The Pest Control Products Market size was valued at USD 26.16 Billion in 2024, and the total revenue is expected to grow at CAGR of 5.5 % from 2025 to 2032, reaching nearly USD 40.15 Billion. The MMR Pest Control Products Market report provides comprehensive coverage of key industry aspects, including Pricing Trend Analysis by Region, addressing product-wise regional trends, cost components, raw material impact, and pricing comparisons across end-users. It examines Sustainability and Environmental Impact, highlighting shifts to biopesticides, eco-friendly formulations, and lifecycle assessments. Consumer Behavior Analysis explores changing preferences, usage patterns, demographic insights, and digital influences. The report also delves into Emerging Technologies and Trends, Import-Export & Trade Dynamics, and Seasonal Demand Analysis. Additionally, it covers Land Use & Application Area Analysis, Supply Chain Overview, and the Regulatory Landscape by Region, ensuring a holistic view of market drivers, challenges, innovations, and compliance requirements across the global pest control industry. Pest control refers to the management and prevention of pests, which include insects, rodents, and other animals, from causing harm to crops, buildings, and other areas. Pest control methods include physical methods such as traps and barriers, as well as chemical methods such as pesticides. The pest control products market is driven by regulatory changes, pest resistance, awareness about hygiene and health risks, and technological advancements. These factors impact product development, consumer demand, and industry performance, leading to market growth. Government rules, which establish guidelines for product safety and environmental impact, play a major role in regulating the market environment for pest control products. Major players in the pest control Product Market is a global presence include Ecolab Inc., Rollins Inc., Terminix International, FMC Corporation, BASF SE, Bayer AG, and Syngenta Group, offering a wide range of pest control products. Asia-Pacific is the fastest-growing region with a market share in. The region is expected to grow at a CAGR of 5.5 % during the forecast period and maintain its dominance by 2032. The Asia-Pacific is attributed to rapid urbanization and economic development creating favorable environments for pests, also growing awareness and increasing disposable income lead to a more demand for pest control product services. The development of major agricultural sectors supports this industry's need for pest control solutions. In Japan, the crop protection sector, the Japanese market is estimated to grow at a CAGR of 5.1% in with a focus on innovative crop protection chemicals and changes in Maximum Residual Limits (MRLs) for various substances and the Pest Control Products driven by increasing demand for organic agricultural products and favorable government policies promoting sustainable farming practices.To know about the Research Methodology :- Request Free Sample Report

Pest Control Products Market Dynamics:

The Importance of Awareness of Pest-Related Diseases Increasing awareness of the health risks associated with pests and the diseases they carry is crucial. Mosquitoes, ticks, and fleas are vectors for infectious diseases like Zika virus and Lyme disease. These insects transmit diseases to humans, which highlights the importance of understanding the risks that pests pose, pests also cause structural damage to homes and buildings, making it necessary to be vigilant about pest infestations. The role of pests in disease transmission underscores the need to address pest control and management practices to mitigate the spread of these diseases. The rising awareness about the health risks linked to pests is essential to protect public health and prevent the spread of diseases. The industry is moving towards more sustainable practices through Integrated Pest Management (IPM), which combines different strategies like biological controls, habitat modification, and target pesticide use to minimize environmental impact. As consumer awareness of health and hygiene problems has risen the demand for pest control in the residential sector also increased. The growing government restrictions on cleanliness requirements in commercial and industrial sectors have raised global demand for pest control in the Pest Control Products Market. The global pest control products market is expected to significantly growth thanks to several factors such as including rapid industrialization, increasing urbanization, the development of conventional formulations because of pest resistance, and the creation of eco-friendly products with reduced toxicity and enhanced biological formulations. All of these factors are expected to create productive opportunities for the Pest Control Products market growth.Pest Control Services Gain Traction in Food and Beverage Industries The increasing use of pest control products in many industries, particularly food and beverage, to remove pests and maintain hygiene is likely to drive pest control product market growth. Various pest control service companies also conduct pest control audits that meet the industry standard for maintaining hygiene and sanitation. So, increased industrial pest control applications are likely to boost market growth. The Costly Landscape of Pest Control Product Registration and Business Licensing The high costs of registering and getting approval for pest control products in the market are a significant challenge for businesses. Registering a pest control business highly costs, although differ based on the state and chosen business structure. Getting the necessary licenses for pest control companies involves huge expenses per exam, with additional costs for worker's compensation insurance and specialized pest control licenses. The process of registering a business and obtaining licenses takes several weeks delaying product approval and market entry. These factors contribute to the financial burden and time constraints faced by businesses in the pest control product market, showing the necessity of proper financial management and planning to effectively deal with those problems. The high costs associated with research and development in this sector act as a barrier to entry for smaller players, limiting competition and innovation. The economic downturns negatively affect the pest control products market, as businesses and individuals reduce flexible spending, and include pest management services.

