Photosensitive Materials Market was valued at USD 15.87 Bn in 2024, and the Global Photosensitive Materials Market is expected to reach USD 26.86 Bn by 2032, growing at a CAGR of 6.8 % during the forecast periodMaterials Photosensitive Market Overview:

Photosensitive materials are substances that change their properties when exposed to light. This change can involve various phenomena, such as the emission of electrons (photoelectric effect), changes in electrical conductivity (photoconductivity), or alterations in chemical structure. Materials Photosensitive Market is a great booster on the 3D printing market as they permit high accuracy and multiplicity of properties that are of immense application with report indicating percentage of 18 percent in industrial equipment, 17 percent in consumer electronics, 16 percent in automotive, 15 percent in aerospace and 13 percent in medical/dental with a clear 75 percent market share within the limits of these applicable 3D printing applications. Asia Pacific dominated the photosensitive materials market in 2024 due to massive and ongoing investments in its semiconductor industry. Countries like Taiwan and China are heavily expanding their chip fabrication facilities, accounting for a large portion of global semiconductor production This report is focused on a comprehensive analysis of the worldwide Photosensitive Materials market, including its historic and current state, as well as the size and trends that will exist in the future. It unravels complicated data in a very simple way, summing up all aspects of the industry, the key players (in terms of leadership, followers, new players), with the PORTER, SWOT and PESTLE analysis. The report offers a transparent view of the competitiveness hence it is an essential guide to an investor.To know about the Research Methodology :- Request Free Sample Report

Photosensitive Materials Market Dynamics:

Increasing use of photosensitive materials in 3D printing to boost the market growth The use of photosensitive materials in 3D printing is driving growth due to high accuracy and resolution, easy to use, and a wide range of properties. The main application areas of 3D printing include industrial equipment, consumer goods and electronics, automobiles, aerospace, and medical, construction. Photosensitive materials market share of 75%. The composition ratio of 3D printing applications in industrial equipment accounts for 18%, consumer products, and electronics account for 17%, automobiles account for 16%, aerospace accounts for 15%, medical/dental accounts for 13%, scientific research modeling, military, construction, etc Technological Advances to Drive the Photosensitive Materials Market in Sustainable Construction Photosensitive materials play a crucial role in the construction industry. They are used for various applications, including photovoltaic panels, light-sensitive coatings, and optical fibers. The market for photosensitive materials in construction is rapidly expanding, driven by the increasing demand for energy-efficient and sustainable solutions. With advancements in technology and growing environmental awareness, the construction industry is embracing photosensitive materials to enhance energy generation, improve lighting systems, and optimize building designs. This trend is expected to continue. High cost of raw materials to restrain the market demand the photosensitive materials Market has been facing certain restraints. The high cost associated with raw materials limit their widespread adoption. Also, the complex manufacturing processes and technical requirements involved in working with photosensitive materials pose challenges for manufacturers and suppliers. Moreover, the availability of alternative materials and technologies may compete with the demand for photosensitive materials.Photosensitive Materials Market Segment Analysis

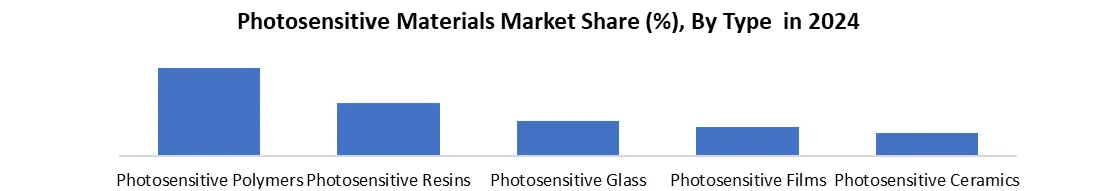

Based on Type, the Photosensitive Materials Market segments have been categorized into Photosensitive Polymers, Photosensitive Resins, Photosensitive Glass, Photosensitive Films, and Photosensitive Ceramics. Among these segments, photosensitive polymers held the largest market share 48% in 2024. This is due to the widespread use of photosensitive polymers in a variety of applications, such as electronics, 3D printing, and medical devices.

