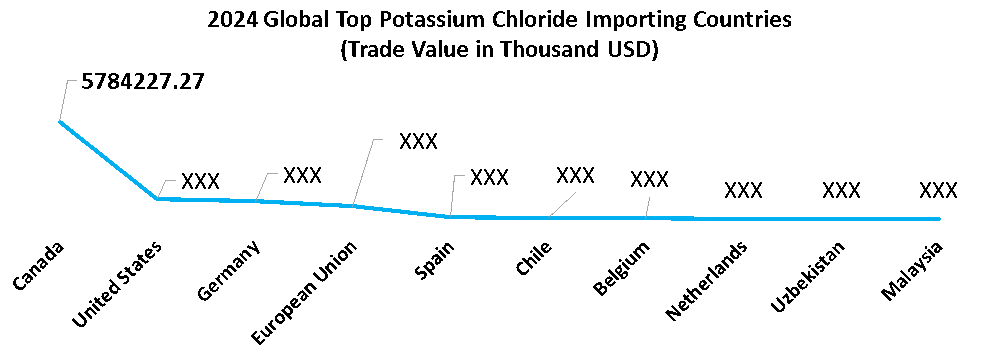

Monte Carlo–derived scenarios under ±20 percent demand variability project fertilizer-grade prices fluctuating between USD 360 and USD 600 per ton through 2032. Pharma-grade prices exhibit a tighter ±5 percent band around USD XX. We forecast the global market to grow from USD XX billion (XX kt) in 2025 to USD XX billion by 2032, achieving a CAGR of X.XX percent. Key inflection years include 2027, when pharma and de-icing segments accelerate to 8 percent YoY, and 2030, when EU processing capacity reaches maturity.Import–Export Analysis North America’s trade balance is shifting from net-exporter to near-neutral by 2030 as domestic consumption tightens. Exports to Latin America and the EU declined from 170 kt to 130 kt and 90 kt to 75 kt respectively between 2021 and 2024. EU exports to North America and Asia Pacific remain modest but growing, with Asia Pacific shipments rising to 50 kt in 2024. By 2032, Italy’s processing hub is expected to reduce net EU imports by 10 percent, while North America approaches equilibrium between production and consumption.

Entry Barriers & Regulatory Timeline

Europe’s REACH regulation (effective 2018) imposes USD1–2 million dossier fees and 12–18 months lead times. The U.S. FDA Drug Master File (DMF) process requires 6–12 months for review and GMP audits, while India’s BIS standards (2022) introduced an 8 percent import duty and local certification. The IMO’s 2023 bulk-shipping packaging rules and anticipated EU anti-dumping duties (2026–2027) could add an additional 5–8 percent to import costs. Navigating these regulatory hurdles demands meticulous timeline planning and capital allocation.Technology Landscape & Major Innovations

Key innovations are reshaping KCl processing. Vacuum crystallization improves purity by +2 ppt over atmospheric methods; automated granulation achieves ±5 percent particle uniformity; AI-driven QA reduces recalls by 40 percent; and zero-waste brine recycling recovers 90 percent of process water. Early adopters of these technologies secure cost advantages and premium market positioning.Competitive Intelligence

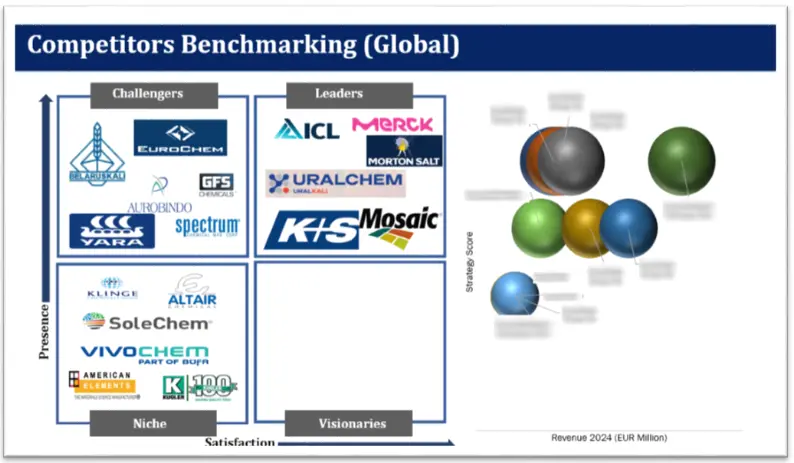

We map 30 competitors into four strategic quadrants. Leaders (Nutrien, Mosaic, ICL) combine scale and tech investments. Innovators (Compass Minerals, Thermo Fisher) focus on ESG-friendly de-icing and micro-granulation. Fast Customizers (EuroChem, Belaruskali) excel with local packaging and flexible SKUs. Niche Specialists (regional pharma co-packers) deliver ultra-high purity in small batches. This quadrant framework clarifies each player’s competitive positioning and highlights differentiation opportunities.

