The Personal Protective Equipment market size was estimated at USD 72.51 Bn. in 2024 and is projected to reach USD 126.23 Bn. by 2032, growing at a CAGR of 5.70% from 2025 to 2032.Personal Protective Equipment Overview

The Personal Protective Equipment Market Report provides an extensive analysis of an industry that is crucial for occupational health and safety in almost all sectors. Personal Protective Equipment is comprised of products that protect people, such as helmets, gloves, eye protection, high-visibility clothing, footwear, respiratory protection, and complete body suits. Personal Protective Equipment is specifically designed to reduce exposure to a wide range of workplace hazards, including chemical, physical, biological, and radiological hazards. The Personal Protective Equipment market includes both reusable and disposable PPE marketed to various industrial sectors, including healthcare, construction, oil & gas, and mining. Personal Protective Equipment Market Driven by rising manufacturing capabilities globally and awareness following the pandemic, has allowed for the availability of PPE to be better than it had been previously to the pandemic. Global health emergencies highlighted the need for localized production hubs and supply chain diversification during instances of supply-demand imbalances. Additionally, the demand side of the Personal Protective Equipment Market has strengthened due to stricter occupational safety regulations, a growing global workforce, and increased awareness of the importance of protecting workers, particularly in emerging economies. Regionally, North America held the largest Personal Protective Equipment Market share in 2024, supported by comprehensive and enforceable regulations such as OSHA and EU-OSHA. Meanwhile, the Asia-Pacific region is emerging as the fastest-growing market globally, driven by rapid urbanization and industrialization in countries like China and India, along with increased government focus on workforce safety.To know about the Research Methodology:-Request Free Sample Report

Personal Protective Equipment Market Dynamics

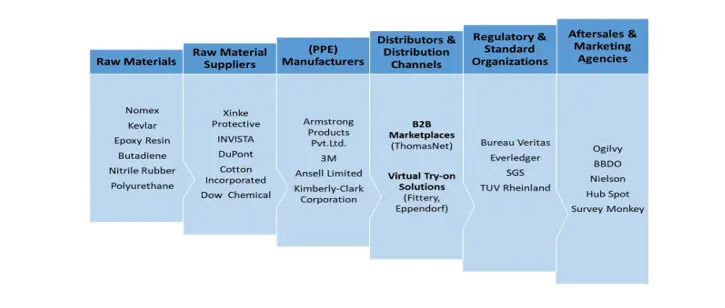

Rising Workplace Safety Regulations to Drive Personal Protective Equipment Market Growth One of the key growth drivers of the Personal Protective Equipment (PPE) market is the increasing implementation of stringent workplace safety regulations across various industries. Regulatory bodies such as the Occupational Safety and Health Administration (OSHA) in the United States, the European Agency for Safety and Health at Work (EU-OSHA), and similar organizations globally have mandated the use of PPE in hazardous work environments, including manufacturing, construction, healthcare, and mining. These regulations compel employers to provide appropriate protective gear to their workers, significantly boosting the demand for products such as helmets, gloves, goggles, respiratory masks, and protective clothing. The report highlights that the enforcement of safety standards, combined with growing awareness about occupational hazards, continues to accelerate the adoption of PPE across developed and developing regions alike. Integration of Smart PPE Technologies to Create Personal Protective Equipment Market Opportunity A significant opportunity in the Personal Protective Equipment (PPE) market lies in the integration of smart technologies into protective gear. The emergence of smart PPE equipment embedded with sensors, connectivity features, and real-time monitoring capabilities has the potential to revolutionize workplace safety. These advanced PPE solutions can track worker health indicators (such as heart rate, temperature, or exposure to harmful gases), send alerts during emergencies, and provide data for safety audits and compliance tracking. The report identifies this technological evolution as a key opportunity for manufacturers to differentiate their offerings, tap into premium market segments, and meet the growing demand for digital safety solutions in high-risk industries such as oil & gas, mining, and healthcare. As industries increasingly prioritize predictive safety and real-time data, smart PPE is expected to witness rapid adoption in the coming years. High Cost of Advanced PPE to Restrain Personal Protective Equipment Market One of the key restraints hindering the growth of the Personal Protective Equipment (PPE) market is the high cost associated with advanced and specialized protective gear. While basic PPE items remain affordable, technologically advanced products—such as smart PPE, multi-layered protective suits, and ergonomically designed equipment—can be significantly more expensive. This poses a challenge, especially for small and medium-sized enterprises (SMEs) and in developing regions where budget constraints often lead to limited adoption. The report notes that the high upfront investment, coupled with maintenance and replacement costs, may deter widespread use, particularly in price-sensitive markets. As a result, despite growing awareness and regulations, cost continues to be a barrier to the full-scale deployment of high-quality PPE solutions. Personal Protective Equipment Industry Ecosystem