Pest Control Products Market Segment Analysis:

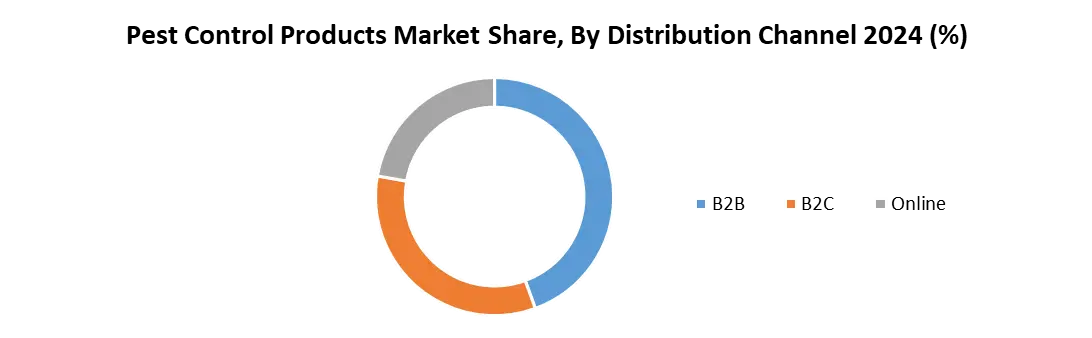

Based on End-User, in 2024, the Commercial segment is expected to dominate the Global Pest Control Products Market due to high demand from offices, hotels, restaurants, and retail spaces. The Residential segment is also growing, driven by urbanization and rising home hygiene awareness. Agriculture contributes through large-scale crop protection needs, while Industrial applications maintain a moderate share in manufacturing, warehouses, and food processing. The Others segment, including institutional and public facilities, holds a smaller share but shows steady growth. Overall, Commercial and Residential lead in volume, while Agriculture and Industrial drive value-focused adoption. Based on the Distribution Channel, in 2024, the B2B segment is expected to dominate the Global Pest Control Products Market, driven by high demand from commercial establishments, industrial facilities, and large-scale agricultural operations requiring bulk procurement and long-term contracts. The B2C segment follows closely, fueled by growing awareness among households, urbanization, and the expanding DIY pest control market. Online channels are witnessing rapid growth, supported by increasing e-commerce adoption, convenience of doorstep delivery, and targeted digital promotions appealing to tech-savvy consumers. Overall, the distribution trend highlights a balance between large-scale institutional purchases via B2B and value-driven, convenience-oriented adoption through B2C and online channels.

Regional Analysis of Pest Control Products Market:

North America dominates the Pest Control Products Market with the largest market share accounting for 57.9% in 2024, the region is expected to grow during the forecast period and maintain its dominance by 2032. North America is dominating thanks to growing awareness of pest-related issues, strong regulations, and public health concerns regarding diseases transmitted by pests, such as Lyme disease and West Nile virus, which drive the market's growth like Lyme disease and West Nile virus drive the market growth. Rapid urbanization creates new surroundings favorable to pest infestations. Increasing construction activity and infrastructure development can disrupt natural habitats, contributing to pest problems, and demand proactive pest control measures driving the market growth.Europe is the second largest growing region in the Pest Control Products Market in 2024 and is significantly growing during its forecast period. A shift towards preventative pest control strategies involves implementing preventive measures to minimize the risk of pest infestation before it occurs, leading to consistent demand for pest control services. Europe has highly stringent regulations controlling the use of pesticides and their effects on the environment. It encourages creativity in the creation of safer and more long-lasting pest control methods, boosting the development of eco-friendly and natural product markets.

