The Global Polyethylene Terephthalate (PET) Market size was valued at USD 34.32 Bn. in 2024, and the total Global Polyethylene Terephthalate (PET) Market revenue is expected to grow by 5.18% from 2024 to 2032, reaching nearly USD 51.41 Bn.Global Polyethylene Terephthalate (PET) Market Overview

Polyethylene terephthalate is the most essnetial thermoplastic polymer resin of the polyester family and is used in garment fibers, fluid and meal vessels, thermoforming for production, and specialty resins in conjunction with glass fiber. PET appear as a transparent or semi-crystalline polymer based on its processing and heating history. PET is typically referred to as polyester in the area of textile applications, but the abbreviation PET is commonly used in the domain of packaging. Polyester accounts for approximately 20% of global polymer output and is the fourth most abundant polymer after polyethylene, polypropylene, and polyvinyl chloride.To know about the Research Methodology :- Request Free Sample Report The increasing demand for packaged goods and the rapid expansion of organized retail, as well as on-demand consumer attention on environmentally sustainable consumer products, drive the Polyethylene Terephthalate (PET) Market growth. Developing economies such as China, India, Brazil, and Indonesia have supplied a major share of the growth through urbanization, growth of disposable income, and shifts in consumer consumption paradigms. The Asia-Pacific region dominates the global Polyethylene Terephthalate (PET) Industry, with China and India emerging as the key growth engines. This leadership is underpinned by abundant manufacturing capacity, competitive cost structures, and supportive government policies that encourage large-scale production and recycling initiatives. The region’s thriving beverage, textiles, and healthcare industries further fuel demand, making Asia-Pacific not only the largest consumer but also the most dynamic producer of PET. Expanding middle-class populations and rapid urbanization continue to drive consumption of bottled beverages, packaged foods, apparel, and healthcare products, all core PET applications.

Global Polyethylene Terephthalate (PET) Market Dynamics

Recycling and sustainable Packaging to Drive the Polyethylene Terephthalate (PET) Market Growth PET, known for its lightweight, durability, and excellent recyclability, has become the preferred material for beverage bottles, food containers, textiles, and various consumer goods. With global governments and regulatory bodies enforcing stricter sustainability regulations, manufacturers and brand owners are compelled to incorporate higher levels of recycled PET (rPET) into their packaging portfolios to meet circular economy goals. Beverage giants and FMCG companies have already committed to using at least 25–50% recycled content in their packaging by 2030, driving demand for PET recycling technologies. The growing consumer awareness about plastic pollution and climate change is pushing companies to transition toward eco-friendly packaging formats such as 100% rPET bottles, refillable containers, and closed-loop recycling models. Technological advancements in chemical and mechanical recycling have improved the quality of rPET. This makes it suitable for premium food-grade applications and expands its penetration in pharmaceuticals, personal care, and e-commerce packaging, which boosts the Polyethylene Terephthalate (PET) Market. PET’s cost-effectiveness compared to alternative bioplastics, coupled with its compatibility with existing recycling infrastructure, positions it as a key enabler of the global green packaging movement. Asia-Pacific and Europe are witnessing strong policy support and infrastructure investments to scale PET recycling capacity, while North America is focusing on public-private partnerships to enhance collection and reuse. Price Fluctuations of Raw Materials to Restrain the Polyethylene Terephthalate (PET) Market Price fluctuations of