Personal Protective Equipment Market Segment Analysis:

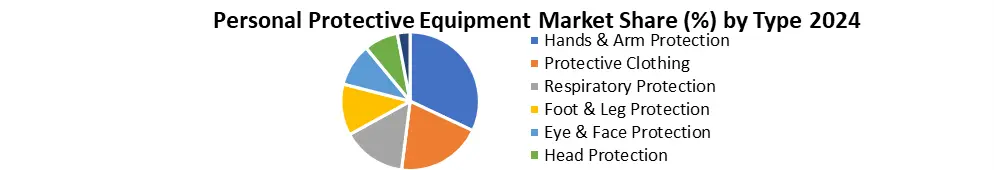

Based on Type the market is segmented into Hands &Arm Protection , Protection Clothing, Respiratory Protection, Foot & Leg Protection, Eye & Face Protection, Head Protection, Others. Among this Hands & Arm Protection held the dominant share in the Personal Protective Equipment Market in 2024. This segment includes gloves, sleeves, arm guards, and other products designed to protect workers from chemical exposure, cuts, abrasions, burns, and biological hazards. The dominance of this segment is primarily attributed to its extensive use across high-risk industries such as healthcare, manufacturing, chemicals, and construction, where hand injuries are common. Increased awareness about workplace safety, stricter regulatory standards, and the rising incidence of occupational hazards have further propelled the demand for this category. Additionally, the COVID-19 pandemic significantly boosted the consumption of disposable gloves, particularly in the healthcare and food industries, reinforcing the segment's leadership in the PPE market.

Personal Protective Equipment Market Regional Insights:

In 2024, North America had the largest market share in the Personal Protective Equipment (PPE) market, due primarily to increasingly stringent occupational health and safety regulations and governmental commitment to worker protections across a variety of industries. The U.S. Occupational Safety and Health Administration (OSHA) exercises extensive safety regulation, which includes PPE usage requirements for sectors such as oil & gas, construction, manufacturing, and healthcare. North America also has several leading PPE manufacturers and innovations in protective technologies (e.g., smart wearables, sustainable materials). Furthermore, the pandemic has led to accelerated awareness and investment in PPE infrastructure in the healthcare and emergency response sectors. In addition to the number of federal initiatives designed to promote workplace safety, increasing awareness and concern around health hazards and industrial accidents will further drive demand for better PPE and certified protective equipment. For instance, 3M Company, a major U.S.-based PPE manufacturer, held an estimated 12% share of the global PPE market in 2024, with strong sales in respiratory protection and disposable protective gear across North America. These factors combined position North America as a mature and heavily regulated market alongside consistent demand and innovation-led growth across public and private sectors. Personal Protective Equipment Market Competitive Landscape The Personal Protective Equipment (PPE) market can be viewed as a dynamic, competitive landscape characterized by innovation, compliance, and the ability to meet a wide range of end-user industrial sector demands. Some of the major global players in the PPE market, such as Honeywell International Inc. (U.S.) and 3M Company (U.S.), have different strategies to defend their market position. Honeywell approaches the PPE segment with a focus on smart, connected PPE, depending on IoT (Internet of Things) and data-driven analytics to enhance safety and compliance for industrial workers in sectors such as oil & gas, construction and manufacturing. In early 2024, Honeywell released its next-generation smart headgear with wearable gas detection systems offering different performance and features, developed with ways to improve hazard monitoring in real-time, complying with OSHA and ANSI. 3M Company's approach focuses more on product diversification, global reach, and the biggest portfolio of respiratory protection, hearing protection and eye protection products in the market. 3M has made significant investments in sustainable materials and environmentally-friendly manufacturing processes, allowing them to strengthen their brand value in Europe and Asia-Pacific, with increasingly stringent environmental regulations. 3M has also increased production capacity in Germany and China in 2024, with the emphasis on sustainable materials and environmentally friendly products to increase supply chain cost resilience. Honeywell's use of digital PPE in intelligent safety ecosystems places it ahead of 3M, but the company's global scalability and innovation potential across traditional protective product categories provide it with an advantage in the market. Their different approaches point to the future of how technology-enhanced PPE can best fit the diverse array of end-user workforce applications Global PPE Market Recent Developments 1 June 2025, Global PPE Market Growth Trends (Global – USA, Germany, China) The Global Personal Protective Equipment (PPE) market is witnessing strong growth driven by stricter workplace safety regulations and increasing demand across industries such as healthcare, construction, and manufacturing. Countries like the USA, Germany, and China are leading this growth due to regulatory mandates and rising awareness of occupational hazards. 2. June 2025, Smart PPE Technology Adoption Rising (North America – USA & Canada, Europe Germany) The Smart PPE market, a growing segment of the overall PPE industry, is gaining traction in North America and Europe, especially in USA, Canada, and Germany. Adoption is driven by increasing use of sensor-based protective gear that enables real-time monitoring of worker health, fatigue, and environmental exposure. 3. April 2025, Rising Use of Head, Eye & Face PPE (Asia-Pacific – India & China) In the Asia-Pacific PPE market, countries like India and China are seeing a significant rise in demand for head, eye, and face protection equipment. This trend is fueled by rapid industrial growth, urbanization, and the enforcement of new safety guidelines in sectors such as construction and heavy engineering. 4 June 2025, Legal Action on Faulty PPE Supply (United Kingdom – UK PPE Market) In the United Kingdom PPE market, the Department of Health & Social Care has taken legal action against a supplier for delivering non-sterile and defective PPE gowns during the COVID-19 pandemic. This has highlighted ongoing concerns about product quality and supply chain integrity in the UK’s PPE procurement process. Personal Protective Equipment Market Key Trends