Competitive Landscape for Pest Control Products Market:

The competitive landscape of the Pest Control Products Market is constantly evolving, with new players emerging and established players adapting their strategies. Building Partnerships and collaboration with established players, research institutions, and investors to leverage expertise and resources. The strategic investments and focus on innovation are pivotal in shaping the future landscape of the Pest Control Products Market as it continues to evolve with the increasing demand for sustainable energy solutions and technological advancements across various industries. The larger pest control service providers have reacted by merging with or acquiring their competitors. In addition, these pest control service providers achieve larger cost savings and advance a bigger market share. Some of the major players analyzed in this report are Anticimex, BASF SE, Bayer AG, Clean kill Environmental Services Ltd., Dodson Pest Control, Inc., Ecolab, FMC Corporation, JG Pest Control, Rollins, Inc. 1. Ecolab Inc. recently announced strong fourth-quarter performance and a positive outlook for 2024, reporting a diluted EPS of $1.41 and an adjusted diluted EPS of $1.55 for the fourth quarter of 2024. 2. Dodson Pest Control, Inc. was involved in philanthropic activities, such as donating to Virginia Tech and contributing to the Bert Dodson Sr. Urban Entomology Enrichment Fund, which reached a $1 million milestone in 2023 3. Rollins, Inc. recently completed the acquisition of Fox Pest Control, a leading pest management company, for $339.3 million. This acquisition was made through the Home Team Pest Defense brand and is expected to be accretive to earnings and cash flow in the first full year of ownership. 4. In June 2023, Bayer AG’s agricultural division Bayer Crop Science partnered with Crystal Crop Protection Ltd. To develop and launch ground-breaking solutions for pest control that are aimed at benefiting paddy growers across India. The partnership indicates a critical turning point in the quest to improve rice farmer yields and crop protection techniques in India. 5. In 2022 Ecolab contributed over $83 million to support communities, with nearly $5 million of the total funding going to organizations aligned with their mission. Ecolab Inc. was involved in providing funding to Ordr Smart Inc., contributing $0.12 million along with Techstars Central, LLC.Pest Control Products Market Scope: Inquiry Before Buying

Global Pest Control Products Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 26.16 Bn. Forecast Period 2025 to 2032 CAGR: 5.5% Market Size in 2032: USD 40.15 Bn. Segments Covered: by Product Type Chemical Pest Control Products Insecticides Rodenticides Others Biological Pest Control Products Predatory Insects Microbials Plant Extracts Others Mechanical Pest Control Products Traps Light traps Adhesive traps Malaise traps Others UV radiation devices Mesh screens Ultrasonic vibrations Others Software & services by Pest Type Insects Termites Rodents Wildlife Others by Mode of Application Powder Sprays Pellets Traps Baits Others by Price Range Premium Medium Economy by End User Commercial Government Institutions Office Buildings Retail Stores Food and Beverage Outlets Hospitality Healthcare Facilities Residential Apartments Individual Houses Agriculture Industrial Manufacturing Metric Tons Warehouses Transportation and Logistics Others by Distribution Channel B2B B2C Online Pest Control Products Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pest Control Products Market Key Players:

1. BASF SE 2. Corteva 3. Bayer AG (Germany) 4. Syngenta AG 5. FMC Corporation 6. Pherobio Technology Co., Ltd. 7. Ecolab Inc. 8. Bell Laboratories, Inc. 9. PelGar International 10. Fort Products UK 11. DE SANGOSSE 12. Suterra LLC (USA) 13. EcoClear Products Inc. (USA) 14. Wilbur-Ellis Company LLC 15. Nisus Corporation 16. Sumitomo Chemical Co., Ltd. (Japan) 17. UPL Limited (India) 18. ADAMA 19. MGK (McLaughlin Gormley King Company) (USA) 20. Ensystex Inc. (China/USA) 21. China National Chemical Corporation (ChemChina) 22. Pelsis Ltd. (France) 23. Killgerm Group Ltd. (UK) 24. Target Specialty Products (USA) 25. Cleankill Environmental Services Ltd. (UK) 26. JG Pest Control (UK) 27. SC Johnson Professional (USA) 28. Amvac Chemical Corporation (USA) 29. Central Life Sciences (USA) 30. Control Solutions, Inc. 31. OthersFrequently Asked Questions:

1] What segments are covered in the Pest Control Products Market report? Ans. The segments covered in the Pest Control Products Market report are based on Product Type, Pest Type, Mode of Application, Price Range, End user, Distribution Channel, and region 2] Which region is expected to hold the highest share of the Pest Control Products Market? Ans. The North America region is expected to hold the highest share of the Pest Control Products Market. 3] What is the market size of the Pest Control Products Market by 2032? Ans. The market size of the Pest Control Products Market by 2032 is USD 40.15 Bn. 4] What is the growth rate of the Pest Control Products Market? Ans. The Global Pest Control Products Market is growing at a CAGR of 5.5 % during the forecasting period 2025-2032. 5] What was the market size of the Pest Control Products Market in 2024? Ans. The market size of the Pest Control Products Market in 2024 was USD 26.16 Bn.

