Plastomer Market size was valued at US$ 4.06 Bn. in 2022, and the total Plastomer revenue is expected to grow at 8.49% from 2022 to 2029, reaching nearly US$ 7.20 Bn.Plastomer Market Overview:

Plastomers are polymers that have the properties of both elastomers and plastics. These flexible materials have excellent clarity, gloss, and elasticity and are frequently preferred over a variety of polymers in a wide range of packaging applications. Plastomers are frequently used as polymer modifiers because they increase the end product's durability, flexibility, and impact strength. Plastomers have seen a significant increase in popularity as compared to traditional polymers in a variety of applications in recent years, fuelling their global demand. According to the Plastic Europe Association, plastic production in Europe has increased in the third quarter of 2022 owing to the ongoing demand from abroad. As a result, rising plastics production, as well as rising demand from automotive, packaging, and other industries, will drive the plastomer market during the forecast period.To know about the Research Methodology:-Request Free Sample Report In this report, the Plastomer market's growth reasons, as well as the market's many segments (Product, Application, and Region), are discussed. Data has been given by market players, regions, and specific requirements. This market report includes a comprehensive overview of all the significant improvements that are presently prevailing in all market segments. Key data analysis is presented in the form of statistics, infographics, and presentations. The study discusses the Plastomer market's Drivers, Restraints, Opportunities, and Challenges. The report helps to assess the market growth drivers and determines how to use these drivers as a tool. The report also helps to rectify and resolve issues related to the global Plastomer market situation.

Plastomer Market Dynamics:

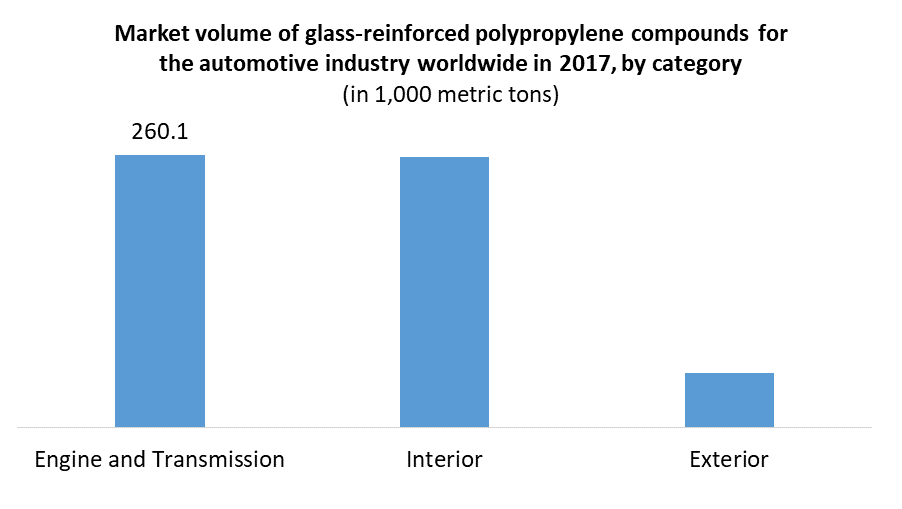

The Increasing demand for plastomers in Automotive: Plastomers are being driven by the growing demand for lightweight vehicles and electric vehicles. The use of plastic in place of metal to reduce vehicle weight and improve thermal and mechanical properties is fueling the plastomers market. Electric vehicle sales have increased over the last decade, according to the International Energy Agency. Vehicle registrations have increased by 42% in 2020, with 10 Billion electric vehicles on the road globally by the end of 2020. With a 4.7 percent increase in sales, the number of electric cars sold in 2020 was around 3.1 Billion, and Europe crossed China as the world's largest electric vehicle market for the first time. As a result, rising demand for electric vehicles will propel the plastomers market during the forecast period. Increasing Trade of Agricultural Product: Packaging is widely used in trade to protect agricultural products such as fruits and vegetables, cereals, oils, and others from being damaged or spoiled. According to the Republic of the Philippines, the Philippines' total agricultural trade in the second quarter of 2022 was $5.37 billion, a 29 percent increase from the first quarter of 2022. The growing agricultural trade will drive up demand for food packaging films all over the world. As a result, increased trade will increase demand for packaging, which will increase demand for plastomers during the forecast period. Growing demand in the Food packaging industries: One of the primary drivers of market growth is the continually rising product demand from the food packaging industry. Plastomers are mostly employed as sealing and melting polymers because of their low density, which helps to preserve the quality and freshness of food products, hence increasing their shelf life. Furthermore, the extensive use of controlled plastomers in the manufacturing of medical and healthcare items is boosting market growth. Plastomers are used in the production of intravenous (IV) bags, continuous ambulatory peritoneal dialysis pouches, pharmaceutical component bags, and bioreactor packaging. They have great package integrity even at low temperatures and can withstand accidental drops. Various product improvements, as well as the use of plastomers in the manufacturing of gaskets, seals, vibration dampening and impact absorption products, acoustical sound insulation systems, cushioning, seats, and hydrophobic and hydrophilic foams are also contributing to market growth. Plastomers are more expensive. Butane, hexane, octane, and other resins are substantially more expensive. Plastomers are high-end items, hence they are more expensive than rubber and other materials. The reason for this is its manufacturing cost; while manufacturing products, the apparatus, and equipment used are more expensive and this machinery requires significant maintenance. As a result of this feature, the product of plastomers is more expensive than its alternative materials which tend to hinder the market growth.

Plastomer Market Segment Analysis:

By Product, the ethylene-propylene segment is expected to increase by approximately 5% during the forecast period. Ethylene propylene has excellent chemical and physical properties such as heat sealability, processability, softness, clarity, and compatibility in blends for films, sheets, and moldable products, and the growing packaging, automotive, and construction sectors will have a significant impact on the overall plastomers market share in the coming years. The construction industry in the United States is a key contributor to the economy, producing over US$1.4 trillion in construction each year. As a result, the usage of Ethylene Propylene plastomers in building activities will raise plastomer demand over the forecast period. By Application, the food packaging segment is expected to increase at a CAGR of 7.2% over the forecast period. They are frequently used as a sealing polymer in the food packaging sector, owing to their low density and the difference between their sealing and melting properties. Furthermore, the product has unique characteristics like flexibility, strength, and good chemical resistance to safeguard food products from contamination and deterioration, making it very desirable all across the food packaging sector.Consumer food habits, changing lifestyles, global travel, and the continuing trend of healthier meals are all creating new prospects for the food sector. The aforementioned developments, primarily in growing nations such as the Asia Pacific and the Middle East will raise product demand that positively impacts the total plastomers market in the forecast period.

Plastomer Market Regional Insights:

In the Asia Pacific, the Plastomer Market is expected to grow owing to the growing consumer appliances, processed food industry, and large infrastructure projects in developing countries such as China, India, Indonesia, and others. The Asia Pacific region held the largest share in the plastomers market in 2022, up to 41%, boosting the demand for packaging films, adhesives and sealants, wires and cable compounds, and others. The rapidly growing food and beverage, pharmaceutical, and personal care industries have a favorable impact on the packaging sector Improved per capita expenditure, purchasing parity, and socioeconomic dynamics will drive demand for packaged food and personal care products. These developments lead to the food and non-food packaging sector, which will assist the plastomers market reach significant growth in the near future. The Plastomer market in Europe is expected to grow at a significant pace over the forecast period owing to increased focus and rising R&D activities in the packaging sector. The objective of the report is to present a comprehensive analysis of the Plastomer market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear, futuristic view of the industry to the decision-makers. The report also helps in understanding the Plastomer market dynamics, and structure by analyzing the market segments and projecting the Plastomer market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Plastomer market make the report investor’s guide.Plastomer Market Scope: Inquire before buying