raw materials remain a significant restraint for the Polyethylene Terephthalate (PET) Market, as the production of PET heavily depends on petrochemical derivatives such as purified terephthalic acid (PTA) and monoethylene glycol (MEG). These feedstocks are directly linked to crude oil prices, which are highly volatile due to geopolitical tensions, supply-demand imbalances, and fluctuations in energy markets. When crude oil prices rise, the cost of PTA and MEG increases, directly raising PET production costs and squeezing manufacturer margins. This volatility creates uncertainty in procurement and pricing strategies for PET producers, leading to inconsistent profit levels and limiting long-term investment in capacity expansions. The unpredictable raw material costs often get passed down to end-users, particularly in packaging, textiles, and automotive industries, making PET less competitive compared to alternative materials such as bio-based plastics, glass, or aluminum. For small and medium-sized manufacturers, raw material cost instability poses even greater challenges, as they have limited bargaining power and fewer resources to absorb or hedge against price spikes.Global Polyethylene Terephthalate (PET) Market Segment Analysis

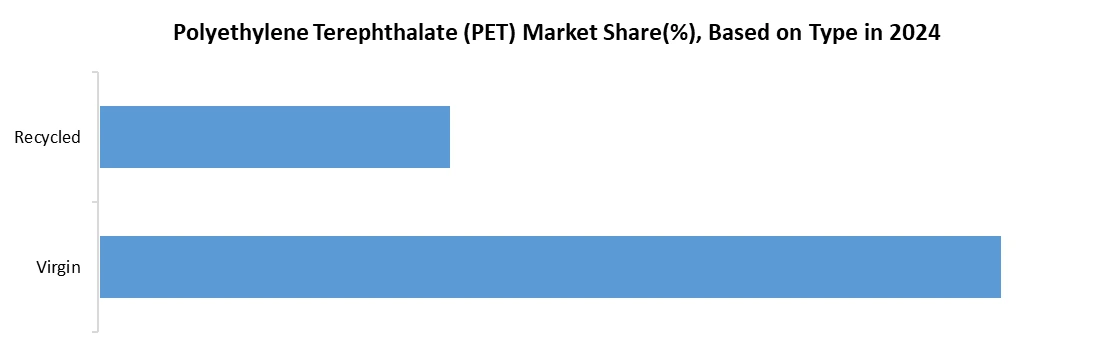

Based on Product, the Polyethylene Terephthalate (PET) Market is segmented into the Resins, Fiber and Others. Resins held the Polyethylene Terephthalate (PET) Market in 2024. The Beverages packaging remains the largest demand driver, as PET resins are extensively used in manufacturing bottles for carbonated soft drinks, bottled water, juices, and functional beverages. Their lightweight nature, high strength, transparency, and excellent barrier properties against moisture and gases make PET resins the preferred choice for packaging companies and beverage brands worldwide. Consumer lifestyle shifts toward convenience and on-the-go consumption have driven the growth of packaged beverages, reinforcing the demand for PET-based solutions. The food packaging industry also relies heavily on PET resins for trays, containers, and films, as the material ensures safety, extends shelf life, and complies with stringent food safety standards. In the pharmaceutical sector, PET resins are increasingly used for drug packaging and medical containers due to their chemical resistance and hygienic properties, which drive the Polyethylene Terephthalate (PET) Market growth.Based on Type, the market is broadly segmented into the virgin and recycled. Virgin is expected to dominate Polyethylene Terephthalate (PET) Market over the forecast period. Virgin PET plays a pivotal role in the Polyethylene Terephthalate (PET) market, particularly in food-grade packaging, where adherence to stringent health and safety regulations is essential. Its unmatched purity, high durability, and ability to preserve the integrity of products make it the material of choice for critical applications such as beverage bottles, pharmaceutical containers, and various food packaging formats that require safe storage and extended shelf life. Virgin PET is chemically stable, resistant to impact, and offers excellent barrier properties against moisture and gases. This ensures that the quality of consumables is maintained from production to consumption, which boosts the Polyethylene Terephthalate (PET) Market growth. Beyond the food and beverage sector, its versatility extends to industries such as textiles, where it is spun into polyester fibers that dominate global apparel and home furnishing markets. In the automotive sector, virgin PET is increasingly used for lightweight components that contribute to fuel efficiency and vehicle performance, while in the electronics industry, it is valued for its consistent performance in insulation, films, and casings. Its cost-effectiveness and reliability reinforce its widespread adoption, making it indispensable for manufacturers that require consistency and regulatory compliance.