1. Pest Control Products Market: Executive Summary 1.1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032) 1.1.2. Market Size (Value in USD Billion, Volume in Metric Tons) - By Segments, Regions, and Country 2. Pest Control Products Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. Revenue (2024) 2.3.5. End-User Segment 2.3.6. Market Share(%)2024 2.3.7. Growth Rate(%) 2.3.8. R&D Spending 2.3.9. Number of New Product Launches 2.3.10. Patents 2.3.11. Adoption of Sustainable/Bio-Based Solutions 2.3.12. Regional Revenue Split 2.3.13. Eco-Certifications 2.3.14. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Pest Control Products Market: Dynamics 3.1. Pest Control Products Market Trends 3.2. Pest Control Products Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis for the Pest Control Products Market 3.6. Analysis of Government Schemes and Support for the Industry 4. Pricing Trend Analysis By Region 4.1. Price Trends by Product Type by Region (2019–2024) 4.2. Cost Breakdown of Key Components (Active Ingredients, Packaging, Formulation) 4.3. Impact of Raw Material Prices (e.g., Pyrethroids, Botanical Extracts) 4.4. Effect of Global Supply Chain and Freight Cost Fluctuations 4.5. Pricing Comparison – Commercial vs. Residential Use Products 5. Sustainability and Environmental Impact Analysis 5.1. Reduction of Chemical Usage & Shift to Biopesticides 5.2. Rise in Eco-Friendly, Biodegradable Formulations 5.3. Global & Regional Push for Environmentally Safer Pest Control Products 5.4. Sustainability Goals of Major Players 5.5. Lifecycle Impact Assessment (LCA) of Synthetic vs. Organic Pest Control Products 6. Consumer Behavior Analysis 6.1. Changing Preferences: Shift Toward Natural/Organic Solutions 6.1.1. DIY vs. Professional Pest Control Services 6.1.2. Increased Awareness of Health & Environmental Risks 6.2. Usage Patterns by Application 6.2.1. Seasonal Demand Fluctuations 6.2.2. Pest Type-Specific Product Preferences 6.3. Demographic Insights 6.3.1. Urban vs. Rural Adoption 6.3.2. income-Based Spending Trends 6.4. Digital & Retail Influence 6.4.1. Role of Online Portals & E-commerce in Product Discovery 6.4.2. Impact of Social Media & Reviews on Brand Preference 7. Emerging Technologies and Trends 7.1. Integration of Smart Pest Monitoring (IoT-based Traps & Sensors) 7.2. Advances in AI-based Pest Detection and Forecasting Tools 7.3. Growth of Drone-Based Agricultural Pest Control 7.4. Innovation in Biocontrol & Microbial Products 7.5. Sustainable Packaging and Dose-Optimized Delivery Systems 8. Import-Export & Trade Analysis 2024 8.1. Top 10 Importing Countries of Pest Control Products 8.2. Top 10 Exporting Countries of Pest Control Products 8.3. Trade Dynamics Influenced by Crop Disease Outbreaks or Pest Surges 8.4. Impact of Regional Bans and Restrictions on Chemical Formulations 8.5. U.S., EU, and APAC Tariff Policies Affecting Global Trade 9. Seasonal Demand Analysis 9.1. Seasonal Pest Patterns and Their Impact on Product Sales 9.2. Seasonal Demand Trends by Region 9.3. Role of Climate Change in Altering Seasonal Cycles 9.4. Retail and E-commerce Seasonal Sales Patterns 9.5. Inventory and Supply Chain Adjustments to Seasonal Shifts 10. Land Use & Application Area Analysis by Country 10.1. Global Agricultural Land Coverage & Key Crop Zones (Top 15 Countries) 10.1.1. Analysis of arable land and permanent crop area 10.1.2. Implications for pest control demand in agriculture (e.g., cereals, fruits, vegetables, cotton) 10.2. Urban vs. Rural Land Distribution and Its Impact on Product Demand 10.2.1. Growing urbanization and pest control needs 10.2.2. Pest hotspots: urban slums, commercial