Supplier Ecosystem & Partnerships

North America’s market is supplied by Nutrien and Mosaic, with regional contract packagers handling granulation. Europe sources feedstock from ICL and K+S AG, supported by EuroChem Service Units for repackaging. CIS producers such as Belaruskali and Uralkali provide tolling opportunities. In Asia Pacific, Chongqing Salt Group serves small-batch pharma needs via local co-packers. Strategic partnerships with blockchain traceability platforms ensure end-to-end provenance transparency.Promotion & Go-to-Market Strategies

For the pharmaceutical segment, exhibiting at CPhI Worldwide, publishing whitepapers on IV-safety, and hosting nephrology webinars positions KCl as a medical-grade leader. In agriculture, digital field trials and pilot “KCl + micronutrient” bundles demonstrate yield uplifts, while sponsorship of major ag-expos in Chicago and Winnipeg builds brand authority. De-icing campaigns leverage Nordic municipality case studies and participation in EU smart-city grants to highlight ESG credentials. B2B lead generation is amplified through targeted LinkedIn campaigns, SEO-optimized landing pages, and e-catalog offers on chemical marketplaces.Strategic Recommendations & Roadmap

From 2025–2026, secure REACH pre-approvals in Italy and Germany and deploy a XX kt modular granulation plant. During 2027–2029, expand fertilizer contracts with top U.S. ag-cooperatives and bid on Canadian municipal de-icing tenders with anti-corrosion blends. By 2030–2032, integrate upstream by building a brine extraction facility, invest in zero-waste technologies, and launch a digital customer portal offering real-time traceability. This phased approach balances speed to market, regulatory compliance, and operational excellence.Business Entry Strategy & Plant Economics

We recommend a three-phase entry roadmap. For example: As a case study of Italy Plant we proceed like in Phase 1 (Years 1–2), secure feedstock via tolling agreements and construct a XX kt modular plant in Italy under EU green grants. In Phase 2 (Years 3–5), scale to XX kt, add fine-powder lines for pharma markets, and co-locate packaging facilities. In Phase 3 (Years 6–8), pursue backward integration through a brine extraction plant and invest in zero-waste water recycling. Estimated CapEx for small (XX kt), medium (XX kt) and large (XX kt) plants; corresponding Opex is USD X per ton.Potassium Chloride Market Scope: Inquire before buying

Potassium Chloride Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 23.63 Bn. Forecast Period 2025 to 2032 CAGR: 4.19% Market Size in 2032: USD 34.20 Bn. Segments Covered: by Form Granular Powdered Crystalline Others by End-Use Industries Agriculture Pharmaceutical Food & Beverages Others by Distribution Channel Offline Online Potassium Chloride Market, by region:

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Potassium Chloride Market, Key Players are

1) Thermo Fisher Scientific 2) Spectrum Chemical 3) Strem Chemicals, Inc. 4) Gfs Chemicals 5) American element 6) Aurobindo Pharma, Usa, Inc 7) Mosaic 8) Nutrien Ltd. 9) Honeywell (Fluka) 10) Morton Salt, Inc 11) Kugler Company 12) GFS Chemicals, Inc. 13) Strem Chemicals, Inc. 14) Wego Chemical Group 15) Thermo Fisher Scientific 16) Selleck Chemicals 17) Parchem 18) CORECHEM Inc. 19) ICL Group Ltd. 20) Arab Potash Company 21) Uralkali 22) Belaruskali 23) Helm AG 24) Agrium Inc 25) Sinofert Holdings Limited 26) OthersFAQs:

1. Which is the dominant market for Potassium Chloride in terms of the region? Ans. APAC is the dominant market for Potassium Chloride in terms of the region. 2. What are the opportunities for new market entrants? Ans. The presence of large number of untapped or undeveloped market act as an opportunity for new entrants. 3. What is expected to drive the growth of the Potassium Chloride market in the forecast period? Ans. Expansion of Precision Farming is expected to drive the potassium chloride market growth. 4. What is the projected market size & growth rate of the Potassium Chloride Market? Ans. Potassium Chloride Market was valued at USD 23.63 Bn in 2024 and the total Potassium Chloride revenue is expected to grow at 4.19% from 2024 to 2032, reaching nearly USD 34.20 Bn. 5. What segments are covered in the Potassium Chloride Market report? Ans. The segments covered are form, end use industry, distribution channel and region.