Category Key Trend Example Product Market Impact Smart PPE Integration Use of sensor-enabled PPE for real-time monitoring of worker health & safety Draeger X-plore Smart Respirator Enhances safety compliance and incident response; growing adoption in hazardous industrial environments Sustainable Materials Shift toward eco-friendly and recyclable PPE components DuPont Tyvek 500 Xpert Coverall (recyclable) Supports ESG goals and reduces environmental impact; preferred in green-certified industries Customization & Fit Demand for gender-specific and ergonomic PPE designs Honeywell Adapt Fit Safety Helmet Improves comfort and compliance; boosts adoption across diverse labor forces, especially in construction. Regulatory Compliance Stricter regional standards for workplace safety equipment OSHA/CE-Certified PPE Kits Drives mandatory usage in regulated sectors; fuels growth in North America and EU PPE markets Personal Protective Equipment Market Scope: Inquire before buying

Personal Protective Equipment Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 72.51 Bn. Forecast Period 2025 to 2032 CAGR: 5.70% Market Size in 2032: USD 126.23 Bn. Segments Covered: by Type Hands & Arm Protection Protective Clothing Respiratory Protection Foot & Leg Protection Eye & Face Protection Head Protection Others by End Use Industry Manufacturing Construction Healthcare Oil & Gas Transportation Food Firefighting Others Personal Protective Equipment Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Personal Protective Equipment Market Key Players

North America 1. 3M – St. Paul, Minnesota, USA 2. Honeywell International Inc. – Charlotte, North Carolina, USA 3. DuPont – Wilmington, Delaware, USA 4. Ansell Ltd. – Melbourne, Victoria, Australia 5. MSA Safety Inc. – Cranberry Township, Pennsylvania, USA Asia Pacific 1. Ansell Ltd. – Melbourne, Australia 2. Top Glove Corporation Bhd – Shah Alam, Malaysia 3. Kossan Rubber Industries – Selangor, Malaysia 4. Sheico Group – Wujie, Yilan County, Taiwan 5. Uvex Safety Group – Fürth, Germany (with strong APAC operations) Europe 1. Uvex Safety Group – Fürth, Germany 2. Drägerwerk AG & Co. KGaA – Lübeck, Germany 3. Delta Plus Group – Apt, Vaucluse, France 4. Sioen Industries NV – Ardooie, Belgium 5. Bollé Brands – Villeurbanne (Lyon), FranceFrequently Asked Questions:

1. Which region has the largest share in the Global Personal Protective Equipment Market? Ans: North America region held the highest share in 2024 2. What is the growth rate of Global Personal Protective Equipment Market? Ans: The Global Personal Protective Equipment Market is growing at a CAGR of 5.70% during the forecasting period 2025-2032. 3. What is the scope of the Global Personal Protective Equipment Market report? Ans: Global Personal Protective Equipment Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in the Global market? Ans: The important key players in the Global Personal Protective Equipment Market are 3M Co., Ansell Limited, MSA Safety Inc., Honeywell International Inc., Kimberly-Clark Corporation, E I DuPont de Nemours and Co., Lakeland Industries, Inc., Sioen Industries NV, Alpha Pro Tech, Ltd., Radians, Inc., Avon Rubber plc, COFRA S.r.l., Uvex Safety Group, Lindstrom Group, BartelsRieger Atemschutztechnik GmbH, Rock Fall (U.K.) Ltd., Mine Safety Appliances (MSA) Company, TEIJIN LIMITED, Polison Corp., Gateway Safety, and Inc. 5. What is the study period of Personal Protective Equipment Market? Ans: The Global Personal Protective Equipment Market is studied from 2024 to 2032.

1. Global Personal Protection Equipment Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Personal Protection Equipment Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Service Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Personal Protection Equipment Market: Dynamics 3.1. Region-wise Trends of Personal Protection Equipment Market 3.1.1. North America Personal Protection Equipment Market Trends 3.1.2. Europe Personal Protection Equipment Market Trends 3.1.3. Asia Pacific Personal Protection Equipment Market Trends 3.1.4. Middle East and Africa Personal Protection Equipment Market Trends 3.1.5. South America Personal Protection Equipment Market Trends 3.2. Global Personal Protection Equipment Market Dynamics 3.2.1. Global Personal Protection Equipment Market Drivers 3.2.1.1. Growth in the PPE Market 3.2.2. Global Personal Protection Equipment Market Opportunities 3.2.2.1. Growing demand for PPE Market 3.2.3. Global Personal Protection Equipment Market Restraints 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Global Personal Protection Equipment Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Global Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 4.1.1. Hands & Arm Protection 4.1.2. Protective Clothing 4.1.3. Respiratory Protection 4.1.4. Foot & Leg Protection 4.1.5. Eye & Face Protection 4.1.6. Head Protection 4.1.7. Others 4.2. Global Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 4.2.1. Manufacturing 4.2.2. Construction 4.2.3. Healthcare 4.2.4. Oil & Gas 4.2.5. Transportation 4.2.6. Food 4.2.7. Firefighting 4.2.8. Others 4.3. Global Personal Protection Equipment Market Size and Forecast, by Region (2024-2032) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Personal Protection Equipment Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 5.1.1. Hands & Arm Protection 5.1.2. Protective Clothing 5.1.3. Respiratory Protection 5.1.4. Foot & Leg Protection 5.1.5. Eye & Face Protection 5.1.6. Head Protection 5.1.7. Others 5.2. North America Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 5.2.1. Manufacturing 5.2.2. Construction 5.2.3. Healthcare 5.2.4. Oil & Gas 5.2.5. Transportation 5.2.6. Food 5.2.7. Firefighting 5.2.8. Others 5.3. North America Personal Protection Equipment Market Size and Forecast, by Country (2024-2032) 5.3.1. United States 5.3.1.1. United States Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 5.3.1.1.1. Hands & Arm Protection 5.3.1.1.2. Protection Clothing 5.3.1.1.3. Respiratory Protection 5.3.1.1.4. Foot Leg Protection 5.3.1.1.5. Eye Face Protection 5.3.1.1.6. Head Protection 5.3.1.1.7. Others 5.3.1.2. United States Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 5.3.1.2.1. Manufacturing 5.3.1.2.2. Construction 5.3.1.2.3. Healthcare 5.3.1.2.4. Oil gas 5.3.1.2.5. Transportation 5.3.1.2.6. Food 5.3.1.2.7. Firefighting 5.3.1.2.8. Others 5.3.2. Canada 5.3.2.1. Canada Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 5.3.2.1.1. Hands & Arm Protection 5.3.2.1.2. Protection Clothing 5.3.2.1.3. Respiratory Protection 5.3.2.1.4. Foot & Leg Protection 5.3.2.1.5. Eye & Face Protection 5.3.2.1.6. Head Protection 5.3.2.1.7. Others 5.3.2.2. Canada Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 5.3.2.2.1. Manufacturing 5.3.2.2.2. Construction 5.3.2.2.3. Healthcare 5.3.2.2.4. Oil Gas 5.3.2.2.5. Transportation 5.3.2.2.6. Food 5.3.2.2.7. Firefighting 5.3.2.2.8. Others 5.3.3. Mexico 5.3.3.1. Mexico Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 5.3.3.1.1. Hands & Arm Protection 5.3.3.1.2. Protection Clothing 5.3.3.1.3. Respiratory Protection 5.3.3.1.4. Foot Leg Protection 5.3.3.1.5. Eye face protection 5.3.3.1.6. Head Protection 5.3.3.1.7. Others 5.3.3.2. Mexico Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 5.3.3.2.1. Manufacturing 5.3.3.2.2. Construction 5.3.3.2.3. Healthcare 5.3.3.2.4. Oil gas 5.3.3.2.5. Transportation 5.3.3.2.6. Food 5.3.3.2.7. Firefighting 5.3.3.2.8. Others 6. Europe Personal Protection Equipment Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.2. Europe Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3. Europe Personal Protection Equipment Market Size and Forecast, By Country (2024-2032) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.1.2. United