zones, housing societies, etc. 10.3. Top Countries by Land Area Dedicated to Crop Protection Markets 10.4. Residential & Commercial Infrastructure Expansion and Rodent/Insect Incidence 10.5. Land Use Shifts and Climate Impact on Pest Breeding Zones 11. Supply Chain Analysis 11.1. Overview of Supply Chain Infrastructure 11.2. Storage and Transport Requirements 11.3. Role of Logistics and Distribution Partners 11.4. Integration of Technology in Pest Control Supply Chains 11.5. Supply Chain Gaps in Developing Regions 12. Regulatory Landscape by Region 12.1. Overview of Global Regulatory Bodies (EPA, REACH, FAO, etc.) 12.2. Product Registration, Labeling, and Compliance Requirements 12.3. Country-wise Bans, Phase-outs, and Maximum Residue Levels (MRLs) 12.4. Impact of Regulatory Changes on Innovation & New Product Launches 12.5. Certifications for Organic, Biodegradable, and Green Pest Control Solutions 13. Pest Control Products Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2024-2032) 13.1. Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 13.1.1. Chemical Pest Control Products 13.1.1.1. Insecticides 13.1.1.2. Rodenticides 13.1.1.3. Others 13.1.2. Biological Pest Control Products 13.1.2.1. Predatory Insects 13.1.2.2. Microbials 13.1.2.3. Plant Extracts 13.1.2.4. Others 13.1.3. Mechanical Pest Control Products 13.1.3.1. Traps 13.1.3.1.1. Light traps 13.1.3.1.2. Adhesive traps 13.1.3.1.3. Malaise traps 13.1.3.1.4. Others 13.1.3.2. UV radiation devices 13.1.3.3. Mesh screens 13.1.3.4. Ultrasonic vibrations 13.1.3.5. Others 13.1.4. Software & services 13.2. Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 13.2.1. Insects 13.2.2. Termites 13.2.3. Rodents 13.2.4. Wildlife 13.2.5. Others 13.3. Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 13.3.1. Powder 13.3.2. Sprays 13.3.3. Pellets 13.3.4. Traps 13.3.5. Baits 13.3.6. Others 13.4. Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 13.4.1. Premium 13.4.2. Medium 13.4.3. Economy 13.5. Pest Control Products Market Size and Forecast, By End user (2024-2032) 13.5.1. Commercial 13.5.1.1. Government Institutions 13.5.1.2. Office Buildings 13.5.1.3. Retail Stores 13.5.1.4. Food and Beverage Outlets 13.5.1.5. Hospitality 13.5.1.6. Healthcare Facilities 13.5.2. Residential 13.5.2.1. Apartments 13.5.2.2. Individual Houses 13.5.3. Agriculture 13.5.4. Industrial 13.5.4.1. Manufacturing Metric Tons 13.5.4.2. Warehouses 13.5.4.3. Transportation and Logistics 13.5.5. Others 13.6. OthersPest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 13.6.1. B2B 13.6.2. B2C 13.6.3. Online 13.7. Pest Control Products Market Size and Forecast, By Region (2024-2032) 13.7.1. North America 13.7.2. Europe 13.7.3. Asia Pacific 13.7.4. Middle East and Africa 13.7.5. South America 14. North America Pest Control Products Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2024-2032) 14.1. North America Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 14.1.1. Chemical Pest Control Products 14.1.1.1. Insecticides 14.1.1.2. Rodenticides 14.1.1.3. Others 14.1.2. Biological Pest Control Products 14.1.2.1. Predatory Insects 14.1.2.2. Microbials 14.1.2.3. Plant Extracts 14.1.2.4. Others 14.1.3. Mechanical Pest Control Products 14.1.3.1. Traps 14.1.3.1.1. Light traps 14.1.3.1.2. Adhesive traps 14.1.3.1.3. Malaise traps 14.1.3.1.4. Others 14.1.3.2. UV radiation devices 14.1.3.3. Mesh screens 14.1.3.4. Ultrasonic vibrations 14.1.3.5. Others 14.1.4. Software & services 14.2. North America Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 14.2.1. Insects 14.2.2. Termites 14.2.3. Rodents 14.2.4. Wildlife 14.2.5. Others 14.3. North America Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 