Global Polyethylene Terephthalate (PET) Market Regional Insights

Asia Pacific held the largest Polyethylene Terephthalate (PET) Market in 2024 and is expected to continue its dominanace over the forecast period. Countries such as China, India, Indonesia, and Malaysia are becoming major growth engines for the Polyethylene Terephthalate (PET) Market, as rapid industrialization and urbanization continue to reshape consumer lifestyles and consumption patterns. The surge in demand for packaged food and beverages, driven by busy urban populations, growing middle-class incomes, and evolving retail channels, has significantly boosted the need for PET packaging solutions such as bottles, trays, and containers. The automotive and electronics sectors in these countries are witnessing a sharp rise in the use of PET-based films and components, given their durability, lightweight nature, and cost-effectiveness compared to traditional alternatives. The influence of global regulatory bodies such as the Environmental Protection Agency (EPA), the International Union for Conservation of Nature (IUCN), and the Intergovernmental Panel on Climate Change (IPCC) is fostering a strong shift toward sustainable production and consumption practices, prompting governments and manufacturers in the region to invest heavily in recycling infrastructure and eco-friendly PET solutions. Among these markets, China and India stand out as the dominant economic powerhouses, offering unmatched opportunities in consumer goods, textiles, and packaging due to their large populations, rising GDP per capita, and robust domestic production ecosystems. Their rapid economic growth, combined with policy support for industrial development and sustainability, has positioned them as central hubs for PET demand not only within Asia but also in the global landscape. This combination of expanding consumer bases, industrial diversification, and regulatory influence ensures that Asia Pacific region remains a key driver of long-term growth for the PET industry. Global Polyethylene Terephthalate (PET) Market Competitive Landscape The global Polyethylene Terephthalate (PET) Market is highly competitive, dominated by several key multinational and regional players. Leading companies such as Indorama Ventures, SABIC, Reliance Industries, DAK Americas, Nan Ya Plastics, Far Eastern New Century, BASF, and M&G Polymers have established strong production capacities and extensive distribution networks, enabling them to serve diverse industries, including packaging, textiles, automotive, and electronics. These companies compete not only on production scale but also on product quality, technological innovation, and sustainability initiatives. Sustainability is becoming a central competitive factor, with many PET producers investing in recycled PET (rPET) and bio-based PET to meet the increasing demand for eco-friendly materials. Companies are implementing closed-loop recycling programs, enhancing PET resin recyclability, and exploring renewable feedstock sources to reduce environmental impact. This focus on green PET production helps differentiate brands and strengthens their position in environmentally conscious markets. Global Polyethylene Terephthalate (PET) Market: Recent developments • September 2024 – Indorama Ventures (Thailand) joint venture in India In September 2024, Indorama Ventures, via its subsidiary IVL Dhunseri Petrochem Industries, partnered with Dhunseri Ventures and Varun Beverages to establish two PET recycling (rPET) plants in India—located in Kathua (Jammu & Kashmir) and Khurdha (Odisha)—with a combined capacity of 100 kt/year, scheduled for completion by the end of 2025. This strategic move aligns with India’s regulatory push for increased recycled plastic content, with mandates rising from 30 % by 2025–26 to 60 % by 2028–29, and marks a significant investment in strengthening the circular economy and waste reduction infrastructure. • May 18, 2023 – Plastipak joined forces with LanzaTech to launch PPKNatura, the world’s first PET resin derived from captured carbon emissions. The resin, made using LanzaTech’s CarbonSmart™ monoethylene glycol (MEG), maintains the performance and purity of virgin PET but carries a significantly lower carbon footprint—ideal for food, personal care, and pharmaceutical packaging applications. Importantly, PPKNatura can be fully recycled at end-of-life, supporting circular-material strategies. This marks a groundbreaking innovation in sustainable PET manufacturing, advancing Plastipak’s ESG goals and reducing fossil resource dependency. Global Polyethylene Terephthalate (PET) Market Trends