Photosensitive Materials Market Regional Analysis

Massive Investment in Semiconductor Industry Creates Asia Pacific Dominance in The Photosensitive Materials Market These Asian countries have been investing heavily and continue to invest in expanding and modernizing their semiconductor fabrication factories (fabs). As an example, Taiwan manufactures more than 60 percent of the global semiconductor industry, and China has revived huge state funds to advance its chip manufacture industry. This direct investment increases the demand of the raw materials required in producing chips such as photosensitive materials. Photosensitive Materials Market Competitive Analysis: Top Key Players of the Photosensitive Materials Market are JSR Corporation (Japan), Tokyo Ohka Kogyo Co., Ltd. (TOK) (Japan), DuPont de Nemours, Inc. (USA), Corning Incorporated (USA), and MicroChem Corp. (USA). JSR Corporation (Japan)is also considered a global leader in the most complex photoresist technologies, particularly in more exotic semiconductor production, such as EUV and ArF imaging, with continuous R&D and its wide global supply chain remaining a major factor in its leadership. DuPont de Nemours, Inc. (USA) due to its wide offering in electronic materials, such as a broad portfolio in photoresists and photosensitive polyimides, as well as its broad global R&D and market scope in a range of high-tech markets, is a formidable competitor. Tokyo Ohka Kogyo Co., Ltd. (TOK) (Japan) stands as a highly specialized and aggressive competitor in the photoresist market, offering a comprehensive portfolio of photolithography chemicals and actively pursuing global market share leadership in advanced photoresists through dedicated R&D and product innovation. Photosensitive Materials Market Key Trends: • Miniaturization and High Resolution in Electronics The relentless demand for smaller, more powerful, and higher-resolution electronic devices (smartphones, tablets, advanced displays, wearables) is a primary driver. • Growth in Semiconductor and Display Manufacturing The expansion of the global semiconductor industry, particularly in Asia Pacific, directly fuels the demand for high-performance photosensitive materials. Similarly, the evolution of display technologies (e.g., OLEDs, flexible displays) requires specialized photosensitive coatings and films. • Advancements in Lithography and Fabrication Processes Continuous innovation in lithographic techniques (e.g., EUV, nanoimprint lithography) and other fabrication methods like laser processing is opening new avenues for photosensitive materials, allowing for precise material structuring without masks. • Convergence of AI and IoT (AIoT) While not directly a material trend, the rapid growth of AIoT applications in smart manufacturing, smart cities, and consumer electronics indirectly boosts the demand for photosensitive materials, as these intelligent systems rely heavily on advanced semiconductor components and sensors. Photosensitive Materials Market Key Development:

Year Company Name Key Development October 11 2025 JSR Corporation (Japan) • Will transfer its in vitro diagnostic (IVD) business and IVD materials business to a new entity (Tokuyama Life Science Co., Ltd. and its group companies) through an absorption-type company split, with all shares being transferred to Tokuyama Corporation. This indicates a strategic divestiture to focus on core areas, likely including advanced semiconductor materials. November 3 2024 DuPont de Nemours, Inc. (USA) • Targeting November 1, 2025, for the completion of the intended separation of its Electronics business (the "Intended Electronics Separation") by way of a spin-off transaction. May 4 2025 Kayaku Advanced Materials Inc. (USA) • Announced an agreement to divest its PriElex® Functional Printed Electronic Materials business line to Heraeus. Aug 12 2024 Merck Group (Germany) • Reported strong Q1 2025 growth, with the Electronics business segment (which includes Semiconductor Solutions supplying materials like photoresists) contributing to overall performance. Photosensitive Materials Market Scope: Inquire Before Buying

Photosensitive Materials Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 15.87 Bn. Forecast Period 2025 to 2032 CAGR: 6.8% Market Size in 2032: USD 26.86 Bn. Segments Covered: by Type Photosensitive Polymers Photosensitive Resins Photosensitive Glass Photosensitive Films Photosensitive Ceramics by Application Printed Electronics 3D Printing Semiconductors Photographic appliances Textiles & garments Automotive Other by End User Electronics Healthcare Automotive Aerospace Packaging Other Photosensitive Materials Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Photosensitive Materials Market Key Players:

Asia Pacific 1. FUJIFILM Electronic Materials (Japan) 2. JSR Corporation (Japan 3. Shin-Etsu Chemical Co., Ltd. (Japan) 4. Sumitomo Chemical Co., Ltd. (Japan) 5. Tokyo Ohka Kogyo Co., Ltd. (TOK) (Japan 6. Toray Industries, Inc. (Japan) 7. Asahi Kasei Corporation (Japan, China, Taiwan) 8. Eternal Materials (Taiwan) 9. Kumho Petrochemical (South Korea) North America: 10. DuPont de Nemours, Inc. (USA) 11. MicroChem Corp. (USA) 12. HD Microsystems (USA) 13. Optigrate (USA) 14. Corning Glass (USA) 15. Metalphoto (USA) 16. Polysciences, Inc. (USA) Europe: 17. BASF SE (Germany) 18. ALLRESIST GmbH (Germany) 19. Agfa-Gevaert (Belgium) 20. ADOX (Germany) 21. Foma Bohemia (Czech Republic) 22. Harman Technology (UK) (ILFORD Photo) 23. Polaroid B.V. (Netherlands)frequently Asked Questions:

1] What is the growth rate of the Global Photosensitive Materials Market? Ans. The Global Photosensitive Material Market is growing at a significant rate of 6.8 % over the forecast period. 2] Which region is expected to dominate the Global Photosensitive Materials Market? Ans. North America region is expected to dominate the Photosensitive Materials Market over the forecast period. 3] What is the expected Global Photosensitive Materials Market size by 2032? Ans. The market size of the Photosensitive Materials Market is expected to reach USD 26.86 Bn by 2032. 4] Who are the top players in the Global Photosensitive Materials Market Industry? Ans. Top Key Players of Photosensitive Materials Market are JSR Corporation (Japan), Tokyo Ohka Kogyo Co., Ltd. (TOK) (Japan), DuPont de Nemours, Inc. (USA), Corning Incorporated (USA), and MicroChem Corp. (USA). 5] Which factors are expected to drive the Global Photosensitive Materials Market growth by 2032? Ans The increasing use of photosensitive materials in 3D printing to boost the market Growth over the forecast period (2025-2032).