14.3.1. Powder 14.3.2. Sprays 14.3.3. Pellets 14.3.4. Traps 14.3.5. Baits 14.3.6. Others 14.4. North America Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 14.4.1. Premium 14.4.2. Medium 14.4.3. Economy 14.5. North America Pest Control Products Market Size and Forecast, By End user (2024-2032) 14.5.1. Commercial 14.5.1.1. Government Institutions 14.5.1.2. Office Buildings 14.5.1.3. Retail Stores 14.5.1.4. Food and Beverage Outlets 14.5.1.5. Hospitality 14.5.1.6. Healthcare Facilities 14.5.2. Residential 14.5.2.1. Apartments 14.5.2.2. Individual Houses 14.5.3. Agriculture 14.5.4. Industrial 14.5.4.1. Manufacturing Metric Tons 14.5.4.2. Warehouses 14.5.4.3. Transportation and Logistics 14.5.5. Others 14.6. North America Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 14.6.1. B2B 14.6.2. B2C 14.6.3. Online 14.7. North America Pest Control Products Market Size and Forecast, by Country (2024-2032) 14.7.1. United States 14.7.1.1. United States Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 14.7.1.1.1. Chemical Pest Control Products 14.7.1.1.1.1. Insecticides 14.7.1.1.1.2. Rodenticides 14.7.1.1.1.3. Others 14.7.1.1.2. Biological Pest Control Products 14.7.1.1.2.1. Predatory Insects 14.7.1.1.2.2. Microbials 14.7.1.1.2.3. Plant Extracts 14.7.1.1.2.4. Others 14.7.1.1.3. Mechanical Pest Control Products 14.7.1.1.3.1. Traps 14.7.1.1.3.1.1. Light traps 14.7.1.1.3.1.2. Adhesive traps 14.7.1.1.3.1.3. Malaise traps 14.7.1.1.3.1.4. Others 14.7.1.1.3.2. UV radiation devices 14.7.1.1.3.3. Mesh screens 14.7.1.1.3.4. Ultrasonic vibrations 14.7.1.1.3.5. Others 14.7.1.1.4. Software & services 14.7.1.2. United States Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 14.7.1.2.1. Insects 14.7.1.2.2. Termites 14.7.1.2.3. Rodents 14.7.1.2.4. Wildlife 14.7.1.2.5. Others 14.7.1.3. United States Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 14.7.1.3.1. Powder 14.7.1.3.2. Sprays 14.7.1.3.3. Pellets 14.7.1.3.4. Traps 14.7.1.3.5. Baits 14.7.1.3.6. Others 14.7.1.4. United States Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 14.7.1.4.1. Premium 14.7.1.4.2. Medium 14.7.1.4.3. Economy 14.7.1.5. United States Pest Control Products Market Size and Forecast, By End user (2024-2032) 14.7.1.6. Commercial 14.7.1.6.1. Government Institutions 14.7.1.6.2. Office Buildings 14.7.1.6.3. Retail Stores 14.7.1.6.4. Food and Beverage Outlets 14.7.1.6.5. Hospitality 14.7.1.6.6. Healthcare Facilities 14.7.1.7. Residential 14.7.1.7.1.1. Apartments 14.7.1.7.1.2. Individual Houses 14.7.1.7.2. Agriculture 14.7.1.7.3. Industrial 14.7.1.7.3.1. Manufacturing Metric Tons 14.7.1.7.3.2. Warehouses 14.7.1.7.3.3. Transportation and Logistics 14.7.1.8. Others 14.7.1.9. United States Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 14.7.1.9.1. B2B 14.7.1.9.2. B2C 14.7.1.9.3. Online 14.7.2. Canada 14.7.2.1. Canada Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 14.7.2.1.1. Chemical Pest Control Products 14.7.2.1.1.1. Insecticides 14.7.2.1.1.2. Rodenticides 14.7.2.1.1.3. Others 14.7.2.1.2. Biological Pest Control Products 14.7.2.1.2.1. Predatory Insects 14.7.2.1.2.2. Microbials 14.7.2.1.2.3. Plant Extracts 14.7.2.1.2.4. Others 14.7.2.1.3. Mechanical Pest Control Products 14.7.2.1.3.1. Traps 14.7.2.1.3.1.1. Light traps 14.7.2.1.3.1.2. Adhesive traps 14.7.2.1.3.1.3. Malaise traps 14.7.2.1.3.1.4. Others 14.7.2.1.3.2. UV radiation devices 14.7.2.1.3.3. Mesh screens 14.7.2.1.3.4. Ultrasonic vibrations 14.7.2.1.3.5. Others 14.7.2.1.4. Software & services 14.7.2.2. Canada Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 14.7.2.2.1. Insects 14.7.2.2.2. Termites 14.7.2.2.3. Rodents 14.7.2.2.4. Wildlife 14.7.2.2.5. Others 