Trends Description Key Examples Impact Area Bio-based PET Commercialization Companies are moving beyond lab trials and launching fully commercialized bio-PET products using bio-paraxylene and sugar-based feedstocks, often in partnership with major chemical and beverage brands. Reliance, Neste, and Suntory's 2024 commercial rollout of bio-PET bottles in Japan Decarbonization, Sustainable Packaging Festival & Event Recycling as Closed-Loop Pilots PET manufacturers are piloting closed-loop recycling at public events, collecting and recycling bottles onsite to create circular awareness and trial real-time systems. Indorama Ventures 2024 PET recycling program at Thailand’s 808 Festival Circular Economy, Brand Engagement Geopolitical Diversification of PET Supply Chains PET producers are expanding operations in India, Oman, and Southeast Asia to reduce dependency on China amid rising geopolitical tensions and trade compliance scrutiny. Indorama Dhunseri JV in India, OCTAL’s expansion in Oman Supply Chain Resilience, Regionalization Polyethylene Terephthalate (PET) Market Scope: Inquire before buying

Global Polyethylene Terephthalate (PET) Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 34.32 Bn. Forecast Period 2025 to 2032 CAGR: 5.18% Market Size in 2032: USD 51.41 Bn. Segments Covered: by Product Resins Fiber Others by Type Virgin Recycled by Production Process Dimethyl terephthalate (DMT) process Terephthalic acid (PTA) process by Application Bottles & Containers Films & Sheets Strapping Engineering Plastics Others by End Use Industry Food and Beverages Pharmaceuticals & Healthcare Personal Care & Home Care Textiles & Apparel Industrial & Automotive Electronics & Electrical Others Polyethylene Terephthalate (PET) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Polyethylene Terephthalate (PET) Market, Key Players

North America 1. DAK Americas LLC – (USA) 2. Nan Ya Plastics Corporation USA – (USA) 3. Far Eastern New Century Corporation – (USA) 4. BASF Corporation – (USA) 5. M&G Polymers USA LLC – (USA) 6. Lotte Chemical USA Corporation – (USA) 7. RTP Company – (USA) 8. Plastipak Holdings Inc. – (USA) 9. PolyQuest Inc. – (USA) Asia Pacific 1. Indorama Ventures Public Company Limited – (Thailand) 2. Sinopec Yizheng Chemical Fibre Co., Ltd. – (China) 3. Reliance Industries Limited – (India) 4. Far Eastern New Century Corporation – (Taiwan) 5. Toray Industries, Inc. – (Japan) 6. SK Chemicals Co., Ltd. – (South Korea) 7. JBF Industries Ltd. – (India) 8. LOTTE Chemical Corporation – (South Korea) 9. Zhejiang Hengyi Group Co., Ltd. – (China) 10. Sanfangxiang Group Co., Ltd. – (China) Europe 1. Indorama Ventures Europe – (Germany) 2. Alpek Polyester UK Ltd. – (United Kingdom) 3. Equipolymers – (Germany/Italy) 4. Novapet S.A. – (Spain) 5. Artenius PET Packaging Europe – (Spain) 6. LyondellBasell Industries N.V. – (Netherlands) 7. BASF SE – (Germany) 8. PET Recycling Team GmbH – (Austria) 9. Polisan Holding – (Turkey) 10. Selenis Portugal S.A. – (Portugal)Frequently Asked Questions

1. Which region has the largest share in the Global Polyethylene Terephthalate (PET) Market? Ans: The Asia Pacific held the highest Polyethylene Terephthalate (PET) Market in 2024. 2. What is the growth rate of the Global Polyethylene Terephthalate (PET) Market? Ans: The Global Polyethylene Terephthalate (PET) Market is expected to grow at a CAGR of 5.18% during the forecast period 2025-2032. 3. What is the scope of the Global Polyethylene Terephthalate (PET) Market report? Ans: The Global Polyethylene Terephthalate (PET) Market report helps with the PESTEL, Porter's, Recommendations for Investors and leaders, and market estimation for the forecast period. 4. Who are the key players in the Global Polyethylene Terephthalate (PET) Market? Ans: The important key players in the Global Polyethylene Terephthalate (PET) Market are Indorama Ventures, SABIC, Reliance Industries, DAK Americas, Nan Ya Plastics, Far Eastern New Century, BASF, M&G Polymers and others. 5. What is the study period of this market? Ans: The Global Polyethylene Terephthalate (PET) Market is studied from 2024 to 2032.