1. Photosensitive Materials Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Photosensitive Materials Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Photosensitive Materials Market: Dynamics 3.1. Region-wise Trends of Photosensitive Materials Market 3.1.1. North America Photosensitive Materials Market Trends 3.1.2. Europe Photosensitive Materials Market Trends 3.1.3. Asia Pacific Photosensitive Materials Market Trends 3.1.4. Middle East and Africa Photosensitive Materials Market Trends 3.1.5. South America Photosensitive Materials Market Trends 3.2. Photosensitive Materials Market Dynamics 3.2.1. Global Photosensitive Materials Market Drivers 3.2.1.1. The increasing use of photosensitive materials in 3D printing 3.2.1.2. Expanding Market for Photosensitive Materials 3.2.2. Global Photosensitive Materials Market Restraints 3.2.3. Global Photosensitive Materials Market Challenges 3.2.4. Global Photosensitive Materials Market Opportunities 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Raw material costs and inflation affecting production expenses 3.4.2. Environmental regulations 3.4.3. Impact of manufacturing processes 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Photosensitive Materials Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 4.1. Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 4.1.1. Photosensitive Polymers 4.1.2. Photosensitive Resins 4.1.3. Photosensitive Glass 4.1.4. Photosensitive Films 4.1.5. Photosensitive Ceramics 4.2. Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 4.2.1. Printed Electronics 4.2.2. 3D Printing 4.2.3. Semiconductors 4.2.4. Photographic appliances 4.2.5. Textiles & garments 4.2.6. Automotive 4.2.7. Other 4.3. Research Centers and Laboratory Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 4.3.1. Electronics 4.3.2. Healthcare 4.3.3. Automotive 4.3.4. Aerospace 4.3.5. Packaging 4.3.6. Other 4.4. Photosensitive Materials Market Size and Forecast, by region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Photosensitive Materials Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 5.1. North America Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 5.1.1. Photosensitive Polymers 5.1.2. Photosensitive Resins 5.1.3. Photosensitive Glass 5.1.4. Photosensitive Films 5.1.5. Photosensitive Ceramics 5.2. North America Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 5.2.1. Printed Electronics 5.2.2. 3D Printing 5.2.3. Semiconductors 5.2.4. Photographic appliances 5.2.5. Textiles & garments 5.2.6. Automotive 5.2.7. Other 5.3. North America Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 5.3.1. Electronics 5.3.2. Healthcare 5.3.3. Automotive 5.3.4. Aerospace 5.3.5. Packaging 5.3.6. Other 5.3.7. North America Photosensitive Materials Market Size and Forecast, by Country (2024-2032) 5.3.8. United States 5.3.8.1. United States Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 5.3.8.1.1. Photosensitive Polymers 5.3.8.1.2. Photosensitive Resins 5.3.8.1.3. Photosensitive Glass 5.3.8.1.4. Photosensitive Films 5.3.8.1.5. Photosensitive Ceramics 5.3.8.2. United States Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 5.3.8.2.1. Printed Electronics 5.3.8.2.2. 3D Printing 5.3.8.2.3. Semiconductors 5.3.8.2.4. Photographic appliances 5.3.8.2.5. Textiles & garments 5.3.8.2.6. Automotive 5.3.8.2.7. Other 5.3.8.3. United States Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 5.3.8.3.1. Electronics 5.3.8.3.2. Healthcare 5.3.8.3.3. Automotive 5.3.8.3.4. Aerospace 5.3.8.3.5. Packaging 5.3.8.3.6. Other 5.3.9. Canada 5.3.9.1. Canada Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 5.3.9.1.1. Photosensitive Polymers 5.3.9.1.2. Photosensitive Resins 5.3.9.1.3. Photosensitive Glass 5.3.9.1.4. Photosensitive Films 5.3.9.1.5. Photosensitive Ceramics 5.3.10. Canada Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 5.3.10.1. Printed Electronics 5.3.10.2. 3D Printing 5.3.10.3. Semiconductors 5.3.10.4. Photographic appliances 5.3.10.5. Textiles & garments 5.3.10.6. Automotive 5.3.10.7. Other 5.3.11. Canada Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 5.3.11.1. Electronics 5.3.11.2. Healthcare 5.3.11.3. Automotive 5.3.11.4. Aerospace 5.3.11.5. Packaging 5.3.11.6. Other 5.3.12. Mexico 5.3.12.1. Mexico Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 5.3.12.1.1. Photosensitive Polymers 5.3.12.1.2. Photosensitive Resins 5.3.12.1.3. Photosensitive Glass 5.3.12.1.4. Photosensitive Films 5.3.12.1.5. Photosensitive Ceramics 5.3.12.2. Mexico Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 5.3.12.2.1. Printed Electronics 5.3.12.2.2. 3D Printing 5.3.12.2.3. Semiconductors 5.3.12.2.4. Photographic appliances 5.3.12.2.5. Textiles & garments 5.3.12.2.6. Automotive 5.3.12.2.7. Other 5.3.12.3. Mexico Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 5.3.12.3.1. Electronics 5.3.12.3.2. Healthcare 5.3.12.3.3. Automotive 5.3.12.3.4. Aerospace 5.3.12.3.5. Packaging 5.3.12.3.6. Other 6. Europe Photosensitive Materials Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 6.1. Europe Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.2. Europe Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.3. Europe Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4. Europe Photosensitive Materials Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4.2. France 6.4.2.1. France Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7. Asia Pacific Photosensitive Materials Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 7.1. Asia Pacific Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4. Asia Pacific Photosensitive Materials Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.4. India 7.4.4.1. India Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 8. Middle East and Africa Photosensitive Materials Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 8.1. Middle East and Africa Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 8.4. Middle East and Africa Photosensitive Materials Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 9. South America Photosensitive Materials Market Size and Forecast by Segmentation (by Value in USD Mn.) (2024-2032) 9.1. South America Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 9.2. South America Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 9.3. South America Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 9.4. South America Photosensitive Materials Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Photosensitive Materials Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Photosensitive Materials Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Photosensitive Materials Market Size and Forecast, By End User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. FUJIFILM Electronic Materials 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. JSR Corporation 10.3. Shin-Etsu Chemical Co., Ltd. 10.4. Sumitomo Chemical Co., Ltd. 10.5. Tokyo Ohka Kogyo Co., Ltd. (TOK) 10.6. Toray Industries, Inc. 10.7. Asahi Kasei Corporation 10.8. Eternal Materials 10.9. Kumho Petrochemical 10.10. DuPont de Nemours, Inc. 10.11. MicroChem Corp. 10.12. HD Microsystems 10.13. Optigrate 10.14. Corning Glass 10.15. Metalphoto 10.16. Polysciences, Inc. 10.17. BASF SE 10.18. ALLRESIST GmbH 10.19. Agfa-Gevaert 10.20. ADOX 10.21. Foma Bohemia 10.22. Harman Technology (ILFORD Photo) 10.23. Polaroid B.V. 11. Analyst Recommendations 12. Photosensitive Materials Market: Research Methodology