Kingdom Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3.2. France 6.3.2.1. France Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.2.2. France Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3.3. Germany 6.3.3.1. Germany Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.3.2. Germany Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3.4. Italy 6.3.4.1. Italy Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.4.2. Italy Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3.5. Spain 6.3.5.1. Spain Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.5.2. Spain Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3.6. Sweden 6.3.6.1. Sweden Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.6.2. Sweden Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3.7. Austria 6.3.7.1. Austria Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.7.2. Austria Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 6.3.8.2. Rest of Europe Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7. Asia Pacific Personal Protection Equipment Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3. Asia Pacific Personal Protection Equipment Market Size and Forecast, By Country (2024-2032) 7.3.1. China 7.3.1.1. China Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.1.2. China Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.2. S Korea 7.3.2.1. S Korea Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.2.2. S Korea Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.3. Japan 7.3.3.1. Japan Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.3.2. Japan Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.4. India 7.3.4.1. India Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.4.2. India Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.5. Australia 7.3.5.1. Australia Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.5.2. Australia Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.6. Indonesia 7.3.6.1. Indonesia Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.6.2. Indonesia Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.7. Philippines 7.3.7.1. Philippines Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.7.2. Philippines Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.8. Malaysia 7.3.8.1. Malaysia Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.8.2. Malaysia Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.9. Vietnam 7.3.9.1. Vietnam Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.9.2. Vietnam Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.10. Thailand 7.3.10.1. Thailand Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.10.2. Thailand Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 7.3.11. Rest of Asia Pacific 7.3.11.1. Rest of Asia Pacific Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 7.3.11.2. Rest of Asia Pacific Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 8. Middle East and Africa Personal Protection Equipment Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 8.3. Middle East and Africa Personal Protection Equipment Market Size and Forecast, By Country (2024-2032) 8.3.1. South Africa 8.3.1.1. South Africa Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 8.3.1.2. South Africa Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 8.3.2. GCC 8.3.2.1. GCC Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 8.3.2.2. GCC Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 8.3.3. Nigeria 8.3.3.1. Nigeria Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 8.3.3.2. Nigeria Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 8.3.4.2. Rest of ME&A Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 9. South America Personal Protection Equipment Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 9.2. South America Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 9.3. South America Personal Protection Equipment Market Size and Forecast, By Country (2024-2032) 9.3.1. Brazil 9.3.1.1. Brazil Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 9.3.1.2. Brazil Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 9.3.2. Argentina 9.3.2.1. Argentina Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 9.3.2.2. Argentina Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 9.3.3. Rest of South America 9.3.3.1. Rest of South America Personal Protection Equipment Market Size and Forecast, By Type (2024-2032) 9.3.3.2. Rest of South America Personal Protection Equipment Market Size and Forecast, By End Use Industry (2024-2032) 10. Company Profile: Key Players 10.1. 3M Company – Saint Paul, Minnesota, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Honeywell International Inc. – Charlotte, North Carolina, USA 10.3. DuPont de Nemours, Inc. – Wilmington, Delaware, USA 10.4. Ansell Limited – Richmond, Victoria, Australia 10.5. Kimberly-Clark Corporation – Irving, Texas, USA 10.6. MSA Safety Incorporated – Cranberry Township, Pennsylvania, USA 10.7. Lakeland Industries, Inc. – Decatur, Alabama, USA 10.8. Alpha Pro Tech, Ltd. – Markham, Ontario, Canada 10.9. Uvex Safety Group – Fürth, Germany 10.10. Mallcom (India) Limited – Kolkata, West Bengal, India 10.11. Bullard – Cynthiana, Kentucky, USA 10.12. Radians, Inc. – Memphis, Tennessee, USA 10.13. Delta Plus Group – Apt, France 10.14. Drägerwerk AG & Co. KGaA – Lübeck, Germany 10.15. Polison Corporation – Taichung, Taiwan 11. Key Findings 12. Analyst Recommendations 13. Personal Protection Equipment Market: Research Methodology