1. Polyethylene Terephthalate (PET) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Polyethylene Terephthalate (PET) Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Polyethylene Terephthalate (PET) Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Polyethylene Terephthalate (PET) Market: Dynamics 3.1. Polyethylene Terephthalate (PET) Market Trends by Region 3.1.1. North America Polyethylene Terephthalate (PET) Market Trends 3.1.2. Europe Polyethylene Terephthalate (PET) Market Trends 3.1.3. Asia Pacific Polyethylene Terephthalate (PET) Market Trends 3.1.4. Middle East and Africa Polyethylene Terephthalate (PET) Market Trends 3.1.5. South America Polyethylene Terephthalate (PET) Market Trends 3.2. Polyethylene Terephthalate (PET) Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Polyethylene Terephthalate (PET) Market Drivers 3.2.1.2. North America Polyethylene Terephthalate (PET) Market Restraints 3.2.1.3. North America Polyethylene Terephthalate (PET) Market Opportunities 3.2.1.4. North America Polyethylene Terephthalate (PET) Market Challenges 3.2.2. Europe 3.2.2.1. Europe Polyethylene Terephthalate (PET) Market Drivers 3.2.2.2. Europe Polyethylene Terephthalate (PET) Market Restraints 3.2.2.3. Europe Polyethylene Terephthalate (PET) Market Opportunities 3.2.2.4. Europe Polyethylene Terephthalate (PET) Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Polyethylene Terephthalate (PET) Market Drivers 3.2.3.2. Asia Pacific Polyethylene Terephthalate (PET) Market Restraints 3.2.3.3. Asia Pacific Polyethylene Terephthalate (PET) Market Opportunities 3.2.3.4. Asia Pacific Polyethylene Terephthalate (PET) Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Polyethylene Terephthalate (PET) Market Drivers 3.2.4.2. Middle East and Africa Polyethylene Terephthalate (PET) Market Restraints 3.2.4.3. Middle East and Africa Polyethylene Terephthalate (PET) Market Opportunities 3.2.4.4. Middle East and Africa Polyethylene Terephthalate (PET) Market Challenges 3.2.5. South America 3.2.5.1. South America Polyethylene Terephthalate (PET) Market Drivers 3.2.5.2. South America Polyethylene Terephthalate (PET) Market Restraints 3.2.5.3. South America Polyethylene Terephthalate (PET) Market Opportunities 3.2.5.4. South America Polyethylene Terephthalate (PET) Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Polyethylene Terephthalate (PET) Industry 3.8. Analysis of Government Schemes and Initiatives For Polyethylene Terephthalate (PET) Industry 3.9. Polyethylene Terephthalate (PET) Market Trade Analysis 3.10. The Global Pandemic Impact on Polyethylene Terephthalate (PET) Market 4. Polyethylene Terephthalate (PET) Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 4.1.1. Resins 4.1.2. Fiber 4.1.3. Others 4.2. Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 4.2.1. Virgin 4.2.2. Recycled 4.3. Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 4.3.1. Dimethyl terephthalate (DMT) process 4.3.2. Terephthalic acid (PTA) process 4.4. Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 4.4.1. Bottles & Containers 4.4.2. Films & Sheets 4.4.3. Strapping 4.4.4. Engineering Plastics 4.4.5. Others 4.5. Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 4.5.1. Food and Beverages 4.5.2. Pharmaceuticals & Healthcare 4.5.3. Personal Care & Home Care 4.5.4. Textiles & Apparel 4.5.5. Industrial & Automotive 4.5.6. Electronics & Electrical 4.5.7. Others 4.6. Polyethylene Terephthalate (PET) Market Size and Forecast, by Region (2024-2032) 4.6.1. North America 4.6.2. Europe 4.6.3. Asia Pacific 4.6.4. Middle East and Africa 4.6.5. South America 5. North America Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 5.1.1. Resins 5.1.2. Fiber 5.1.3. Others 5.2. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 5.2.1. Virgin 5.2.2. Recycled 5.3. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 5.3.1. Dimethyl terephthalate (DMT) process 5.3.2. Terephthalic acid (PTA) process 5.4. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 5.4.1. Bottles & Containers 5.4.2. Films & Sheets 5.4.3. Strapping 5.4.4. Engineering Plastics 5.4.5. Others 5.5. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 5.5.1. Food and Beverages 5.5.2. Pharmaceuticals & Healthcare 5.5.3. Personal Care & Home Care 5.5.4. Textiles & Apparel 5.5.5. Industrial & Automotive 5.5.6. Electronics & Electrical 5.5.7. Others 5.6. North America Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 5.6.1.1.1. Resins 5.6.1.1.2. Fiber 5.6.1.1.3. Others 5.6.1.2. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 5.6.1.2.1. Virgin 5.6.1.2.2. Recycled 5.6.1.3. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 5.6.1.3.1. Dimethyl terephthalate (DMT) process 5.6.1.3.2. Terephthalic acid (PTA) process 5.6.1.4. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 5.6.1.4.1. Bottles & Containers 5.6.1.4.2. Films & Sheets 5.6.1.4.3. Strapping 5.6.1.4.4. Engineering Plastics 5.6.1.4.5. Others 5.6.1.5. United States Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 5.6.1.5.1. Food and Beverages 5.6.1.5.2. Pharmaceuticals & Healthcare 5.6.1.5.3. Personal Care & Home Care 5.6.1.5.4. Textiles & Apparel 5.6.1.5.5. Industrial & Automotive 5.6.1.5.6. Electronics & Electrical 5.6.1.5.7. Others 5.6.2. Canada 5.6.2.1. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 5.6.2.1.1. Resins 5.6.2.1.2. Fiber 5.6.2.1.3. Others 5.6.2.2. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 5.6.2.2.1. Virgin 5.6.2.2.2. Recycled 5.6.2.3. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 5.6.2.3.1. Dimethyl terephthalate (DMT) process 5.6.2.3.2. Terephthalic acid (PTA) process 5.6.2.4. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 5.6.2.4.1. Bottles & Containers 5.6.2.4.2. Films & Sheets 5.6.2.4.3. Strapping 5.6.2.4.4. Engineering Plastics 5.6.2.4.5. Others 5.6.2.5. Canada Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 5.6.2.5.1. Food and Beverages 5.6.2.5.2. Pharmaceuticals & Healthcare 5.6.2.5.3. Personal Care & Home Care 5.6.2.5.4. Textiles & Apparel 5.6.2.5.5. Industrial & Automotive 5.6.2.5.6. Electronics & Electrical 5.6.2.5.7. Others 5.6.3. Mexico 5.6.3.1. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 5.6.3.1.1. Resins 5.6.3.1.2. Fiber 5.6.3.1.3. Others 5.6.3.2. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 5.6.3.2.1. Virgin 5.6.3.2.2. Recycled 5.6.3.3. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 5.6.3.3.1. Dimethyl terephthalate (DMT) process 5.6.3.3.2. Terephthalic acid (PTA) process 5.6.3.4. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 5.6.3.4.1. Bottles & Containers 5.6.3.4.2. Films & Sheets 5.6.3.4.3. Strapping 5.6.3.4.4. Engineering Plastics 5.6.3.4.5. Others 5.6.3.5. Mexico Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 5.6.3.5.1. Food and Beverages 5.6.3.5.2. Pharmaceuticals & Healthcare 5.6.3.5.3. Personal Care & Home Care 5.6.3.5.4. Textiles & Apparel 5.6.3.5.5. Industrial & Automotive 5.6.3.5.6. Electronics & Electrical 5.6.3.5.7. Others 6. Europe Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.2. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.3. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.4. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.5. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6. Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.1.2. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.1.3. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.1.4. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.1.5. United Kingdom Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6.2. France 6.6.2.1. France Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.2.2. France Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.2.3. France Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.2.4. France Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.2.5. France Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.3.2. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.3.3. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.3.4. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.3.5. Germany Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.4.2. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.4.3. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.4.4. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.4.5. Italy Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.5.2. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.5.3. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.5.4. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.5.5. Spain Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.6.2. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.6.3. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.6.4. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.6.5. Sweden Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.7.2. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.7.3. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.7.4. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.7.5. Austria Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 6.6.8.2. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 6.6.8.3. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 6.6.8.4. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 6.6.8.5. Rest of Europe Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.3. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.4. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.5. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6. Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.1.2. China Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.1.3. China Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.1.4. China Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.1.5. China Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.2.2. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.2.3. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.2.4. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.2.5. S Korea Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.3.2. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.3.3. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.3.4. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.3.5. Japan Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.4. India 7.6.4.1. India Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.4.2. India Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.4.3. India Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.4.4. India Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.4.5. India Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.5.2. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.5.3. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.5.4. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.5.5. Australia Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.6. Indonesia 7.6.6.1. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.6.2. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.6.3. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.6.4. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.6.5. Indonesia Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.7. Malaysia 7.6.7.1. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.7.2. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.7.3. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.7.4. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.7.5. Malaysia Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.8. Vietnam 7.6.8.1. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.8.2. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.8.3. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.8.4. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.8.5. Vietnam Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.9. Taiwan 7.6.9.1. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.9.2. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.9.3. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.9.4. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.9.5. Taiwan Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 7.6.10. Rest of Asia Pacific 7.6.10.1. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 7.6.10.2. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 7.6.10.3. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 7.6.10.4. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 7.6.10.5. Rest of Asia Pacific Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 8. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 8.3. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 8.4. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 8.5. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 8.6. Middle East and Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 8.6.1.2. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 8.6.1.3. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 8.6.1.4. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 8.6.1.5. South Africa Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 8.6.2. GCC 8.6.2.1. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 8.6.2.2. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 8.6.2.3. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 8.6.2.4. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 8.6.2.5. GCC Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 8.6.3. Nigeria 8.6.3.1. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 8.6.3.2. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 8.6.3.3. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 8.6.3.4. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 8.6.3.5. Nigeria Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 8.6.4. Rest of ME&A 8.6.4.1. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 8.6.4.2. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 8.6.4.3. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 8.6.4.4. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 8.6.4.5. Rest of ME&A Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 9. South America Polyethylene Terephthalate (PET) Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 9.2. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 9.3. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process(2024-2032) 9.4. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 9.5. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 9.6. South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 9.6.1.2. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 9.6.1.3. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 9.6.1.4. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 9.6.1.5. Brazil Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 9.6.2.2. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 9.6.2.3. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 9.6.2.4. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 9.6.2.5. Argentina Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Product (2024-2032) 9.6.3.2. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Type (2024-2032) 9.6.3.3. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Production Process (2024-2032) 9.6.3.4. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by Application (2024-2032) 9.6.3.5. Rest Of South America Polyethylene Terephthalate (PET) Market Size and Forecast, by End Use Industry (2024-2032) 10. Company Profile: Key Players 10.1. DAK Americas LLC – (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Nan Ya Plastics Corporation USA – (USA) 10.3. Far Eastern New Century Corporation – (USA) 10.4. BASF Corporation – (USA) 10.5. M&G Polymers USA LLC – (USA) 10.6. Lotte Chemical USA Corporation – (USA) 10.7. RTP Company – (USA) 10.8. Plastipak Holdings Inc. – (USA) 10.9. PolyQuest Inc. – (USA) 10.10. Indorama Ventures Public Company Limited – (Thailand) 10.11. Sinopec Yizheng Chemical Fibre Co., Ltd. – (China) 10.12. Reliance Industries Limited – (India) 10.13. Far Eastern New Century Corporation – (Taiwan) 10.14. Toray Industries, Inc. – (Japan) 10.15. SK Chemicals Co., Ltd. – (South Korea) 10.16. JBF Industries Ltd. – (India) 10.17. LOTTE Chemical Corporation – (South Korea) 10.18. Zhejiang Hengyi Group Co., Ltd. – (China) 10.19. Sanfangxiang Group Co., Ltd. – (China) 10.20. Indorama Ventures Europe – (Germany) 10.21. Alpek Polyester UK Ltd. – (United Kingdom) 10.22. Equipolymers – (Germany/Italy) 10.23. Novapet S.A. – (Spain) 10.24. Artenius PET Packaging Europe – (Spain) 10.25. LyondellBasell Industries N.V. – (Netherlands) 10.26. BASF SE – (Germany) 10.27. PET Recycling Team GmbH – (Austria) 10.28. Polisan Holding – (Turkey) 10.29. Selenis Portugal S.A. – (Portugal) 11. Key Findings 12. Industry Recommendations 13. Polyethylene Terephthalate (PET) Market: Research Methodology 14. Terms and Glossary