14.7.2.3. Canada Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 14.7.2.3.1. Powder 14.7.2.3.2. Sprays 14.7.2.3.3. Pellets 14.7.2.3.4. Traps 14.7.2.3.5. Baits 14.7.2.3.6. Others 14.7.2.4. Canada Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 14.7.2.4.1. Premium 14.7.2.4.2. Medium 14.7.2.4.3. Economy 14.7.2.5. Canada Pest Control Products Market Size and Forecast, By End user (2024-2032) 14.7.2.5.1. Commercial 14.7.2.5.1.1. Government Institutions 14.7.2.5.1.2. Office Buildings 14.7.2.5.1.3. Retail Stores 14.7.2.5.1.4. Food and Beverage Outlets 14.7.2.5.1.5. Hospitality 14.7.2.5.1.6. Healthcare Facilities 14.7.2.5.2. Residential 14.7.2.5.2.1. Apartments 14.7.2.5.2.2. Individual Houses 14.7.2.5.3. Agriculture 14.7.2.5.4. Industrial 14.7.2.5.4.1. Manufacturing Metric Tons 14.7.2.5.4.2. Warehouses 14.7.2.5.4.3. Transportation and Logistics 14.7.2.5.5. Others 14.7.2.6. Canada Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 14.7.2.6.1. B2B 14.7.2.6.2. B2C 14.7.2.6.3. Online 14.7.3. Mexico 14.7.3.1. Mexico Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 14.7.3.1.1. Chemical Pest Control Products 14.7.3.1.1.1. Insecticides 14.7.3.1.1.2. Rodenticides 14.7.3.1.1.3. Others 14.7.3.1.2. Biological Pest Control Products 14.7.3.1.2.1. Predatory Insects 14.7.3.1.2.2. Microbials 14.7.3.1.2.3. Plant Extracts 14.7.3.1.2.4. Others 14.7.3.1.3. Mechanical Pest Control Products 14.7.3.1.3.1. Traps 14.7.3.1.3.1.1. Light traps 14.7.3.1.3.1.2. Adhesive traps 14.7.3.1.3.1.3. Malaise traps 14.7.3.1.3.1.4. Others 14.7.3.1.3.2. UV radiation devices 14.7.3.1.3.3. Mesh screens 14.7.3.1.3.4. Ultrasonic vibrations 14.7.3.1.3.5. Others 14.7.3.1.4. Software & services 14.7.3.2. Mexico Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 14.7.3.2.1. Insects 14.7.3.2.2. Termites 14.7.3.2.3. Rodents 14.7.3.2.4. Wildlife 14.7.3.2.5. Others 14.7.3.3. Mexico Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 14.7.3.3.1. Powder 14.7.3.3.2. Sprays 14.7.3.3.3. Pellets 14.7.3.3.4. Traps 14.7.3.3.5. Baits 14.7.3.3.6. Others 14.7.3.4. Mexico Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 14.7.3.4.1. Premium 14.7.3.4.2. Medium 14.7.3.4.3. Economy 14.7.3.5. Mexico Pest Control Products Market Size and Forecast, By End user (2024-2032) 14.7.3.5.1. Commercial 14.7.3.5.1.1. Government Institutions 14.7.3.5.1.2. Office Buildings 14.7.3.5.1.3. Retail Stores 14.7.3.5.1.4. Food and Beverage Outlets 14.7.3.5.1.5. Hospitality 14.7.3.5.1.6. Healthcare Facilities 14.7.3.5.2. Residential 14.7.3.5.2.1. Apartments 14.7.3.5.2.2. Individual Houses 14.7.3.5.3. Agriculture 14.7.3.5.4. Industrial 14.7.3.5.4.1. Manufacturing Metric Tons 14.7.3.5.4.2. Warehouses 14.7.3.5.4.3. Transportation and Logistics 14.7.3.5.5. Others 14.7.3.6. Mexico Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 14.7.3.6.1. B2B 14.7.3.6.2. B2C 14.7.3.6.3. Online 15. Europe Pest Control Products Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2024-2032) 15.1. Europe Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 15.2. Europe Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 15.3. Europe Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 15.4. Europe Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 15.5. Europe Pest Control Products Market Size and Forecast, By End user (2024-2032) 15.6. Europe Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 15.7. Europe Pest Control Products Market Size and Forecast, By Country (2024-2032) 15.7.1. United Kingdom 15.7.2. France 15.7.3. Germany 15.7.4. Italy 15.7.5. Spain 15.7.6. Sweden 15.7.7. Russia 15.7.8. Rest of Europe 16. Asia Pacific Pest Control Products Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2024-2032) 