Global Plastomer Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $4.06 Bn Forecast Period 2023 to 2029 CAGR: 8.49 % Market Size in 2029: US $ 7.20 Bn. Segments Covered: by Product Ethylene propylene Ethylene butene Ethylene hexene Ethylene octene by Application Adhesives Compounding foams Food packaging Non-food packaging Wire & Cables Automotive Others Plastomer Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Plastomer Market Key Players

1. The DOW Chemical Company 2. Saudi Basic Industries Corporation (SaBIC) 3. Borealis AG 4. Mitsui Chemicals Inc. 5. LG Chem Ltd. 6. Exxonmobile 7. Sumitomo Corporation 8. SK Group 9. Alpha Group 10.Plastomer Corporation. 11.Royal Dutch Shell 12.Chevron Phillips Chemical Company 13.LyondellBasell 14.Plastomer Technologies 15.Westlae Chemical Corporation. FAQs: 1. Which is the potential market for the Plastomer in terms of the region? Ans. In the APAC region, the growing consumer appliances, processed food industry, and large infrastructure projects are expected to drive the Plastomer market over the forecast period. 2. What is expected to drive the growth of the Plastomer market in the forecast period? Ans. Plastomers are being driven by the growing demand for lightweight vehicles and electric vehicles. 3. What is the projected market size & growth rate of the Plastomer Market? Ans. Plastomer Market size was valued at US$ 4.06 Bn. in 2022 and the total Plastomer revenue is expected to grow at 8.49 % through 2022 to 2029, reaching nearly US$ 7.20 Bn. 4. What segments are covered in the Plastomer Market report? Ans. The segments covered are Product, Application, and Region.

1. Global Plastomer Market: Research Methodology 2. Global Plastomer Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Plastomer Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Plastomer Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Plastomer Market Segmentation 4.1. Global Plastomer Market, by Product (2022-2029) • Ethylene propylene • Ethylene butene • Ethylene hexene • Ethylene octene 4.2. Global Plastomer Market, by Application (2022-2029) • Adhesives • Compounding foams • Food packaging • Non-food packaging • Wire & Cables • Automotive • Others 5. North America Plastomer Market(2022-2029) 5.1 North American Plastomer Market, By Product (2022-2029) • Ethylene propylene • Ethylene butene • Ethylene hexene • Ethylene octene 5.2 North America Plastomer Market, By Application (2022-2029) • Adhesives • Compounding foams • Food packaging • Non-food packaging • Wire & Cables • Automotive • Others 5.3 North America Plastomer Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Plastomer Market (2022-2029) 6.1. European Plastomer Market, By Product (2022-2029) 6.2. European Plastomer Market, By Application (2022-2029) 6.3 European Plastomer Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Plastomer Market (2022-2029) 7.1. Asia Pacific Plastomer Market, By Product (2022-2029) 7.2. Asia Pacific Plastomer Market, By Application (2022-2029) 7.3. Asia Pacific Plastomer Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Plastomer Market (2022-2029) 8.1. Middle East and Africa Plastomer Market, By Product (2022-2029) 8.2. Middle East and Africa Plastomer Market, By Application (2022-2029) 8.3. Middle East and Africa Plastomer Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Plastomer Market (2022-2029) 9.1. South America Plastomer Market, By Product (2022-2029) 9.2. South America Plastomer Market, By Application (2022-2029) 9.3 South America Plastomer Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Adhesives 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 The DOW Chemical Company 10.3 Saudi Basic Industries Corporation (SaBIC) 10.4 Borealis AG 10.5 Mitsui Chemicals Inc. 10.6 LG Chem Ltd. 10.7 Exxonmobile 10.8 Sumitomo Corporation 10.9 SK Group 10.10 Alpha Group 10.11 Plastomer Corporation. 10.12 Royal Dutch Shell 10.13 Chevron Phillips Chemical Company 10.14 LyondellBasell 10.15 Plastomer Technologies 10.16 Westlae Chemical Corporation.