1. Potassium Chloride Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032), 1.1.2. Market Size (USD) (Value) (Volume) and Market Share (%)- 2. Potassium Chloride Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Portfolio 2.2.4. End-Users Segment 2.2.5. Revenue (2024) 2.2.6. Distribution Network 2.2.7. YoY Growth Rate 2.2.8. No. of Production Facilities (%) 2.2.9. Geographical Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 2.5. Competitive Positioning 3. Potassium Chloride Market: Dynamics 3.1. Market Trends 3.2. Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Global Potassium Chloride Industry 4. Global Potassium Chloride Market Size and Forecast by Segmentation (by Value in USD) (by Volume in Metric Tons) (2024-2032) 4.1. Global Potassium Chloride Market Size and Forecast, By Form (2024-2032) 4.1.1. Granular 4.1.2. Powdered 4.1.3. Crystalline 4.1.4. Others 4.2. Global Potassium Chloride Market Size and Forecast, By End-Use Industry (2024-2032) 4.2.1. Agriculture 4.2.2. Pharmaceutical 4.2.3. Food & Beverages 4.2.4. Others 4.3. Global Potassium Chloride Market Size and Forecast, By Distribution Channel (2024-2032) 4.3.1. Offline 4.3.2. Online 5. North America Potassium Chloride Market Size and Forecast by Segmentation (by Value in USD) (by Volume in Metric Tons) (2024-2032) 5.1. North America Market Size and Forecast, By Form 5.2. North America Market Size and Forecast, By End-Use Industry 5.3. North America Market Size and Forecast, By Distribution Channel 5.4. North America Market Size and Forecast, by Country 5.4.1. United States 5.4.1.1. United States Market Size and Forecast, By Form 5.4.1.2. United States Market Size and Forecast, By End-Use Industry 5.4.1.3. United States Market Size and Forecast, By Distribution Channel 5.4.2. Canada 5.4.3. Mexico 6. Europe Potassium Chloride Market Size and Forecast by Segmentation (by Value in USD) (by Volume in Metric Tons) (2024-2032) 6.1. Europe Market Size and Forecast, By Form 6.2. Europe Market Size and Forecast, By End-Use Industry 6.3. Europe Market Size and Forecast, By Distribution Channel 6.4. Europe Market Size and Forecast, by Country 6.4.1. United Kingdom 6.4.2. Germany 6.4.3. France 6.4.4. Italy 6.4.5. Spain 6.4.6. Sweden 6.4.7. Russia 6.4.8. Rest of Europe 7. Asia Pacific Potassium Chloride Market Size and Forecast by Segmentation (by Value in USD) (by Volume in Metric Tons) (2024-2032) 7.1. Asia Pacific Market Size and Forecast, By Form 7.2. Asia Pacific Market Size and Forecast, By End-Use Industry 7.3. Asia Pacific Market Size and Forecast, By Distribution Channel 7.4. Asia Pacific Market Size and Forecast, by Country 7.4.1. China 7.4.2. S. Korea 7.4.3. India 7.4.4. Japan 7.4.5. Australia 7.4.6. Indonesia 7.4.7. Malaysia 7.4.8. Philippians 7.4.9. Thailand 7.4.10. Vietnam 7.4.11. Rest of Asia Pacific 8. Middle East and Africa Potassium Chloride Market Size and Forecast by Segmentation (by Value in USD) (by Volume in Metric Tons) (2024-2032) 8.1. Middle East and Africa Market Size and Forecast, By Form 8.2. Middle East and Africa Market Size and Forecast, By End-Use Industry 8.3. Middle East and Africa Market Size and Forecast, By Distribution Channel 8.4. Middle East and Africa Market Size and Forecast, by Country 8.4.1. South Africa 8.4.2. GCC 8.4.3. Egypt 8.4.4. Nigeria 8.4.5. Rest of MEA 9. South America Potassium Chloride Market Size and Forecast by Segmentation (by Value in USD) (by Volume in Metric Tons) (2024-2032) 9.1. South America Market Size and Forecast, By Form 9.2. South America Market Size and Forecast, By End-Use Industry 9.3. South America Market Size and Forecast, By Distribution Channel 9.4. South America Market Size and Forecast, by Country 9.4.1. Brazil 9.4.2. Argentina 9.4.3. Colombia 9.4.4. Chile 9.4.5. Rest of South America 10. Company Profile: Key Players 10.1 Thermo Fisher Scientific 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2 Spectrum Chemical 10.3 Strem Chemicals, Inc. 10.4 Gfs Chemicals 10.5 American Element 10.6 Aurobindo Pharma, USA, Inc 10.7 Mosaic 10.8 Nutrien Ltd. 10.9 Honeywell (Fluka) 10.10 Morton Salt, Inc 10.11 Kugler Company 10.12 GFS Chemicals, Inc. 10.13 Strem Chemicals, Inc. 10.14 Wego Chemical Group 10.15 Thermo Fisher Scientific 10.16 Selleck Chemicals 10.17 Parchem 10.18 CORECHEM Inc. 10.19 ICL Group Ltd. 10.20 Arab Potash Company 10.21 Uralkali 10.22 Belaruskali 10.23 Helm AG 10.24 Agrium Inc 10.25 Sinofert Holdings Limited 10.26 Others 11. Key Findings 12. Analyst Recommendations 13. Potassium Chloride Market – Research Methodology