16.1. Asia Pacific Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 16.2. Asia Pacific Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 16.3. Asia Pacific Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 16.4. Asia Pacific Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 16.5. Asia Pacific Pest Control Products Market Size and Forecast, By End user (2024-2032) 16.6. Asia Pacific Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 16.7. Asia Pacific Pest Control Products Market Size and Forecast, by Country (2024-2032) 16.7.1. China 16.7.2. S Korea 16.7.3. Japan 16.7.4. India 16.7.5. Australia 16.7.6. Indonesia 16.7.7. Malaysia 16.7.8. Philippines 16.7.9. Thailand 16.7.10. Vietnam 16.7.11. Rest of Asia Pacific 17. Middle East and Africa Pest Control Products Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2024-2032) 17.1. Middle East and Africa Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 17.2. Middle East and Africa Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 17.3. Middle East and Africa Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 17.4. Middle East and Africa Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 17.5. Middle East and Africa Pest Control Products Market Size and Forecast, By End user (2024-2032) 17.6. Middle East and Africa Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 17.7. Middle East and Africa Pest Control Products Market Size and Forecast, By Country (2024-2032) 17.7.1. South Africa 17.7.2. GCC 17.7.3. Nigeria 17.7.4. Rest of ME&A 18. South America Pest Control Products Market Size and Forecast by Segmentation (by Value in USD Billion, Volume in Metric Tons) (2024-2032) 18.1. South America Pest Control Products Market Size and Forecast, By Product Type (2024-2032) 18.2. South America Pest Control Products Market Size and Forecast, By Pest Type (2024-2032) 18.3. South America Pest Control Products Market Size and Forecast, By Mode of Application (2024-2032) 18.4. South America Pest Control Products Market Size and Forecast, By Price Range (2024-2032) 18.5. South America Pest Control Products Market Size and Forecast, By End user (2024-2032) 18.6. South America Pest Control Products Market Size and Forecast, By Distribution Channel (2024-2032) 18.7. South America Pest Control Products Market Size and Forecast, By Country (2024-2032) 18.7.1. Brazil 18.7.2. Argentina 18.7.3. Colombia 18.7.4. Chile 18.7.5. Rest of South America 19. Company Profile: Key Players 19.1. BASF SE 19.1.1. Company Overview 19.1.2. Business Portfolio 19.1.3. Financial Overview 19.1.4. SWOT Analysis 19.1.5. Strategic Analysis 19.1.6. Recent Developments 19.2. Corteva 19.3. Bayer AG (Germany) 19.4. Syngenta AG 19.5. FMC Corporation 19.6. Pherobio Technology Co., Ltd. 19.7. Ecolab Inc. 19.8. Bell Laboratories, Inc. 19.9. PelGar International 19.10. Fort Products UK 19.11. DE SANGOSSE 19.12. Suterra LLC (USA) 19.13. EcoClear Products Inc. (USA) 19.14. Wilbur-Ellis Company LLC 19.15. Nisus Corporation 19.16. Sumitomo Chemical Co., Ltd. (Japan) 19.17. UPL Limited (India) 19.18. ADAMA 19.19. MGK (McLaughlin Gormley King Company) (USA) 19.20. Ensystex Inc. (China/USA) 19.21. China National Chemical Corporation (ChemChina) 19.22. Pelsis Ltd. (France) 19.23. Killgerm Group Ltd. (UK) 19.24. Target Specialty Products (USA) 19.25. Cleankill Environmental Services Ltd. (UK) 19.26. JG Pest Control (UK) 19.27. SC Johnson Professional (USA) 19.28. Amvac Chemical Corporation (USA) 19.29. Central Life Sciences (USA) 19.30. Control Solutions, Inc. 19.31. Others 20. Key Findings 21. Analyst Recommendations 22. Pest Control Products Market – Research Methodology